INTRODUCTION

Trade credit happens when a firm sells its products or services on credit and does not receive cash immediately. It is an essential marketing tool, acting as a bridge for the movement of goods through the production and distribution stages to customers. A firm grants trade credit to protect its sales from the competitors and to attract the potential customers to buy its products at favourable terms. Trade credit creates accounts receivable or trade debtors (also referred to book debts in India) that the firm is expected to collect in the near future. The customers from whom receivables or book debts have to be collected in the future are called trade debtors or simply as debtors and represent the firm’s claim or asset. A credit sale has three characteristics:1 First, it involves an element of risk that should be carefully analysed. Cash sales are totally riskless, but not the credit sales, as the cash payments are yet to be received. Second, it is based on economic value. To the buyer, the economic value in goods or services passes immediately at the time of sale, while the seller expects an equivalent value to be received later on. Third, it implies futurity. The buyer will make the cash payment for goods or services received by him, in a future period.

Debtors constitute a substantial portion of current assets of several firms. For example in India, trade debtors, after inventories, are the major components of current assets. They form about one-third of current assets in India. Granting credit and creating debtors amount to blocking of the firm’s funds. The interval between the date of sale and the date of payment has to be financed out of working capital. This necessitates the firm to get funds from banks or other sources. Thus, trade debtors represent investment. As substantial amounts are tied-up in trade debtors, it needs careful analysis and proper management.

CREDIT POLICY: NATURE AND GOALS

Daily credit sales × Average collection period

A firm’s investment in accounts receivable depends on: (a) the volume of credit sales, and (b) the collection period. For example, if a firm’s credit sales are `30 lakh per day and customers, on an average, take 45 days to make payment, then the firm’s average investment in accounts receivable is:

`30 lakh × 45 = `1,350 lakh

The investment in receivables may be expressed in terms of costs of sales instead of sales value.

The volume of credit sales is a function of the firm’s total sales and the percentage of credit sales to total sales. Total sales depend on market size, firm’s market share, product quality, intensity of competition, economic conditions etc. The financial manager hardly has any control over these variables. The percentage of credit sales to total sales is mostly influenced by the nature of business and industry norms. For example, car manufacturers in India, until recently, were not selling cars on credit. They required the customers to make payment at the time of delivery; some of them even asked for the payment to be made in advance. This was so because of the absence of genuine competition and a wide gap between demand for and supply of cars in India. This position changed after economic liberalization which led to intense competition. In contrast, the textile manufacturers sold two-thirds of their total sales on credit to the wholesale dealers. The textile industry is still going through a difficult phase.

There is one way in which the financial manager can affect the volume of credit sales and collection period and consequently, investment in accounts receivable. That is through the changes in credit policy. The term credit policy is used to refer to the combination of three decision variables: (i) credit standards, (ii) credit terms, and (iii) collection efforts, on which the financial manager has influence.

Credit standards are the criteria to decide the types of customers to whom goods could be sold on credit. If a firm has more slow-paying customers, its investment in accounts receivable will increase. The firm will also be exposed to higher risk of default.

Credit terms specify duration of credit and terms of payment by customers. Investment in accounts receivable will be high if customers are allowed extended time period for making payments.

Collection efforts determine the actual collection period. The lower the collection period, the lower will be the investment in accounts receivable and vice versa.

Goals of Credit Policy

A firm’s credit policy aims at maximizing shareholders’ wealth through increase in sales leading to net improvement in profitability. Increased sales will not only increase operating profits, but will also require additional investment and costs. Hence, a trade-off between incremental return and cost of incremental investment is involved.

A firm may follow a lenient or a stringent credit policy. The firm, following a lenient credit policy, tends to sell on credit to customers on very liberal terms and standards; credits are granted for longer periods even to those customers whose creditworthiness is not fully known or whose financial position is doubtful. In contrast, a firm following a stringent credit policy sells on credit on a highly selective basis, only to those customers who have proven creditworthiness and who are financially strong. In practice, firms follow credit policies ranging between stringent to lenient.

Marketing Tool

In practice, companies may grant credit for several other reasons such as the company’s position, buyer’s status and requirement, dealer relationship, transit delays, industrial practice, etc.

Why at all do firms sell on credit? Firms use credit policy as a marketing tool for expanding sales. In a declining market, it may be used to maintain the market share. Credit policy helps to retain old customers and create new customers by weaning them away from competitors. In a growing market, it is used to increase the firm’s market share. Under a highly competitive situation or recessionary economic conditions, a firm may loosen its credit policy to maintain sales or to minimize erosion of sales.

Maximization of Sales vs Incremental Profit

Is sales maximization the goal of the firm’s credit policy? If it was so, the firm would follow a very lenient credit policy, and would sell on credit to everyone. Firms in practice do not follow very loose credit policy just to maximize sales. Sales do not expand without costs. The firm will have to evaluate its credit policy in terms of both return and costs of additional sales. Additional sales should add to the firm’s operating profit. There are three types of costs involved:

(a) Production and selling costs (b) Administration costs and delinquency costs

(c) Default costs and bad-debt losses (d) Opportunity cost and capital cost

(a) Production and Selling Costs

These costs increase with expansion in sales. If sales expand within the existing production capacity, then only the variable production and selling costs will increase. If capacity is added for sales expansion resulting from loosening of credit policy, then the incremental production and selling costs will include both variable and fixed costs.

![]()

production and selling costs ( COST) is the incremental contribution ( CONT) of the change in the credit policy.

(b) Administration Costs and Delinquency Costs

When the firm loosens its credit policy, two types of costs are normally involved: (a) credit investigation and supervision costs and (b) collection costs. The firm is required to analyze and supervise a large number of accounts when it loosens its credit policy. Similarly, the firm will have to intensify its collection efforts to collect outstanding bills from financially less sound customers. The incremental costs of credit administration will be nil if the existing credit department, without any additional costs, can implement the new credit policy. This will be the case when the credit department has idle capacity.

In addition to the normal receivable administration cost, the firm may have to deal with delinquent accounts. Delinquent accounts refer to debtors who delay in making payments to the firm within the specified credit period. Delinquent costs refer to those receivable (debtors) administration costs that are incurred to make collections, making phone calls, reminding debtors or any other cost necessary to collect delayed receivables. In fact, the follow-up costs of delayed receivables are referred to delinquent costs.

(c) Default costs and Bad-debt Losses

(d) Opportunity Cost and Capital Cost

Delinquency may result in the non-payment of receivables, which results in the bad-debt losses. Default costs arise due to the failure of debtors to make any payment of the amount due to him/her. Bad-debt losses arise when the firm is unable to collect its accounts receivable. The size of bad-debt losses depends on the quality of accounts accepted by the firm. Thus a firm tends to sell to customers with relatively less credit standing when it loosens its credit policy. Some of these customers delay payments, and some of them do not pay at all. As a result, bad-debt losses increase. The firm can certainly avoid or minimize these losses by adopting a very tight credit policy. Is minimization of bad-debt losses a goal of credit policy? If it was so, no firm will ever sell on credit to anyone. If this happens, then the firm is not availing the opportunity of using credit policy as a marketing tool for expanding sales, and will incur opportunity cost in terms of lost contribution.

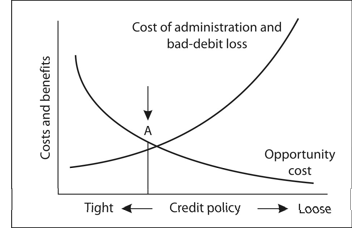

The evaluation of a change in a firm’s credit policy involves analysis of:2 opportunity cost of lost contribution credit administration costs and bad-debt losses

Note that a tight credit policy means rejection of certain types of accounts whose creditworthiness is doubtful. This results into loss of sales and consequently, loss of contribution. This is an opportunity cost to the firm. As the firm starts loosening its credit policy, it accepts all or some of those accounts which the firm had earlier rejected. Thus, the firm will recapture lost sales and thus, lost contribution. The opportunity cost of lost contribution declines with the loosening of credit policy.

In addition to the opportunity cost, the firm is required to make investment in receivables. During the credit period, the firm’s funds remain tied up in receivables. Further, they may be required to make payments for the costs incurred in the production of goods (such as raw material, labour etc.) which are sold on credit. This means that the firm has to wait for the cash collection from debtors, but may be required to pay cash to creditors, workers etc. The capital cost is the cost of funds which are tied-up in receivables.

These two costs behave contrary to each other. Consider Figure 17.1. You can see that as the firm moves from tight to loose credit policy, the opportunity cost declines (that is, the firm recaptures lost sales and thus, lost contribution), but the credit administration costs and baddebt losses increase (that is, more accounts have to be handled which also include bad accounts which ultimately fail to pay). How should the firm determine its credit policy? The firm’s credit policy will be determined by the trade-off between opportunity cost and credit administration costs and bad debts losses. In the Figure 17.1, this trade-off occurs at point A where the total of opportunity costs of lost contribution and credit administration costs and bad-debts losses is minimum. Does point A represent optimum credit policy? How can a firm establish an optimum credit policy?

CREDIT POLICY VARIABLES

In establishing an optimum credit policy, the financial manager must consider the important decision variables which influence the level of receivables. As stated in the preceding section, the major controllable decision—variables—includes the following:

Credit standards and analysis

Credit terms

Collection policy and procedures

The financial manager or the credit manager may administer the credit policy of a firm. It should, however, be appreciated that credit policy has important implications for the firm’s production, marketing and finance functions. Therefore, it is advisable that a committee that consists of executives of production, marketing and finance departments formulates the firm’s credit policy. Within the framework of the credit policy, as laid down by this committee, the financial or credit manager should ensure that the firm’s value of share is maximized. He does so by answering the following questions:

What will be the change in sales when a decision variable is altered?

What will be the cost of altering the decision variable?

How would the level of receivables be affected by changing the decision variable? How are expected rate of return and cost of funds related?

The most difficult part of the analysis of impact of change in the credit policy variables is the estimation of sales and costs. Even if sales and costs can be estimated, it would be difficult to establish an optimum credit policy, as the best combination of the variables of credit policy is quite difficult to obtain. For these reasons, the establishment of credit policy is a slow process in practice. A firm will change one or two variables at a time and observe the effect. Based on the actual experience, variables may be changed further, or the change may be reversed. It should also be noted that the firm’s credit policy is greatly influenced by economic conditions. As economic conditions change, the credit policy of the firm may also change. Thus, the credit policy decision is not one time static decision. The impacts of changes in the major decision variables of credit policy are discussed below.3

Credit Standards

Credit standards are the criteria which a firm follows in selecting customers for the purpose of credit extension. The firm may have tight credit standards; that is, it may sell mostly on cash basis, and may extend credit only to the most reliable and financially strong customers. Such standards will result in no bad-debt losses, and less cost of credit administration. But the firm may not be able to expand sales. The profit sacrificed on lost sales may be more than the costs saved by the firm. On the contrary, if credit standards are loose, the firm may have larger sales. But the firm will have to carry larger receivables. The costs of administering credit and bad-debt losses will also increase. Thus, the choice of optimum credit standards involves a trade-off between incremental return and incremental costs.

Credit Analysis

Character refers to the customer’s willingness to pay. The financial or credit manager should judge whether the customers will make honest efforts to honour their credit obligations. The moral factor is of considerable importance in credit evaluation in practice.

Credit standards influence the quality of the firm’s customers. There are two aspects of the quality of customers: (i) the time taken by customers to repay credit obligations and (ii) the default rate. The average collection period (ACP) determines the speed of payment by customers. It measures the number of days for which credit sales remain outstanding. The longer the average collection period, the higher is the firm’s investment in accounts receivable. Default rate can be measured in terms of bad-debt losses ratio—the proportion of uncollected receivables. Bad-debt losses ratio indicates default risk. Default risk is the likelihood that a customer will fail to repay the credit obligation. On the basis of past practice and experience, the financial or credit manager should be able to form a reasonable judgment regarding the chances of default. To estimate the probability of default, the financial or credit manager should consider three C ’s: (a) character, (b) capacity, and (c) condition.4

Capacity refers to the customer’s ability to pay. Ability to pay can be judged by assessing the customer’s capital and assets which he may offer as security. Capacity is evaluated by the financial position of the firm as indicated by analysis of ratios and trends in firm’s cash and working capital position. The financial or credit manager should determine the real worth of assets offered as collateral (security).

Condition refers to the prevailing economic and other conditions which may affect the customers’ ability to pay. Adverse economic conditions can affect the ability or willingness of a customer to pay. An experienced financial or credit manager will be able to judge the extent and genuineness to which the customer’s ability to pay is affected by the economic conditions.

Information on these variables may be collected from the customers themselves, their published financial statements and outside agencies which may be keeping credit information about customers. A firm should use this information in preparing categories of customers according to their creditworthiness and default risk. This would be an important input for the financial or credit manager in formulating its credit standards. The firm may categorize its customers, at least, in the following three categories:

Good accounts; that is, financially strong customers.

Bad accounts; that is, financially very weak, high risk customers.

Marginal accounts; that is, customers with moderate financial health and risk (falling between good and bad accounts).

Credit Terms

The firm will have no difficulty in quickly deciding about the extension of credit to good accounts and rejecting the credit request of bad accounts. Most of the firm’s time will be taken in evaluating marginal accounts; that is, customers who are not financially very strong but are also not so bad to be outrightly rejected. A firm can expand its sales by extending credit to marginal accounts. But the firm’s costs and bad-debt losses may also increase. Therefore, credit standards should be relaxed till the point where incremental return equals incremental cost.

The stipulations under which the firm sells on credit to customers are called credit terms. These stipulations include: (a) the credit period, and (b) the cash discount.

Credit Period

The length of time for which credit is extended to customers is called the credit period. It is generally stated in terms of a net date. For example, if the firm’s credit terms are ‘net 35’, it is expected that customers will repay credit obligation not later than 35 days. A firm’s credit period may be governed by the industry norms. But depending on its objective, the firm can lengthen the credit period. On the other hand, the firm may tighten its credit period if customers are defaulting too frequently and bad-debt losses are building up.

A firm lengthens credit period to increase its operating profit through expanded sales. However, there will be net increase in operating profit only when the cost of extended credit period is less than the incremental operating profit. With increased sales and extended credit period, investment in receivables would increase. Two factors cause this increase: (a) incremental sales result in incremental receivables and (b) existing customers will take more time to repay credit obligation (i.e., the average collection period will increase), thus increasing the level of receivables. Let us consider an example.

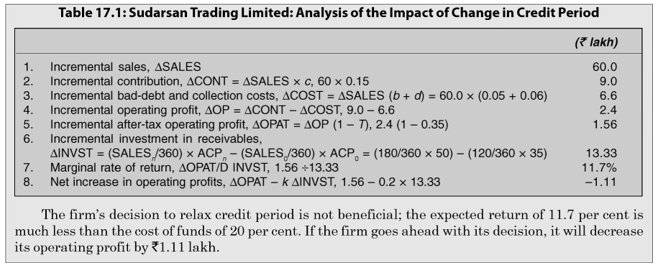

| ILLUSTRATION 17.1: Change in Credit Period Policy |

| Sudarsan Trading Limited is considering to increase its credit period from ‘net 35’ to ‘net 50.’ The firm’s sales are expected to increase from `120 lakh to `180 lakh and average collection period to increase from 35 days to 50 days. The bad-debt loss ratio and collection costs ratio are expected to remain at 5 per cent and 6 per cent respectively. The firm’s variable costs ratio is 85 per cent, corporate tax rate is 35 per cent and the after-tax required rate of return is 20 per cent.

Table 17.1 contains the analysis of the impact of changing the credit period. Note that incremental investment in receivables is calculated, assuming that credit period will increase from 35 days to 50 days for all customers. |

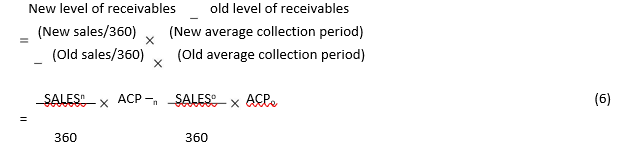

You may notice in Table 17.1, the way in which the incremental investment in receivables has been calculated. Incremental investment in receivables can be calculated by using the following formula:

where SALESn is new sales, SALES0 is present sales, ACPn is new average collection period and ACP0 is old collection period.

For a quick calculation, we can use the following equation to determine the net increase in operating profit:

![]()

where (INVST) is equal to: incremental investment

Note that c is contribution ratio, b bad-debt ratio, d collection cost, ACP collection period and T tax rate.

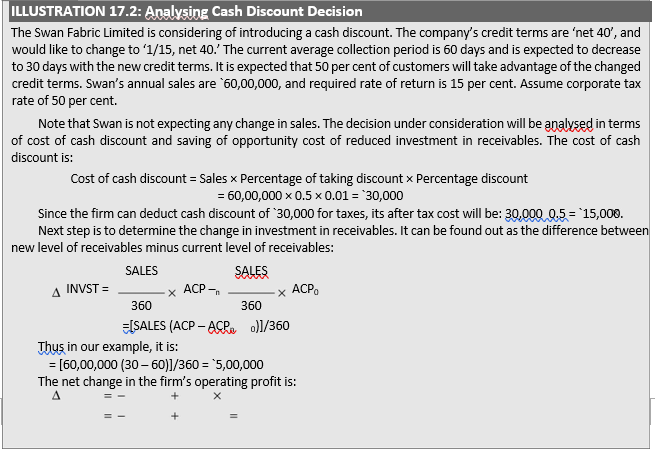

Cash Discounts

A cash discount is a reduction in payment offered to customers to induce them to repay credit obligations within a specified period of time, which will be less than the normal credit period. It is usually expressed as a percentage of sales. Cash discount terms indicate the rate of discount and the period for which it is available. If the customer does not avail the offer, he must make payment within the normal credit period.

In practice, credit terms would include: (a) the rate of cash discount, (b) the cash discount period, and (c) the net credit period. For example, credit terms may be expressed as ‘2/10, net 30.’ This means that a 2 per cent discount will be granted if the customer pays within 10 days; if he does not avail the offer he must make payment within 30 days.

A firm uses cash discount as a tool to increase sales and accelerate collections from customers. Thus, the level of receivables and associated costs may be reduced. The cost involved is the discounts taken by customers.

OPAT 15,000 0.15 5,00,000

15,000 75,000 `60,000

The new credit terms are expected to be beneficial to the firm.

Collection Policy and Procedures

A collection policy is needed because all customers do not pay the firm’s bills in time. Some customers are slow-payers while some are non-payers. The collection efforts should, therefore, aim at accelerating the collections from slow-payers and reducing the bad-debt losses. A collection policy should ensure prompt and regular collection. Prompt collection is needed for fast turnover of working capital, keeping collection costs and bad-debts within limits and maintaining collection efficiency. Regularity in collections keeps debtors alert, and they tend to pay their dues promptly.

The collection policy should lay down clear-cut collection procedures. The collection procedures for past dues or delinquent accounts should also be established in unambiguous terms. The slow-paying customers should be handled very tactfully. Some of them may be permanent customers. The collection process initiated quickly, without giving any chance to them, may antagonize them, and the firm may lose them to competitors.

The responsibility for collection and follow-up should be explicitly fixed. It may be entrusted to the accounts or sales department, or to a separate credit department. The coordination between accounts and sales departments is necessary and must be ensured formally. The accounting department maintains the credit records and information. If it is responsible for collection, it should consult the sales department before initiating an action against non-paying customers. Similarly, the sales department must obtain past information about a customer from the accounting department before granting credit to the customer.

Though collection procedures should be firmly established, individual cases should be dealt with on their merits. Some customers may be temporarily in tight financial position and in spite of their best intentions may not be able to pay on due date. This may be due to recessionary conditions, or other factors beyond the control of the customers. Such cases need special considerations. The collection procedure against them should be initiated only after they have overcome their financial difficulties and do not intend to pay promptly.

The firm should decide about offering cash discount for prompt payment. Cash discount is a cost to the firm for ensuring faster recovery of cash. Some customers fail to pay within the specified discount period, yet they may make payment after deducting the amount of cash discount. Such cases must be promptly identified and necessary action should be initiated against them to recover the full amount.

In practice, companies may take certain precautions vis-à-vis collections. Some companies require their customers to give pre-signed cheques. Bills discounting is another practice in India. Unfortunately, it is not very popular with a number of companies. Some companies provide a penal rate of interest for debtors who fail to pay in time.

Check Your Concepts

- State and define the three credit policy variables.

- What is credit analysis? How is it carried out?

- What is meant by character, capital and condition in credit analysis?

- Why does a firm give cash discount to its debtors? How does it affect the firm’s profitability?

What is the correct basis for credit granting decision?

CREDIT EVALUATION OF INDIVIDUAL ACCOUNTS

For effective management of credit, the firm should lay down clear cut guidelines and procedures for granting credit to individual customers and collecting individual accounts. The firm need not follow the policy of treating all customers equal for the purpose of extending credit. Each case may be fully examined before offering any credit terms. Similarly, collection procedure will differ from customer to customer. With the permanent, but temporarily defaulting, customers, the firm may not be very strict in following the collection procedures. The credit evaluation procedure of the individual accounts should involve the following steps: (1) credit information, (2) credit investigation, (3) credit limits, and (4) collection procedures.5

Credit Information

In extending credit to customers, the firm would ensure that receivables will be collected in full and on due date. Credit should be granted to those customers who have the ability to make the payment on time. To ensure this, the firm should have credit information concerning each customer to whom the credit will be granted.

Little progress has been made in India in the matter of developing the sources of credit information in the name of secrecy and confidentiality. The sources of credit information in advanced countries include independent information service companies, banks, fellow business firms and associates, competitors, suppliers etc. In India, banks are sometimes used to collect information about potential customers.

Collecting credit information involves cost. The cost of collecting information should, therefore, be less than the potential profitability. For small accounts, comprehensive information may not be collected; the decision to grant credit may be made on the basis of limited information. In addition to cost, the time required to collect information should also be considered. The decision to grant credit cannot be delayed for long because of the time involved in collecting the credit information. Depending on these two factors of time and cost, any, or a combination of the following sources may be employed to collect the information.

Financial Statement

One of the easiest ways to obtain information regarding the financial condition and performance of the prospective customer is to scrutinize his financial statements—balance sheet and the profit and loss account. The published financial statements of public limited companies are easily available. The real difficulty arises in obtaining the financial statements from partnership firms or individuals, particularly the audited accounts since they do not have legal obligation to audit their accounts. The credit granting firm must insist on the audited financial statements. In case of firms that have seasonal sales, data on monthly sales, inventory and cash flows ought to be sought and analyzed.

Bank References

Trade References

Another source of collecting credit information is the bank where the customer maintains his account. In advanced countries like USA, many banks have large credit departments which can provide detailed credit information. The firm should seek to obtain the information through its bank. A customer can also be requested to instruct his banker to provide information required by the firm. In India, banks as a source of information are not very useful because of their indifference in providing information. A bank does not provide unambiguous answers to the enquiries made by a firm. Even if it provides information to the firm about the conduct of the customer’s account, it can not be taken as a complete basis for believing that the customer will be able to settle his dues in time. More information from other sources may be collected to supplement it.

A firm can ask the prospective customer to give trade references. It may insist to give the names of such persons or firms with whom the customer has current dealings. This is a useful source to obtain credit information at no cost. The trade referees may be contacted personally to obtain all relevant information required by a firm. A customer can, however, furnish misleading references. To guard against this, the honesty and seriousness of the referees should be examined. The firm can insist on furnishing of the references of people or firms of repute.

Other Sources

A firm can also obtain information about the prospective customer from the credit rating organizations (such as CRISIL, CARE or ICRA) and trade and industry associations. In advanced countries like the USA, credit bureau reports are an important source of information about a customer.

Credit Investigation and Analysis

After having obtained the credit information, the firm will get an idea regarding the matters which should be further investigated. The factors that affect the extent and nature of credit investigation of an individual customer are:6

The type of customer, whether new or existing.

The customer’s business line, background and the related trade risks.

The nature of the product—perishable or seasonal.

Size of customer’s order and expected further volumes of business with him. Company’s credit policies and practices.

Analysis of Credit File

The firm should maintain a credit file for each customer. It should be updated with the information about the customer collected from the reports of salesmen, bankers and directly from the customer. The firm’s trade experiences with the customer and his performance report based on financial statements submitted by him should also be recorded in his credit file. A regular examination of the customer’s credit file will reveal to the firm the credit standing of the customer. Whenever the firm experiences a change in the customer’s paying habit or receives a request for extended credit terms or large order on credit, his credit file should be thoroughly scrutinized. The intensity and depth of credit review on investigation will depend upon the quality of the customer’s account and the amount of credit involved. A little review will be required in case of the customers who have had clear deals with the firm in the past. But a comprehensive investigation will be required in case of the customers whose quality of accounts is falling and who have not been able to honour the firm’s credit terms regularly in the past.

Analysis of Financial Ratios

Analysis of Business and its Management

The evaluation of the customer’s financial conditions should be done very carefully. The financial statements submitted by the prospective customer will form a basis to analyze the performance and trends of his business activities. Ratios should be calculated to determine the customer’s liquidity position and ability to repay debts. The performance of the customer should be compared with industry average and his nearest competitors. This will be helpful in determining whether his relatively poor performance is due to some general economic condition affecting the whole industry, or it is due to the internal inefficiencies of the applicant.

Besides appraising the financial strength of the applicant, the firm should also consider the quality of management and the nature of the customer’s business. The firm should conduct a management audit to identify the management weaknesses of the customer’s business. An over-centralized structure of the customer’s business, without proper management systems, can degenerate into mismanagement, over-trading and business failure.

If the nature of the customer’s business is highly fluctuating or he has financially weak buyers or his business depends on a few buyers, then it is relatively risky to extend credit to him. The implications of these aspects should be fully understood before extending credit to customers.

Credit Limit

A credit limit is a maximum amount of credit which the firm will extend at a point of time. It indicates the extent of risk taken by the firm by supplying goods on credit to a customer.7 Once the firm has taken a decision to extend credit to the applicant, the amount and duration of the credit have to be decided. The decision on the magnitude of credit will depend upon the amount of contemplated sale and the customer’s financial strength. In case of customers who are frequent buyers of the firm’s goods, a credit limit can be established. This would avoid the need to investigate each order from the customers. Depending on the regularity of payment, the line of credit for a customer can be fixed on the basis of his normal buying

pattern. For example, if a customer normally buys goods of `25,000 per month on an average, for him the line of credit can be fixed at this level. In case of a customer who is not fairly regular in settling the dues, the credit limit may be fixed with reference to the outstanding amount.

The credit limit must be reviewed periodically. If tendencies of slow paying are found, the credit can be revised downward. At times, a customer may ask for the amount of credit in excess of his credit limit. The firm may at such times agree to his request if the product has a high margin or if additional sales help to use the unutilized capacity of the firm, and the cost of expected delayed payment or bad-debt loss is less than the expected incremental profit.

The firm has not only to determine the amount of credit but also the duration of credit. Keeping in view the industry norm, the normal collection period should be determined. Some customers can seek relaxation in the collection period. As has been discussed earlier, a longer collection period involves costs—the opportunity costs of funds being tied-up for a longer period and the cost of possible bad-debt losses. But if the extended credit period motivates sales, a comparison between the cost of extended credit period and the additional profit resulting from the increased sale should be made. If profits exceed costs, the collection period may be extended, otherwise not.

The firm should follow a well laid-down collection policy and procedure to collect dues from its customers. When the normal credit period granted to a customer is over, and he has not made the payment, the firm should send a polite letter to him reminding that the account is overdue. If the customer does not respond, the firm may send progressively strong-worded letters. If receivable still remains uncollected, letters may be followed by telephone, telegram, and personal visit of the firm’s representative. If the payment is still not made, the firm may initiate a legal action against the customer. Before taking the legal action, the firm must examine the customer’s financial condition. If it is weak, legal action against him will simply hasten his insolvency. The firm will not be able to get anything from the customer. Under such situation, it is better to be patient and wait, or accept reduced payment in the settlement of the account.

Collection Efforts

Check Your Concepts

- What types of credit information is needed for analysing individual accounts? How is this information analysed and used?

- What factors affect credit investigation and analysis? What steps are needed to carry out creditinvestigation of individual accounts?

- Why is the determination of credit limit for individual accounts important? What are theconsiderations in deciding credit limits for customers?

- What are steps involved in the collection efforts while collecting dues from individual accounts?

| Summary | |

| Trade credit creates debtors (book debts) or accounts receivable. It is used as a marketing tool to maintain or expand the firm’s sales. A firm’s investment in accounts receivable depends on volume of credit sales and collection period. The financial manager can influence volume of credit sales and collection period through credit policy. Credit policy includes credit standards, credit terms, and collection efforts. Credit standards are criteria to decide to whom credit sales can be made and how much. If the firm has soft standards and sells to almost all customers, its sales may increase but its costs in the form of baddebt losses and credit administration will also increase. Therefore, the firm will have to consider the impact in terms of increase in profits and increase in costs of a change in credit standards or any other policy variable. The incremental return that a firm may gain by changing its credit policy should be compared with the cost of funds invested in receivables. The firm’s credit policy will be considered optimum at the point where incremental rate of return equals the cost of funds. The cost of funds is related to risk; it increases with risk. Thus, the goal of credit policy is to maximize the shareholders wealth; it is neither maximization of sales nor minimization of baddebt losses. The conditions for extending credit sales are called credit terms and they include the credit period and cash discount. Cash discounts are given for receiving payments before than the normal credit period. All customers do not pay within the credit period. Therefore, a firm has to make efforts to collect payments from customers. Collection efforts of the firm aim at accelerating collections from slowpayers and reducing baddebt losses. The firm should in fact thoroughly investigate each account before extending credit. It should gather information about each customer, analyse it and then determine the credit limit. Depending on the financial condition and past experience with a customer, the firm should decide about its collection tactics and procedures. |

|

Review Questions

- Explain the objective of credit policy? What is an optimum credit policy? Discuss.

- Is the credit policy that maximizes expected operating profit an optimum credit policy? Explain.

- What benefits and costs are associated with the extension of credit? How should they be combinedto obtain an appropriate credit policy?

- What is the role of credit terms and credit standards in the credit policy of a firm?

- What shall be the effect of the following changes on the level of the firm’s receivables:

What are the objectives of the collection policy? How should it be established?

-

- Interest rate increases

- Recession

- Production and selling costs increase.

- The firm changes its credit terms from ‘2/10, net 30’ to ‘3/10, net 30.’

- ‘The credit policy of a company is criticized because the bad-debt losses have increased considerablyand the collection period has also increased.’ Discuss under what conditions this criticism may not be justified.

- What credit and collection procedures should be adopted in case of individual accounts? Discuss.

- How would you monitor receivables? Explain the pros and cons of various methods.

- What is factoring? What functions does it perform?

- Explain the features of various types of factoring.

- How does factoring differ from bills discounting and short-term financing?

Quiz Exercises

- A firm’s credit sales are `300 crore. Its average collection period is 45 days. What is the firm’s average investment in accounts receivable?

- L M Company has sales of `250 crore. Its current collection period is 30 days. It is thinking of extending the collection period to 40 days. The sales are likely to increase by 20 per cent. The company’s contribution ratio is 30 per cent. The required rate of return is 12 per cent. Should the company change its collection period?

- A firm is considering changing its credit terms from ‘net 30’ to ‘net 60.’ The bad-debt losses areexpected to remain at 2 per cent of sales. Incremental production, selling and collection costs are 70 per cent of sales and expected to remain constant over the range of anticipated sales increases. The relevant opportunity cost for receivables is 15 per cent. Current credit sales are `200 crore and current level of receivables is `20 crore. If the credit terms are changed, the current sale is expected to change to `260 crore and the firm’s receivables level will also increase. The new credit terms will cause the firm’s collection period to increase by 30 days. Calculate the present collection period and the collection period after the proposed change in credit terms. What level of receivables is implied by the new collection period? Determine the increased investment in receivables if the new credit terms are adopted.

- A company has a 20 per cent required rate of return. It is currently selling on terms of ‘net 20’.The credit sales of the company are `100 crore a year. The company’s collection period currently is 45 days. If the company offered terms of ‘2/10, net 30’, 60 per cent of its customers will take the discount and the collection period will be reduced to 40 days. Should the terms be changed?

- A firm has current sales of `200 lakh. The firm has unutilized capacity; therefore, with a view to boost its sales, it is considering lengthening its credit period from 30 days to 45 days. The average collection period will also increase from 30 to 45 days. Bad-debt losses are estimated to remain constant at 3 per cent of sales. The firm’s sales are expected to increase by `36 lakh. The variable production, administrative and selling costs are 70 per cent of sales. The firm’s corporate tax rate is 35 per cent, and it requires an after-tax return of 15 per cent on its investment. Should the firm change its credit period?