INTRODUCTION

Cash is the important current asset for the operations of the business. It is the basic input needed to keep the business running on a continuous basis; it is also the ultimate output expected to be realized by selling the service or product manufactured by the firm. The firm should keep sufficient cash, neither more nor less. Cash shortage will disrupt the firm’s manufacturing operations while excessive cash will simply remain idle, without contributing anything towards the firm’s profitability. Thus, a major function of the financial manager is to maintain a sound cash position.

Cash is the money which a firm can disburse immediately without any restriction. The term cash includes coins, currency and cheques held by the firm, and balances in its bank accounts. Sometimes near-cash items, such as marketable securities or bank term deposits, are also included in cash. The basic characteristic of near-cash assets is that they can readily be converted into cash. Generally, when a firm has excess cash, it invests it in marketable securities. This kind of investment contributes some profit to the firm.

FACETS OF CASH MANAGEMENT

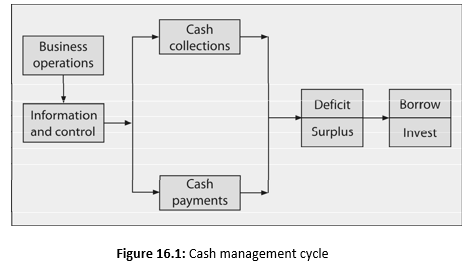

Cash management is concerned with the managing of: (i) cash flows into and out of the firm, (ii) cash flows within the firm, and (iii) cash balances held by the firm at a point of time by financing deficit or investing surplus cash. It can be represented by a cash management cycle as shown in Figure 16.1. Sales generate cash which has to be disbursed. The surplus cash has to be invested while deficit has to be borrowed. Cash management seeks to accomplish this cycle at a minimum cost. At the same time, it also seeks to achieve liquidity and control. Cash management assumes more importance than other current assets because cash is the most significant and the least productive asset that a firm holds. It is significant because it is used to pay the firm’s obligations. However, cash is unproductive. Unlike fixed assets or inventories, it does not produce goods for sale. Therefore, the aim of cash management is to maintain adequate control over cash position to keep the firm sufficiently liquid and to use excess cash in some profitable way.

Cash management is also important because it is difficult to predict cash flows accurately, particularly the inflows, and there is no perfect coincidence between the inflows and outflows of cash. During some periods, cash outflows will exceed cash inflows, because payments for taxes, dividends, or seasonal inventory build up. At other times, cash inflow will be more than cash payments because there may be large cash sales and debtors may be realized in large sums promptly. Further, cash management is significant because cash constitutes the smallest portion of the total current assets, yet management’s considerable time is devoted in managing it. In recent past, a number of innovations have been done in cash management techniques. An obvious aim of the firm these days is to manage its cash affairs in such a way as to keep cash balance at a minimum level and to invest the surplus cash in profitable investment opportunities.

In order to resolve the uncertainty about cash flow prediction and lack of synchronization between cash receipts and payments, the firm should develop appropriate strategies for cash management. The firm should evolve strategies regarding the following four facets of cash management:

Cash planning Cash inflows and outflows should be planned to project cash surplus or deficit for each period of the planning period. Cash budget should be prepared for this purpose.

Managing the cash flows The flow of cash should be properly managed. The cash inflows should be accelerated while, as far as possible, the cash outflows should be decelerated.

Optimum cash level The firm should decide about the appropriate level of cash balances. The cost of excess cash and danger of cash deficiency should be matched to determine the optimum level of cash balances.

Investing surplus cash The surplus cash balances should be properly invested to earn profits. The firm should decide about the division of the cash balance between alternative short-term investment opportunities such as bank deposits, marketable securities, or inter-corporate lending.

The firm’s need to hold cash may be attributed to the following three motives:1

The ideal cash management system will depend on the firm’s products, organization structure, competition, culture and options available. The task is complex, and decisions taken can affect important areas of the firm. For example, to improve collections if the credit period is reduced, it may affect sales. However, in certain cases, even without fundamental changes, it is possible to significantly reduce cost of cash management system by choosing a right bank and controlling the collections properly.

The transactions motive

The precautionary motive

The speculative motive

Transaction Motive

The transactions motive requires a firm to hold cash to conduct its business in the ordinary course. The firm needs cash primarily to make payments for purchases, wages and salaries, other operating expenses, taxes, dividends etc. The need to hold cash would not arise if there were perfect synchronization between cash receipts and cash payments, i.e., enough cash is received when the payment has to be made. But usually cash receipts and payments are not perfectly synchronized. For those periods, when cash payments exceed cash receipts, the firm should maintain some cash balance to be able to make required payments. For transactions purpose, a firm may invest its cash in marketable securities. Usually, the firm will purchase securities whose maturity corresponds with some anticipated payments, such as dividends, or taxes in the future. Notice that the transactions motive mainly refers to holding cash to meet anticipated payments whose timing is not perfectly matched with the cash receipts.

Precautionary Motive

The precautionary motive is the need to hold cash to meet contingencies in the future. It provides a cushion or buffer to withstand some unexpected emergency. The precautionary amount of cash depends upon the predictability of cash flows. If cash flows can be predicted with accuracy, less cash will be maintained for an emergency. The amount of precautionary cash is also influenced by the firm’s ability to borrow at short notice when the need arises. Stronger the ability of the firm to borrow at short notice, less will be the need for precautionary balance. The precautionary balance may be kept in cash and marketable securities. Marketable securities play an important role here. The amount of cash set aside for precautionary reasons is not expected to earn anything; therefore, the firm should attempt to earn some profit on it. Such funds should be invested in high-liquid and low-risk marketable securities. Precautionary balance should, thus, be held more in marketable securities and relatively less in cash.

Speculative Motive

CASH PLANNING

The speculative motive relates to the holding of cash for investing in profit-making opportunities as and when they arise. The opportunity to make profit may arise when the security prices change. The firm will hold cash, when it is expected that interest rates will rise and security prices will fall. Securities can be purchased when the interest rate is expected to fall; the firm will benefit by the subsequent fall in interest rates and increase in security prices. The firm may also speculate on materials’ prices. If it is expected that materials’ prices will fall, the firm can postpone materials’ purchasing and make purchases in future when price actually falls. Some firms may hold cash for speculative purposes. By and large, business firms do not engage in speculations. Thus, the primary motives to hold cash and marketable securities are the precautionary motives.

Cash flows are inseparable parts of the business operations of firms. A firm needs cash to invest in inventory, receivables and fixed assets and to make payment for operating expenses, in order to maintain growth in sales and earnings. It is possible that the firm may be making adequate profits, but may suffer from the shortage of cash as its growing needs may be consuming cash very fast. The ‘cash poor’ position of the firm can be corrected if its cash needs are planned in advance. At times, a firm can have excess cash with it if its cash inflows exceed cash outflows. Such excess cash may remain idle. Again, such excess cash flows can be anticipated and properly invested if cash planning is resorted to. Cash planning is a technique to plan and control the use of cash. It helps to anticipate the future cash flows and needs of the firm and reduces the possibility of idle cash balances (which lowers firm’s profitability) and cash deficits (which can cause the firm’s failure).

Cash planning protects the financial condition of the firm by developing a projected cash statement, from a forecast of expected cash inflows and outflows, for a given period. The forecasts may be based on the present operations or the anticipated future operations. Cash plans are very crucial in developing the overall operating plans of the firm.

Cash planning may be done on daily, weekly or monthly basis. The period and frequency of cash planning generally depends upon the size of the firm and philosophy of the management. Large firms prepare daily and weekly forecasts. Medium-size firms usually prepare weekly and monthly forecasts. Small firms may not prepare formal cash forecasts because of the non-availability of information and small-scale operations. But, if the small firms prepare cash projections, it is done on monthly basis. As a firm grows and business operations become complex, cash planning becomes inevitable for its continuing success.

Cash Forecasting and Budgeting

Cash budget is the most significant device to plan for and control cash receipts and payments. A cash budget is a summary statement of the firm’s expected cash inflows and outflows over a projected time period. It gives information on the timing and magnitude of expected cash flows and cash balances over the projected period. This information helps the financial manager to determine the future cash needs of the firm, plan for the financing of these needs and exercise control over the cash and liquidity of the firm.2

The time horizon of a cash budget may differ from firm to firm. A firm whose business is affected by seasonal variations may prepare monthly cash budgets. Daily or weekly cash budgets should be prepared for determining cash requirements if cash flows show extreme fluctuations. Cash budgets for a longer intervals may be prepared if cash flows are relatively stable.

Short-term Cash Forecasts

Cash forecasts are needed to prepare cash budgets. Cash forecasting may be done on short or long-term basis. Generally, forecasts covering periods of one year or less are considered short-term; those extending beyond one year are considered long-term.

It is comparatively easy to make short-term cash forecasts. The important functions of carefully developed short-term cash forecasts are:

To determine operating cash requirements To anticipate short-term financing To manage investment of surplus cash.

The short-term forecast helps in determining the cash requirements for a predetermined period to run a business. If the cash requirements are not determined, it would not be possible for the management to know how much cash balance is to be kept in hand, to what extent bank financing be depended upon and whether surplus funds would be available to invest in marketable securities.

To know the operating cash requirements, cash flow projections have to be made by a firm. As stated earlier, there is hardly a perfect matching between cash inflows and outflows. With the short-term cash forecasts, however, the financial manager is enabled to adjust these differences in favour of the firm.

It is well-known that, for their temporary financing needs, most companies depend upon banks. One of the significant roles of the short-term forecasts is to pinpoint when the money will be needed and when it can be repaid. With such forecasts in hand, it will not be difficult for the financial manager to negotiate short-term financing arrangements with banks. This in fact convinces bankers about the ability of the management to run its business.

The third function of the short-term cash forecasts is to help in managing the investment of surplus cash in marketable securities. Carefully and skilfully designed cash forecast helps a firm to: (i) select securities with appropriate maturities and reasonable risk, (ii) avoid over and under-investing and (iii) maximize profits by investing idle money.

Short-run cash forecasts serve many other purposes. For example, multi-divisional firms use them as a tool to coordinate the flow of funds between their various divisions as well as to make financing arrangements for these operations. These forecasts may also be useful in determining the margins or minimum balances to be maintained with banks. Still other uses of these forecasts are:3

Planning reductions of short and long-term debt

Scheduling payments in connection with capital expenditures programmes

Planning forward purchases of inventories

Checking accuracy of long-range cash forecasts Taking advantage of cash discounts offered by suppliers Guiding credit policies.

Short-term Forecasting Methods

Two most commonly used methods of short-term cash forecasting are:

The receipt and disbursements method The adjusted net income method.

Receipts and disbursements method

The receipts and disbursements method is generally employed to forecast for limited periods, such as a week or a month. The adjusted net income method, on the other hand, is preferred for longer durations ranging from a few months to a year. Both methods have their pros and cons. The cash flows can be compared with budgeted income and expense items if the receipts and disbursements approach is followed. On the other hand, the adjusted income approach is appropriate in showing a company’s working capital and future financing needs.

Cash flows in and out in most companies on a continuous basis. The prime aim of receipts and disbursements forecasts is to summarize these flows during a predetermined period. In case of those companies where each item of income and expense involves flow of cash, this method is favoured to keep a close control over cash.

Three broad sources of cash inflows can be identified: (i) operating, (ii) non-operating, and (iii) financial. Cash sales and collections from customers form the most important part of the operating cash inflows. Developing a sales forecast is the first step in preparing a cash forecast. All precautions should be taken to forecast sales as accurately as possible. In case of cash sales, cash is received at the time of sale. On the other hand, cash is realized after sometime if sale is on credit. The time in realizing cash on credit sales depends upon the firm’s credit policy reflected in the average collection period. Consider an example.4

ILLUSTRATION 16.1: Short-term Cash Forecasting

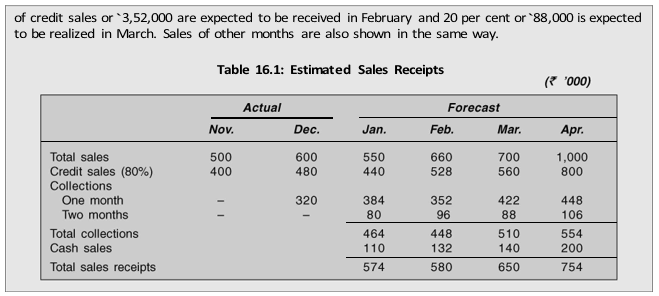

Suppose that a firm makes 80 per cent of its sales on a 30-day credit. Its actual experience shows that 80 per cent of debtors are realized after one month and 20 per cent after two months, after goods are sold. With this information, the expected cash receipts from sales can be calculated if sales forecast are available. For example, sale receipts for January, February, March and April are calculated in Table 16.1 on the basis of assumed sales forecasts.

It can be seen from Table 16.1 that total sales for January are estimated to be `5,50,000, of which 80 per cent (i.e., `4,40,000) are credit sales and 20 per cent (i.e., `1,10,000) are cash sales. The 80 per cent

It can easily be noted that cash receipts from sales will be affected by changes in sales volume and the firm’s credit policy. To develop a realistic cash budget, these changes should be accounted for. If the demand for the firm’s products slackens, sales will fall and the average collection period is likely to be longer which increases the chances of bad debts. In preparing cash budget, account should be taken of sales discounts, returns and allowances and bad debts, as they reduce the amount of cash collections from debtors.

Non-operating cash inflows include sale of old assets and dividend and interest income. The magnitude of these items is generally small. When the internally-generated cash flows are not sufficient, the firm resorts to external sources. Borrowings and issuance of securities are external financial sources. These constitute financial cash inflows.

The next step in the preparation of a cash budget is the estimate of cash outflows. Cash outflows include: (i) operating outflows: cash purchases, payments of payables, advances to suppliers, wages and salaries and other operating expenses, (ii) capital expenditures, (iii) contractual payments: repayment of loan, interest and tax payments; and (iv) discretionary payments: ordinary and preference dividend. In case of credit purchases, a time lag will exist for cash payments. This will depend on the credit terms offered by the suppliers.

It is relatively easy to predict the expenses of the firm over short run. Firms usually prepare capital expenditure budgets, therefore, capital expenditures are predictable for the purposes of cash budget. Similarly, payments of dividend do not fluctuate widely and are paid on specific dates. Cash outflow can also occur when the firm repays its long-term debt. Such payments are generally planned and, therefore, there is no difficulty in predicting them.

Once the forecasts for cash receipts and payments have been developed, they can be combined to obtain the net cash inflow or outflow for each month. The net balance for each month would indicate whether the firm has excess cash or deficit. The peak cash requirements would also be indicated. If the firm has a policy of maintaining some minimum cash balance, arrangements must be made to maintain this minimum balance in periods of deficit. The cash deficit can be met by borrowing from banks. Alternatively, the firm can delay its capital expenditures or payments to creditors or postpone payment of dividends.

One of the significant advantages of cash budget is to determine the net cash inflow or outflow so that the firm is enabled to arrange finances. However, the firm’s decision for appropriate sources of financing should depend upon factors such as cost and risk. Cash budget helps a firm to manage its cash position. It also helps to utilize ideal funds in better ways. On the basis of cash budget, the firm can decide to invest the surplus cash in marketable securities and earn profits.

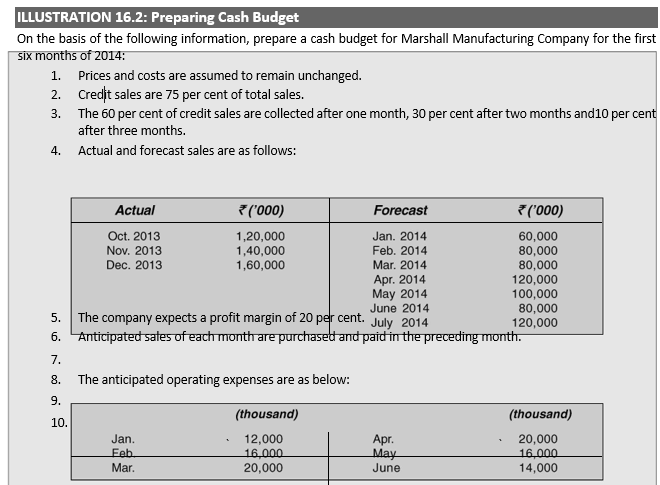

The preparation of a cash budget is explained in Illustration 16.2.

- Interest on 12 per cent debenture, `100 million is to be paid in each quarter.

- An advance tax of `20 million is due in April.

- A purchase of equipment of `12 million is to be made in June.

- The company has a cash balance of `40 million at 31 December 2009, which is the minimum balance to be maintained. Funds can be borrowed in multiples of `2 million on a monthly basis at 18 per cent annum.

- Interest is payable on the first of the month after the borrowing.

- Rent is `0.80 million per month.

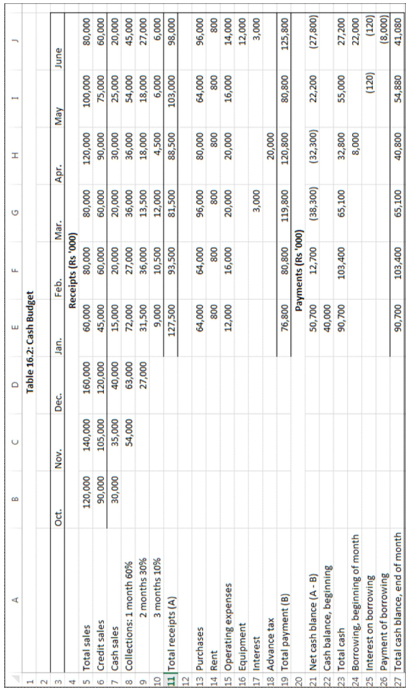

In Table 16.2, cash inflows are estimated in accordance with the company’s total sales and collection policy. For example, of the total sales of `60 million for January, 25 per cent (`15 million) are collected as cash sales in January, 60 % of credit sales (60% of `45 million = `27 million) are collected in February; 30% (`135 million) in March and remaining 10% (`4.5 million) in April. Similarly, the sales of other months are broken.

Section B of Table 16.2 shows all anticipated cash payments. Anticipated sales for each month are purchased and paid in the preceding month. As the profit margin is 20%, the cost of purchases will be 80% of sales. Thus, for the month of February, purchases equal to 80% of its anticipated sales of `80 million (i.e., `64 million purchases) will be made and paid in January. Other items of cash outflows shown are rent, wages and salaries, taxes, capital expenditures and interest on debt. The quarterly payment of interest will be made in March and June. In order to maintain a minimum cash balance of

`40 million, `8 million will have to be borrowed in the month of April. Interest at 18% on this amount will be paid only in May.

The difference between total receipts and total payments gives us the net cash flow. To this is added the beginning of month’s balance to get the total cash balance in a particular month. In April, the total balance is `32.8 million; therefore, to maintain the minimum requirements of `40 million, a borrowing of `8 million will be made. In May, there is a cash balance of `62.88 million after paying interest of `0.12 million; therefore, `8 million can be repaid without impairing the minimum cash balance requirement. Again, `14 million will have to be borrowed in June to maintain cash balance at `40 million.

The virtues of the receipt and payment methods are:

It gives a complete picture of all the items of expected cash flows.

It is a sound tool of managing daily cash operations.

This method, however, suffers from the following limitations:

Its reliability is reduced because of the uncertainty of cash forecasts. For example, collections may be delayed, or unanticipated demands may cause large disbursements. It fails to highlight the significant movements in the working capital items.

Adjusted Net Income Method

This method of cash forecasting involves the tracing of working capital flows. It is sometimes called the sources and uses approach. Two objectives of the adjusted net income approach are: (i) to project the company’s need for cash at a future date and (ii) to show whether the company can generate the required funds internally, and if not, how much will have to be borrowed or raised in the capital market.

As regards the form and content of the adjusted net income forecast, it resembles the cash flow statement discussed previously. It is, in fact, a projected cash flow statement based on pro forma financial statements. It generally has three sections: sources of cash, uses of cash and the adjusted cash balance. This procedure helps in adjusting estimated earnings on an accrual basis to a cash basis. It also helps in anticipating the working capital movements.

In preparing the adjusted net income forecasts items such as net income, depreciation, taxes, dividends, etc., can easily be determined from the company’s annual operating budget. Normally, difficulty is faced in estimating working capital changes; the estimates of accounts receivable (debtors) and inventory pose problem because they are influenced by factors such as fluctuations in raw material costs, changing demand for the company’s products and possible delays in collections. Any error in predicting these items can make the reliability of forecast doubtful.

One popularly used method of projecting working capital is to use ratios relating accounts receivable and inventory to sales. For example, if the past experience tells that accounts receivable of a company range between 32 per cent to 36 per cent of sales, an average rate of 34 per cent can be used. The difference between the projected figure and that on the books will indicate the expected increase or decrease in cash attributable to receivable.

The benefits of the adjusted net income method are:

It highlights the movements in the working capital items, and thus, helps to keep a control on a firm’s working capital.

It helps in anticipating a firm’s financial requirements.

The major limitation of this method is:

It fails to trace cash flows, and therefore, its utility in controlling daily cash operations is limited.

Sensitivity Analysis

The example on cash budget in Table 16.2 is not entirely meaningful since it is based on only one set of assumptions about cash flows. The estimates of cash flows in the example may be considered based on expected or most probable values. In practice, many alternatives are possible because of uncertainty. One useful method of getting insights about the variability of cash flows is sensitivity analysis. A firm can, for example, prepare cash budget based on three forecasts; optimistic, most probable and pessimistic. On the basis of its experience, the firm would know that sales could decrease at the most by 20 per cent, under unfavourable conditions, as compared to the most probable estimate. Thus, cash budget can be prepared under three sales conditions. Knowledge of the outcome of extreme expectations will help the firm to be prepared with contingency plans. A cash budget prepared under worst conditions will prove to be useful to the management to face those circumstances.

Long-term Cash Forecasting

Long-term cash forecasts are prepared to give an idea of the company’s financial requirements in the distant future. They are not as detailed as the short-term forecasts are. Once a company has developed a long-term cash forecast, it can be used to evaluate the impact of, say, new product developments or plant acquisitions on the firm’s financial condition, for three, five, or more years in the future. The major uses of the long-term cash forecasts are:5

It indicates as company’s future financial needs, especially its working capital requirements.

Long-term cash forecasts may be made for two, three or five years. As with the shortterm forecasts, the company’s practices may differ on the duration of long-term forecasts to suit its particular needs.

It helps to evaluate proposed capital projects. It pinpoints the cash required to finance these projects as well as the cash to be generated by the company to support them. It helps to improve corporate planning. Long-term cash forecasts compel each division to plan for the future and to formulate projects carefully.

The short-term forecasting methods, i.e., the receipts and disbursements method and the adjusted net income method, can also be used in long-term cash forecasting. Long-term cash forecasting reflects the impact of growth, expansion or acquisitions; it also indicates financing problems arising from these developments.

Check Your Concepts

- What is cash planning? What purpose does it serve?

- What is a cash budget? How does it differ from cash forecast?

- What are the objectives of short-term cash forecasts?

- What are the methods of preparing short-term cash forecasts?

- What are the uses of long-term cash forecasting?

MANAGING CASH COLLECTIONS AND DISBURSEMENTS

Once the cash budget has been prepared and appropriate net cash flow established, the financial manager should ensure that there does not exist a significant deviation between projected cash flows and actual cash flows. To achieve this, cash management efficiency will have to be improved through a proper control of cash collection and disbursement. The twin objectives in managing the cash flows should be to accelerate cash collections as much as possible and to decelerate or delay cash disbursements as much as possible.

Accelerating Cash Collections

A firm can conserve cash and reduce its requirements for cash balances if it can speed up its cash collections. The first hurdle in accelerating the cash collection could be the firm itself. It may take a long time to process the invoice. Days taken to get the invoice to buyers adds to order processing delay. In India, yet another problem is with regard to the extra time enjoyed by the buyers in clearing of bills; particularly, the government agencies take time beyond what is allowed by the sellers in paying bills. Cash collections can be accelerated by reducing the lag or gap between the time a customer pays bill and the time the cheque is collected and funds become available for the firm’s use.

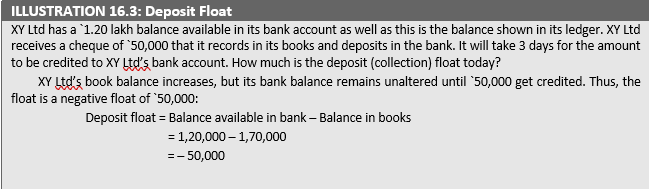

The amount of cheques sent by customer which are not yet collected is called collection or deposit float. Within this time gap, the delay is caused by the mailing time, i.e. the time taken by cheque in transit and the processing time, i.e., the time taken by the firm in processing cheque for internal accounting purposes. This also depends on the processing time taken by the bank as well as the inter bank system to get credit in the desired account. The greater the firm’s deposit float, the longer the time taken in converting cheques into usable funds. In India, these floats can assume sizeable proportions as cheques normally take a longer time to get realized than in most countries.6 An efficient financial manager will attempt to reduce the firm’s deposit float by speeding up the mailing, processing and collection times. How can this be achieved? A firm can use decentralized collection system and lock-box system to speed up cash collections and reduce deposit float.

Decentralized Collections

A large firm operating over wide geographical areas can speed up its collections by following a decentralized collection procedure. A decentralized collection procedure, called concentration banking in USA, is a system of operating through a number of collection centres, instead of a single collection centre centralized at the firm’s head office. The basic purpose of the decentralized collections is to minimize the lag between the mailing time from customers to the firm and the time when the firm can make use of the funds. Under decentralized collections, the firm will have a large number of bank accounts operated in the areas where the firm has its branches. All branches may not have the collection centres. The selection of the collection centre will depend upon the volume of billing. The collection centres will be required to collect cheques from customers and deposit in their local bank accounts. The collection centre will transfer funds above some predetermined minimum amount to a central or concentration bank account, generally at the firm’s head office, each day. A concentration bank is one where the firm has a major account—usually-disbursement account.7 Funds can be transferred to a central or concentration bank by wire transfer or telex or fax or electronic mail. Decentralized collection procedure is, thus, a useful way to reduce float.

Decentralized collection system saves mailing and processing time and, thus, reduces the deposit float, and consequently, the financing requirements. For example, suppose a company has credit sales of `146 crore per year. Its collections will average `40 lakh per day (146 crore ÷ 365). If the company could reduce its mailing and processing time from five days to three days and deposit cheques into the bank two days earlier, outstanding balance would be reduced by `80 lakh. If the annual borrowing rate was 18 per cent, the company has saved an opportunity cost of `14.40 lakh on annual basis. Thus, a decentralized collection system results in potential savings which should be compared with the cost of maintaining the system. The system should be adopted only when savings are greater than cost.

Lock-box System

Another technique of speeding up the mailing, processing and collection time which is quite popular in USA and European countries, and has been now introduced in the developing countries, is the lock-box system. Some foreign and Indian banks in India have started providing this service to individuals and firms in India. In case of the concentration banking, cheques are received by a collection centre and after processing, are deposited in the bank. Lock-box system helps the firm to eliminate the time between the receipt of cheques and their deposit in the bank. In a lock-box system, the firm establishes a number of collection centres, considering customer locations and volume of remittances. At each centre, the firm hires a post office box and instructs its customers to mail their remittances to the box. The firm’s local bank is given the authority to pick up the remittances directly from the local-box. The bank picks up the mail several times a day and deposits the cheques in the firm’s account. For the internal accounting purposes of the firm, the bank prepares detailed records of the cheques picked up.

The lock-box system involves cost. For the services provided under a lock-box arrangement, banks charge a fee or require a minimum balance to be maintained. Whether a lock-box system should be used or not will depend upon the comparison between its cost and benefits. Generally the benefits will exceed if the average remittances are very large and the firm’s cost of financing is high.

Two main advantages of the lock-box system are:8 First, the bank handles the remittances prior to deposit at a lower cost. Second, the cheques are deposited immediately upon receipt of remittances and their collection process starts sooner than if the firm would have processed them for internal accounting purposes prior to their deposit. The firm can still process the cheques on the basis of the records supplied by the bank without delaying the collection. Thus, lock-box system eliminates the period between the time cheques are received by the firm and the time they are deposited in the bank for collection.

Controlling Disbursements

The effective control of disbursement can also help the firm in conserving cash and reducing the financial requirements. Disbursements arise due to trade credit, which is a (spontaneous) source of funds. The firm should make payments using credit terms to the fullest extent. There is no advantage in paying sooner than agreed. By delaying payments as much as possible, the firm makes maximum use of trade credit as a source of funds—a source which is interest free. To illustrate the point, suppose a company purchased raw materials worth `730 million in 2004 and followed the policy of paying within credit terms offered by the supplier. If the company paid one day earlier, creditors’ balance would decline by one day’s purchase. Trade credit would decrease by `2 million (`730 million ÷ 365) and financing requirement from other sources will increase by this amount. If the interest rate is 18 per cent, the company’s interest costs will increase by `3,60,000 on an annual basis.

Delaying disbursement results in maximum availability of funds. However, the firms that delay in making payments may endanger its credit standing. This can put the firm in difficulties in obtaining enough trade credit. Also, the suppliers may build implicit costs in the prices of goods supplied, and may also reduce the quality. On the other hand, paying early may not result in any substantial advantage to the firm unless cash discounts are offered. Thus, keeping in view the norms of the industry, the firm should pay within the terms offered by the suppliers. While, for accelerated collections a decentralized collection procedure may be followed, for a proper control of disbursements, a centralized system may be advantageous. The payments of bills should be made from a single central account. For the local payees, who are far from the central account, the transit time will increase and the firm will gain by this delay.

Disbursement or Payment Float

Some firms use the technique of ‘playing the float’ to maximize the availability of funds. When the firm’s actual bank balance is greater than the balance shown in the firm’s books, the difference is called disbursement or payment float. The difference between the total amount of cheques drawn on a bank account and the balance shown on the bank’s books is caused by transit and processing delays. If the financial manager can accurately estimate when the cheques issued will be deposited and collected, he or she can invest the ‘float’ during the float period to earn a return. However, it is a risky game and should be played very cautiously.

| ILLUSTRATION 16.4: Payment Float |

| AB Ltd has a balance of `20 lakh in its books as well as in its bank account. It issues an outstation cheque for `2 lakh that will take 7 days to clear. AB Ltd’s book balance will reduce to `18 lakh immediately when the cheque is written. But its bank will not charge until 7 days. Thus, it has a payment float of `2 lakh available for 7 days. |

Check Your Concepts

- What is a deposit float? What are its consequences?

- Why should a firm have decentralized cash collection procedures?

- What is concentration banking? How does it work?

- How does a lock-box system operate?

- Explain the ‘clearing system’ in India.

- What is meant by ‘playing the float’.

INVESTING SURPLUS CASH IN MARKETABLE SECURITIES

There is a close relationship between cash and money market securities or other short-term investment alternatives. Investment in these alternatives should be properly managed. Excess cash should normally be invested in those alternatives that can be conveniently and promptly converted into cash. Cash in excess of the required of operating cash balance may be held for two reasons. First, the working capital requirements of the firm fluctuate because of the elements of seasonality and business cycles. The excess cash may build up during slack seasons but it would be needed when the demand picks up. Thus, excess cash during slack season is idle temporarily, but has a predictable requirement later on. Second, excess cash may be held as a buffer to meet unpredictable financial needs. A firm holds extra cash because cash flows cannot be predicted with certainty. Cash balance held to cover the future exigencies is called the precautionary balance and is usually invested in the short-term money market investments until needed.

Instead of holding excess cash for the above-mentioned purpose, the firm may meet its precautionary requirements as and when they arise by making short-term borrowings. The choice between the short-term borrowings and liquid assets holding will depend upon the firm’s policy regarding the mix of short-term financing.

The excess amount of cash held by the firm to meet its variable cash requirements and future contingencies should be temporarily invested in marketable securities, which can be regarded as near moneys. A number of marketable securities may be available in the market. The financial manager must decide about the portfolio of marketable securities in which the firm’s surplus cash should be invested.

Selecting Investment Opportunities

A firm can invest its excess cash in many types of securities or short-term investment opportunities. As the firm invests its temporary cash balance, its primary criterion in selecting a security or investment opportunity will be its quickest convertibility into cash, when the need for cash arises. Besides this, the firm would also be interested in the fact that when it sells the security or liquidates investment, it, at least, gets the amount of cash equal to the investment outlay. Thus, in choosing among alternative investments, the firm should examine three basic features of security: safety, maturity and marketability.9

Safety

Maturity

Usually, a firm would be interested in receiving as high a return on its investment as is possible. But the higher returns-yielding securities or investment alternatives are relatively more risky. The firm would invest in very safe securities as the cash balance invested in them is needed in near future. Thus, the firm would tend to invest in the highest yielding marketable securities subject to the constraint that the securities have acceptable level of risk. The risk referred here is the default risk. The default risk means the possibility of default in the payment of interest or principal on time and in the amount promised. The default in payment may mean more than one thing. In an extreme case, the security may not be redeemed at all. In a less severe case, the security may be sold at a loss, when the firm needs cash. To minimize the chances of default risk and to ensure safety of principal or interest, the firm should invest in safe securities. Other things remaining constant, higher the default risks, higher the return from security. Low-risk securities will earn low return.

Maturity refers to the time period over which interest and principal are to be made. The price of long-term security fluctuates more widely with the interest rate changes than the price of short-term security. Over time, interest rates have a tendency to change. Because of these two factors, the long-term securities are relatively more risky. For safety reasons, therefore, the firms for the purpose of investing excess cash prefer short-term securities.

Marketability

Marketability refers to convenience and speed with which a security or an investment can be converted into cash. The two important aspects of marketability are price and time. If the security can be sold quickly without loss of price, it is highly liquid or marketable. The government treasury bills fall under this category. If the security needs time to sell without loss, it is considered illiquid. As the funds invested in marketable securities will be needed by the firm in near future, it would invest in the securities that are readily marketable. The securities that have low marketability usually have higher yields in order to attract investment. Thus, differences in marketability also cause differences in the security yields.

Types of Short-term Investment Opportunities

The following short-term investment opportunities are available to companies in India, to invest their temporary cash surplus:

Treasury bills Treasury bills (TBs) are short-term government securities. The usual practice in India is to buy treasury bills at a discount and redeem them at par on

maturity. The difference between the issue price and the redemption price, adjusted for the time value of money, is return on treasury bills. They can be bought and sold any time; thus, they have liquidity. Also, they do not have the default risk.

Commercial papers Commercial papers (CPs) are short-term, unsecured securities issued by highly creditworthy large companies. They are issued with a maturity of three months to one year. CPs are marketable securities, and therefore, liquidity is not a problem.

Certificates of deposits Certificates of deposits (CDs) are papers issued by banks acknowledging fixed deposits for a specified period of time. CPs are negotiable instruments that make them marketable securities.

Bank deposits A firm can deposit its temporary cash in a bank for a fixed period of time. The interest rate depends on the maturity period. For example, the current interest rate for a 30 to 45 days deposit is about 3 per cent and for 180 days to one year is about 6–7 per cent. The default risk in most of the bank deposits is quite low.

Money market mutual funds Money market mutual funds (MMMFs) focus on shortterm marketable securities such as TBs, CPs, CDs or call money. They have a minimum lock-in period of 30 days, and after this period, an investor can withdraw his or her money any time at a short notice or even across the counter in some cases. They offer attractive yields; yields are usually 2 per cent above than on bank deposits of same maturity. MMMFs are of recent origin in India, and they have become quite popular with institutional investors and some companies.

Inter-corporate deposits Inter-corporate lending/borrowing or deposits (ICDs) is a popular short-term investment alternative for companies in India. Generally a cash surplus company will deposit (lend) its funds in a sister or associate company or with outside companies with high credit standing. In practice, companies can negotiate inter-corporate borrowing or lending for very short periods. The risk of default is high, but returns are quite attractive.

Check Your Concepts

- What are marketable securities?

- What criteria are followed to select marketable securities for investing cash surplus?

- What are the short-term instruments available in India for investing short-term cash surplus?

| Summary | |

| Cash is required to meet a firm’s transactionary and precautionary needs. A firm needs cash to make payments for acquisition of resources and services for the normal conduct of business. It keeps additional funds to meet any emergency situation. Some firms may also maintain cash for taking advantages of speculative changes in prices of input and output.

Management of cash involves three things: (a) managing cash flows into and out of the firm, (b) managing cash flows within the firm, and (c) financing deficit or investing surplus cash and thus, controlling cash balance at a point of time. It is an important function in practice because it is difficult to predict cash flows and there is hardly any synchronization between inflows and outflows. Firms prepare cash budget to plan for and control cash flows. Cash budget is generally prepared for short periods such as weekly, monthly, quarterly, halfyearly or yearly. For making forecasts of cash receipts and payments, two approaches are used in practice: (i) the receipts and disbursements method, and (ii) the adjusted net income method. |

|

The receipts and disbursements method is employed to forecast for shorter periods. The individual items of receipts and payments are identified and analysed. Cash inflows could be categorized as: (i) operating, (ii) nonoperating, and (iii) financial. Cash outflows could be categorized as: (i) operating, (ii) capital expenditure, (iii) contractual, and (iv) discretionary. Such categorization helps in determining avoidable expenditures.

The adjusted net income method uses pro forma income statement (profit and loss statement) and balance sheet to work out cash flows (by deriving pro forma cash flow statement). As cash flows are difficult to predict, a financial manager does not base his forecasts only on one set of assumptions. He or she considers possible scenarios and performs a sensitivity analysis. At least, forecasts under optimistic, most probable and pessimistic scenarios can be worked out.

Cash budget will serve its purpose only if the firm can accelerate its collections and postpone its payments within allowed limits. The main concerns in collections are: (a) to obtain payment from customers within the credit period, and (b) to minimize the lag between the time a customer pays the bill and the time cheques etc. are collected.

A number of methods such as concentration banking and lockbox system can be followed to expedite conversion of an instrument (e.g. cheque, draft, bills, etc.) into cash.

The financial manager should be aware of the instruments of payments, and choose the most convenient and least costly mode of receiving payment. Disbursements or payments can be delayed to solve a firm’s working capital problem. But this involves cost that, in the long run, may prove to be highly detrimental. Therefore, a firm should follow the norms of the business.

A firm should hold an optimum balance of cash, and invest any temporary excess amount in shortterm (marketable) securities. In choosing these securities, the firm must keep in mind safety, maturity and marketability of its investment.

Review Questions

- Explain the three principal motives for holding cash.

- What are the advantages of cash planning? How does cash budget help in planning the firm’s cashflows?

- Explain and illustrate the utility of a cash budget.

- Illustrate with example the modus operandi of preparing a cash budget.

- Explain the techniques that can be used to accelerate the firm’s collections.

- What are the advantages of decentralized collection over a centralized collection?

- What is a lock-box system? How does it help to reduce the cash balances?

- Distinguish between a deposit float and a payment float. What are the advantages and dangers of‘playing the float?’ Explain the techniques for managing float.

- What are the objectives of a firm in controlling its disbursements? How can the disbursements beslowed down?

- Explain the criteria that a firm should use in choosing the short-term investment alternatives inorder to invest surplus cash.

Quiz Exercises

- A firm has a `84 lakh balance available in its bank account. It receives a cheque of `50 lakh that it records in its books and deposits in the bank. It will take 3 days for the amount to be credited to the firm’s bank account. How much is the deposit (collection) float today?

- A company has a balance of `200 lakh in its books as well as in its bank account. The company issues an outstation cheque for `45 lakh that will take 7 days to clear. The company’s book balance will reduce immediately when the cheque is written. But its bank will not charge until 5 days. How much is the payment float available to the company?

- ABC Limited estimates its total cash requirement as `20 crore next year. The company’s opportunity cost of funds is 16 per cent per annum. The company will have to incur `150 per transaction when it converts its short-term securities to cash. Determine the optimum cash balance. How much is the total annual cost of the demand for the optimum cash balance? How many deposits will have to be made during the year?

- Nice Furniture Ltd is currently following a centralized collection system. Most of its customers are located in the cities of Northern India. The remittances mailed by customers to the central location take three days to reach. Before depositing the remittances in the bank, the firm looses two days in processing them. The daily average collection of the firm is `12 lakh. The company is thinking of establishing a lock-box system. It is expected that such a system will reduce mailing time by one day and processing time by one day. (i) Find out the reduction in cash balances expected to result from the adoption of the lock-box system. (ii) Determine the opportunity cost of the present centralized collection system if the interest rate is assumed to be 15 per cent. (iii) Should the lock-box system be established if its annual cost is `24,500?

XYZ Company has a policy of maintaining a minimum cash balance of `50 lakh. The standard deviation of the company’s daily cash flows is `20 lakh. The annual interest rate is 14 per cent. The transaction cost of buying or selling securities is `150 per transaction. Determine XYZ’s upper control limit and the return point as per the Miller-Orr model.

- PKJ Limited has annual sales of `165 crore. The company has investment opportunities in the money market to earn a return of 12 per cent per annum. If the company could reduce its float by 2 days, what would be the company’s total return?