INTRODUCTION

So far we have discussed the management of fixed assets and long-term financing. In this part, issues relating to the management of current assets will be discussed. The management of current assets is similar to that of fixed assets in the sense that in both cases a firm analysis their effects on its return and risk. The management of fixed and current assets, however, differs in three important ways: First, in managing fixed assets, time is a very important factor; consequently, discounting and compounding techniques play a significant role in capital budgeting and a minor one in the management of current assets. Second, the large holding of current assets, especially cash, firm’s liquidity position (and reduces riskiness), but also reduces the overall profitability. Thus, a risk-return trade-off is involved in holding current assets. Third, levels of fixed as well as current assets depend upon expected sales, but it is only the current assets which can be adjusted with sales fluctuations in the short run. Thus, the firm has a greater degree of flexibility in managing current assets.

CONCEPTS OF WORKING CAPITAL

There are two concepts of working capital—gross and net.

Gross working capitalrefers to the firm’s investment in current assets. Current assets are the assets which can be converted into cash within an accounting year and include cash, short-term securities, debtors (accounts receivable or book debts), bills receivable and stock (inventory).

The two concepts of working capital—gross and net—are not exclusive; rather, they have equal significance from the management viewpoint.

Net working capital refers to the difference between current assets and current liabilities. Current liabilities are those claims of outsiders which are expected to mature for payment within an accounting year and include creditors (accounts payable), bills payable and outstanding expenses. Net working capital can be positive or negative. A positive net working capital will arise when current assets exceed current liabilities. A negative net working capital occurs when current liabilities are in excess of current assets.

Focusing on Current Assets Management

The gross working capital concept focuses attention on two aspects of current assets management:

(1) How to optimize investment in current assets? (2) How should current assets be financed?

The consideration of the level of investment in current assets should avoid two danger points—excessive and inadequate investment in current assets. Investment in current assets should be just adequate to the needs of the business firm. Excessive investment in current assets should be avoided because it impairs the firm’s profitability, as idle investment earns nothing. On the other hand, inadequate amount of working capital can threaten the solvency of the firm because of its inability to meet its current obligations. It should be realized that the working capital needs of the firm may be fluctuating with changing business activity. This may frequently cause excess or shortage of working capital. The management should be prompt to initiate an action and correct imbalances.

Another aspect of the gross working capital points to the need of arranging funds to finance current assets. Whenever a need for working capital funds arises due to the increasing level of business activity or for any other reason, financing arrangement should be made quickly. Similarly, if suddenly, some surplus funds arise they should not be allowed to remain idle, but should be invested in short-term securities. Thus, the financial manager should have knowledge of the sources of working capital funds as well as investment avenues where idle funds may be temporarily invested.

Focussing on Liquidity Management

Net working capital is a qualitative concept. It indicates the liquidity position of the firm and suggests the extent to which the working capital needs may be financed by permanent sources of funds. Current assets should be sufficiently in excess of current liabilities to constitute a margin or buffer for maturing obligations, within the ordinary operating cycle of a business. In order to protect their interests, short-term creditors always like a company to maintain current assets at a higher level than current liabilities. It is a conventional rule to maintain the level of current assets twice the level of current liabilities. However, the quality of current assets should be considered in determining the level of current assets vis-à-vis current liabilities. A weak liquidity position poses a threat to the solvency of the company and makes it unsafe and unsound. A negative working capital means a negative liquidity, and may prove to be harmful for the company’s reputation. Excessive liquidity is also bad. It may be due to mismanagement of current assets. Therefore, prompt and timely action should be taken by the management to improve and correct the imbalances in the liquidity position of the firm.

Check Your Concepts

The net working capital concept also covers the question of judicious mix of long-term and short-term funds for financing the current assets. For every firm, there is a minimum amount of net working capital which is permanent. Therefore, a portion of the working capital should be financed with the permanent sources of funds such as equity share capital, debentures, longterm debt, preference share capital or retained earnings. Management must, therefore, decide the extent to which current assets should be financed with equity capital and/or borrowed capital. In summary, it may be emphasized that both gross and net concepts of working capital are equally important for the efficient management of working capital. There is no precise way to determine the exact amount of gross, or net working capital for any firm. The data and problems of each company should be analysed to determine the amount of working capital. There is no specific rule as to how current assets should be financed. It is not feasible in practice to finance current assets by short-term sources only. Keeping in view the constraints of the individual company, a judicious mix of long and short-term finances should be invested in current assets. Since current assets involve cost of funds, they should be put to productive use.

- Explain the gross and net concepts of working capital.

- What is the significance of the gross concept of working capital?

- What is the net concept of working capital?

OPERATING AND CASH CONVERSION CYCLE

The need for working capital to run the day-to-day business activities cannot be overemphasized. We will hardly find a business firm which does not require any amount of working capital. Indeed, firms differ in their requirements of the working capital.

We know that a firm should aim at maximizing the wealth of its shareholders. In its endeavour to do so, a firm should earn sufficient return from its operations. Earning a steady amount of profit requires successful sales activity. The firm has to invest enough funds in current assets for generating sales. Current assets are needed because sales do not convert into cash instantaneously. There is always an operating cycle involved in the conversion of sales into cash.

There is a difference between current and fixed assets in terms of their liquidity. A firm requires many years to recover the initial investment in fixed assets such as plant and machinery or land and buildings. On the contrary, investment in current assets is turned over many times in a year. Investment in current assets such as inventories and debtors (accounts receivable) is realized during the firm’s operating cycle that is usually less than a year.1 What is an operating cycle?

Operating cycle is the time duration required to convert sales, after the conversion of resources into inventories, into cash. The operating cycle of a manufacturing company involves three phases:

Acquisition of resourcessuch as raw material, labour, power and fuel, etc. Manufacture of the product which includes conversion of raw material into work-inprogress into finished goods.

Sale of the producteither for cash or on credit. Credit sales create accounts receivable for collection.

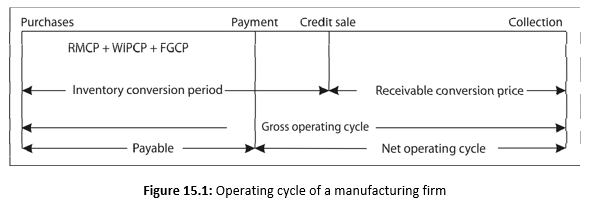

How is the length of operating cycle determined? Figure 15.1 illustrates this.2 The length of the operating cycle of a manufacturing firm is the sum of: (i) inventory conversion period (ICP) and (ii) debtors(receivables) conversion period (DCP). The inventory conversion period is the total time needed for producing and selling the product. Typically, it includes: (a) raw material conversion period (RMCP), (b) work-in-process conversion period (WIPCP), and (c) finished goods conversion period (FGCP). The debtors conversion period is the time required to collect the outstanding amount from the customers. The total of inventory conversion period and debtors conversion period is referred to as gross operating cycle (GOC).

These phases affect cash flows, which most of the time, are neither synchronized nor certain. They are not synchronized because cash outflows usually occur before cash inflows. Cash inflows are not certain because sales and collections which give rise to cash inflows are difficult to forecast accurately. Cash outflows, on the other hand, are relatively certain. The firm is, therefore, required to invest in current assets for a smooth, uninterrupted functioning. It needs to maintain liquidity to purchase raw materials and pay expenses such as wages and salaries, other manufacturing, administrative and selling expenses and taxes, as there is hardly a match between cash inflows and outflows. Cash is also held to meet any future exigencies. Stocks of raw material and work-in-process are kept to ensure smooth production and to guard against non-availability of raw material and other components. The firm holds stock of finished goods to meet the demands of customers on continuous basis and sudden demand from some customers. Debtors (accounts receivable) are created because goods are sold on credit for marketing and competitive reasons. Thus, a firm makes adequate investment in inventories, and debtors, for smooth, uninterrupted production and sale.

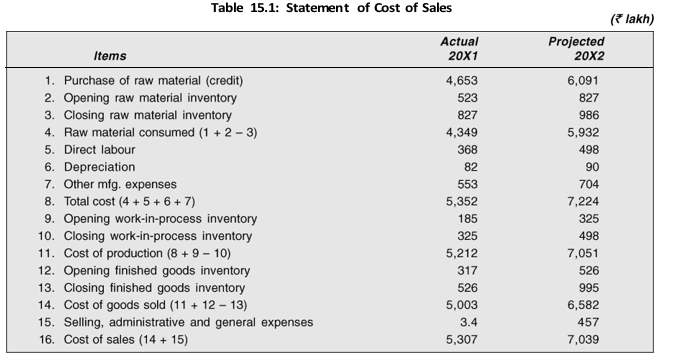

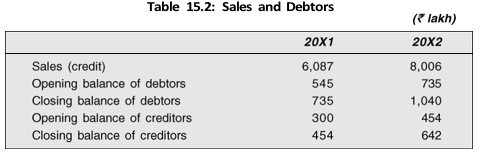

In practice, a firm may acquire resources (such as raw materials) on credit and may temporarily postpone payment of certain expenses. Payables, which the firm can defer, are spontaneous sources of capital to finance investment in current assets. The creditors (payables) deferral period (CDP) is the length of time the firm is able to defer payments on various resource purchases. The difference between (gross) operating cycle and payables deferral period is net operating cycle (NOC). If depreciation is excluded from expenses in the computation of operating cycle, the net operating cycle also represents the cash conversion cycle (CCC). It is the net time interval between cash collections from sale of the product and cash payments for resources acquired by the firm. It also represents the time interval over which additional funds, called working capital, should be obtained, in order to carry out the firm’s operations. The firm has to negotiate working capital from sources such as commercial banks. The negotiated sources of working capital financing are called non-spontaneous sources. If the net operating cycle of a firm increases, it means further need for negotiated working capital.Let us illustrate the computation of the length of an operating cycle. Consider the statement of costs of sales for a firm given in Table 15.1.

The firm’s data for sales and debtors and creditors are given in Table 15.2.

Gross Operating Cycle (GOC)

The firm’s gross operating cycle (GOC) can be determined as inventory conversion period (ICP) plus debtors conversion period (DCP). Thus, GOC is given as follows: Gross operating cycle = Inventory conversion period + Debtors conversion period

GOC = ICP + CDP (1)

Inventory Conversion Period

What determines the inventory conversion period? The inventory conversion (ICP) is the sum of raw material conversion period (RMCP), work-in-process conversion period (WIPCP) and finished goods conversion period (FGCP):

ICP = RMCP + WIPCP + FGCP (2)

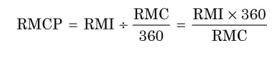

Raw material conversion period (RMCP) The raw material conversion period (RMCP) is the average time period taken to convert material in to work-in-process. RMCP depends on: (a) raw material consumption per day, and (b) raw material inventory. Raw material consumption per day is given by the total raw material consumption divided by the number of days in the year (using 30 days for 12 months, i.e., 360 days). The raw material conversion period is obtained when raw material inventory is divided by raw material consumption per day. Similar calculations can be made for other inventories, debtors and creditors. The following formula can be used:

Raw material inventory

Raw material conversion period =

[Raw material consumption]/360

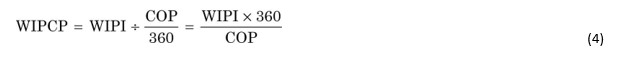

Work-in-process conversion period (WIPCP): Work-in-process conversion period (WIPCP) is the average time taken to complete the semi-finished work or work-inprocess. It is given by the following formula:

Work-in-process inventory

Work-in-process conversion period =

[Cost of production]/360

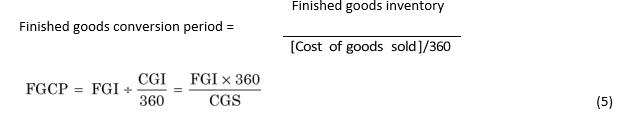

Finished goods conversion period (FGCP): Finished goods conversion period (FGCP) is the average time taken to sell the finished goods. FGCP can be calculated as follows:

Debtors (Receivables) Conversion Period (DCP)

Debtors conversion period (DCP) is the average time taken to convert debtors into cash. DCP represents the average collection period. It is calculated as follows:

![]()

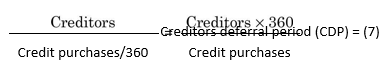

Creditors (Payables) Deferral Period (CDP)

Creditors (payables) deferral period (CDP) is the average time taken by the firm in paying its suppliers (creditors). CDP is given as follows:

Cash Conversion or Net Operating Cycle

Net operating cycle (NOC) is the difference between gross operating cycle and payables deferral period.

Net operating cycle = Gross operating – Creditors deferral period

NOC = GOC – CDP (8)

Net operating cycle is also referred to as cash conversion cycle. Some people argue that depreciation and profit should be excluded in the computation of cash conversion cycle since the firm’s concern is with cash flows associated with conversion at cost; depreciation is a non-cash item and profits are not costs. A contrary view is that a firm has to ultimately recover total costs and make profits; therefore, the calculation of operating cycle should include depreciation, and even the profits. Also, in using the above-mentioned formulae, average figures for the period may be used.

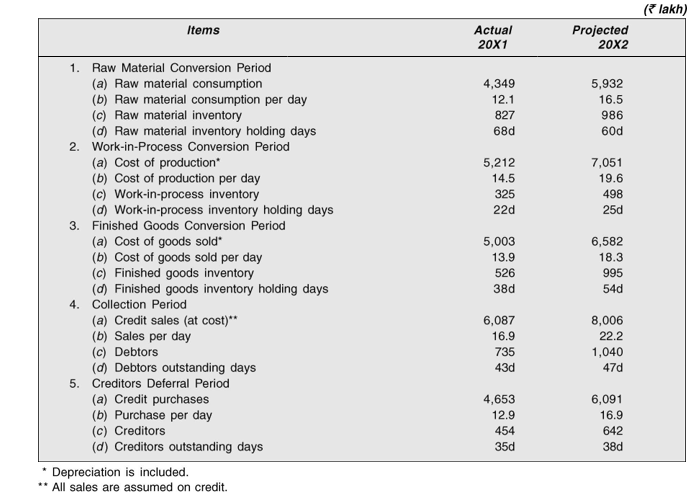

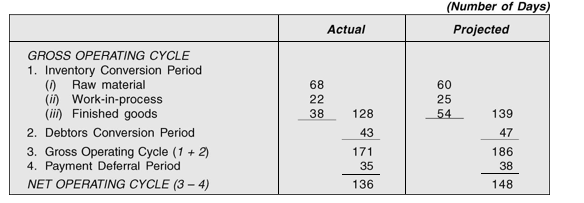

For our example, Table 15.3 shows detained calculations of the components of a firm’s operating cycle. Table 15.4 provides the summary of calculations.

We note a significant change in the company’s policy for 20X2 with regard to the finished goods inventory. It is expected to increase to 54 days holding from 38 days in the previous year. One reason could be a conscious policy decision to avoid stock-out situations and carry more finished goods inventory to expand sales. But this policy has a cost; the company, in the absence of a significant increase in payables (creditors) deferral period, will have to negotiate higher working capital funds. In the case of the firm in our example, its net operating cycle is expected to increase from 136 days to 148 days (Table 15.4). How does a company manage its inventories, debtors and suppliers’ credit? How can it reduce its operating cycle? We shall attempt to answer these questions in the next four chapters.

During 20X1, the daily raw material consumption was `12.1 lakh and the company held an ending raw material inventory of `827 lakh. If we assume that this is the average inventory held by the company, the raw material consumption period works out to be 68 days. You may notice that for 20X2, the projected raw material conversion period is 60 days. This has happened because both consumption (`16.5 lakh per day) and level of inventory (`986 lakh) have increased, but the consumption rate has increased (by 36.4 per cent) much more than the increase in inventory holding (by 19.2 per cent). Thus, the raw material conversion period has declined by 8 days. Raw material inventory is the result of daily raw material consumption and total raw material consumption during a period, raw material? given the company’s production targets. Thus, raw material inventory is controlled through control over purchases and production. We can similarly interpret other calculations in Table 15.3.

The operating cycle concept as shown in Figure 15.1 relates to a manufacturing firm. Non-manufacturing firms such as wholesalers and retailers will not have the manufacturing phase. They will acquire stock of finished goods and convert them into debtors (receivables) and those debtors into cash. Further, service and financial enterprises will not have inventory of goods (cash will be their inventory). Their operating cycles will be the shortest. They need to acquire cash, then lend (create debtors) and again convert the lending into cash.

Table 15.3: Operating Cycle Calculation

Table

15.4: Summary of Operating Cycle Calculations

PERMANENT AND VARIABLE WORKING CAPITAL

We know that the need for current assets arises because of the operating cycle. The operating cycle is a continuous process and, therefore, the need for current assets is felt constantly. But the magnitude of current assets needed is not always the same; it increases and decreases over time. However, there is always a minimum level of current assets which is continuously required by a firm to carry on its business operations. Permanent or fixed working capital is the minimum level of required current assets. It is permanent in the same way as the firm’s fixed assets are. Depending upon the changes in production and sales, the need for working capital, over and above the permanent working capital, will fluctuate. For example, extra inventory of finished goods will have to be maintained to support the peak periods of sale, and investment in debtors (receivables), may also increase during such periods. On the other hand, investment in raw material, work-in-process and finished goods will fall if the market is slack.

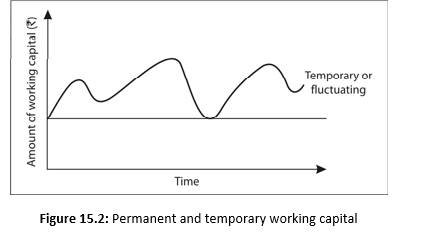

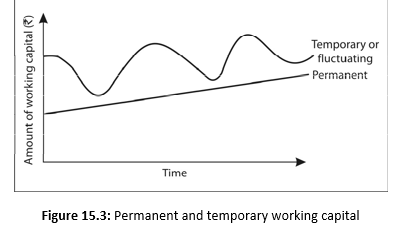

Fluctuating or variable working capital is the extra working capital needed to support the changing production and sales activities of the firm. Both kinds of working capital— permanent and fluctuating (temporary)—are necessary to facilitate production and sale through the operating cycle. But the firm, to meet liquidity requirements that will last only temporarily, creates a temporary working capital. Figure 15.2 illustrates differences between permanent and temporary working capital. It is shown that permanent working capital is stable over time, while temporary working capital is fluctuating—sometimes increasing and sometimes decreasing. However, the permanent working capital line need not be horizontal if the firm’s requirement for permanent capital is increasing (or decreasing) over a period. For a growing firm, the difference between permanent and temporary working capital can be depicted through Figure 15.3.

BALANCED WORKING CAPITAL POSITION

The firm should maintain a sound working capital position. It should have adequate working capital to run its business operations. Both excessive as well as inadequate working capital positions are dangerous from the firm’s point of view. Excessive working capital means holding costs and idle funds which earn no profits for the firm. Paucity of working capital not only impairs the firm’s profitability but also results in production interruptions and inefficiencies and sales disruptions.

The dangers of excessive working capital are as follows:3

It results in unnecessary accumulation of inventories. Thus, chances of inventory mishandling, waste, theft and losses increase.

It is an indication of defective credit policy and slack in collection period. Consequently, higher incidence of bad debts results, which adversely affects profits.

Negligent excessive working capital makes management negligent which degenerates into managerial inefficiency.

Tendencies of accumulating inventories tend to make speculative profits grow. This may tend to make dividend policy liberal and difficult to cope with in future, when the firm is unable to make speculative profits.

Inadequate working capital is also bad and has the following dangers:4

It stagnates growth. It becomes difficult for the firm to undertake profitable projects for non-availability of working capital funds.

It becomes difficult to implement operating plans and achieve the firm’s profit target. Operating inefficiencies creep in when it becomes difficult even to meet day-to-day commitments.

Fixed assets are not efficiently utilized for the lack of working capital funds. Thus, the firm’s profitability would deteriorate.

Paucity of working capital funds render the firm unable to avail attractive credit opportunities, etc.

The firm loses its reputation when it is not in a position to honour its short-term obligations. As a result, the firm faces tight credit terms.

An enlightened management should, therefore, maintain the right amount of working capital on a continuous basis. Only then a proper functioning of business operations will be ensured. Sound financial and statistical techniques, supported by judgement, should be used to predict the quantum of working capital needed at different time periods.

A firm’s net working capital position is not only important as an index of liquidity but it is also used as a measure of the firm’s risk. Risk in this regard means chances of the firm being unable to meet its obligations on due date. The lender considers a positive net working capital as a measure of safety. All other things being equal, the more the net working capital a firm has, the less likely that it will default in meeting its current financial obligations. Lenders such as commercial banks insist that the firm should maintain a minimum net working capital position.

There are no set rules or formulae to determine the working capital requirements of firms. A large number of factors, each having a different importance, influence working capital needs of firms. The importance of factors also changes for a firm over time. Therefore, an analysis of relevant factors should be made in order to determine total investment in working capital. The following is the description of factors which generally influence the working capital requirements of firms.5

Nature of Business

Working capital requirements of a firm are basically influenced by the nature of its business. Trading and financial firms have a very small investment in fixed assets, but require a large sum of money to be invested in working capital. Retail stores, for example, must carry large stocks of a variety of goods to satisfy varied and continuous demands of their customers. A large departmental store like Walmart may carry, say, over 20,000 items. Some manufacturing businesses, such as tobacco manufacturers and construction firms, also have to invest substantially in working capital and a nominal amount in fixed assets. In contrast, public utilities may have limited need for working capital and have to invest abundantly in fixed assets. Their working capital requirements are nominal because they may have only cash sales and supply services, not products. Thus, no funds will be tied up in debtors and stock (inventories). For the working capital requirements most of the manufacturing companies will fall between the two extreme requirements of trading firms and public utilities. Such companies have to make adequate investment in current assets depending upon the total assets structure and other variables.

Market and Demand Conditions

The working capital needs of a firm are related to its sales. However, it is difficult to precisely determine the relationship between volume of sales and working capital needs. In practice, current assets will have to be employed before growth takes place. It is, therefore, necessary to make advance planning of working capital for a growing firm on a continuous basis.

Growing firms may need to invest funds in fixed assets in order to sustain growing production and sales. This will, in turn, increase investment in current assets to support enlarged scale of operations. Growing firms need funds continuously. They use external sources as well as internal sources to meet increasing needs of funds. These firms face further problems when they retain substantial portion of profits, as they will not be able to pay dividends to shareholders. It is, therefore, imperative that such firms do proper planning to finance their increasing needs for working capital.

Sales depend on demand conditions. Large number of firms experience seasonal and cyclical fluctuations in the demand for their products and services. These business variations affect the working capital requirement, specially the temporary working capital requirement of the firm. When there is an upward swing in the economy, sales will increase; correspondingly, the firm’s investment in inventories and debtors will also increase. Under the boom period, additional investment in fixed assets may be made by some firms to increase their productive capacity. This act of firms will require further additions of working capital. To meet their requirements of funds for fixed assets and current assets under the boom period, firms generally resort to substantial borrowing. On the other hand, when there is a decline in the economy, sales will fall and consequently, levels of inventories and debtors will also fall. Under a recession, firms try to reduce their short-term borrowings.

Seasonal fluctuations not only affect the working capital requirement but also create production problems for the firm. During periods of peak demand, increasing production may be expensive for the firm. Similarly, it will be more expensive during slack periods when the firm has to sustain its working force and physical facilities without adequate production and sales. A firm may, thus, follow a policy of level production, irrespective of seasonal changes in order to utilize its resources to the fullest extent. Such a policy will mean accumulation of inventories during off-season and their quick disposal during the peak season.

The increasing level of inventories during the slack season will require increasing funds to be tied up in the working capital for some months. Unlike cyclical fluctuations, seasonal fluctuations generally conform to a steady pattern. Therefore, financial arrangements for seasonal working capital requirements can be made in advance. However, the financial plan or arrangement should be flexible enough to take care of some abrupt seasonal fluctuations.

Technology and Manufacturing Policy

A strategy of level or steady production may be maintained in order to resolve the working capital problems arising due to seasonal changes in the demand for the firm’s product. A steady or level production policy will cause inventories to accumulate during the off-season periods and the firm will be exposed to greater inventory costs and risks. Thus, if costs and risks of maintaining a constant production schedule are high, the firm may adopt a variable production policy, varying its production schedules in accordance with changing demand. Those firms, whose productive capacities can be utilized for manufacturing varied products, can have the advantage of diversified activities and solve their working capital problems. They will manufacture the original product line during its increasing demand and when it has an off-season, other products may be manufactured to utilize physical resources and working force. Thus, production policies will differ from firm to firm, depending on the circumstances of individual firm.

The manufacturing cycle (or the inventory conversion cycle) comprises the purchase and use of raw materials and the production of finished goods. Longer the manufacturing cycle, larger will be the firm’s working capital requirements. For example, the manufacturing cycle in the case of a boiler, depending on its size, may range between six to twenty-four months. On the other hand, the manufacturing cycle of products, such as detergent powder, soaps and chocolates, may be a few hours. An extended manufacturing time span means a larger tie-up of funds in inventories. Thus, if there are alternative technologies of manufacturing a product, the technological process with the shortest manufacturing cycle may be chosen. Once a manufacturing technology has been selected, it should be ensured that manufacturing cycle is completed within the specified period. This needs proper planning and coordination at all levels of activity. Any delay in manufacturing process will result in accumulation of work-in-process and wastage of time. In order to minimize their investment in working capital, some firms, specifically those manufacturing industrial products, have a policy of asking for advance payments from their customers. Non-manufacturing firms, service and financial enterprises do not have a manufacturing cycle.

Credit Policy

The credit policy of the firm affects the working capital by influencing the level of debtors. The credit terms to be granted to customers may depend upon the norms of the industry to which the firm belongs. But a firm has the flexibility of shaping its credit policy within the constraint of the industry norms and practices. The firm should use discretion in granting credit terms to its customers. Depending upon the individual case, different terms may be given to different customers. A liberal credit policy, without rating the credit-worthiness of customers, will be detrimental to the firm and will create a problem of collection later on. The firm should be prompt in making collections. A high collection period will mean tie-up of large funds in debtors. Slack collection procedures can increase the chance of bad debts.

In order to ensure that unnecessary funds are not tied up in debtors, the firm should follow a rationalized credit policy, based on the credit standing of customers and other relevant factors. The firm should evaluate the credit standing of new customers and periodically review the credit-worthiness of the existing customers. Any case of delayed payments should be thoroughly investigated.

Availability of Credit from Suppliers

The working capital requirements of a firm are also affected by credit terms granted by its suppliers. A firm will need less working capital if liberal credit terms are available to it from the suppliers. Suppliers’ credit finances the firm’s inventories and reduces the cash conversion cycle. In the absence of suppliers’ credit the firm will have to borrow funds from a bank. The availability of credit at reasonable cost from banks is crucial. It influences the working capital policy of a firm. A firm without the suppliers’ credit, but which can get bank credit easily, on favourable conditions, will be able to finance its inventories and debtors without much difficulty.

Operating Efficiency

Price Level Changes

The operating efficiency of the firm relates to the optimum utilization of all its resources at minimum costs. The efficiency in controlling operating costs and utilizing fixed and current assets leads to operating efficiency. The use of working capital is improved and pace of cash conversion cycle is accelerated with operating efficiency. Better utilization of resources improves profitability and, thus, helps in releasing the pressure on working capital. Although it may not be possible for a firm to control prices of materials or wages of labour, it can certainly ensure efficient and effective use of its, labour and other resources.

The increasing shifts in price level make the functions of financial manager difficult. She should anticipate the effect of price level changes on working capital requirements of the firm. Generally, rising price levels will require a firm to maintain higher amount of working capital. Same levels of current assets will need increased investment when prices are increasing. However, companies that can immediately revise their product prices with rising price levels will not face a severe working capital problem. Further, firms will feel effects of increasing general price level differently as prices of individual products move differently. Thus, it is possible that some companies may not be affected by rising prices while others may be badly hit.

Check Your Concepts

- Explain how nature of business, market conditions and technology affect a firm’s working capital requirement.

- What is the effect of credit policy and price level changes on working capital?

- What do you mean by operating efficiency? How does it affect working capital?

ISSUES IN WORKING CAPITAL MANAGEMENT

Working capital management refers to the administration of all components of working capital—cash, marketable securities, debtors (receivables), stock (inventories) and creditors (payables). The financial manager must determine the levels and composition of current assets. He must see that right sources are tapped to finance current assets, and that current liabilities are paid in time.

There are many aspects of working capital management which make it an important function of the financial manager:6

Time Working capital management requires much of the financial manager’s time.

Investment Working capital represents a large portion of the total investment in assets. Criticality Working capital management has great significance for all firms but it is very critical for small firms.

Growth The need for working capital is directly related to the firm’s growth.

Empirical observations show that the financial managers have to spend much of their time to the daily internal operations, relating to current assets and current liabilities of the firms. As the largest portion of the financial manager’s valuable time is devoted to working capital problems, it is necessary to manage working capital in the best possible way to get the maximum benefit.

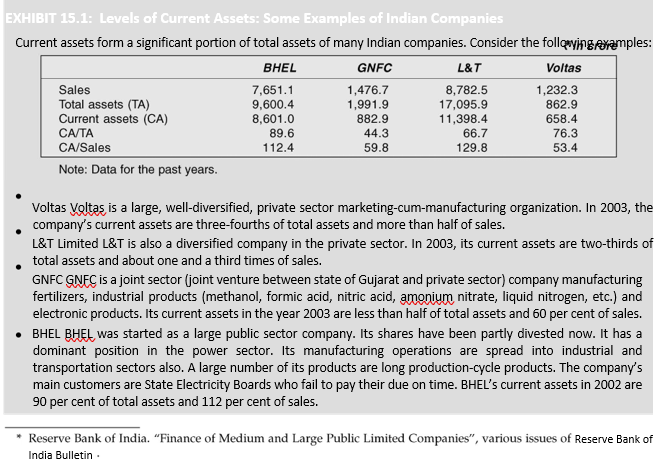

Investment in current assets represents a very significant portion of the total investment in assets. For example, in the case of the large and medium public limited companies in India, current assets constitute about 60 per cent of total assets or total capital employed.* In a large company such as Bharat Heavy Electricals Limited (BHEL), current assets as a percentage of total assets may be as high as, say, 90 per cent. (See Exhibit 15.1 for examples of other companies). This clearly indicates that the financial manager should pay special attention to the management of current assets on a continuing basis. Actions should be taken to curtail unnecessary investment in current assets.

Working capital management is critical for all firms, especially for small firms. A small firm may not have much investment in fixed assets, but it has to invest in current assets. Small firms in India face a severe problem of collecting their debts (book debts or receivables). Further, the role of current liabilities in financing current assets is far more significant in case of small firms, as, unlike large firms, they face difficulties in raising long-term finances.

There is a direct relationship between a firm’s growth and its working capital needs. As the sales grow, the firm needs to invest more in inventories and debtors. These needs become very frequent and fast when the sales grow continuously. The financial manager should be aware of such needs and finance them quickly. Continuous growth in sales may also require additional investment in fixed assets.

It may, thus, be concluded that all precautions should be taken for the effective and efficient management of working capital. The finance manager should pay particular attention to the levels of current assets and the financing of current assets. To decide the levels and financing of current assets, the risk–return implications must be evaluated.

Current Assets to Fixed Assets Ratio

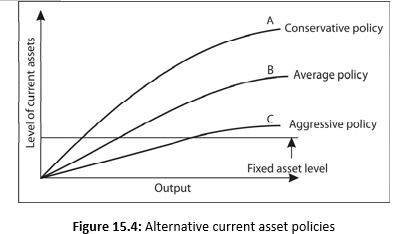

The level of the current assets can be measured by relating current assets to fixed assets.9 Dividing current assets by fixed assets gives CA/FA ratio. Assuming a constant level of fixed assets, a higher CA/FA ratio indicates a conservative current assets policy and a lower CA/ FA ratio means an aggressive current assets policy, assuming other factors to be constant. A conservative policy implies greater liquidity and lower risk; while an aggressive policy indicates higher risk and poor liquidity. Moderate Coverage) current assets policy falls in the middle of conservative and aggressive policies. The current assets policy of the most firms may fall between these two extreme policies. The alternative current assets policies may be shown with the help of Figure 15.4.

The financial manager should determine the optimum level of current assets so that the wealth of shareholders is maximized.7 A firm needs fixed and current assets to support a particular level of output. However, to support the same level of output, the firm can have different levels of current assets. As the firm’s output and sales increase, the need for current assets increases. Generally, current assets do not increase in direct proportion to output; current assets may increase at a decreasing rate with output. This relationship is based upon the notion that it takes a greater proportional investment in current assets when only a few units of output are produced, than it does later on, when the firm can use its current assets more efficiently.8

In Figure 15.4 alternative A indicates the most conservative policy, where CA/FA ratio is greatest at every level of output. Alternative C is the most aggressive policy, as CA/FA ratio is lowest at all levels of output. Alternative B lies between the conservative and aggressive policies and is an average policy.

Liquidity vs Profitability: Risk–Return Trade-off

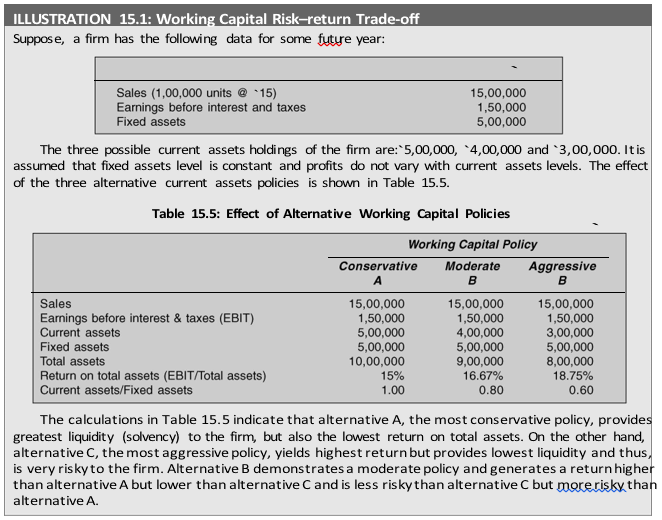

As it is not possible to estimate working capital needs accurately, the firm must decide about levels of current assets to be carried. Given a firm’s technology and production policy, sales and demand conditions, operating efficiency, etc., its current assets holdings will depend upon its working capital policy. It may follow a conservative or an aggressive policy. These policies involve risk–return trade-offs.10 A conservative policy means lower return and risk, while an aggressive policy produces higher return and risk.

The firm would make just enough investment in current assets if it were possible to estimate working capital needs exactly. Under perfect certainty, current assets holdings would be at the minimum level. A larger investment in current assets under certainty would mean a low rate of return on investment for the firm, as excess investment in current assets will not earn enough return. A smaller investment in current assets, on the other hand, would mean interrupted production and sales, because of frequent stock-outs and inability to pay to creditors in time due to restrictive policy.

The two important aims of the working capital management are: profitability and solvency. Solvency, used in the technical sense, refers to the firm’s continuous ability to meet maturing obligations. Lenders and creditors expect prompt settlements of their claims as and when due. To ensure solvency, the firm should be very liquid, which means larger current assets holdings. If the firm maintains a relatively large investment in current assets, it will have no difficulty in paying claims of creditors when they become due and will be able to fill all sales orders and ensure smooth production. Thus, a liquid firm has less risk of insolvency; that is, it will hardly experience a cash shortage or a stock-out situation. However, there is a cost associated with maintaining a sound liquidity position. A considerable amount of the firm’s funds will be tied up in current assets, and to the extent this investment is idle, the firm’s profitability will suffer.

To have higher profitability, the firm may sacrifice solvency and maintain a relatively low level of current assets. When the firm does so, its profitability will improve as fewer funds are tied up in idle current assets, but its solvency would be threatened and would be exposed to greater risk of cash shortage and stock-outs.

Illustration 15.1 is a simple example of risk–return trade-off.11 The calculation of riskreturn trade-off is difficult and returns are affected differently by different assets, and generalization is not possible.

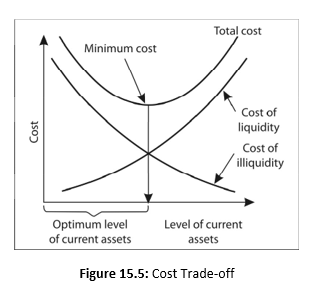

The Cost Trade-off

The cost of illiquidity is the cost of holding insufficient current assets. The firm will not be in a position to honour its obligations if it carries too little cash. This may force the firm to borrow at high rates of interest. This will also adversely affect the creditworthiness of the firm and it will face difficulties in obtaining funds in the future. All this may force the firm into insolvency. Similarly, the low level of stocks will result in loss of sales and customers may shift to competitors. Also, low level of debtors may be due to tight credit policy, which would impair sales further. Thus, the low level of current assets involves costs that increase as this level falls.

A different way of looking into the risk–return trade-off is in terms of the cost of maintaining a particular level of current assets. There are two types of costs involved: cost of liquidity and cost of illiquidity. If the firm’s level of current assets is very high, it has excessive liquidity. Its return on assets will be low, as funds tied up in idle cash and stocks earn nothing and high levels of debtors reduce profitability. Thus, the cost of liquidity (through low rates of return) increases with the level of current assets.

In determining the optimum level of current assets, the firm should balance the profitabilitysolvency tangle by minimizing total costs—cost of liquidity and cost of illiquidity. This is illustrated in Figure 15.5. It is indicated in the figure that with the level of current assets the cost of liquidity increases while the cost of illiquidity decreases and vice versa. The firm should maintain its current assets at that level where the sum of these two costs is minimized. The minimum cost point indicates the optimum level of current assets in Figure 15.5.

Check Your Concepts

- State the reasons that make working capital management as an important function of the financial manager.

- What is the significance of current assets to fixed assets ratio?

- Briefly explain the liquidity versus profitability debate in managing working capital.

- Explain the cost trade-off theory of working capital.

ESTIMATING WORKING CAPITAL NEEDS

The most appropriate method of calculating the working capital needs of a firm is the concept of operating cycle. However, a number of other methods may be used to determine working capital needs in practice. We shall illustrate here three approaches which have been successfully applied in practice:

Current assets holding period To estimate working capital requirements on the basis of average holding period of current assets and relating them to costs based on the company’s experience in the previous years. This method is essentially based on the operating cycle concept.

Ratio of sales To estimate working capital requirements as a ratio of sales on the assumption that current assets change with sales.

Ratio of fixed investment To estimate working capital requirements as a percentage of fixed investment.

The calculations are based on the following assumptions regarding each of the three methods:

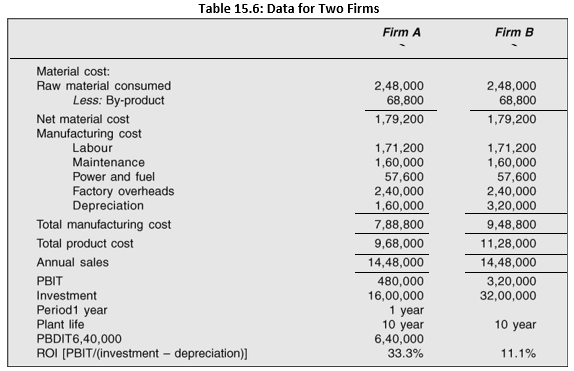

To illustrate the above methods of estimating working capital requirements and their impact on rate of return we shall take examples of two hypothetical firms (as given in Table 15.6).

Method 1: Inventory: one month’s supply of each of raw material, semi-finished goods and finished material. Debtors: one month’s sales. Operating cash: one month’s total cost.

Method 2: 25–35% of annual sales.

Method 3: 10–20% of fixed capital investment.

The following calculations based on data of firm A are made to show how three methods work. You may complete calculations for firm B.

Method 1: Current Assets Holding Period

Let us first compute inventory requirements as shown below: Raw material: one month’s supply: `2,48,000 12 = `20,667

Semi-finished material: one month’s supply (based on raw material plus assume one-half of normal conversion cost):

`20,667 + (`1,71,200 + `1,60,000 + `57,600) 1/2 12 = `20,667 + 16,200 = `36,867

Finished material: one month’s supply:

`968,00 12 = `80,666

`20,667 + `36,867 + `80,666 = `1,38,200

The total inventory needs are:

After determining the inventory requirements, projection for debtors and operating cash should be made.

Debtors: One month’s sales:

`14,48,000 12 = `1,20,667

Operating cash: One month’s total cost:

`9,68,000 12 = `80,667

Thus the total working capital required is:

`1,38,200 + 1,20,667 + `80,666 = `3,39,533

Method 2: Ratio of Sales

The average ratio is 30 per cent. Therefore, 30 per cent of annual sales, `14,48,000 is `4,34,400.

Method 3: Ratio of Fixed Investment

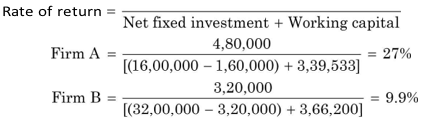

The ratio of current assets to fixed investment ranges between 10 to 20 per cent. We shall use the average rate of 15 per cent. The 15 per cent of fixed investment, `16,00,000 is `2,40,000. The first method gives details of the working capital items. This approach is subject to error if markets are seasonal. As per the first method the working capital requirement is `3,39,533. If this figure is considered in calculating the rate of return, it is lowered from 33.3 per cent to 27 per cent. On the other hand, the return of Firm B drops from 11.1 per cent to 9.9 per cent. The estimated working capital for firm B as per the first method is `366,200.

Rates of return are calculated as follows:

PBIT

You may notice that investments have been taken minus depreciation.

The second method has a limited reliability. Its accuracy is dependent upon the accuracy of sales estimates. The rate of return of Firm A drops to 25.6 per cent and that of Firm B to 9.7 per cent, when the working capital computed by this method is incorporated.

Third method relates working capital to investment. If estimate of investment is inaccurate, this method cannot be relied upon. This method is not generally used in practice to estimate working capital needs. The rates of return from Firms A and B are respectively 28.6 per cent and 9.5 per cent, when the working capital computed by this method is considered.

A number of factors will govern the choice of methods of estimating working capital. Factors such as seasonal variations in operations, accuracy of sales forecasts, investment cost and variability in sales price would generally be considered. The production cycle and credit and collection policy of the firm would have an impact on working capital requirements. Therefore, they should be given due weightage in projecting working capital requirements.

- Explain the current assets holding period method of estimating working capital.

- What is the sales ratio method of working capital estimation?

- How does the fixed investment ratio method of working capital estimation work?

POLICIES FOR FINANCING CURRENT ASSETS

A firm can adopt different financing policies vis-à-vis current assets. Three types of financing may be distinguished as:

Long-term financing The sources of long-term financing include ordinary share capital, preference share capital, debentures, long-term borrowings from financial institutions and reserves and surplus (retained earnings).

Short-term financing The short-term financing is obtained for a period less than one year. It is arranged in advance from banks and other suppliers of short-term finance in the money market. Short-term finances include working capital funds from banks, public deposits, commercial paper, factoring of receivables, etc.

Spontaneous financing Spontaneous financing refers to the automatic sources of short-term funds arising in the normal course of a business. Trade (suppliers’) credit and outstanding expenses are examples of spontaneous financing. There is no explicit cost of spontaneous financing. A firm is expected to utilize these sources of finances to the fullest extent. The real choice of financing current assets, once the spontaneous sources of financing have been fully utilized, is between the long-term and short-term sources of finances.

What should be the mix of short and long-term sources in financing current assets?

Depending on the mix of short and long-term financing, the approach followed by a company may be referred to as: matching approach conservative approach aggressive approach

Matching Approach

The firm can adopt a financial plan which matches the expected life of assets with the expected life of the source of funds raised to finance assets. Thus, a ten-year loan may be raised to finance a plant with an expected life of ten years; stock of goods to be sold in thirty days may be financed with a thirty-day commercial paper or a bank loan. The justification for the exact matching is that, since the purpose of financing is to pay for assets, the source of financing and the asset should be relinquished simultaneously. Using long-term financing for shortterm assets is expensive as funds will not be utilized for the full period. Similarly, financing long-term assets with short-term financing is costly as well as inconvenient, as arrangements for the new short-term financing will have to be made on a continuing basis.

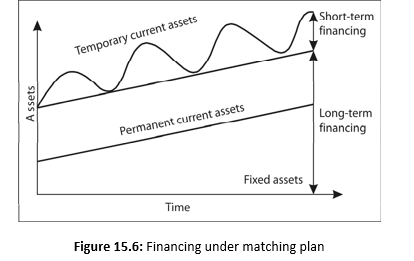

When the firm follows a matching approach (also known as hedging approach), long-term financing will be used to finance fixed assets and permanent current assets and short-term financing to finance temporary or variable current assets. However, it should be realized that exact matching is not possible because of the uncertainty about the expected lives of assets.

Figure 15.6 is used to illustrate the matching plan over time.13 The firm’s fixed assets and permanent current assets are financed with long-term funds and as the level of these assets increases, the long-term financing level also increases. The temporary or variable current assets are financed with short-term funds and as their level increases, the level of short-term financing also increases. Under a matching plan, no short-term financing will be used if the firm has a fixed current assets need only.

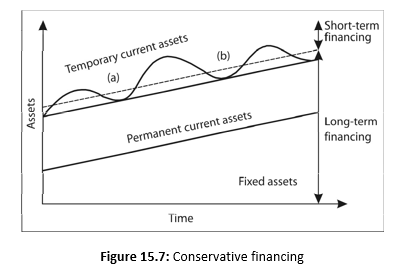

Conservative Approach

A firm in practice may adopt a conservative approachin financing its current and fixed assets. The financing policy of the firm is said to be conservative when it depends more on long-term funds for financing needs. Under a conservative plan, the firm finances its permanent assets and also a part of temporary current assets with long-term financing. In the periods when the firm has no need for temporary current assets, the idle long-term funds can be invested in the tradable securities to conserve liquidity. The conservative plan relies heavily on long-term financing and, therefore, the firm has less risk of facing the problem of shortage of funds. The conservative financing policy is shown in Figure 15.7.14 Note that when the firm has no temporary current assets [e.g., at (a) and (b)], the released long-term funds can be invested in marketable securities to build up the liquidity position of the firm.

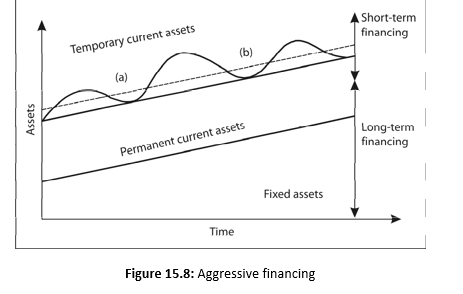

Aggressive Approach

A firm may be aggressive in financing its assets. An aggressive policy is said to be followed by the firm when it uses more short-term financing than warranted by the matching plan. Under an aggressive policy, the firm finances a part of its permanent current assets with short-term financing. Some extremely aggressive firms may even finance a part of their fixed assets with short-term financing. The relatively large use of short-term financing makes the firm more risky. The aggressive financing is illustrated in Figure 15.8.15

Short-term vs Long-term Financing: A Risk–Return Trade-off

A firm should decide whether or not it should use short-term financing. If short-term financing has to be used, the firm must determine its portion in total financing. This decision of the firm will be guided by the risk–return trade-off. Short-term financing may be preferred over

long-term financing for two reasons: (i) the cost advantage and (ii) flexibility.16 But shortterm financing is more risky than long-term financing.

Cost

Short-term financing should generally be less costly than long-term financing. It has been found in developed countries, like USA, that the rate of interest is related to the maturity of debt. The relationship between the maturity of debt and its cost is called the term structure of interest rates. The curve, relating to the maturity of debt and interest rates, is called the yield curve. The yield curve may assume any shape, but it is generally upward sloping. Figure 15.9 shows the yield curve. The figure indicates that more the maturity greater the interest rate.

As discussed earlier in this book, the justification for the higher cost of long-term financing can be found in the liquidity preference theory. This theory says that since lenders are risk averse, and risk generally increases with the length of lending time (because it is more difficult to forecast the more distant future), most lenders would prefer to make short-term loans. The only way to induce these lenders to lend for longer periods is to offer them higher rates of interest.

The cost of financing has an impact on the firm’s return. Both short and long-term financing have a leveraging effect on shareholders’ return. But the short-term financing ought to cost less than the long-term financing; therefore, it gives relatively higher return to shareholders. It is noticeable that in India short-term loans cost more than long-term loans. Banks are the major suppliers of the working capital finance in India. Their rates of interest on working capital finance are quite high. The main source of long-term loans are financial institutions which till recently were not charging interest at differential rates. The prime rate of interest charged by financial institutions is lower than the rate charged by banks.

Flexibility

It is relatively easy to refund short-term funds when the need for funds diminishes. Longterm funds such as debenture loan or preference capital cannot be refunded before time. Thus, if a firm anticipates that its requirements for funds will diminish in near future, it would choose short-term funds.

Risk

Although short-term financing may involve less cost, it is more risky than long-term financing. If the firm uses short-term financing to finance its current assets, it runs the risk of renewing borrowings again and again. This is particularly so in the case of permanent assets. As discussed earlier, permanent current assets refer to the minimum level of current assets which a firm should always maintain. If the firm finances its permanent current assets with short-term debt, it will have to raise new short-term funds as debt matures. This continued financing exposes the firm to certain risks. It may be difficult for the firm to borrow during stringent credit periods. At times, the firm may be unable to raise any funds and consequently, its operating activities may be disrupted. In order to avoid failure, the firm may have to borrow at most inconvenient terms. These problems are much less when the firm finances with long-term funds. There is less risk of failure when the long-term financing is used.

Risk–return Trade-off

Thus, there is a conflict between long-term and short-term financing. Short-term financing is less expensive than long-term financing, but, at the same time, short-term financing involves greater risk than long-term financing. The choice between long-term and shortterm financing involves a trade-off between risk and return. This trade-off may be further explained with the help of an example in Illustration 15.2.

Check Your Concepts

- Under what conditions should working capital be financed by long-term or short-term funds?

- What is the trade-off between long-term and short-term financing of working capital?

- ILLUSTRATION 15.2: Working Capital Financing: Risk–return Trade-off

Explain the three financing approaches—conservative, aggressive and matching.

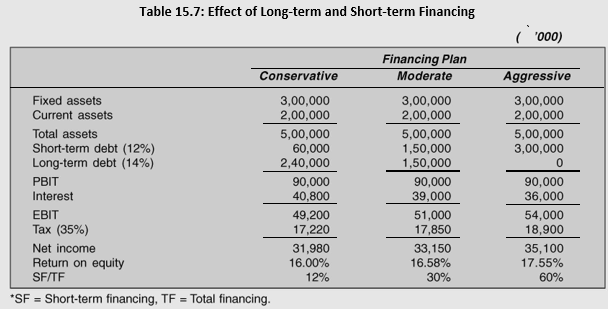

Suppose that a firm has an investment of `50 crore in assets, `30 crore invested in fixed assets and `20 crore in current assets. It is expected that assets will yield a return of 18 per cent before interest and taxes. Tax rate is assumed to be 35 per cent. The firm maintains a debt ratio of 60 per cent. Thus, the firm’s assets are financed by 40 per cent equity, that is, `20 crore equity funds are invested in its total assets. The firm has to decide whether it should use a 12 per cent short-term debt or a 14 per cent longterm debt to finance its current assets. The financing plans would affect the return on equity funds differently. The calculations of return on equity are shown in Table 15.7.

It is shown in Table 15.7 that return on equity is highest under the aggressive plan and lowest under the conservative plan. The results of moderate plan are in between these two extremes. However, the aggressive plan is the most risky as short-term financing as a ratio of total financing is maximum in this case. The short-term financing to total financing ratio is minimum in case of the conservative plan and, therefore, it is less risky.

Table 15.7: Effect of Long-term and Short-term Financing

| Summary | |

| Gross working capital refers to the firm’s investment in current assets.

Net working capital means the difference between current assets and current liabilities, and therefore, represents that position of current assets which the firm has to finance either from longterm funds or bank borrowings. A firm is required to invest in current assets for a smooth, uninterrupted production and sale. How much a firm will invest in current assets will depend on its operating cycle. Operating cycle is defined as the time duration which the firm requires to manufacture and sell the product and collect cash. Thus, operating cycle refers to the acquisition of resources, conversion of raw materials into workinprocess into finished goods, conversion of finished goods into sales and collection of sales. Larger is the operating cycle, larger will be the investment in current assets. In practice, firms acquire resources on credit. To that extent, firm’s need to raise working finance is reduced. The term net operating cycle is used for the difference between operating cycle (or gross operating cycle) and the payment deferral period (or the period for which creditors remain outstanding). The manufacturing cycle (that is conversion of raw material into workinprocess into finished goods) is a component of operating cycle, and therefore, it is a major determinant of working capital requirement. Manufacturing cycle depends on the firm’s choice of technology and production policy. The firm’s credit policy is another factor which influences the working capital requirement. It depends on the nature and norms of business, competition and the firm’s desire to use it as a marketing tool. The requirement for working capital finance will be reduced to the extent the firm is able to exploit the credit extended by suppliers. Depending on the possible availability of working capital finance and its own profitability, a firm may carry more or less investment in current assets than warranted by technical factors. The firm’s decision about the level of investment in current assets involves a tradeoff between risk and return. When the firm invests more in current assets it reduces the risk of illiquidity, but loses in terms of profitability, since the opportunity of earning from the excess investment in current assets is lost. The firm therefore is required to strike a right balance. The financing of current assets also involves a tradeoff between risk and return. A firm can choose from short or longterm sources of finance. If the firm uses more of shortterm funds for financing both current and fixed assets, its financing policy is considered aggressive and risky. Its financing policy will be considered conservative if it makes relatively more use in financing its assets. A balanced approach is to finance permanent current assets by longterm sources and ‘temporary’ current assets by shortterm sources of finance. Theoretically, shortterm debt is considered to be risky and costly to finance permanent current assets. |

|

Let us summarize our discussion on the structure and financing of current assets. The relative liquidity of the firms assets structure is measured by current assets to fixed assets (or current assets to total assets) ratio. The greater this ratio, the less risky as well as less profitable will be the firm and vice versa. Similarly, the relative liquidity of the firm’s financial structure can be measured by the short-term financing to total financing ratio. The lower this ratio, the less risky as well as profitable will be the firm and vice versa. In shaping its working capital policy, the firm should keep in mind these two dimensions—relative asset liquidity (level of current assets) and relative financing liquidity (level of short-term financing) of the working capital management. A firm will be following a very conservative working capital policy if it combines a high level of current assets with a high level of long-term financing (or low level of short-term financing). Such a policy will not be risky at all but would be less profitable. An aggressive firm, on the other hand, would combine high level of current assets with a low level of long-term financing (or high level of short-term financing). This firm will have high profitability and high risk. In fact, the firm may follow a conservative financing policy to counter its relatively liquid assets structure in practice. The conclusion of all this is that the considerations of assets and financing mix are crucial to the working capital management.

Review Questions

- Explain the concept of working capital. Are gross and net concepts of working capital exclusive? Discuss.

- What is the importance of working capital for a manufacturing firm? What shall be therepercussions if a firm has (a) paucity of working capital, (b) excess working capital?

- What is the concept of working capital cycle? What is meant by cash conversion cycle? Why arethese concepts important in working capital management? Give an example to illustrate.

- Briefly explain factors that determine the working capital needs of a firm.

- How is working capital affected by (a) sales, (b) technology and production policy, and (c) inflation? Explain.

- Define the working capital management. Why is it important to study the management of workingcapital as a separate area in financial management?

- Illustrate the profitability-solvency tangle in the current assets holding.

- How would you determine the optimum level of current assets? Illustrate your answer.