DEFINITIONS

Budget (A plan in money)

A budget is defined as:

“A plan quantified in monetary terms, prepared and approved prior to a defined period of time, usually showing planned income to be generated and/or expenditure to be incurred during that period and the capital to be employed to attain a given objective.”

A budget is therefore an agreed plan which evaluates in financial terms the various targets set by a company’s management. It includes a forecast profit and loss account, balance sheet, accounting ratios and cash flow statements which are often analysed by individual months to facilitate control.

Budgets are normally constructed within the broader framework of a company’s long-term strategic plan covering the next five to ten years. This strategic plan sets out the company’s long-term objectives, whilst the budget details the actions that must be taken during the following year to ensure that its short and long-term goals are achieved.

Budgetary Control

A definition of budgetary control is:

“The establishment of budgets relating the responsibilities of executives to the requirements of a policy, and the continuous comparison of actual with budgeted results, either to secure by individual action the objective of that policy or to provide a basis for its revision.”

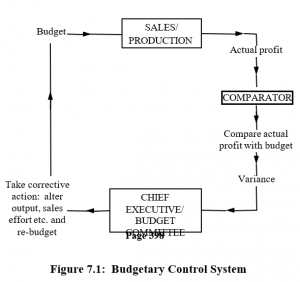

Companies aim to achieve objectives by constantly comparing actual performance against budget. Differences between actual performance and budget are called variances. An adverse variance reduces profit and a favourable variance improves profitability.

Budgetary control therefore allows management to review variances to identify aspects of the business that are performing better or worse than expected. In this way a company will be able to monitor its sales performance, expenditure levels, capital expenditure projects, cash flow, and asset and liability levels. Corrective action will be taken to reduce the impact of adverse trends.

Financial budgets are prepared in the same format as the company’s profit and loss, balance sheet and cash flow statements. In this way it is easy to compare actual and budgeted results and calculate variances.

ADVANTAGES OF BUDGETARY CONTROL SYSTEMS

Agreed Targets

Budgets establish targets for each aspect of a company’s operations. These targets are set in conjunction with each manager. In this way managers are committed to achieving their budgets. This commitment also acts as a motivator.

Problems Identified

Budgets systematically examine all aspects of the business and identify factors that may prevent a company achieving its objectives.

Problems are identified well in advance, which in turn allows a company to take the necessary corrective action to alleviate the difficulty. For example, a budget may indicate that the company will run short of cash during the winter period because of the seasonal nature of the service being provided. By anticipating this position the company should be able to take corrective action or arrange additional financing.

Scope for Improvement Identified

Budgets will identify all those areas that can be improved, thereby increasing efficiency and profitability.

Positive plans for improving efficiency can be formulated and built into the agreed budget. In this way a company can ensure that its plans for improvement are actually implemented.

Improved Co-ordination

All managers will be given an outline of the company’s objectives for the following year. Each manager will then be asked to formulate their own plans so as to ensure that the company’s overall objectives are achieved.

All the managers’ plans will be combined and evaluated so that a total budget for the company can be prepared. During this process the company will ensure that each individual plan fits in with the company’s overall objectives.

Control

It is essential for a company to achieve, if not exceed, its budget.

Achievement of budget will be aided by the use of a budgetary control system which constantly monitors actual performance against the budget. All variances will be monitored and positive action taken in order to correct those areas of the business that are failing to perform.

Raising Finance

Any provider of finance will want to satisfy itself that the company is being managed correctly and that a loan will be repaid and interest commitments honoured.

The fact that a company has established a system of budgetary control will help to demonstrate that it is being managed correctly. The budget will also show that the company is able to meet all its commitments.

TYPES OF BUDGET

There are a number of different types of budget covering all aspects of a company’s operations. These can be summarised into the following categories.

Operating Budgets

Master budgets cover the overall plan of action for the whole organisation and normally include a budgeted profit and loss account and balance sheet.

The master budget is analysed into subsidiary budgets which detail responsibility for generating sales and controlling costs. Detailed schedules are also prepared showing the build-up of the figures included in the various budget documents.

Capital Budgets

These budgets detail all the projects on which capital expenditure will be incurred during the following year, and when the expenditure is likely to be incurred. Capital expenditure is money spent on the acquisition of fixed assets such as buildings, motor cars and equipment.

The capital budget enables the fixed asset section of the balance sheet to be completed and provides information for the cash budget.

Cash Budgets

This budget analyses the cash flow implications of each of the above budgets. It is prepared on a monthly basis and includes details of all cash receipts and payments. The cash budget will also include the receipt of finance from loans and other sources together with forecast repayments.

PREPARATION OF BUDGETS

Timetable

Each company prepares its budgets at a specific time of the year. The process is very timeconsuming and allowance must be made for:

- Each manager to prepare his estimates

- The accumulation of the managers’ estimates so that a provisional budget can be built up for the whole company

- The provisional budget to be reviewed and any changes to be agreed

A large company with a January to December financial year will therefore probably commence its budget preparation in August of the preceding year. This will allow 4-5 months for the work to be completed. If it is to be completed successfully, it is essential that a timetable is prepared detailing what information is required and the dates by which it must be submitted. The preparation of budgets is a major project and it must be managed correctly.

Organisation

As we have just said, the preparation of budgets is a very important task which is given a high level of visibility within the company. The overall co-ordination of the budgeting process is therefore handled at a high level.

Budgeting may be the responsibility of the Finance Director, who will have responsibility for bringing together the directors and managers’ initial estimates. The Finance Director will specify the information that is required and the dates by which it is required. S/he will also circulate a set of economic assumptions so that all directors and managers are preparing their forecasts against the same economic background.

The Financial Director will eliminate most of the obvious inconsistencies from the initial estimates and submit a preliminary budget to the Chairman of the company and its Board of Directors. The Board will consider the overall framework of this preliminary budget so as to ensure that the budget is acceptable and that it gives the desired results.

The Board must also ensure that the budget is realistic and achievable. If the Board does not accept any part of the budget then it will be referred back to the relevant managers for further consideration.

Some companies set up a budget committee to co-ordinate the budgeting process. This committee carries out similar functions to those we described earlier, but will involve more of the company’s senior directors and managers. This committee will probably be chaired by the Chairman of the company.

The final budget must be accepted by the Board of Directors. It will then form the agreed plan for the following year against which performance will be monitored and controlled.

Profit and Loss Account

Limiting Factors

A company’s financial performance will be constrained by what are known as limiting factors, which may include:

- Demand for products

- Supply of skilled labour

- Supply of key components

- Capacity or space

Each of these constraints limit the company’s ability to generate sales and profits. Sales cannot exceed the demand for products, and production cannot exceed the limits imposed by labour and material availability and capacity.

It is essential that a company recognises the fact that it may have a limiting factor, as this will govern the overall shape of its budget.

Sales

Sales budgets are normally prepared by the company’s marketing department. The sales budget of a small company may be set by its managing director working in conjunction with his sales team. The sales budget will take into account the following factors:

- What is the sales trend for each product/service? Are sales increasing or decreasing and why?

- Will any new product/service be launched and when?

- Will any of the existing products/services be phased out?

- What price increases can be obtained during the year?

- What is the advertising and promotional budget likely to be?

- What will be the pattern of sales throughout the period covered by the budget?

- What will the company’s competitors be doing?

− Are they introducing new products?

− What is their pricing policy?

− Are they being aggressive in order to gain market share?

− What is their advertising expenditure likely to be?

− Are there any new competitors entering the market?

Cost of Sales

Having established a preliminary sales budget, it is necessary to calculate the cost of sales. Most companies know how much each of their products cost to produce. These costs must be updated to allow for the forecast level of price increases and proposed changes to specifications or methods.

Labour Costs

Labour costs will be calculated by multiplying the number of people required to complete the budget by their rates of pay. Full allowance will have to be made for any planned wage increases.

Overheads

The sales budget will be circulated to all managers with responsibility for controlling costs. These documents will enable each manager to understand the proposed scale of the company’s operations. Each manager will consider the items of expenditure that he must incur in order to ensure that the company can achieve its sales targets.

Each manager will already understand the cost of running his area and from this information he should be able to estimate the cost levels required for the budget year. By accumulating all the managers’ individual estimates it is possible for the company to build up a total cost budget.

Profit before Tax

Sales − Cost of sales − Overheads = Profit before tax

Taxation

From the budgeted level of profit, the company will be able to calculate the level of corporation tax payable.

Dividends

Dividends will be budgeted based on the forecast level of profits and the company’s overall financial policy.

Retained Earnings

Profit before tax − Tax − Dividends = Retained earnings Retained earnings will be added to the balance sheet reserves.

The preceding data will be converted into a budgeted profit and loss account which should be analysed to individual months and prepared in the same format as the company’s management accounts.

There will also be detailed operating statements which allocate costs to individual managers. These statements are also prepared on a monthly basis so that actual expenditure can be compared with budget.

Balance Sheet

Having completed a budgeted profit and loss account, it is then necessary to complete a budgeted balance sheet.

Fixed Assets Capital Budgets

Each manager will be asked to submit details of his capital expenditure requirements, together with a brief summary of the reasons why the expenditure is necessary. A more detailed appraisal will be required before the expenditure is actually committed.

The capital budget will include items such as:

− New buildings

− Machinery and equipment

− Office equipment

− Computers

− Commercial vehicles

− Motor cars

The sum total of all the managers’ capital expenditure requirements will form a provisional capital budget.

Disposals

Fixed assets may be sold or dismantled during the year. These will be listed and an estimate made of any sales proceeds that may arise.

If a company sells a fixed asset for more than its net book value then a profit will be made. A loss will result if an asset is sold for less than its net book value.

Depreciation

The first step in completing budgeted depreciation is to calculate the charge for the year on the assets already owned by the company. This will require the company to examine each of its assets and calculate the depreciation charge.

All companies are required to keep a fixed asset register, which includes details of all their fixed assets. Many companies have computerised their fixed asset registers, which considerably improves the speed with which this part of the budgeting process can be completed.

A company must also calculate the depreciation charge on the projects included in its capital budget. A total depreciation charge can then be derived.

Cash in Hand and at Bank

In practice the budgeting process will use cash as the balancing figure in the balance sheet. This approach may seem strange but, if you think about it, you will see that a company’s cash position will be the result of everything else that the company does.

(iv) Creditors

Creditors will be calculated in a very similar way to the above debtors calculation. A target creditors ratio will be determined, which will then be applied to the purchases figure derived from other parts of the budgeting process.

Creditors ratio = Creditors ×365 days Credit purchases

Budgeted creditors = Creditors ratio × Credit purchases

365

Bank Overdraft

The cash budgeting process may indicate that a bank overdraft will be required.

Share Capital

The value of a company’s share capital will only change if new shares are issued. This decision will be taken at the highest level within a company.

Reserves

The opening balance on reserves will be known. The final figure will be the opening balance plus or minus the value of retained earnings taken from the budgeted profit and loss account.

Loans

The opening position will be known. The final figure will be the opening position plus the value of any new loans less the value of loans repaid.

All the preceding data will be presented in the budgeted balance sheet in the same format as the company adopts for its monthly accounts. This statement will also be prepared on a monthly basis to facilitate comparison with actual results.

Budget Review

The company has now completed provisional profit and loss, capital, cash and balance sheet budgets.

The provisional budget will be considered by the Board of Directors. The Board must satisfy itself that the budget is achievable and consistent with the company’s overall strategy. If the Board accepts the budget it will become the standard by which the company will be monitored throughout the following year. If the Board does not accept part of the budget then it will be referred back to management for further work.

In large groups of companies, the budget will also have to be approved by the Board of the company’s holding company.

CONTROL MECHANISM

The budget will detail all aspects of the company’s operations. The company will prepare monthly profit and loss accounts, operating statements, cash flow statements and balance sheets. Each of the figures in these documents will be compared with the budget. Variances will be calculated (the differences between actual and budgeted results). Excessive costs and inadequate sales will be highlighted and positive action will be required in order to ensure that the company corrects any adverse variances.

Management by Exception

When a system of budgetary control is in operation, the principle of management by exception can be applied, i.e. when presenting information on actual results to management, attention should be given mainly to those areas where there is a deviation from budget.

Regular Presentation of Information

The accounting function should be organised to produce the actual figures for comparison with the budgets at the earliest possible point of time. The accounts headings should be the same as the budget headings, so that the minimum processing work is necessary on the figures.

The expense involved in collecting the cost figures must be borne in mind. A balance should be struck between keeping costs to the minimum and obtaining the maximum amount of useful information.

The budget committee should be in possession of the comparison between actual and budget expenses within two to three weeks from the close of an accounting period. Each period should be examined in detail by the budget committee, and managerial action taken where necessary.

Prompt presentation of information is important because any adverse trends will probably be continuing while data is being collected and analysed. If action is to be taken to contain the results for the succeeding period, it must be taken quickly, so the time required to collect and analyse the data must be minimised.

Variance Interpretation

Any variances shown by the budget statements should be interpreted by the budget officer. He should give his view on whether the variance is regarded as controllable or noncontrollable.

This part of the operation is most important. The skill and experience of the budget officer will be of the greatest value to management, who wish to know not only the extent of any deviation from plan, but more importantly, the reasons for it and any action being taken to correct it.

Note that the purpose of such information is not to punish any individual for not keeping to his budget (though it may sometimes be necessary to point out that results are unacceptable) but rather to obtain information that will assist management to ensure that future budgets are accurate and that greater effort is made to achieve them. The budget may also need to be updated in the light of results achieved to date, by preparing a re-forecast.

Remember that one possible cause of variances is poor initial forecasting and budgeting. Techniques should be kept under constant review and improved over time in the light of experience.

FLEXIBLE BUDGETS

Many companies use budgeting simply to compare actual performance with the budget that was set during the previous financial year. This directs attention towards achieving the agreed financial targets. The budget is fixed and all variances are reported.

However, as we saw in the previous section, if sales are greater than budget then it can be expected that cost of sales and variable overheads will also be higher. It is possible to compare actual results with what is therefore known as a flexible budget. A flexible budget is defined as:

“A budget which, by recognising the difference in behaviour between fixed and variable costs in relation to fluctuations in output, turnover, or other variable factors such as number of employees, is designed to change appropriately with such fluctuations.”

. BEHAVIOURAL IMPLICATIONS

Budgetary control is a very powerful tool which highlights all departures from the agreed budget. It is therefore vitally important that all managers are involved in the budget-setting process so that they feel committed to achieving their targets. It also needs to be recognised that managers will play the ‘budget game’ and endeavour to ensure they have achievable targets. It is quite common to find that the company’s first budget estimates show it plunging into massive losses. Sales and marketing staff have been cautious with their sales estimates and views on price increases, whilst line managers have been unduly pessimistic about costs and endeavour to secure the maximum capital budget so that they can implement all their projects.

It takes time to tease out their genuine expectations, and this process must be handled very carefully in order to avoid the appearance of imposing budgetary targets on managers. The eventual target should be realistic but stretching – so as to provide a challenge to the people involved.

Having constructed the budget, it is also important to recognise that some managers may attempt to bend the system so that adverse variances are not reported in their area. It is not unknown for managers to put incorrect codes on their purchase orders so that costs are shown in another manager’s operating statement, or reported elsewhere on their own. Naturally this does nothing to help define better budgets in the following years.

It is also essential that the basis of the budget-setting process is understood. In practice it is often based on the company’s current position and then updated for changes expected in the forthcoming year. This can lead to established inefficiencies being built into next year’s targets. An alternative approach is called zero-based budgeting, which challenges the accepted way of doing things and attempts to construct budgets based on the way operations would be established if they were being set up for the first time. The budget must obviously start from the company’s current position, but this type of analysis should encourage the company to progress towards a better way of structuring its activities.

We will cover zero-based budgeting in detail later.

BUDGETING AND LONG-TERM OBJECTIVES

Budgetary control is important, but the correct balance needs to be maintained between the company’s short and long-term goals. Budgetary control tends to highlight short-term financial objectives, and this highlighting is sometimes reinforced by management incentive schemes geared to achieving budget. Great care must therefore be exercised to ensure that decisions are not taken which protect short-term profitability at the expense of the long-term position of the company. For example, research and development costs can be cut without any immediate impact on the company; however, it is likely to have a major impact on the company’s long-term position.

PUBLIC SECTOR BUDGETS

Preparation of the Budget

This section details specific steps in the budget preparation process, as it’s one of the core functions of the Chief Budget Manager. The budget preparation process is coordinated by the National Budget Department at MINECOFIN and all the budget related documents are posted at their website http://www.minecofin.gov.rw/ministry/directorates/nb.

The First Budget Call Circular

The budget preparation call circular is triggered by the issuance of the First Budget Call Circular (BCC). The BCC is issued in accordance with Article 28 of OBL, and provides information to guide the Chief Budget Managers in the preparation of the budget. The 1st BCC is normally issued in October and it is important that Chief Budget Managers start using it from October.

The 1st BCC is not intended to seek budget submissions from budget agencies but is rather aimed at giving advance information to facilitate timely coordination and effective planning within the sectors to allow formulation of policy based budgets within individual budget agencies at a later stage. The 1st BCC is aimed at inducing discussions at the sector level on priority activities to be funded through the Government budget for the following financial year. These priorities should be reflected in joint sector review report and should be the basis for submission of the budget requests in response to the 2nd BCC, normally issued in early December.

The Second Budget Call Circular

As indicated above, the 1st BCC issued in October is meant to provide advance information to budget agencies to better prepare and make informed plans and budgets. The 2nd Budget Call Circular is issued in early December requiring budget agencies to prepare detailed budget submissions for the following financial year. The 2nd BCC, which is also prepared by National Budget Department, includes:

- The total indicative resource envelope derived from the macro-fiscal framework consistent with the broad policy objectives. The indicative ceilings are issued at high level at line ministries, provinces and other high level government institutions. This is to allow coordination and prioritization of activities at the high level of Government programmes. The parent institutions (Ministries and other high level institutions) that have been allocated ceilings are required to immediately undertake consultative process with all affiliated agencies to agree on individual agency ceilings that shall be the basis for the detailed budget estimates to be entered in the budget system (SmartFMS).

- Budget submission formats (Annexes) to be submitted by each budget agency to assist in preparation of the Finance Law (including externally and internally financed projects, internally generated revenues, earmarked transfers to districts, Agency MTEFs, Strategic Issues Papers (SIPs).

Strategic Issues Papers (SIPs)

The Strategic Issues Papers (SIPs) and Agency MTEFs are prepared by line ministries after consultation with their affiliated agencies, projects and districts. At this stage, information is gathered regarding projects support and sector budget support.

The SIPs and agency MTEFs are submitted to MINECOFIN and analyzed by NBD. Budget consultations are then held between line ministries and MINECOFIN (in March) to agree on final ceilings to submit to Cabinet & Parliament.

As indicated above, budget preparation is one of the most important responsibilities for a Chief Budget Manager. Chief Budget Managers should ensure that the contents of the guidelines are strictly adhered to and all issues therein are addressed in their draft budget estimates.

Submission and approval of budgets

The procedures for preparation, presentation and approval of budgets are provided for under Chapter III Articles 28-45.

It should be noted that no budget should be provided for urgent and unforeseen expenditures with a budget of a central government agency as provided in article 31 of the OBL. Such a budget is only provided under the budget of Ministry of Finance and Economic Planning. However, each district may provide for such expenditure in its own budget as provided under article 32 of the law.

Article 35: Expenditure estimates shall be prepared by budget Agencies, based on the available resources and the guidelines issued by the Minister. Each budget Agency shall have a separate budgetary line (vote) in the budget. Expenditure estimates of each budget Agency are organized in a programmatic, economic and functional classification, in line with international classification standards.

Article 6 of the OBL obliges government institutions to reflect all the revenues including grants and all expenditures within their budgets. Chief Budget Managers should ensure during budget preparation that this requirement is respected.

In order to meet the constitutional obligation as per Article 79 to submit the draft budget estimates and MTEF to parliament before commencement of the budget session, the draft estimates of Budget Agencies should reach MINECOFIN not later than January 28th, in hard copies and electronically through SmartFMS. This gives NBD time to analyse the budgets and conduct Budget Hearings for all Sector Ministries. In months 8-9 (February/March), the detailed draft budget is prepared by MINECOFIN along with accompanying Budget Framework Paper (BFP).

The BFP sets out the macroeconomic context of the draft budget as well as the key policy choices underlying the proposed resource allocation. The BFP is discussed by Cabinet and recommendations are incorporated. The BFP and draft Budget is discussed with donors at the second Joint Budget Support Review. It is at this point that Development Partners make firm commitments for the coming year.

In accordance with article 79 of the Constitution of the Republic of Rwanda of June 4, 2003 as amended to date, the Cabinet shall submit the draft budget to the Chamber of Deputies before the beginning of the budget session. This is further elaborated in Article 42 of OBL. The Minister presents the draft estimates and BFP to Parliament in the 10th month of the financial year (April).

The Parliamentary Committee on Budget and State Property in collaboration with other sectoral committees scrutinizes the BFP and the draft budget estimates and submits a report to plenary containing recommendations to the Executive for improvement of the BFP and draft budget estimates. This report is normally submitted before the end of May and becomes the basis for revising the BFP and preparing the draft Finance Law.

After the approval of the draft finance law by Cabinet around the first week of June, the draft finance is submitted to Parliament and is officially laid before the Parliament by the Minister of Finance and Economic Planning during the second week of June. The budget is ordinarily voted and approved by Parliament before commencement of the next fiscal year.

Preparation and approval of Local Government Budgets

The Intergovernmental Fiscal Relations Unit (IGFR) in MINECOFIN acts as the coordinating unit between the district and national budget cycle.

Districts carry out their own review of last year’s performance which is discussed at the Joint Action Forum in month 2 (August). During budget preparation, districts participate in consultations with line ministries on Earmarked Transfers. MINECOFIN (IGFR) sends out the District Budget Call Circular for Districts to prepare their budgets. Following the finalization of the BFP at the national level, districts prepare their detailed budget based on final resource envelopes agreed at Districts’ Joint Action Forum and transfers from Central Government communicated by the Ministry of Finance and Economic Planning.

As required under article 43 of the OBL, the draft budgets of local administrative entities shall be submitted to the executive committee of such an entity for further analysis before submission to the local council of such an entity for examination and approval. When the draft budget of local administrative entities has been approved by Council, they shall make it public to the general meeting of the residents convened by the Executive Committee of the local administrative entity, in each sector. Revised Budget

Article 45 of OBL provides for revision of budget after six months of implementing the budget. The proposed changes shall be consistent with the approved medium-term strategies and budget framework; and if they are different from the approved budget framework, the reasons thereof shall be notified to the Parliament or to the local Council of such an entity.

Accordingly, the Chief Budget Managers are required to monitor closely the implementation of their budget by keeping a close eye on issues that might require revision after six months of implementing the budget. These should be the issues that cannot be handled through budget re-allocation like information on project funds that has just been communicated by the donor, under- spending of a project that might require some adjustment in the procurement plan and thus budget revision etc.

Requests for budget revision should be communicated to the Ministry of Finance and Economic Planning by the first week of December to have an informed decision of whether a budget revision is warranted or not by the end of December.