INTRODUCTION

Planning and Control

One of the principal objects of any management accounting system should be to assist in the planning and control of operations. The techniques of budgetary control and standard costing can help management carry out this vital function.

In this study unit and the next we will be looking at the objectives and methods of standard costing; these will help you understand its purpose, the methods by which standards are set, the procedures for calculating variances, and the interpretation of variances. In subsequent study units we will look in detail at budgetary control.

Budgetary Control and Standard Costing Compared

Whereas budgetary control is concerned with the overall plans of the organisation and assignment of responsibilities for control over revenues and expenditure, standard costing is concerned with the establishment of detailed performance levels, together with the related costs and revenues per unit and in total for the planned activities of the organisation.

Both budgetary control and standard costing have certain features in common:

- The setting of targets or standards

- The recording of actual results

- The comparison of actual results with standards (or budgeted)

- The computation of variances and their analysis

These all assist in defining the ‘gatekeeper’ role of the management accountant.

Definitions

The Chartered Institute of Management Accountants, in its terminology, gives the following definitions:

Standard Costing

A technique which uses standards for costs and revenues for the purpose of control through variance analysis.

Standard Cost

A predetermined calculation of how much costs should be under specified working conditions. It is built up from an assessment of the value of cost elements and correlates technical specifications and the quantification of materials, labour and other costs to the prices and/or wage rates expected to apply during the period in which the standard cost is intended to be used. Its main purposes are to provide bases for control, through variance accounting, for the valuation of stock and work in progress and, in some cases, for fixing selling prices.

Value and Use of Standards

We can see from these definitions that standards are compiled prior to production taking place, and that they relate to specific assessments of physical quantities and cost. They are, in fact, yardsticks against which actual quantities and costs or revenues can be measured. If circumstances or conditions change, then a revision of standards will be required – so the standards in use reflect the current specifications. The standards may also be subject to annual or periodic updating.

TYPES OF STANDARD COST AND SYSTEM

• Ideal Standard Costs

These are based on ideal conditions – i.e. 100% efficiency is expected from workers, machinery and management: it is only in an automatic and very efficiently run factory that ideal standard costs are likely to be achieved.

• Attainable Standards

These are based on attainable conditions, and they are more realistic than ideal standard costs. Provided that all the factors of production are made as efficient as possible before the standards are set, the standard costs are likely to be of great practical value. They represent, to workers and management, realistic figures, capable of achievement. The variances really do mean increased or reduced efficiency.

• Basic Standard Costs

These are a special type of standard cost. The idea is to select a ‘base year’, and then set the standards (ideal or attainable at that time). The standard costs then remain in force for a number of years without being revised.

Their main advantage is that trends in costs over a number of years can be seen quite easily. Another advantage is that the actual value of stocks is known – and so there is no problem of converting standard costs to actual costs for use in final accounts. This assumes, of course, that it is desirable to use the actual cost of the stocks. There is a tendency to advocate the use of the standard costs for stock valuation and, if this view is taken, there is no disadvantage in using ordinary standard costs.

The chief weakness of basic standards is that they do not allow the efficiency achieved to be measured.

• Current Standard Costs

These are standard costs which represent current conditions – i.e. they are kept up-todate. Ideal standards and attainable standards are current standard costs, which are changed when conditions change (normally once a year).

SETTING STANDARDS

• Direct Materials

- Direct Labour • Variable Overheads • Fixed overheads • Sales Variances

Essential Prerequisites

- Before manufacturing costs can be predetermined, the following factors must be stated: (i) The volume of output.

- The relevant, clearly-defined, conditions of working (grade of materials, etc.).

- The predetermined level of efficiency.

Each element of cost – material, labour and overhead – must be taken in turn, and the standard cost for each product determined. The object must be to ascertain what the costs should be, not what they will be.

- Before any attempt is made to set the standards, all functions entering into production should be examined and made efficient. Only then will it be possible to have standard costs which represent true measures of efficiency.

- The following have then to be predetermined: (i) Standard Quantities

Due allowance should be made for normal losses or wastage. Abnormal losses should be excluded from the standards, as these are not true costs.

Standard Prices or Rates

The aim should be to estimate the trend of prices or rates, and then predetermine these having full regard to expected increases or reductions.

Standard Quality or Grade of Materials, Workers or Services

Unless the appropriate grade of material or worker is clearly defined when the standards are set, there will be great difficulty in measuring accurately any variance which may arise. A lower-grade material may mean an adverse material usage variance and a favourable material price variance – the one tending, to some extent, to cancel out the other. This sort of situation is bound to arise, unless materials are standardised and the appropriate grade for a product strictly defined: all variances are, in some way, related to each other.

Application of Standard Costing

Standard costing is applied most successfully to continuous or repetitive operations, where large volumes of a standard product are produced. The application of standard costing principles to job costing systems is more difficult, as products will vary – each one may be unique. As the products themselves are not standardised, the emphasis will be on the machines and operations concerned. Standard feeds and speeds for machines may be developed, as well as output for handwork operations. These standards will then be applied to the specifications for individual products.

Setting Standard Costs for Direct Materials

The product is analysed into its detailed material requirements, and all the materials are listed on a form called a standard material specification.

Material Quantities

Determination of material quantities may be accomplished by one of the following methods:

- Referring to past records – e.g. stores records kept when historical costing was adopted.

- Making a model of the product, noting all significant facts when the test runs are carried out.

- Establishing the relationship between the size or weight of the product and the material content, thereby calculating the standard quantity – in the case of screws, for example, the weight of the screws will indicate the metal content, and a standard quantity can then be fixed.

Great care must be exercised in calculating a reasonable allowance to cover unavoidable material wastage – owing to cutting, for example.

Material Prices

Standard prices for materials will be set by the purchasing officer and the accountant.

The actual practice adopted can vary from company to company. Some companies set standards based on what is expected to be the average price ruling during the budget year. This has the effect of over-costing products during the first half of the year, and under-costing them during the second half. These differences are called variances; we will cover their calculation in the next study unit.

An alternative approach is to set standard prices based on actual prices ruling on the first day of the new financial year. This can be completed before the year begins, as suppliers generally notify price increases in advance. As standards are based on actual prices at the beginning of the year, it is necessary to calculate a budget for material price variances which is the company’s estimate of the impact inflation will have on material prices.

This approach has the advantage that costs are based on actual prices and not on forward estimates which may or may not be accurate. The standard cost represents the actual cost on the first day of the year and can be used with confidence by the marketing team. As the year progresses the actual material prices will be compared with these standard prices and the financial impact on the company calculated. By comparing actual prices with the prices ruling on the first day of the year, it is possible to get an accurate assessment of the rate of inflation applicable to material purchases. This information will be compared with the forecast rate of inflation built into the company’s budget, and can be used to assess the need for selling price adjustments or other corrective actions.

Standard Cost

The standard cost is obtained as follows:

Standard quantity × Standard price

This will be done for each type of material, and the totals added together to arrive at the standard material cost for the product.

Setting Standard Costs for Direct Labour

An analysis of the operations required to manufacture each product will be essential before the standards are set. The correct grade of worker for each operation must also be established.

Standard Time for Each Operation

The standard time for each operation will be set by one of the following methods:

- Referring to past records, and then adjusting to allow for any changes in conditions.

- Use of time-studies based on work study. Each element of an operation is timed, and then a total standard is determined by adding together all the element times and adding on allowances for relaxation, interruption, etc.

- Employment of synthetic time-studies. This is really a combination of (a) and (b). Detailed records are built up by the use of the time-studies, and then, from these records, the appropriate elemental times are selected to arrive at the total standard time for any operation which has not been timed.

Standard Wage Rates

As with material prices, the actual practice adopted will vary from company to company. Some companies base their standards on what they expect to be the average rate during the budget year. This means that they have to anticipate wage increases and changes in methods. An alternative approach is to base standard labour costs on the rates and methods applicable on the first day of the financial year, and then forecast variances based on projected wage increases and changes in methods. In this way the standard labour cost for each product represents the actual cost on the first day of the financial year, and provides similar advantages to those which we outlined in the previous section on material prices.

When an incentive method of payment is in operation, setting the standard rate may be relatively simple. For example, for a piece-rate system, the standard rate will be the fixed rate per piece. To avoid having too many rates, average rates may be used.

To summarise, the standard cost for direct labour is:

Standard direct labour-hour × Standard direct labour rate

Setting Standard Costs for Overheads – Variable

– Fixed

Overhead costs are often the most difficult costs to predetermine.

Preliminary Classification

One of the first steps will be to divide such costs into the following three classes:

- Fixed overhead costs

- Variable overhead costs

- Semi-variable overhead costs

Fixed Overhead Costs

In this class, the total remains the same irrespective of output, and they are often known as policy costs. Top management determines the extent of the fixed costs when formulating policy.

Variable Overhead Costs

In this class, the total increases with increased output, and reduces with decreased output, since variable overhead costs are fixed at so much per unit of output or standard hour. For example, the rate may be RWF0.35 per unit – so, for each additional unit of output to be produced, a further RWF0.35 must be included in the budget.

Semi-variable Overhead Costs

These are partly fixed and partly variable, and they have to be divided into two parts – thus showing quite clearly the fixed element and the variable element. Once the division has been made, predetermination of the costs is greatly facilitated. The two methods used for separating fixed and variable costs are both statistical techniques:

- Use of a regression chart

- Use of the method of least squares

Determination of Standard Amounts

This may be done by using past records or by using a form of time-study, when work can be divided into work units. For example, it may be possible to estimate the requirements so far as factory cleaners are concerned by fixing a time per square yard of floor for sweeping, washing, or other appropriate tasks.

volume of output must be predetermined, especially so that total variable costs for each type of expense may be calculated. Particular attention must be paid to the allowances to be made for normal time losses (labour absenteeism, waiting for material, tools, etc.) and also the abnormal time losses owing to a falling-off in the volume of sales. It has been suggested that up to 20%, or even more, may have to be deducted to arrive at a ‘normal capacity to manufacture’, and a further 20% or thereabouts deducted to arrive at a figure to cover losses of sales (known as the ‘normal capacity to produce and sell’). In the latter case, the long-term (say, six or seven years) figures are taken, and then a net yearly average is calculated.

Preparation of Budgets for Factory Overheads

Once the appropriate capacity has been selected and the costs have been classified into fixed or variable, the factory budgets can be prepared. Usually they are prepared departmentally – i.e. a separate budget for each cost centre or department. The hourly rate (machine-hour or direct labour-hour) is then calculated for each cost centre, and applied on the appropriate standard cost card.

For each volume of output, it is possible to have a cost equation, which may take the following form:

(Variable Units to)

Total for each class of expenses = Fixed costs + (cost per unit × be made)

The ‘units to be made’ may be expressed in terms of physical units or in standard hours. The variable cost per unit will have been ascertained from the direct material and labour content, together with variable overheads. Once the variable cost per unit has been calculated, the budget may be built up stage by stage, by entering each expense, and then its amount.

note in particular the fact that in practice two types of budget are in use:

Fixed Budget

This shows the output and costs for one volume of output only; it thus represents a rigid plan.

Flexible Budget

A number of outputs will be shown, together with the cost for each type of expense. The fixed costs will be the same for all volumes of output, whereas the variable costs will increase with increases in activity.

Standard Product Costs

Standard product costs are compiled for each product made. This is done by bringing together the standard product materials specifications, the standard operations, the performance standards, and the standard rates. A standard product cost card is shown in Figure 5.1.

Machine Time or Operator Time

So far, the standard rates for labour and overheads have been expressed in terms of operator time. However, in some circumstances the direct process time is relevant to the machinehour, rather than the labour-hour. In these cases, labour and overhead are expressed in terms of a machine-hour rate.

Computerised Systems

The standard-setting process is enhanced if the company has invested in computerised Material Requirements Planning (MRP) systems which require a detailed breakdown of every component and sub-component used in the finished product. These systems are used in the production planning and purchasing functions, and allow companies to ‘explode’ the forecast production programme into a detailed list of all the material and components required to manufacture it. This requirement can then be compared with the company’s stock positions so that order quantities can be calculated. It is therefore relatively easy to add the standard cost of each component to the computer system, which then enables the computer to calculate the standard cost of each product. The purchasing system is often linked into MRP systems and as a result it is also possible to update standard costs to actual costs.

TYPES OF VARIANCE

The difference between a standard cost (or budgeted cost) and an actual cost is known as a variance.

Favourable and Adverse Variance

Variances may be favourable or adverse. If actual cost exceeds standard or budgeted cost, then the variance is adverse. On the other hand, if actual cost is less than standard or budgeted cost, then the variance is favourable. Note that overhead volume variance is an exception to this general statement. An adverse variance is usually shown in brackets.

Classification According to Cost Element

To make the variances as informative as possible, they are analysed according to each element of cost – i.e. material, labour and overhead. A further analysis is then made, under each heading (material, etc.), according to price and quantity.

We will be discussing further subdivisions of some of these variances later.

THE STANDARD HOUR

CIMA Definition

Perhaps the most satisfactory way of explaining this expression is to consider the definition put forward in the CIMA terminology. This defines the standard hour/minute as:

The quantity of work achievable at standard performance, expressed in terms of a standard unit of work in a standard period of time.

Measure of Output Achieved

From this definition, you can see that a standard hour refers to a measurement of output, and not to the physical passage of time. If an operative works harder than envisaged by the standards, he may produce 1.25 standard hours within the physical time of 60 minutes; and, conversely, if he works more slowly than standard he may only produce 0.75 standard hours in 60 minutes.

In assessing output, the time passage will be 60 minutes and the number of units produced in that time will be recorded to establish the output of a standard hour. Suppose a factory produces rulers, and in 60 minutes it is observed that an operative can produce 400 rulers, then 1 standard hour’s output will be assessed at 400 rulers. Further, suppose that, in the course of an 8-hour day, the output of an operative was 3,600 rulers; on the basis of the agreement the output would be assessed at 9 standard hours.

Note: 9 standard hours have been produced in 8 clock hours. This distinction between standard hours and clock hours is vital to the statistics of standard costing.

MEASURES OF CAPACITY

CIMA Definitions

The CIMA terminology includes three measures of capacity:

Full Capacity

Production volume expressed in standard hours that could be achieved if sales orders, supplies and workforce were available for all installed workplaces.

Practical Capacity

Full capacity less an allowance for known unavoidable volume losses.

- Budgeted Capacity

Standard hours planned for the period, taking into account budgeted sales, supplies and workforce availability.

Level of Activity Ratios

Using the above measures as a starting point, various ratios can be developed to show the level of activity attained, and the efficiency of production. The CIMA terminology refers to three ratios: idle capacity, production volume and efficiency.

You can see that full capacity refers to an ideal situation, where there are no losses of any kind. Practical capacity reflects an attainable level of performance, while budgeted capacity takes into account anticipated conditions in relation to sales, production and labour facilities which will be available.

LIMITATIONS OF STANDARD COSTING

There are criticisms of the appropriateness of standard costing in the modern industrial environment. The main ones include:

- Standard costing was developed when the business environment was more stable and operating conditions were less prone to change. Stable conditions cannot be assumed in today’s dynamic environment.

- Performance to standard used to be considered satisfactory, but constant improvement must now be aimed for in order to remain competitive.

- The emphasis on labour variances is no longer appropriate with increasingly automated production methods.

A business’s decision to use standard costing must depend on its effectiveness in helping managers make correct decisions. Standard costing may be useful even where the final output is not standardised. It may be possible to identify various standard components and activities for which standards can be set and used effectively in planning and control. Also, the use of demanding performance levels in standard costs may help to encourage continuous improvement.

Remember that if comparison between actual and standard cost is to be meaningful, standards must be valid and relevant, so it is important for standard cost to be kept as up-to-date as possible. Frequent updating of standards may be required to ensure that they fairly represent the latest methods and operations, and the latest prices which must be paid for the resources being used.

PURPOSE OF VARIANCE ANALYSIS

Guide to Management Action

Having established quantity standards for sales, materials and direct labour with the relevant standard sales and cost values, actual operational results are compared with the standard allowances. The differences between the money values for the actual and standard results are known as variances. These variances are intended as a guide to the management, to identify the causes of discrepancies between actual and standard performance and to provide a basis for corrective action and decision-making.

Follow-up Procedures

It is important that follow-up procedures are established to investigate the causes of significant variances – otherwise the full benefits of standard costing will not be realised.

MEANING AND POSSIBLE CAUSES OF VARIANCES

In studying the analysis of variances, you should not only understand the techniques of the calculations but also the meaning and possible causes of variances.

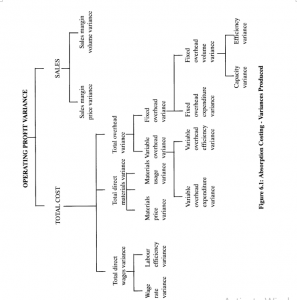

Scheme of Analysis: Absorption Costing

Variances are calculated for

- Sales

- Direct wages

- Direct materials

- Variable overheads

- Fixed overheads

In each case, the variances are classified according to their nature – whether price, efficiency or volume – each type of variance having its own title. The analysis of variable and fixed overheads will depend upon whether absorption or marginal costing methods are used. In the following calculations, absorption costing principles are adopted. The forms of analysis used when marginal (variable) costing methods are employed will be given later. The chart in Figure 6.1 shows the main variances produced under absorption costing methods.

| Sales | –

|

Sales margin price variance Sales margin volume variance |

| Direct wages | –

|

Wage rate variance

Labour efficiency variance |

| Direct materials | –

|

Materials price variance Materials usage variance |

| Variable overheads | –

|

Variable overheads expenditure variance Variable overheads efficiency variance |

| Fixed overheads | –

|

Fixed overheads expenditure variance

Fixed overheads volume variance, divided into: – Capacity variance – Efficiency variance

|

There are also other sub-variances for sales, direct materials and direct wages.

Fixed Overheads

We are assuming that the company uses absorption costing methods. As you will remember, under absorption costing methods fixed overheads are allocated to products for the purpose of calculating unit costs and stock values. We have already established that the standard cost for fixed overheads is RWF1 per hour, and this will be used for the purpose of calculating overhead variances.

Fixed Overhead Expenditure Variance

As the fixed overheads are unaffected by changes in volume within certain ranges, the budget figure can be used for the purpose of comparison with the actual overhead incurred.

The formula is:

Actual fixed overhead − Budgeted fixed overhead

Sales Variances

Under absorption costing methods, the sales variances are based on profit margins. The two main variances are the sales margin price variance and sales margin volume variance.

Reason for the Variance

This variance, together with the sales margin volume variance, is the responsibility of the sales department. The change in selling prices may have resulted from sales at specially discounted prices or from allowances for quantity purchases. The company might operate in an industry in which prices are determined by market leaders, and it may be forced to follow the market trends. The sales department must also check that price concessions given by its sales staff are justified, and take care that any major price reductions are authorised by senior staff.

Analysing Variances: Marginal Costing

The variance analysis has so far been based on a system of absorption costing. Under a variable or marginal costing system, there would be only one variance for fixed overheads – the expenditure variance – as, in this method of costing, all fixed overheads would be charged to the accounting period concerned, and no allocations would be made to production units. The fixed overhead variances for capacity and efficiency would not apply but it would become part of the sales margin volume variance.

RELATIONSHIPS BETWEEN VARIANCES AND INVESTIGATION OF THEIR CAUSES

Interrelationship of Variances

Variances may be interrelated through some connecting factor. Frequently, a favourable variance for one cost factor may result in an adverse variance for another. Lower-quality materials may be purchased, giving a favourable materials price variance. However, this possibly results in production delays or difficulties – giving an adverse variance for labour efficiency. A lower, less skilled, grade of labour may be used at a lower rate of pay – producing a favourable direct wage rate variance. This may result in extended production times – giving an adverse labour efficiency variance. Similarly, a greater volume of sales may be achieved by selling at lower prices than standard – giving a favourable sales volume variance but an adverse sales price variance. These (and other) linking causes should be considered in analysing standard costing variances, so that individual variances are not considered in isolation.

Significant Variances

As we have already noted, the full benefits of standard costing will not be realised unless variances are analysed and investigated, and corrective action taken where shown to be necessary.

Not every variance will justify the time and expense of investigation, and some consideration must be given to determining what are to be regarded as significant variances. Minor variations, either in terms of money value or as percentages of the amounts involved, need not call for investigation. It will be necessary to decide for each element of cost the control limits within which variances can be allowed to occur without investigation. Upper and lower control limits may be set, and only when variances are outside these limits will investigation be required.

- Materials Price, Mix and Yield Variances

In process industries it is common for two or more materials to be mixed together to produce a new material. There will be a standard specification for the proportion of each material to be used – a standard mix, or mixture – which will also specify the allowance for normal wastage from a given input of material. This specification will usually be a standard batch of mixture, according to the normal quantity of input, to produce a given volume of output. This type of operation can lead to variances arising from variations in the mix of materials or the amount of wastage incurred, and the yield obtained from a given input. The material usage variances can therefore be analysed to show the causes arising from these two factors.

Interpretation of Variances:

Sales Price Margin Variance

This variance, as we explained earlier, shows the profit or loss arising from changes in selling prices. This is a responsibility of the sales department.

Sales Mix Margin Variance

This variance shows the variation in profit arising from a different composition of sales from the budgeted amounts. It may be caused by falling demand for some products and rising demand for others. Some products may be more easily sold, and salespeople have concentrated on products which have a more rapid turnover but possibly less profit. Our adverse variance has been shown because more products with lower profit margins have been sold than budgeted, and investigations would be required to find the cause. The advent of new competition can be a factor.

-

Sales Volume Margin Variance

This variance indicates the loss or gain in profit through sales quantities being above or below budget levels. The causes for this variance have been previously outlined.

Costing Method in Use

In answering examination questions on the subject of sales variances, take care to find whether answers should be based on standard contributions or standard profit margins – depending upon whether marginal or absorption costing methods are to be used.

PLANNING AND REVISION VARIANCES

Outdated Standards

Standards may become outdated because of changes in market prices, wage rates, selling prices or other causes. In many organisations the standards will be revised only once a year, so that any changes which take place during the year will give rise to variances.

Material Price Change

At the time of setting a standard price for a particular material, a price of RWF5 per kg may appear to be realistic but, owing to factors outside the control of the organisation, the price may rise to RWF6 per kg. The rise of RWF1 will be uncontrollable so far as the purchasing department is concerned. But the purchasing department may sometimes be able to secure materials on slightly more favourable terms than the general rise in prices. Two variances can then be calculated:

- A planning revision variance, reflecting the general rise in prices

- A price variance arising from the purchasing department’s efficiency in purchasing above or below the current market price.

Interpretation of variances:

- The price variance, in this case, shows the purchasing department’s efficiency in purchasing supplies below the current market price.

- The planning revision variance shows the effect of price changes which have arisen since the standards were prepared, and it is uncontrollable so far as the purchasing department is concerned.

Similar variances can be prepared for wage rate variances or other cost or sales factors where changes in wage rates or other changes have occurred after the standards have been prepared.

Revision Variances

Various changes may occur during the period when standards are in operation, so the standard cost of production may change.

- Temporary changes – if the changes that take place during production are of a temporary nature, usual variance analysis will indicate the influence on the standard cost of production. Management action should follow to correct the situation.

- Permanent changes – if the changes are in material used, grade of labour used, or in methods of production and are of a permanent nature, the standards themselves will need to be revised. Under such circumstances revision variances could be calculated for a short period of time. On revising the whole structure of standard costs and variance analysis, say at the end of a year, any permanent changes will be incorporated.

Generally, temporary changes tend to be controllable requiring management action, whilst permanent changes are often outside the control of the management