FACTOR AND INPUT COSTS

Production Factors and Costs

In Study Unit 1 we examined how the factors of production – land, labour and capital – contributed to total production. We also saw that some factors could be regarded as fixed and others variable, and that this distinction helped to provide us with the important distinction between the short run, when at least one significant production factor was fixed, and the long run when all factors could be varied.

The payments made to the owners of production factors in return for their use in the process of production are, of course, the costs of production which the production organisation (firm) has to pay in order to produce goods and services. More strictly these are termed the private production costs. These factor payments, in very general terms are rent to the owners of land, interest to the owners of capital and wages to the providers of labour. Disregarding land for the sake of using very simple models we can, initially, regard capital as the major fixed production factor and labour as the variable factor.

Fixed Costs

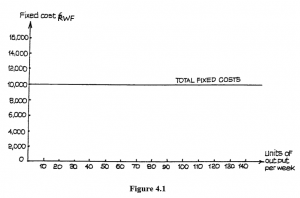

These are the costs of the fixed factors, i.e. those elements which are not being increased as production or output is being raised. The total fixed costs for a given range of output can be illustrated in the simple graph shown in Figure 4.1.

Examples of fixed costs include rent for land or buildings, the rental charge for telephone or telex, rates, the salary of a manager, and the fee for a licence to make use of another company’s patent. All these costs can change, but the point is they do not change as production level changes. The cost has to be met, whatever the level of output and sales.

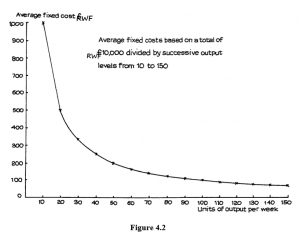

The graph of average fixed costs, i.e. total fixed costs divided by the number of units of output produced, is shown in Figure 4.2. This is based on the fixed costs of RWF10,000 assumed in Figure 4.1. Notice the steep fall at the lower levels of output, and the much more gentle slope of the curve at higher levels. Between 140 and 150 units of output per week, the fall in average fixed costs is only from RWF71 to RWF67 (approximately).

Variable Costs

These are the costs of inputs which are increased as output increases. They include the costs of basic materials, of some labour – e.g. engineering machinists paid on “piece rates” (according to the amount produced) – petrol for delivery vehicles, and so on.

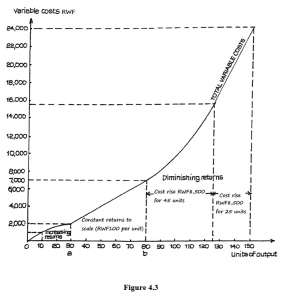

The behaviour of variable costs depends on the pattern of production returns. If production is rising faster than the input of variable elements, then costs are increasing proportionally less than the rise in output. This is because each extra unit of input is adding more to production than it is to cost. This is possible at the lower levels of production represented by 0a in Figure 4.3.

Later, costs are likely to rise in the same proportion as output – this being the stage of constant returns, shown between output levels 0a and 0b. Then, as we reach the level of diminishing returns, costs rise faster (more steeply) than production. This is shown beyond level 0b.

Total and Average Costs

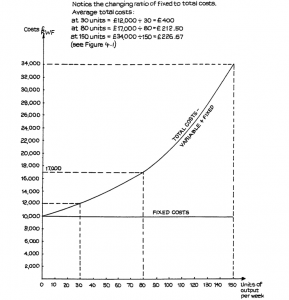

If we combine fixed and variable costs, we obtain total costs. So, if we combine Figure 4.1 which shows total fixed costs, with Figure 4.3, we obtain the graph of total costs. This is shown in Figure 4.4.

From the total costs we can obtain average total costs, simply by dividing the total by each successive level of output. Average total costs are often referred to just as average costs. Figure 4.5 shows the graph of average total costs, which has been derived from the total cost curve shown in Figure 4.4.

This is the typical shape of the curve in the short run (remember, while fixed costs remain fixed). Because it falls to a minimum point and then rises, it is often referred to as the “U- shaped” average cost curve, although as you can see, a more accurate description is that of an L with its toe turned upwards. Only if there are particularly severe increasing costs (diminishing returns) to scale, and fixed costs are a very small proportion of total costs, will the second half of the “U” be at all steep, and the efficient firm should never allow itself to reach this position.

The modern firm is more likely to have a high proportion of fixed to total costs, because of the swing from labour to labour-saving machinery.

Marginal Costs

You have already met marginal utility and marginal revenue – the change in total utility or revenue as output changes. You will not then be surprised to know that marginal cost is the change in total cost as output changes. Once again, we relate this change to a single unit of output, so that, if we are moving in steps of ten, as in our cost example so far, we shall have to divide any change from one step to the next by ten.

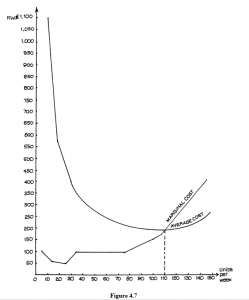

In Figure 4.7, the marginal cost graph has been combined with the average cost graph. Notice where these two curves intersect.

The rising marginal cost curve cuts the average cost curve roughly at 110 units per week. This is the output level which we have already noted as the lowest level of the average total cost curve. This illustrates a rule that you must remember. The rising marginal cost curve always cuts the average cost curve at its lowest point. If you think a little, you will see that it must do that. If the cost of the last unit to be produced is less than the average up to that point, then the new average will be a little lower. If the cost of the last unit is higher than the average up to that point, then the new average will be a little higher.

The “flat” part of the average cost curve is prolonged. The question, then, is whether this merely stretches the average cost curve – delaying the point of eventual diminishing returns and the rise of the U shape – or whether it can be continued indefinitely in order to prevent the U shape completely and make the long-run average cost curve L-shaped.

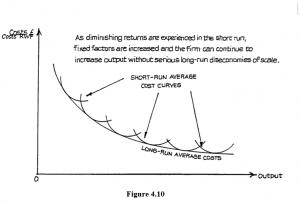

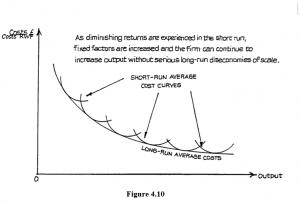

The relationship between short- and long-run average cost curves is sometimes shown as in Figure 4.10. This emphasises the fact that one reason for the increase in fixed factors and costs is to overcome the effect of short-run diminishing returns.

ECONOMIC COSTS

We are now beginning to see production costs from a variety of angles.

• Opportunity Costs

These were identified in Study Unit 1 and may be defined as the cost of using resources in one activity measured in terms of the lost opportunity of using them to produce the next best alternative that had to be sacrificed.

• Absolute Costs

These are the full costs of the factors used in the activity under consideration. They may be measured in monetary terms but the real absolute cost is best measured by the actual quantity of factors used, e.g. the amount of land or the numbers of people employed.

• Private Costs

These are the costs actually paid by the producer to the owners or providers of the production factors employed. They are the costs usually taken into account by the accountant and are measured in monetary terms, since the accountant has to account for the use of whatever finance has been entrusted to the production organisation. We have been looking at these costs in this study unit and have also examined the important distinction between fixed and variable costs.

- External Costs

We will go on to look at these now.

EXTERNAL COSTS AND BENEFITS

These are also sometimes referred to as “externalities”.

External Costs

Not all the costs of factors used in the production process are paid by the producer as private costs. Suppose, for example, that, during a dry summer, a farmer watered his crops with water pumped from a canal, and as a result, the canal level fell and it could no longer be used by waterway travellers. Unless the farmer paid compensation to the travellers, it is clear that they would be contributing to the costs of the farmer’s production. Because these costs are being paid by people external to the production process, they are called “external costs”.

We can think of many examples of such costs. Travellers who incur additional fuel and machine-wear costs resulting from traffic delays, when these delays are caused by repairs needed to make good damage brought about by very heavy lorries travelling at high speeds, are contributing to the costs of transporting goods by these heavy lorries. If a proportion of the cost of road repairs is paid from general taxation, then all taxpayers are contributing to the costs of road travel – even those tax payers who rarely travel at all.

Other examples of external costs include the poisoning of rivers by industrial waste, the pollution of sea coasts by waste oil discharged by oil tankers, the sickness and early deaths of workers from industrial diseases. The list is almost endless, and you can probably add to it from your own observation. Some costs may even be borne by later generations e.g. pollution.

External Benefits

In contrast, it is possible for people to receive benefits from production towards the cost of which they have not contributed. These are external benefits. If a large firm builds modern roads or provides other transport facilities which are then available for use by the general community, then that community gains external benefits. If a business firm provides a good canteen and housing for its workers and, by improving standards of housing and welfare, improves the health of workers and their families, then this, too, is an external benefit. We are well aware of cases where firms cause damage to the environment but there are also cases where firms improve the environment by renovating property, creating sports grounds, or even parks.

Economics of Externalities

It might be thought that economists would favour external benefits and dislike external costs but, in fact, economic theory suggests that all externalities distort the use of resources, and that even external benefits are probably better provided in other ways. The danger of external costs can easily be recognised. If, for example, road users, especially heavy goods vehicle users, do not pay the full costs of their road use but pass some of these on to the rest of the community, then the relative costs of, say, transporting goods by road – as opposed to by rail or water – are distorted in favour of road. Consequently, goods are carried by road transport at a higher cost to the community than it would have paid if they had been carried, say, by rail. The community is not making the most efficient possible use of its available resources, and its living standards are lower than they would otherwise be because some production is being lost. Moreover, the problem tends to increase. If road transport is artificially cheap, then goods are diverted to road from rail. Road services are overcrowded, and there is pressure to devote more land to roads. Rail services are under-used. Agricultural and residential land is lost to roads to carry traffic which could otherwise have been carried by substitute services.

This is what we mean when we say that externalities distort the use of scarce economic resources.

Enternalities and the Government

What can be done about externalities? Does the community just have to accept their existence? Clearly neither the producers who are able to pass costs to others nor the buyers of their goods or services who obtain reduced prices because of the reduction in private costs are likely to volunteer to pay more unless they are obliged to do so. They could not do so as individuals in competitive markets. Only the government, acting on behalf of the community as a whole and reacting to political pressures, can take effective measures and the options open to government are the following.

- Legislate to make actions considered undesirable illegal and enforce the law. In a democracy such laws must be acceptable to the community as a whole; care must be taken to ensure that desirable benefits are not lost and that the cost of law enforcement is not out of proportion to the costs avoided.

- Legislate to ensure that producers behave in a socially acceptable way and follow practices designed to avoid the undesirable external costs. Water and sanitation companies may be required to achieve certain minimum standards. The costs of complying with the law thus become private costs and part of the production cost which must be met by users of the goods and services. All producers then become subject to the same requirements so that none can gain a competitive advantage by not complying with the standards. If producers have to compete with foreign imports, the government will have to ensure that these imports are subject to the same minimum standards.

- Impose special taxes designed to make some products very expensive and so discourage their use. There are several objections to this course of action. The government might start to rely on the revenue from the taxes and so take care to keep them at a level where the products are still bought and used; the taxes may well then cease to deter or reduce the external costs. Alternatively the government might impose very high taxes with the result that there is widespread tax evasion; the cost of collecting the tax and punishing evaders then rises to impose additional burdens on the community.

Clearly it is more desirable to try and ensure that external costs are removed altogether than that they should simply become private costs. Even if employers are forced to pay adequate compensation to workers whose lungs are damaged by dusty manufacturing processes, the workers still suffer. However, if manufacturers are required to have efficient dust extraction equipment, private costs are increased but the health of the workers is improved. At the same time care must be taken to ensure that external costs are not simply exported. For example, one way of dealing with dangerous gases might be to ensure that they are expelled through very high chimneys, but unfortunately these may simply redirect the gases to another country for that country to bear the cost.

There is no universal and simple method of dealing with externalities, but on the whole it does appear that the market economies have been more successful in controlling and reducing undesirable external costs associated with environmental pollution than have the old command economies. This is probably because in the more open and consumer-oriented societies producers and government have had to be willing to respond to pressures from the public when that public has been determined to eliminate socially unacceptable practices.

COSTS AND THE GROWTH OF ORGANISATIONS

Returns to Scale

We have already seen the results of increasing inputs of a variable factor when at least one other production factor is held constant. We saw that this was likely to bring about increasing, then constant, and then diminishing marginal returns. However, we have also pointed out that, in the long run, all factors can be increased, and there is the possibility of economies of scale resulting for the continued growth in size of the firm. We must now look at this possibility more closely, but first we must be clear as to the meaning of returns to scale when all factors are being increased. If a given proportional increase in factors results in a larger proportional increase in output, then the firm is enjoying increasing returns, or economies of scale. This would be the case, for example, if a 10% increase in factor inputs produced a 20% increase in production output.

If the proportional increase in output is the same as the proportional increase in factor inputs – e.g. when a 15% increase in factors produces a 15% increase in output – then the firm is experiencing constant returns. If, however, a 15% increase in factor inputs produces less than a 15% increase in output – only 10%, say – then the firm is suffering decreasing returns, or diseconomies of scale.

Economies of Scale

Real scale economies, as defined above, should be distinguished from purely pecuniary or monetary economies which do not represent a more efficient use of factors but which are the result of the superior bargaining power of the large firm in the market. A large customer, for instance, can often gain discounts greater than can be justified on the grounds of savings in delivery or distribution costs, and workers in some large firms may be willing to accept a lower wage in return for what is believed to be greater security of employment or the social prestige of working for a famous organisation. Real economies – the genuine efficiencies in the use of production factors resulting from growth in the scale of activities – can be identified in the following main areas.

Labour Economies

These result from greater opportunities for the division of labour which increase with the skills of the work-force, save time and allow greater mechanisation. The automated assembly line in modern motor-vehicle assembly is an extreme example of this.

Technical Economies

These result chiefly from the use of specialised capital equipment. Large firms are able to make use of equipment that could not be fully employed by smaller operations, and large firms are also able to support reserve machines to avoid disruption following breakdown. A small firm, using three machines, adds one-third to its capital cost if it tries to add a further machine to keep in reserve. A large firm employing 20 machines adds only one-twentieth if it decides to do likewise.

Marketing Economies

Very great economies are available from large-scale advertising. A televisioncommercial film using “top” stars is very expensive to make, but the cost per potential customer is very low if essentially the same film can be shown in several different countries. Large firms can also afford to keep very skilled marketing specialists fully employed.

Financial Economies

Large firms are able to obtain finance from markets that are denied to small firms, and multinationals can raise money in many different countries. Nevertheless, although financial economies still exist, we do have to recognise that finance markets have, in recent years, become more responsive to the needs of smaller enterprises.

Distribution and Transport Economies

Transport movements and the location of depots can be carefully planned by large organisations, so that vehicles and storage space are used efficiently.

Managerial Economies

These arise from the employment of specialised managers and managerial techniques, although many of these techniques have been developed in order to overcome the problems of managing large organisations, so that many economists suggest that managerial economies of scale are often exaggerated and difficult to achieve in practice.

Diseconomies of Scale

Diseconomies of scale are usually associated with the problems rising out of the management and control of large organisations. Formal communication systems are necessary but are expensive to maintain. Whereas the manager of a small organisation can see what is going on around him in the course of his daily work, the manager of a large firm may have to establish an inspection system to obtain equivalent information – which is unlikely to be as reliable.

There can also be a loss of control over managers at the lower levels of the “managerial pyramid”. These managers may then pursue their own private objectives – e.g. building up the power of their own department – at the expense of efficiency and profitability.

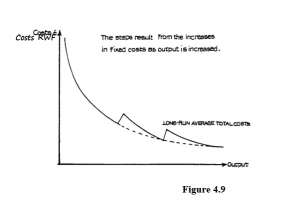

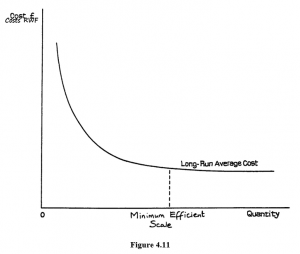

Diseconomies of scale, then, are mostly managerial. If diseconomies just balance economies, i.e. when a 10% increase in factor inputs produces the same (10%) increase in production output, the long-run average cost curve will have the L shape of Figure 4.11. If economies of scale continue roughly to balance diseconomies, this shape may be retained over a long period. If, however, diseconomies start to rise substantially, then the long-run average cost will again start to rise.

Notice here the position of what is called the Minimum Efficient Size (or Scale) (MES), also known as the Minimum Optimum Scale (MOS). Up to this output level there are significant gains from internal economies of scale, and firms below the MES are at a cost disadvantage when competing against those up to or beyond that size. However, beyond the MES, further cost savings are not significant, and there is no cost advantage in further growth. On the other hand the shape of the curve can change as firms learn how to overcome sources of inefficiency, in particular managerial inefficiency, especially when new managerial skills and communication technology are introduced. It is possible to control very large firms today in ways that would have been impossible half a century ago. Jet travel and modern telecommunications, not to mention computers and microelectronics, have transformed management techniques.

External Economies

The economies of scale listed earlier all apply to the individual firm and they are known as internal economies of scale. There are other economies that are external to the firm and which arise when an industry grows large or when business firms congregate in a particular area. External economies usually arise from the development of specialised services available to many firms. For example, an area containing numbers of small engineering companies may provide opportunities to support one or more specialised toolmakers. Each engineering company can call on the specialist, without having to carry the full cost of having its own specialised department. External economies help small firms to survive in competition with larger organisations. However, if one or two companies become dominant and they internalise these economies by setting up their own specialised departments which they are large enough to keep fully employed, then the external economies may be lost to the smaller firms, which can then no longer survive in the market.

SMALL FIRMS IN THE MODERN ECONOMY

It is sometimes assumed that, because of economies of scale, large firms are always likely to be more efficient and to be able to produce at lower cost than small firms. If this were true, small firms would be much less numerous than they are. Of course, one reason for their survival is that the definition of a small firm tends to change in time. As the average size of the firm grows, so firms which would have been considered large become classified as small. Moreover, if we take as the main qualification to be considered a small firm, the fact that the whole enterprise is controlled by a small group of employer-managers (usually all belonging to the one family), continued advances in technology, including information technology, enable one or two people to control larger enterprises, so that in fact, many more firms can now grow larger and still, in fundamental respects, remain small.

Economies of Scale

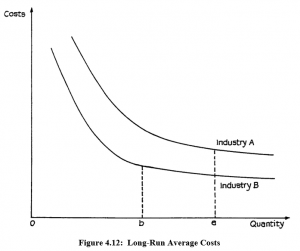

A closer look at economies of scale shows that large firms are not always inevitable. If we assume that the typical successful large company has an L-shaped cost curve, this can still cover a number of different possibilities.

Figure 4.12 shows two possible long-run average cost curves. It shows that each reaches a point where further cost reductions as output increases are very small. As noted in the previous section, this point is known as the minimum efficient size: it is reached at 0b for industry B and 0a for industry A. We would, therefore, expect firms in industry A to be rather larger than in industry B. There is no further significant advantage for firms when they grow beyond these points.

This minimum efficient size, of course, must be related to the size of the market. If, for example, industry B served a much larger market than industry A then we would expect many more firms competing in B than in A. Some world markets have room only for a very few firms. Here, fixed costs are very high and only very large organisations can consider entry.

The oil industry is an example of this. In contrast, the manufacture of many kinds of plastic household fittings does not require very expensive equipment, and many small firms are able to compete successfully in the market. The general term “economies of scale” also covers both internal and external economies, and it is only internal economies that favour large firms. External economies, such as specialised services, are available to all firms in an area or industry, and these, in fact, often help small firms to survive. It is when the number of small firms drops below the level necessary for the survival of the specialist as an independent organisation that all the remaining small firms are faced with severe problems, and may have to disappear.

Special services to industry – such as industrial cleaners, photographers, designers and others – often serve a restricted market and are likely to remain small. This is especially likely to be true if the service is localised. The service may only be needed occasionally by any one firm, but when it is needed the need is urgent and some one has to be found very quickly. Small local firms are better placed to provide a satisfactory service than a large national organisation.

The minimum efficient size is not the only determinant of the size of firm likely to be found within an industry. The attitudes, abilities and objectives of owners or senior executives play an important part. We can always expect to find some large firms in sectors when small firms form the majority.

At the same time we are also likely to find small firms in industries where the MES is large, implying that only very large firms could survive. This may be because they serve a specialist niche which forms a small part of a larger market. Industry definitions can be misleading. The term “motor industry” covers activities ranging from motor vehicle assembly to the manufacture of small, specialised components. These activities are not really comparable and the MES for a component manufacturer could be much smaller than for vehicle assembly. Nevertheless it is the giant corporations which dominate the industry. If one of these fails, large numbers of the satellite firms which supply goods and services to it are also likely to fail. If the dominant firms all prosper, the satellites also flourish.

Services

Services generally tend to be smaller than manufacturing organisations, although there are, of course, some very large service firms developing in activities such as the law, accounting and business consultancy. On the other hand, these large firms tend to serve large-scale customers. A leading international accountant is not really suited to “do the books” of the small corner shop. In any case, the shop would not be able to pay the accountant’s fees. There will always, therefore, be small local firms of accountants, solicitors and so on. If any of these meet problems they cannot handle themselves, then they may be able to call on the specialist services of the giant.

As the service sector of the economy, including the rising leisure services, grows, so the scope for small firms continues to increase and as already suggested, new technology based on the chip and the microcomputer is enabling the small firm to achieve a level of administrative efficiency that would have seemed impossible only a short while ago. A business-owner who can afford to spend around RWF2,000,000 to RWF3,000,000 on a computer, software packages and a good printer can maintain accounting and secretarial services with just one or two people, whereas the same standard of service would have required an office of 15 or more people – or a very expensive mainframe computer complete with specialist programmer – only twenty years or so ago.

Traditionally, the small-firm sector has been seen as the seed-bed of enterprise and the nursery in which tomorrow’s giants are reared. The microcomputer industry itself is an example. It was not the giant computer monopolists that produced the microcomputer but brilliant electronics engineers working on their own initiative. There will always be scope for the entrepreneurial genius.

Recent Trends

During the 1980s, in the UK for instance, small firms faced a more favourable financial climate. Small-scale enterprise became fashionable and received government support through the Business Expansion and Small Business Loans Guarantee Schemes. The London Stock Exchange also sought to make it easier for smaller companies to raise capital by developing the Unlisted Securities Market (USM) and, for a time, a Third Market. The USM was closed in the mid-1990s and has been replaced by an “alternative market”, the AIM which is intended to operate more effectively for smaller companies within the structure of the London Stock Exchange. You should look out for this development and watch its progress.

Any form of government intervention tends to distort markets. Even socially worthy schemes to assist the unemployed can create as many problems as they solve. If, for example, an unemployed person is given government financial help to start a new window-cleaning business in an area where demand is roughly in equilibrium with supply from existing window cleaners, the entry of a new, subsidised cleaner is likely to undermine and drive out of business one or more of the established small firms which do not enjoy government financial help. The result may be that one person leaves the dole queue and is replaced in it by two others.

The banks also became disillusioned with the small-firm sector and reversed the policies that were proving to lead to heavy losses. There is still official encouragement for the creation of new small firms, and the number of people entering self-employment always increases when unemployment rises, as many people decide that the risks of starting in business are preferable to unemployment; but no one any longer believes that small firms offer a serious solution to current economic problems.

In an economic depression, large as well as small firms suffer and many companies which had developed into conglomerates of different, often unrelated, activities as a result of the mergers of the 1960s and 1970s rediscovered the virtues of specialisation and sold, closed or allowed managers to “buy out” those enterprises which did not fit into the mainstream of their “core activities”. Many of the management buy-outs were heavily dependent on bank finance and a high proportion have become victims of the depression. Others have survived and prospered once released from the weight of large company bureaucracy. In spite of the difficulties, there are still large numbers of small firms and as the 1990s have shown that growth and size are no guarantee of security, fewer of these will wish to grow too rapidly and become too dependent on borrowed funds.

In recent years earlier tendencies which resulted in large firms internalising specialised activities have been reversed. Specialist departments which had proved difficult to keep fully employed have been closed and in many cases the specialists have been helped to form their own businesses, supported with contracts from their former employers. These newly independent firms are once again able to provide their specialist services to large and small organisations.

New communications technology is leading to a revival of a very old form of enterprise – what may be seen as a collection of independent firms, all working under the overall guidance of a central, largely marketing, organisation. Computer software production is often produced on this basis, with self-employed programmers producing software to detailed requirements set by the central marketing body.

Many small retailers have found it possible to survive as members of a larger “voluntary chain” made up of retailers and wholesalers, e.g. Super Spar in South Africa.

Franchising is another way in which independent traders work under a degree of central control. These organisational structures all combine some of the advantages of large-scale operation with the benefits of the small entrepreneur working for him/herself.

Although the life expectancy of the majority of small firms continues to be short, there are nearly always people willing to fill the gaps left by the casualties. The small firm sector as such continues to exist and the record of innovation and enterprise from small firms compares favourably with the large corporations. A healthy and dynamic economy requires a diversity of firms of all sizes and activities. Most large organisations have occasion to rely on the services of small firms: often they use them to fulfil contracts which are too small for them to carry out profitably but which are necessary to retain the goodwill of valued customers. Moreover the continued existence of smaller rivals can often be a healthy reminder to large corporations that they are neither immortal nor indispensable. The growth of own-brand labels developed by the large supermarket chains has provided openings for many smaller manufacturers who could not otherwise have hoped to compete with the established food corporations.

The flexibility and versatility of the modern market economy, then, depends on the existence of many different sorts and sizes of organisation, and this diversity is essential to the maintenance of high living standards and wide employment opportunities.