INTRODUCTION

External funds available for a period of one year or less are called short-term finance. In India, short-term funds are used to finance working capital. Two most significant short-term sources of finance for working capital are: trade credit and bank borrowing. The use of trade credit has been increasing over years in India. Trade credit as a ratio of current assets is about 40 per cent. Bank borrowing is the next important source of working capital finance. Before the 70s, bank credit was liberally available to firms. It became a restricted resource in the 80s and 90s because of the change in the government policy; banks were required to follow the government prescribed norms in financing working capital requirements of firms. Now there are no government norms, and banks are free to take business decisions in granting finance for working capital.

Two other short-term sources of working capital finance which have recently developed in India are: (i) factoring of receivables and (ii) commercial paper. We have already discussed factoring in an earlier chapter.

TRADE CREDIT

Trade credit refers to the credit that a customer gets from suppliers of goods in the normal course of business. In practice, the buying firms do not have to pay cash immediately for the purchases made. This deferral of payments is a short-term financing called trade credit. It is a major source of financing for firms. In India, it contributes to about one-third of the short-term financing. Particularly, small firms are heavily dependent on trade credit as a source of finance since they find it difficult to raise funds from banks or other sources in the capital markets.

Trade credit may also take the form of bills payable. When the buyer signs a bill—a negotiable instrument—to obtain trade credit, it appears on the buyer’s balance sheet as bills payable. The bill has a specified future date, and is usually used when the supplier is less sure about the buyer’s willingness and ability to pay, or when the supplier wants cash by discounting the bill from a bank. A bill is formal acknowledgement of an obligation to repay the outstanding amount. In USA, promissory notes—a formal acknowledgement of an obligation with a promise to pay on a specified date—are used as an alternative to the open account, and they appear as notes payable in the buyer’s balance sheet.

Trade credit is mostly an informal arrangement, and is granted on an open account basis. A supplier sends goods to the buyer on credit which the buyer accepts, and thus, in effect, agrees to pay the amount due, as per sales the terms in the invoice. However, he does not formally acknowledge it as a debt; he does not sign any legal instrument. Once the trade links have been established between the buyer and the seller, they have each other’s mutual confidence, and trade credit becomes a routine activity which may be periodically reviewed by the supplier. Open account trade credit appears as sundry creditors (known as accounts payable in USA) on the buyer’s balance sheet.

Credit Terms

Credit terms refer to the conditions under which the supplier sells on credit to the buyer, and the buyer is required to repay the credit. These conditions include the due date and the cash discount (if any) given for prompt payment. Due date (also called net date) is the date by which the supplier expects payment. Credit terms indicate the length and beginning date of the credit period. Cash discount is the concession offered to the buyer by the supplier to encourage him to make payment promptly. The cash discount can be availed by the buyer if he pays by a certain date which is quite earlier than the due date. The typical way of expressing credit terms is, for example, as follows: ‘3/15, net 45’. This implies that a 3 per cent discount is available if the credit is repaid on the 15th day, and in case the discount is not taken, the payment is due by the 45th day.

Benefits and Costs of Trade Credit

As stated earlier, trade credit is normally available to a firm; therefore, it is a spontaneous source of financing. As the volume of the firm’s purchase increases, trade credit also expands. Suppose that a firm increases its purchases from `50,000 per day to `60,000 per day. Assume that these purchases are made on credit terms of ‘net 45’, and the firm makes payment on the 45th day. The average accounts payable outstanding (trade credit finance) will expand to `27 lakh (`60,000 × 45) from `22.50 lakh (`50,000 × 45). The major advantages of trade credit are as follows:1

Easy availability Unlike other sources of finance, trade credit is relatively easy to obtain. Except in the case of financially very unsound firms, it is almost automatic and does not require any negotiations. The easy availability is particularly important to small firms which generally face difficulty in raising funds from the capital markets.

Flexibility Flexibility is another advantage of trade credit. Trade credit grows with the growth in firm’s sales. The expansion in the firm’s sales causes its purchases of goods and services to increase which is automatically financed by trade credit. In contrast, if the firm’s sales reduce, purchases will decline and consequently trade credit will also decline.

Informality Trade credit is an informal, spontaneous source of finance. It does not require any negotiations and formal agreement. It does not have the restrictions which are usually parts of negotiated sources of finance.

The supplier extending trade credit incurs costs in the form of the opportunity cost of funds invested in accounts receivable and cost of any cash discount taken by the buyer. Does the supplier bear these costs? Most of the time he passes on all or part of these costs to the buyer implicitly in the form of higher purchase price of goods and services supplied. How much of the costs can he really pass on depends on the market supply and demand conditions. Thus if the buyer is in a position to pay cash immediately, he should try to avoid implicit costs of trade credit by negotiating lower purchase price with the supplier.

Is trade credit a cost-free source of finance? It appears to be cost-free since it does not involve explicit interest charges. But in practice, it involves implicit cost. The cost of credit may be transferred to the buyer via the increased price of goods supplied to him. The user of trade credit, therefore, should be aware of the costs of trade credit to make use of it intelligently. The reasoning that it is cost-free can lead to incorrect financing decisions.

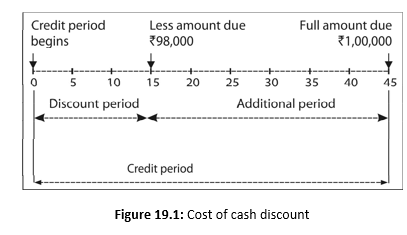

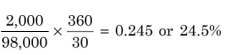

Credit terms sometimes include cash discount if the payment is made within a specified period. The buyer should take a decision whether or not to avail it. A trade-off is involved. If the buyer takes discount, he benefits in terms of less cash outflow, but then he foregoes the credit granted by the supplier beyond the discount period. In contrast, if he does not take discount, he avails credit for the extended period but pays more. The buyer incurs an opportunity cost when he does not avail cash discount. Suppose that the Nirmal Company is extended `1,00,000 credit on terms of ‘2/15, net 45’. As shown in Figure 19.1, Nirmal can either pay less amount (1,00,000 – 0.02 × 1,00,000 = `98,000) by the end of the discount period i.e. the 15th day or the full amount (`1,00,000) by the end of the credit period, i.e., the 45th day. If the firm foregoes cash discount and does not pay on the 15th day, it can use `98,000 for an additional period of 30 days, and implicitly paying `2,000 in interest. If a credit of `98,000 is available for 30 days by paying `2,000 as interest, how much is the annual rate of interest? It can be found as follows:

Implicit interest rate =

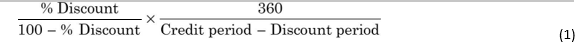

We can also use the following formula to calculate the implicit rate of interest: Implicit interest rate:

Using data of our example, we obtain:

![]()

As the example above indicates, the annual opportunity cost of foregoing cash discount can be very high. Therefore, a firm should compare the opportunity cost of trade credit with the costs of other sources of credit while making its financing decisions.

ACCRUED EXPENSES AND DEFERRED INCOME

For meeting its financing needs, should a company stretch its accounts payable? When a firm delays the payment of credit beyond the due date, it is called stretching accounts payable. Stretching accounts payable does generate additional short-term finances, but it can prove to be a very costly source. The firm will have to forgo the cash discount and may also be required to pay penalty interest charges. Thus the firm will not only be charged higher implicit costs, but its creditworthiness will also be adversely affected. If the firm stretches accounts payable frequently, it may not be able to obtain any credit in future. It may also find it difficult to obtain finances from other sources once its creditworthiness is seriously damaged.

In addition to trade credit, accrued expenses and deferred income are other spontaneous sources of short-term financing.2 Accrued expenses are a more automatic source since, by definition, they permit the firm to receive services before paying for them.

Accrued Expenses

Accrued expenses represent a liability that a firm has to pay for the services which it has already received. Thus they represent a spontaneous, interest-free sources of financing. The most important component of accruals is wages and salaries, taxes and interest.

Accrued wages and salaries represent obligations payable by the firm to its employees. The firm incurs a liability the moment employees have rendered services. They are, however, paid afterwards, usually at some fixed interval like one month. The longer the payment interval, the greater are the amount of funds provided by the employees. Legal and practical aspects constrain the flexibility of a firm in lengthening the payment interval.

Accrued taxes and interest constitute another source of financing. Corporate taxes are paid after the firm has earned profits. These taxes are paid quarterly during the year in which profits are earned. This is a deferred payment of the firm’s obligation and thus, is a source of finance. Like taxes, interest is paid periodically during a year while the firm continuously uses the borrowed funds. Thus accrued interest on borrowed funds requiring semi-annual interest payments can be used as a source of financing for a period as long as six months. Note that these expenses are not postponable for long and a firm does not have much control over their frequency and magnitude. It is a limited source of short-term financing.

Deferred Income

Deferred income represents funds received by the firm for goods and services which it has agreed to supply in future. These receipts increase the firm’s liquidity in the form of cash; therefore, they constitute an important source of financing.

Check Your Concepts

Advance payments made by customers constitute the main item of deferred income. These payments are common in case of expensive products like boilers, turnkey projects, large contracts or where the product is in short supply and the seller has a strong bargaining power as compared to the buyer. These payments are not recorded as revenue until goods and services have been delivered to the customers. They are, therefore, shown as a liability in the firm’s balance sheet.

- What are accrued expenses? Give examples of accrued expenses.

- What is meant by deferred income? What are the examples of deferred income?

- Why are accrued expenses and deferred income sources of short-term finance?

BANK FINANCE FOR WORKING CAPITAL

Banks are the main institutional sources of working capital finance in India. After trade credit, bank credit is the most important source of financing working capital requirements. A bank considers a firm’s sales and production plans and the desirable levels of current assets in determining its working capital requirements. The amount approved by the bank for the firm’s working capital is called credit limit. Credit limit is the maximum amount of funds which a firm can obtain from the banking system. In the case of firms with seasonal businesses, banks may fix separate limits for the peak level credit requirement and normal, non-peak level credit requirement indicating the periods during which the separate limits will be utilized by the borrower. In practice, banks do not lend 100 per cent of the credit limit; they deduct margin money. Margin requirement is based on the principle of conservatism and is meant to ensure security. If the margin requirement is 30 per cent, bank will lend only up to 70 per cent of the value of the asset. This implies that the security of bank’s lending should be maintained even if the asset’s value falls by 30 per cent.

Forms of Bank Finance

A firm can draw funds from its bank within the maximum credit limit sanctioned. It can draw funds in the following forms: (a) overdraft, (b) cash credit, (c) bills purchasing or discounting, and (d) working capital loan.

Overdraft

Under the overdraft facility, the borrower is allowed to withdraw funds in excess of the balance in his current account, up to a certain specified limit, during a stipulated period. Though overdrawn amount is repayable on demand, it generally continues for a long period by annual renewals of the limits. It is a very flexible arrangement from the borrower’s point of view since he can withdraw and repay funds whenever he desires within the overall stipulations. Interest is charged on daily balances—on the amount actually withdrawn—subject to some minimum charges. The borrower operates the account through cheques.

Cash Credit

Purchase or Discounting of Bills

The cash credit facility is similar to the overdraft arrangement. It is the most popular method of bank finance for working capital in India. Under the cash credit facility, a borrower is allowed to withdraw funds from the bank upto the sanctioned credit limit. He is not required to borrow the entire sanctioned credit at once, rather, he can draw periodically to the extent of his requirements and repay it by depositing surplus funds in his cash credit account. There is no commitment charge; therefore, interest is payable on the amount actually utilized by the borrower. Cash credit limits are sanctioned against the security of current assets. Though funds borrowed are repayable on demand, banks usually do not recall such advances unless they are compelled by adverse circumstances. Cash credit is a most flexible arrangement from the borrower’s point of view.

Under the purchase or discounting of bills, a borrower can obtain credit from a bank against its bills. The bank purchases or discounts the borrower’s bills. The amount provided under this agreement is covered within the overall cash credit or overdraft limit. Before purchasing or discounting the bills, the bank satisfies itself as to the creditworthiness of the drawer. Though the term ‘bills purchased’ implies that the bank becomes owner of the bills, in practice, bank holds bills as security for the credit. When a bill is discounted, the borrower is paid the discounted amount of the bill (viz., full amount of bill minus the discount charged by the bank). The bank collects the full amount on maturity.

To encourage bills as instruments of credit, the Reserve Bank of India introduced the new bill market scheme in 1970. The scheme was intended to reduce the borrowers’ reliance on the cash credit system which is susceptible to misuse. It was also envisaged that the scheme will facilitate banks to deploy their surpluses or deficits by rediscounting or selling the bills purchased or discounted by them. Banks with surplus funds could repurchase or rediscount bills in the possession of banks with deficits. There can be situation where every bank wants to sell its bills. Therefore, the Reserve Bank of India plays the role of the lender of last resort, under the new bill market scheme. Unfortunately, the scheme has not worked successfully so far.

Letter of Credit

Suppliers, particularly the foreign suppliers, insist that the buyer should ensure that his bank will make the payment if he fails to honour its obligation. This is ensured through a letter of credit (L/C) arrangement. A bank opens an L/C in favour of a customer to facilitate his purchase of goods. If the customer does not pay to the supplier within the credit period, the bank makes the payment under the L/C arrangement. This arrangement passes the risk of the supplier to the bank. Bank charges the customer for opening the L/C. It will extend such facility to financially sound customers. Unlike cash credit or overdraft facility, the L/C arrangement is an indirect financing; the bank will make payment to the supplier on behalf of the customer only when he fails to meet the obligation.

Working Capital Loan

A borrower may sometimes require ad hoc or temporary accommodation, in excess of the sanctioned credit limit, to meet unforeseen contingencies. Banks provide such accommodation through a demand loan account or a separate non-operable cash credit account. The borrower is required to pay a higher rate of interest above the normal rate of interest on such additional credit.

Security Required in Bank Finance

Banks generally do not provide working capital finance without adequate security. The following are the modes of security which a bank may require.

Hypothecation

Under hypothecation, the borrower is provided with working capital finance by the bank against the security of movable property, generally inventories. The borrower does not transfer the property to the bank; he remains in the possession of property made available as security for the debt. Thus, hypothecation is a charge against property for an amount of debt where neither ownership nor possession is passed to the creditor. Banks generally grant credit hypothecation only to first class customers with highest integrity. They do not usually grant hypothecation facility to new borrowers.

Under this arrangement, the borrower is required to transfer the physical possession of the property offered as a security to the bank to obtain credit. The bank has a right of lien and can retain possession of the goods pledged until payment of the principal, interest and any other expenses is made. In case of default, the bank may either (a) sue the borrower for the amount due, or (b) sue for the sale of goods pledged, or (c) after giving due notice, sell the goods.

Pledge

Mortgage

Mortgage is the transfer of a legal or equitable interest in a specific immovable property for the payment of a debt. In case of mortgage, the possession of the property may remain with the borrower, with the lender getting the full legal title. The transferor of interest (borrower) is called the mortgagor, the transferee (bank) is called the mortgagee, and the instrument of transfer is called the mortgage deed.

The credit granted against immovable property has some difficulties. They are not self liquidating. Also, there are difficulties in ascertaining the title and assessing the value of the property. There is limited marketability, and therefore, security may often be difficult to realize. Also, without the court’s decree, the property cannot be sold. Usually, for working capital finance, the mode of security is either hypothecation or pledge. Mortgages may be taken as additional security.

Lien

Lien means right of the lender to retain property belonging to the borrower until he repays credit. It can be either a particular lien or general lien. Particular lien is a right to retain property until the claim associated with the property is fully paid. General lien, on the other hand, is applicable till all dues of the lender are paid. Banks usually enjoy general lien.

Commercial paper (CP) is an important money market instrument in advanced countries like USA to raise short-term funds. In India, on the recommendation of the Vaghul Working Group, the Reserve Bank of India (RBI) introduced the commercial paper scheme in the Indian money market in 1989. Commercial paper, as it is known in the advanced countries, is a form of unsecured promissory note issued by firms to raise short-term funds. The commercial paper market in the USA is a blue-chip market where financially sound and highest rated companies are able to issue commercial papers. The buyers of commercial papers include banks, insurance companies, unit trusts and firms with surplus funds to invest for a short period with minimum risk. Given this investment objective of the investors in the commercial paper market, there would exist demand for commercial papers of highly creditworthy companies.

Eligibility, Use and Maturity

In India, the Reserve Bank of India regulates the issue of commercial papers. Those companies are allowed to issue commercial papers which have a tangible net worth of

`5 crore, i.e., `50 million, the fund based working capital limit of not less than `5 crore, and the firm should be listed and it is required to obtain necessary credit rating from credit rating agencies. The minimum current ratio should be 1.33 : 1. All issue expenses will be borne by the issuing company. These norms imply that only the large, highly rated companies are able to operate in the commercial paper market in India. In fact, in USA it is mostly the largest companies that raise funds from the commercial paper market. However, recently some smaller companies and large foreign companies have been able to tap the commercial paper market in USA. A company can issue CPs amounting to 75 per cent of the permitted bank credit.

The Vaghul Working Group had recommended that the size of a single issue should be at least `1 crore and the size of each commercial paper should not be less than `5 lakh. The RBI had provided for the minimum issue of `25 lakh (rather than `5 lakh as recommended by the Vaghul Committee).

What is the maturity of commercial papers? In the USA it runs from 1 to 270 days. In India, on the other hand, the maturity runs between 91 to 180 days. In USA, the commercial paper market existed for long period, but the use of commercial paper started since the World War II and increased in a significant way during 1960s and 1970s because of the tight money conditions. In recent years, some US companies have made aggressive use of commercial papers and have used them even for the partial financing of the long-term assets. In India, it is expected that commercial paper will be used only for short-term financing and as an alternative source of finance to bank credit and other short-term sources. Since the beginning of 1993, the volume of CPs has significantly increased because of the large surplus funds available from the banking sector as well as the limited availability of other assets. On 31 August 2003, the commercial papers total amount outstanding was `7,646 crore. The low and high interest rates were, respectively, 5 per cent and 6.65 per cent, showing a spread of 165 basis points.

Cost

Though the Reserve Bank of India regulates the issue of commercial paper, the market determines the interest rate. In advanced countries like USA, the interest rate on a commercial paper is a function of prime lending rate, maturity, credit-worthiness of the issuer and the rating of the paper provided by the rating agency. In the USA two main rating agencies— Standard & Poor’s and Moody’s—have three-point rating schemes with the safest paper rated 1 and the riskiest 3. In India, there are three rating companies – CRISIL, CARE and ICRA that provide ratings for CPs. CRISIL awards P1 plus, P1, P2 plus, and P2 ratings for CPs, and ICRA awards five ratings: A1 plus, A2, A3, A4 and A5. Rating depends on debt obligations, cash accruals, unused cash credit limits and tradable securities like units.

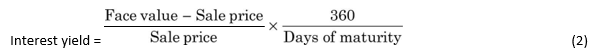

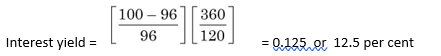

Interest rate on commercial paper is generally less than the bank borrowing rate. A firm does not pay interest on commercial paper rather sells it at a discount rate from face value. The yield calculated on this basis is referred to as interest yield. The interest yield can be found as follows:

Sales price will be net of flotation costs associated with the issue of commercial paper. Suppose a firm sells 120-day commercial paper (`100 face value) for `96 net, the interest yield will be 12.5 per cent:

0.125 (1 – 0.35) = 0.0813 or 8.13 per cent.

Interest on CP is tax deductible: therefore, the after-tax interest will be less. Assuming that the firm’s marginal tax rate is 35 per cent, the after-tax interest yield is 8.13 per cent:

In India, the cost of a CP will include the following components:

discount rating charges stamp duty issuing and paying agent (IPA) charges

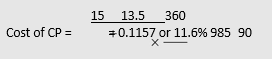

ILLUSTRATION 19.1: Cost of Commercial Paper

Suppose a company issues a 90-day CP of a face value of `1,000 at `985. The credit rating expenses are 0.5 per cent of the size of issue, IPA charges being 0.35 per cent and stamp duty 0.5 per cent. What is the cost of CP?

The discount is `15 and rating and IPA charges and stamp duty amounts to: 1.35 per cent × `1,000 = `13.5. Thus, the cost of CP is:

Merits and Demerits

There are two important advantages of commercial paper from the issuing firm’s point of view: It is an alternative source of raising short-term finance, and proves to be handy during periods of tight bank credit.

It is a cheaper source of finance in comparison to the bank credit. Usually, interest yield on commercial paper is less than the prime rate of interest.

From an investor’s point of view, it provides an opportunity to make a safe, short-term investment of surplus funds.

The following are the limitations of this source of financing:

It is an impersonal method of financing. If a firm is unable to redeem its paper due to financial difficulties, it may not be possible for it to get the maturity of paper extended. It is always available to the financially sound and highest rated companies. A firm facing temporary liquidity problems may not be able to raise funds by issuing new paper. The amount of loanable funds available in the commercial paper market is limited to the amount of excess liquidity of the various purchasers of commercial paper. It cannot be redeemed until maturity. Thus if a firm doesn’t need the funds any more, it cannot repay it until maturity and will have to incur interest costs.

Check Your Concepts

- What is a commercial paper? What are its merits and demerits as a source of short-term finance?

- What is the cost of issuing a commercial paper?

Summary

Trade credit refers to the credit that a buyer obtains from the suppliers of goods and services. Payment is required to be made within a specified period. Suppliers sometimes offer cash discount to buyers for making prompt payment. Buyer should calculate the cost of foregoing cash discount to decide whether or not cash discount should be availed. The following formula can be used: % Discount 360

Most important shortterm sources of financing current assets are: (a) trade credit,

(b) deferred income and accrued expenses, and

(c) bank finance. The first two sources are available in the normal course of business, and therefore, they are called spontaneous sources of working capital finance. They do not involve any explicit costs. Bank finances have to be negotiated and involve explicit costs. They are called nonspontaneous or negotiated sources of working capital finance. Two alternative ways of raising shortterm finances in India are: factoring and commercial paper.

![]()

A buyer should also consider the implicit costs of trade credit, and particularly, that of stretching accounts payable. These implicit costs may be built into the prices of goods and services. Buyer can negotiate for lower prices for making payment in cash.

Accrued expenses and deferred income also provide some funds for financing working capital. However, it is a limited source as payment of accrued expenses cannot be postponed for a long period. Similarly, advance income will be received only when there is a demand–supply gap or the firm is a monopoly.

Bank finance is the most commonly negotiated source of the working capital finance. It can be availed in the forms of overdraft, cash credit, purchase/discount of bills and loan. Each company’s working capital need is determined as per the norms. These norms are based on the recommendation of the Tandon Committee and later on, the Chore Committee. The policy is to require firms to finance more and more of their capital needs from sources other than bank. Banks are the largest providers of working capital finance to firms.

Commercial paper is an important money market instrument for raising shortterm finances. Firms, banks, insurance companies, individuals etc. with shortterm surplus funds invest in commercial papers. Investors would generally invest in commercial paper of a financially sound and creditworthy firm. In India, commercial papers of 91 to 180 days maturity are being floated. The interest rate will be determined in the market. The yield on commercial paper can be calculated as follows:

CP yield = [Face value – Sale price / Sale price] × [360 / Days to maturity]