5.1 When should Security be taken?

No amount of security will make a poor lending proposition viable. Banks are not pawnbrokers, who lend against the pledge of an asset. Banks wish to know that a customer’s borrowing plans are viable, particularly those concerning repayment of the borrowing. Where loans are granted to purchase a specific asset, e.g. a building, the lender would clearly look to the security of that asset.

Similarly, when a bank is lending pending repayment from sale of an asset, e.g. bridging finance, then a charge over the asset to be sold would be expected. Other cases where security may be sought are treated on their own merits. If the source of repayment is not, in the lender’s eyes, fully certain, and there is no readily available alternative source, then it is better to ask for security.

5.2 Assessment of Risk

The decision whether to take security or not should be based on risk; ask whether;

Budgets and forecasts are in line with what has gone before?

Projected sales are supported by firm orders?

The figures stand up to sensitivity analysis of possible falls in sales volumes or

increases in costs/

Gearing is high (above 70% say) or interest cover below 3x?

The bank has had good experience of previous management forecasts?

5.2 Gone concern break-up analysis

If a business is forced into insolvency, you need to be able to assess the risk of any loss on your lending by analysis the business’s assets on a ‘gone concern’ basis before lending. If there is likely to be a shortfall of assets over liabilities on this basic, then it is

an indication that you should take security to cover it.

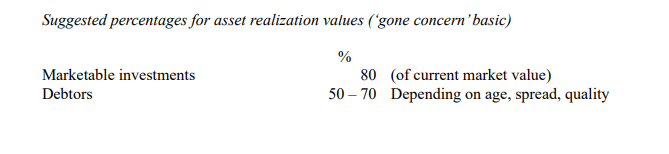

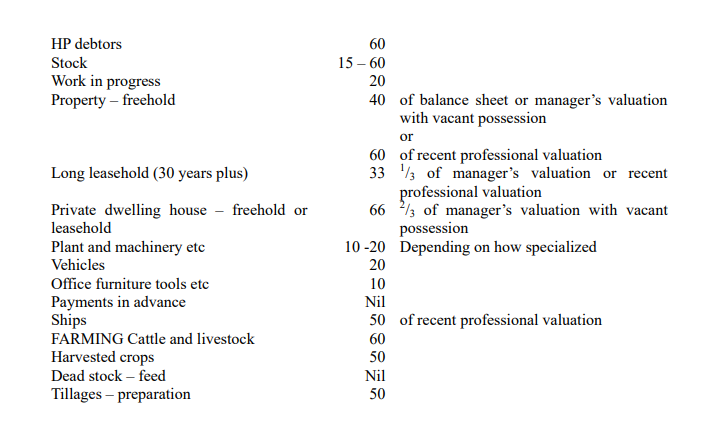

Break-up values can be calculated from the latest audited (or reliable interim) figures and the balance sheet figures may be substantially reduced by this exercise. Below is suggested percentage values of balance sheet figures to be used but, here again, these will vary from bank to bank, and depend on individual circumstances. Experience shows, however that amounts raised in realizations are almost always far less than expected.

Some of the reasons for this are that:

- If trading ceases, assets lose value i.e. work in progress is worth little if unfinished, and finished goods are difficult to dispose of once it is known that the business is likely to close. Many small traders make a good living buying ‘bankrupt stock’ at rock bottom prices for resale on market stalls.

- The book values of the assets will be historical, and they have probably not been amended in line with market conditions.

- The book value of fixed assets assumes that they have no other use. In addition, land and buildings may need planning permission for any change of use.

- If a business is short of cash, it is unlikely to maintain its fixed assets in good condition, e.g. vehicles may not have been serviced, premises may not have serviced, and premises may not have decorated.

- If there is a general recession hitting the trade or area, the market for the assets will be well depressed. Short leases, particularly, may well be worthless or contain insolvency clauses enabling the lessor to regain possession.

- When a business fails, its debtors look for reasons not to pay. These include breach of contact, poor quality, denial of receipt of goods, contra items and perhaps, set off-the last of course being perfectly legitimate.

Note: Whilst it is the intention that these percentages are to be adopted in the majority of cases, they are not regarded as rigid. If it is felt necessary to include a different valuation, the percentage and the reason should be stated.

Check the percentages used by your bank lending managers when allocating values to balance sheets assets on a ‘gone concern’ basis. Compare them with the above figures.

5.3 Security and Margins

It is unlikely that in most cases realization of security will produce 100% of the valuation. The longer the period between taking the security and the bank’s sale of it, the more the divergence in valuation will be. In addition, costs of sale (including insurance and

maintenance) and unpaid interest will eat into the net proceeds available to repay the original borrowing. Banks therefore try to leave a margin between the value of the security and the maximum amount they will lend to cover such contingencies to ensure

that sufficient funds will remain to repay them if the borrower fails.

5.4 Debentures

A modern bank debenture will normally be secured by:

1. A legal first charge over freehold and leasehold property including building and trade fixtures and plant and machinery fixed to the floor. (Do not confuse these with fixed assets in the balance sheet which also include movable assets.)

2. An equitable first charge on all future freehold and leasehold property including fixtures.

3. A legal first charge over all book debts and other debts now and from time to time owing and over goodwill and uncalled capital.

4. A floating charge over all other assets both present and future, typically stock, movable plant and machinery and motor vehicles.

5. A floating charge over intellectual property rights.

A floating charge should be taken while the company can still be proved to be solvent, otherwise the charge will be set aside under s. 245. Insolvency Act 1986 if the company becomes insolvent within 12 months of the charge being granted or as a consequence of it

being granted. More commonly, sufficient credit turnover should have passed through the account to cover the debit balance on the date the charge was created (Clayton’s case).

Perhaps the most important reason for taking a floating charge over all or substantially all of the company’s assets is that it enables the floating charge holder to appoint an administrative receiver and thereby effectively control the company’s liquidation.

In a company winding up, the order of priority of payments from asset sales is:

- The expenses of the winding up.

- Holders of fixed charges – from the sale of the assets charged.

- Preferential creditors

- Holders of floating charges

- Unsecured creditors.

- Shareholders

You should be aware of the probability of retention of title clauses (Romalpa clauses) enabling a supplier to retain title of goods supplied until he is paid in full. If a substantial proportion of the assets consists of stock and debtors, then the terms of trade and

purchase involves need to be examined for retention of title clauses before giving any value to those assets. As general guidance (in a difficult legal area) Romalpa problems usually only arise where the goods supplied can be identified and remain in their original

supplied state and have not been combined with other goods during manufacturing. Also watch for ‘all monies’ retention entitlements, i.e. applying to all sums owing to the supplier and not just sums owed on the particular contract of supply. Remember, too, that

Romalpa can work both ways, and your customer may be imposing such term s on his customers.

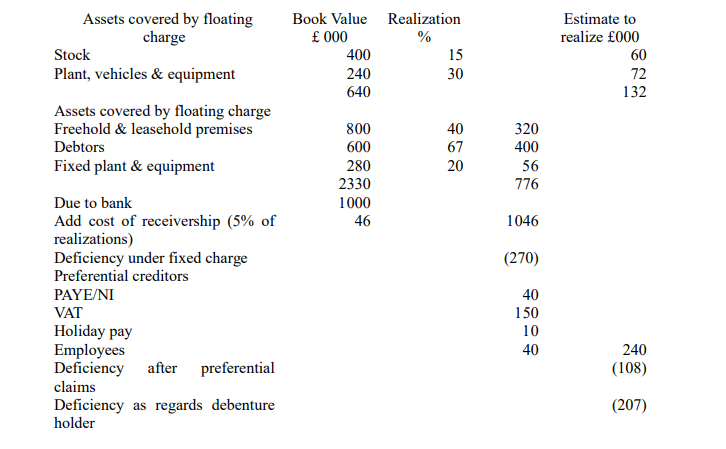

Valuation of debentures

Below is the examiner’s own example of an actual debenture valuation, showing that despite total assets of £ 2.32 million against borrowing of £ 1million the bank as debenture holder still finished up with a £ 270,000 loss. It is based on a real and typical

case and shows the impact of applying discount factors to book values.

In this example a loss of £ 270,000 was incurred despite apparently being more than twice covered by total assets on book values. It illustrates two import ant lessons.

A floating charge often has only limited value.

The need for a strong debenture formula if this is the bank’s prime security.

5.5 Summary of Lending Considerations

Before moving on to look at various specialist aspects of lending, recap the areas you need to consider when analyzing lending propositions and take a brief look at how the examiner likes a candidate’s answer to be set out.

Lending considerations review

The customer

- How long has he/she been known to you and what is the worth of the relationship?

- Does he/she live locally? The business will be easier to monitor if so.

- Who exactly are you lending to? Take particular care in group situations. Satisfying yourself that you are clear on this matter.

The business

Consider:

- The type of business involved

- What opportunities or threats face businesses in this line?

- How does your customer compare with others in the same sector?

- Ensure that the supplier / customer bases are well spread and sound and the geographical, market and product spreads are well diversified.

The management

Consider

- Is there a good spread of management expertise in all areas such as production, marketing and financial skills with a sufficient background of relevant experience?

- Are management and business objectives clearly defined?

- Is there evidence of good internal financial control?

- Ensure that the business is not over-reliant on one man (consider keyman insurance) and that suitable deputies / successors have been trained to step in if needed.

The lending proposition

Consider

- The borrowing requested should be sufficient, realistic and of the correct type for the purpose, which should be properly defined.

- The term requested should match the purpose and the resulting repayment requirements should be well within the customer’s ability. Consider whether a capital repayment holiday is appropriate.

- Be clear about what the borrower is contributing to the proposition and ensure it is already in place or definitely available when required.

The financial information

Consider

- How reliable are the accounts presented to you? If not audited by reputable accountants (and unqualified) have you good reason based on past experience, to trust unaudited or internally prepared interim or management figures?

- The last three years’ audited accounts should be available and copies should be produced promptly to you as soon as available. Check for any unusual accounting practices by reading the notes to the accounts.

- Compare and contrast the usual ratios and examine the underlying figures if sudden changes occur.

- Up-to-date management accounts including balance sheet profit and loss account, cash flow analysis and debenture figures should be the minimum provided in most cases.

- Watch for deterioration in quality if internal systems or personnel change.

- Diarize for receipt of regular future figures.

- How well do management accounts compare with eventual audited accounts when received?

- Are forecast figures realistic in terms of past performance market place, competition, economic situation and any other relevant factors? Monitor them with actual figures when available.

Security

Consider

- Is security sensibly valued standard security margin formulae are helpful as guide, but use common sense to assess actual worth

- Do not allow drawdown of borrowing until the security agreed is deposited and all necessary formalities are complete. If in doubt about the worth of the security held, seek professional valuations from reputable valuers and update regularly.

- Where debentures / fixed and floating charges are held, you will need to insist on regularly updated internal management figures for the underlying assets to enable regularly.

- Ensure covenants are fully compiled with.

- Ensure all assets charged to the bank are fully insured.

- When lending to groups of companies, full cross-guarantees tying in all group members should be taken.

- If possible take charges over security to support guarantees, which otherwise should not be relied upon.

Other lending relationships

Consider

Is there evidence in the balance sheets of the customer enjoying facilities from other providers of finance and consider how your security may be affected b charges held by them.

Get full details of other financial facilities from the customer, supported by documentation if possible.

Remuneration

Consider

- Agree on interest, commission, fee and securities charges.

- Interest rates and fees for contingent liabilities should reflect the risk involved to the lender.

Other issues

Consider

- The quality of the borrower’s financial advisers. As businesses grow they can, for example, outgrow their accountants.

- What are the implications of getting involve d with environmentally unsound or politically incorrect customers.

5.6 Layout of Examination Answers

The examiner’s preferred lending application format is shown below.

1. Introduction

Nature and history of the business.

Purpose / amount / period

2. Market and products

3. Physical and production resources

4. Assessment of management

5. Trading performance

6. Projected financial position

7. Management information and controls

8. Security and conditions

9. Remuneration

10. Summary and recommendations