6.1 How to Identify Problems Early

Unlike most retailers, lending bankers cannot sit back and relax once the product has been sold. The risk continues until the borrowing is fully repaid, and regular monitoring of the accounts is necessary to spot the vital early warning signs which may indicate that a formerly profitable account is about to turn into an expensive write-off. The earlier problems are identified, the sooner corrective action can be taken. It should be obvious that the bank must automatically monitor the customer’s actual performance against his budget and cash flow forecast. To this end a condition of lending is often that up-to-date management figures be produced to the bank within a certain period. At the same time assessments of debenture values should be updated, and formulae monitored. Any excesses over agreed limits must also be invested promptly. But what other areas can you keep an eye on to help avoid unpleasant surprises?

6.2 Danger Signs

You need to watch the following areas. If any of the signs appear it does not automatically signify problems but could do, particularly if several appear close together.

Internal records

Look for:

- Unauthorized excesses.

- Turnover increasing or decreasing unusually

- Hard-core borrowing appearing on current accounts

- Unpaid cheques in and out;

- Cheques for round amounts

- Uncleared effects – possible cross firing.

- Special collections in or out

- Status enquiries in or out

- County court judgment.

- New standing orders / direct debits to finance companies.

- Stopped cheques in and out

- Unusual cash withdraws

- Local news, rumour, information from staff about problems.

Visits or interviews

Look for:

- Difficulties in getting hold of directors

- Lack of long-term plans

- Failure to meet orders

- Reliance on one supplier or customer

- Buying goods offered cheaply without forward planning

- Diversification

- Delays in cash coming in

- Request for release of security (particularly third party)

- Changes in terms of trade.

- Idle assets (effect on return on capital employed)

- Dead stock

- Pressure from creditors

- Management changes, succession, balance, ability to react to changes.

- Changes in attitude since last meeting

Audited accounts

Look for

- Evidence of new borrowing elsewhere

- High gearing

- Small surplus or losses

- Accounts late or only draft

- Two sets of accounts

- Auditors changes or unusually high audit fee

- Auditors’ certificate qualified

- Other bankers

- Revalued assets

- Figures not tying in with management accounts or debenture figures

Management accounts

Look for

- Late, non-existent or sketchy accounts

- Debenture formula breached

- Figures not tying in with previous figures or with last audited accounts

- Increase in preferential creditors

- Targets not met

- No assumptions with forecast

- Losses

- Margins of safety small or reducing

- Customers lost or not well spread

- Pricing by guesswork

- Arithmetic wrong

6.3 Action to be taken as soon as Possible

If the above monitoring confirms that there is cause for concern, then you must take prompt and positive action on the following lines.

- Discuss matters with the customer. Very occasionally warning signs can mislead and you will find that there is no problem.

- Collect as much information as possible

- Consider what is known – do you need to know more?

- Check your existing security – is it compete and effective?

- Set objectives for the way forward. At this stage you may have to decide t accept some eventual loss.

- Obtain the borrower’s understanding of, and commitment to, any plans for repayment, particularly timing and amounts. Get agreement in writing if possible.

- Take firm control of the position. If agreements are not carried out by he customer, take speedy and firm action. Do not make threats you cannot or will not carry out if needs be.

- Keep your superiors/head office advised of the situation, taking care to obtain their permission (if required) for any legal action.

6.4 Remedial Action

Financial difficulties in businesses usually arise in the first instance through lack of cashflow rather than lack of profits and in the long, running out of cash is the most common cause of insolvency. If a company is having problems, then it needs first of all to improve its cashflow by improving profit margins or fully utilizing business assets. A good way to examine the possibilities is to take a close at the main constituents of the balance sheet and profit and loss account to see where improvements can be made.

Example 6.1

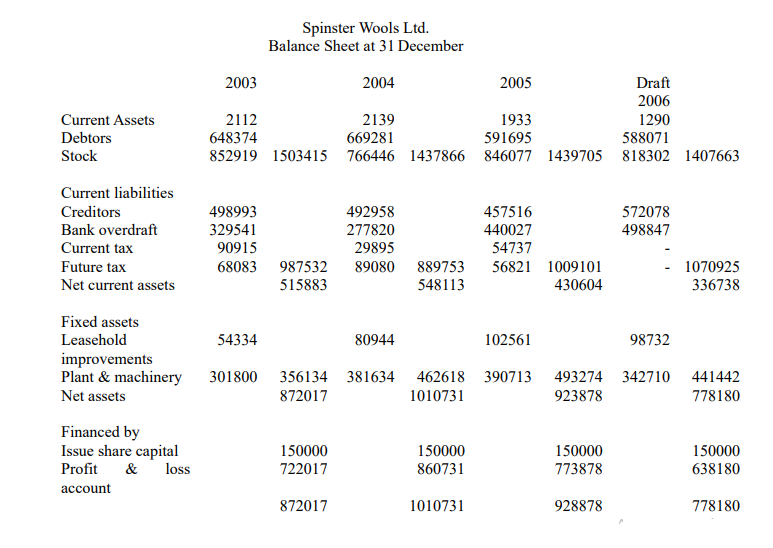

Spinster Wools Ltd manufacture hand knitting wool yarns mainly sold direct to retailers. They have banked with you for over 30 years and until recently have always been profitable; despite periods when had knitting has gone out of fashion. Two years ago there was a sudden drop in the market for hand knitting wools. The directors of Spinster expected this drop to be temporary, but market conditions have continued to worsen. A recent article in the Financial Times has speculated that the market for hand knitting wool might reduce by a further 20% before any recovery takes place.

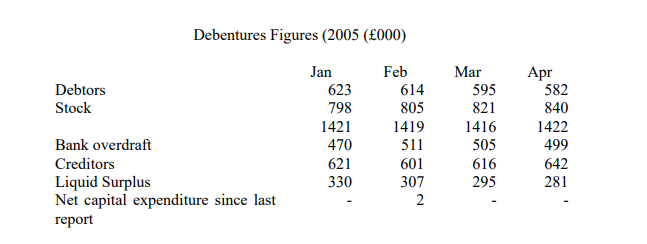

The company currently has an overdraft limit of £500,000. Last year, as a condition of continuing the facility, you took a debenture as security with a formula of 1.5 times cover of the overdraft by debtors and 2.5 times debtors and stock. Recently there has been pressure on the limit, excesses have occurred and the debenture formula has been breached.

The directors have sent you copy of draft accounts for 2006. They now call and tell you:

- They require an increased overdraft limit of £600,000 to see the company over the traditionally poor summer sales period.

- Their auditors are of the opinion that they should write down the value of stocks by £300,000.

- They will be unable to restore the debtor element of the debenture formula and, if the stock write down takes place, will not be able to be reduced to 1 times debtors and 2 times debtors and 2 times debtors and stock.

Set out, with reasons, the response you would make to the directors of Spinster Wools Ltd and also your immediate action plan.

To do this you must have a clear understanding of ratio analysis and a deal of common sense. You should address the following issues – but remember, the list is a prompt, not an exhaustive summary.

- The company’s previous history.

- The market within which the company now operates.

- The quality of its management.

- The nature of its stock.

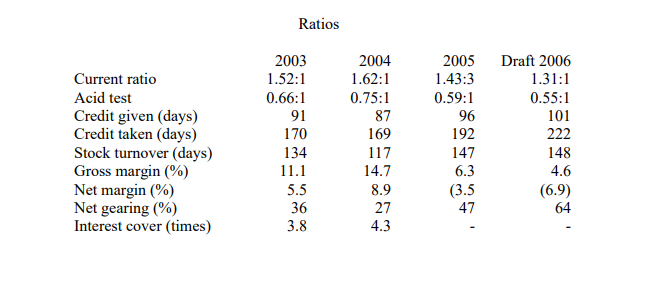

- An assessment of the ratios you are given.

- Which ratios will be affected by the stock write-off?

- The nature of the company’s debtor book

- What is the effect of relaxing the debenture formula?

- How safe is the bank at the present limit?

- How safe will the bank be at the requested limit?

- Would you agree to help as requested? If not, what?

Solution

Background information

This is a long-standing customer whom you would wish to help if possible. The business has a track record of good performance and profitability. But, it is a one-product company trapped in a declined market. Market conditions are unlikely to improve in the immediate future. The management do not appear to be doing very much about the situation i.e. no redundancy programme etc.

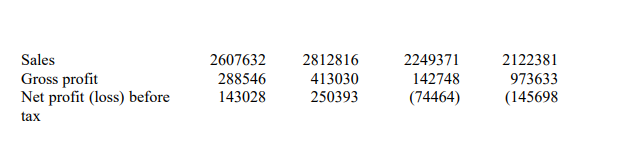

Financial analysis

Capital structure

Gearing is at acceptable levels but is deteriorating and after the stock write-off is likely to get worse. Capital expenditure appears to have been financed by short-term borrowing. There will be a further reduction in Net Total Assets (NTAs) if the stock write-off takes

place which it obviously should). The true NTA figure has probably been overstated in the recent past if the stock has been overvalued.

Liquidity

Current ratio and acid test are deteriorating steadily but on the audited figures are still just about at acceptance levels. However, the debentures figures indicate that this will not be the case after the stock write-off. Credit given is rising: this is a surprising trend given the company’s need for cash. Are all the debtors good?

Stock taken is rising to uncomfortable levels and there is probably creditor pressure. Stock turnover is poor, reflecting the unsaleable stocks identified by the auditors.

Profitability

The gross margin has deteriorated steadily suggesting increasing pressure on prices in the poor market. The net losses are getting worse as sales fall and margins are squeezed. The debenture figures indicate further losses despite the winter being the ‘good reason’. With the predicted further market fall and the advert of the poorer summer season things are going to get worse rather than better.

Bank account

The pressure on the limit and the excesses suggest creditor pressure.

The debenture figures show a hard-core not far short of the limit.

The increased limit is needed to meet the cash shortfall but there ought to be some detailed projections made.

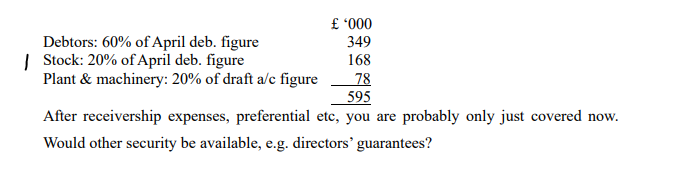

Security

The debenture formula has been breached (the debtor element) for some months and it is arguable that the bank has been slow to react. There is no way the formula can be maintained in the foreseeable future but would the bank be safe if it was relaxed as

requested?

The debtors are the best asset but small wool shops are probably having a hard time as well. Are they good? You need a detailed analysis.

A break-even would look something like this:

Decision

There is a dearth of good management data on which reach a conclusion where more information is needed. Losses are likely to continue so the bank’s risk will increase further if nothing is done. Relaxing the debenture formula is the same as releasing security at a time when risk is increasing and would be agreed with great reluctance. A thorough investigation of the company is required, investigating accountants should be appointed. Overall it is difficult to see how receivership can be avoided.

Services

In this situation, it is that any services would be marked. This question requires an appreciation of the risks of rapidly expanding an under capitalized business, the risks in documentary credit liabilities and the problems of high fashion goods as security