7.1 Appraisal of farming customers

The financial statements of a farming business

These consist of:

- Audited accounts for the past three years.

- A specially formulated ‘farmers balance sheet’ or ‘statement of assets or liabilities’, usually on the bank’s standard forms.

- A cash flow forecast (supported by operational and capital budgets).

- Gross margin budgets.

- A calculation of the ‘rental equivalent’ of the business – this can be expressed as a cost per effective ace or as a percentage of gross output.

We examine each of these in due course.

Before lending to a f arming customer, you will wish to take a close look at the far m and the farmer and a visit to the far m is essential to investigate the:

- Effective acreage of the farm, ignoring nonproductive areas of building, woodland, water etc.

- Quality of stocking and cropping on the farm.

- Layout of the farm – accessibility of fields for milking, convenience for ploughing etc.

- Capacity and condition of buildings – housing for animals and storage for crops/

- Farmer’s experience and management ability.

- How close is the farmer to the business? If not very close, has he good quality staff and communications in places?

- What succession plans has the farmer put into operation – family managers/

- Check budgets against past performance!

7.2 The Farmer’s Audited Accounts

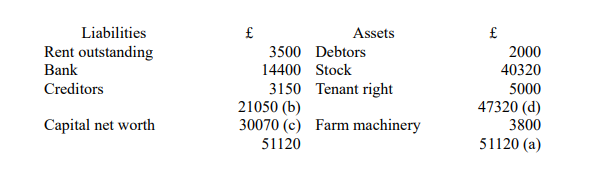

The accounts may well be historic but it is well worth looking at the balance sheet The following simplified balance sheet illustrates what can be revealed and whether certain items might require further investigation.

- Total assets (a) – are there any intangibles or fictitious assets?

- Total debts (b) – debt structure long / short-term?

- Total assets (a) : total debts (b) – debts should be well covered.

- Net worth (c), i.e. total debts minus total debts. This is the margin or buffer for the business. (This could well be understated).

- Total assets (a) current assets (d) – what is the proportion of quickly realizable assets?

- Current assets (d): total debts (b) – this represents the liquidity of the business.

Can current debts be repaid without resorting to sale of fixed assets?

Then after examining the trading and profit and loss account record:

Stock: sales turnover – dependent on type of farm enterprises.4

Debtors: sales – debtors figure in farming should be well covered.

Profits – are they being earned and retained? Look at the resulting profit and loss account balance.

Then the bank lending

Net worth: bank lending

Net worth: total liabilities – is the balance being maintained or deteriorating?

All these ratios become more meaningful when you compare trends over several years’ balance sheets, It is dangerous to make a judgment on the year’s figures in isolation.

Limitations of audited accounts

Some of the limitations are:

Purpose. The accounts are often prepared for taxation purposes only. They may therefore not give a true indication of the net worth of the business.

- Land, building an machinery may well be undervalued on a cost less depreciation basis.

- Stock may be undervalued and the accountant could accept the farmer’s valuation without verifying this.

- Sales involves could be carried forward into the next accounting period, therefore reducing profits earned.

- There may be long delays between the date of audit and the date to which the accounts refer. They may well be 12 – 18 months out of date before you see them.

- Individual firms of accountants may apply different interpretations to certain items in the accounts.

- The basic of valuation of a number of items may differ from the current value. However you could express these reservations about the accounts of many other businesses.

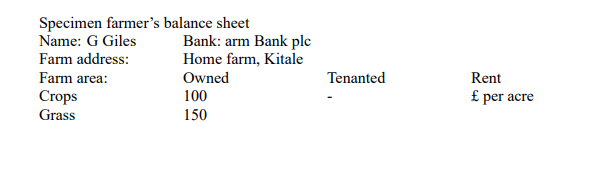

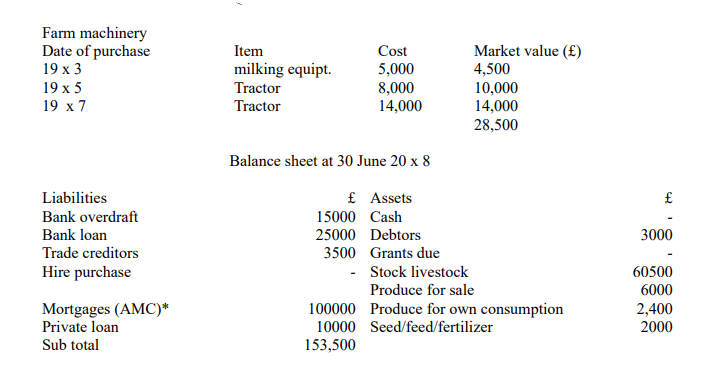

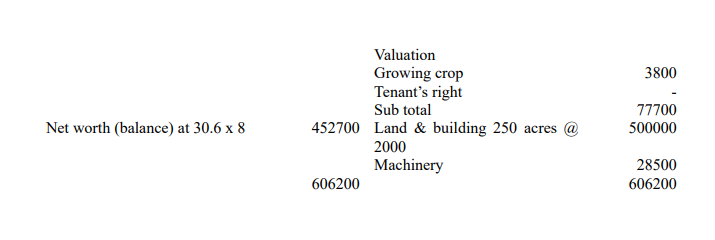

7.3 The Farmer’s Confidential Balance Sheet /Statement of Asset and Liabilities.

This is a management document and not an audited financial statement which provides an up to date statement of the:

- Assets and liabilities of the farmer’s business, at realistic market values; and

- Net worth of the business, which is the difference between total assets and total liabilities, also at a realistic market value. The net worth of the business is the value of the proprietor’s stake.

Other items

Contingent liabilities None

Leasing None

Non farming assets Endowment policy with a current surrender value of £ 4,800

*Agricultural Mortgage Corporation plc

In the case of dairy farmers it would be appropriate to note the amount of quota allocated and its open market value.

Interpretation of farmer’s statement

A farmer’s balance sheet, if prepared annually, gives an indication of changes in the net worth of the business over time. Increases in net worth would indicate either retained profits or an increase in the valuation of fixed assets. The net worth of a business gives an

up to date market valuation of he farmer’s investment in his business.

Te farmer’s balance sheet also gives a picture of the asset structure of the business and the value of assets per acre. Since freehold land is very expensive, it will be more useful for comparing the assets of a farm against what is ‘normal’ to calculate the value per acre

of total assets less freehold land and building i.e. ‘tenant’s assets per acre’.

The normal ‘value’ will vary from region to region and between different f arming activities (daily, arable etc). The value of tenant’s assets per acre of the farm under review can be compared with that of other farmer customers.

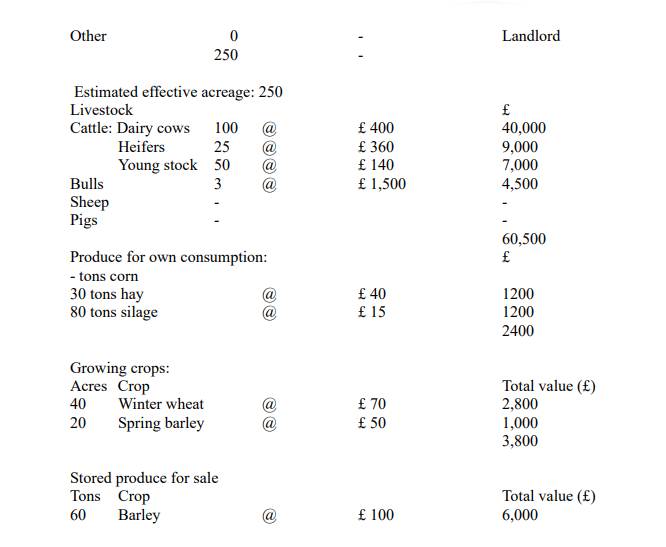

7.4 Farmer’s Assets

The assets of a farm will depend on whether a farm is owned or tenanted and on the type of farming undertaken.

Physical assets

Note of the following physical assets shown in a farmer’s balance sheet.

- Land and building – if owner occupied, land will be the major item.

- Farm machinery

- Livestock

- Crops in process of growing – usually valued at cost of valuable inputs (seed, fertilizer etc) consumed to get them to present state.

- Harvested crops not yet sold.

- Harvested crops kept for own consumption e.g. animal feed such as silage or hay.

- Stock of fertilizer, seed, purchased feed, pesticides etc.

The farmer’s balance sheet will of course also include such items as debtors, creditors, cash or bank overdraft.

Hidden assets and farmland values

There may be a hidden reserve in the valuation of the farmland. This must be taken into account when assessing the customer’s stake in a lending proposition. Examples are:

- The farmer owns the land, but the value in the audited accounts is below its current market value.

- A tenant farmer buying land he currently rents will pay less than the open market price with vacant possession, the landlord usually making allowance for the tenant’s improvements to land and buildings.

7.5 Rental Equivalent

The most important financial statements for assessing the ability of the farmer to serviceva loan are the budget and cash flow forecast. A rough and ready guide to help with assessing the farmer’s ability to repay is an estimate of the farmer’s rent and finance

charges per annum, referred to as the ‘rental equivalent’ of the business. The total rental equivalent per annum is then divided by the total acreage to obtain a ‘rental equivalent’ per acre. It is useful to discuss this with the farmer who usually has a ‘gut feeling’ as to the level of rental equivalent per acre that he can cope with successfully.

The figure is calculated by including the following charges per annum.

Rent and rates X

Bank overdraft interest X

Bank loans interest and capital repayments X

Agricultural Mortgage Corporation – interest and capital repayment X

Hire purchase charges X

Leasing charges X

Merchant credit charges X

Private loans – interest and capital X

Total rental equivalent X

This total is then divided by the effective acreage. If the rental equivalent is high, you might suspect that the farmer would struggle to meet his loan repayments. So what figure is high? (Effective acreage is that which is used for agriculture, excluding roads, farm

steading, scrub and woodland).

The interpretation of this rental equivalent depends on the type of farm and farming system. As a general guide, £ 50 per acre if often talked of as a figure below which servicing could not be too difficult. Above £50 per ace needs a closer look. This is only a general guideline – so be careful, more is said about this later.

The rental equivalent per acre is a cost per acre that does not take into account the value of the income earned from the land. A further guideline for ‘serviceability’ is therefore rent equivalent as a proportion of gross output where gross output is defined as total farm

returns plus the value of produce used for farm’s own consumption less purchases of livestock and other products bought for resale.

The guidelines that might then be applied are that if the rental equivalent as a proportion of gross output is:

- Less than 10% there should be little problem about servicing the loan

- Between 10% an d 15% – this is usual

- Between 15% and 20% – This is a little on high side and needs investigation

- More than 30% – this is high.

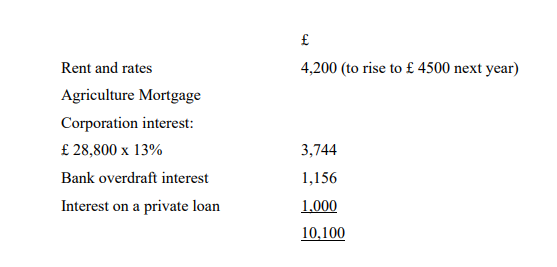

Rental equivalents: example

Worzel Gummidge farms 190 acres of land, half of which is rented and half owned. In the year of 30 September 20 x 4, his costs included the following:

The AMC loan outstanding at 30 September 20 x 4 is £27,000. The interest rate on the loan is 13%. Capital repayments on loan amount to £1,800 per annum. He would now like to purchase a further 10 acres of land, and to borrow £9,000 from his to do so.

The bank would lend him money at 3% above base rate which is currently, say, 9% for a term of 10 years. Interest on the bank loan in the first year would be 12% x £9,000 – £ 1080 but this ignores capital repayments. The annual repayment on a loan will be calculated approximately using the usual formulae or tables provided. In case it works out at approximately £ 1,600 per annum. Of this, £1,080 will be interest in the first year and £520 capital repayment.

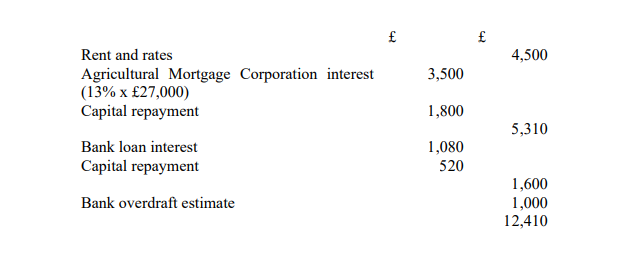

Rental equivalent example: calculations

Mr. Gummidge therefore predicts his rent and rates and finance costs for the coming year, with the bank loan to be:

(Note that whereas interest is charged against the farm’s profits, capital repayments are not. The farm will need to generate sufficient cash flow out of profits plus depreciation minus drawing, to make the capital repayments).

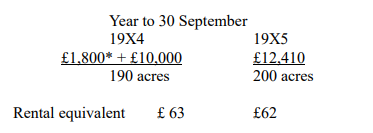

The rental equivalent per acre can now be calculated:

*Capital payment to AMC

To decide whether or not these rental equivalents are high, you can:

- Express the total rental equivalent as a percentage of this gross output of the farm as described above;

- Compare the rental equivalent per acre with ‘standard’ values for the rental equivalent for Mr. Gummidge’s particular type of farming.

You cannot be expected to remember all typical ‘standard’ rental equivalents in the examination room and so, as a very general guideline, it might help to assume that:

- Rental equivalent per acre if £50 – 60, this average:

- Rental equivalent per acre is £ 70 – 80; this is high and only a good farmer could possible manage to bear such costs successfully.

In the example of Mr. Gummidge, the rental equivalent per acre will be about average, perhaps and so bank would not reject his lending proposition on the basis of high rental equivalent. As with all ratios, the trend should be studied.

7.6 Other Calculations to Aid Assessment

Net worth trends

On examining a farmer’s statement, check quickly that the up-to-date net worth figure is in excess of 60% of total assets. Lower than this may be a danger sign, but the trend from year to year is more important and any fall in this percentage figure requires explanation.

Asset structure: tenant’s assets / acre

Use this formula to check how efficiently the farmer is using his assets. To give good comparisons with other farmers who may be tenants or owner-occupiers, you should exclude the value of land and property so that you are comparing like with like. A rough

average figure is £400 worth of tenant’s assets per productive acre (£1000 per hectare ),but variations between £300 and £600 per acre are seen ,depending on type of farming, with dairying being at the top end of the scale and livestock at the bottom. Too high a

figure suggests that assets are being wasted unproductively; too low, that the land could perhaps produce more, given more tenant’s assets. Farming bankers can quickly build up their own files of typical local assets/acre figures for different types of farm.

Gearing

This is the relationship between total borrowings (including all borrowed funds, irrespective of length of credit allowed) and the net worth of the business. For tenant Farmers a ratio approaching or exceeding 1:1 will be very difficult to cope with unless

very high productivity and profitability is present. Much depends on the make-up of the assets and liabilities, and owner-occupied land values complicate the calculation and you may disregard them if necessary for comparative purposes.

7.7 Monitoring and Control of Farming Advances

In the past, as long as they were fully secured, banks have tended not to worry about their borrowing farmers. However, conditions have become more difficult for farmers, and there has been an increase in the failure rate of farming enterprises since the fall in land

prices in the mid 1980s.Nowadays it is important to treat farming as any other business, with less emphasis on security.

7.8 Security for Farm Lending

If the land is owner occupied a first or second mortgage over the land can be taken. Some farms are operated by limited companies, in which case the usual fixed and floating charge may be taken. However, most farmers operate as sole traders or partnerships and

in addition to the usual forms of security, the following special types of security for farming advances should be considered:

- Agricultural (floating) charge;

- Charges over milk sales contracts;

- Agricultural credit corporation guarantees

An agricultural (floating) charge

Such a charge covers all the farmer’s farming assets, including crops, animals and farm machinery. It does not capture debts due to the farmer, or EC milk quotas, which are a personal asset of the farmer, and are of particular value, nor does the charge cover the land. Otherwise, similar rights to those under a limited company debenture are obtained, including the power to appoint a receiver to take over and realise assets. The disadvantages of an agricultural charge are that farmers try to resist giving them, in the belief that registration will damage their standing in the farming community and that if a receiver is eventually appointed the farm and stock ill already be run down and landlords or bailiffs for other creditors may have seized stock already.

Charges over milk sales contracts

These are useful in controlling an important debtor not covered by the agricultural charge. This ensures that milk proceeds come direct to the bank. Where farmers have regular contracts to supply produce, then charges can also be sought over these contracts

Agricultural credit corporation guarantees These are available sometimes from this government backed body to support a farmer’s

borrowing from a bank. It is similar to the small firms’ loan guarantee scheme in that it tends to support farmers needing finance for viable plans. It is normally provided for tenant farmers who cannot offer land as security