8.1 Finance for Exporters: Overdrafts / Loans

In addition to usual secured or unsecured loans and overdrafts in sterling, the same products can be made available to customers in foreign currencies. If non-sterling facilities are taken, the exporter should ensure that he has income in the currency of the borrowing with which to make repayments. If he has to use sterling income to repay currency loans, then he exposes himself to possible adverse currency movements.

8.2 Other bank Finance for Exporters

Advances against bills of exchange / collections

Banks will lead up to 100% with resource against bills, or bills and documents sent on collection basis. The bills will be hypothecated to the bank as security. In addition, the bank will take prior status enquires on the drawees, ensure that the goods involved are of

a type suit ale for easy resale, and insist on assignment of the credit insurance on the transaction.

Negotiation of foreign bills of exchange

Bills of Exchange can be bought by the bank, with resource, for up to 100% of the bill’s face value. The bank then collects the bill on its own account to repay the loan.

Discounting bills of exchange

Banks will discount accepted bills of exchange up to 100% for customers. Usually the acceptor will be a first class UK Bank which has accepted the bill under the terms of a documentary credit for payment at a future date (usually 30, 60 or 90 days)

Beneficiary under documentary credits

A bank will lend to a good customer who is due to export under a documentary credit, usually to enable him supply the goods for the export transaction. The bank must be happy that the customer can comply with the terms of the credit in every respect. Resource to the customer is maintained.

Smaller exports scheme

For customers with low export turnover (say £ 2m or less) banks will provide ‘non resource’ finance under an umbrella policy held by the bank. The bank in effect, negotiates bills drawn by customers for exports. Providing the customer has fully carried out the export transaction, and then the bank’s policy will pay out if the bill is not paid. If the customer has not complied with the commercial contract or policy rules, then the bank reserves the right of eventual resource against the customer. The main issuer of short-term (up to two years) exporter policies is now NCM Ltd. which took over from ECGD in this field.

Short-term finance for exporters

This is similar to the smaller exports scheme, but for customers with larger turnover and their own export credit policies. Buyers may benefit from credit terms up to two years.

Medium – term supplier credit

Where the supplier gives his customer credit for between two and five years (usually for capital exports), ECGD will guarantee to refund the bank up to 85% of the transaction if it provides finance. A 15% deposit from the buyer is taken in advance.

Example 8.1

Fatties Ltd manufactures and sells ladies clothing in larger sizes. The company has banked with you for over 20 years. The management of the business has until recently been in the hands of the two main shareholders. Fred and Sidney Plump. Two years ago they decided to appoint a new Marketing Director, Mrs. Stout, as they felt that the selling of their traditional garments needed revamping. Mrs. Stout has identified an expanding market for higher fashion outsize garments particularly through mail order companies.

The company did not have the manufacturing capacity to meet any significant extra demand and the directors decided to import the additional garments from suppliers in Hong Kong. The Hong Kong manufacturer were only prepared to supply Fatties and give

the company the 60 day credit terms it was seeking, on the basis that it established irrevocable documentary credit limit. These have been of short duration and you have not returned any cheques.

You are currently providing Fatties with an overdraft and /or documentary credit limit of £250,000. As security you have been of short duration and you have not returned any cheques.

The company shows its new designs to customers about six months in advance of the expected delivery of the garments. It has just completed the showing to customers of its spring 1997 designs. There has been a high level of interest I these from mail order companies who have been a high level of interest in these from mail order companies who have placed a better than expected level of preliminary orders.

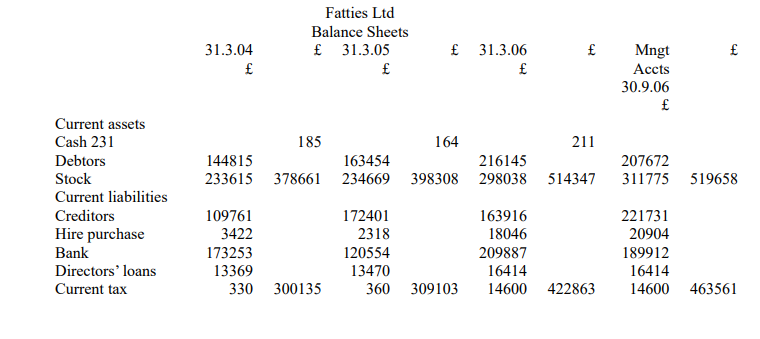

The directors are forecasting sales of £1.3m for the next six months and expect to import more from Hong Kong to meet demand. They call to see you to ask for an increase in the combined facility to £450,000. They produce financial information, including management accounts in the form of projected balance sheets covering the next six months.

How would you respond to the directors’ request?

Solution

This question requires an appreciation of the risks of rapidly expanding an under capitalized business, the risks in documentary credit liabilities and the problems of high fashion goods as security.

Initial reaction and assessment

The company has banked with you for over 20 years and you will want to help if possible.

The management is experienced but the expansion strategy is by no means without risk.

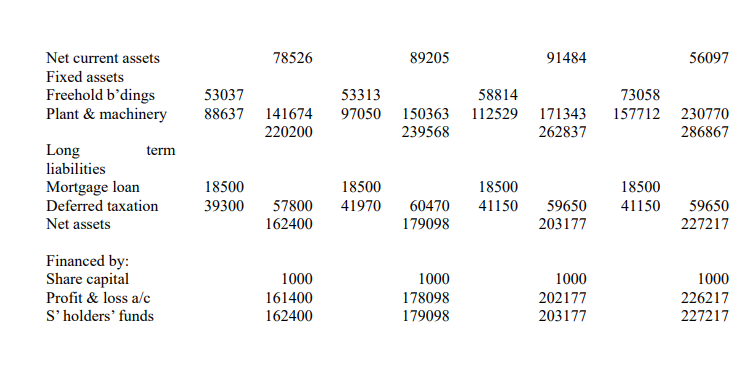

Ratios

There is a seasonal aspect to the business and these needs to be borne in mind when considering the ratios.

The bank account figures suggest March and September are near the low point in the company’s liquidity cycle.

The change in the nature of the business in 1996 will affect the figures and make it difficult to draw firm conclusions.

Liquidity

Both current ratio and acid test suggest a slow deterioration since the expansion programme began.

The credit taken figures show a big reduction between 1995 and 1996 but this can be explained by the change to importing a significant proportion of the garments. Credit given is steady\: the September 1996 figures are not strictly comparable with the others.

Stock turnover is improving suggesting a possible rise in efficiency. However, this again may reflect the change from manufacturing to buying a large portion of garments from subcontractors.

Profitability

Gross margin is declining steadily; is the company buying sales?

Net margin is thin and the company is vulnerable if there is a problem, for example with deliveries or quality which would affect sales.

There has been a steady pattern of retentions, albeit not at a level to sustain expansion without a need for significantly increased limits.

Financial structure

There is no obvious trend in interest cover but anything below three times is thin for a business of this type.

Gearing is high and there is no readily identifiable trend downwards. The creditors are increasingly taking the working capital strain and a significant element of this is effectively guaranteed by the bank through the documentary credit liabilities.

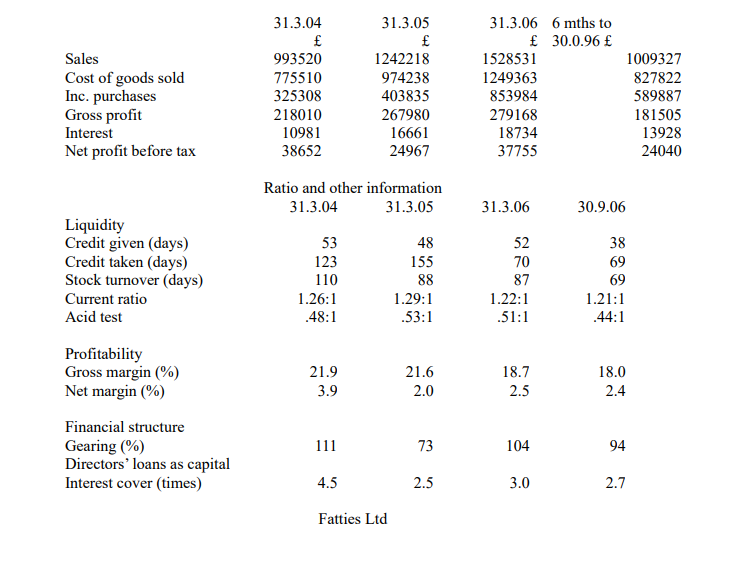

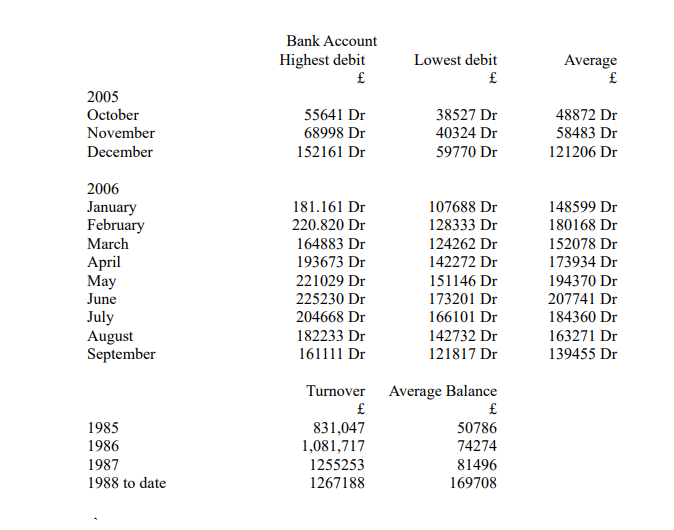

Bank account

There have been excess albeit of a temporary nature but there is pressure on the limit. If seasonal factors are ignored, borrowing is increasing steadily and there is now a significant hard-core. The projections suggest the worsening trend will continue.

Projections

The requested facility is obviously needed if the projections are correct.

From the balance sheet figures it can be deduced that profit before tax is forecast to be £ 107,000 for the next six months, with net profit margin at 8.4%. This looks exceptionally optimistic compared to past performance.

Management accounts

These appear to be produced quickly so good monitoring information should be available.

Security

There is a mortgage loan secured on the freehold deeds so that primary security for the bank is the current assets.

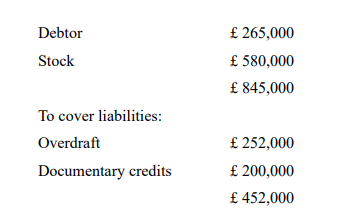

At proposed peak exposure in January 1989 cover will be:

There is therefore 187% cover by current assets including 59% cover by debtor.

The documentary credits have to be included in any security cover calculation as in the case of difficult they will eventually turn into borrowing. Security cover is thin. The stock is fashion garments which will probably not raise 25% of book value on a break up.

Even though the debtors are ostensibly good names i.e. mail order companies, in all receiverships there are refusals to pay because of disputes over quality etc. 75% realization would probably be a realistic figure.

Using these figures, debtors would realize £199,000 at peak exposure whilst stock would only realize £145,000. Ignoring preferential claims and retention of title problems, £ 344,000 would be raised to cover exposure of £ 452,000.

Plant and machinery again generally does not realize large sums. The second mortgage again generally does not realize large sums.

The joint and several guarantee of £50,000 from the directors is unsupported. What assets do they have outside the business?

Analysis and conclusions

The bank’s main short-term risk lies in the company not realizing its sales targets having invested heavily in high fashion stock.