4.1 Introduction

To deal adequately with lending at this level, you must ensure that you are up to date with your accountancy studies, particularly the principles of management accounting and accounting ratios.

4.2 Non-financial Appraisal of Business

Markets and products

In most businesses sales are the main source of income and profit and it is therefore essential to confirm that the company’s products are appropriate for its markets, and will continue to be so, compared with its competitors. Ant drop in sales is worrying and, for

some businesses, can be fatal. You must keep yourself up to date on the business environment at a national and local level. In the light of your knowledge you should check that your business borrowers are fully aware of the strengths and weaknesses of their own products and of the opportunities and threats existing in their markets. For example they should have considered:

Products – Position in product life cycle (new, mature, and declining), profitability, new developments, market segmentation, spread of customers, share of total market?

Competition – Local, national, regional, international, comparative prices?

Supply / demand – Availability of alternative e suppliers, volatility of demand, exposure to currency risks, skilled workforce / personnel, new technologies, fashion, buying habits?

Research of markets – Where are tomorrow’s customers / products? Are today’s markets declining, static, expending?

Resources

If a company is to supply the right products t the right markets at the right price, then it has to have the appropriate production resources in place exactly when needed i.e. the company needs to monitor the present and continued availability and quality of its

premises, machinery, vehicles and labour force. It must plan ahead carefully in all these aspects if its production is not to be adversely affected at a time when the company can ill afford it.

Management

If a bank is to lead to a company, it must have complete confidence in the character and ability of the management; these qualities must be objectively assessed. Qualifications, experience, age, health, personal and financial commitment must be confirmed. The

company must have a good mix of qualities spread amongst the management team with, as a minimum, production, marketing and financial skills. It is helpful if there is a training and succession plan to reduce the management on retirement or promotion.

A visit to the business to meet all directors and managers is essential, at which time the resources can also be examined.

4.3 Assessment of Financial Information

By financial information it means primary the latest audited accounts, including income statement, cashflow and financial position statement (balance sheet). These figures are usually several months out of date by the time the bank receives them, but larger

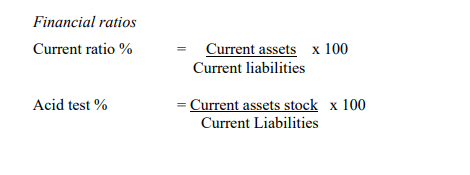

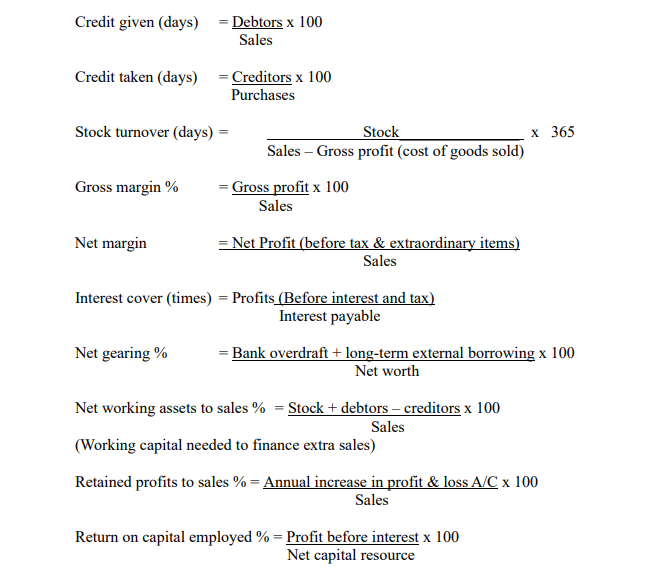

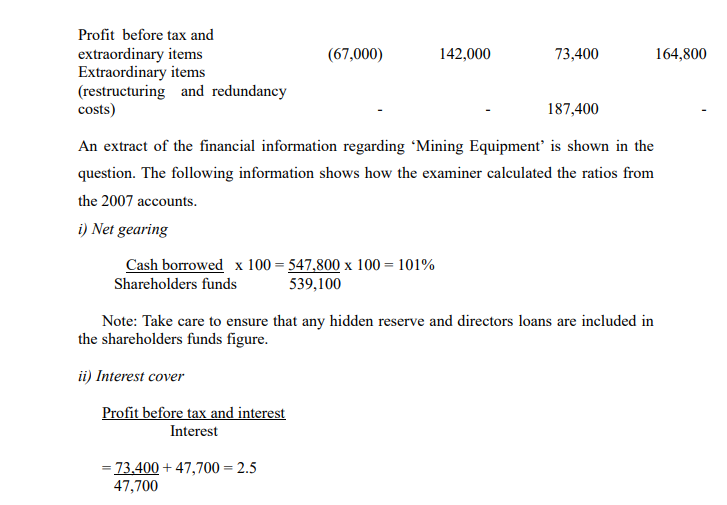

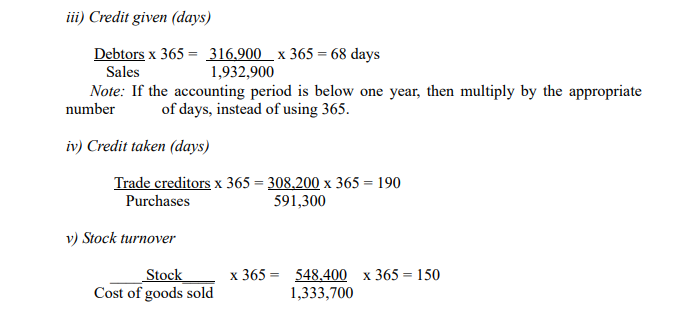

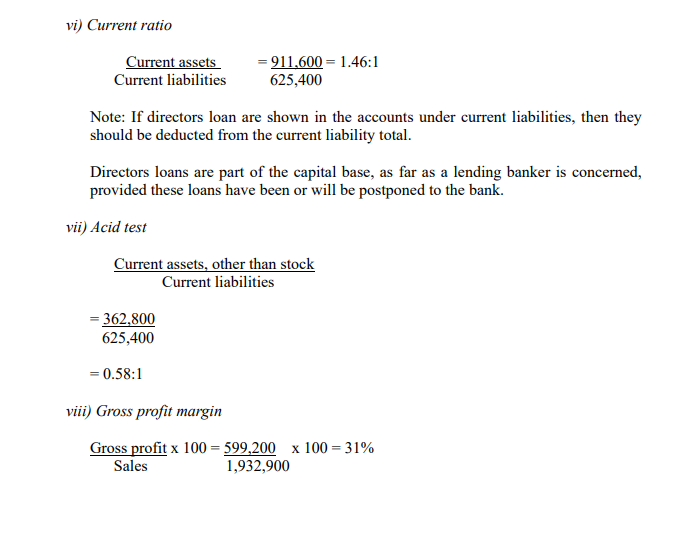

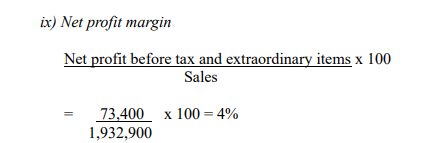

businesses are able to supply the bank with up to date interim figures which will be audited. The following are the key ratios to be considered when dealing with financial information.

Notes:

Where figures are altering significantly from year to year, it is possible to take an average of two years’ balance sheet figures, rather than simply the latest year end figure. However, this approach is rare.

Be careful where the time span covered by the figures being compared varies i.e. a full year’s audited figures against six months management figures, particularly where trade is seasonal, and sales or purchases may be concentrated in one part of the year.

Example 4.1

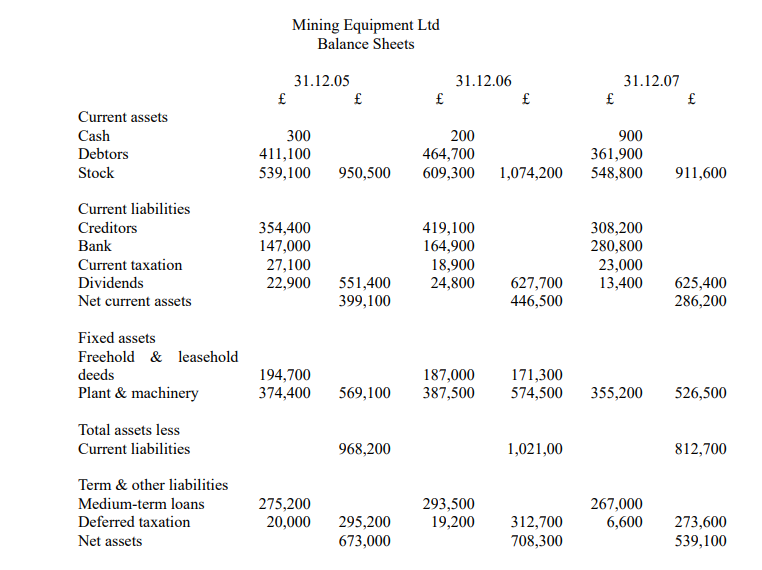

Mining Equipment Ltd. currently banks with one of your competitors and has been a long-standing marketing target for your branch. The company was founded over 30 years ago and has been with its present bankers for most of that tome. It manufactures, in

factory in a development area in the north of England, machinery used in the mining industry. By far its largest customer is British Coal.

Following the year long strike in the British coal mining industry which ended in 2005, British Coal has been closing coal mines. Your Economics Department considers that this trend is likely to continue in the UK although overseas mining markets may be more

buoyant. Mining Equipment Ltd has not found trading conditions easy since the end of the mining strike, and last year the directors decided to stop producing certain loss-making products.

This involved closing down a department of the factory and making a number of employees redundant. After taking these steps the directors are confident the business will have a healthy future. The company currently enjoys an over draft limit of £ 400,000 together with a medium term loan of which the present balance is £255,000 with seven years of its term to run.

These facilities are secured by a mortgage over the company’s freehold and leasehold properties.

The directors have recently had their annual review meeting with their present bank, at which they produced their latest audited accounts, projections for the current financial year and management accounts for the first quarter of the current financial year. These

management accounts show sales on target but also reveal a loss of £25,000 which the directors put down to temporary production difficulties following on from the rationalization at the factory. They still expect to be able to meet their profit target for the full year despite this setback.

Their bank has agreed to renew the limits, but is insisting on having additional security in the form of a debenture and personal guarantees from the directors. The directors consider that their present bank’s stance is unreasonable and approach you to take over the company’s account without the benefit of the additional security.

Required

Set out in note form your analysis of the company’s present financial position. Indicate with reasons, the response you would make to the company’s request.

Note: If the examiner chooses not to give you the cost of goods sold figure, then he will use the sales figure. However, the method of calculation is irrelevant; it is the trend which matters.

Brief notes on the significance and / or derivation of various figures

Balance sheet items

1. Shareholders funds

This is calculated as

Share capital

+ profit and loss balance in balance sheet

+ reserves

+ directors loans if postponed

+ any hidden reserve in fixed assets*

– goodwill

* A hidden reserve arises when the question states that fixed assets are valued at a certain figure, and this figure exceeds the balance sheet value.

Solution

Background and initial reaction

The company has been around for a reasonable length of time and has been profitable in the past, but is coming to you from other bankers, and therefore you should take care in your approach. It has had problems in the immediate past, but it appears to have taken

remedial action. However, it is locked into a market which at least in the foreseeable future is going to be difficult.

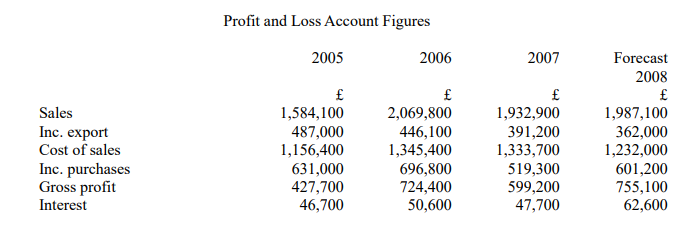

It is heavily dependent on one major customer with the risks this entails of being squeezed on price etc. Exports sales, where the market is likely to be more buoyant, are declining and forecast to fall further.

Although the management has taken steps to rationalize the business it is arguable that they have been slow to recognize the probable effects of pit closures in waiting for two years after the strike. This brings in focus their management ability and experience. This

may not reflect well on their forecasts for the future against the background of adverse independent opinion. The company is a long standing customer of its present bankers and they will not have taken the step of requesting more security lightly. The signing why

their present bankers are requesting for security is a warning sign.

Capital structure

Gearing has increased and is now at an uncomfortable level for a manufacturing business of this kind. It is projected to fall in 2008, but only marginally, and if profits are not made the fall is unlikely to come about. Net worth has been up and down recently and there is no steady trend of retained profits. There was a loss on trading in 2005 and a further loss in 2007 as a result of restructuring. There is no steady trend in interest cover, but 2007 is probably the most settled year to look at, and it appears thin for a business of this type.

Liquidity

Both the current ratio and acid test are declining and in absolute terms for this type of business, are less than good.

Less credit is being given as the company has tried to keep its borrowing down. With a major dominant customer this trend is surprising so are abnormal discounts being given

which will affect profits?

The company is able to obtain substantial credit from its suppliers. This would be unlikely to continue if there were any doubts about the company’s future. The confidence of the creditors may be dented by the granting of a debenture as it would suggest its

bankers are not confident of the future following the restructuring. If credit is cut back, a higher borrowing requirement wills arrear. Stock turnover is improving, suggesting that the company is improving its efficiency.

Profitability

Sales and profitability have been up and down. The 2005 figures have been adversely affected by the miners’ strike whilst the 2006 improvement reflects British Coal’s subsequent re-equipment needs and was therefore a one –off. The 2007 figures are probably the best guide to future trends. The net margin is thin whilst the gross margin is wide, suggesting that there is a heavy level of overheads which may not be covered if sales targets are not met.

Projections

The effects of the rationalization will be reflected in the forecasts making comparison with previous figures difficult. The projections, with a significant increase in both gross and net profit margin over what has been seen previously, look depending, particularly

against the background of a difficult market place. The expected loss in the first quarter, mo matter what the excuse, is not a good sign. Capital expenditure is planned to run significantly ahead of the depreciation charge with a consequent cash drain if profits are

not made.

Security

It appears that a significant element of the deeds is in a development area. Such properties are not likely to be easy to sell and may not therefore be good security. The best asset in the balance sheet is undoubtedly the debtors, with a large portion due from British Coal. The stock and plant and machinery would probably not raise 50% of book value on a break up and again are less than ideal security. What would personal guarantees from the directors be worth? What personal assets do the directors have?

Decision

The company faces an uncertain future. Its market appears to be declining and it is now heavily borrowed so that any option for diversification which requires cash will be limited.

The management seems to have been slow to react to the situation which was probably foreseeable and there is a question mark against them. The company’s own bankers are in the best position to assess the directors’ performance and if they want more security

this is a warning sign.

Against this background a debenture would appear to be essential security to pick up the debtors. Even so, debtor cover would be thin with the other assets in the balance sheet of questionable value. However, this could have an adverse effect on the raise the overall

borrowing requirement to an-unacceptable level.

Personal guarantees also appear essential to back the directors’ expressions of confidence for the business’s future. On the terms offered, taking the company’s account is not an attractive proposition. Even with a debenture there are plenty of potential problems with the company which suggests that this is not a good time to acquire the account in any circumstances.