DEMAND

In the first sections of this chapter you will be learning about the many issues that need to be considered in decisions about the price which can be charged for a product or service. The first issues relate to demand.

Issue 1: the relationship between price and demand

Demand is normally elastic because demand will increase as prices are lowered.

There are two extremes in the relationship between price and demand. A supplier can either sell a certain quantity, Q, at any price (as in graph (a)). Demand is totally unresponsive to changes in price and is said to be completely inelastic. Alternatively, demand might be limitless at a certain price P (as in graph (b)), but there would be no demand above price P and there would be little point in dropping the price below P. In such circumstances demand is said to be completely elastic.

A more normal situation is shown below. The downward-sloping demand curve shows the inverse relationship between unit selling price and sales volume. As one rises, the other falls. Demand is elastic because demand will increase as prices are lowered.

Price elasticity of demand (η)

Price elasticity of demand is a measure of the extent of change in market demand for a good in response to a change in its price.

Price elasticity of demand (η), which is a measure of the extent of change in market demand for a good in response to a change in its price, is measured as:

The change in quantity demanded, as a % of demand

The change in price, as a % of the price

Since the demand goes up when the price falls, and goes down when the price rises, the elasticity has a negative value, but it is usual to ignore the minus sign.

Elastic and inelastic demand

The value of demand elasticity may be anything from zero to infinity.

Demand is referred to as inelastic if the absolute value is less than 1 and elastic if the absolute value is greater than 1.

Think about what this means.

- Where demand is inelastic, the quantity demanded falls by a smaller percentage than the percentage increase in price.

- Where demand is elastic, demand falls by a larger percentage than the percentage rise in price.

If demand is elastic, a reduction in price would lead to a rise in total sales revenue. If demand is inelastic, a reduction in price would lead to a fall in total sales revenue.

Price elasticity and the slope of the demand curve

Generally, demand curves slope downwards. Consumers are willing to buy more at lower prices than at higher prices. In general, elasticity will vary in value along the length of a demand curve.

- If a downward sloping demand curve becomes steeper over a particular range of quantity, then demand is becoming more inelastic.

- A shallower demand curve over a particular range indicates more elastic

The ranges of price elasticity at different points on a downward sloping straight line demand curve are illustrated in the diagram below.

- At higher prices on a straight line demand curve (the top of the demand curve), small percentage price reductions can bring large percentage increases in quantity This means that demand is elastic over these ranges, and price reductions bring increases in total expenditure by consumers on the commodity in question.

- At lower prices on a straight line demand curve (the bottom of the demand curve), large percentage price reductions can bring small percentage increases in quantity. This means that demand is inelastic over these price ranges, and price increases result in increases in total expenditure.

Two special values of price elasticity

- Demand is perfectly inelastic (η = 0). There is no change in quantity demanded, regardless of the change in price. The demand curve is a vertical straight line (as in graph (a) in Issue 1).

- Perfectly elastic demand (η = ∞). Consumers will want to buy an infinite amount, but only up to a particular price level. Any price increase above this level will reduce demand to zero. The demand curve is a horizontal straight line (as in graph (b) in Issue 1).

Elasticity and the pricing decision

In practice, organisations will have only a rough idea of the shape of their demand curve: there will only be a limited amount of data about quantities sold at certain prices over a period of time and, of course, factors other than price might affect demand. Because any conclusions drawn from such data can only give an indication of likely future behaviour, management skill and expertise are also needed. Despite this limitation, an awareness of the concept of elasticity can assist management with pricing decisions.

- (With inelastic demand, increase prices because revenues will increase and total costs will reduce (because quantities sold will reduce).

With elastic demand, increases in prices will bring decreases in revenue and decreases in price will bring increases in revenue. Management therefore have to decide whether the increase/decrease in costs will be less than/greater than the increases/decreases in revenue.

- In situations of very elastic demand, overpricing can lead to massive drops in quantity sold and hence profits, whereas under-pricing can lead to costly inventory outs and, again, a significant drop in profits. Elasticity must therefore be reduced by creating

a customer preference which is unrelated to price (through advertising and promotion).

- In situations of very inelastic demand, customers are not sensitive to price. Quality, service, product mix and location are therefore more important to a firm’s pricing strategy.

- In practice, the prices of many products, such as consumer durables, need to fall over time if demand is to rise. Costs must therefore fall by the same percentage to maintain margins.

Determining factors

| Factors that determine the degree of elasticity | Detail |

| The price of the good | |

| The price of other goods | For two types of good the market demand is interconnected.

a) Substitutes, so that an increase in demand for one version of a good is likely to cause a decrease in demand for others. Examples include rival brands of the same commodity (like Coca-Cola and Pepsi-Cola). b) Complements, so that an increase in demand for one is likely to cause an increase in demand for the other (e.g. cups and saucers). |

| Income | A rise in income gives households more to spend and they will want to buy more goods. However this phenomenon does not affect all goods in the same way.

a) Normal goods are those for which a rise in income increases the demand. b) Inferior goods are those for which demand falls as income rises, such as cheaper juice or beer. c) For some goods demand rises up to a certain point and then remains unchanged, because there is a limit to which consumers can or want to consume. Examples are basic foodstuffs such as salt and cassava. |

| Tastes and fashions | A change in fashion will alter the demand for a good, or a particular variety of a good. Changes in taste may stem from psychological, social or economic causes. There is an argument |

| Factors that determine the degree of elasticity | Detail |

| that tastes and fashions are created by the producers of products and services. There is undeniably some truth in this, but the modern focus on responding to customers’ needs and wants suggests otherwise. | |

| Expectations | Where consumers believe that prices will rise or that shortages will occur they will attempt to inventory up on the product, thereby creating excess demand in the short term. |

| Obsolescence | Many products and services have to be replaced periodically. a) Physical goods are literally ‘consumed’. Carpets become threadbare, glasses get broken, foodstuffs get eaten, children grow out of clothes. b) Technological developments render some goods obsolete. Manual office equipment has been largely replaced by electronic equipment, because it does a better job, more quickly, quietly, efficiently and effectively. c) Software programmes become “overtaken” by new innovations. Operations systems viz. Windows 7 has replaced previous systems |

| Size of the market | The larger the market, the more inelastic the demand for the product in broad terms. For example, the demand for bread is relatively inelastic, whereas that the more expensive cuts of beef may be more elastic. |

| Necessities | Demand for basic items such as rice toilet rolls and cassava/manihot is, on the whole, price inelastic. |

Issue 2: demand and the market

Economic theory suggests that the volume of demand for a good in the market as a whole is influenced by a variety of variables.

| • The price of the good | • Obsolescence |

| • The price of other goods | • Tastes and fashion |

| • Expectations | • The perceived quality of the product |

| • The size and distribution of household income |

Issue 3: demand and the individual firm

The volume of demand for one organisation’s goods rather than another’s is influenced by three principal factors: product life cycle, quality and marketing.

Product life cycle

Product life cycle is ‘The period which begins with the initial product specification, and ends with the withdrawal from the market of both the product and its support. It is characterised by defined stages including research, development, introduction, maturity, decline and abandonment.’

(CIMA Official Terminology)

Most products pass through the following phases.

| Phase | Description |

| Introduction | The product is introduced to the market. Heavy capital expenditure will be incurred on product development and perhaps also on the purchase of new non-current assets and building up inventory for sale. On its introduction to the market, the product will begin to earn some revenue, but initially demand is likely to be small. Potential customers will be unaware of the product or service, and the organisation may have to spend further on advertising to bring the product or service to the attention of the market. |

| Growth | The product gains a bigger market as demand builds up. Sales revenues increase and the product begins to make a profit. The initial costs of the investment in the new product are gradually recovered. |

| Maturity | Eventually, the growth in demand for the product will slow down and it will enter a period of relative maturity. It will continue to be profitable. The product may be modified or improved, as a means of sustaining its demand. |

| Saturation and decline | At some stage, the market will have bought enough of the product and it will therefore reach ‘saturation point’. Demand will start to fall. For a while, the product will still be profitable in spite of declining sales, but eventually it will become a loss-maker and this is the time when the organisation should decide to stop selling the product or service, and so the product’s life cycle should reach its end. |

Case Study

During 2001, low cost PC maker Dell had to discount prices heavily to show continual growth despite market saturation.

The life expectancy of a product will influence the pricing decision. Short-life products must be quite highly priced so as to give the manufacturer a chance to recover the investment and make a worthwhile return. This is why fashion goods and new high technology goods, for example, tend to be highly priced.

The current tendency is towards shorter product life cycles. Notwithstanding this observation, the life cycles of different products may vary in terms of length of phases, overall length and shape.

- Fashion products have a very short life and so do high technology products because they become rapidly out-dated by new fashions and new technological developments.

- Different versions of the same product may have different life cycles, and consumers are often aware of this. For example, the prospective buyer of a new car is more likely to purchase a recently introduced Ford than a Nissan that has been on the market for several years, even if there is nothing to choose in terms of quality and price.

Quality

One firm’s product may be perceived to be better quality than another’s, and may in some cases actually be so, if it uses sturdier materials, goes faster or does whatever it is meant to do in a ‘better’ way. Other things being equal, the better quality good will be more in demand than other versions.

Marketing

You may be familiar with the ‘four Ps’ of the marketing mix, all of which influence demand for a firm’s goods.

| P… | Details |

| Price | |

| Product | |

| Place | This refers to the place where a good can be, or is likely to be, purchased.

• If a good is difficult to obtain, potential buyers will turn to substitutes. • Some goods have no more than local appeal. |

| Promotion | This refers to the various means by which firms draw attention to their products and services.

• A good brand name is a strong influence on demand. • Demand can be stimulated by a variety of promotional tools, such as free gifts, money off, shop displays, direct mail and media advertising. |

In recent years, emphasis has been placed, especially in marketing, on the importance of non-price factors in demand. Thus the roles of product quality, promotion, personal selling and distribution and, in overall terms, brands, have grown. While it can be relatively easy for a competitor to copy a price cut, at least in the short term, it is much more difficult to copy a successful brand image.

Some larger organisations go to considerable effort to estimate the demand for their products or services at differing price levels; in other words, they produce estimated demand curves. A knowledge of demand curves can be very useful: for example, a large transport company such as KBS might be considering an increase in bus fares. The effect on total revenues and profit of the fares increase could be estimated from a knowledge of the demand for transport services at different price levels. If an increase in the price per ticket caused a large fall in demand (that is, if demand were price-elastic) total revenues and profits would fall; whereas a fares increase when demand is price-inelastic would boost total revenue and since a transport authority’s costs are largely fixed, would probably boost total profits too.

BLANK

OTHER ISSUES THAT INFLUENCE PRICING DECISIONS

As well as demand, a range of other issues influence pricing decisions including the market in which an organisation operates, competition, quality and price sensitivity.

Issue 4: markets

The price that an organisation can charge for its products will be determined to a greater or lesser degree by the market in which it operates. Here are some familiar terms that might feature as background for a question or that you might want to use in a written answer.

- Perfect competition: many buyers and many sellers all dealing in an identical product. Neither producer nor user has any market power and both must accept the prevailing market price.

- Monopoly: one seller who dominates many buyers. The monopolist can use his market power to set a profit-maximising price.

- Monopolistic competition: a large number of suppliers offer similar, but not identical, products. The similarities ensure elastic demand whereas the slight differences give some monopolistic power to the supplier.

- Oligopoly: where relatively few competitive companies dominate the market. Whilst each large firm has the ability to influence market prices the unpredictable reaction from the other giants makes the final industry price indeterminate. Cartels are often formed.

Issue 5: competition

In established industries dominated by a few major firms, it is generally accepted that a price initiative by one firm will be countered by a price reaction by competitors. In these circumstances, prices tend to be fairly stable, unless pushed upwards by inflation or strong growth in demand.

If a rival cuts its prices in the expectation of increasing its market share, a firm has several options.

- It will maintain its existing prices if the expectation is that only a small market share would be lost, so that it is more profitable to keep prices at their existing level. Eventually, the rival firm may drop out of the market or be forced to raise its prices.

- It may maintain its prices but respond with a non-price counter-attack. This is a more positive response, because the firm will be securing or justifying its current prices with a product change, advertising, or better back-up services.

- It may reduce its prices. This should protect the firm’s market share so that the main beneficiary from the price reduction will be the consumer.

- It may raise its prices and respond with a non-price counter-attack. The extra revenue from the higher prices might be used to finance an advertising campaign or product design changes. A price increase would be based on a campaign to emphasise the quality difference between the firm’s own product and the rival’s product.

Fighting a price war

Peter Bartram (Financial Management, March 2001) suggested a number of ways to fight a price war.

- Sell on value, not price, where value is made up of service, response, variety, knowledge, quality, guarantee and price.

- Target service, not product market niches, to build in the six non-price factors in (a) above.

Case Study

The Marriott hotel chain has chosen to compete in the premium market on service. When guests arrive, instead of queuing at a busy reception, they are met at the front door by a host who gives them their room key.

Use ‘package pricing’ to attract customers

Case Study

Computer retailers in Europe and USA such as Time and PC World have beaten discounters by offering peripherals, discounted software and extended warranties as part of their more expensive packages.

- Make price comparisons difficult. Terrestrial and mobile phone companies offer a bewildering variety of rates and discount offers which disguise the core price and make comparisons almost impossible.

- Build up key accounts, as it is cheaper to get more business from an existing customer than to find a new one. Customer profitability analysis, covered in Chapter 16, is important here.

- Explore new pricing models. E-business provides opportunities to use new pricing models.

- On-line auctions for a wide range of products are carried out on certain websites.

- Other websites use a ‘community shopping’ pricing model, where the price of an item falls as more people buy it.

- Marginal cost pricing is used on certain websites to get rid of inventory such as unsold theatre tickets and holidays.

Case Study

The makers of desk-top printers sell printers at a heavily discounted price and make up the “difference” by heavily priced ink cartridges. Coca Cola is experimenting with a vending machine that varies the cost of a can of coke in line with changes in temperature: the hotter the weather, the higher the price.

Other issues

| Issue | Explanation/example |

| Price sensitivity | This will vary amongst purchasers. Those that can pass on the cost of purchases will be the least sensitive and will therefore respond more to other elements of perceived value. For example, the business traveller will be more concerned about the level of service and quality of food in looking for an hotel than price, provided that it fits the corporate budget. In contrast, the family on holiday is likely to be very price sensitive when choosing an overnight stay. |

| Price perception | This is the way customers react to prices. For example, customers may react to a price increase by buying more. This could be because they expect further price increases to follow (they are ‘stocking up’). Some believe that the more expensive an item the better the quality. Some people buy expensive to show off !! |

| Compatibility with other products | A typical example is operating systems on computers, for which a user would like to have a wide range of compatible software available. For these types of product there is usually a cumulative effect on demand. The more people who buy one of the formats, the more choice there is likely to be of software for that format. This in turn is likely to influence future purchasers. The owner of the rights to the preferred format will eventually find little competition and will be able to charge a premium price for the product. |

| Competitors | An organisation, in setting prices, sends out signals. Competitors are likely to react to these signals in some way. In some industries (such as petrol retailing) pricing moves in unison; in others, price changes by one supplier may initiate a price war, with each supplier undercutting the |

| Issue | Explanation/example |

| others. Competition is discussed in more detail below. | |

| Competition from substitute products | These are products which could be transformed for the same use or which might become desirable to customers at particular price levels. For example, Coffee beans, ground coffee and Instant Coffee: As Instant coffee becomes more expensive, so ordinary ground coffee or even roasted beans become more attractive. One way around this is to sell Instant coffee granules rather than powder. |

| Suppliers | If an organisation’s suppliers notice a price rise for the organisation’s products, they may seek a rise in the price for their supplies to the organisation on the grounds that it is now able to pay a higher price. |

| Inflation | In periods of inflation the organisation may need to change prices to reflect increases in the prices of supplies and so on. Such changes may be needed to keep relative (real) prices unchanged. |

| Quality | In the absence of other information, customers tend to judge quality by price. Thus a price change may send signals to customers concerning the quality of the product. A price rise may indicate improvements in quality, a price reduction may signal reduced quality, for example through the use of inferior components. |

| Incomes | In times of rising incomes, price may become a less important marketing variable compared with product quality and convenience of access (distribution). When income levels are falling and/or unemployment levels rising, price will become a much more important marketing variable. |

| Ethics | Ethical considerations are a further factor, for example whether or not to exploit short-term shortages through higher prices. |

BLANK

PROFIT MAXIMISATION IN IMPERFECT MARKETS

In imperfect markets there will be an optimum price/output level at which profits are maximised.

Some businesses enjoy a monopoly position in their market or something akin to a monopoly position, even in a competitive market. This is because they develop a unique marketing mix, for example a unique combination of price and quality, or a monopoly in a localised area.

The significance of a monopoly situation is as follows.

- The business has choice and flexibility in the prices it sets.

- Because the business has this freedom of choice in pricing, it will find that at higher prices demand for its products or services will be less. Conversely, at lower prices, demand for its products or services will be higher.

- There will be an optimum price/output level at which profits will be maximised.

(Note. Imperfect markets are markets in which price is affected by the amount supplied to the market and/or there is limited demand.)

Case Study

A large public transport organisation might be considering an increase in bus fares fares. The effect on total revenues and profit of the fares increase could be estimated from a knowledge of the demand for transport services at different price levels. If an increase in the price per ticket caused a large fall in demand (that is, if demand were price-elastic) total revenues and profits would fall; whereas a fares increase when demand is price-inelastic would boost total revenue and since a transport organisation’s costs are largely fixed, would probably boost total profits too.

BLANK

DERIVING THE DEMAND CURVE

The demand curve shows the relationship between the price charged for a product and the subsequent demand for that product.

When demand is linear the equation for the demand curve is P = a – bQ/∆Q where P = the price Q = the quantity demanded a = the price at which demand would be nil b = the amount by which the price falls for each stepped change in demand

∆Q = the stepped change in demand

The constant a is calculated as follows.

a = current price + Current quantity at current price ×b Change in quantity when price is changed by b

You need to learn these formulae.

This looks rather complicated in words, but it is very easy once the numbers are substituted. Note that you are not given these formulae in the exam.

Example: deriving the demand curve

Note the currency values are in thousands of francs( Rwf in this example = Rwf’000)

The current price of a product is Rwf12. At this price the company sells 60 items a month. One month the company decides to raise the price to Rwf14, but only 45 items are sold at this price. Determine the demand equation.

THE PROFIT-MAXIMISING PRICE/OUTPUT LEVEL

Microeconomic theory and profit maximisation

Microeconomic theory suggests that as output increases, the marginal cost per unit might rise (due to the law of diminishing returns) and whenever the firm is faced with a downward sloping demand curve, the marginal revenue per unit will decline.

Eventually, a level of output will be reached where the extra cost of making one extra unit of output is greater than the extra revenue obtained from its sale. It would then be unprofitable to make and sell that extra unit.

Profits will continue to be maximised only up to the output level where marginal cost has risen to be exactly equal to the marginal revenue.

Profits are maximised using marginalism theory when marginal cost (MC) = marginal revenue (MR).

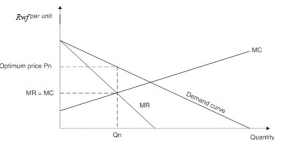

Profits are maximised at the point where MC = MR, ie at a volume of Qn units. If we add a demand curve to the graph, we can see that at an output level of Qn, the sales price per unit would be Pn.

It is important to make a clear distinction in your mind between the sales price and marginal revenue. In this example, the optimum price is Pn, but the marginal revenue is much less. This is because the ‘additional’ sales unit to reach output Qn has only been achieved by reducing the unit sales price from an amount higher than Pn for all the units to be sold, not just the marginal extra one. The increase in sales volume is therefore partly offset by a reduction in unit price; hence MR is lower than Pn.

Determining the profit-maximising selling price: using equations

The optimaum selling price can be determined using equations (i.e. where MC = MR).

You could be provided with equations for marginal cost and marginal revenue and/or have to devise them from information in the question. By equating the two equations you can determine the optimum price. Remember, marginal cost is the extra cost of producing one extra unit, marginal revenue is the extra revenue from that one extra unit. Marginal revenue may not be the same as the price charged for all units up to that demand level, as to increase volumes the price may have to be reduced. The following example provides an illustration.

Determining the profit-maximising selling price: visual inspection of a tabulation of data

The optimum selling price can also be determined using tabulation, graphs and gradients.

To determine the profit-maximising selling price:

- Work out the demand curve and hence the price and the total revenue (PQ) at various levels of demand.

- Calculate total cost and hence marginal cost at each level of demand.

Finally calculate profit at each level of demand, thereby determining the price and level of demand at which profits are maximised.

Determining the profit-maximising selling price: graphical approach

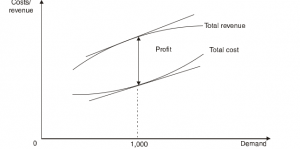

The diagrams below show that profits are maximised at the point where the vertical distance between the total revenue curve and the total costs curve is at a maximum (which is fairly obvious if you think about it since profits are maximised when the difference between cost and revenue is maximised). This profit-maximising demand level also corresponds to the point at which the MC and MR curves intersect, as we would expect. Notice how the profit-maximising price can be read off from the demand curve.

Determining the profit-maximising selling price: using gradients

Suppose we were to draw tangents to the total revenue and total cost curves at the points at which profit is maximised. As you can see, the gradients of these tangents are the same.

The gradient of the total cost curve is the rate at which total cost changes with changes in volume, which is simply marginal cost. Likewise, the gradient of the total revenue curve is the rate at which total revenue changes with changes in volume, which is the marginal revenue. At the point of profit maximisation, the two gradients are equal and hence, once again, MC = MR.

Optimum pricing in practice

There are problems with applying the approach described above in practice for the following reasons:

- It assumes that the demand curve and total costs can be identified with certainty. This is unlikely to be so.

- It ignores the market research costs of acquiring knowledge of demand.

- It assumes the firm has no production constraint which could mean that the equilibrium point between supply and demand cannot be reached.

- It assumes the objective is to maximise profits. There may be other objectives.

Case Study

Microsoft dominates the market for many types of computer software, but this domination was not achieved by setting short-term profit-maximising selling prices for the MS-DOS and Windows operating systems. By offering cheap licences to PC manufacturers for use of these operating systems, Microsoft word processing, spread-sheet, graphics and database packages have become almost industry-standard.

- It assumes that price is the only influence on quantity demanded. We saw in Sections 1 and 2 that this is far from the case.

- It is complicated by the issue of price discrimination (the practice of charging different unit selling prices for the same product). We look at price discrimination in the next chapter.

- Although there are arguments for the applicability of the concept of the profitmaximising unit selling price in traditional markets where homogenous, massproduced products are in continuous supply (such as public transport), the modern trend is towards short product life cycles and a high degree of product differentiation.

Further reading

Read the article that appeared in Financial Management in May 2006.

This article takes a humorous approach to the application of optimum pricing but could well form the basis of a question in the exam.

CHAPTER ROUNDUP

- Demand is normally elastic because demand will increase as prices are lowered.

- Price elasticity of demand is a measure of the extent of change in market demand for a good in response to a change in its price.

- If demand is elastic a reduction in price would lead to a rise in total sales revenue. If demand is inelastic, a reduction in price would lead to a fall in total sales revenue.

- The volume of demand for one organisation’s goods rather than another’s is influenced by three principal factors: product life cycle, quality and marketing.

- As well as demand, a range of other issues influence pricing decisions including the market in which an organisation operates, competition, quality and price sensitivity.

- In imperfect markets there will be an optimum price/output level at which profits are maximised.

- When demand is linear the equation for the demand curve is P = a – bQ/∆Q Where:

- = the price

- = the quantity demanded

- = the price at which demand would be nil

- = the amount by which the price falls for each stepped change in demand ∆Q = the stepped change in demand

The constant a is calculated as follows.

Current quantity at current price a = current price+ ×b

Change in quantity when price is changed by b

You need to learn these formulae.

- Profits are maximised using marginalism theory when marginal cost (MC) = marginal revenue (MR).

- The optimum selling price can be determined using equations (i.e. when MC = MR).

- The optimum selling price can also be determined using tabulation, graphs and gradients.