INTRODUCTION AND DEFINITIONS

You have so far in your studies learned how cost accounting differs from financial accounting, how we can set up double entry cost accounts, how expenditure can be categorised into cost elements, and the nature of these cost elements, and we have touched on the two accounting techniques of absorption costing and marginal costing.

We are now going to examine the first element of cost – material. Before we do so, however, you should study carefully the following definitions of the various kinds of materials stock:

Raw Materials

This is unprocessed stock awaiting conversion into saleable products. Remember that the finished product of one process or industry is often the raw material of the next process or another industry.

Bulk Materials

These are materials not in unit form, i.e. they cannot be counted but must be measured by weight, volume, bars, tubes or sheets. Such materials are not suitable for the work in hand without any change in form.

Part-Finished Stock

This is work-in-progress which has not reached the stage of completion as a part or component.

Finished Goods

These are manufactured goods, ready for sale or despatch, e.g. to a customer or agent. They may also be known as manufactured stock or completed stock, and represent work-in-progress which has been completed and transferred physically, and by entry in the accounts, from the manufacturing department to the warehouse.

Finished Parts

These are items or component parts which are in store and are awaiting either final assembly or sale as spares.

Scrap Material

This is discarded material which has some recovery value and which is usually either disposed of without further treatment (other than reclamation and handling), or reintroduced into the production process in place of raw material.

Indirect Materials

These are materials which cannot be identified as part of the product, e.g. material for the machine which makes the product.

Consumable Stores

This term refers to certain direct materials, such as lubricants, waste, cleaning materials, etc

ACCOUNTING FOR MATERIALS

Accounting for materials is every bit as important as accounting for cash.

Waste

Adequate control is necessary to guard against the many forms of waste which occur, such as carelessness, pilfering, breakages, breaking bulk materials into small lots, overstocking, etc.

Overstocking

This causes loss by wasting space and congesting the stores; physical deterioration through evaporation, shrinkage, damp or rust; obsolescence, so that space is wasted by out-of-date material; and loss of interest on capital needlessly locked up.

Inefficient purchasing may result in direct financial loss by buying in the wrong markets or at the wrong time, and in indirect loss by holding up the work on account of the failure to secure deliveries at the required time.

Advantages of Accounting for Materials

The advantages of stores (material) accounting may be summarised briefly as follows:

- A check on the honesty of staff is provided.

- Differences are detected, investigated and prevented in the future.

- Production is not held up for lack of materials.

- Overstocking is avoided.

- Systematic buying is facilitated.

- Obsolete stocks are detected and dealt with.

- Wastage due to various causes can be measured.

- In the event of a fire which damages materials in stores but not the relative records, or of a burglary, there is evidence available to produce to the insurance company in connection with the amount of the claim.

OUTLINE OF PROCEDURES

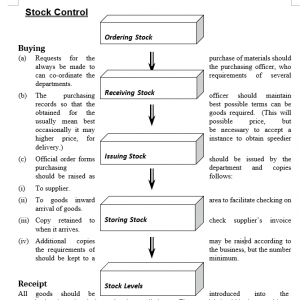

We shall now briefly outline the procedures necessary in the purchase, receipt, storage, issue and transfer of materials.

organisation through a designated and controlled area. The material should be inspected by a competent official, who should prepare, in duplicate, a goods received note. One of these forms should be passed to the purchasing department for comparison with the copy of the order form and the invoice when it comes to hand. The second copy will be passed to the storeman, who will enter details on the bin card when receiving the goods. (Bin cards are more fully described in the next study unit.)

It is common for a firm supplying goods to require a signature of an authorised official of the recipient organisation. Such procedures obviously improve the internal controls within the supplier but often the recipient is acknowledging that he has received the goods, in full, in good condition. In many cases the necessary testing and checking will take some time so it is usual to sign the delivery note and add the word “unexamined”. This provides satisfactory evidence to the supplier that a delivery was made, without preventing the recipient from taking action should some of the goods be missing or defective.

It is essential that the goods are thoroughly checked as soon as possible after receipt and that the supplier is advised of any problems at the earliest opportunity. Normally all contact on such matters will be made by the buyer, who will make use of other technical expertise within the organisation as necessary.

Depending upon the nature of the product, it is sometimes possible to undertake sample checking of quantity or quality. In some circumstances it may be necessary to undertake a full testing procedure, on a strictly limited basis, often to the point of actually destroying the component. Again, depending upon the nature of the product, the purchaser may have made it a condition of his order that, if the specified sample fails his acceptance test, he will be entitled to reject the whole batch. Such procedures are often used by multiple retailers, especially in the clothing industry.

If the materials are not in good condition, the purchasing department must be informed immediately, so that the supplier can be contacted. Often, a goods rejected note is prepared to maintain a formal record and to prevent inadvertent payment of the invoice.

Storage

The point at which goods are stored should be functionally designed and have adequate security. Each storage area should allow easy handling of, and access to, each commodity stored. The sites of stores in an organisation should be carefully planned in relation to cost reduction. Having one centralised store will reduce accommodation costs and wages but will result in more internal transportation and longer lead-times for production departments to get hold of materials.

Issue

The main transactions affecting a system of material control arise from the issue of materials from storage. All materials are issued on an authorisation known as a “stores requisition”. This form, usually issued by the production planning department, is the authority for the storeman to pass out goods from his care into the production flow. The storeman receives a departmental signature for the goods, and enters details on the appropriate bin card.

The requisitions, bearing the number of the cost unit or department for which the goods are to be used, are passed to the cost department, where they will be priced. Following normal double entry principles, we must credit the material accounts and debit the job or process accounts with the value of materials used.

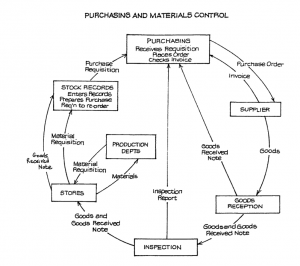

Flowchart

The following flowchart (Figure 11) illustrates the movement of goods and paperwork as

ORGANISATION AND DOCUMENTATION OF PURCHASING

The Objects of a Purchasing System

- To obtain the right quality of materials.

- To obtain the right quantity of materials.

- To obtain delivery in such a manner as to co-ordinate the receipt of stocks with the production programme or sales requirements.

- To pay the minimum price for the materials purchased, consistent with (a) to (c).

- To carry the minimum stocks without causing loss of production through shortage of materials.

Main Documents

- Purchase Requisition Form

- Purchase Order Form

- Specification of Materials

- Goods Received Note

- Goods Rejected Note

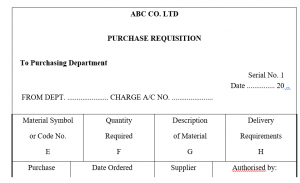

The Purchase Requisition

The form used to advise the purchasing department of the factory requirements and also to authorise the purchasing department to make the necessary purchase is the purchase requisition

![]()

The purchase requisition is completed as follows:

- Spaces A, B and C are filled in by the purchasing department.

- The signature in space D is that of one of the officials who are authorised to sign the requisition.

- Spaces E, F, G are filled in by the storekeeper.

- A space may also be provided for the insertion by the purchasing department of the price per unit of the material and the total value of the order, to enable a control to be maintained of purchase commitments.

- A copy of the purchase requisition will be retained by the person or department originating it.

- In space E the stock code number is entered.

- The “Quantity Required” (space F) is regulated by the maximum and minimum stocks, which are fixed by the management. The maximum stock is the amount above which the storekeeper may not allow the stock in hand to rise, and the minimum stock is the amount below which the stock in hand should not fall.

In space F the unit of quantity (i.e. lbs, tons, etc.) must be stated clearly, to avoid any possible under- or over-ordering. It may be of advantage to have a separate space for “Unit of Quantity”. To save re-handling on delivery, it is essential to indicate the form in which the goods are to be delivered, e.g. in cartons of 100 units or pallets holding 1 gross of packets, etc.

- In space H the delivery instructions should include the unloading bay or direct to place or usage, etc. Date required by may also be inserted.

Normally, three copies of the purchase requisition will be prepared and routed, as follows:

- To the purchasing department.

- To the planning department for information purposes, or this copy may be held by the authorising executive.

- Retained by the issuing department.

A list of officials with power to authorise requisitions should be compiled and properly authorised requisitions only should be accepted by the purchasing department. Most requisitions will come from the storekeeper, when stocks of standard materials need replenishing. Requisitions may also be initiated by:

- Production control department, for materials to be issued direct to jobs.

- Plant engineer, for materials required for capital projects or maintenance. Heads of administrative departments, for indirect materials not kept as standard stock.

The Purchase Order

An official form, known as a purchase order, must be sent out for every order, to show the supplier that the order is an official one on behalf of the firm, and so that the receiving system can function efficiently. In the case of new or non-standard materials, issue of the order will be preceded by a tendering procedure so that the best supplier can be selected.

The purchase order normally incorporates the purchaser’s terms and conditions of purchase; acceptance of the order is deemed to imply acceptance under the purchaser’s terms. This is an important consideration regarding the ultimate acceptance of the goods and any subsequent claims made for defective goods. A significant amount of a purchasing officer’s time can often be taken up in agreeing whose terms are applicable to a particular order.

PURCHASE ORDER

| ABC CO. LTD & ADDRESS Order No. ……………..

To: …………………………………………. Please quote this No. on your Invoice …………………………………………. ………………………………………….

|

||||

| Date ……………………..

Please supply in accordance with the instructions given on the back of this order. |

||||

| Our Code | Quantity | Particulars | Rate | Amount |

|

|

|

Your quotation

No. ……………………….

Terms:

Signed for ABC Co. Ltd ……………………….. |

|

|

Figure 13

Copies of the purchase order will generally be distributed as follows:

- To the supplier.

- To the receiving department.

- To the accounting department.

- To the department which issued the purchase requisition.

- Retained by the purchasing department.

Specification of Materials

| ABC CO. LTD

SPECIFICATION OF MATERIALS

Inward Order No. No. Details Date Delivery Note Date |

|||||

| Item No. |

Details |

Quantity |

Code

(if stock |

For use of Storekeeper | |

| Remarks | Purchase | ||||

| Material) | Req. No. | ||||

| 1

2 3 4 5 6 7 8 9 10 |

|

|

|

|

|

| Compiled by Drawing Office Ref.:

Checked by Planning Office Ref.: |

|||||

Figure 14

A specification of materials (also known as a bill of materials) is a form which shows all the materials and items which will be required for a particular order; this is prepared by the drawing office.

On receipt of such specification, the storekeeper will be able to foresee the requirements of the particular job concerned, and will make sure that he has the necessary materials in stock. If he is short of any of them, he will prepare a stock purchase requisition, and will inform the planning department so that any readjustment of plans necessitated by a shortage of material may be made.

RECEIVING DEPARTMENT

Duties

- Receiving and signing for goods from suppliers.

- Unloading the goods. (The department will have a copy of the purchase order, so that arrangements can be made in advance for any special apparatus required.)

- Checking the contents as to quantity and condition and conformity with the purchase order.

- Taking the necessary steps to have the goods tested or inspected.

- Notifying the stores department or the requisitioning department of the receipt of goods.

- Delivering the goods to the appropriate point of storage or usage.

Goods Inwards Book and Goods Received Note

A goods inwards book may be kept to record all receipts from suppliers. Often goods cannot be checked immediately on unloading, and recording the receipt of the goods in the goods inwards book will ensure adequate control of the goods. The particulars usually recorded in the goods inwards book are:

- Date received

- Supplier and carrier

- Very brief description of the goods

- Reference to the goods received note when compiled.

The next step is the preparation of the goods received note (see below).

Spaces A to G on the form shown (Figure 15) will be filled in at the goods receiving department. It will then be sent with the goods to the stores department, where the goods will be unpacked and their quality and condition inspected. If he is satisfied, the inspector will then sign in the space H and the document will be forwarded to the purchasing department. If the inspector is dissatisfied with the goods, he will issue a goods rejected slip and send this to the purchasing department.

| ABC CO. LTD

GOODS RECEIVED NOTE

Supplier: No. 1

…………………….. G ……………………….. ………………………………………………….. ………………………………………………….. Date Received ………………. 19 ……… |

||||||

| Code No. | Quantity Received | Description of Material | Remarks | |||

| A | B | C | ||||

| Purchase Order No. |

Carrier |

Received by: |

Inspected by: |

|||

| D | E | F | H | |||

Figure 15

Space may be provided on the goods received note for the insertion of a goods rejected slip number and the bin or location number where the goods are finally placed by the storekeeper. Space may also be provided for the number and type of containers and for reference to a separate report, e.g. inspection, shortage, damage report.

Rejected Goods

When goods are found to be defective or otherwise not in accordance with the order, they will be rejected. When goods are rejected, a routine similar to the following should be adopted:

- A goods rejected note, similar to that shown in Figure 16 should be prepared in triplicate.

- One copy of this note should be sent to the purchasing department, which will then arrange with the supplier to obtain credit and arrange for the replacement of the rejected goods.

- The second copy should be sent to the planning department, which may have to modify its plans regarding work with the material concerned.

- The third copy is filed in the stores.

| GOODS REJECTED NOTE

No.: …………………………….

Supplier: …………………………………….. Examined by: …………………………….

Order No.: ………………………………….. Date ………………………………………..

|

||||

| Code | Specification No. | Remarks | Steps Taken | Signature (Purch. Dept) |

|

|

|

|

|

|

Figure 16

PROCEDURE IN THE ACCOUNTS DEPARTMENT

Now let us look at what is happening on the financial accounting side of the business.

Checking the Invoices

The supplier’s invoice will arrive some time after the goods.

It will be necessary to devise carefully a system to check against errors on invoices. A suitable system is where each invoice is, on receipt, entered into an invoice register and numbered. It is then impressed with a rubber stamp, designed as shown in Figure 17.

Spaces (b) and (c) will be filled in by the purchasing department; the requisite numbers are obtained by reference to the copy order book, in which the number of goods received note will have been entered. If each invoice is entered and registered under a serial number, this number being entered in the copy order book, there should be no possibility of passing a duplicate invoice. The register of invoices may be compiled in the purchasing department, the serial number being entered into space (a). The person who is responsible for checking calculations will initial in space (d).

INVOICE STAMP

| Register No. | (a) |

| Order No. | (b) |

| G.R. Note No. | (c) |

| Calculations Checked | (d) |

| Checked with Order | (e) |

| Prices Checked | (f) |

| Allocation | (g) |

| Bought Journal Forward | (h) |

| Stores Ledger

Forward Job Ledger |

(j) |

| Passed for Payment | (k) |

Figure 17

In large businesses, where hundreds or thousands of invoices are handled daily, the calculations may be checked by a special department.

Spaces (e) and (f) will be initialled by a member of the purchasing department, reference being made to the signature on the goods received note for confirmation that the goods are of the required quality and quantity.

The account to which the purchase is to be charged, e.g. whether it is ordinary stock material or whether it is material purchased for a specific job which has to be charged to the cost account for that job, will be entered in space (g). The folio of the entry in either the stores ledger (for standard materials) or the job ledger (for orders in connection with special jobs) will be entered in space (j).

The invoices will then be passed to the accounts office, where they will be entered in the purchase journal for posting to the bought ledger and the bought ledger control account. The purchase journal folio will be entered in space (h).

Finally, the invoice will be passed for payment by the authorised official, who signs in space (k).

THE STOREKEEPER AND STORES ISSUES

Duties of the Storekeeper

The storekeeper has considerable responsibility.

The following is a list of his duties:

- To receive materials into the store.

- To keep all items in store neatly packed in their own containers and in the position allotted to them.

- To issue materials against a duly signed stores requisition.

- To see that no unauthorised person is allowed to enter the store. Normally, the only persons allowed access to the stores, apart from the storekeeper himself, are his assistants, stock-takers and auditors.

- In some cases the responsibility for checking the quantity of goods in each container or bin will rest with the storekeeper.

- To issue a stock requisition whenever the reorder level is reached (see later).

- To maintain records of receipts and issues. (h) To report on any slow-moving and obsolete stocks.

The General Routine for Stores Issues

In no circumstances should materials be issued from store without the presentation of a materials or stores requisition signed by an authorised person (see Figure 18). Only by strict enforcement of this rule is it possible to guard against the misuse of materials and the pilfering of stores.

| ABC CO. LTD Serial No. …………………..

STORES REQUISITION Please supply to ……………………….. Dept Date ………………. 20 …….

Job No. ……………….

|

||||||

| Code No. | Description of Material | Quantity | Price | Amount | Stores Ledger | |

| Required |

Issued |

|||||

|

|

|

|

|

|

|

|

|

Signed: Issued by: Received by: Cost Office Ref.: ……………………. ………………………. ………………………. ………………………….. Foreman |

||||||

Figure 18

The price and amount will be entered by the cost office after the document has been recorded by the stores.

The routine in connection with the above requisition is as follows:

- When any material is required for a job in a department, the foreman makes out a stores (or materials) requisition. He signs this and it is taken to the storekeeper. Note that frequently the requisitions for a particular job are made out by the planning or progress department from the bill of materials and passed to the foreman only when he is ready to start the job. It is also sometimes required that the requisition number should be entered on the bill of materials.

- The storekeeper then issues the materials and signs the requisition, which is also signed by the person receiving the goods.

- The requisitions are forwarded regularly to the cost office, where the issues are priced (see later).

Materials Returned to Stores

Any unused materials normally should be returned to stores together with a stores return note, sometimes referred to as a stores credit note. This document gives similar details to the stores requisition but is usually printed in a distinguishing colour, e.g. red. The routine in connection with the returns note is similar to that with the requisition.

Sundry Transfers of Materials

If goods are transferred from one cost unit to another after leaving the stores, it is necessary to charge the receiving cost unit with the value of materials concerned and to credit the cost unit originally charged. This is achieved by raising a materials transfer slip, which bears a description of the goods transferred, the references of both cost units and the signatures of both supervisors concerned.

Transfers should be made only if the goods are immediately required by another department and if it is clearly more efficient (because of location) to make a direct transfer. Otherwise all unused materials should be returned to the stores, as described above, for reissue.

STOCK LEVELS

In order to ensure that the flow of production is not impaired by the lack of materials and also that excessive capital is not tied up in stocks, it is necessary to ensure that the level of stock held always lies between certain limits.

Maximum Quantity

This represents the greatest amount of an item of stock which should be carried if the best use is to be made of working capital.

In determining the maximum stock level, the following are among the factors considered: (a) Capital tied up in stocks.

- Capital available.

- Cost of storage (including rent, insurance, labour costs).

- Storage space available.

- Consumption rate.

- Economic purchasing quantities (see later).

- Market conditions and prices, seasonal considerations.

- Nature of material – possible deterioration or obsolescence.

Minimum Quantity

This represents the level below which the stock should not normally be allowed to fall if the requirements of production are to be met.

The minimum level is determined by the rate of consumption of materials and the time taken between placing an order and receiving the material.

Reorder Level

It is necessary to set a point at which an order must be placed. This point is known as the reorder level. It will be higher than the minimum level, to cover use during the period before the order is received.

Reorder Quantity

The reorder quantity is the quantity which should be ordered at the time the reorder level is reached. It will depend on the discounts available from suppliers for bulk ordering, the cost of placing an order and the cost of storage (see later).

| Formulae | |

| • | Reorder level = Maximum consumption × Maximum reorder period. |

| • | Minimum stock = Reorder level – (Normal consumption × Normal reorder period). |

| •

|

Maximum stock = Reorder level + Reorder quantity – (Minimum consumption × Minimum reorder period). |

| •

|

Average stock = Minimum stock + ½ Reorder quantity. |

These levels should be reviewed periodically to ensure that they reflect current conditions.

Example

Component A is used as follows:

| Normal usage | 50 per week |

| Minimum usage | 25 per week |

| Maximum usage | 75 per week |

| Reorder quantity | 300 |

| Reorder period | 4-6 weeks |

Calculate the reorder level, the minimum and maximum levels, and the average stock level.

Solution

Reorder level = Maximum consumption × Maximum reorder period

= 75 × 6

= 450

Minimum level = Reorder level – (Normal consumption × Normal reorder period)

= 450 – 50 × 5

= 200

Maximum level = Reorder level + Reorder quantity – (Minimum consumption ×

Minimum reorder period)

= 450 + 300 – (25 × 4)

= 650

Average level = Minimum stock + one half Reorder quantity

= 200 + (300 ÷ 2)

= 350.

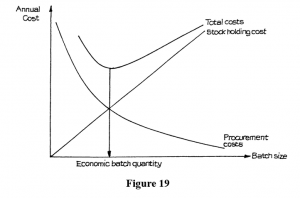

ECONOMIC ORDER QUANTITY

Formula

There is a formula which tells a company the optimum batch size in which to purchase goods.

| The formula is:

Q = 2CC21D |

Where:

Q is the economic order quantity;

D is the annual demand for the product;

C2 is the fixed cost of placing an order, i.e. delivery charges, clerical time in placing order, checking invoice, etc., which do not vary with the size of the order; if the goods are produced internally it will include fixed production costs incurred specifically in producing the batch, e.g. tool setting; C1 is the annual cost of holding one unit of stock.

You should notice that the model is rather limited: the unit cost is assumed to be constant. There is no provision for quantity discounts which might make it more attractive to purchase larger quantities.

Or

| Formula: | C H 2 D C o

|

Where:

D o = Demand

C = Cost of Ordering

C H = Cost of holding

The position of the economic batch quantity can be illustrated graphically (see Figure 19). Obviously, the larger the batches which are bought, the fewer batches there need to be to cover the annual demand. Therefore, the total fixed cost (S × number of batches) decreases as the batch size increases. Conversely, buying larger batches will increase the average stock held, and therefore increase the total stockholding cost. The economic batch quantity is at the point where total costs are minimised

STOCK TURNOVER

| This term expresses the number of times stock is sold or used within a given period. Usually it is expressed as a ratio:

Cost of sales for a specific period Average value of stock held

(Average value of stock held is (Opening value + Closing value) ÷ 2.) |

ACCOUNTING RECORDS REQUIRED FOR MATERIALS

Bin Cards

Bin cards are prime entry records of the quantities of stock, kept on an in/out/balance basis, held in designated storage areas.

These records are maintained at the physical point of storage and usually show only quantities, not costs, of items held. The storekeeper is responsible for keeping the bin cards up-to-date.

The bin card records receipts, issues and the balance remaining in stock. The receipts side will show entries from goods received notes and returned to stores notes and the issues portion shows the goods passed to production as per stores requisition slips. The balance on hand shown on the card should equal the physical number of items in stock.

The bin card may also show the materials allocated, i.e. reserved for a particular cost unit but not yet issued; and free stock, which is the balance on order and on hand less the allocated stock. This is because the reorder level is sometimes set in terms of the free stock level.

Stores Ledger Accounts

These accounts are maintained in a stores ledger held in the cost office, an account being opened for each item held in stock. The entries mirror the transactions shown on the bin cards, but show the values as well as quantities. The physical separation of the bin cards and stores ledger accounts and the fact that different staff are involved helps prevent fraud or pilfering of materials. Having a dual record also helps to detect clerical error.

STOCKTAKING

This is a process whereby stocks (which may comprise direct and indirect materials, work-inprogress and finished goods) are physically counted and are then valued item by item.

Perpetual Inventory and Continuous Stocktaking

When the stores balances are recorded after every issue or receipt of materials, a perpetual inventory is in operation. This can be combined with a continuous stocktaking system whereby a few items are actually counted every day. The physical quantity in stock is then compared with the balance shown in the records.

The advantages of this system are as follows:

The temporary dislocation of work caused by end-of-period stocktaking is avoided.

- The daily checking of items can be so arranged that all items are checked at least twice a year, and fast-moving or valuable lines can be checked more frequently. Checking should be carried out by non-stores staff, and advance notice should not be given of which items are to be checked each day.

- Explanations of differences between physical stock and records can be made more easily and perhaps measures can be taken to prevent a recurrence.

Such differences might be due to:

- Evaporation;

- Absorption of moisture; unavoidable differences.

- Losses in breaking bulk;

- Unavoidable approximation in measuring issues;

- Pilferage;

- causing damage; Poor storage conditions or handling, avoidable differences.

- Careless measurement.

- There is a reinforcement of the need for honesty on the part of the staff.

- The annual accounts can be prepared earlier, as the book value of the stores is acceptable for balance sheet purposes. The stock value can also be used to prepare monthly accounts.

- The opportunity can be taken to check that maximum stock levels are not being exceeded so that the disadvantages of excessive stocks are more easily avoided.

The perpetual inventory routine needs to be thoroughly documented within the organisation, and active measures taken to ensure that laid-down procedures are followed. This is necessary not only to gain the greatest internal advantage of this approach, but also in order that the auditors may be convinced of the validity of the stock figures. To this end the auditors will generally spend a lot of time satisfying themselves that the system is working correctly, especially in the early years after its implementation.

Methods of Stocktaking

Individual Count

Where items are individual and of the same generic group, it is necessary to count the number of each type held in stock.

As a general rule this is only carried out when items are of reasonable size; where nuts, bolts or nails are concerned, it is usual to weigh the items or estimate the amount by experience. The individual count method is very slow and laborious if there are a large number of items involved. This method can be greatly speeded up if stock is stored in standard quantities or bundles, so that it merely becomes a question of counting the number of bundles.

Measurement of Liquids

The method by which the liquid is stored and used will very largely determine the way in which the physical stocktaking should be carried out. If liquid is delivered in bulk and drawn off for use automatically, it is usual for meters to be installed which give the usage for a period and the volume remaining in storage. The tolerance of accuracy is normally very small and, subject to practical experience, it is usual to accept the reading on the meters for purposes of stocktaking. Electronic measuring devices are extremely accurate and can be relied on to provide a high degree of accuracy.

In certain cases usage may be measured by a type of meter which does not record deliveries or stock remaining, e.g. a petrol pump of the older type. A theoretical stock value will be continuously maintained, but the contents of the tank will be compared with this at regular intervals. A dip-stick will normally be used for this purpose. This method of measurement relies on the fact that one dip-stick is maintained for each size of tank, and the degree of accuracy will depend on the calibration of the stick.

Measurement by Calculation

There are many materials which are solids but cannot be counted individually, e.g. coal, flour or sugar. The amount of such items can be calculated by ascertaining the cubic space taken up measured, for example, in cubic feet; so that by using the known weight of the commodity per cubic foot, the total weight can be obtained for pricing.

Measurement by Technical Estimate

Where goods are incapable of being counted or measured by scientific means, it may be necessary to resort to technical estimates.

Organisation of Annual Stocktaking

Many large organisations, which are not working on a perpetual inventory system, will arrange for the physical stocks to be counted before the year end. This is a satisfactory arrangement provided suitable systems are in place to monitor stock movements between the date of the physical check and the financial year end. The auditors must be advised in advance if this route is to be followed and it must be emphasised how important it is to have in place procedures to monitor stock movement and to ensure that they are being correctly followed.

With an annual stocktake (rather than a continuous system) the greatest problem is that of getting the full procedure carried out in the time allowed. The deadline allowed for the completion of stock figures is some time before the completion of the annual accounts. As the physical count cannot take place before the close of the last day’s business, the time available is short and the work to be done considerable.

Preparatory Work

Time will be saved at the stocktaking if preparatory work can be carried out prior to commencement of stocktaking. Jobs which can be done are: the typing of forms, the entering of static information such as description and in certain cases price, the grouping of forms by departments and the issue of stocktaking forms at least one week in advance of the date of action.

One week before stocktaking, therefore, a responsible official can check that the correct forms have been issued to the various sections and departments and have been completed in respect of date, heading and all static information. This will eliminate one of the common bottle-necks caused by people complaining that they did not receive the correct forms or did not receive any forms at all.

Careful design of forms can also save time at the actual stocktaking. They should be on stout card so that they are not damaged in the stores, logically laid out so that the person completing them can work from left to right, and should ask only for relevant information.

Physical Counting and Measurement

This should be carried out by non-stores staff (but the stores staff should be on hand to assist by showing the stocktakers the location of each item). The stocktakers should only be required physically to measure the stock and enter this on forms on which the description of each item has already been entered: all other entries to be made can be done in the cost office. The auditors should normally be invited to attend the physical count, although their appearance will depend upon the materiality of the stock figure.

Valuation

Having ascertained the quantity of stock, this has to be converted to a value in RWF. We will consider this later.

- Checking

On completion of the calculation and the checking, it should be the specific responsibility of the official in charge of stocktaking to ensure that all stock sheets issued have been returned fully completed.

Any additional sheets relating to new types of stock should be specially studied, so that at the following stocktaking the appropriate preparatory work can be carried out. All sections should then be merged into a stock summary, taking care to ensure a full audit trail back from the final stock value to the individual items of stock.

Conclusion

If the suggestions on form design and organisation of staff are carried out, accurate physical stock figures can be obtained. Nevertheless, an annual stocktaking is a major undertaking needing a lot of work.

THE PRICING OF MATERIAL ISSUES

Problem of Pricing

In times of changing prices, firms have to decide on how they will price the materials issued to production, when they are trying to arrive at overall production costs. Should it be the price they actually paid for the material, or the current price of the same type of material (which could well be higher)?

There are several different methods of pricing material issues, which we shall now discuss.

At Market Price Ruling at the Date of Issue

When quoting for business, it may be necessary to include materials on the basis of their market price at the time, even though they may have been bought some time earlier at a higher price; for, if a firm gives a high quotation in an attempt to recover the full cost of the materials, it may lose the business altogether to a competitor whose quotation is based on the current market price.

Conversely, if a manufacturer has, through good fortune or foresight, acquired considerable stocks of a material at a price below that currently ruling and he acquires business which will use those materials, he will want to take advantage of this good buying by placing a quote which includes the current market value of the materials. (The manufacturer will not always get away with this! In particular, if he is a contractor for a government department he will be obliged to charge for the materials at cost.)

The use of market prices therefore gives credit for good buying and the reverse for bad buying. The difficulty is to establish the current market price and, as this does not line up with the actual cost of the materials, it is necessary to operate an adjustment account to take care of the differences.

At Inflated Cost

This method is used to cover the unavoidable wastage which may occur in certain circumstances. The changes which often take place in this wastage render the method inaccurate and an adjustment account will have to be opened.

At Cost Price

Issue of materials is usually carried out on this basis, and clearly it is not necessary to use an adjustment account. There are several conventions by which materials can be issued at cost price; the most usual are described below.

FIFO – First In, First Out

This is a method pricing material issues using the oldest purchase price first, i.e. the oldest items in stock shown by the stock records are issued first.

If the transactions involved are numerous, this method involves a great deal of clerical effort, and it is therefore best used for slow-moving stock where the value is high and the price does not fluctuate a great deal. In times of rising prices, the valuation of issues tends to be low. On the other hand, the value placed on the closing stock will reflect current prices, since if the first stock to come in is deemed to be the first issued, it is the latest stock which remains.

Advantages of FIFO

- Probably represents what is really happening within the stores.

- Easy to use.

- Easy to explain to managers.

- The closing stock value should be near market value.

Disadvantages of FIFO

- Can be difficult to operate.

- Issues of stock can be at a lower cost than market price, especially in a period of inflation.

LIFO – Last In, First Out

This is a method of pricing material issues using the last purchase price first.

When this method is in operation, stores issued are charged at the prices of the latest items in the stock from which the materials are drawn. In times of inflation, therefore, the cost of the present high-priced material is charged to production as it is incurred. On the other hand, closing stocks will be conservatively valued. Like FIFO, the method can be cumbersome to operate and possibly inequitable.

- Advantages of LIFO

- Fairly accurate method of accounting for inflation.

- Helps decision making.

- Stock that is issued is close to market value of stock.

Disadvantages of LIFO

- Can be difficult to operate.

- Difficult to explain to managers.

- Variations in prices.

- Closing stocks become undervalued when compared to market value.

Advantages of Weighted Average Price

- Any fluctuations in price are smoothed out.

- Decision making is made easier using this method.

- Easier to operate.

Disadvantages of Weighted Average Price

- Prices and closing stock values can be lower than the market value.

- When using this system, actual price can run into several decimal places.

- Standard Price

This is the method adopted when a standard costing system is in operation. Purchases are posted to the stock account at the predetermined standard price and issues are priced at standard price. The difference between the actual cost of purchases and their value at standard price, called the “price variance”, is posted to a separate account.

- Replacement Price

Under this method, stores are issued at the current replacement price. Using standard manual record cards it is not possible to maintain details of the value of goods in stock, although the physical balance is maintained and may be multiplied by the current replacement price to arrive at a replacement cost stock figure. This stock figure would need to be adjusted subsequently, before it could be used in the financial accounts of the company.

Good records are essential, as the replacement price at the time of each issue must be known and this is only likely to be realistic in a fully computerised environment. The system has the advantage that all issues are made at current economic value, but this in itself will lead to the generation of sundry profits and losses on stock holdings.

OBSOLETE, DORMANT AND SLOW-MOVING STOCK

Obsolete Stock

Obsolete stock can be a serious matter. All stock represents cash and should be turned into products and sold to bring the money back in again.

Obsolete stock is dead cash. All possible steps must be taken to prevent stock from becoming obsolete by the co-ordination of the efforts of all concerned. For example, the design department may agree to a modification being held back until existing stocks have been used; or the sales department may have a big “push” on an item which is shortly to be dropped, so as to clear out stocks.

Yet some obsolescence is unavoidable. It is a good thing to keep a separate section of the stores, to which any stocks declared obsolete should be transferred immediately.

Thought must be given as to whether there will be a demand for spares for old models still in existence and, if so, some parts must be set aside for this purpose.

The remaining problem then is the one of finding the best possible market for the remainder. The buying department is usually in the best position to do this.

Remember, it is not only the cost of the materials which is tied up, but storage space, labour, etc.

Dormant and Slow-Moving Stock

In addition to obsolete stock there is the problem of dormant stock, and of slow-moving stock. Dormant stock means an item which has not moved for a considerable period. It is not obsolete because it has not been replaced by a new item, and in the future it is expected to move again.

Slow-moving stock may consist of items which are only issued at long intervals. Obviously an item like this will not be featured as a stock receipt until, after a long interval, it drops to reorder level. At that time, either the storekeeper will mark the reorder requisition “SM” so that the matter will be investigated, or, in the case of an automatic system, the item will be printed out by the computer as an exception for special study.

JUST-IN-TIME (JIT)

Traditionally organisations in the West have used a “push” production flow system. This system has the following stages:

- Buy raw materials and place them in stock

- Produce goods based on sales forecasts

- Requisition goods from stock and make products according to the production schedule

- Place finished goods into finished goods store

- Sell to customers from finished goods when customers request products

However, Japanese companies, most notably Toyota, developed a different system, known as Just-In-Time or Stockless Production. This system is not a “push” system but a “pull” system.

A product is not made until the customer requests it and components are not made until they are required by the next production stage. In a full JIT system, virtually no stock is held; that is no raw material stock and no finished goods stock, but there will usually be a small amount of work-in-progress.

JIT stock management methods seek to eliminate any waste that arises in the manufacturing process as a result of using stock. JIT purchasing methods apply the JIT principle to deliveries of material from suppliers. With JIT production methods, stock levels of raw materials, work-in-progress and finished goods are reduced to a minimum or eliminated altogether by improved work-flow planning and closer relationships with suppliers.

Advantages of JIT

JIT stock management methods seek to eliminate waste at all stages of the manufacturing process by minimising or eliminating stock, defects, breakdowns and production delays. This is achieved by improved workflow planning, emphasising quality control and firm contracts between buyer and supplier.

One advantage of JIT stock management methods is a stronger relationship between buyer and supplier. This offers security to the supplier, who benefits from regular orders, continuing future business and more certain production planning. The buyer benefits from lower stock holding costs, lower investment in stock and work-in-progress and the transfer of stock management problems to the supplier. The buyer may also benefit from bulk purchase discounts or lower purchase costs.

The emphasis on quality control in the production process reduces scrap, re-working and setup costs, while improved production design can reduce or even eliminate unnecessary material movements. The result is a smooth flow of material and work through the production system, with no queues or idle time.

Disadvantages of JIT

A JIT stock management system may not run as smoothly in practice as theory may suggest, since there may be little room for manoeuvre in the event of unforeseen delays. For example, there is little room for error on delivery times.

The buyer is also dependent on the supplier for maintaining the quality of delivered materials and components. If delivered quality is not up to the required standard, expensive downtime or a production standstill may arise, although the buyer can protect against this by including guarantees and penalties in the suppliers contract. If the supplier increases prices, the buyer may find that it is not easy to find an alternative supplier who can meet his needs at short notice.