WEDNESDAY: 6 April 2022. Afternoon paper.

Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Do NOT write anything on this paper.

QUESTION ONE

1. An agency relationship in management of investment and finance arises where one or more parties hires another to perform on his behalf some services and then delegates decision making authority to the hired party.

Required:

In relation to the above statement, explain three main forms of agency relationship that could arise in a limited company. (6 marks)

2. Outline four categories of asset classes available in the investment environment. (4 marks)

3. Maisha Bora Investments Ltd. wishes to raise funds amounting to Sh.100 million to finance a project in the following manner:

- Sh.60 million from debt.

- Sh.40 million from floating new ordinary shares.

The present capital structure of the company is made up as follows:

- 6,000,000 fully paid ordinary shares of Sh.10 each.

- Retained earnings of Sh.40 million.

- 2,000,000, 10% preference shares of Sh.20 each.

- 400,000, 6% long term debentures of Sh.150 each.

Additional information:

- The current market value of the company’s ordinary shares is Sh.60 per share.

- The expected ordinary share dividends in a year’s time is Sh.2.40 per share.

- The average growth rate in both dividends and earnings has been 10% over the past ten years and this growth rate is expected to be maintained in the foreseeable future.

- The company’s long term debentures are currently trading at Sh.100 each. The debentures will mature in 100 years.

- The preference shares were issued four years ago and still trade at face value.

- Corporate tax rate is 30%.

Required:

Cost of ordinary share capital. (2 marks)

Cost of debt capital. (3 marks)

Cost of preference share capital. (1 mark)

The company’s market weighted average cost of capital (WACC). (4 marks)

(Total: 20 marks)

QUESTION TWO

1. Assess four factors that an entrepreneur should take into account when deciding whether to use short term sources or long term sources to finance business operations. (4 marks)

2. Discuss four common features of alternative investments. (4 marks)

3. Outline four types of fixed income securities. (4 marks)

4. Describe four challenges faced by banks as new entrants in the provision of mortgage finance. (4 marks)

5. Summarise four purposes of derivative market in your country. (4 marks)

(Total; 20 marks)

QUESTION THREE

1. Explain six roles played by financial intermediaries to an economy. (6 marks)

2. Examine three challenges of the average rate of return (AAR) method for appraising new investment projects. (3 marks)

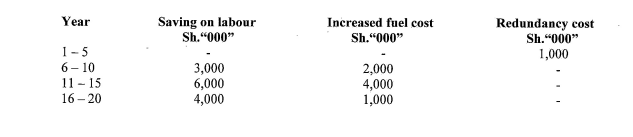

3. Biashara Ltd. is considering the acquisition of a grading machine whose expected impact on the cash flows would be as follows:

Additional information:

- The machine can be acquired at Sh.3 million.

- The machine has a nil residual value.

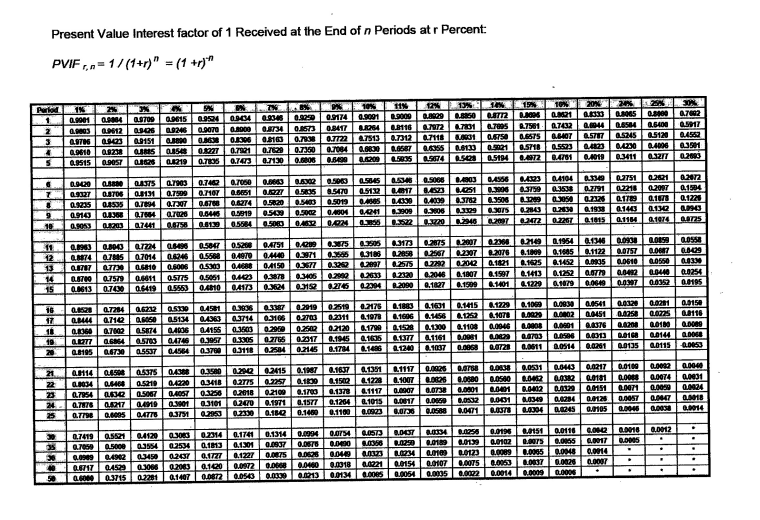

- The cost of capital is 10%.

- Ignore corporate tax.

Required:

Using the Net Present Value (NPV) method, advise Biashara Ltd. whether the machine should be acquired. (7 marks)

Outline four advantages of using the NPV technique in project appraisal. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. Simon Makori borrowed Sh.1,000,000 on 1 March 2022 from Dena Conuriercial Bank repayable semi-annually over a three year period. The interest rate on the loan was 10% per annum.

Required:

A loan repayment schedule over the three year period. (6 marks)

2. Explain the following theories in relation to valuation of financial assets:

Technical theory. (2 marks)

Random walk theory. (2 marks)

Fundamental theory. (2 marks)

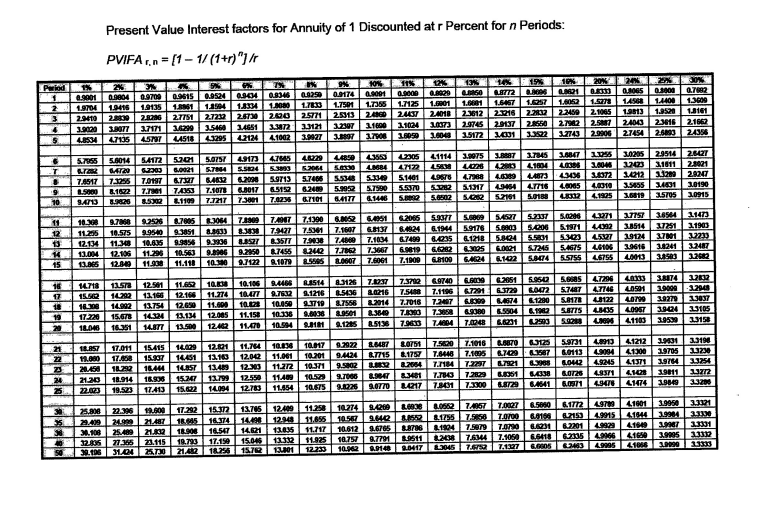

3. The dividend per share (DPS) of Mambo Yote Limited as at 31 December 2021 was Sh.25. The company’s financial analyst has predicted that dividends would grow at a rate of 20% for the first five years and thereafter growth rate would fall to a constant rate of 7% per annum. The analyst has also projected a required rate of return of 10% for the equity market. Mambo Yote Limited shares have a similar risk to the typical equity market.

Required:

The intrinsic value of shares of Mambo Yote Limited as at 31 December 2021. (8 marks)

(Total: 20 marks)

QUESTION FIVE

1. Explain two sources of finance in Islamic financing. (4 marks)

2. The following information relates to two forex bureaus; Tausi Forex Bureau and Ziko Forex Bureau.

Required:

Compute the gain from locational arbitrage for a Kenyan investor with Ksh.2,000,000. (4 marks)

3. Samuel Kakuju wishes to make an investment of Sh.100,000 to pay school fees for his children. He will make the deposit at the end of every year.

Required:

The future value of a Sh.100,000 investment made at the end of every year for 5 years assuming the required rate of return is 12% compound annually. (6 marks)

4. The financial manager of Jumbo Technologies Limited has received the following data from a proposed investment project. The expected returns from the project are related to future performance of the economy over the period as follows:

Economic scenario Probability of occurrence (Pi) Rate of return (r)

Strong growth 0.25 15%

Moderate growth 0.50 12%

Low growth 0.25 8%

Required:

The expected rate of return from the proposed investment project. (2 marks)

The standard deviation of the proposed investment project. (4 marks)

(Total: 20 marks)