MONDAY: 4 April 2022 Morning Paper Time Allowed: 3 hours

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show all your workings. Do NOT write anything on this paper.

QUESTION ONE

1. Discuss four stages of the portfolio management process. (8 Marks)

2. In relation to Capital Market Theory:

Describe three assumptions of the Arbitrage Pricing Theory (APT) (3 matks)

Highlight three uses of multifactor models in portfolio management (3 marks)

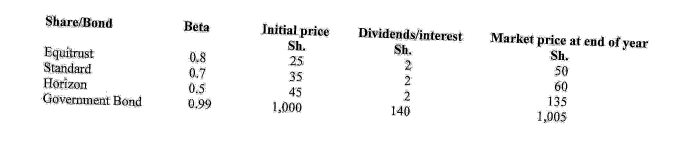

3. An investor holds the following portfolio:

Required:

The average return Of the portfolio given a risk free rate of 14 % (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Jane Kisire has an investment portfolio worth Sh.5 million. She is 68 years old, retired and has no children. After her death, she wishes to leave her portfolio to a local play theatre that has given her relatively free access to play performance over the past decade. Her health is better than average and she maintains an active lifestyle consisting of frequent swimming, biking and hiking. She estimates that to maintain her standard of living, she needs approximately 814500,000 per year Expenses are expected to grow at an expected inflation rate of 5%. She states that as a retiree, fter tolerance for risk is “below average’.

Required:

Determine the investor’s return objective. (2, marks)

Discuss the investor’s ability to take risk. (2 marks)

Explain the time horizon and liquidity constraints for the inVeglet. (3 marks)

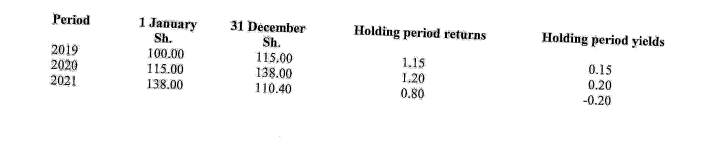

2.Reno Management Company has availed you the following information regarding an investment being considered by one of their Clients:

Required:

Compute the arithmetic Mean (M) and the geometric mean (GM): (4 marks)

Give a reason Why GM is considered a more superior measure than AM: ( 1 mark)

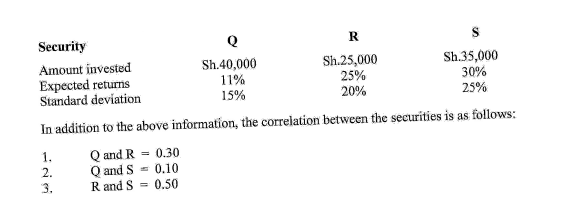

3.An investor is considering three &Sada, Q, R and S to include in .a portfolio. He is intending to invest different amounts of money in each asset since he has been informed that the expected returns and risks for each security are different as shown below:

Required:

Determine the covariances of securities Q and R, Q and S and, R acid S. (4 marks)

The portfolio risk based on Markowitz model. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. In the investment sector, requirement and importance of documentation cannot be overemphasised as they form the backbone on which solid contracts are sealed.

In relation to the above statement, evaluate the rationale of internal and external documents within the investment and for each category, give suitable examples that are applicable in your country. (4 `marks)

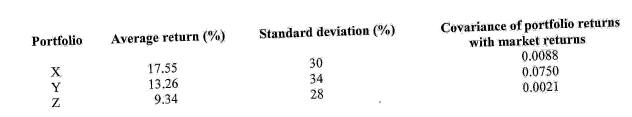

2.The following information relates to the performance of three potforlios X, Y and Z during the year ended 31 December 2021:

Additional Information;

- The market return and the risk-free rate averaged. 14% and 7% respectively during the year ended 31 December 2021.

- The standard deviation of the market return is 10%.

Required:

Evaluate the perforrnance of the three portfolio using:

Sharpe’s performance Measure. (3 marks)

Treynor’s performance measure, (3 marks)

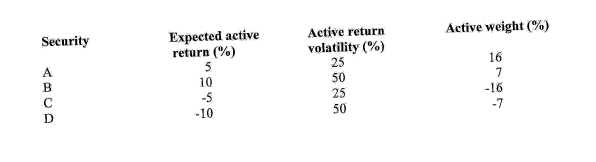

3. The following information relates to four individual securities whose active returns are uncorelated with other and forecasts are independent from year to year:

Additional Information:

1. The benchmark portfolio for these four securities is equally weighted.

2. The forecasted return on the benchmark portfolio is 10%.

Required:

Calculate the portfolio weights and total expected returns of each of the four securities, (4 marks)

Determine the total return and active return of the managed portfolio. (2 marks)

Evaluate the active risk of managed portfolio. (2. marks)

Given the information coefficient of 0.20, a breadth of 4 and active risk of 7.5%, determine the information ratio (IR) using the law of active management, (2 marks)

(Total 20 marks)

QUESTION FOUR

1. With respect to behavioural finance, explain the following terminologies as they impact making portfolio decisions:

Overconfidence bias. ( 2 mark)

Belief perseverance bias. (2 marks)

Regret avoidance bias, (2 marks)

Explain four strategies that portfolio manager could, employ in order to overcome psychological biases

in (i) to (iii) above. (4 marks)

2. Explain the following fintech terms as used in investment management;

Text analytics and natural language, processing. (1 mark)

High frequency trading. (1 mark)

Distributed ledger technology. (1 mark)

Cryptocurrency. (1 mark)

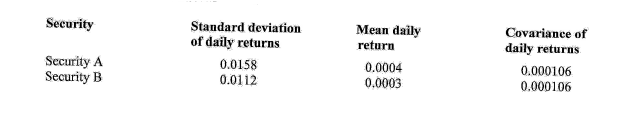

3. The following information relates to a portfolio that is invested 60% in Security A and 40% in Security

There are 250 tradings in a year, and the portfolio has a value of sh.10 million

The following standard deviation are made available:

5% 1.65

1% 2.31

Required:

Calculate the 5% anual value at risk (Var), (6 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise four differences between. “securities market line (SML)” and “capital market-lint (CML)”, (4 marks)

2. Explain the following terms as used in the fundamental law of active management

Information Coefficient (IC). (1 mark)

Breath (I mark)

Transfer Coefficient (TC). (1 mark)

Active risk. (1 mark)

3. In relation to private wealth management:

Explain the the term “estate planning” (2 marks)

Differentiate between a “revocable trust” and an “irrevocable trust”. (2 marks)

4.Jospbat Musyoka is determining the, impact of taxes on his expected investment returns and wealth accumulations. Musyoka’s applicable tax jurisdiction requires a flat tax rate of 20% which applies to all types of income and is taxed annually. Musyoka expects a 7% per year return on his investment over a 20 year time horizon and his initial portfolio value is set at Sh.100,000.

Required:

Evaluate Musyoka’s expected wealth at the end of 20 years. (2 marks)

Calculate the tax drag in percentage terms. (2 marks)

If the return comes in form of deferred capital gains tax affected at the end of the investment horizon, evaluate Musyoka’s expected wealth after 20 years. (2 marks)

Musyoka has a current investment With market value of sh. 100,000 and a cost of Sh.80,000., Evaluate. Musyoka’s expected wealth after 20 years, (2 marks)

(Total; 20 marks)