FRIDAY: 21 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. The Basel III accord is a set of financial reforms that was developed by the Basel Committee on Banking Supervision (BCBS), with the aim of strengthening regulation, supervision and risk management within the banking industry. Basel III was introduced to improve the banks’ ability to handle shocks from financial stress and to strengthen their transparency and disclosure.

In light of the above statement, explain three principles of Basel III accord. (6 marks)

Explain two implications of Basel III accord on the banking industry. (4 marks)

2. Explain four methods of payment that could be used in international business. (4 marks)

3. Describe six ways that the central bank could use to intervene in the foreign exchange market in your country. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Examine two reasons why emerging economies adopt trade restrictions. (4 marks)

2. Mwangaza Enterprises is a company incorporated in Kenya with its core business being importation of high quality electronics from United Kingdom. The firm enjoys three month’s credit from the date it procures a consignment of the gadgets. On 1 February 2021, Mwangaza Enterprises imported a consignment worth 500,000 Sterling Pounds (£).

Additional information:

- The spot rate on 1 February 2021 and 1 May 2021 were as follows:

As at 1 February 2021, Shilling futures were forecasted to trade at 0.00675 (contract size 1,000,000) during the month of May 2021.

Required:

Demonstrate how Mwangaza Enterprises could have used a futures contract as a hedging tool, indicating any hedging gain or loss. (4 marks)

The number of futures contracts that Mwangaza Enterprises could have purchased if the contract size was 1,500,000. (2 marks)

3. The following data has been provided by a foreign exchange market:

Spot exchange rate: United States dollar and Sterling pound ($:£) = 1.3500 — 1.3550

Annual risk free interest rate (one-year maturity):

United Kingdom Sterling Pound (£) 1.50% — 1.56%

United States Dollar ($) 4.55% — 4.58%

Required:

The bid-ask quote for the one-year forward exchange rate between the United States dollar and the Sterling pound ($:£). (4 marks)

Paul Njoya is an international businessman. He wishes to calculate the cross rate between the Euro (€) and the South Korean Won (E:Won).

A major dealer on the Forex Market provides the following quotes:

United States Dollar/South Korean Won: ($:Won) 1014.0 — 1015.0

Euro/United States Dollar: (€:$) 1.52000 — 1.62500

Required:

The bid ask cross exchange rate between the Euro and South Korean Won (E:Won). (4 marks)

Suggest two factors that could affect the bid-ask spread in (i) and (ii) above. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Argue six cases why Multi-National Corporations (MNCs) engage in foreign direct investments (FDIs). (6 marks)

2. Analyse three methods that could be used to determine whether a transfer price between parents and subsidiaries is reasonable. (6 marks)

3. Mac Limited is a Kenyan based company that has just constructed a manufacturing plant in Rwanda.

The following additional information is provided:

- The construction cost is 9 billion Rwandese Francs (RWF).

- Mac Limited intends to leave the plant open for three years.

- During the three years of operation, Rwandese Francs cash flows are expected to be as follows:

Year 1 2 3

Cash flows (RWF “Billions”) 3 3 2

- Operating cash flows will begin one year from today and are remitted back to the parent at the end of each year.

- At the end of the third year, Mac Limited expects to sell the plant for 5 billion RWF.

- The required rate of return is 14%.

- It currently takes 9 RWF to buy one Kenya Shillings (KES).

- Rwandan Franc is expected to depreciate by 5% per year.

Required:

Advise Mac Limited whether it should undertake the project using the Net Present Value (NPV) method. (8 marks)

(Total: 20 marks)

QUESTION FOUR

1. PNK Limited, a Kenyan based Multinational Corporation (MNC) has subsidiaries in Eastern and Western African Countries. The company intends to hedge its translation exposure due to fluctuations in the value of subsidiaries home country’s currencies.

Required:

Argue four cases against hedging translation exposure in the context of the above statement. (4 marks)

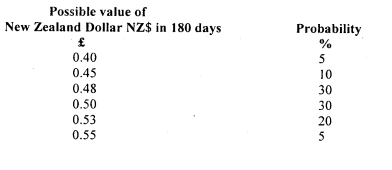

2. Assume that Victoria Limited, a company based in the United Kingdom (UK) imported goods from New Zealand and needs 100,000 New Zealand dollars (NZ$) 180 days from now. The company is trying to determine whether to hedge this position. Victoria Limited has developed the following probability distribution for the New Zealand dollar:

Additional information:

- The 180-day forward rate of the New Zealand dollar is 1.52.

- The spot rate of the New Zealand dollar is £0.49.

Required:

A feasibility analysis table indicating the possible real costs of hedging. (6 marks)

The probability that hedging will be more costly to the firm than not hedging. (2 marks)

The expected value of the additional cost of hedging. (3 marks)

3. Summarise five benefits of a centralised cash management system to a multinational enterprise. (5 marks)

(Total: 20 marks)

QUESTION FIVE

1. Summarise five indicators of high country risk that a multinational corporation should consider when making international investment decisions. (5 marks)

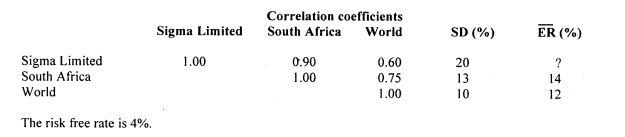

2. The following information relates to Sigma Limited, a manufacturing company based in South Africa; South Africa Stock Exchange market index; and the world market index, together with the standard deviation (SD) of returns and the expected returns (ER):

Required:

The domestic country beta for Sigma Limited. (2 marks)

The world beta. (2 marks)

The equity cost of capital for Sigma Limited using Capital Asset Pricing Model (CAPM). (Assume that South Africa Stock Exchange market is segmented from the rest of the world). (2 marks)

Sigma Limited’s cost of equity capital using CAPM. (Assume that South Africa Stock Exchange market is integrated with the rest of the world). (2 marks)

3. Explain the meaning of the term “Green movement” as applied in International Finance. (2 marks)

Describe five benefits that a multinational corporation could gain by embracing the green movement ideologies. (5 marks)

(Total: 20 marks)