FRIDAY: 21 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are show n at the end of the question. Show ALL your workings.

QUESTION ONE

1. Modern financial markets employ a wide range of derivative instruments that could suit different needs of their clients.

In light of the above statement, describe four types of swaps available to market participants in your country. (4 marks)

2. Examine live types of risks associated with trading derivatives. (5 marks)

3. Describe two uses of index futures. (4 marks)

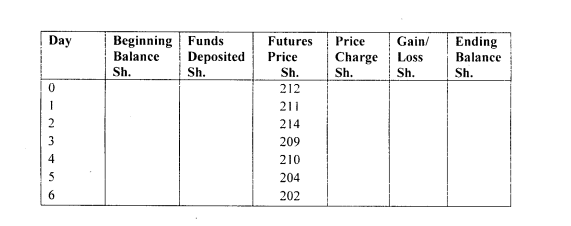

4. The current price of a futures contract is Sh.212. The initial margin requirement is Sh.10 and the maintenance margin required is Sh.8. An investor can go long 20 contracts, meet all margin calls but does not withdraw any excess margin. The contract is purchased at the settlement price of that day, so there is no mark to market profit or loss on the day of purchase.

The investor has provided the table below:

Required:

Complete the table above. (6 marks)

Determine the total gains or losses by the end of day 6. ( 1 mark)

(Total: 20 marks)

QUESTION TWO

1. Highlight four features of a forward contract. (4 marks)

2. A 1 year semi-annual equity swap which is based on an index is at 985 and has a fixed interest rate of 4.4%. 90 days after the initiation of the swap, the index is at 982 and the London Interbank Offered Rate (LIBOR) is at 4.6% for 90 days and 4.8% for 270 days. The notional value of the equity swap is Sh.2 million.

Required:

The value of the swap to the equity payer. (4 marks)

3. An investor has an equity portfolio with a 60% allocation to small-cap stocks and a 40% allocation to large cap stocks.

The portfolio is currently valued at Sh.150 million. The investor wishes to reduce the small cap allocation to 45% and increase the large cap allocation to 55% for a period of nine months. The large cap beta is 1.15 and the small cap beta is 1.25. A small cap futures contract that expires in nine months is priced at Sh.195,750 and has a beta of 1.12. A large cap futures contract that expires in nine months is priced at Sh.215,750 and has a beta of 0.92. Both contracts have multipliers of I. After nine months, the large cap stocks are up 4.75% and small cap stocks are up 6.25%. The large cap futures price is Sh.223.762 and the small cap futures price is Sh.206,712.

Required:

The market value of the portfolio using futures to adjust the allocation. (8 marks)

Citing two reasons, explain why the returns on the futures overlay strategy is not the same as that of a cash market strategy. (2 marks)

4. A spot price of an asset is Sh.50, the interest rate is 6.25%, the futures value of the storage cost is Sh.1.35 and the futures expires in 15 months.

Required:

Determine the futures price. (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Distinguish between “over the counter (OTC)” and “Exchange market” as used in derivatives trading. (4 marks)

2. Wazembo Limited’s share is trading for Sh.70 and pays a Sh.2.20 dividend in one month. The one-month risk free rate is 10% quoted on an annual compounding basis. The share (racks ex-dividend the same day the single share forward contract expires.

Required:

The one-month forward price for Wazembo Limited’s ordinary share. (3 marks)

3. A firm has entered into a receive-floating 6×9 FRA – forward rate agreement at a rate of 0.86%, with a notionalamount of Sh.10 million LIBOR. The six-month spot Shilling London interbank offered rate (LIBOR) was 0.628% and the nine-month Shilling LIBOR was 0.712%. The 6×9 FRA rate is quoted in the market at 0.86%. After 90 days have passed, the three-month Shilling LIBOR is 1.25% and the six-month Shilling LIBOR is 1.35%.

Required:

Calculate the value of the original receive-floating 6×9 FRA after 90 days. (4 marks)

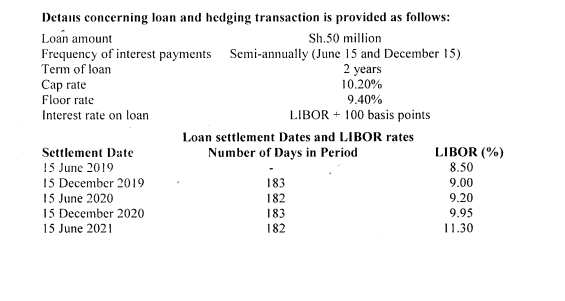

4. Top-Tech Limited arranged a floating rate loan on 15 June 2019 to finance the construction of one of its factories. The company’s Chief Executive Officer (CEO) has approached you to help reduce the firm’s exposure to the risk of rising interest rates. You respond by purchasing caplets and selling floorlets to establish a zero-cost position. Details concerning the loan transaction and hedging transaction are summarised below. The LIBOR rates and the number of days falling within each settlement period are also provided.

Required:

Calculate the effective interest due on 15 June 2020. (7 marks)

Determine the caplet payoff on 15 June 2021. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Outline three advantages and three limitations of the Black-Scholes-Merton (BSM) model. (6 marks)

The underlying is priced at Sh.225 and the continuously compounded dividend yield is 2.7%. The exercise price is Sh.200. The continuously compounded risk free rate is 5.25%. The time to expiration is three years and the volatility is 0.15.

Required:

The price of a call option using the Black-Schole-Merton (BSM) model adjusted for cash flows on the underlying. (4 marks)

2. Tyson Mkubwa is a financial analyst and would like to obtain the value of a European call option with two years to expiration and an exercise price of Sh.100. The underlying bond is Sh.100 par value, 7% annual coupon bond with three years to maturity.

The interest rate at the start of the call option contract is 3% and it is expected to either go up to 5.99% or down to 4.44% in year 1. Interests rates are expected to change into 3 levels in years 2, that is, 8.56%, 6.34% or 4.7% respectively.

The bond price at the end of year 2 is expected to be Sh.98.56 at 8.56%, Sh.100.62 at 6.34% and 102.20 at 4.7% interest rates respectively.

Required :

Construct a two-period binomial tree for option price. (8 marks)

Determine the option value today. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Derivative contracts are largely classified into either forwed commitments or contingent claims.

Citing relevant examples, distinguish between “forward commitments” and “contingent claims”. (6 marks)

2. Proton Ltd. is a Kenyan company that issues a bond with a face value of Sh.1.2 billion and a coupon rate of 5.25%.

Proton Ltd. decides to use a swap so as to convert this bond into a dollar-denominated bond.

The current exchange rate is Sh.120/$. The fixed interest rate on the dollar-denominated swaps is 6% and the fixed interest rate of the shilling-denominated swaps is 5%. All payments to be made annually.

Required:

1. Assess how swap will be executed. (3 marks)

2. Identify the cash flows at start. (2 marks)

3. Generate all interest cash flows of each interest payment date. (2 marks)

4. Identify the cash flows at the expiration of the bond. (2 marks)

3. The following information is available on put and call options on an asset:

Call price Sh.3.50

Put price Sh.9

Exercise price Sh.50

Forward price Sh.45

Days to option expiration 175 days

Risk-free rate 4%

Required:

Using put-call forward parity, calculate prices of the following:

1. Synthetic call option. (1 mark)

2. Synthetic put option. (1 mark)

3. Synthetic forward contract. ( 1 mark)

For each of the 3 synthetic instruments in (i), (ii) and (iii) above, identify -any mispricing by comparing the actual price with the synthetic price. (2 marks)

(Total: 20 marks)