THURSDAY: 20 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Describe five qualities of a valid benchmark as used in evaluating portfolio performance. (5 marks)

2. BlackBrick Limited (BBL) offers a defined benefit pension plan to its employees. Joshua Mutiso, a portfolio manager has collected the following details about BBL:

- The plan is fully funded.

- The average age of the participants is 38 years.

- The active to retired participant’s ratio is 3:1.

- The company has reported strong financial results in the current financial year.

- The discount rate used to determine the present value of future obligations is 8%.

- The duration of plan liabilities is 22 years.

- The sponsor has proposed a return objective of 8.5%.

- BBL offers a one-for-one inflation indexation through a cost of living allowance.

- Future benefits are twice as high relative to accrued benefits and are attributable to future real wage growth.

- BBL is considering the inclusion of an early retirement provision.

Required:

State BBL’s return objective. (2 marks)

Identify two purposes which the sponsor may have in stating a return objective of 8.5%. (2 marks)

Formulate the risk tolerance, liquidity and time horizon components for BBL’s investment policy statement (IPS). (6 marks)

3. Gibson Kipsang has recently inherited Sh.5 million and wishes to invest in equities.

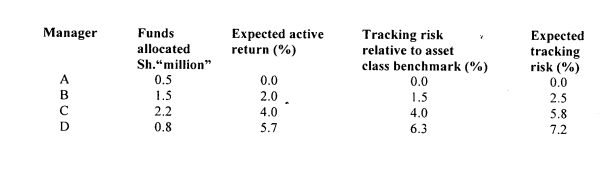

He identifies and allocates the funds to a set of four managers each with their distinct investment styles as follows:

Required:

The portfolio’s active return with respect to the equities allocation. (2 marks)

Determine the manager with the highest true active risk. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain how each of the following behavioural factors could affect asset allocation:

Illusion of control. (2 marks)

Mental accounting. (2 marks)

Availability bias. (2 marks)

2, Rose Ambani is analysing the trading costs of her most recent purchase of 1,000 shares of Tambun Ltd.

She accumulates the following facts for her evaluation:

- The benchmark price was Sh.60 per share.

- The order was placed last Tuesday, when the shares of Tambun Ltd. closed at Sh.59.90 per share. 500 shares were purchased at a price of Sh.61.05 per share. Commission and fees were Sh.50.

- On Wednesday, 200 more shares were purchased at Sh.62.05 per share. Commission and fees were Sh.20. Shares of Tambun Ltd. closed at Sh.61.03 during the same day.

- On Thursday, no more shares were purchased and the order was cancelled. The market closed at Sh.62.00 per share.

Rose meant to use this data to calculate the implementation shortfall of her trade.

Required:

The total implementation shortfall for the trade in the shares of Tambun Ltd. (4 marks)

Determine the contribution of the various cost components to the total implementation shortfall. (4 marks)

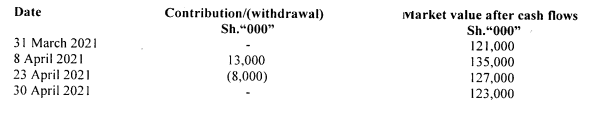

3. Sospeter Obonyo has gathered the following data to evaluate the performance of a portfolio manager:

Required:

The time weighted rate of return for the manager for the month of April 2021. (6 marks)

(Total: 20 marks)

QUESTION THREE

1. Highlight three reasons why commodity returns are weakly correlated with stock and bonds returns. (3 marks)

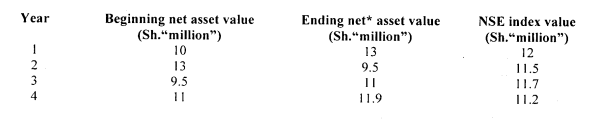

2. Ruth Wangu is a high net worth (HNW) investor who invests with an equity manager with a quoted base fee rate of 0.50% of beginning asset under management (AUM) plus 30% of performance in excess of the NSE Index.

Four years later, Wangu evaluates the performance of the equity manager relative to the NSE index as a benchmark index.

The equity manager fund is subject to a high water mark (HWM).

* Gross of investment management fees.

Required:

Calculate the value of the high watermark, gross of investment management fees at the end of the third year. (2 marks)

Determine the amount of fees which will be received by the equity manager in the fourth year. (2 marks)

Discuss two relative strengths of adopting a performance fee based structure. (2 marks)

Discuss two relative weaknesses of adopting a performance-fee based structure. (2 marks)

3. Moses Abongo is a financial analyst who has recently joined the graduate trainee scheme of a large buyside multi- asset investment manager. The scheme will involve Abongo spending time in all of the major divisions of the firm, first of which is the fixed income division.

Abongo initially works alongside Roberto James, a bond fund manager who specialises in dedication strategies designed to ensure that portfolios meet the future liabilities of investors. One of Roberto’s clients is Abdi Ali, a high net worth individual who is aiming to meet a personal liability due in 10 years’ time, the present value of which is equal to Sh.2,951,100.

Abdi Ali’s current portfolio consists of three bonds, details of which are displayed below. Each holding is of Sh.1 million.

Abdi Ali’s fixed income portfolio

Security Price (Sh.) Macaulay Duration Modified duration

Bond 1 102.36 3.7 3.6

Bond 2 97.61 9.9 9.7

Bond 3 95.14 16.9 16.6

Roberto James also runs a portfolio for John Muturi. This portfolio is engaged in a dedication strategy known as contingent immunisation.

Details of the strategy are given below:

John Muturi contingent immunisation strategy

Current portfolio value Sh.30 million

Portfolio modified duration 5.5

Liability to be repaid in 8 years Sh.40 million

Effective annual discount rate applied to liabilities 5%

Roberto James demonstrates to Moses Abongo how a derivatives overlay could be used to close the current duration gap on the portfolio run for John Muturi. He collects information on a relevant futures contract which is displayed below:

Futures Contract Information

National principal Sh.100,000

Coupon 6%

Range of maturities of deliverable bonds 8 years to 12 years

Basis point value (BVP) for one futures contract Sh.76.22

Required:

1. The current money duration of the Abdi Ali fixed income portfolio. (4 marks)

2. Determine whether or not Abdi Ali’s fixed income portfolio is immunised. (3 marks)

3. The number of futures contract required to close the duration gap. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain three advantages of using futures instead of cash market instruments to alter portfolio risk. (3 marks)

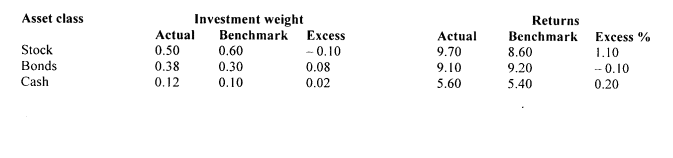

2. You have been provided with the following information relating to a portfolio manager’s performance for the period ended 31 March 2021:

Required:

Compute the value added by the manager and comment on the performance. (4 marks)

Using attribution analysis, break down the value added computed in (i) above into allocation effect and selection effect. (6 marks)

3. Brian Kingi, a private investor has a total market value of an initial portfolio of Sh.30 million of which Sh.9 million is invested in the money market fund, a risk free asset. The remaining Sh.2 1 million is invested in risky securities, that is, Sh.11.34 in equity (E) and Sh.9.66 million in long-term bond (B). The bond and equity holdings comprise the risky portfolio.

Required:

1. The weight of the risky and risk free investments in the complete portfolio. (1 mark)

2. The weights of equity and debt holdings in the risky portfolio. (1 mark)

3. The weights of equity and debt holdings in the complete portfolio. (1 mark)

4. Assuming that Brian Kingi wishes to decrease risk by reducing the allocation to the risky portfolio to 0.56, calculate the amount of the equity and bond holdings that must be sold to achieve this objective. (4 marks)

(Total: 20 marks)

QUESTION FIVE

1. Portfolio revision is the process of selling certain investments in portfolio and purchasing new ones to replace them.

Highlight three reasons for portfolio revision. (3 marks)

2. In relation to global credit bond portfolio management:

Explain the dominant type of structure in the investment-grade credit market. (2 marks)

Determine three strategies portfolio implication of the dominant structure identified in (i) above. (3 marks)

3. Discuss three characteristics of best execution of a portfolio decision. (6 marks)

4. The spot exchange rate between the Brazilian real (BRL) and United States Dollar (USD) is 2.41. The interest rate in the two countries are 6% and 1% respectively.

Required:

Estimate the one year forward exchange rate for the Brazilian real. (2 marks)

State the steps to initiate a carry trade. (2 marks)

Calculate the profit on the trade if the spot exchange rate is unchanged and the trade is initiated by borrowing 100 currency units. (2 marks)

(Total: 20 marks)