THURSDAY: 20 May 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Private investors use structured products to gain access to alternative investments.

In light of the above statement, cite four reasons for popularity of structured products in the recent past. (8 marks).

2. Explain the meaning of the following terms as used in commodities market:

Contract for differences (CFDs). (2 marks)

Calendar spread strategy. (2 marks)

3. Stawi Fund is a hedge fund with a value of Sh.250 million at the beginning of 2018. The fund charges 2.5% management fees based on the asset under management (AUM) at the beginning of the year and a 25% incentive fee with a 7.51)/0 hurdle rate and uses a high water mark (HWM) provision. Incentive fees are calculated on gains net of management fees.

The closing values for each year before fees are as follows:

Year Amount

Sh.”000″

2018 285,450

2019 288,120

2020 307,670

Required:

The total fees and investor’s net return for each of the three years. (8 marks)

(Total: 20 marks)

QUESTION TWO

1. Highlight five disadvantages of investing in real estate as an alternative investment class. (5 marks)

2. Explain three incentives for hedge funds replication strategies in the context of hedge fund management (6 marks)

A hedge fund utilises a strategy which generates profits on assets of 0.3% per month. The interest expense on its leverage is 0.2% per month. The fund seeks a return on equity (ROE) of 0.8%.

Required:

Determine the leverage that the fund must utilise to generate the desired return on equity (ROE). (3 marks)

3. Webmill Group Limited manages a Sh.250 million private equity fund. Investors committed to a total of Sh.300 million over the term of the fund and a specified carried interest of 20% and a hurdle rate of 10%. Carried interest is distributed on a deal by deal basis. 60% of the Sh.250 million has been invested at the beginning of year 1 in Kimbo Ltd. with the remaining 40% invested in Tidco Ltd. Both firms are sold at the end of the third year, realising a Sh.45 million profit for Kimbo Ltd. and a Sh.35 million profit for Tidco Ltd.

Required:

The carried interest paid to the fund’s general partner for Kimbo Ltd. and Tidco Ltd. (6 marks)

(Total: 20 marks)

QUESTION THREE

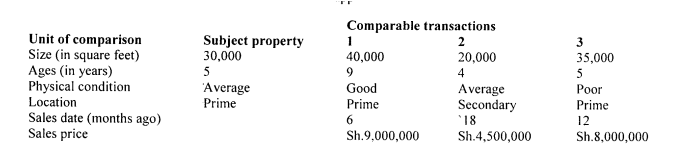

1. An appraiser has been asked to estimate the value of a warehouse and has collected the following information:

- Each adjustment is based on the unadjusted sales price of the comparable.

- Properties depreciate at the rate of 2% per annum.

- Condition adjustment; Good: + 5%, average: none, poor: —5%.

- Location adjustment: Prime — none, secondary —10%.

- Over the past 24 months, sales price has been appreciating at the rate of 0.5% per month.

Required:

Calculate the estimated value of the warehouse using the sales comparison method. (10 marks)

2. Abby Mutugi recently completed a Monte Carlo simulation analysis of a collateralised mortgage obligation (CMO) tranche. Abby’s analysis included six equally weighted paths, with the present value calculated using four different discounts rates, shown below:

Representative path Present value if spread Present value if spread Present value if spread

is 50 basis points is 60 basis points is 70 basis points

1 70 68 66

2 73 70 68

3 68 66 64

4 71 69 68

5 77 75 73

6 75 73 71

The actual market price of the CMO tranche is 70.17.

Required:

The tranche’s option adjusted spread (OAS). (4 marks)

3. An investor currently holds the following structured products:

- A fairly new home equity-backed asset backed security (ABS).

- Automobile receivable-backed asset backed security (ABS).

- Planned amortisation class (PAC) collateralised mortgage obligation (CMO).

- Support bonds collateralised mortgage obligation (CMO).

He is concerned about the expected decline in interest rates:

Required:

Giving two reasons in each case, identify the cash flow of the ABS that will be more affected by the decline in interest rates and the ABS that will be less affected by a decline in interest rates. (4 marks)

Explain the effects of decline in interest rates on the two types of collateralised mortgage obligations (CMOs). (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Discuss the lifecycle stages of a venture capital fund. (10 marks)

2. Explain the meaning of the following terms as used in alternative investments:

Rolling contracts. (1 mark)

Marking to market. (1 mark)

High water mark (HWM). (1 mark)

Prepayment tranching. (1 mark)

Credit tranching. (1 mark)

3. The following information relates to commodities futures contract traded at the derivatives exchange market:

Futures prices Futures prices Changes in

Contract maturity as at April 2021 as at March 2021 spot price

Sh. Sh. Sh.

May 2021 1.445 1395 17.5

June 2021 1,425 1382.50 17.5

July 2021 1,394 1350.50 17.5

Required:

The roll return. (3 marks)

Identify the term structure of the futures prices illustrated above. (1 mark)

Demonstrate a futures strategy that will provide a positive return in (ii) above. (1 mark)

(Total: 20 marks)

QUESTION FIVE

1. Francis Thuo has been appointed as a private equity manager at KKQ Limited a private equity firm and is interested in identifying a potential leveraged buyout firm to acquire.

Required:

Advise Francis Thuo on five characteristics of a well suited leveraged buyout (LBO) candidate. (5 marks)

2. Outside service providers provide professional services that are vital to the formation and continued operation of alternative investment funds.

In light of the above statement, identify four legal documents prepared by advocates in relation to hedge funds. (4 marks)

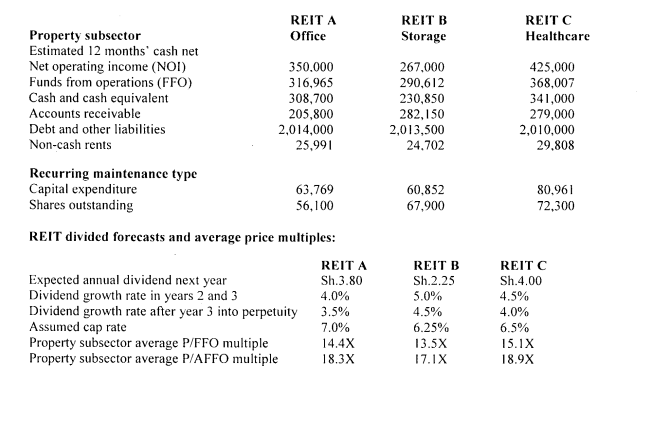

3. An investment analyst has gathered the following data on three different real estate investment trusts (REITs):

Select REIT financial information (All figures in shillings):

The cost of equity capital for all REITs is 8% and the risk free rate is 4.0%. The analyst wants to value each REIT using four different methodologies:

Method 1: Net asset value (NAV).

Method 2: Discounted cash flow valuation using a two step dividend model.

Method 3: Relative valuation using property subsector price to funds from operations (P/FFO) multiple.

Method 4: Relative valuation using property subsector average price to funds from operations (P/AFFO) multiple.

Required:

Determine the value per share of the following:

REIT A using valuation method I. (3 marks)

REIT B using valuation method 3. (2 marks)

REIT C using valuation method 2. (3 marks)

REIT A using valuation method 4. (3 marks)

(Total: 20 marks)