THE KENYA NATIONAL EXAMINATIONS COUNCIL

BUSINESS EDUCATION SINGLE AND GROUP CERTIFICATE EXAMIN ATIONS

DIPLOMA IN SALES AND MARKETING

FINANCIAL ASPECTS OF MARKETING

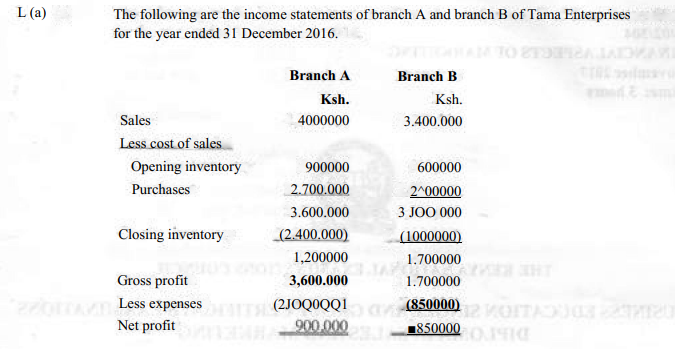

(i) For each firm, calculate:

I. gross profit margin;

U. net profit margin;

III. average inventory;

IV. inventory turnover rate.

(ii > Advise the management on the profitability of the branches. (10 marks)

Rateq Traders buy* and sells product P4. The follow ing information relates to the

product:

Annual demand

Reorder quantity

Minimum consumption

Maximum consumption

Reorder period

Calculate:

88000 units.

7,000 units.

400 units per day.

1.000 units per day.

3-5 days.

(t) reorder level.

(ii) minimum stock level

(iii) maximum stock level.

(iv) average stock level.

(v) stock turnover period in days.

(Take 1 year = 365 days)

Explain each of the following accounting concepts:

(i) money measurement,

(ii) prudence,

fiii) dual aspect,

(iv) business entity (8 marks)

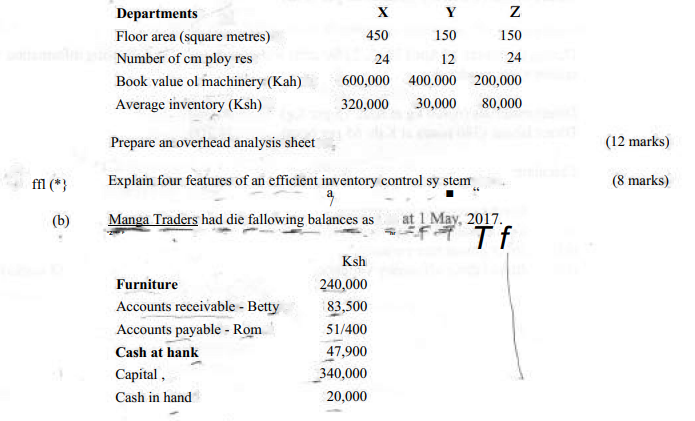

Mento Limited has three production departments, X, Y and Z The following are the estimated overheads for the year 2016

Rentnksh

150,000

Supervision 400,000

Electricity 75,000

Depreciation of machinery 120,000

Canteen expenses 25,(XX)

Insurance of machinery 60,000

Insurance of inventory 24,000

Additional information

The following transactions look place during the month of May 2017 2017 Month

May I Purchased equipment worth Ksh. 22,000 by cheque,

2 Bought goods for Ksh. 310JOOO form Ali chi credit.

3 Sold goods for Ksh. 76.500 in cash.

4 Paid rent of Ksh. 363)00 by cheque.

8 The proprietor took Ksh, 10,000 cash for personal use.

10 Betty settled her account in full by cheque.

15 Sold goods for Ksh, 142,000 to Dana as credit.

20 The proprietor brought in a table valued at Ksh. 6.000 to used in

the business.

31 Paid wages amounting to Ksh. 18,000 in cash.

From the mfonnabon above, prepare ledger accounts. (12 marks)

Tekat Limited manufactures a single product. The following is the standard variable cost per unit of the product. Ksh

Direct materials (3 kg @ Ksh. 18 per kg) 54

Direct labour (0.2 hours fa: Ksh, 60 per hour) 12 ’ &

During the month of April 2015, 2,000 units were produced. The following information

relates to the production. Ksh

Direct materials (6.400 kg al Ksh. 15 per Kg) 96,00y

Direct labour (380 hours at Ksh. 65 per hour) 24,700

Calculate.

direct material price vaijapcc;

direct materia) usage variance?

direct labour rate variance*

direct labour efficiency variance?

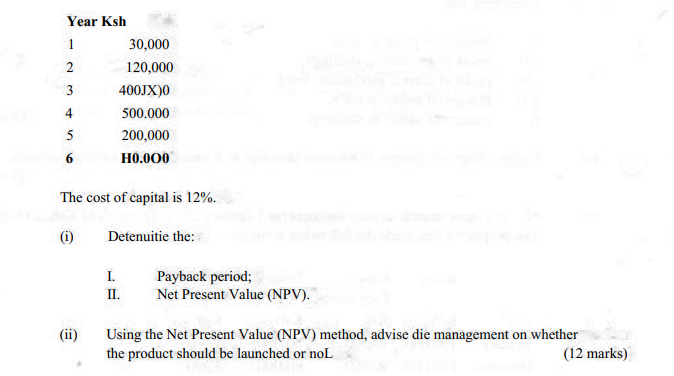

(b) Fames Enterprises is considering launching a new product in the market. The initial capital outlay is Ksh. 1,250,000.

The following are the expected cash inflows.

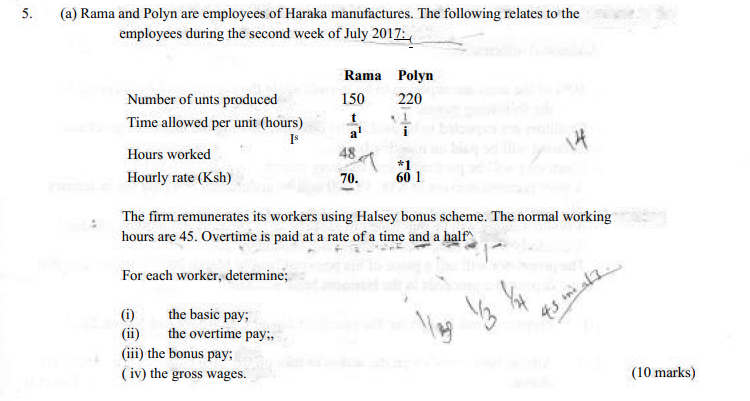

Jiman Manufacturers make a single product. The variable cost per unit is Ksh. 40. The selling price per unit is Ksh. 70, The annual fixed costs are Ksh, i .200,000. The current production is 50,000 units.

Determine the:

breakeven point in units; break even point in shillings; prnfiL at current production level, margin of safety in units;

margin of safely in shillings. |10 marks)

Explain four advantages of retained earnings as a source of finance Io a business, (8 marks)

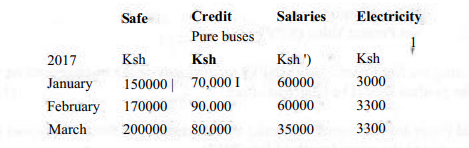

Moran Trager intends to start business on I January 2017 with cash of Ksh. 350,000.

The proprietor has made the following estimates:

Additional information:

– 60% of the sales arc expected to be m cash white the balance will be received jp the fol lowing, month.

– Creditors are expected to be paid in the month following the month of purchase.

– Salaried will be paid on monthly basis.

– Electricity will he paid at the end of every month.

– A sales prniTitiuun event of Ksh. 48.000 will be undertaken and paid for in January

2017.

– A motor vehicle will he purchased in January 2017 lor Ksh. 350,000 by chuquc.

– A quarterly rent of Ksh. 36,00 will be paid in January 2017.

– The proprietor will sell a piece of his personal land iii March 2017 for Ksh. 200,000 and deposit the proceeds in lite business bank uccijutilA

(j) Prepare a cash budgd for the month of January. February utid March 2017.

(ii) Advise the proprietor on the action to take on the cash balances obtained eel (0 above. (12 marks)

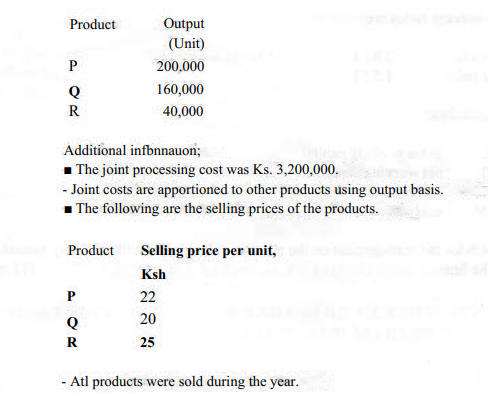

7. (a) Minek Limited process three products P, Q and R in a joint cwt operation Ihe following information re laics to Lhe production during the year ended 31 December 2016.

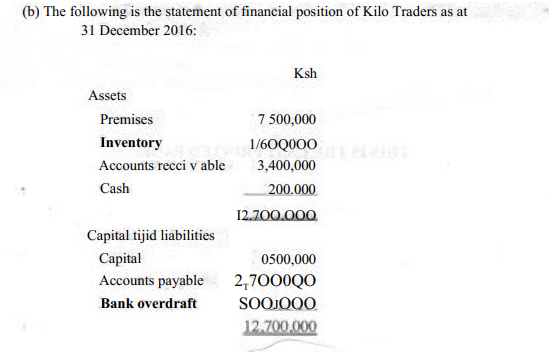

industry average ratios are:

Current ratio 2.8 : 1

Acid test ratio 1.5; I

(i) Calculate:

I. gF0S8 working capital;

II. net working capital;

III. current ralio;

IV. acid test ratio.

(ii) Advice the management on the action to take based on the liquidity position of the firm.