Explain five users of financial statements of an organisation. (10 marks)

(b) The following information was extracted from the financial statements of Kaluma Limited for the year ended 31 December 2015.

Accounts receivable Ksh

8,400,000

Cash 3,100,000

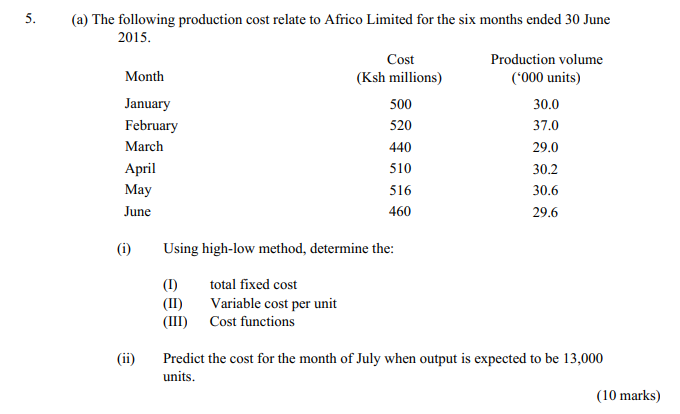

Inventories 2,500,000

Sales 46,700,000

Cost of goods sold 38,100,000

Total current liabilities 17300,000

All sales were made on credit.

The following are the average ratios for the industry:

Current ratio 2:1

Acid test ratio 1:1

Accounts receivable turnover 11.20 times

Inventory turnover 19.40 times

(i) Calculate each of the following ratios:

(I) Current ratio

(II) Acid test ratio

(III) Accounts receivable turnover

(IV) Inventory turnover

(ii) Evaluate the company’s performance against the industry average.

(10 marks)

(a) Tready Limited has forecasted its annual demand of commodity KX to be 3,000,000 units. The purchase price of each unit is Ksh. 20. The annual holding cost per unit is 5% of the purchase prince. The cost of making an order is Ksh. 300.

Calculate the:

(II)economic order quantity (EOQ) ‘ total inventory cost.

The management is planning to change the current EOQ to 80,000 units. Advise the management on the viability of the plan.

(b) A manufacturing company has two departments, A and B. Department A manufactures two products; P and Q. The products may be sold internally to department/^br to an external market. The internal transfers are at cost. v

The following is the cost structure of product P and product Q.

(i) Sales to the external market require an additional 20% on cost.

(ii) The department has limited labour hours available.

(iii) The labour hours required for each product are 2.5 hours and 5 hours for product

P and product Q respectively.

(iv) Department B requires product Q from department A for its manufacturing process.

I Determine the price to be charged:

(I) for supply of product Q to department B

(II) to the external market

II Advise the management of department A on the market to concentrate on. (10 marks)

# (a) Explain five limitations of relying on credit cards as a source of finance for a business organisation. (10 marks)

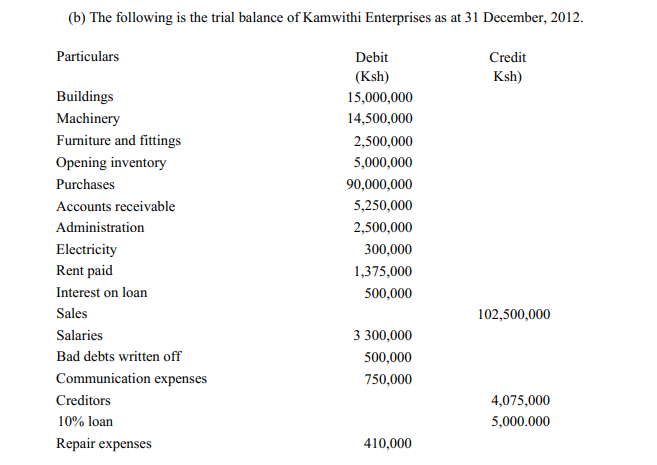

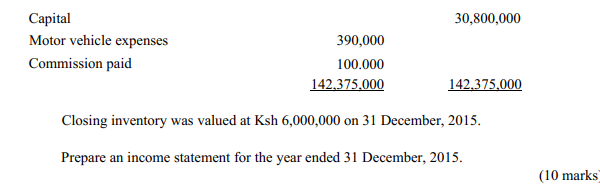

(b) The following data ware extracted from the records of Baharia Manufacturing

Company.

Average usage

Minimum usage

Maximum usage

Economic order quantity

Re-order period

Determine the:

(i) Re-order level

(ii) Maximum stock level

(iii) Minimum stock level

(iv) Average stock level

Peter, Karim and Tom are engaged in the production of cakes in department X, Y and Z respectively. It is expected tha^4jOQff cakes should be produced in aj^ve^y week of ‘hours each< ~

• Employees in department X are paid at rate of Ksh 100 per hour.

• Employees of department Y are paid at the rate of Ksh 1,000 per day

• Employees of department Z are paid Ksh 8 per cake produced.

In the month of December 2015, it was ascertained that each worker put in 240 hours producing 3,820 cakes in a period of 21 days. Overtime and bonus do not apply in this company.

Calculate the amount of wages earned by each employee during the month. (9 marks)

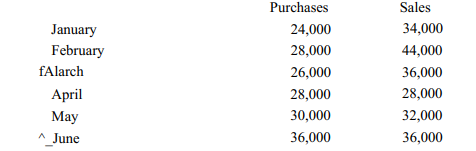

(b) Mamudi is a trader who buys and sells food items at Walima market. The following information relates to the business over a six month period from January 2015 to June 2015.

Additional information:

• On 1 May 2015, a new hand cart was was sold on 15 June for Ksh 10,000 for Ksh 16,000. The old hand card

• Overhead expenses amounted to Ksh 1,600 and arc paid one month after expenditure ./

• Wages of Ksh 2,000 are paid in the month that they are incurred

• All sales are on credit and they are on a two-month credit period

• One-half of the purchases are on credit and are settled one after the purchase

• The expected bank overdraft as at 1st March 2015 was Ksh 2,000.

(i) Prepare a cash budget for each month from March 2015 to June 2015.

(ii) Comment on the cash position for the period.

6, (a) Mohamed and sons Limited intends to sell product TX at an exhibition organised by the association of manufacturers. They purchase the products at Ksh 500“each, and are allowed to return all unsold products. The exhibition stands is charged a rent of Ksh 200,000 per 9vent payable in advance. The products will be sold at Ksh 900 each.

(i) Determine the number of units of the product to be sold in order to:

(I) break-even

(II) In order to realise a profit target of Ksh 1.8 million

(ii) Shally, one of the customers at the exhibition has offered to buy the entire stock

of product TX at a price of Ksh 650 each. Advise the management on whether to accept offer

(8 marks)

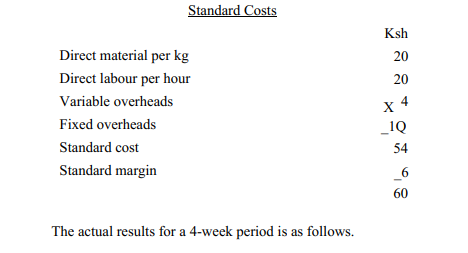

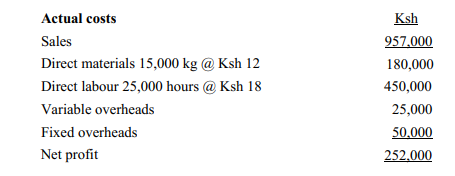

(b) Ndedero Limited manufactures and sells fruit juices. The standard cost per unit is as follows:

The budgeted output was 15,500 units while the actual output is 16,500 units.

Calculate each of the following variances:

(i) Materials price variance

(ii) Materials usage variance

(iii) Labour rate variance

(iv) Sales margin price variance

(v) Sales margin quantity variance

(12 marks)

7. (a) A company has two alternative projects A and B, with an initial cash outlay of Ksh 500,000 and Ksh 600,000 respectively. Each project has an economic life of 5 years. Project A has a residual value of Ksh 50,000 while project B has no residual value.

Annual profits before depreciation for each project is Ksh 200,000.

(i) Using the Accounting rate of return (ARR) method, advise the management on the project to undertake.

(ii) Outline two limitations of using the above method in decision making. (10 marks)

(b) Highlight five characteristics of process costing systems.