THE KENYA NATIONAL EXAMINATIONS COUNCIL

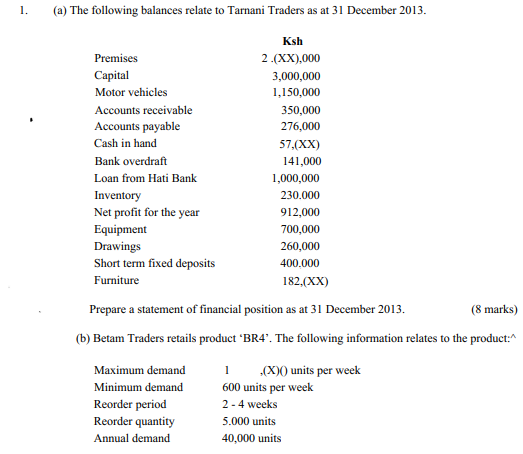

BUSINESS EDUCATION SINGLE AND GROUP CERTIFICATE EXAMINATIONS

STAGE III

DIPLOMA IN SALES AND MARKETING

MODULE III

FINANCIAL ASPECTS OF MARKETING

(i) Calculate the:

(I) reorder level;

(II) minimum stock level;

(HI) maximum stock level;

(IV) average stock level;

(V) stock turnover rate.

(ii) The standard turnover rate for product BR4 is 13 times. Advise the

management on the action to take.

2. (a) Pawa Manufacturers remunerates its employees using the Rowan bonus scheme.

The following information relates to two employees, Gcnga and Hamisi. for the week ended 25 January 2015.

Genga Hamisi

Number of units produced 100 90

Time allowed per unit (hours) 0.6 0.6

Time taken (hours) 48 40

The basic hourly rate of pay is Ksh 50.

(i) For each employee, calculate the:

(I) basic pay;

(II) bonus pay;

(III) gross earning;

(IV) labour cost per unit.

(ii) Comment on the efficiency of the employees. (10 marks)

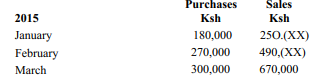

(b) Mutama intends to commence a wholesale business on 1 January 2015. The following information has been compiled for the preparation of a cash budget.

• The proprietor will bring in capital of Ksh 500,(XX) in cash on I January 2015.

• A quarterly rent of Ksh 120,(XX) will be paid in advance at the beginning of each quarter.

• A loan of Ksh 9OO,(XX) will be obtained from Tisa Bank in January 2015.

• The credit purchases and credit sales arc expected to be as follows:

• A motor vehicle will be purchased for Ksh 650,00 in February 2015. A down payment of Ksh 250,000 will be made immediately and the balance will be settled in the following month.

• An amount of Ksh 100,000 of the loan from Tisa Bank will be repaid in March 2015.

Prepare a cash budget for the months of January, February and March 2015.

3. (a) Explain four uses of financial ratio analysis. (8 marks)

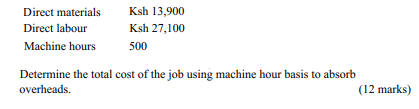

(b) The following estimates relates to Wananchi Manufacturers for the year ending 30 June 2014.

Ksh

Production overheads 1,200,000

Direct materials 800,000

Direct labour 2,400,000

Direct labour hours 24,000

Machine hours 50,000

Output (units) 400,000

0) Calculate the overhead absorption rate using each of the following bases:

(I) direct materials percentage;

(II) direct labour percentage;

(III) machine hours;

(IV) output.

Job No. 274 was undertaken in July 2014. The following details relate to the job.

4. (a) Explain four advantages of a budgetary control system in an organization. (8 marks)

(b) On 1 January 2015, Farida started a business with Ksh 180,000 in cash. The following transactions took place during the month:

2015

January 1 Opened a business bank account and deposited Ksh 125,000 of the cash.

2 The proprietor brought in a personal motor van worth Ksh 1,600,000 to be used in the business.

4 Bought furniture for Ksh 52,000 and paid by cheque.

5 Bought goods on credit from Mwanzo for KSh 86,000.

10 Sold goods for Ksh 24,000 and received cash.

15 Sold goods on credit to Kazi Limited for Ksh 45,000.

20 Paid office expenses amounting to Ksh 15,000 in cash.

27 The proprietor withdrew Ksh 20,000 from the bank for personal use.

28 Paid Mwanzo Ksh 60,000 by cheque.

30 Received the amount due from Kazi Limited by cheque.

31 Received a commission of Ksh 28,000 by cheque from a supplier.

Prepare ledger accounts to records the transactions above.

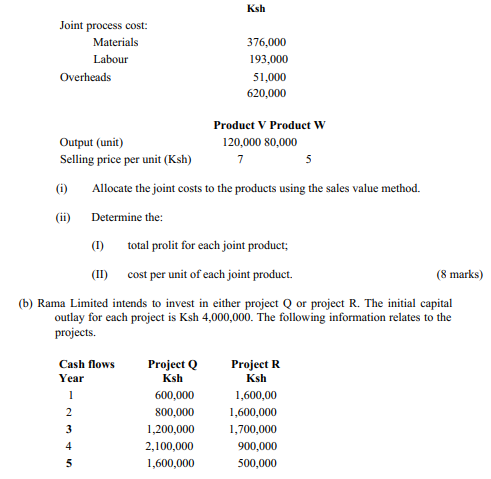

5. (a) Vcwanda Limited manufactures two products V and W in a single process. Thefollowing information relates to production during the year ended 31 December 2013.

The company’s cost of capital is 14%.

(i) For each project, determine the:

(I) payback period;

(II) net preset value (NPV);

(ii) Advise the management on the project to invest in.

6. (a) Explain five advantages of using internal sources of finance by a company. (10 marks)

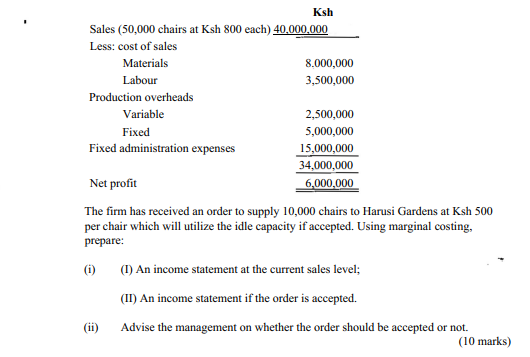

(b) Elegon Limited manufactures chairs for garden sites. Currently, the firm is operating at 80% capacity. The following is the income statement for the year ended 31 December 2013:

Calculate:

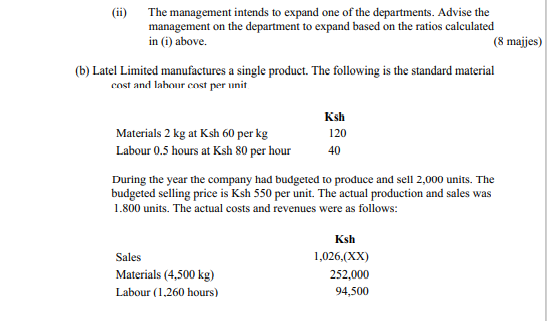

(i) material price variance;

(ii) material usage variance;

(iii) labour rate variance;

(iv) labour efficiency variance;

(v) sales price variance;

(vi) sales volume variance.