MONDAY: 1 August 2022. Afternoon paper. Time Allowed: 2 hours.

This paper is made up of fifty (50) Multiple Choice Questions. Answer ALL the questions by indicating the letter (A, B, C or D) that represents the correct answer. Do NOT write anything on this paper.

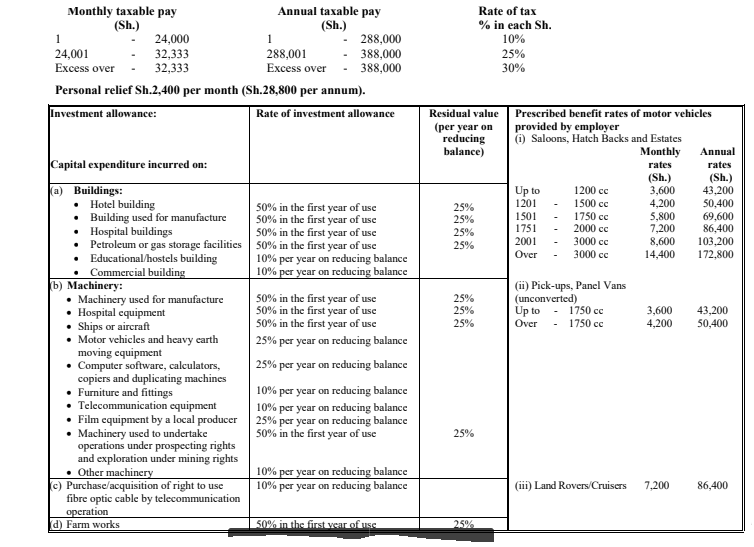

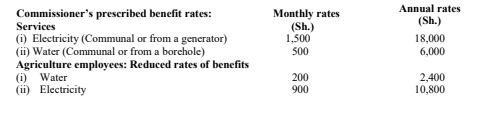

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax).

Year of income 2021.

Assume that the following rates of tax applied throughout the year of income 2021:

1. Which one of the following is a basis of tax classification?

A. By time

B. By income

C. By effect

D. By volume (2 marks)

2. Identify which one of the following factors could influence tax shifting?

A. Purpose of the product

B. Elasticity of demand and supply

C. Level of production

D. Education level of suppliers (2 marks)

3. An optimal tax system is the one that fulfils most of the principles of taxation. Which one of the following principles is not a principle of taxation?

A. Equity

B. Simplicity

C. Diversity

D. Progressive (2 marks)

4. Sarah Mamito, a sole trader made a loss of Sh.1,816,000 in the year 2020 and a profit of Sh.2,043,000 in 2021. What was the taxable amount for the year 2021?

A. Sh.1,816,000

B. Sh.2,043,000

C. Sh.227,000

D. Nil (2 marks)

5. Which one of the following is not a reason why accounting profit may be different from taxable profit.

A. Inclusion of non taxable income in the income statement

B. Allowable expense may be omitted

C. Inclusion of non business income

D. Use of different methods of accounting (2 marks)

6. Azan Ltd. is a manufacturing company that prepares its accounts to 31 December every year. On 7 July 2021, Azan Ltd. imported a processing machinery and incurred the following costs:

• Cost of machinery Sh.550,000

• Freight charges Sh.100,000

• Insurance on transit Sh.20,000

• Duty on import Sh.130,000

What is the qualifying cost of investment allowance which can be claimed by Azan Ltd. in respect of the

processing machines?

A. Sh.800,000

B. Sh.550,000

C. Sh.670,000

D. Sh.680,000 (2 marks)

7. Which of the following is NOT an advantage of progressive taxes?

A. Yields more revenue

B. Its economical

C. Reduced coverage

D. Promotes equality (2 marks)

8. Which one of the following is a purpose of levying tax?

A. To raise revenue

B. To increase inequalities

C. To increase import

D. To increase population (2 marks)

9. Which of the following is a function of a revenue authority?

A. File tax on behalf of the taxpayer

B. Training the taxpayers and recruiting of tax agents

C. Enforcing measures to increase sales

D. To jail tax evaders (2 marks)

10. Basatu Ltd. prepares its account every year. The company submitted its tax returns for the year of assessment 2021 on 15 May 2022 showing a balance of tax payable of Sh.59,000. The balance of tax was paid on 31 May 2022 in relation to the tax return for the year of assessment 2021. Which of the following statement is NOT TRUE?

A. The company has submitted the tax return within the submission due date

B. The company was late in paying the balance of the tax payable

C. The due date of the payment of the balance of Sh.59,000 is on 30 June 2022

D. The balance of tax payable will attract late payment interest (2 marks)

11. Which one of the following factors influences taxable capacity?

A. Level of income

B. Location of taxpayer

C. Age of population

D. Education level of the community (2 marks)

12. Which one of the following circumstances qualifies for a refund of value added tax (VAT) paid?

A. VAT paid on bad debts

B. VAT penalties paid

C. Death of the taxpayer soon after payment

D. Underpayment resulting from withholding VAT system (2 marks)

13. Kibet Michael received the following benefits from his employer for the year ended 31 December 2021:

• Annual basic pay Sh.2,500,000

• Travel allowance Sh.60,000

• Employer paid on his behalf insurance premiums amounting to Sh.90,000 during the year

• Medical expenses paid by the employer Sh.120,000. The employer has a medical scheme covering top management only.

Required:

Determine Kibet’s taxable income for the year ended 31 December 2021.

A. Sh.2,500,000

B. Sh.2,590,000

C. Sh.2,770,000

D. Sh.2,650,000 (2 marks)

14. Which one of the following statements is true about stamp duty?

A. It is levied by the government on value added to a product

B. The rate of stamp duty in urban areas is 4% and 2% in rural areas

C. It is paid in advance and the taxpayer does not get a direct reward

D. It is payable at the end of an accounting period (2 marks)

15. Wetu Traders imported goods in December 2021 valued at Sh.900,000 being cost, insurance and freight excluding import duty and VAT, import duty rate was 20% during the month. Determine the VAT payable by Wetu Traders for the month of December 2021?

A. Sh.172,800

B. Sh.144,000

C. Sh.180,000

D. Sh.200,448 (2 marks)

16. Woodperker Ltd. is a withholding tax agent and deals with electronic goods. During the month of September 2021, the company purchased electronics from Makuti Traders worth Sh.626,400 inclusive of VAT. How much tax did the company withhold?

A. Sh.86,400

B. Sh.100,224

C. Sh.10,800

D. Sh.12,528 (2 marks)

17. Cyrus Mtuku is an employee of Chen Ltd. During the year ended 31 December 2021, he contributed Sh.12,000 per month to cater for insurance for his life insurance premium. His gross salary was Sh.150,000 per month. Determine his total tax relief for the year of income 2021.

A. Sh.28,800

B. Sh.60,000

C. Sh.50,400

D. Sh.21,600 (2 marks)

18. The following are advantages of withholding tax EXCEPT?

A. Enhances compliance

B. It protects the health of citizens

C. It is economical

D. It reduces chances of tax evasion (2 marks)

19. Which one of the following is NOT a reason why a person registered for VAT may be deregistered?

A. Death of a sole trader

B. Non payment of VAT

C. Leaving the country

D. Insolvency or bankruptcy (2 marks)

20. Which one of following is a way of evading taxes?

A. Full declaration of the taxable income

B. Claiming expenses one of is entitled to

C. Investing outside the country

D. Overstating the allowable expense. (2 marks)

21. Which one of the following is an obligation of a registered person for VAT purposes?

A. To file returns on due dates

B. To enforce payment of VAT charged

C. To increase the rate of VAT charged from time to time

D. To exempt a person from paying VAT upon request. (2 marks)

22. Identify which one of the following is NOT a disadvantage of capital allowances.

A. Enjoyed mostly by manufacturers thereby discriminating other economic players

B. Enjoyed mostly by the poor thereby reducing the gap between the rich and the poor

C. Investors might close shop and move to other destinations once the tax incentive cease

D. Results in loss of revenue for the government as it reduces tax payable (2 marks)

23. Which one of the following omissions does NOT constitute an offence under the pay as you earn (PAYE) regulation?

A. Failure to deduct PAYE

B. Failure to file returns

C. Failure to remit PAYE deducted by 20th of next month

D. Failure to have operational PAYE system (2 marks)

24. Elite Manufacturers Ltd. commenced operations on 1 January 2021, after incurring the following expenditure:

Sh.

• Factory building 240,000,000

• Processing machinery 96,000,000

• Delivery vans 7,200,000

• Director’s Saloon car 3,600,000

Required:

Determine the investment allowance due to Elite Manufacturers Ltd. for the year 2021.

A. Sh.336,000,000

B. Sh.170,550,000

C. Sh.170,700,000

D. Sh.184,200,000 (2 marks)

25. Which one of the following is a circumstance under which a late objection might be accepted by the commissioner?

A. When the taxpayer is committed to a new assignment to the extent to which he/she cannot handle his/her tax matters

B. When the taxpayer is undertaking a new capital project

C. When the taxpayer is held in a police custody

D. When the taxpayer has no power in the office (2 marks)

26. Earnest Washwa’s gross residential rental income for the month of December 2021 was Sh.720,000. During the month of December 2021 he incurred the following expenses in relation to the rental properties:

• Caretaker salary Sh.20,000

• Repair and maintenance Sh.48,000

• Mortgage interest paid Sh.180,000

Required:

Determine the rental income tax payable by Earnest Washwa for the month of December 2021.

A. Sh.141,600

B. Sh.195,600

C. Sh.72,000

D. Sh.14,160 (2 marks)

27. Which one of the following statements explains the earliest when value added tax (VAT) is due and payable?

A. When goods are manufactured and packed for distribution

B. When a quotation is requested

C. When an invoice is issued in respect of supply

D. When there is shortage of goods in the market (2 marks)

28. Which of the following statements is TRUE about Home Ownership Savings Plan (HOSP)?

A. Sh.96,000 per annum is allowed for tax purposes while computing PAYE

B. Sh.48,000 per annum is allowed for tax purposes while computing PAYE

C. It is not an allowable deduction in computing PAYE

D. Sh.36,000 per annum is allowed while computing PAYE (2 marks)

29. What is the taxable house benefit for an agricultural employee provided with a house in a farm or plantation?

A. Taxable amount is 10% of the total income less own contribution towards the house

B. Taxable amount is 15% of the total income less own contribution towards the house

C. Taxable amount is 10% of the employment income less own contribution towards the house

D. Taxable amount is 15% of the employment income less own contribution towards the house (2 marks)

30. For a mortgage interest to qualify to be an allowable deduction, it must meet the following criteria EXCEPT?

A. The loan must be acquired from the employer

B. The loan is obtained from a recognised financial institution

C. The loan was acquired to purchase own residential house

D. The loan was acquired to construct or repair own residential house (2 marks)

31. Which one of the following statements explains the meaning of advance tax?

A. Tax levied on commercial vehicles before being licensed to operate in Kenya

B. Tax levied by the government for certain transactions and documents

C. Tax levied on locally manufactured goods

D. Tax levied on incomes earned by an individual (2 marks)

32. Jack Too is an employee of Taly Ltd. During the year 2021, he received an income Sh.3,000,000 before housing benefit. He was housed by the employer in a rented house where the employer paid Sh.30,000 per month and the market value of the house was Sh.45,000. How much is housing benefit due to Jack Too for year 2021?

A. Sh. 450,000

B. Sh. 540,000

C. Sh. 360,000

D. Sh. 720,000 (2 marks)

33. Which of the following taxes is not a pseudo tax?

A. Petroleum levy

B. Airport levy

C. Excise duty

D. Catering levy (2 marks)

34. The following circumstances can lead to import duty paid to be refunded EXCEPT?

A. It was paid in error as a result of wrong calculation or overpayment

B. Where the imported goods are returned to the seller

C. Where the goods are used to manufacture for local consumption

D. Where goods are destroyed or damaged while under custom control (2 marks)

35. Which among the following actions can the revenue authority NOT undertake to recover overdue tax?

A. Holding property of the tax payer as security for the unpaid tax

B. Ask the bank to freeze the bank accounts of defaulters

C. Issue of distress order where the assets of the tax payer are auctioned to recover the tax due and payable

D. The commissioner can jail the tax payer for the tax due and payable (2 marks)

36. The following are benefits of integrating functions of various departments of the revenue authority EXCEPT?

A. Results to efficiency

B. Reduction of operational cost

C. Reduction of tax collected

D. Increase customer satisfaction (2 marks)

37. Goods and services exempted from value added tax (VAT) are listed under which schedule?

A. First schedule

B. Second schedule

C. Third schedule

D. Forth schedule (2 marks)

38. When a trader is able to pass an increase in tax to the consumer and occurs through sales when the demand of the product is inelastic. This kind of shifting is referred to as___________________.

A. Straight shifting

B. Online shifting

C. Backward shifting

D. Forward shifting (2 marks)

39. Kenland Ltd. had the following expenses in their financial statement for the year ended 31 December 2021:

Sh.

• Christmas party for directors 450,000

• Entertainment expense for customers 390,000

• Meals to employee of the company 240,000

• Entertainment for directors 140,000

Required:

Determine the total allowable expense for Kenland Ltd. for income tax purposes.

A. Sh.840,000

B. Sh.630,000

C. Sh.590,000

D. Sh.1,220,000 (2 marks)

40. What is the tax position on telephone bills paid by an employer on behalf of an employee?

A. It is a tax-free benefit

B. The taxable amount is 2% per month on the telephone bills

C. The taxable amount is 30% of the total telephone bill

D. The taxable amount is the actual telephone bill (2 marks)

41. Ezekiel Mwema is registered for value added tax (VAT) purposes. During the month of May 2022, he had an operating stock valued at Sh.2,784,000. He made purchases during the month amounting to Sh.10,440,000 and sales amounting to Sh.16,240,000. Closing stock was valued at Sh.2,900,000. All transactions are inclusive of VAT at the rate of 16% where applicable.

Required:

Determine the VAT payable by or refundable to Ezekiel Mwema for the month of May 2022.

A. Sh.816,000

B. Sh.800,000

C. Sh.756,000

D. Sh.1,440,000 (2 marks)

42. Which of the following are the correct due months for payment of instalment tax?

A. 1st, 4th and 9th month

B. 4th, 6th, 9th and 12th month

C. 6th, 9th and 12th month

D. 4th, 6th, 8th and 12th month (2 marks)

43. Identify which of the following income that has the correct withholding tax rate for a resident person.

A. Management fees 10%

B. Interest from bank 10%

C. Professional fee 5%

D. Winning from betting and gaining 5% (2 marks)

44. Which one of the following expenses is not allowable for the purpose of computing capital gains tax (CGT)?

A. Mortgage interest

B. Cost of advertising to find a buyer

C. Allowance for bad debt

D. Legal fee (2 marks)

45. Jack Oloo, an employee of Emberk Ltd. was provided with a saloon car of 2500cc by the company on 1 September 2021. The car had been purchased for Sh.2,500,000 in the year 2018. The net book value as at 1 January 2021 was Sh.1,800,000.

Required:

What is Jack’s taxable benefit for the year of income 2021 in relation to the saloon car provided by the employer?

A. Sh.600,000

B. Sh.432,000

C. Sh.200,000

D. Sh.103,200 (2 marks)

46. Which of the following statements explains the meaning of proportional tax?

A. This is where tax is levied at a flat rate on income earned by a person

B. This is a tax which each individual pays a fixed amount in a month or a year

C. This is a tax adjusted in a manner that as the rate decreases income increases and more tax is levied

D. This is where a tax is levied at a graduated scale rate on income earned by a person (2 marks)

47. Which of the following instruments is not exempted from stamp duty?

A. Instruments of divorce

B. Adoption of deed

C. Insurance policies

D. Letter of allotment of shares (2 marks)

48. Ellim Ltd.’s net taxable profit for the year ended 31 December 2021 was Sh.18,720,000. The total instalment tax paid during the year ended 31 December 2021 was Sh.4,972,000.

Required:

Determine the net tax payable (if any) by Ellim Ltd. for the year ended 31 December 2021

A. Sh.5,616,000

B. Sh.4,680,000

C. Sh.4,972,000

D. Sh.644,000 (2 marks)

49. Which one of the following is not a positive role of import duty in an economy?

A. Protect local industries from cheap imports

B. It raises revenue for the government

C. Discourage consumption of harmful products

D. Discourage growth of local industries (2 marks)

50. Which of the following is not considered as an employer for Pay As You Earn (PAYE) purposes under definition of an “employer”?

A. Any person having control of payment of remuneration

B. Any paying officer of government or the public authority

C. Any person owing money to an individual taxpayer or a company

D. Any agent, manager or other representative in Kenya of any employer who is outside Kenya (2 marks)