MONDAY: 1 August 2022. Morning paper. Time Allowed: 2 hours.

This paper is made up of fifty (50) Multiple Choice Questions. Answer ALL the questions by indicating the letter (A, B, C or D) that represents the correct answer. Do NOT write anything on this paper.

1. Maendeleo Ltd. reported the following: assets Sh.500,000, liabilities Sh.350,000 and capital of Sh.100,000. What is the balance in retained earnings?

A. Sh.450,000

B. Sh.50,000

C. Sh.250,000

D. Sh.750,000 (2 marks)

2. A machine that cost Sh.120,000 has an accumulated depreciation of Sh.50,000. The machine is being depreciated at the rate of 10% per annum on a reducing balance basis. Calculate the machine’s depreciation for the year.

A. Sh.50,000

B. Sh.70,000

C. Sh.12,000

D. Sh.7,000 (2 marks)

3. The credit entry for net profit is on the credit side of:

A. The trading account

B. Statement of profit or loss account

C. The drawings account

D. The capital account (2 marks)

4. Which of this best describes a statement of financial position?

A. An account proving the books balance

B. A record of closing entries

C. A listing of balances of expenses

D. A statement of assets and liabilities (2 marks)

5. Carriage inwards is charged to the trading account because:

A. It is an expense connected with buying goods

B. It should not go in the statement of financial position

C. It is not part of motor expenses

D. Carriage outwards goes in the profit and loss account (2 marks)

6. Given figures showing: Sales Sh.8,200; Opening inventory Sh.1,300; Closing inventory Sh.900; Purchases Sh.6,400; Carriage inwards Sh.200, the cost of goods sold figure is:

A. Sh.6,800

B. Sh.6,200

C. Sh.7,000

D. Sh.7,900 (2 marks)

7. The reason for giving special consideration to cash accounting procedures includes all of the following except:

A. Security problems involved

B. Large number of transactions involved

C. Possibility of fraud

D. Reliance on different accounting principles rather than on non-cash transactions (2 marks)

8. The costs of putting goods into a saleable condition should be charged to:

A. Trading account

B. Trial balance

C. Statement of financial position

D. Sales ledgers (2 marks)

9. Suppliers’ personal accounts are found in the:

A. Nominal ledger

B. General ledger

C. Purchases ledger

D. Sales ledger (2 marks)

10. The sales day book is best described as:

A. Part of the double entry system

B. Containing customers’ accounts

C. Containing real accounts

D. A list of credit sales (2 marks)

11. Which of the following are personal accounts?

(i) Buildings

(ii) Wages

(iii) Debtors

(iv) Creditors

A. (i) and (iv) only

B. (ii) and (iii) only

C. (iii) and (iv) only

D. (ii) and (iv) only (2 marks)

12. When Benard Mutua writes a cheque for Sh.50,000 and sends it to Susan, then Benard is known as:

A. The payee

B. The banker

C. The drawer

D. The creditor (2 marks)

13. If you want to make sure that your money will be safe when cheques are sent by the post, you should:

A. Not use the postal service in future

B. Always pay by cash

C. Always take the money in person

D. Cross your cheques ‘Account Payee only, Not Negotiable’ (2 marks)

14. An accounts clerk is issued with Sh.20,000 per week for petty cash. The first week of July 2022 the accounts clerk had used Sh.12,000 out of the total amount. How much did the chief accountant, reimburse the accounts clerk in the second week of July?

A. Sh.20,000

B. Sh.8,000

C. Sh.12,000

D. Sh.32,000 (2 marks)

15. A debit balance of Sh.1,000 in cash account shows:

A. There was Sh.1,000 cash in hand

B. Cash has been overspent by Sh.1,000

C. Sh.1,000 was the total cash paid out

D. The total of cash received was less than Sh.1,000 (2 marks)

16. Sh.5,000 cash taken from the cash till and banked is entered as follows:

A. Debit cash column Sh.5,000: Credit bank column Sh.5,000

B. Debit bank column Sh.5,000: Credit cash column Sh.5,000

C. Debit cash column Sh.5,000: Credit cash column Sh.5,000

D. Debit bank column Sh.5,000: Credit bank column Sh.5,000 (2 marks)

17. A credit balance of Sh.2,000 on the cash column of the cash book would mean?

A. We have spent Sh.2,000 more than we have received

B. We have Sh.2,000 cash in hand

C. The bookkeeper has made a mistake

D. Someone has stolen Sh.2,000 cash (2 marks)

18. Posting transactions in accounting means:

A. Making the first entry of a single-entry transaction

B. Entering items in a cash book

C. Making an entry of a double entry transaction

D. Something other than the above (2 marks)

19. A cash discount is best described as a reduction in the sum to be paid

A. If payment is made earlier than the agreed payment date

B. If payment is made by cash, not cheque

C. If payment is made either by cash or cheque

D. If purchases are made for cash, not on credit (2 marks)

20. Discounts received are:

A. Deducted when we receive cash

B. Given by us when we sell goods on credit

C. Deducted by us when we pay our accounts

D. Received from debtors (2 marks)

21. The total of the discounts received column in the cash book is posted to:

A. The debit side of the discounts allowed account

B. The debit side of the discounts received account

C. The credit side of the discounts allowed account

D. The credit side of the discounts received account (2 marks)

22. Sales invoices are first entered in:

A. The cash book

B. The purchases journal

C. The sales account

D. The sales journal (2 marks)

23. The total of the sales journal is entered on:

A. The credit side of the sales account in the general ledger

B. The credit side of the general account in the sales ledger

C. The debit side of the sales account in the sales ledger

D. The debit side of the sales day book (2 marks)

24. A purchase invoice shows 5 items of Sh.8,000 each, less trade discount of 25% and cash discount of 5% if paid within ten days. If payment is made within eight days, how much will the buyer pay?

A. Sh.28,500

B. Sh.28,000

C. Sh.26,000

D. Sh.40,000 (2 marks)

25. An alternate name for a sales journal is:

A. Sales invoice

B. Sales day book

C. Daily sales

D. Sales ledger (2 marks)

26. Define the term depreciation:

A. The amount spent to buy non-current assets

B. The salvage value of a non-current asset

C. The part of the cost of the non-current asset consumed during its period of use by the firm

D. The amount of money spent replacing non-current assets (2 marks)

27. A firm bought a machine for Sh.6,500,000. It is to be depreciated at the rate of 25% on reducing balance basis.

Calculate the net book value of the machine after two years?

A. Sh.1,625,000

B. Sh.4,875,000

C. Sh.1,218,750

D. Sh.3,656,250 (2 marks)

28. When financial statements are prepared, the bad debts account is closed by transfer to the:

A. Statement of financial position

B. Statement of profit or loss

C. Trading account

D. Allowance for doubtful debts (2 marks)

29. The allowance for doubtful debt is created:

A. Where debtors become bankrupt

B. When debtors cease to be in business

C. To provide for possible bad debts

D. To write off bad debts (2 marks)

30. A profit making business that is a separate legal entity and in which ownership is divided into shares is known as:

A. Sole proprietorship

B. Company

C. Partnership

D. Corporation (2 marks)

31. The properties owned by a business enterprise are known as:

A. Assets

B. Liabilities

C. Shareholders’ equity

D. Owners equity (2 marks)

32. A list of assets, liabilities and owners equity of a business entity as at a specific date is referred to as:

A. A statement of financial position

B. A statement of profit or loss

C. A statement of owner’s equity

D. A retained earnings statement (2 marks)

33. If total assets increased by Sh.245,000 during a period of time and total liabilities increased by Sh.112,000 during the same period. Calculate the amount and direction (increase or decrease) of the period’s change in the owner’s equity is:

A. Sh.357,000 increase

B. Sh.357,000 decrease

C. Sh.133,000 increase

D. Sh.133,000 decrease (2 marks)

34. What does a debit signify?

A. An increase in an asset account

B. A decrease in an asset account

C. An increase in a liability account

D. An increase in the owner’s capital (2 marks)

35. Select one of the errors below that is not disclosed by a trial balance:

A. Error of principle

B. Compensating error

C. Error of overstating one account

D. Error of omission (2 marks)

36. How should the receipt of cash from customers in payment of their accounts be recorded in the books of account?

A. Debit to cash; credit to accounts receivable

B. Debit to accounts receivable; credit to cash

C. Debit to cash; credit to accounts payable

D. Debit to accounts payable; credit to cash (2 marks)

37. The list of balances and the titles of the accounts in the ledger as at a given date is known as:

A. Statement of profit or loss

B. Statement of financial position

C. Retained earnings statement

D. Trial balance (2 marks)

38. If the estimated amount of depreciation on machinery for a period is Sh.75,000, the entry to record depreciation would be:

A. Debit depreciation expense, Sh.75,000; credit equipment, Sh.75,000

B. Debit equipment, Sh.75,000; credit depreciation expense, Sh.75,000

C. Debit depreciation expenses, Sh.75,000; credit accumulated depreciation Sh.75,000

D. Debit accumulated depreciation, Sh.75,000; credit depreciation expense Sh.75,000 (2 marks)

39. If the furniture and fittings account has a balance of Sh.342,100 and its accumulated depreciation account has a balance of Sh.23,895. What is the book value of furniture and fittings?

A. Sh.365,995

B. Sh.342,100

C. Sh.23,895

D. Sh.318,205 (2 marks)

40. Which of the following accounts should be closed to the statement of profit or loss at the end of a period?

A. Sales account

B. Salary expense account

C. Both sales and salary expense accounts

D. Neither sales nor salary expense accounts (2 marks)

41. A buyer has returned goods purchased on credit. Which document will inform the buyer of the acceptance of the goods returned by the seller?

A. A debit note

B. A credit note

C. An invoice

D. A bill (2 marks)

42. Jane purchased goods from a supplier for Sh.43,000, terms trade discount 5%. She paid Sh.1,500 for transport. She also received a cash discount of 2% for early payment. What is the cost of sales purchases?

A. Sh.40,850

B. Sh.44,500

C. Sh.41,533

D. Sh.41,490 (2 marks)

43. Which amount of inventory will appear in the trial balance at the end of the period?

A. Inventory at the beginning of the current period

B. Inventory at the end of the current period

C. Cost of inventory sold during the current period

D. Inventory sold during the period (2 marks)

44. The statement in which the total of all expenses are deducted from the total of all revenues is known as:

A. Trading statement

B. Statement of profit or loss

C. Statement of financial position

D. Cash flow statement (2 marks)

45. In the statement of profit or loss, the excess of net sales over the cost of sales is referred to as:

A. Net loss

B. Gross loss

C. Gross profit

D. Net profit (2 marks)

46. On 1 July 2022, salary expense had a credit balance of Sh.550,000. On 30 July 2022, the salaries of the month amounting to Sh.1,821,700 were paid. What was the salary expense for July 2022?

A. Sh.1,821,700

B. Sh.1,271,700

C. Sh.550,000

D. Sh.2,371,700 (2 marks)

47. At the end of the financial year, the adjusting entry for accrued salaries was inadvertently omitted. The effect of the error would be to:

A. Understate expense for the year

B. Overstate net income for the year

C. Understate liabilities at the end of the year

D. All of the above (2 marks)

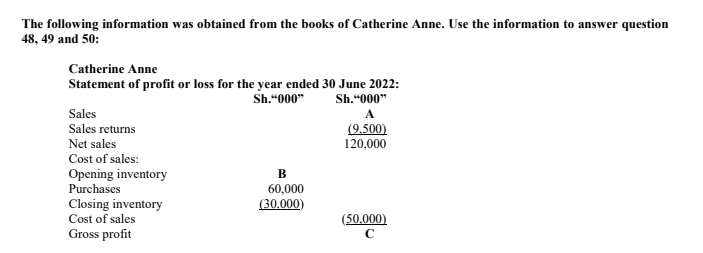

48. Calculate the value of A

A. Sh.110,500

B. Sh.120,000

C. Sh.129,500

D. Sh.30,000 (2 marks)

49. Calculate the value of B

A. Sh.20,000

B. Sh.90,000

C. Sh.30,000

D. Sh.110,500 (2 marks)

50. Calculate the value of C

A. Sh.90,000

B. Sh.110,500

C. Sh.70,000

D. Sh.129,500 (2 marks)