November 2021. Time allowed: Two Hours

This paper has two sections. Section One has twenty (20) short response/computational questions. Section Two has three (3) computational questions. All questions are compulsory. Marks allocated to each question are shown at the end of the question. Any assumptions made must be clearly and concisely stated.

RATES OF TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2020.

Assume that the following rates of tax applied throughout the year of income 2020.

Monthly taxable pay Annual taxable pay Rate of tax

(Sh.) (Sh.) % in each Sh.

1 – 24,000 1 – 288,000 10%

24,001 – 40,667 288,001 – 488,000 15%

40,668 – 57,334 488,001 – 688,000 20%

Excess over – 57,334 Excess over – 688,000 25%

Personal relief Sh.2,400 per month (Sh.28,800 per annum).

Prescribed benefit rates of motor vehicles provided by employer

Monthly rates Annual rates

(Sh.) (Sh.)

1. Saloons, Hatch Backs and Estates

Up to 1200 cc 3,600 43,200

1201 1500 cc 4,200 50,400

1501 1750 cc 5,800 69,600

1751 2000 cc 7,200 86,400

2001 3000 cc 8,600 103,200

Over 3000 cc 14,400 172,800

2. Pick-ups, Panel Vans (unconverted)

Up to 1750 cc 3,600 43,200

Over 1750 cc 4,200 50,400

3. Land Rovers/Cruisers 7,200 86,400

Commissioner’s prescribed benefit rates

Monthly rates Annual rates

Services (Sh.) (Sh.)

Electricity (Communal or from a generator) 1,500 18,000

Water (Communal or from a borehole) 500 6,000

Agriculture employees: Reduced rates of benefits

Water 200 2,400

Electricity 900 10,800

SECTION ONE

[40 MARKS] [1 Hour]

- What name is given to a type of tax that is heavier on the poor than on the rich? (2 marks)

- The transfer of tax burden from one tax payer to another is called. (2 marks)

- Name the tax that is charged on importation of goods into a country. (2 marks)

- Naiposhi sold land that he had acquired twenty years ago. Which tax is payable on this transaction? (2 marks)

- A company is paying its employees for the month of October 2020. What is the due date for remitting Pay as you earn (PAYE) deductions? (2 marks)

- Amani has received an end of year cash gift of Sh. 20,000 from his employer. What is taxable value of this gift? (2 marks)

- Kulei has received an end of year gift in form of a mobile phone worth Sh. 20,000. What is the taxable value of this gift? Give reason for your answer. (2 marks

- Identify two initiatives that the government can employ to minimize chances of tax evasion. (2 marks)

- Laban was offered 100,000 shares by the employer at a price of Sh.17 per share. These shares are trading in the local securities exchange at Sh. 26 per share. Calculate the taxable benefit on this offer. (2 marks)

- Mawele was sent on official duty to Lamu for 10 days. A night out allowance of Sh. 7,000 was paid by the employer. Calculate the taxable benefit on this allowance. (2 marks)

- Hamisi fell sick in the month of October 2020 and the employer paid his hospital bills of Sh. 900,000 to Pwani Special Hospital. The employer has standing arrangement with the hospital for all the employees. State the tax treatment of this benefit. (2 marks)

- McHarmony a US citizen working for KC Ltd. Nairobi is entitled to air tickets for travelling back to the USA every summer. Is this benefit taxable? Give a reason for your answer. (2 marks)

- Beth, a company secretary is provided with a car by the employer. The 1500 cc car cost the company Sh.1,300,000. Determine that taxable value of this car for the year. (2 marks)

- Mugo Wachiuri, a Pastor earned a salary of Sh. 32,000 in July 2020. Determine his net tax payable for the month. (2 marks)

- ABD traders made purchases for Sh.200,000 and sales for Sh.360,000 for the month of July 2020. Given that the prices are quoted exclusive of VAT and VAT rate is 16%, determine the VAT payable for the month. (2 marks)

- WacuKairu, a sole proprietor paid her hospital bills of Sh. 1,600,000 in the year 2020. How much of this expense is deductible against her taxable profits. (2 marks)

- Matthews, a clothes dealer made a taxable profit of Sh. 2,400,000 in the year 2020. However, in the year 2019 he had made a loss of Sh. 600,000 from the same business. Determine his taxable amount for the year 2020. (2 marks)

- Amunga, a hardware shop dealer makes an average monthly sales of Sh.600,000. Should he register for value added tax? Give a reason for your answer. (2 marks)

- A company’s bank account has been credited with interest of Sh. 85,000 for the deposits held for the last one year. If the bank pays interest on deposits at 4% computed on straight line basis, how much deposits does the company have with the Bank. (2 marks)

- State the due date for filing VAT returns for October 2020 transactions. (2 marks)

(Total: 40 marks)

SECTION TWO

[60 MARKS] [1 Hour]

- Identify four benefits from employment that are exempted from tax. (4 marks)

Tiberius Kagwima is an employee of Farm Prime Retail outlets Ltd. The following details relate to his income for the year ended 31 December 2020:

- His basic salary was Sh.260,000 per month (PAYE deducted Sh.76,680).

- Annual bonus at 15 % of his annual salary.

- He was also given an annual allowance of Sh.20,000 to compensate for the higher cost of living.

- The company provided him with a new 2,500 cc car costing Sh.3,500, 000. It is estimated that 40% of the car’s use related to official duties.

- A house rented by the employer at Sh.24,000 per month. The employer deducted Sh.2,500 from his salary every month to cover rent for the house.

- The employer paid his bills, water Sh.15,000 and electricity Sh.28,000 for the year

- He contributes 8,000 per month to a registered pension scheme, the employer contributes an equal amount.

- For the year ended 31 December 2020, the employer provided Mr. Tiberius Kagwima with groceries valued at Sh.43,000.

- He was selected as the employee of the year on 31 December 2020. This award carried a cash gift of Sh.45,000

- He has a life insurance policy for self and family for which he pays a total premium of Sh.45,000 per annum.

His other income included:

- Profits from a barber shop Sh.600,000.

- Profits from his horticultural farm Sh.150,000.

Required:

Determine Mr Tiberius Kagwima’s taxable income for the year of income 2020. (14 marks)

Compute the net tax payable. (2 marks)

(Total: 20 marks)

- List five records that must be kept for purposes of accounting for VAT. (5 marks)

Identify any four details required in a tax invoice. (4 marks)

Given below were the purchases and sales made by Mada Limited during the month of October 2020. The prices were inclusive of VAT at the standard rate of 16 percent.

1 October Purchased 400 units at Sh.5,800 per unit

3 October Sold 40 units at Sh.8,700 per unit

5 October Sold 80 units at Sh.8,700 per unit

11 October Customers returned 10 units that had been bought on 1 October 2020

21 October Sold 200 units at Sh.11,600 per unit

25 October Purchased 300 units at Sh.6,960 per unit

26 October Sold 80 units at Sh.8,700 per unit

28 October Returned 40 of the units that had been purchased on 25 October 2020

30 October Sold 200 units at Sh.9,280 per unit

30 October Paid monthly bills, electricity Sh. 17,400, Telephone Sh. 11,600 and Water Sh.15,000

Required:

Prepare the VAT account for the month of October 2020. (11 marks)

(Total: 20 marks)

- Explain four benefits of using online tax filing systems. (8 marks)

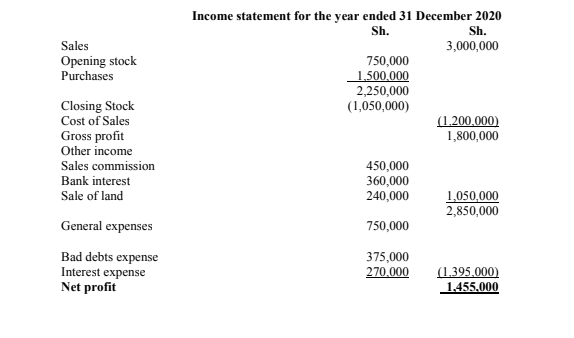

The following income statement was obtained from Tabby Kaguta, a shopkeeper in Malava Market:

The following additional information is provided:

- Tabby realised a forex exchange gain of Sh.30,000 on her imported stock.

- The general expenses in the income statement include:

Delivery van bought in May 2020 for Sh.450,000.

Subscriptions to Estate Mothers Association Sh.35,000.

Donations to her local church Sh.78,000.

Depreciation on assets Sh.100,000.

Medical bills for her family Sh.9,000.

Out of court settlement for inheritance dispute Sh.78,000.

- Bad debt expense includes general provision for doubtful debts Sh.120,000.

- Interest expense is made of interest on bank overdraft 180,000 and interest on loan acquired to buy land 90,000.

- She had also invested in the following assets:

Computers Sh.300,000

Furniture Sh.450,000.

Required:

Determine Tabby Kaguta’s taxable income for the year of income 2020. (12 marks)

(Total: 20 marks)