November 2021. Time allowed: Two hours

This paper has two sections. Section One has twenty (20) multiple choice/short computational questions. Section Two has three computational questions. All questions are compulsory. Marks allocated to each question are shown at the end of the question.

SECTION ONE

[40 MARKS] [40 MINUTES]

1. Planning, recording, analysing and interpreting financial information is best referred to as:

A. Accounting

B. Balance sheet

C. Accounting equation

D. Accounting system

(2 marks)

2. The partnership form of business organisation is best described as:

A. It’s a common form of organisation for service-type businesses.

B. It’s a separate legal entity.

C. Enjoys an unlimited life.

D. Has limited Liability

(2 marks)

3. Funds received before the delivery of goods and services would be shown as:

A. Unearned revenue on the statement of income.

B. Unearned revenue on the statement of financial position

C. A credit to cash

D. Sales or service revenue on the statement of earnings

(2 marks)

4. If the adjusting entry for unearned revenues is not made, which of the following is true:

A. Credit will be overstated

B. Assets will be overstated.

C. Revenues will be overstated.

D. Liabilities will be overstated.

(2 marks)

5. On a classified balance sheet of a Kenyan company, current assets are customarily listed in which order:

A. In the order of liquidity.

B. In the order of acquisition.

C. With the largest dollar amounts first.

D. In alphabetical order.

(2 marks)

6. The amounts appearing on an income statement should agree with the amounts appearing on the post-closing trial

balance. This statement is:

(a) True

(b) False

(2 marks)

7. A financial statement that reports assets, liabilities and owner’s equity on a specific date is a:

A. Balance sheet

B. Accounting record

C. Accounting equation

D. Account balance

(2 marks)

8. Business activities that change the amounts in the accounting equation are:

A. Assets

B. Transactions

C. Accounts payable

D. Equities

(2 marks)

9. What is a account balance?

A. The owner’s investment

B. The amount in an account

C. A business entity

D. The sum of all assets

(2 marks)

10. Anything of value that is owned is:

A. Owner’s Equity

B. Liabilities

C. Assets

D. Unit of measurement

(2 marks)

11. One-person ownership is referred to as a:

A. Sole Proprietorship

B. Corporation

C. Partnership

D. None of the above.

(2 marks)

12. All of the following are examples of a service business except

A. Nail salon

B. Car wash

C. Plumbing company

D. A department store

(2 marks)

13. Owner’s equity is best described as:

A. Liabilities

B. The amount owed by a company

C. The amount remaining after liabilities are subtracted from the assets

D. The relationship among assets, liabilities & owner’s equity

(2 marks)

14. An equation showing the relationship among assets, liabilities & owner’s equity is:

(a) The accounting equation

(b) Owner’s equity

(c) The accounting system

(d) All of the above

(2 marks)

15. What are equities?

(a) Financial right to the assets of a business

(b) Anything of value that is owned

(c) An amount owed by a business

(d) Fixed assets

(2 marks)

16. The standard accounting equation is

(a) A = L + C or OE

(b) A+L + C = OE

(c) L = A + OE

(d) None of the above

(2 marks)

17. Organised summaries of a business ‘s financial activities are best described as:

A. Accounting systems

B. Accounting processes

C. Accounting records

D. Transactions

(2 marks)

18. A proper net worth statement heading contains the name of the company, the title and date.

A. True

B. False

(2 marks)

19. What does “on account” refer too?

A. Buy now, get later

B. Received goods, pay later

C. Assets increasing

D. Loans

(2 marks)

20. The term used when the owner’s personal financial information is recorded separately from their business is:

A. Business entity

B. Unit of measurement

C. Owner’s equity

D. None of the above

(2 marks)

(Total: 40 marks)

SECTION TWO

[60 MARKS] [1 Hour 20 Minutes]

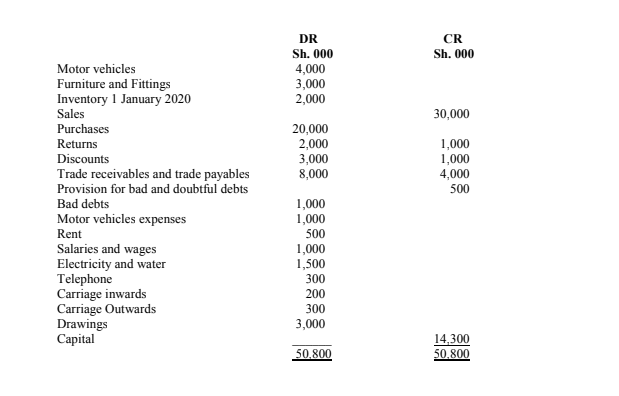

21. Mr Patapata is a merchant operating in Namanga border town.

His trial balance for the year ended 31 December 2020 is as shown below:

Additional information:

Stock on 31 December 2020 amounted to Sh. 3,000,000

Motor vehicle expenses unpaid amount to Sh.300,000

Unpaid electricity and water amount to Sh. 100,000

Depreciation is provided on motor vehicles and fixtures at 20% and 10% respectively on cost

Required:

- Income statement for the year ended 31 December 2020. (12 marks)

- Statement of financial position as at 31 December 2020. (8 marks)

(Total: 20 marks)

22. B and M commenced business on 2 January 2021 with capital of Sh.2,000,000 in the bank. The following transactions took place during the month of January 2021:

January

2 Purchased goods worth Sh.175,000 on credit from Mathew

3 Bought furniture and fittings Sh.150,000 paying by cheque

5 Sold goods for cash Sh.275,000

6 Bought goods on credit Sh.114,000 from Peter

10 Paid rent by cash Sh.15,000

12 Bought stationery Sh.27,000 by cash

18 Goods returned to Mathew Sh.23,000

21 Rented out part of premises receiving rent by cheque Sh.5,000

23 Sold goods on credit to Urbanus for Sh.77,000

24 Bought a motor vehicle paying by cheque Sh.300,000

30 Paid the month’s wages by cash Sh.117,000

31 The proprietor took cash for himself Sh.44,000.

Required:

Record the above transactions in necessary ledger accounts. (14 marks)

Extract a trial balance as at 31 January 2021. (6 marks)

(Total: 20 marks)

23. Baba Ndogo sole proprietorship received their bank statement for the month of July 2021.

The bank balance was Sh.571,500 whereas the cash book balance was Sh.46,250.

The following discrepancies were later discovered:

- Bank charges of Sh.3,000 had not been entered in the cash book.

- Cheques totaling Sh. 22,500 had not yet been presented.

- Receipts of Sh.26,500 had not been entered in cash book.

- The bank had not been credited with receipts of Sh.98,500.

- Standing order amounting to Sh. 62,000 had not been entered into the cash book.

- Payment of Sh.74,900 were entered into the cash book as Sh.79,400.

- A cheque of Sh.150,000 from debtors had been returned by the bank marked refer to drawer.

- The opening cash balance of Sh.329,250 was recorded as a debit balance instead of a credit balance.

- An old cheque payment amounting to Sh.44,000 had been written back in the cash book but the bank had already honored it.

Required:

- Adjusted cash book balance. (12 marks)

- Bank reconciliation statement. (8 marks)

(Total: 20 marks)