INTRODUCTION

Dividend decision of firm is yet another crucial area of financial management. The important aspect of dividend policy is to determine the amount of earnings to be distributed to shareholders and the amount to be retained in the firm. Retained earnings are the most significant internal sources of financing the growth of the firm. On the other hand, dividends may be considered desirable from shareholders’ point of view as they tend to increase their current return. Dividends, however, constitute the use of the firm’s funds. Dividend policy involves the balancing of the shareholders’ desire for current dividends and the firm’s needs for funds for growth.

ISSUES IN DIVIDEND POLICY

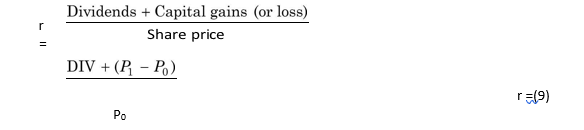

In theory, the objective of a dividend policy should be to maximize a shareholder’s return so that the value of his investment is maximized. Shareholders’ return consists of two components: dividends and capital gains. Dividend policy has a direct influence on these two components of return.

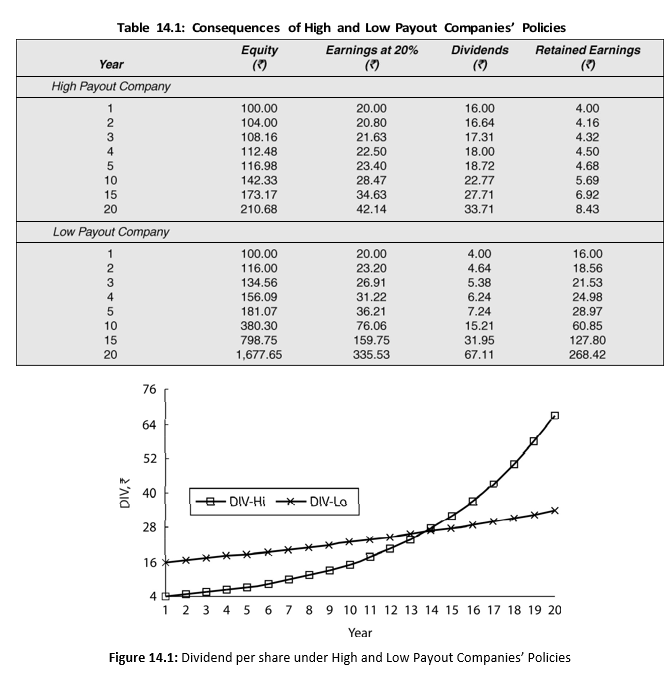

Let us consider an example to highlight the issues underlying the dividend policy. Payout ratio—which is dividend as a percentage of earnings or dividend per share as a percentage of earnings per share—is an important concept vis-à-vis the dividend policy. Retention ratio is 100 per cent minus payout percentage. Suppose two companies, Low Payout Company and High Payout Company, both have a return on equity (ROE) of 20 per cent. Assume that both companies’ equity consists of one share each of `100. High Payout Company distributes 80 per cent while Low Payout Company distributes 20 per cent of its earnings as dividends. As you may recall, growth rate is the product of return on equity (ROE) times retention ratio (b):

![]()

For Low Payout Company, the growth rate is: g = 0.20 0.80 = 0.16 or 16%

For High Payout Company the growth rate will be: g = 0.20 0.20 = 0.04 or 4%

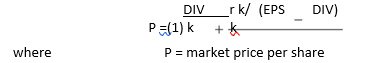

It may be seen from Table 14.1 that High Payout’s dividend is initially four times that of Low Payout’s. However, over a long period of time, Low Payout overtakes High Payout’s dividend payments. As shown in Figure 14.1, in our example, fourteenth year onwards Low Payout’s dividend exceeds that of High Payout. Note that Low Payout retains much more than High Payout, and as a consequence, Low Payout’s earnings, dividends and equity investment are growing at 16 per cent while that of High Payout’s at 4 per cent only.

A low payout policy might produce a higher share price because it accelerates earnings growth. Investors of growth companies will realize their return mostly in the form of capital gains (resulting from the appreciation in the share value). Dividend yield—dividend per share divided by the market price per share—will be low for such companies. The impact of dividend policy on future capital gains is, however, complex. Capital gains occur in distant future, and therefore, many people consider them uncertain. It is not sure that low-payout policy will necessarily lead to higher prices in reality. It is quite difficult to clearly identify the effect of payout on share price. Share price is a reflection of so many factors that the long-run effect of payout is quite difficult to isolate.

A high payout policy means more current dividends and less retained earnings, which may consequently result in slower growth and perhaps lower market price per share. As stated earlier, low payout policy means less current dividends, more retained earnings and higher capital gains, and perhaps higher market price per share. Capital gains are future earnings while dividend

are current earnings. Dividends in most countries are taxed more than capital gains.* Therefore, it is quite plausible that some investors would prefer high-payout companies while others may prefer low-payout companies.

What does dividend policy imply? Paying dividends involves outflow of cash. The cash available for the payment of dividends is affected by the firm’s investment and financing decisions. A decision to incur capital expenditure implies that less cash will be available for the payment of dividends. Thus, investment decision affects dividend decision. If the firm’s value is affected, is it because of the investment decision or the dividend decision? Given the firm’s capital expenditure, and that it does not have sufficient internal funds to pay dividends, it can

![]()

raise funds by issuing new shares. In this case, the dividend decision is not separable from the firm’s financing decision.

The firm will have a given amount of cash available for paying dividends, given its investment and financing decisions. Thus, a dividend decision involves a trade-off between the retained earnings and issuing new shares. It is essential to separate the effect of dividend changes from the effects of investment and financing decisions. Do changes in the dividend policy alone affect the value of the firm? What factors are important in formulating a dividend policy in practice?

On the relationship between dividend policy and the value of the firm, different theories have been advanced. These theories can be grouped into two categories: (a) theories that consider dividend decision to be irrelevant and (b) theories that consider dividend decision to be an active variable influencing the value of the firm. In the latter, there are two extreme views, that is: (i) dividends are good as they increase the shareholder value; (ii) dividends are bad since they reduce the shareholder value. The following is the critical evaluation of some important theories representing these points of views.

Check Your Concepts

- Define payout ratio, retention ratio and dividend yield.

- How do high payout and low payout policies affect future earnings, dividends and growth?

- What is meant by dividend policy?

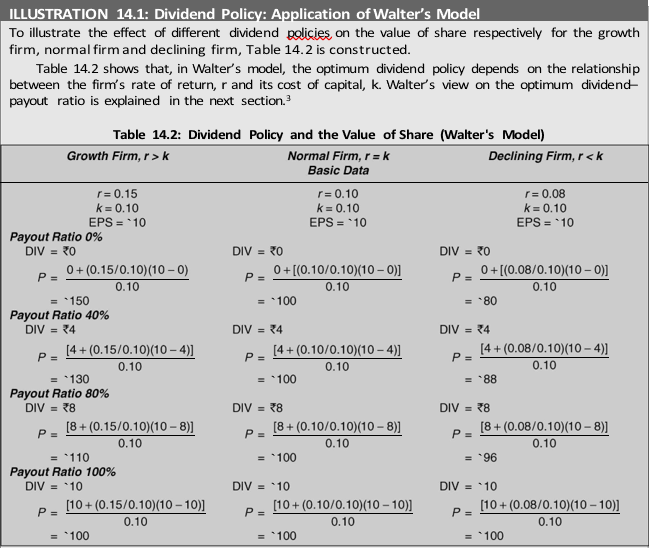

DIVIDEND RELEVANCE: WALTER’S MODEL

Internal financingThe firm finances all investment through retained earnings; that is, debt or new equity is not issued.

Professor James E Walter argues that the choice of dividend policies almost always affect the value of the firm.1 His model, one of the earlier theoretical works, shows the importance of the relationship between the firm’s rate of return, r, and its cost of capital, k, in determining the dividend policy that will maximize the wealth of shareholders. Walter’s model is based on the following assumptions:2

Constant return and cost of capitalThe firm’s rate of return, r, and its cost of capital, k, are constant.

100 per cent payout or retentionAll earnings are either distributed as dividends or reinvested internally immediately.

Constant EPS and DIV Beginning earnings and dividends never change. The values of the earnings per share, EPS, and the dividend per share, DIV, may be changed in the model to determine results, but any given values of EPS or DIV are assumed to remain constant forever in determining a given value.

Infinite time The firm has a very long or infinite life.

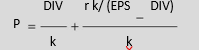

Walter’s formula to determine the market price per share is as follows:

DIV = dividend per share

EPS = earnings per share r = firm’s rate of return (average) k = firm’s cost of capital or capitalization rate Equation (1) reveals that the market price per share is the sum of the present value of two sources of income: (i) the present value of the infinite stream of constant dividends, DIV/k and (ii) the present value of the infinite stream of capital gains arising from internal growth, [r/k (EPS – DIV)]/k. When the firm retains a perpetual sum of (EPS – DIV) at r rate of return, its present value will be: r/k (EPS – DIV). This quantity can be known as a capital gain which occurs when earnings are retained within the firm. If retained earnings occur every year, the present value of an infinite number of capital gains, r/k (EPS – DIV), will be equal to: [r/k (EPS – DIV)]/k.

Growth Firm: Internal Rate more than Opportunity Cost of Capital (r > k)

Growth firms

are those firms which expand rapidly because of ample investment opportunities yielding returns higher than the opportunity cost of capital (r > k). These firms are able to reinvest earnings at a rate (r) which is higher than the rate expected by shareholders (k). They will maximize the value per share if they follow a policy of retaining all earnings for internal investment. It can be seen from Table 14.2 that the market value per share for the growth firm is maximum (i.e., `150) when it retains 100 per cent earnings and minimum (i.e., `100) if it distributes all earnings. Thus, the optimum payout ratio for a growth firm is zero. The market value per share P, increases as payout ratio declines when r > k.

Normal Firms: Internal Rate equals Opportunity Cost of Capital (r = k)

Most of the firms do not have unlimited surplus-generating investment opportunities. After exhausting super profitable opportunities, normal firms earn on their investments rate of return equal to the cost of capital, r = k. For normal firms with r = k, the dividend policy has no effect on the market value per share in Walter’s model. It can be noticed from Table 14.2 that the market value per share for the normal firm is same (i.e., `100) for different dividendpayout ratios. Thus, there is no unique optimum payout ratio for a normal firm. One dividend policy is as good as the other. The market value per share is not affected by the payout ratio when r = k.

Declining Firms: Internal Rate less than Opportunity Cost of Capital (r<k)

Declining firms do not have any profitable investment opportunities to invest the earnings. These firms would earn on their investments rates of return less than the minimum rate required (r < k) by investors. Investors of such firm would like earnings to be distributed to them so that they may either spend it or invest elsewhere to get a rate higher than earned by the declining firms. The market value per share of a declining firm with r < k will be maximum when it does not retain earnings at all. It can be observed from Table 14.2 that, when the declining firm’s payout ratio is 100 per cent (i.e., zero retained earnings) the market value per share is `100 and it is `80 when payout ratio is zero. Thus, the optimum payout ratio for a declining firm is 100 per cent. The market value per share, P, increases as payout ratio increases when r < k.

Thus, in Walter’s model, the dividend policy of the firm depends on the availability of investment opportunities and the relationship between the firm’s internal rate of return, r and its cost of capital, k. Thus:

Retain all earnings when r > k

Dividend (or retention) policy has no effect when r = k.

Distribute all earnings when r < k

Thus, dividend policy in Walter’s model is a financing decision. When dividend policy is treated as a financing decision, the payment of cash dividends is a passive residual.4

Criticism of Walter’s Model

Walter’s model is quite useful to show the effects of dividend policy on all equity firms under different assumptions about the rate of return. However, the simplified nature of the model can lead to conclusions that are not true in general, though true for the model. The following is a critical evaluation of some of the assumptions underlying the model.

No External Financing

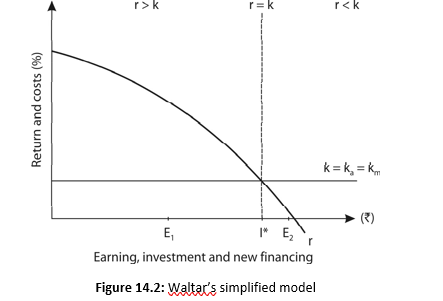

Walter’s model of share valuation mixes dividend policy with investment policy of the firm. The model assumes that retained earnings finance the investment opportunities of the firm and no external financing—debt or equity—is used for the purpose. When such a situation exists, either the firm’s investment or its dividend policy or both will be sub-optimum. This is shown graphically in Figure 14.2.5 The horizontal axis represents the amount of earnings, investment and new financing in rupees. The vertical axis shows the rates of return and the cost of capital. It is assumed that the cost of capital, k, remains constant, regardless of the amount of new capital raised.

Thus, the average cost of capital ka is equal to the marginal cost of capital, km. The rates of return on investment opportunities available to the firm are assumed to be decreasing. This implies that the most profitable investments will be made first and the poorer investments made last. In Figure 14.2, I* rupees of investment occurs where r = k. I* is the optimum investment regardless of whether the capital to finance this investment is raised

by selling shares, debentures, retaining earnings or obtaining a loan. If the firm’s earnings are E1, then (I* – E1) amount should be raised to finance the investments. However, external financing is not included in Walter’s simplified model. Thus, for this situation Walter’s model would show that the owner’s wealth is maximized by retaining and investing firm’s total earnings of E1 and paying no dividends. In a more comprehensive model allowing for outside financing, the firm should raise new funds to finance I* investment. The wealth of the owners will be maximized only when this optimum investment is made.

Constant Return, r

Constant Opportunity Cost of Capital, k

Walter’s model is based on the assumption that r is constant. In fact, r decreases as more and more investment is made. This reflects the assumption that the most profitable investments are made first and then the poorer investments are made. The firm should stop at a point where r = k. In Figure 14.2, the optimum point of investment occurs at I* where r = k; if the firm’s earnings are E2 it should pay dividends equal to (E2 – I)*; on the other hand, Walter’s model indicates that, if the firm’s earnings are E2, they should be distributed because r < k at E2. This is clearly an erroneous policy and will fail to optimize the wealth of the owners.

A firm’s cost of capital or discount rate, k, does not remain constant; it changes directly with the firm’s risk. Thus, the present value of the firm’s income moves inversely with the cost of capital. By assuming that the discount rate, k, is constant, Walter’s model abstracts from the effect of risk on the value of the firm.

DIVIDEND RELEVANCE: GORDON’S MODEL

Myron Gordon develops one very popular model explicitly relating the market value of the firm to dividend policy.6 Gordon’s model is based on the following assumptions:7 All-equity firmThe firm is an all-equity firm, and it has no debt.

No external financingNo external financing is available. Consequently, retained earnings would be used to finance any expansion. Thus, just as Walter’s model, Gordon’s model too confounds dividend and investment policies.

Constant returnThe internal rate of return, r, of the firm is constant. This ignores the diminishing marginal efficiency of investment as represented in Figure 14.2.

Constant cost of capitalThe appropriate discount rate, k for the firm remains constant. Thus, Gordon’s model also ignores the effect of a change in the firm’s risk class and its effect on k.

Perpetual earningsThe firm and its stream of earnings are perpetual.

No taxesCorporate taxes do not exist.

Constant retentionThe retention ratio, b, once decided upon, is constant. Thus, the growth rate, g = br, is constant forever.

Cost of capital greater than growth rate The discount rate is greater than growth rate, k = g. If this condition is not fulfilled, we cannot get a meaningful value for the share.

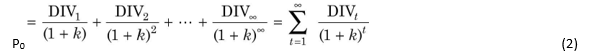

According to Gordon’s dividend-capitalization model, the market value of a share is equal to the present value of an infinite stream of dividends received by the shareholders. Thus:

However, the dividend per share is expected to grow when earnings are retained. The dividend per share is equal to the payout ratio, (1 – b) times earnings per share, EPS; that is, DIVt = (1 – b) EPSt where b is the fraction of retained earnings. It is assumed that the retained earnings are reinvested within the all-equity firm at the firm’s internal rate of return, r. This allows earnings to grow at g = br per period. When we incorporate growth in earnings and dividends, resulting from the retained earnings, in the dividend-capitalization model, the present value of a share is determined by the following formula:

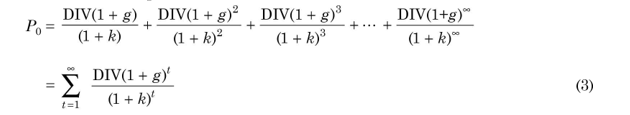

When Equation (3) is solved it becomes:

Substituting EPS (1 – b) for DIV1 and br for g, Equation (4) can be rewritten as

Equation (5) explicitly shows the relationship of expected earnings per share, EPS1, dividend policy as reflected by retention ratio, b, internal profitability, r, and the all-equity firm’s cost of capital, k, in the determination of the value of the share. Equation (5) is particularly useful for studying the effects of dividend policy on the value of the share.

Let us consider the case of a normal firm where the internal rate of return of the firm equals its cost of capital, i.e., r = k. Under this situation, Equation (5) may be expressed as follows:

Equation (7) shows that regardless of the firm’s earnings per share, EPS1, or risk (which determines k), the firm’s value is not affected by dividend policy and is equal to the value of assets per share. That is, when r = k, dividend policy is irrelevant since b, completely cancels out of Equation (7). Interpreted in economic sense, this finding implies that, under competitive conditions, the opportunity cost of capital, k, must be equal to the rate of return generally available to investors in comparable shares. This means that any funds distributed as dividends may be invested in the market at the rate equal to the firm’s internal rate of return. Consequently, shareholders can neither lose nor gain by any change in the company’s dividend policy, and the market value of their shares must remain unchanged.8

Considering the case of the declining firm where r < k, Equation (7) indicates that, if the retention ratio, b, is zero or payout ratio, (1 – b), is 100 per cent the value of the share is equal to: rA

If r < k then r/k < 1 and from Equation (8) it follows that P0 is smaller than the firm’s investment per share in assets, A. It can be shown that if the value of b increases, the value of the share continuously falls.9 These results may be interpreted as follows:

P0 = k (b = 0) (8)

If the internal rate of return is smaller than k, which is equal to the rate available in the market, profit retention clearly becomes undesirable from the shareholders’ standpoint. Each additional rupee (sic) retained reduces the amount of funds that shareholders could invest at a higher rate elsewhere and thus further depresses the value of the company’s share. Under such conditions, the company should adopt a policy of contraction and disinvestment, which would allow the owner to transfer not only the net profit but also paid in capital (or a part of it) to some other, more remunerative enterprise.10

Finally, let us consider the case of a growth firm where r > k. The value of a share will increase as the retention ratio, b, increases under the condition of r > k. However, it is not clear as to what the value of b should be to maximize the value of the share, P0. For example, if b = k/r, Equation (5) reveals that denominator, k – br = 0, thus making P0 infinitely large, and if b = 1, k – br becomes negative, thus making P0 negative. These absurd results are obtained because of the assumption that r and k are constant, which underlie the model. Thus, to get the meaningful value of the share, according to Equation (5), the value of b should be less than k/r. Gordon’s model is illustrated in Illustration 14.2.

Gordon’s model’s conclusions about dividend policy are similar to that of Walter’s model. This similarity is due to the resemblance of assumptions that underlie both the models. Thus the Gordon model suffers from the same limitations as the Walter model.

DIVIDEND AND FINANCING: RESIDUAL THEORY

When dividend decision is treated as a financing decision, the net earnings of the firm may be considered as a source of long-term funds. With this approach, dividends will be paid only when the firm does not have profitable investment opportunities. The firm grows at a faster rate when it accepts highly profitable investment projects. External equity could be raised to finance investments. But retained earnings are preferred because, unlike external equity, they do not involve any flotation costs. In addition, in India companies are required to pay dividend distribution tax on the distributed dividend. Thus, firms have more funds available to invest than what shareholders could invest if they received dividends. The distribution of cash dividends causes a reduction in internal funds available to finance profitable investment opportunities and consequently, either constrains growth or requires the firm to find other costly sources of financing.16 Thus, profitable firms may retain their earnings as a part of long-term financing decision. The dividends will be paid to shareholders when a firm cannot profitably reinvest earnings. This approach is referred to as the residual theory of dividend, and it is supported by both Walter’s model and Gordon’s model.

DIVIDEND AND UNCERTAINTY: THE BIRD-IN-THE-HAND ARGUMENT

According to Gordon’s model, dividend policy is irrelevant where r = k, when all other assumptions are held valid. But when the simplifying assumptions are modified to conform more closely to reality, Gordon concludes that dividend policy does affect the value of a share even when r = k. This view is based on the assumption that under conditions of uncertainty, investors tend to discount distant dividends (capital gains) at a higher rate than they discount near dividends. Investors, behaving rationally, are risk averse and, therefore, have a preference for near dividends to future dividends. The logic underlying the dividend effect on the share value can be described as the bird-in-the-hand argument. Kirshman, first of all, put forward the bird-in-the-hand argument in the following words:

Graham and Dodd also hold a similar view when they state:

Of two stocks with identical earnings record, and prospects but the one paying a larger dividend than the other, the former will undoubtedly command a higher price merely because stockholders prefer present to future values. Myopic vision plays a part in the price-making process. Stockholders often act upon the principle that a bird in the hand is worth two in the bush and for this reason are willing to pay a premium for the stock with the higher dividend rate, just as they discount the one with the lower rate.11

The typical investor would most certainly prefer to have his dividend today and let tomorrow take care of itself. No instances are on record in which the withholding of dividends for the sake of future profits has been hailed with such enthusiasm as to advance the price of the stock. The direct opposite has invariably been true. Given two companies in the same general position and with the same earning power, the one paying the larger dividend will always sell at a higher price.12 (Emphasis added)

Myron Gordon has expressed the bird-in-the-hand argument more convincingly and in formal terms. According to him, uncertainty increases with futurity; that is, the further one looks into the future, the more uncertain dividends become. Accordingly, when dividend policy is considered in the context of uncertainty, the appropriate discount rate, k, cannot be assumed to be constant. In fact, it increases with uncertainty; investors prefer to avoid uncertainty and would be willing to pay higher price for the share that pays the greater current dividend, all other things held constant. In other words, the appropriate discount rate would increase with the retention rate. Thus, distant dividends would be discounted at a higher rate than near dividends. Symbolically, kt > kt – 1 for t = 1, 2, … because of increasing uncertainty in the future. As the discount rate increases with the length of time, a low dividend payment in the beginning will tend to lower the value of share in future.

Incorporating uncertainty into his model, Gordon concludes that dividend policy affects the value of the share. His reformulation of the model justifies the behaviour of investors who value a rupee of dividend income more than a rupee of capital gains income. These investors prefer dividend above capital gains because dividends are easier to predict, are

less uncertain and less risky, and are therefore, discounted with a lower discount rate.13 However, all do not agree with this view.

Check Your Concepts

- What is the bird-in-the-hand argument of dividend?

- What are Gordon’s arguments regarding the uncertainty of capital gains?

DIVIDEND IRRELEVANCE: THE MILLER–MODIGLIANI (MM) HYPOTHESIS

According to Miller and Modigliani (MM), under a perfect market situation, the dividend policy of a firm is irrelevant, as it does not affect the value of the firm.14 They argue that the value of the firm depends on the firm’s earnings that result from its investment policy. Thus, when investment decision of the firm is given, dividend decision—the split of earnings between dividends and retained earnings—is of no significance in determining the value of the firm.

A firm, operating in perfect capital market conditions, may face one of the following three situations regarding the payment of dividends:

The firm has sufficient cash to pay dividends.

The firm does not have sufficient cash to pay dividends, and therefore, it issues new shares to finance the payment of dividends.

The firm does not pay dividends, but shareholders need cash.

In the second situation, when the firm issues new shares to finance the payment of dividends, two transactions take place. First, the existing shareholders get cash in the form of dividends, but they suffer an equal amount of capital loss since the value of their claim on assets reduces. Thus, the wealth of shareholders does not change. Second, the new shareholders part with their cash to the company in exchange for new shares at a fair price per share. The fair price per share is the share price before the payment of dividends less dividend per share to the existing shareholders. The existing shareholders transfer a part of their claim (in the form of new shares) to the new shareholders in exchange for cash. There is no net gain or loss. Both transactions are fair, and thus, the value of the firm will remain unaltered after these transactions.

In the first situation, when the firm pays dividends, shareholders get cash in their hands, but the firm’s assets reduce (its cash balance declines). What shareholders gain in the form of cash dividends, they lose in the form of their claims on the (reduced) assets. Thus, there is a transfer of wealth from one shareholders’ pocket to another pocket. There is no net gain or loss. Since it is a fair transaction under perfect capital market conditions, the wealth of shareholders will remain unaffected.

In the third situation, if the firm does not pay any dividend a shareholder can create a homemade dividend by selling a part of his/her shares at the market (fair) price in the capital market for obtaining cash. The shareholder will have less number of shares. He or she has exchanged a part of his or her claim on the firm to a new shareholder for cash. The net effect is the same as in the case of the second situation. The transaction is a fair transaction, and no one loses or gains. The value of the firm remains the same, before or after these transactions. Consider an example.

| ILLUSTRATION 14.3: Dividend Irrelevance: The Miller–Modigliani Hypothesis |

| The Himgir Company Limited currently has 2 crore outstanding shares selling at a market price of `100 per share. The firm has no borrowing. It has internal funds available to make a capital expenditure

(Capex) of `30 crore. The Capex is expected to yield a positive net present value of `20 crore. The firm |

also wants to pay a dividend per share of `15. Given the firm’s Capex plan and its policy of zero borrowing, the firm will have to issue new shares to finance payment of dividends to its shareholders. How will the firm’s value be affected (i) if it does not pay any dividend; (ii) if it pays dividend per share `15?

The firm’s current value is: 2 × 100 = `200 crore. After the Capex, the value will increase to: 200 + 20 = `220 crore. If the firm does not pay dividends, the value per share will be: 220/2 = `110.

If the firm pays a dividend of `15 per share, it will entirely utilize its internal funds (15 × 2 = `30 crore), and it will have to raise `30 crore by issuing new shares to undertake Capex. The value of a share after paying dividend will be: 110 – 15 = `95. Thus, the existing shareholders get a cash of `15 per share in the form of dividends, but incur a capital loss of `15 in the form of reduced share value. They neither gain nor lose. The firm will have to issue: 30 crore/95 = 31,57,895 (about 31.6 lakh) shares to raise `30 crore. The firm now has 2.316 crore shares at `95 each share. Thus, the value of the firm remains as: 2.316 × 95 = `220 crore.

The crux of the MM dividend hypothesis, as explained above, is that shareholders do not necessarily depend on dividends for obtaining cash. In the absence of taxes, flotation costs and difficulties in selling shares, they can get cash by devising ‘homemade dividend’ without any dilution in their wealth. Therefore, firms paying high dividends (i.e., high-payout firms), need not command higher prices for their shares. A formal explanation of the MM hypothesis is given in the following pages.

MM’s hypothesis of irrelevance is based on the following assumptions:15

Perfect capital markets The firm operates in perfect capital markets where investors behave rationally, information is freely available to all, and transactions and flotation costs do not exist. Perfect capital markets also imply that no investor is large enough to affect the market price of a share.

Investment policy The firm has a fixed investment policy.

No taxes Taxes do not exist; or there are no differences in the tax rates applicable to capital gains and dividends. This means that investors value a rupee of dividend as much as a rupee of capital gains.

No risk Risk of uncertainty does not exist. That is, investors are able to forecast future prices and dividends with certainty, and one discount rate is appropriate for all securities and all time periods. Thus, r = k = kt for all t.

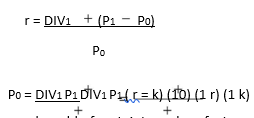

Under the MM assumptions, r will be equal to the discount rate, k, and identical for all shares. As a result, the price of each share must adjust so that the rate of return, which is composed of the rate of dividends and capital gains, on every share will be equal to the discount rate and be identical for all shares. Thus, the rate of return for a share held for one year may be calculated as follows:

where P0 is the market or purchase price per share at time 0, P1 is the market price per share at time 1 and DIV1 is dividend per share at time 1. As hypothesized by MM, r should be equal for all shares. If it is not so, the low-return yielding shares will be sold by investors who will purchase the high-return yielding shares. This process will tend to reduce the price of the low-return shares and increase the prices of the high-return shares. This switching or arbitrage will continue until the differentials in rates of return are eliminated. The discount rate will also be equal for all firms under the MM assumptions since there are no risk differences.

From MM’s fundamental principle of valuation described by Equation (9), we can derive their valuation model as follows:

since r = k in the assumed world of certainty and perfect markets. Multiplying both sides of Equation (10) by the number of shares outstanding, n, we obtain the total value of the firm if no new financing exists:

If the firm sells m number of new shares at time 1 at a price of P1, the value of the firm at time 0 will be:

MM’s valuation Equation (12) allows for the issue of new shares, unlike Walter’s and Gordon’s models. Consequently, a firm can pay dividends and raise funds to undertake the optimum investment policy (as explained in Figure 14.1). Thus, dividend and investment policies are not confounded in the MM model, like Walter’s and Gordon’s models. As such, MM’s model yields more general conclusions.

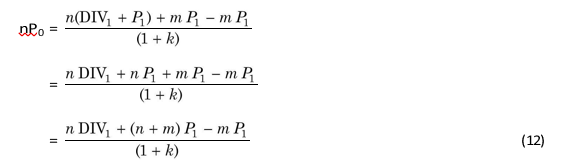

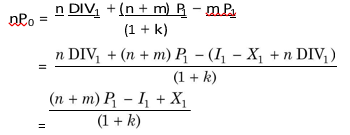

The investment programmes of a firm, in a given period of time, can be financed either by retained earnings or the issue of new shares or both. Thus, the amount of new shares issued will be:

![]()

the total amount of investment during the first period and X1 is the total net profit of the firm during the first period.

By substituting Equation (13) into Equation (12), MM showed that the value of the firm is unaffected by its dividend policy, Thus,

A firm which pays dividends will have to raise funds externally to finance its investment plans. MM’s argument, that dividend policy does not affect the wealth of the shareholders, implies that when the firm pays dividends, its advantage is offset by external financing. This means that the terminal value of the share (say, price of the share at first period if the holding period is one year) declines when dividends are paid. Thus, the wealth of the shareholders— dividends plus terminal price—remains unchanged. As a result, the present value per share after dividends and external financing is equal to the present value per share before the payment of dividends. Thus, the shareholders are indifferent between payment of dividends and retention of earnings.

Check Your Concepts

- Explain the concept of ‘homemade dividend’.

- Explain the crux of MM’s argument about dividend irrelevance.

- What are the assumptions of MM’s dividend irrelevance argument?

ILLUSTRATION 14.4: Dividend Policy with and without Issue of Shares

The Vikas Engineering Co. Ltd, currently has one lakh outstanding shares selling at `100 each. The firm has net profits of `10 lakh and wants to make new investments of `20 lakh during the period. The firm is also thinking of declaring a dividend of `5 per share at the end of the current fiscal year. The firm’s opportunity cost of capital is 10 per cent. What will be the price of the share at the end of the year if (i) a dividend is not declared; (ii) a dividend is declared. (iii) How many new shares must be issued? The price of the share at the end of the current fiscal year is determined as follows:

P0 DIV(1 1 k)P1

P1 P0(1 k) DIV1

The value of P1 when dividend is not paid is:

P1 = `100(1.10) – 0 = `110

The value of P1 when dividend is paid is:

P1 = `100(1.10) – `5 = `105

It can be observed that whether dividend is paid or not the wealth of shareholders remains the same. When the dividend is not paid the shareholder will get `110 by way of the price per share at the end of the current fiscal year. On the other hand, when dividend is paid, the shareholder will realize `105 by way of the price per share at the end of the current fiscal year plus `5 as dividend.

The number of new shares to be issued by the company—to finance its investments is determined as follows:

m P1 I (X nDIV )1

105m 20,00,000 (10,00,000 5,00,000)

105m 15,00,000 m 15,00,000/105 14,285 shares.

DIVIDEND POLICY AND PRACTICE

We have discussed in earlier in the chapter whether or not dividends affect the value of a share. The theoretical views differ on this issue. On the one hand, we have the view that dividends increase the value of the share. On the other hand, there is the view that dividends are bad as they result in the payment of higher taxes (because of the difference in the ordinary income and capital gains tax rates), and thus, they reduce the shareholders’ wealth. We also have a moderate view, which asserts that because of the information value of dividends, some dividends should be always paid to maintain the value of the share. Given these theoretical differences, how do companies set their dividend policies in practice? What factors do they consider in setting their policies?

OBJECTIVES OF DIVIDEND POLICY

As discussed in the previous chapter, a firm’s dividend policy has the effect of dividing its net earnings into two parts: retained earnings and dividends. The retained earnings provide funds to finance the firm’s long-term growth. It is the most significant source of financing a firm’s investments in practice. Dividends are paid in cash. Thus, the distribution of earnings uses the available cash of the firm. A firm which intends to pay dividends and also needs funds to finance its investment opportunities will have to use external sources of financing, such as the issue of debt or equity. Dividend policy of the firm, thus, has its effect on both the long-term financing and the wealth of shareholders. As a result, the firm’s decision to pay dividends may be shaped by the following two possible viewpoints.

Firm’s Need for Funds

Shareholders’ Need for Income

Fast growing and highly profitable firms are continuously in need of funds to finance their expansion and growth. These firms cannot always approach capital markets for raising share capital or debt. Thus, these companies will not follow a fixed dividend policy and use their profits to finance profitable investment opportunities. As stated earlier, given the funds needs of profitable firms for investments the dividend decision becomes a residual decision.

One may argue that capital markets are not perfect; therefore, shareholders are not indifferent between dividends and retained earnings. Because of the market imperfections and uncertainty, shareholders may prefer near dividends to future dividends and capital gains. Thus, the payment of dividends may significantly affect the market price of the share. Higher dividends may increase the value of the shares and low dividends may reduce the value. It is believed by some that, in order to maximize wealth under uncertainty, the firm must pay enough dividends to satisfy investors.17 Investors in high tax brackets, on the other hand, may prefer to receive capital gains rather than dividends when dividends are taxed at higher rate than capital gains. Their wealth will be maximized if firms retain earnings rather than distributing them.

The management of a firm, while evolving a dividend policy, must strike a proper balance between the above-mentioned two approaches. When the firm increases the retained portion of the net earnings, shareholders’ current income in the form of dividends, decreases. But the use of retained earnings to finance profitable investments will increase the future earnings. On the other hand, when dividends are increased, shareholders’ current income will increase, but the firm may have to forego some investment opportunities for want of funds and consequently, the future earnings may decrease. Management should develop a dividend policy, which divides the net earnings into dividends and retained earnings in an optimum way to achieve the objective of maximizing the wealth of shareholders. The development of such policy will be greatly influenced by investment opportunities available to the firm and the value of dividends as against capital gains to the shareholders. The other possible aspects of the dividend policy relate to the stability of dividends, the constraints on paying dividends and the forms of dividends.

PRACTICAL CONSIDERATIONS IN DIVIDEND POLICY

The view that dividends are irrelevant is not entirely correct, once we modify the assumptions underlying this view to consider the realities of the world. In practice, every firm follows some kind of dividend policy. The typical dividend policy of most firms is to retain between one-third to half of the net earnings and distribute the remaining amount to shareholders. Companies in India specify dividends in terms of a dividend rate which is a percentage of the paid-up capital per share. Most of them also tend to increase dividend rate particularly when their profits increase substantially.

There are a very few exceptions to the practice of paying high dividends and continuously increasing dividends. For example, deliberating on the Great Eastern Shipping Co. Ltd (1992– 93) dividend policy, the Chairman stated:

… We do not intend to maintain dividends as a percentage of the face value of your share, nor do we intend to maintain dividend at a fixed rupee value…. it is our intention to retain as much profit as we possibly can, ideally we should like to retain all our earnings, we certainly believe that to be in the shareholders’ interest, … payment of dividends is an inefficient way of increasing shareholders’ wealth. That, had we been a new company the most sensible policy may well have been to pay no dividends and accumulate our profits. This is a policy followed by the most successful companies in the world. We have been inhibited in doing so by tradition and conventional wisdom. … The following questions relate to the dividend policy of a firm:

What are the firm’s financial needs given its growth plans and investment opportunities? Who are the firm’s shareholders and what are their preferences with regard to dividend payments?

What are the firm’s risks—business and financial?

What are the firm’s constraints—financial and legal—in paying dividends?

Is control a consideration for the firm?

Should the firm follow a stable dividend policy?

How should the firm pay dividends—cash dividend or bonus shares or shares buyback?

It is not easy to answer these questions. A number of factors will have to be evaluated to analyze each of these questions to evolve a long-term dividend policy for the firm. Broadly speaking, to develop a long-term dividend policy, the directors of a company should aim at bringing a balance between the desires of shareholders and the needs of the company. The factors that generally influence the dividend policy of the firm are discussed next.18

Firm’s Investment Opportunities and Financial Needs

Firms should tailor their dividend policies to their long-term investment opportunities to have maximum financial flexibility and avoid financial frictions and costs of raising external funds. Growth firms have a large number of investment opportunities requiring substantial amount of funds. Hence they will give precedence to the retention of earnings over the payment of dividends in order to finance its expanding activities. For matured firms, investment opportunities occur infrequently. These firms may distribute most of their earnings. The retained earnings of these firms during periods, when they do not have investment opportunities, may be invested in short-term securities yielding nominal returns. Some of these firms may follow the policy of paying 100 per cent dividends and raise external funds when investment opportunities occur.

Generally, retained earnings should be used as a source of internal financing only when a company has profitable investment opportunities. If shareholders themselves have better investment opportunities, the earnings should be distributed to them so that they may be able to maximize their wealth. Theoretically, when the company has an internal rate of return greater than the return required by shareholders, it would be to the advantage of shareholders to allow the reinvestment of earnings by the company. When the company does not have highly profitable opportunities and earns a rate on investment, which is lower than the rate required by shareholders, it is not in the interest of shareholders to retain earnings.

Thus, depending on the needs to finance their long-term investment opportunities, companies may follow different dividend policies. Mature companies that have fewer investment opportunities may generally have high payout ratios. Shareholders of these companies would be more interested in dividends, as they obtain higher return on their investments outside the company. The share prices of such companies are very sensitive to dividend changes. The directors of these companies retain only a small portion of the earnings to meet emergent financial needs and to finance the occasional investment opportunities and distribute the rest. Growth companies, on the other hand, have plenty of investment opportunities and hence, they may have low payout ratios. They are continuously in need of funds to finance their fast growing fixed assets. The distribution of earnings will reduce the funds of the company. Therefore, sometimes growth companies retain most of their earnings and issue bonus shares, regularly or from time to time, to satisfy the dividend needs of shareholders. These companies would slowly increase the amount of dividends as the profitable investment opportunities start fading.

It is sometimes argued that, even if the company has highly profitable investment opportunities, earnings should be distributed and funds should be raised externally to finance the investment. This will exert a discipline on the company’s management in proper deployment of funds. But companies in practice prefer to retain earnings because issuing new share capital is inconvenient as well as involves flotation costs. If the company raises debt, the financial obligations and risk will increase. As a matter of fact, directors may neither follow a practice of paying 100 per cent dividends, nor a practice of retaining 100 per cent earnings. The company may have a target payout ratio consistent with its investment opportunities and may like to achieve it slowly and steadily. In the absence of profitable investment opportunities, it can pay some ‘extra’ dividend, but still retain some earnings for the continued existence of the enterprise. Though shareholders are the owners of the company and directors should follow a policy desired by them, yet they cannot sacrifice the interests of other groups, such as debt holders, employees, society and customers. Shareholders are the residual claimants to the earnings of the company. Directors must retain some earnings, whether or not profitable investment opportunities exist, to maintain the company as a sound and solvent enterprise and to have financial flexibility. Only a financially sound and flexible company can discharge its debt obligations, provide monetary benefits to its employees, produce quality products for its customers and make social contributions by paying taxes and making donations.19

Shareholders’ Expectations

Legally, the board of directors has the discretion to decide the distribution of the earnings of a company. Shareholders are the legal owners of the company, and directors, appointed by them, are their agents. Therefore, directors should give due importance to the expectations of shareholders in the matter of dividend decision. Shareholders’ preference for dividends or capital gains may depend on their economic status and the effect of tax differential on dividends and capital gains. In most countries, dividend income is taxed at a rate higher than the capital gains. A wealthy shareholder, in a high income tax bracket, may be interested in capital gains than current dividends. On the other hand, a retired person with small means, whose main source of income is dividend, would like to get regular dividend and may not be interested in capital gains.* The ownership concentration in a firm may define the shareholders’ expectations.

In case of a closely held company, the body of the shareholders is small and homogeneous and management usually knows the expectations of shareholders. Therefore, they can easily adopt a dividend policy which satisfies most shareholders. If most of the shareholders are in high tax brackets and have a preference for capital gains to current dividend incomes, the company can establish a dividend policy of paying sufficient dividends and retaining the earnings within the company, subject to its growth opportunities.

It is a formidable task to ascertain the preferences of shareholders in a widely held company. The number of shareholders is very large, they are dispersed and they may have diverse desires regarding dividends and capital gains. Hence it is not possible in case of widely held company to follow a dividend policy, which equally satisfies all shareholders. The firm may follow a dividend policy, which serves the purpose of the dominating group, but does not completely neglect the desires of others. Shareholders of a widely held company may be divided, for example, into four groups: small, retired, wealthy and institutional shareholders.20

It should be obvious from the above discussion that, in the case of a widely held company, the interests of the various shareholders’ groups are in conflict. It is not easy to reconcile these conflicting interests of the different types of shareholders. However, the board of directors

Small shareholders are not the frequent purchasers of the shares. They hold a small number of shares in a few companies with the purpose of receiving dividend income, or sometimes making capital gains. They may not have a definite investment policy. They purchase shares only when their savings permit. Retired and old people generally invest in shares to get a regular income. They use their savings or provident or pension funds to purchase shares. These persons may, therefore, select shares of the companies that have a history of paying regular and liberal dividends. However, a retired person who has some source of income and is in a high tax bracket may be interested in capital gains as well. Wealthy investors are very much concerned with the dividend policy followed by a company. They have a definite investment policy of increasing their wealth and minimizing taxes. These persons are in high tax brackets and the dividends received in cash by them would be taxed at a high rate. Therefore, they generally prefer a dividend policy of retaining earnings and distributing bonus shares. The wealthy shareholders’ group is quite dominating in many companies as they hold relatively large blocks of shares and are able to influence the composition of the board of directors by their significant voting rights. On the dividend policies of these companies, this group will have a considerable influence. Institutional investors purchase large blocks of shares to hold them for relatively long periods of time. Institutional investors, unlike wealthy shareholders, are not concerned with personal income taxes but with profitable investments. Most institutional investors avoid speculative issues, seek diversification in their investment portfolio and favour a policy of regular cash dividend payments.

should consider two points.21 First, the board should adopt a dividend policy, which gives some consideration to the interests of each of the groups comprising a substantial proportion of shareholders. Second, the dividend policy, once established, should be continued as long as it does not interfere with the financing needs of the company. A definite dividend policy, followed for a long period in the past, tends to create a particular kind of clientele for the company. That is, it attracts those investors who consider the dividend policy in accord with their investment requirements. If the company suddenly changes its dividend policy, it may work to the detriment of these shareholders, as they may have to switch to other companies to fulfil their investment needs. Thus, an established dividend policy should be changed slowly and only after having analysed its probable effects on the existing shareholders.

Constraints on Paying Dividends

Most companies recognize that the shareholders have some desire to receive dividends, although shareholders are also interested in the capital gains. How much dividend should a company pay? The company’s decision regarding the amount of earnings to be distributed as dividends depends on legal and financial constraints.

Legal Restrictions

The legal rules act as boundaries within which a company can operate in terms of paying dividends. Acting within these boundaries, a company will have to consider many financial variables and constraints in deciding the amount of earnings to be distributed as dividends.

The dividend policy of the firm has to evolve within the legal framework and restrictions. The directors are not legally compelled to declare dividends. For example, the Indian Companies Act provides that dividend shall be declared or paid only out of the current profits or past profits after providing for depreciation. However, the Central Government is empowered to allow any company to pay dividend for any financial year out of the profits of the company without providing for depreciation. The Central Government shall give such relief only when it is in the public interest. The dividend should be paid in cash, but a company is not prohibited to capitalize profits or reserves (retained earnings) for the purpose of issuing fully paid bonus shares (stock dividend). It has been held in some legal cases that capital profits should not be distributed as dividends unless (i) the distribution is permitted by the company’s Articles of Association and (ii) the profits have been actually realised.

Liquidity

The payment of dividends means cash outflow. Although a firm may have adequate earnings to declare dividend, it may not have sufficient cash to pay dividends. Thus, the cash position of the firm is an important consideration in paying dividends; the greater the cash position and overall liquidity of a company, the greater will be its ability to pay dividends. A mature company is generally liquid and is able to pay large amount of dividends. It does not have much investment opportunities; much of its funds are not tied up in permanent working capital and, therefore, it has a sound cash position. On the other hand, growing firms face the problem of liquidity. Even though they make good profits, they continuously need funds for financing growing fixed assets and working capital. Because of the insufficient cash or pressures on liquidity, in case of growth firms, management may follow a conservative dividend policy.

Financial Condition and Borrowing Capacity

The financial condition or capability of a firm depends on its use of borrowings and interest charges payable. A high degree of financial leverage makes a company quite vulnerable to changes in earnings, and also, it becomes quite difficult to raise funds externally for financing its growth. A highly levered firm is, therefore, expected to retain more to strengthen its equity base. However, a company with steady growing earnings and cash flows and without much investment opportunities, may follow a high dividend payment policy in spite of high amount of debt in its capital structure. A growth firm lacking liquidity may borrow to pay dividends. But this is not a sound policy. This will adversely affect the firm’s financial flexibility. Financial flexibility includes the firm’s ability to access external funds at a later date. The firm may lose the flexibility and capacity of raising external funds to finance growth opportunities in the future.

Access to the Capital Market

A company that is not sufficiently liquid can still pay dividends if it is able to raise debt or equity in the capital markets. If it is well established and has a record of profitability, it will not find much difficulty in raising funds in the capital markets. Easy accessibility to the capital markets provides flexibility to the management in paying dividends as well as in meeting the corporate obligations. A fast growing firm, which has a tight liquidity position, will not face any difficulty in paying dividends if it has access to the capital markets. A company that does not have sound cash position and it is also unable to raise funds, will not be able to pay dividends. Thus, the greater the ability of the firm to raise funds in the capital markets, greater will be its ability to pay dividends even if it is not liquid.

Restrictions in Loan Agreements

Inflation

Lenders may generally put restrictions on dividend payments to protect their interests when the firm is experiencing low liquidity or low profitability. As such the firm agrees, as part of a contract with a lender, to restrict dividend payments. For example, a loan agreement may prohibit payment of dividends as long as the firm’s debt–equity ratio is in excess of, say, 1.5 : 1 or when the liquidity ratio is less than, say, 2 : 1 or may require the firm to pay dividends only when some amount of current earnings has been transferred to a sinking fund established to retire debt. These are some of the examples of the restrictions put by lenders on the payment of dividends. When these restrictions are put, the company is forced to retain earnings and have a low payout.

Inflation can act as a constraint on paying dividends. Our accounting system is based on historical costs. Depreciation is charged on the basis of original costs at which assets were acquired. As a result, when prices rise, funds equal to depreciation set aside would not be adequate to replace assets or to maintain the capital intact. Consequently, to maintain the capital intact and preserve their earnings power, firms earnings may avoid paying dividends. On the contrary, some companies may follow a policy of paying more dividends during high inflation in order to protect the shareholders from the erosion of the real value of dividends. Companies with falling or constant profits may not be able to follow this policy.

Control

The objective of maintaining control over the company by the existing management group or the body of shareholders can be an important variable in influencing the company’s dividend policy. When a company pays large dividends, its cash position is affected. As a result, the company will have to issue new shares to raise funds to finance its investment programmes. The control of the existing shareholders will be diluted if they do not want or cannot buy additional shares. Under these circumstances, the payment of dividends may be withheld and earnings may be retained to finance the firm’s investment opportunities.

Check Your Concepts

- How do a firm’s investment opportunities and need for funds affect its dividend policy?

- How shareholders’ desire for income can influence a firm’s dividend decision?

- How should a firm reconcile the conflict between its needs for funds and shareholders’ desirefor current income in deciding the dividend policy?

STABILITY OF DIVIDENDS

Stability of dividends is considered a desirable policy by the management of most companies in practice. Many surveys have shown that shareholders also seem generally to favour this policy and value stable dividends higher than the fluctuating ones. All other things being the same, the stable dividend policy may have a positive impact on the market price of the share.

Stability of dividends also means regularity in paying some dividend annually, even though the amount of dividend may fluctuate over the years, and may not be related with earnings. There are a number of companies, which have records of paying dividend for a long, unbroken period. More precisely, stability of dividends refers to the amounts paid out regularly. Three forms of such stability may be distinguished: Constant dividend per share or dividend rate

Constant payout

Constant dividend per share plus extra dividend

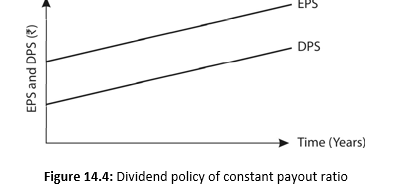

Constant Dividend per Share or Dividend Rate

In India, companies announce dividend as a per cent of the paid-up capital per share. This can be converted into dividend per share. A number of companies in India follow the policy of paying a fixed rate on paid-up capital as dividend every year, irrespective of the fluctuations in the earnings. This policy does not imply that the dividend per share or dividend rate will never be increased. When the company reaches new levels of earnings and expects to maintain them, the annual dividend per share (or dividend rate) may be increased. The relationship between earnings per share and the dividend per share under this policy is shown in Figure 14.3.

It is easy to follow this policy when earnings are stable. However, if the earnings pattern of a company shows wide fluctuations, it is difficult to maintain such a policy. With earnings fluctuating from year to year, it is essential for a company, which wants to follow this policy, to build up surpluses in years of higher than average earnings to maintain dividends in years of below average earnings. In practice, when a company retains earnings in good years for this purpose, it earmarks this surplus as dividend equalization reserve. These funds are invested in current assets like tradable (marketable) securities, so that they may easily be converted into cash at the time of paying dividends in bad years.

A constant dividend per share policy puts ordinary shareholders at per with preference shareholders irrespective of the firm’s investment opportunities or the preferences of shareholders.22 Those investors who have dividends as the only source of their income may prefer the constant dividend policy. They do not accord much importance to the changes in share prices. In the long run, this may help to stabilize the market price of the share.23

Constant Payout

The ratio of dividend to earnings is known as payout ratio. Some companies may follow a policy of constant payout ratio, i.e., paying a fixed percentage of net earnings every year. With this policy the amount of dividend will fluctuate in direct proportion to earnings. If a company adopts a 40 per cent payout ratio, then 40 per cent of every rupee of net earnings will be paid out. For example, if the company earns `2 per share, the dividend per share will be `0.80 and if it earns `1.50 per share the dividend per share will be `0.60. The relation between the earnings per share and the dividend per share under this policy is exhibited in Figure 14.4.

This policy is related to a company’s ability to pay dividends. If the company incurs losses, no dividends shall be paid regardless of the desires of shareholders. Internal financing with retained earnings is automatic when this policy is followed. At any given payout ratio, the amount of dividends and the additions to retained earnings increase with increasing earnings and decrease with decreasing earnings. This policy does not put any pressure on a company’s liquidity since dividends are distributed only when the company has profits.24

Constant Dividend per Share plus Extra Dividend

For companies with fluctuating earnings, the policy to pay a minimum dividend per share with a step-up feature is desirable. The small amount of dividend per share is fixed to reduce the possibility of ever missing a dividend payment. By paying extra dividend (a number of companies in India pay an interim dividend followed by a regular, final dividend) in periods of prosperity, an attempt is made to prevent investors from expecting that the dividend represents an increase in the established dividend amount. This type of policy enables a company to pay constant amount of dividend regularly without a default and allows a great deal of flexibility for supplementing the income of shareholders only when the company’s earnings are higher than the usual, without committing itself to make larger payments as a part of the future fixed dividend. Certain shareholders like this policy because of the certain cash flow in the form of regular dividend and the option of earning extra dividend occasionally.

We have discussed three forms of stability of dividends. Generally, when we refer to a stable dividend policy, we refer to the first form of paying constant dividend per share. A firm pursuing a policy of stable dividend, as shown in Figure 14.3, may command a higher price for its shares than a firm which varies dividend amount with cyclical fluctuations in the earnings as depicted in Figure 14.4.

Merits of Stability of Dividends

The stability of dividends has several advantages as discussed below: Resolution of investors’ uncertainty

Investors’ desire for current income

Institutional investors’ requirements

Raising additional finances

Resolution of Investors’ Uncertainty

We have argued in the previous chapter that dividends have informational value, and resolve uncertainty in the minds of investors. When a company follows a policy of stable dividends, it will not change the amount of dividends if there are temporary changes in its earnings. Thus, when the earnings of a company fall and it continues to pay the same amount of dividend as in the past, it conveys to investors that the future of the company is brighter than suggested by the drop in earnings. Similarly, the amount of dividends is increased with increased earnings level only when it is possible to maintain it in future. On the other hand, if a company follows a policy of changing dividends with cyclical changes in the earnings, shareholders would not be certain about the amount of dividends.

Investors’ Desire for Current Income

There are many investors, such as old and retired persons, women, etc., who desire to receive regular periodic income. They invest their savings in the shares with a view to use dividends as a source of income to meet their living expenses. Dividends are like wages and salaries for them. These investors will prefer a company with stable dividends to the one with fluctuating dividends.

Institutional Investors’ Requirements

Raising Additional Finances

Financial, educational, and social institutions, and unit trusts also invest funds in shares of companies. In India, financial institutions such as IFCI, IDBI, LIC, and UTI are some of the largest investors in corporate securities. Every company is interested to have these financial institutions in the list of their investors. These institutions may generally invest in the shares of those companies, which have a record of paying regular dividends. These institutional investors may not prefer a company which has a history of adopting an erratic dividend policy. Thus, to cater the requirement of institutional investors, a company prefers to follow a stable dividend policy.

A stable dividend policy is also advantageous to the company in its efforts to raise external finances. Stable and regular dividend policy tends to make the share of a company as quality investment rather than a speculation. Investors purchasing these shares intend to hold them for long periods of time. The loyalty and goodwill of shareholders towards a company increases with stable dividend policy. They would be more receptive to an offer by the company for further issues of shares. A history of stable dividends serves to spread ownership of outstanding shares more widely among small investors, and thereby reduces the chance of loss of control. The persons with small means, in the hope of supplementing their income, usually purchase shares of the companies with a history of paying regular dividends. A stable dividend policy also helps the sale of debentures and preference shares. The fact that the company has been paying dividend regularly in the past is a sufficient assurance to the purchasers of these securities that no default will be made by the company in paying their interest or preference dividend and returning the principal sum. The financial institutions are the largest purchasers of these securities. They purchase debentures and preference shares of those companies which have a history of paying stable dividends.

Danger of Stability of Dividends

The greatest danger in adopting a stable dividend policy is that once it is established, it cannot be changed without seriously affecting investors’ attitude and the financial standing of the company. If a company, with a pattern of stable dividends, misses dividend payment in a year, this break will have an effect on investors more severe than the failure to pay dividend by a company with unstable dividend policy. The companies with stable dividend policy create a ‘clientele’ that depends on dividend income to meet their living and operating expenses. A cut in dividend is considered as a cut in ‘salary.’ Because of the serious depressing effect on investors due to a dividend cut, directors have to maintain stability of dividends during lean years even though financial prudence would indicate elimination of dividends or a cut in it. Consequently, to be on the safe side, the dividend rate should be fixed at a conservative figure so that it may be possible to maintain it even in lean periods of several years. To give the benefit of the company’s prosperity, extra or interim dividend, can be declared. When a company fails to pay extra dividend, it does not have a depressing effect on investors as the failure to pay a regular dividend does.

- Explain three forms of stability of dividend.

- What are the advantages of stability of dividend?

Cash Dividend

The usual practice is to pay dividends in cash. Other options are payment of the bonus shares (referred to as stock dividend in USA) and shares buyback. In this section, we shall also discuss share split. The share (stock) split is not a form of dividend; but its effects are similar to the effects of the bonus shares.

Companies mostly pay dividends in cash. A company should have enough cash in its bank account when cash dividends are declared. If it does not have enough bank balance, arrangement should be made to borrow funds. When the company follows a stable dividend policy, it should prepare a cash budget for the coming period to indicate the necessary funds, which would be needed to meet the regular dividend payments of the company. It is relatively difficult to make cash planning in anticipation of dividend needs when an unstable policy is followed.

The cash account and the reserve account of a company will be reduced when the cash dividend is paid. Thus, both the total assets and the net worth of the company are reduced when the cash dividend is distributed. The market price of the share drops in most cases by the amount of the cash dividend distributed.25

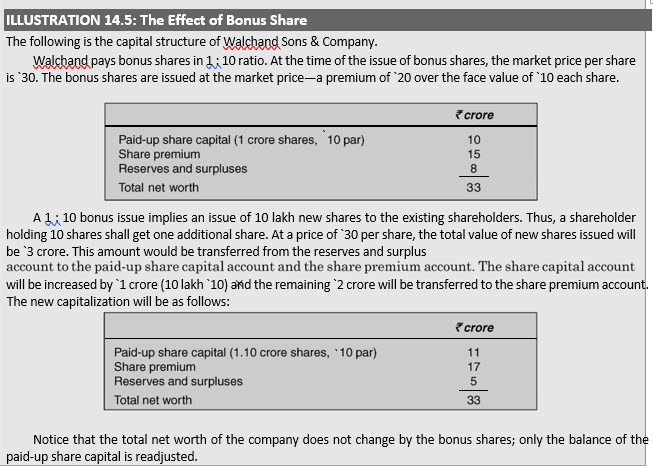

Bonus Shares (Stock Dividend)

An issue of bonus shares is the distribution of shares free of cost to the existing shareholders. In countries like USA issue of bonus shares is called stock dividend. In India, bonus shares are issued in addition to the cash dividend and not in lieu of cash dividend. Hence companies in India may supplement cash dividend by bonus issues. Issuing bonus shares increases the number of outstanding shares of the company. The bonus shares are distributed proportionately to the existing shareholder. Hence there is no dilution of ownership. For example, if a shareholder owns 100 shares at the time when a 10 per cent (i.e., 1 : 10) bonus issue is made, she will receive 10 additional shares. The declaration of the bonus shares will increase the paid-up share capital and reduce the reserves and surplus (retained earnings) of the company. The total net worth (paid-up capital plus reserves and surplus) is not affected by the bonus issue. In fact, a bonus issue represents a recapitalization of reserves and surplus.

It is merely an accounting transfer from reserves and surplus to paid-up capital. The following example illustrates this point.

Bonus Shares and Shareholders’Wealth

Does the issue of bonus shares increase the wealth of shareholders? Normatively speaking, the issue of bonus shares does not affect the wealth of shareholders. The earnings per share and market price per share will fall proportionately to the bonus issue. Let us illustrate this point.

Suppose, as a result of increasing the number of shares by 10 per cent, the earnings per share of Walchand Co. will decrease by 10 per cent, the market price per share will also fall by 10 per cent, all other things being equal. Suppose the net earnings of the company are `2.20 crore, the earnings per share before the declaration of the bonus issue is `2.20 (`2.20 crore/1.00 crore) and after the bonus shares, the earnings per share are `2 (`2.20 crore/1.10 crore). However, the proportional earnings of shareholders will remain unchanged. Thus, the total earnings of a shareholder holding 100 shares before the bonus shares is `220 (`2.20 × 100) and his total earning will still be `220 after the bonus issue (`2.00 × 110). Similarly, the market price per share will drop by `2.73; that is, `30 (1 – 1.00/1.10). The total market value of the shareholder’s holdings after the bonus shares is `3,000 (`27.27 × 110), same as the total value before the bonus shares. Thus, the bonus shares have no impact on the wealth of shareholders. In practice, it is observed that immediately after the announcement of bonus issue, the market price of a company’s share changes depending on the investor’s expectations. Sometimes a sharp decline in the share price may be observed if the bonus issue falls short of the investors’ expectation.

It may be emphasized here that the market value of the share may improve as a result of the bonus issue if it is followed by increased dividends in the immediate future. If the dividends do not increase, it is likely that the market price may fall. This is confirmed by an empirical study conducted under the Indian context.26

Advantages of Bonus Shares

Prima facie, the bonus shares do not affect the wealth of the shareholders. In practice, however, it carries certain advantages both for the shareholders and the company.27

Shareholders

The following are advantages of the bonus shares to shareholders:

Tax benefit One of the advantages to shareholders in the receipt of bonus shares is the beneficial treatment of such dividends with regard to income taxes. When a shareholder receives cash dividend from the company, in most countries, this is included in his ordinary income and taxed at ordinary income tax rate. But the receipt of bonus shares by the shareholder is not taxable as income. Further, the shareholder can sell the new shares received by way of the bonus issue to satisfy his desire for income and pay capital gain taxes, which are usually less than the income taxes on the cash dividends. The shareholder could sell a few shares of his original holding to derive capital gains. But selling the original shares are considered as a sale of asset by some shareholders. They do not mind selling the shares received by way of the bonus shares as they consider it a windfall gain and not a part of the principal. Note that in India as per the current law, investors do not pay any taxes on dividends but they have to pay tax on capital gains. Hence, the Indian law makes bonus shares less attractive than dividends.

Future dividends may increase If a company has been following a policy of paying a fixed amount of dividend per share and continues it after the declaration of the bonus issue, the total cash dividends of the shareholders will increase in the future. For example, a company may be paying a `1 dividend per share and pays 1:1 bonus shares with the announcement that the cash dividend per share will remain unchanged. If a shareholder originally held 100 shares, he will receive additional 100 shares. His total cash dividend in future will be `200 (`1 × 200) instead of `100 (`1 × 100) received in the past. The increase in the shareholders’ cash dividend may have a favourable effect on the value of the share. It should be, however, realized that the bonus issue per se has no effect on the value of the share; it is the increase in earnings from the company’s invests that affects the value.

Indication of higher future profits The issue of bonus shares is normally interpreted by shareholders as an indication of higher profitability. When the profits of a company do not rise, and it declares a bonus issue, the company will experience a dilution of earnings as a result of the additional shares outstanding. Since a dilution of earnings is not desirable, directors usually declare bonus shares only when they expect rise in earnings to offset the additional outstanding shares. Bonus shares, thus, may convey some information that may have a favourable impact on the value of the shares. But it should be noticed that the impact on value is that of the growth expectation and not the bonus shares per se.

Psychological value The declaration of the bonus issue may have a favourable psychological effect on shareholders. The receipt of bonus shares gives them a chance to sell the shares to make capital gains without impairing their principal investment. They also associate it with the prosperity of the company. Because of these positive aspects of the bonus issue, the market usually receives it positively. The sale of the shares, received by way of the bonus shares, by some shareholders widens the distribution of the company’s shares. This tends to increase the market interest in the company’s shares, thus supporting or raising its market price.

Company

The bonus share is also advantageous to the company. The advantages are:

Conservation of cash The declaration of a bonus issue allows the company to declare a dividend without using up cash that may be needed to finance the profitable investment opportunities within the company. The company is thus, able to retain earnings and at the same time satisfy the desires of the shareholders to receive dividend. We have stated earlier that directors of a company must consider the financial needs of the company and the desires of the shareholders while making the dividend decision. These two objectives are often in conflict. The use of bonus issue represents a compromise which enables directors to achieve both these objectives of a dividend policy. The company could retain earnings without declaring bonus shares issue. But the receipt of bonus shares satisfies shareholders psychologically. Also, their total cash dividend can increase in future when cash dividend per share remains the same. Note that in India, bonus shares cannot be issued in lieu of dividends; hence the cash conservation argument for issuing bonus shares is not a strong argument.

More attractive share price Sometimes the intention of a company in issuing bonus shares is to reduce the market price of the share and make it more attractive to investors. If the market price of a company’s share is very high, it may not appeal to small investors. If the price could be brought down to a desired range, the trading activity would increase. Therefore, the bonus issue is used as a means to keep the market price of the share within a desired trading range. As we shall discuss below, this objective can also be achieved by share split.