MAASAI MARA UNIVERSITY

REGULAR UNIVERSITY EXAMINATIONS

2013/2014 ACADEMIC YEAR

FIRST YEAR SECOND SEMESTER

SCHOOL OF BUSINESS & ECONOMICS

DIPLOMA IN BUSINESS MANAGEMENT

COURSE CODE: DBM 19

COURSE TITLE: FINANCIAL MANAGEMENT

DATE: 15TH APRIL 2014 TIME: 9.00A.M –12.00P.M.

INSTRUCTIONS TO CANDIDATES

Answer question ONE compulsorily then choose any other THREE

QUESTION 1

a) Briefly explain five roles of the financial manager in the organization. [5 mrks]

b) Differentiate between systematic and unsystematic risks giving relevant examples in each [ 6 mrks]

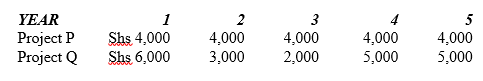

c) A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years. The company required rate of return is 12% and the appropriate corporate tax rate is 30%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cashflows expected to be generated by the projects are as follows.

Required:

Calculate for each project

i. The average rate of return [ 5 marks]

ii. The net present value [ 7 marks]

iii. Profitability index [ 2 marks]

Advice which project should be accepted?

QUESTION 2

a) Discuss any 3 merit and 2 demerits of .mergers in Kenya [10 marks]

b) Explain any five Factors determining dividend policy in a firm. [ 5 marks]

QUESTION 3

Solox traders provided the following details for their cash budget for the next three months.

i) On 1 April 2013 the balance brought forward was shs 90,000

ii) On 5 April to pay rent of shs 24,000.

i) On 10 April to buy equipment costing Kshs90, 000. Half of the Kshs90, 000 is to be paid in April, and there will be two further payments (each amounting to Kshs22, 500) in May and June.

ii) Goods for resale will be purchased according to the following schedule:

iii) March to May Kshs8,000

iv) June to August Kshs10,000

v) Suppliers will give one month’s credit.

vi) Sales are expected to be Kshs15, 000 in each of the first three months, and will rise to Kshs20, 000 a month starting July. All sales are on a credit and are collected as follows; 60% during the month of sale and 40 % in the next months.

vii) Monthly wages of Kshs2,000 are payable in each month.

viii) Personal drawing Kshs1,000 per month .

ix) Kshs1,000 per month to be spend on marketing. Half of the Kshs1,000 is payable in the same month, and the other half is payable in the following month.

x) Other expenses of Kshs2,900 per month are expected – payable in the same month.

xi) Depreciation on the equipment is 25% pa on cost.

Required

a) Prepare a cash budget for the period 1 April to July 2013. [10 marks]

c) Explain the benefits of budgeting in a firm. [5 marks]

QUESTION 4

a) Discuss the agency problem between the share holders and management and explain how you will overcome the challenges associated with the theory. [ 10 marks]

b) Factors Determining Working Capital Requirements of the firm [ 5 marks ]

QUESTION 5

The following costs were incurred by a manufacturing company

Labour 16,000

Material 24, 000

Direct Selling cost 4,000

Fixed costs 100,000

Selling Price Per Unit is Shs 60

Normal periods sales are 1,000 units at shs 60 each, but upto 1,300 units could be sold in a normal period.

The company is considering various alternatives to maximize their profits.

i) Reduce the price to shs 50 each and sell all that could be produced

ii) Increase the price to shs 80 each at which price sales would drop to 800 units

iii) Keep the present plan.

Required

a) Calculate the P/V ratio for each alternative [ 5 marks]

b) Calculate the BEP for each alternative [ 7 marks ]

c) Advice the management on the best alternative [ 3 marks]

QUESTION 6

Jemin limited provided the following stock information for the period starting July 2012

Annual consumption: 36,000 units

Purchase price per units: shs. 54

Ordering cost per order: shs . 150

Inventory carrying cost is 20% of the Price per unit.

Determine

a) Economic order quantity [ 4 marks ]

b) Number of orders per year [ 3 marks]

c) Time between the orders [ 3 marks]

d) Total cost incurred [ 5 marks]