MAASAI MARA UNIVERSITY

SCHOOL OF BUSINESS AND ECONOMICS

DEPARTMENT OF BUSINESS MANAGEMENT

DIPLOMA IN BUSINESS MANAGEMENT

END OF SEMESTER EXAMINATION APRIL 2014

DBM 013: FINANCIAL ACCOUNTING 1

Instructions:

Answer question one and any 0ther three

QUESTION 1

a) Explain any five limitations of financial accounting [ 5 mks]

b) Discuss the difference between the public and private companies [ 5 marks ]

c) Explain the term “bank reconciliation” and state the reasons for its preparation. (5 marks)

d) On 31 October 2013, the cashbook of Mwea Enterprises Ltd. Showed a debit balance of

Sh.1, 710,000. This did not agree with the balance shown in the bank statement.

Upon investigation, the accountant discovered the following errors:

(a) A cheque paid to Kindaruma for Sh.306,000 had been entered in the cashbook as Sh.387,000

(b) Cash paid into the bank by a customer for Sh.90,000 had been entered in the cashbook as Sh.81,000

(c) A transfer of Sh.1,110,000 to Central Savings Bank had not been posted to the cash book.

(d) A receipt of Sh.9,000 shown in the bank statement had not been posted in the cashbook.

(e) Cheques drawn amounting to Sh.36,000 had not been paid into the bank.

(f) The cash book balance had been incorrectly brought down at 1 November 2003 as a debit balance of Sh.1,080,000 instead of a debit balance of Sh.990,000

(g) Bank charges of Sh.18,000 do not appear in the cash book.

(h) A receipt of Sh.810,000 paid into the bank on 31 October 2004 appeared in the bank statement on 1 November 2004.

(i) A standing order of Sh.27,000 had not been recorded in the cash book.

(j) A cheque for Sh.45,000 previously received and paid into the bank had been returned by the customer’s bank marked “account closed”.

(k) The bank received a direct debit of Sh.90,000 from an anonymous customer.

(l) Cheques banked had been totaled at Sh.135,000 instead of Sh.153,000.

(m) A cheque drawn in favour of Nyaga for Sh.120,000 had been entered on the debit side of the cashbook.

Required;

(i) Adjusted cash book as at 31 October 2013. (6 marks)

(ii) A bank reconciliation statement as at 31 October 2013. (4marks)

QUESTION 2

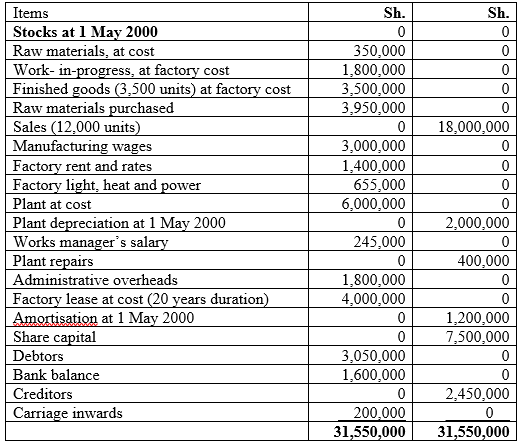

Kaluwax Ltd. manufactures one product which it sells to the wholesale trade. The following trial balance was extracted from the books of the company at 30 April 2001:

The following additional information is available:

1. Plant depreciation is to be provided at 10% on the cost of plant owned at the year end.

2. Raw materials costing Sh.500,000 were in stock on 30 April 2001.

3. Finished goods are transferred to the warehouse as soon as they are completed. During the year, 10,000 units were completed and transferred to the warehouse. Work-in-progress at the end of the financial year (at factory cost) amounted to Sh.2,300,000.

4. There was no wastage or pilferage during the current year.

Required:

a) Manufacturing, trading and profit and loss account for the year ended 30 April 2001.

(15 marks)

QUESTION3

c) Explain any five sources of financing a public company [ 10 marks]

d) Explain the various causes of depreciation [ 5 marks]

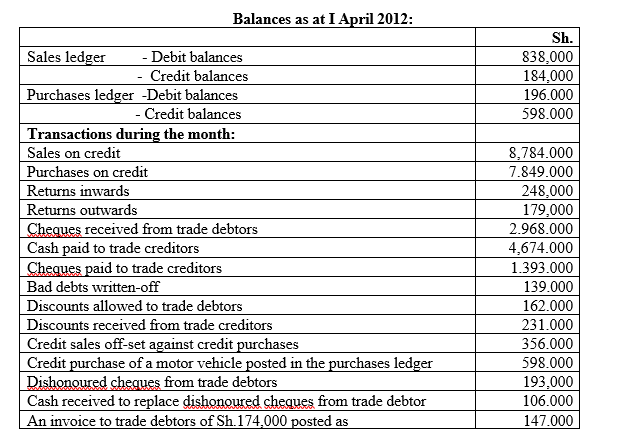

QUESTION4

(b) The following information has been extracted from the books of Mutero Traders Limited for

the month of April 2012.

Required:

The sales ledger and purchases ledger control accounts for the month ended 30 April 2012. (15 marks)

QUESTION 5

Write short notes on the following terms as used in accounting

(a) Error of commission (2 marks)

(b) Error of principle (2 marks)

(c) Complete reversal of entries (2 marks)

(d) Compensating errors (2 marks)

(e) Employees (2 marks)

(f) The Government. (3 marks)

(g) The public. (2 marks)

QUESTION6

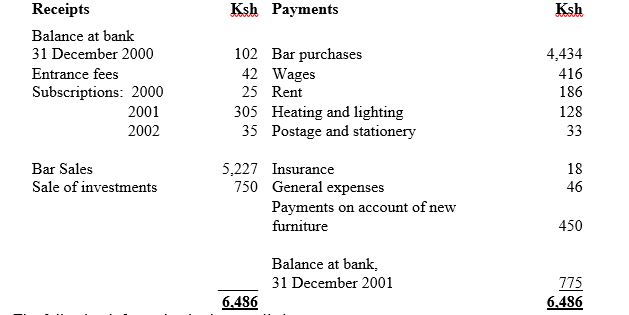

The following is the receipts and payments account of the Friendship Club for the year ended 31 December 2001:

b)On 31 December 2000, the club held investments which cost Ksh500. During the year ended 31 December 2000, these were sold for Ksh750.

c) Furniture was valued at Ksh300 on 31 December 2000. On June 2001, the club purchased additional furniture at a cost of Ksh520. Depreciation of all furniture is to be provided for at the rate of 10% per annum.

Required:

(a) Prepare the bar trading accounting [ 3 marks ]

(b) Prepare an income and expenditure account for the year ended 31 December 2001.

[ 5 marks]

(c) Prepare a balance sheet as at that date [ 7 marks]