KASNEB SYLLABUS

PAPER NO. 4 PRINCIPLES OF ACCOUNTING AND TAXATION

UNIT DESCRIPTION

This paper is intended to equip the candidate with knowledge, skills and attitudes that will enable him/her to prepare and interpret financial statements and compute taxes for various entities in a non-complex environment.

LEARNING OUTCOMES

A candidate who passes this paper should be able to:

- Prepare books of original entry and basic ledger accounts under the double entry system

- Prepare basic financial statements of corporations and not for profit organisations

- Prepare non-complex tax computations for individuals and corporations

- Interpret information in financial and tax statements for decision making.

MASOMO MSINGI PUBLISHERS APP – Click to download and access complete materials in PDF

CONTENT

- Introduction to Accounting

- The nature and purpose of accounting

- Users of accounting information and their respective needs

- Accounting Standards and their purposes (IFRS, IASs, IPSAS)

- Regulatory framework (ICPAK, IASB, IAESB, IPSASB), the Companies Act

- Professional ethics

- Principles, concepts and conventions underlying the preparation of accounting statements

- Accounting Procedures and Techniques

- Accounting Cycle

- Double entry book-keeping

- Books of original entry (journals, ledgers, cashbooks)

- Balancing accounts and preparing the trial balance

- Depreciation of non-current assets including their disposal (by part exchange; ordinary sale; accident)

- Preparation of movement of property, plant equipment (as per International Financial Reporting Standards)

- Trade receivables, bad debts write-offs and provision for bad and doubtful debts

- Accruals, prepayments, reserves and provisions necessary adjustments in statements of financial performance

- Introduction to simple statements of financial performance

- Statements of financial position

- Final accounting statements of a sole trader

- Financial statements of a partnership business reflecting changes in partnerships such as admission, retirement and dissolution

- Introduction to Simple Company Accounts

- Company Formation – Documents

- Share capital and reserves

- Issue of shares at par; premium; discount

- Over and under subscriptions

- Allotment and calls on shares, forfeiture of shares

- Preparation of statements of financial performance and appropriation account and the statement of financial position

- Published accounts: Components of a complete set of published financial statements only

- Accounting for Non-Profit Making Organisations

- Features of Non-profit making organisations

- Types of funds and their accounting treatment

- Income and expenditure account

- Statement of financial position

- Public Sector Accounting and Financial System

- Features of public sector entities (as compared to private sector)

- Structure of the public sector (National and county governments, State Corporations, Departments and Agencies)

- Regulation and oversight [International Public Sector Accounting Standards Board, Director of Accounting Services, National Treasury, Parliamentary Committees, Accounting Officers at national and county levels, Current PFM Acts

- Objectives of public sector financial statements and Standards (IPSAS)

- Accounting techniques in public sector such as budgeting, cash, accrual, commitment and fund accounting) (Preparation of financial statements excluded)

- Introduction to Taxation

- History of taxation

- Types of taxation

- Principles of an optimal tax system

- Single versus multiple tax systems

- Classification of tax systems

- Tax shifting

- Factors that determine tax shifting

- Tax evasion and tax avoidance

- Taxable capacity

- Fiscal policies

- The Revenue Authority; history, structure and mandate

- Investment Allowances

- Rationale for investment allowances

- Investment allowance: Ordinary manufacturers

- Industrial building deductions

- Wear and tear allowances

- Farm works deductions

- Shipping investment deduction

- Other deductions

- Customs Taxes and Excise Taxes

- Customs procedure

- Import and export duties

- Prohibitions and restriction measures

- Transit goods and bond securities

- Purposes of customs and excise duties

- Goods subject to customs control

- Import declaration form, pre-shipment inspection, clean report of findings

- Excisable goods and services

- Application for excise duty (licensing)

- Use of excise stamps

- Offences and penalties

- Excisable goods management system

SAMPLE WORK

Complete copy of CS Principles of Accounting and Taxation Study Notes is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

TOPIC 1

INTRODUCTION TO ACCOUNTING

NATURE AND PURPOSE OF ACCOUNTING

Accounting is considered the language of business. It has evolved throughout the years as information needs changed and became more complex. After finishing this article, the reader should be able to have a general understanding about accounting, be acquainted with the different definitions, know the different types of information found in accounting reports, and know the different uses of accounting information.

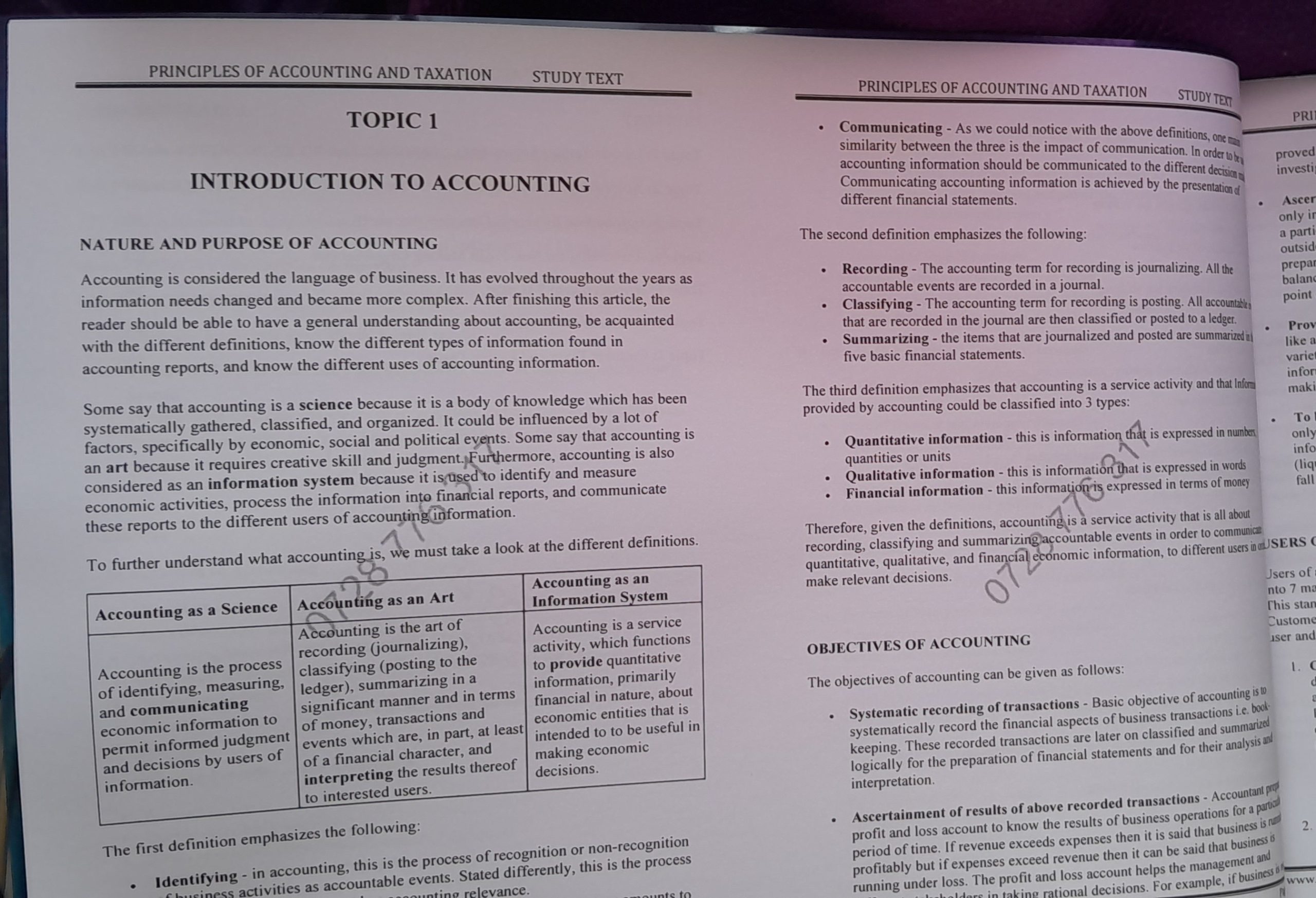

Some say that accounting is a science because it is a body of knowledge which has been systematically gathered, classified, and organized. It could be influenced by a lot of factors, specifically by economic, social and political events. Some say that accounting is an art because it requires creative skill and judgment. Furthermore, accounting is also considered as an information system because it is used to identify and measure economic activities, process the information into financial reports, and communicate these reports to the different users of accounting information.

To further understand what accounting is, we must take a look at the different definitions.

| Accounting as a Science | Accounting as an Art | Accounting as an Information System |

| Accounting is the process of identifying, measuring, and communicating economic information to permit informed judgment and decisions by users of information. | Accounting is the art of recording (journalizing), classifying (posting to the ledger), summarizing in a significant manner and in terms of money, transactions and events which are, in part, at least of a financial character, and interpreting the results thereof to interested users. | Accounting is a service activity, which functions to provide quantitative information, primarily financial in nature, about economic entities that is intended to to be useful in making economic decisions. |

The first definition emphasizes the following:

- Identifying – in accounting, this is the process of recognition or non-recognition of business activities as accountable events. Stated differently, this is the process which determines if an event has accounting relevance.

- Measuring – in accounting, this is the process of assigning monetary amounts to the accountable events.

- Communicating – As we could notice with the above definitions, one main similarity between the three is the impact of communication. In order to be useful, accounting information should be communicated to the different decision makers. Communicating accounting information is achieved by the presentation of different financial statements.

The second definition emphasizes the following:

- Recording – The accounting term for recording is journalizing. All the accountable events are recorded in a journal.

- Classifying – The accounting term for recording is posting. All accountable events that are recorded in the journal are then classified or posted to a ledger.

- Summarizing – the items that are journalized and posted are summarized in the five basic financial statements.

The third definition emphasizes that accounting is a service activity and that Information provided by accounting could be classified into 3 types:

- Quantitative information – this is information that is expressed in numbers, quantities or units

- Qualitative information – this is information that is expressed in words

- Financial information – this information is expressed in terms of money

Therefore, given the definitions, accounting is a service activity that is all about recording, classifying and summarizing accountable events in order to communicate quantitative, qualitative, and financial economic information, to different users in order to make relevant decisions.

OBJECTIVES OF ACCOUNTING

The objectives of accounting can be given as follows:

- Systematic recording of transactions – Basic objective of accounting is to systematically record the financial aspects of business transactions i.e. book-keeping. These recorded transactions are later on classified and summarized logically for the preparation of financial statements and for their analysis and interpretation.

- Ascertainment of results of above recorded transactions – Accountant prepares profit and loss account to know the results of business operations for a particular period of time. If revenue exceeds expenses then it is said that business is running profitably but if expenses exceed revenue then it can be said that business is running under loss. The profit and loss account helps the management and different stakeholders in taking rational decisions. For example, if business is not proved to be remunerative or profitable, the cause of such a state of affair can be investigated by the management for taking remedial steps.

- Ascertainment of the financial position of the business – Businessman is not only interested in knowing the results of the business in terms of profits or loss for a particular period but is also anxious to know that what he owes (liability) to the outsiders and what he owns (assets) on a certain date. To know this, accountant prepares a financial position statement popularly known as Balance Sheet. The balance sheet is a statement of assets and liabilities of the business at a particular point of time and helps in ascertaining the financial health of the business.

- Providing information to the users for rational decision-making – Accounting like a language of commerce communes the monetary results of a venture to a variety of stakeholders by means of financial reports. Accounting aims to meet the information needs of the decision-makers and helps them in rational decision-making.

- To know the solvency position: By preparing the balance sheet, management not only reveals what is owned and owed by the enterprise, but also it gives the information regarding concern’s ability to meet its liabilities in the short run (liquidity position) and also in the long-run (solvency position) as and when they fall due.

MASOMO MSINGI PUBLISHERS APP – Click to download and access complete materials in PDF

USERS OF ACCOUNTING INFORMATION AND THEIR NEEDS

Users of accounting information could be divided into 7 major groups which could be easily be remembered using the acronym GESCLIP. This stands for Government, Employees, Suppliers (trade creditors), Customers/Clients/Consumers, Lenders, Investors, and Public. Let us then discuss each user and find out why they need accounting information.

- Government – the government needs accounting information during its day-to-day operations. The government needs accounting information to assess the amount of tax to be paid by a business or an individual (like the Bureau of Internal Revenue or the Internal Revenue Service when assessing income tax, estate tax, donor’s tax or other taxes); accounting information is needed when determining the fees to be charged in acquiring a business permit or a mayor’s permit; when the Securities and Exchange Commission determines the legality of the amount of share capital subscribed, accounting information is used; when the government deals with certain economic problems like inflation, still accounting information is used. Of course, this list could go on and on.

- Employees – if you are an employee working in the accounting, finance or sales department, definitely, accounting information is essential. However, the use of accounting information is not delimited to employee working under accounting related departments. Employees need accounting information to know if the business could provide the necessary benefits that is due to them. Through accounting information, employees would not be in the dark with regards to the operations of the firm that they are working for.

- Suppliers and Other Trade Creditors – suppliers and trade creditors are providers of merchandise on account to different business establishments. Some examples of suppliers are Coca-Cola and Pepsi. Coca-Cola and Pepsi products that are sold to different fast-food chains and supermarkets but are not paid in cash immediately. Before extending credit to customers, Coca-Cola and Pepsi should look into the accounting records of an entity to determine if they would sell their products on account or not. Telecommunication providers like Smart Telecom, Globe, and At&t, could also be considered as suppliers. Before getting a plan from these telecommunication providers, they ask for different proofs of income from the clients availing of a plan. This is because suppliers could determine from the accounting information if a business or an individual has the ability to pay accounts on time.

- Customers/Clients/Consumers – Customers need accounting information in order to determine the continuity of a business, most especially when there is a long-term engagement between the parties or if the customer is dependent on the enterprise. For instance, students have to go to a financially stable school that could continue to provide quality education until they graduate. Through accounting information, customers could also check if prices that are being charged are reasonable. Students could look into the financial statements of a school and determine if they are being charged the right tuition fees.

- Lenders – Lenders have similar needs as suppliers wherein they interested in accounting information that enable them to determine the ability of a client to pay their obligations and the interest attached when the loan becomes due. However, in contrast to suppliers, lenders are providers of money (like banks or lending institutions) while suppliers are providers of tangible goods.

- Investors and Businessmen – Investors need accounting information in order to make relevant decisions. Through accounting information, they could determine whether to purchase stocks, sell stocks or hold the stock. Businessmen could determine which operations to continue or discontinue, which product line is profitable, and many more. They need to know about the financial performance, position, and cash flows of a business.

- Public – All of us need accounting information. We want to know the status of the economy, we want to know what is happening with our favorite fast food chains, we want to know the status of retirement plants, families need to budget their money, monitor receipts and disbursements, and many more.

ELEMENTS OF FINANCIAL STATEMENTS

The elements of financial statements are the general groupings of line items contained within the statements. These groupings will vary, depending on the structure of the business. Thus, the elements of the financial statements of a for-profit business vary somewhat from those incorporated into a nonprofit business (which has no equity accounts).

Examples of the Elements of Financial Statements

The main elements of financial statements are as follows:

- Assets. These are items of economic benefit that are expected to yield benefits in future periods. Examples are accounts receivable, inventory, and fixed assets.

- Liabilities. These are legally binding obligations payable to another entity or individual. Examples are accounts payable, taxes payable, and wages payable.

- Equity. This is the amount invested in a business by its owners, plus any remaining retained earnings.

- Revenue. This is an increase in assets or decrease in liabilities caused by the provision of services or products to customers. It is a quantification of the gross activity generated by a business. Examples are product sales and service sales.

- Expenses. This is the reduction in value of an asset as it is used to generate revenue. Examples are interest expense, compensation expense, and utilities expense.

Of these elements, assets, liabilities, and equity are included in the balance sheet. Revenues and expenses are included in the income statement. Changes in these elements are noted in the statement of cash flows.

SAMPLE WORK

Complete copy of CS Principles of Accounting and Taxation Study Notes is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com

REGULATION AND OTHER PRINCIPLES GUIDING THE ACCOUNTING PROFESSION

INSTITUTE OF CERTIFIED PUBLIC ACCOUNTANT (ICPAK)

The Institute of Certified Public Accountants of Kenya (ICPAK) was established in 1978. The Institute is a member of the Pan-African Federation of Accountants (PAFA) and the International Federation of Accountants (IFAC), the global umbrella body for the accountancy profession. The Vision of the Institute is ‘A world class professional accountancy institute‘, while the Mission is ‘To develop and promote internationally recognised accountancy profession that upholds public interest through effective regulation, research and innovation’.

The Institute is guided by the following core values: Credibility, Professionalism and Accountability. The Institute draws its mandate from the Accountants Act (no 15 of 2008).

Its mandate includes:

The Accountants Act No 15, 2008 prescribes the following as the functions of the Institute:

- To promote standards of professional competence and practice amongst members of the Institute

- To promote research into the subject of accountancy and finance and related matters, and the publication of books, periodicals, journals and articles in connection therewith;

- To promote the international recognition of the Institute.

- To advise the Examination Board on matters relating to examinations standards and policies;

- To advise the Minister on matters relating to financial accountability in all sectors of the economy;

- To carry out any other functions prescribed for it under any of the other provisions of this Act or any other written law and

- To do anything incidental or conducive to the performance of any of the preceding functions.

TOPIC 5

INTRODUCTION TO TAXATION

DEFINITION OF TAX, TAXATION AND TYPES OF TAXES IN KENYA

Dr. Dalton defines tax as a compulsory contribution levied on persons of a state for a common purpose. While Prof. Sallingman, says tax is a compulsory contribution from a person to the government to meet the expenses incurred in the common interest of all without reference to special benefits conferred.

Tax can therefore be comprehensively defined as:

Compulsory/involuntary payment by a tax payer without directly obtaining goods or services (as a “quid pro quo”) in return

In other words, there are no direct goods or services given to a tax payer i.e. no direct benefit in return for the tax paid. The tax payer can, however enjoy goods or services provided by the government like any other citizen without any preference or discrimination

Characteristics of Tax

- It is a compulsory contribution from the people to the government hence anyone who refuses to pay tax is punished.

- It’s a payment of the people to the government to finance its functions for the benefit of all

- It’s not paid for a specific service rendered by the government to the person paying the tax. This means that the person can’t ask the government to provide a service to him for the tax he has paid. And one cannot refuse to pay tax because he does not require the services of the government.

Taxation is the part of public finance that deals with the means and/or a system of raising money to finance government by way of Taxes among other sources. All governments require payment of money – taxes – from people.

Governments use tax revenues to provide goods and services to the public (its Citizens) i.e. pay soldiers & police, build dams & roads, operate schools & hospitals, provided food for the poor & medical care to the elderly, and for hundreds of other purposes. Without taxes to funds its activities, government could not exist.

Generally, Taxation is part of a boarder discussion on public finance while Public Finance is the section of economic theory that deals with public expenditure and revenue.

Whereas Public Revenue is the cash inflow of the government from various sources, which include: –

- Taxes

- Fees levied on services provided by the government i.e. Motor Vehicle registration fees, Import licensing fees etc.

- Fines charged on law brokers

- State property fees i.e. Entrance fees for Game Reserves

- Public debts i.e. Treasury Bills

- Disposal of public investments i.e. Sale of government shareholding in parastatals

- Donor Aid i.e. IMF, World Bank

- Grants

Public expenditure on the other hand is the allocation of public revenue to the various functions of the government like recurrent expenditure which is day to day operations of the government i.e. salaries and wages of civil servants. Capital expenditure, which includes investment, projects of the government i.e. Building Schools, Roads and Hospitals.

Functions of the Government

Governments world over are expected to carry out certain activities as part of their services to the public. These are divided into four major functions, namely: –

- Administration: The government oversees the administration of the country by for instance in the Kenyan scenario, creation of provinces; Districts; Divisions; Locations and Sub-Location.

- Protection: A good government must ensure the security of its people from external aggression and internal security must be provided. This is done through The Armed Forces and The Police.

- Social functions: The government provides social facilities like Housing, Education and Health care among others

- Development functions: It is the duty of the government to develop and maintain transport and communication network, agricultural systems and the economic infrastructure in general.

Principally, the role of governments is to enable us to appreciate the importance of government sector and therefore towards this end in trying to fulfill the above functions modern governments generally undertake the following: –

- Security (external & internal) involving military, police & other protective services.

- Justice or settlement of disputes

- The regulation & control of economy including coinage, weights and measures, the business practices, operation of public sector undertakings

- Social and cultural welfare through education, social relief, social insurance, health and other activities.

- Conservation of natural resources.

- Promotion of the unity of the state by control of transportation and communication.

- Administration and financial system, government revenue expenditure and fiscal control.

- Education and employment.

- Public health.

- Uplifting of weaker sections of the society.

- Restoration of social justice in the society.

To perform the above functions effectively and adequately, the government needs funds

MASOMO MSINGI PUBLISHERS APP – Click to download and access complete materials in PDF

TYPES OF TAXES IN KENYA

Income Taxes

Income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. By law, businesses and individuals must file an income tax return every year to determine whether they owe any taxes or are eligible for a tax refund. Income tax is a key source of funds that the government uses to fund its activities and serve the public.

They include among others: Corporation taxes for companies, PAYE for individuals, Capital gains tax, Advance tax, Presumptive tax, Fringe benefit tax, Withholding tax.

Consumption Taxes

A consumption tax, sometimes referred to as a “spendings tax,” is a tax levied on consumption spending on goods and services. The tax base of such a tax is the money spent on consumption. It closely resembles the income tax except that the tax base is spending, not income. The important difference is that the tax base is expenditure rather than income.

They include among others: Value Added Tax, excise duty, Withholding tax

Customs Duties

Customs Duty is a tax imposed on imports & exports. The rates of customs duties are either specific or on ad valorem basis, that is, it is based on the value of goods traded.

Other Taxes, Fees & Levies

These include:

- Entertainment tax

- Petroleum Development Fund

- Import Declaration & Fund (IDF)

- Foreign Motor Vehicle Inspection Fee

- Road Maintenance Levy

- Road Transit Toll Levy

- Aviation Revenue

- Revenue Stamps

- Kenya Bureau of Standards (KEBS) Levy

HISTORY OF TAXATION

World History

Benjamin Franklin (January 17, 1706 to April 17, 1790), a polymath, inventor, scientist, printer, politician, freemason and diplomat best known as one of the Founding Fathers who drafted the Declaration of Independence and the Constitution of the United States once said, “In this world, nothing can be said to be certain, except death and taxes.” Emphasizing on the inevitability of both

Contrary to this popular believe in recent times, taxes haven’t been around forever. Sure, there were taxes in ancient Greek, ancient Egypt, and ancient Roman governments in times of war levied taxes on their citizens to pay for military expenses and other public services. Taxation evolved significantly as empires expanded and civilizations become more structured. But the idea of sales taxes, income taxes, payroll taxes, and other types of taxes is mostly a modern invention.

“The earliest known tax records, dating from approximately six thousand years B.C., are in the form of clay tablets found in the ancient city-state of Lagash in modern day Iraq,” according to a publication on the Association of Municipal Assessors of New Jersey (AMANJ) website. This early form of taxation was kept to a minimum, except during periods of conflict or hardship.

What does the Bible say about paying taxes?

In Matthew 22:17–21, the Pharisees asked Jesus a question: “‘Tell us then, what is your opinion? Is it right to pay taxes to Caesar or not?’ But Jesus, knowing their evil intent, said, ‘You hypocrites, why are you trying to trap me? Show me the coin used for paying the tax.’ They brought Him a denarius, and He asked them, ‘Whose portrait is this? And whose inscription?’ ‘Caesar’s,’ they replied. Then He said to them, ‘Give to Caesar what is Caesar’s, and to God what is God’s.'” In full agreement, the apostle Paul taught, “This is also why you pay taxes, for the authorities are God’s servants, who give their full time to governing. Give everyone what you owe him: If you owe taxes, pay taxes; if revenue, then revenue; if respect, then respect; if honor, then honor” (Romans 13:6–7).

MASOMO MSINGI PUBLISHERS APP – Click to download and access complete materials in PDF

Taxation History in Kenya

Initial Stage: Portuguese

This can be traced back to the Portuguese who arrived at the Kenyan coast and took over from the Arabs and signed the first recorded treaty that involved a form of taxation in in 1502. The then Sultan Ibrahim of Malindi was held against his wishes and forced to accept defeat. While being held hostage during negotiations on Vasco da Gamma’s boat, a treaty of surrender was signed with Portugal for an annual tribute of 1,500 meticals of gold.

By the end of the rule of the Arabs and Portuguese along the East coast of Africa the existing balance of taxation that was inherited by the British included a capitation tax payable per head of slave exported and customs revenue shared equally between the Arabs and Portuguese. The tax base was, however, limited to traders only.

Second Stage: British

The British who ruled what is presently Kenya and Uganda together to form British East Africa Protectorate colonial tax policy supported its own economy. This was done initially through the Chartered company concept. However, later in order to encourage rule from within the territory to make it viable after the accidental discovery of arable land in Kenya. They introduced the following taxes:

- Hut and Poll Tax in 1901, (fee payable by all locals per hut through labor, money, and grain or stock.),

- Land tax 1908,

- Income tax 1921,

- Graduated personal tax 1933

Third Stage: Post independence

Soon after independence Kenya had income tax, corporation tax, trade taxes and excise taxes. Value-added taxes were introduced later. During the first decade and a half of independence, the government mainly dealt with taxation as there was a desperate need.

Fourth Stage: Currently

The new Constitution which was approved by 67% of Kenyan voters was presented to the Attorney General of Kenya on 7th April 2010, officially published on 6th May 2010,

SAMPLE WORK

Complete copy of CS Principles of Accounting and Taxation Study Notes is available in SOFT copy (Reading using our MASOMO MSINGI PUBLISHERS APP) and in HARD copy

Phone: 0728 776 317

Email: info@masomomsingi.com