COST ACCOUNTING SYSTEMS

The Principle of Double Entry

In some businesses, the cost accounts may consist of little more than statistical memoranda, but in a business of any size or complexity, it is preferable for the cost accounts to be kept on a double entry basis, as this will provide more detailed information and a check on the arithmetical accuracy of the entries.

While double entry cost accounts are generally to be preferred, you must remember that the system has to suit the business and not the reverse. An elaborate system should not be introduced merely for the sake of theory; the purpose of cost accounting is to provide management with information.

We shall assume that you are familiar with the elements of double entry book-keeping, and the arguments which show the necessity of keeping the financial accounts on a proper double entry basis. The same arguments apply to the cost accounts. As in financial accounts, the golden rule applies – “for every credit there is a debit” – and if you keep to this you will not go far wrong.

Main Classification

Accounting systems which are used for costs may be classified as follows:

Interlocking Systems

In these systems two separate ledgers are kept, one for costing figures (the cost ledger) and one for financial figures (the financial ledger). Most figures in the cost ledger will have been extracted from the financial ledger. For example, materials entering the store, which will be recorded in the cost ledger, will already appear in the purchases account in the financial ledger. This is why the systems are described as “interlocking”. Since both ledgers describe the transactions of the business during the same period, they must be capable of reconciliation.

Integrated or Integral Systems

In these systems one ledger is kept, in which both the financial and cost data are recorded.

INTEGRATED OR INTEGRAL SYSTEMS

Description

Integrated accounts are a set of accounting records which provide financial and cost accounts using a common input of data for all accounting purposes.

An integrated accounting system avoids the need to open a cost ledger control account and to reconcile the cost and financial accounts.

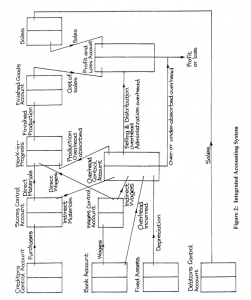

Figure 2 shows the accounting flow within an integrated system. If you compare this flowchart with Figure 1 you will see that they are very similar. In the integrated system the debtors, creditors, bank and fixed assets accounts have replaced the cost ledger control account.

In the interlocking system these accounts were, of course, part of the financial ledger, and the cost ledger control account was the means of interlocking the two ledgers, transferring items from the financial to the cost ledger. The integrated system is more straightforward as this intermediate step is eliminated.

If you now compare the integrated system with what you learned about the financial ledger in your Accounting Framework course, you will notice that the integrated system has dispensed with the purchases account. The figure of purchases is derived from the creditors control account and posted straight to the stores control account.

Advantages of Integrated Accounting Systems

Provided that integrated accounting can be fitted conveniently into the organisation, there are five distinct advantages:

- Savings in accounting costs can be made.

- There is no need for reconciliation of cost and financial accounts.

- Better use can be made of accounting information, since all the facts are known. Together with this is the better co-operation which should ensue from the cost and financial accounting staff also being “integrated”.

- Single data capture greatly simplifies automated linkages between the process control systems, accounting systems and the overall management information systems.

- When introducing computerised systems, it is not sensible to use two separate ledgers, with all the attendant control problems. Computer systems are best at handling large volumes of data and exercising overall control, but problems often arise when control level interfaces are necessary such as when two or more ledgers are maintained. To overcome these problems the purchase and sales ledger areas of a computerised accounting system are usually kept apart from the nominal ledger and are physically defined as separate modules by the software supplier

If the accounts are not computerised, the work has to be sub-divided and, historically, this was why separate ledgers evolved for the cost and financial accounts.