SECTION A (32 marks)

Answer ALL the questions in this section.

1. Slate three uses of cost of capital in business management. (3 marks)

2. Outline three uses of financial ratios to the management of any business organization. (3 marks)

3. Highlight three advantages of investment appraisal to a business. (3 marks)

4. State three types of costs associated with holding stock in a business. (3 marks)

5. Nyungu Limited intends to invest Ksh. 6,000,000 in a project. The present values of the expected cash inflows for a period of 4 years are as follows:

Year Present Values

1 818,200

2 2,066,000

3 2,253,900

4 1,862,700

Advise the management whether to undertake the project or not. using the Net Present Value approach. (4 marks)

6. Karim deposited Ksh. 100,000 in a bank account for a period of 4 years at a compound interest rate of 8% per annum. Determine the amount in his account at the end of the 4 years. (4 marks)

7. Outline three functions of financial intermediaries in an economy. (3 marks)

8. State three external sources of finance to a business organisation. (3 marks)

9. Outline three assumptions of the Economic Order Quantity (EOQ) model. (3 marks)

10. Highlight three differences between preference shares and ordinary shares, as sources of business finance.

SECTION B (68 marks)

Answer ALL the questions in this section.

Explain four features of venture capital. (8 marks)

Outline six factors which may determine working capital requirements of a firm. (9 marks)

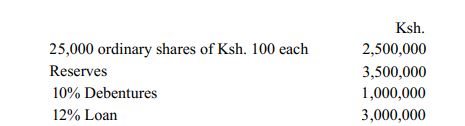

The following is the capital structure of Lambak Limited as at 31 December 2015. 25,000 ordinary shares of Ksh. 100 each Reserves

The market price of each ordinary share was Ksh. 125 while dividend paid per share was Ksh 5.00. The corporation tax was 30%.

Calculate the Weighted Average Cost of Capital. (9 marks)

Explain four functions of merchant banks. (8 marks)

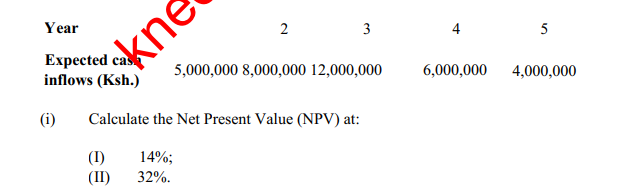

Magnet Ventures has borrowed Ksh. 20,000,000 from a bank at an interest rate of 14% per annum, which it intends to invest in a project. The following are the expected cash inflows from the project.

(ii) Using the results in (i) above, determine the Internal Rate of Return (IRR) of the project.

(iii) Advise the management on whether to invest in the project or not. (9 marks

(b) The following information relates to Material B28 used by Mamba Limited.

Normal usage 100 units per week

Maximum usage 50 units per week

Minimum usage 50 units per week

Reorder Quantity (EOQ) 500 units

Lead time 5-7 weeks

Calculate each of the following:

(i) Re-order level;

(ii) Minimum stock level;

(iii) Maximum stock level;

(iv) Average stock level. (8 marks)

14. (a) Explain the use of each of the following ratios in making business decisions:

(i) Return on capital employed;

(ii) Net assets turnover;

(iii) Current ratio;

(iv) Gearing ratio.

(8 marks)

(b) Mumo is planning to invest in a machine in 6 year’s time. The machine is expected to cost Ksh. 12,000,000. He intends to make the following deposits at the beginning of each year.

Year Amount (Ksh.)

1 500,000

2 1,000,000

3 2,000,000

4 2,500,000

5 1.000,000

The bank pays interest on deposits at the rate of 8% per annum.

Determine the amount he needs to deposit at the beginning of the sixth year to enable him buy the machine.