SECTION A (32 marks)

Answer ALL the questions in this section.

1. Highlight two disadvantages of using retained earnings as a source of finance to a company. (2 marks)

2. Highlight three reasons why it may be necessary for the Central Bank of Kenya to control money supply in the economy. (3 marks)

3. The annual demand of a material is 10,000 units. The cost per unit of the material is Ksh 20.

The ordering costs are Ksh. 1,600 per order. The carrying cost per unit is Ksh 2 per annum.

Calculate the Economic Order Quantity. (3 marks)

4. Bakari intends to buy a motor vehicle in two years’ time, which will cost Ksh. 605,000. The compound interest rate is 10% per annum.

Determine the money to be saved at the beginning of the period. (3 marks)

5. List four cost components of the weighted average cost of capital. (4 marks)

6. Outline two types of ratios which may be used to evaluate the liquidity position of a business. (4 marks)

7. A project requires an initial cash outlay of Ksh. 500,000. The expected inflows for 5 years are:

Ksh. 100,000, Ksh. 160,000, Ksh. 200,000, Ksh. 240,000 and Ksh. 300,000. Determine the payback period. (4 marks)

8. Outline the importance of business finance to an organisation. (2 marks)

9. In the recent past, the number of financial institutions which have collapsed in country Q has increased. Advise the governor of the central bank of county Q on two measures which may be taken to avert the trend. (4 marks)

10. Outline three advantages of preference shares, as a source of finance to a company. (3 marks)

SECTION B (68 marks)

Answer ALL the questions in this section.

11. (a) Explain four disadvantages of using working capital cycle in ascertaining a company’s liquidity position. (8 marks)

(b) Mega Limited intends to invest in a project. The following are the expected cash flows of the project:

Year Outflows (Ksh) Inflows (Ksh)

0 1,700,000

1 550,000 350,000

2 600,000

3 840,000

4 790,000

5 920,000

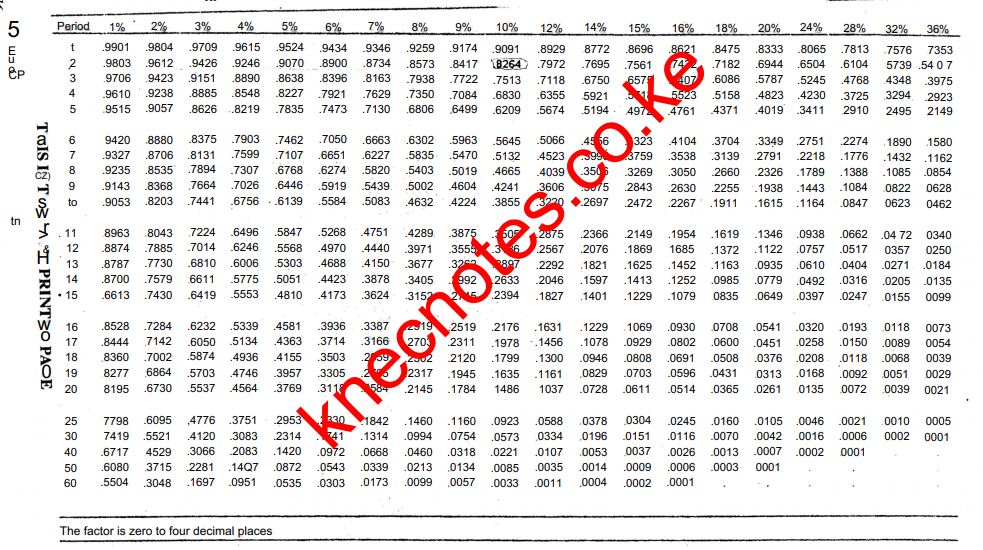

The cost of the capital is 12% per annum.

(i) Determine the present value of the project.

(ii) Using the profitability index method, advise the management on whether to invest in the project or not. (9 marks)

12. (a) Explain four methods which may be used by the Central Bank of Kenya to control the supply of money in the economy. (8 marks)

(b) Beka Limited had the following capital structure as at 31 December 2015:

Ksh

3,300,000

550,000

1,100,000

550,000

5,500,000

The company’ paid dividends on ordinary‘ shares at the rate of Ksh. 1.50 per share. The ordinary shares, preference shares and debentures are currently selling at Ksh. 40,

Ksh. 15 and Ksh. 100, respectively. The tax rate is 30%.

Calculate:

165,000 ordinary shares of Ksh. 20 each

55, 000 10% preference shares of Ksh. 10 each

10% long-term loan

12% debentures of Ksh. 100 each

Capital employed

(i) the cost of each component of capital;

(ii) the weighted average cost of capital. (9 marks)

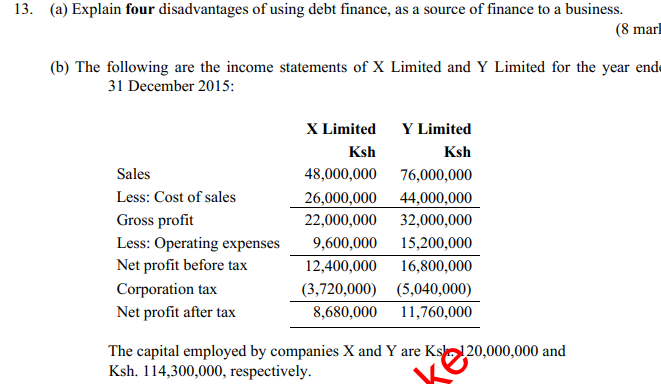

(i) For each of the companies, calculate the following ratios:

(I) Net profit margin;

(II) Operating ratio; . .

(III) Return on capital employed;

(IV) Gross profit margin.

(n) Using the results in (l) above, determine the company that has a better control of operational costs. (9 marks)

14. (a) Explain four functions performed by commercial banks as agents of the customers. (8 marks)

(b) Explain six factors which may influence the credit policy of a firm.