SECTION A (32 marks)

Answer ALL questions in this section.

1. List four methods that the Central Bank of Kenya may use to lower the cost of credit in the economy. (4 marks)

2. Outline the importance of business finance to an organization. (3 marks)

3. Highlight three benefits of the use of credit cards as a source of finance. (3 marks)

4. Pemba Limited has 100,000 ordinary shares of Ksh 10 each. The company earned a profit of Ksh 100,000 and paid out the whole a mount as dividends to the ordinary shareholders in a certain year. The current market price of an ordinary share is Ksh 15. Calculate the

cost of equity. (3 marks)

5. List three motives of holding cash in an organisation. (3 marks)

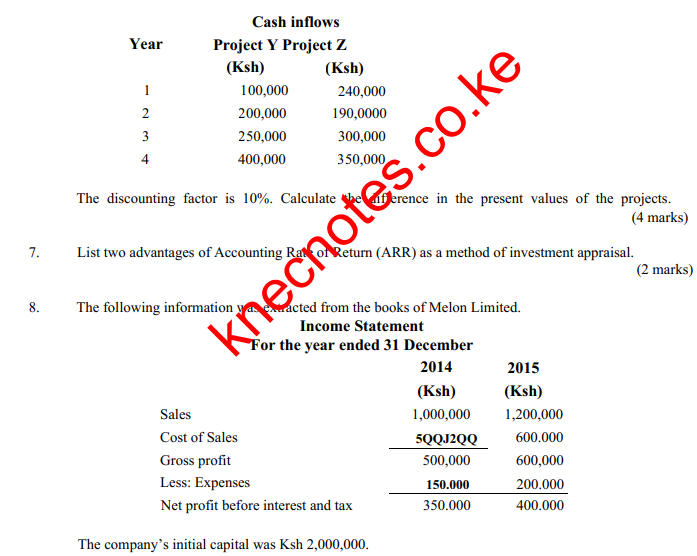

6. The following are the expected cash inflows of two projects, Y and Z

Calculate the return on capital employed for each year.

9. Outline four differences between debt financing and equity financing.

10. State three services rendered by finance houses.

SECTION B (68 marks)

Answer ALL questions in this section.

11. (a) Explain four advantages of using equity shares as a source of business finance. (8 marks)

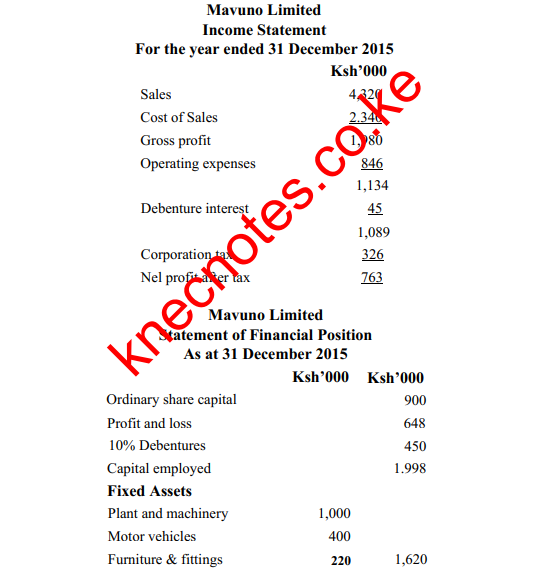

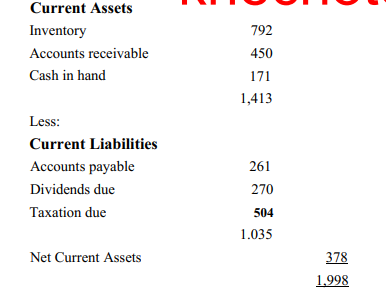

(b) The following is the summarised financial statements of Mavuno Limited for the year ended 31 December, 2015:

Calculate each of the following ratios:

I. Current ratio;

II. Stock turnover ratio;

III. Gross profit margin; –

IV. Average debt collection period.

Based on the value of current ratio ascertained in (i)I above, comment on the liquidity position of the firm. (I mark)

12. (a) Paradise Limited had the following capital structure as at 31 December 2014: 39,000 Ordinary shares of Ksh 25 each

975,000

8.5% Preference share capital 450,000

Retained earnings 285,000

12% Debentures 280,000

The market value of each ordinary share was sh.30. The company expects to pay dividends of Ksh 1.50 per share on ordinary shares in the year 2014.

The corporation tax rate is 30%.

Calculate the:

(i) cost of each component of capital;

(ii) Weighted Average Cost of Capital (WACC).Explain the meaning of each of the following terms as used in inventory management:

(i) Re-order level;

(ii) Periodic review;

(iii) Hybrid;

(iv) Economic order quantity. (8 marks)

Explain four factors that should be taken into account when selecting a source of business finance. (8 marks)

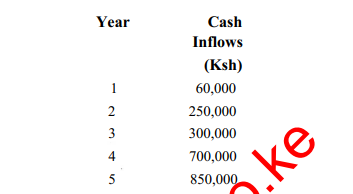

Manyasi Limited intends to invest Ksh 1,000,000 in a project. The money was borrowed from Express Bank at an interest rate of 16% per annum.

The following are the expected cash inflows from the project.

(i) Calculate the profitability index (PI) of the project.

(ii) Using the results of (i) above, advise the management whether to invest in the project or not. (9 marks)

Outline six challenges faced by commercial banks in their effort to provide credit to their customers. (9 marks)

Individuals prefer a shilling today compared to a shilling in future. Explain four reasons for the preference