UNIVERSITY EXAMINATIONS: 2013/2014

ORDINARY EXAMINATION FOR THE BACHELOR OF SCIENCE

IN INFORMATION TECHNOLOGY

BIT 1309 FINANCIAL MANAGEMENT FOR IT

DATE: APRIL, 2014 TIME: 2 HOURS

INSTRUCTIONS: Answer Question ONE and any other TWO

QUESTION ONE

a) Describe any Six users of financial statements. Within your description, comment

on the needs of each user. (12 Marks)

b) Discuss the limitations of financial accounting (6 Marks)

c) i. Discuss main stages in the accounting cycle (4 Marks)

ii. How are the stages described above relate to input- processing- output

relationship of a system (4 Marks)

d) Differentiate between direct and indirect costs in the context of manufacturing

accounts (4 Marks)

QUESTION TWO

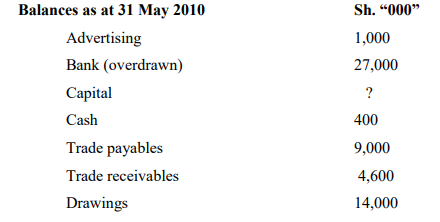

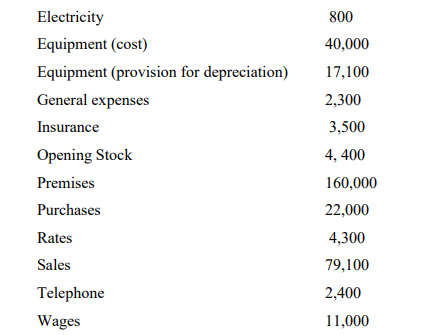

The following ledger balances were extracted from the books of the Rufus Hotel:

Required:

i) Prepare a Trial Balance as at 31 May 2010, disclosing the Capital balance (4 Marks)

and

ii) Statement of Financial performance for the year ended 31 May 2010 and the

Statement of Financial position as at that date, incorporating the following

adjustments: (16 Marks)

a) The closing stock at 31 May 2010 was Sh.3600,000

b) Provide for depreciation on equipment 20% per annum on a straight line basis

c) Insurance is prepaid by Sh.500,000

d) An electricity bill of Sh.200,000 is outstanding

QUESTION THREE

Assume you started a business on 1st

March 2013. Prepare the necessary accounts

balance them off and extract a trial balance from the following information.

March 1 Started firm with capital in cash of Shs.250,000.

“ 2 Bought goods on credit from the following persons: R Kamanzi

Shs.54,000; P Muiru Shs. 87,000; J Rufus Shs.25,000; D Wasilwa

Sh.76,000; Ian Matu Shs.64,000.

“4 Sold goods on credit to: C Wanje Shs.43,000; B Linda Shs.62,000 ; F

Karimi Shs.176,000.

“ 6 Paid rent by cash Shs.12,000.

“ 9 C Wanje paid us his account by cheque Shs33,000.

“ 10 F Karimi paid us Shs.150,000 by cheque.

“ 12 We paid the following by cheque: J Rufus Shs.25,000; R Kamanzi

Shs.54,000.

“ 15 Paid carriage by cash Shs.23,000.

“ 18 Bought goods on credit from P Muiru Shs.43,000; Wasilwa Kshs.110,000.

“ 21 Sold goods on credit to B Linda Shs.67,0000.

“ 31 Paid rent by cheque Shs.18,000.

QUESTION FOUR

a) Give the accounting definition of the term depreciation (2 Marks)

b) Using a suitable example in each case explain the factors that cause the assets to

depreciate (6 Marks)

c) The following information appeared in the balance sheet as Paradiso transporters

Ltd as at 31 December 2010

Motor vehicles Sh. “000”

Cost 13,500

Accumulated depreciation (5750)

NBV 7750

The following is information is relevant for the year 2011

1 Acquired a pick-up KBM at a cost of 15,000,000

2 Disposed off a bus KBA at 750,000. This bus was acquired in the year 2008 at cost

of 3m.

3 Traded in an old truck for a new one making an additional cash payment of 1.2m.

The old truck was acquired in 2008 at a cost 2.4 m and for trading purposes was

valued at 900,000.

4 As per the company’s policy motor-vehicles are depreciated at 15% straight line

basis full depreciation is given in the years of acquisition non in the year of disposal

Required

Prepare:

i. Motor-vehicle account (4 Marks)

ii. Provision for depreciation account (4 Marks)

iii. Motor-vehicle disposal account (4 Marks)

QUESTION FIVE

a) Discuss the significant differences between receipts and payments account and

income and expenditure account (8 Marks)

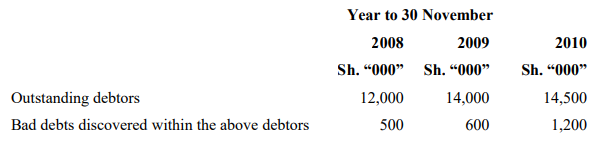

b) The Sellassie Hotel has been trading for a number of years. In November 2007, in

anticipation of a debt problem, a provision for doubtful debts of Sh.400,000 was

created. In subsequent years a provision of 4% of outstanding debtors is to be

made at the end of each year.

The following data applies:

Bad debts discovered within the above debtors 500 600 1,200

Required:

Calculate the provision for doubtful debts, (use net debtors) and

i. Show the income statement entries relating to bad and doubtful debts for the

years ended 30 November 2008, 2009 and 2010 (6 Marks)

ii. State the value of debtors to be shown in the statement of Financial position as at

30 November each year (6 Marks)