TUESDAY: 2 August 2022. Morning paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Examine three return characteristics that differentiate traditional investments from alternative investments. (6 marks)

2. Describe four types of alternative investments. (4 marks)

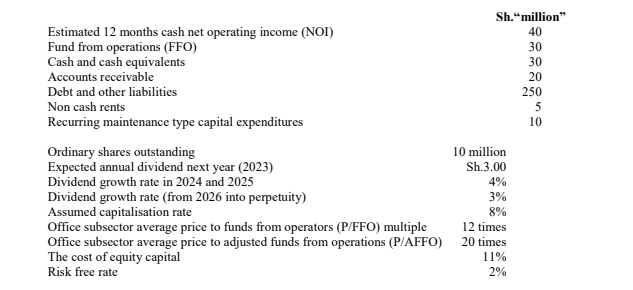

3. Perminus Riungu is using the following information to analyse a potential investment in an industrial building:

Selected real estate investment trust (REIT) financial information as at 30 June 2022 is provided below:

Required:

Calculate the value of Perminus Riungu’s potential investment using:

The net asset value (NAV) approach. (2 marks)

Price to funds from operations (FFO) approach. (3 marks)

Price to adjusted funds from operations (AFFO) approach. (2 marks)

Discounted cash flow approach. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four investment characteristics of real estate investment trusts (REITs). (4 marks)

2. The following information relates to a planned amortisation class (PAC) structure:

• Sh.100 million mortgage pool structure

• The weighted average coupon rate (WAC) is 8.125%

• The weighted average maturity (WAM) is 357 months.

• The pass through rate is 7.5%

• The seasoning factor is 3. This is the factor that accounts for the prepayment based on the season.

• The planned amortisation class public securities association (PSA) prepayment model speed is 90 : 90 PSA model.

Required:

The PAC cash flow for the first month. (8 marks)

3. A single tenant office building was leased six years ago at Sh.2,500,000 per year. The next rent review occurs in two years. The estimated rental value in two years based on current market conditions is Sh.3,200,0000 per year. The contract term rent is discounted at 7% and the incremental rent is discounted at 8%.

Required:

The value of the office building today using the layer method. (4 marks)

4. Faraja investors have invested in a mortgage with a Sh.10,000,000 principal balance outstanding. The scheduled monthly principal payment is Sh.28,610. The mortgage pool has a conditional prepayment rate (CPR) of 6% and the pool is seasonal.

Required:

The single monthly mortality (SMM) rate. (1 mark)

The estimated prepayment for the month using the information in 4 (i) above. (1 mark)

The single monthly mortality rate (SMM) in month 10, assuming 175% Public Securities Association (PSA). (2 marks)

(Total: 20 marks)

QUESTION THREE

1. Discuss three roles of financial markets in alternative investments. (6 marks)

2. A hedge fund has identified investment opportunities in the distressed debt-market due to the supply constraints after the global Covid-19 pandemic.

Required:

In relation to the above statement, evaluate four distressed debt investment strategies. (4 marks)

3. A leveraged buyout (LBO) transaction is valued at Sh.1,000 million and has the following characteristics:

1. Exit occurs in five years time at a projected multiple of 1.80 of the company’s initial cost.

2. It is financed with 60% debt and 40% equity.

3. The Sh.400 million equity investment is composed of:

• Sh.310 million in preference shares held by the private equity firm

• Sh.80 million in equity held by the private equity firm

• Sh.10 million in equity held by the management equity participation

4. The preference shares are guaranteed a 14% compound annual return payable at exit.

5. The equity of the private equity firm is promised 90% of the company’s residual value at exit after creditors and preference shares are paid.

6. Management equity receives the other 10% residual value.

7. By exit, the company will have paid off Sh.350 million of the initial Sh.600 million in debt using operating cash flow.

Required:

Calculate the following:

The payoff of the company’s claimants. (4 marks)

The internal rate of return for the equity claimants. (4 marks)

The payoff multiple for the equity claimants. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain three factors that could contribute to successful securitisation. (3 marks)

2. A venture capital firm, Metro Ltd. is considering a 5 year expansion plan. The firm will require Sh.30 million in the first round of financing and a second round of financing three years later worth Sh.20 million to finance the expansion required at the exit. The firm is expected to be worth Sh.500 million after 5 years. The founders of Metro Ltd. will hold 10 million ordinary shares.

You are further informed that the relevant discount rates are 40% for the first year and 30% for the last two years.

Required:

The price per share of Metro Ltd. at the time of second round of financing. (8 marks)

3. Consider a mortgage security with a base rate of 7.64% and an initial price of Sh.98,781. Its effective duration is based to a change in interest rates of 25 basis points.

Additional information:

1. Bond price when the yield declines Sh.99.949

2. Bond price when the yield increases Sh.97.542

Required:

The duration of the bond when the yield changes by 25 basis points. (2 marks)

4. The following information relates to a collateralised debt obligation (CDO):

1. The CDO is a Sh.200 million structures – the collateral will have an initial value of Sh.200 million.

2. The collateral consists of entirely of bonds with 15 years remaining until maturity and a coupon rate equal to the 15 year Treasury rate plus 350 basis points.

3. The senior tranche represents Sh.150 million (75% of the structures) and carries a floating – coupon rate equal to LIBOR plus 150 basis points.

4. There is one Sh.20 million mezzanine tranche, and it carries a fixed coupon equal to the Treasury rate at origination plus 175 basis points.

5. The manager of the trust has entered into an interest rate plus 125 basis points and receive LIBOR. The national amount for this swap is Sh.150 million.

6. The 15 year Treasury rate is 7.5% at the time of origination for this CDO.

Required:

The interest received by the CDO from the collateral. (1 mark)

The interest received by the CDO from the swap counterparty. (1 mark)

The total interest paid by the CDO to the senior and mezzanine tranches. (2 marks)

The total interest paid by the CDO to the swap counterparty. (1 mark)

The net cash flow to the equity tranche. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Assess three types of crowdfunding as a new form of alternative investment. (6 marks)

2. Describe three arbitrage-based strategies used by hedge funds. (6 marks)

3. Alex Mikoye is a portfolio manager for a commodity investment fund. He has observed that the recent global Covid-19 pandemic and the supply constraints has resulted in higher demand for commodities. He investigates trading opportunities in palm oil, a key ingredient in the production of cooking oil. The spot price is Sh.183,146 per tonne and the three month forward contract price is Sh.181,407 per tonne. He decides to implement a reverse cash and carry arbitrage to profit from the difference between the spot and forward market. He can borrow or lend cash at an interest rate of 5% and the lease rate for palm oil is 6%. These are continuously compounded interest rates. He believes that manufacturers will increase their inventories of palm oil in expectation of higher sale. This higher demand may increase the convenience yield in this market.

Required:

Describe two components of the synthetic commodity position in this arbitrage. (2 marks)

Calculate Alex Mikoye’s profit on a reverse cash and carry arbitrage in the palm oil market. (4 marks)

Explain how a higher convenience yield for palm oil would affect the no arbitrage price range for the forward price. (2 marks)

(Total: 20 marks)