MONDAY: 1 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Describe two characteristics of a bond that could determine the degree of reinvestment risk. (4 marks)

2. Analyse the key features of the following securities:

Floating rate notes. (2 marks)

Catastrophe bonds. (2 marks)

High yield securities. (2 marks)

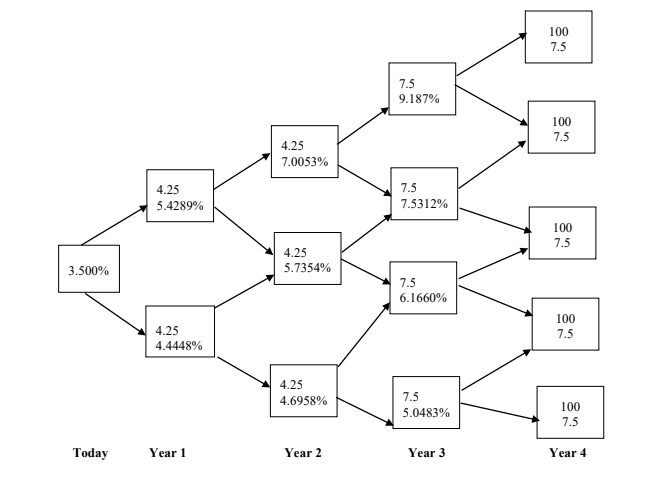

3. A four year step up callable note pays 4.25% for two years then 7.5% for two more years. This note is callable at par at the end of year 2 and year 3. The following binomial tree is available. The note has a par value of Sh.100.

Required:

Evaluate the value of step-up callable note. (8 marks)

4. A treasury bill auctioned 1 August 2021, is sold at a price of Sh.99.014167 per Sh.100 face value. At issue, the bill had 182 days to maturity.

Required:

Determine the bill’s rate on a discount basis. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four factors that could affect the repo rate. (4 marks)

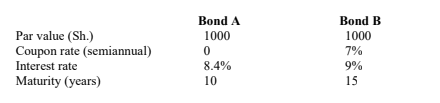

2. An investor is considering the following bonds:

Required:

The price of bond A and bond B. (4 marks)

If bond B’s coupon rate is 9%, determine the bond’s price and justify your answer. (3 marks)

3. Determine the yield for a 15 year zero coupon bond with maturity value of Sh.1,000 selling at the price of Sh.252.12. (2 marks)

4. A corporate bond with a coupon rate of 10% maturing 1 March 2027 is purchased with a settlement date of 17 July 2021. The next coupon payment will be made on 1 September 2021. The yield to maturity is 6.5%. The investors uses the 30/360 day count convention. Coupon is paid semiannually on 1 September and 1 March.

Required:

Calculate the bond’s clean price if the par value is Sh.100. (7 marks)

(Total: 20 marks)

QUESTION THREE

1. Differentiate between “Macaulay Duration” and “Modified Duration”. (4 marks)

Compare how modified duration and effective duration measure the sensitivity of the bond to changes in interest rates. (2 marks)

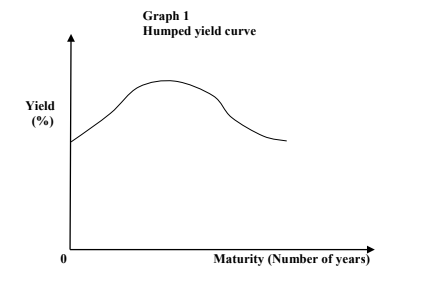

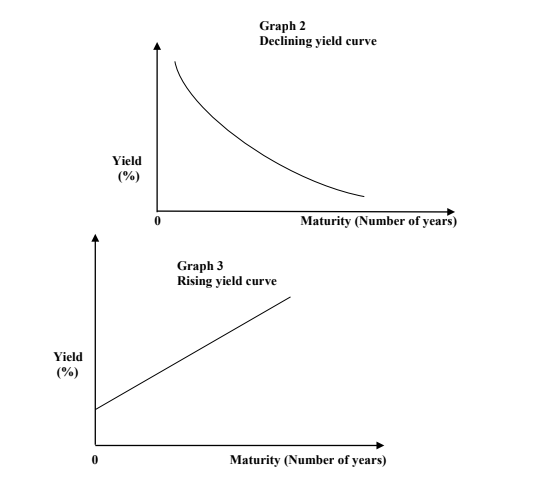

2. You have been provided with the following three yield curves graphs:

Required:

Explain each of these yield curves under the following hypotheses:

Liquidity premium. (3 marks)

Pure or unbiased expectations. (3 marks)

Market segmentation. (3 marks)

3. Explain the term “interest rate risk”. (1 mark)

Explain the roles of a bond’s coupon and maturity in determining the level of interest rate risk. (2 marks)

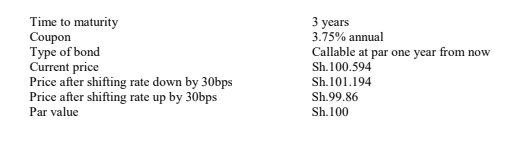

4. The following information is available on a certain bond:

Required:

The effective duration of the bond. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. Explain three reasons why the term maturity of bonds is of concern to investors. (3 marks)

2. Assess three factors affecting the value of convertible bonds. (6 marks)

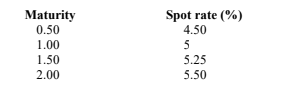

3. A 2 year Sh.1,000 par, 5% semiannual pay corporate bond has a zero volatility spread of 45%. The following spot rate curve is available:

Required:

The price of the bond. (3 marks)

4. Bond Y is a discount bond with a 6% coupon, a yield to maturity (YTM) of 9% and 15 years to maturity.

Required:

If interest rates remain unchanged, determine the price of this bond in 5 years, 10 years and 15 years. (3 marks)

Explain your answer in 4 (i) above. (1 mark)

5. A Treasury security is trading at Sh.965. The Treasury spot rates are as shown below:

The Treasury security is a 1.5 year, 4% coupon Treasury note.

Required:

The no-arbitrage price of the Treasury security. (2 marks)

Show how the investor should treat the arbitrage (if any). (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Examine six negative covenants found in a bond indenture. (6 marks)

2. Discuss three mechanisms of initial bond public offering in your country. (6 marks)

3. The price of a 1.5 year coupon Treasury security is Sh.99.45. The six month spot rate and the one year spot rate are 8.0% and 8.3% respectively. The Treasury security has a par value of Sh.100.

Required:

Calculate the 1.5 year spot rate. (3 marks)

4. An investor with a three year investment horizon is considering purchasing a 20 year, 8% coupon bond for Sh.828.40. The yield to maturity for this bond is 10%. The investor expects to reinvest the coupon interest payments at an annual interest rate of 6% and that at the end of the investment horizon, the 17 year bond will be selling to offer a yield to maturity of 7%.

Required:

The bond’s total return using an effective annual interest basis. (5 marks)

(Total: 20 marks)