TUESDAY: 2 August 2022. Afternoon paper. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

Do NOT write anything on this paper.

QUESTION ONE

1. Describe two costs associated with rebalancing a portfolio. (4 marks)

2. Discuss three factors that should be considered when setting the corridor for an asset class. (6 marks)

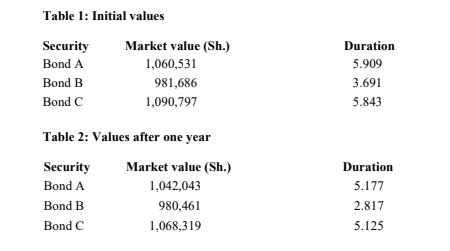

3. Peter Mwangangi is a financial analyst. He manages a portfolio consisting of three bonds with equal par value amounts of Sh.1,000,000 each. Table 1 shows the market value of the bonds and their durations (the price includes accrued interest).

Table 2 contains the market value of the bonds and their durations one year later.

Peter Mwangangi would like to maintain the portfolio’s shilling duration at the initial level by rebalancing the portfolio. He chose to rebalance using the existing security proportions of one third each.

Required:

The initial portfolio shilling duration. (3 marks)

The portfolio shilling duration after one year. (3 marks)

The rebalancing ratio necessary for the rebalancing. (2 marks)

The cash required for the rebalancing. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Examine five challenges faced when managing emerging markets currency exposures. (5 marks)

2. Outline four characteristics of a customised benchmark. (4 marks)

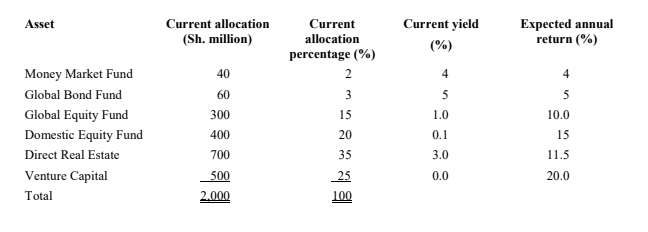

3. Hope University (HU) is a private domestic university with a Sh.2 billion endowment fund as of fiscal year ended 31 May 2022. The fund is heavily dependent on its endowment fund to support ongoing expenditures because the university’s enrolment growth and tuition revenue have not met expectations in recent years. The endowment fund must make a Sh.126 million annual contribution which is indexed to inflation to HU’s general operating budget. The domestic inflation is expected to rise by 2.5% annually and the higher education cost index is anticipated to rise by 3% annually. The endowment has also budgeted Sh.200 million due on 31 January 2023 representing a final payment for construction of a new main library.

The HU endowment fund asset allocation as at 31 May 2022 is shown below:

Required:

Investment policy statement (IPS) for Hope University endowment fund clearly covering the following elements; return, risk, time horizon and liquidity. (11 marks)

(Total: 20 marks)

QUESTION THREE

1. Agnes Kwamboka is a financial consultant at Puma Asset Managers. A client is meeting with her and Agnes asks the client to consider adding international investment to his portfolio. Agnes explains to the client her methodology for developing capital market expectations and determining a recommended asset allocation. In her approach to developing capital market expectations, Agnes utilises sample statistics from the most recent twenty years of market security and foreign exchange price data as estimates of asset class expected returns, expected volatilities of return and expected correlations of returns. Agnes recommends the possible allocation of investments to South African real estate because prices of real estate tend to lag returns from the stock market. With the South Africa stock market index registering positive returns recently, Agnes expects that the wealth gains from the equity market will

now be a positive factor for real estate prices.

Required:

Propose five specific limitations to Agnes Kwamboka’s approach to developing capital market expectations. (5 marks)

Identify one problem in using historical estimates of return correlations for alternative asset such as real estate. (1 mark)

Explain how the problem in (a) (ii) above biases the formulation of expectations for real estate investment. (2 marks)

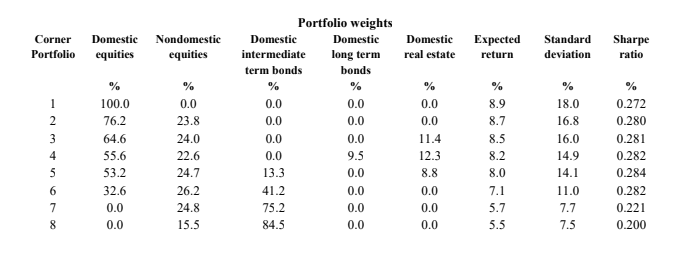

2. Neema Foundation is an organisation whose mission is to ensure credible elections in the country. The risk tolerance and return requirement for the foundation are provided below:

Risk tolerance: Above average (maximum 15% annual standard deviation of returns).

Return requirement: To earn an average annual return to meet a spending rate of 7.5% (including expected inflation) and management fee of 0.6%.

To help the directors of the Foundation assess the appropriate strategic asset allocation for their portfolio, a financial consultant has prepared the following data which describes eight corner portfolios and risk a free portfolio.

A risk free portfolio is available and is expected to return 4%. Neema Foundation regulations prohibits short positions or the use of margin but allows investment in any portfolio or combination of portfolios described above. In addition to satisfying the risk tolerance and return requirement, Neema Foundation Directors consider the Sharpe ratio to be a dominant factor in asset allocation decision.

A director of Neema Foundation is concerned how the strategic asset allocation would change if the return requirement for the foundation including expected inflation and management fee was only 6% and the endowments risk tolerance was consistent with a maximum 12% annual standard deviation of returns.

Required:

Using mean variance analysis:

Determine, with three reasons the portfolios to be combined in the optimal strategic asset allocation for the Foundation. (3 marks)

Determine the appropriate portfolio weights for the domestic equities and domestic intermediate term bonds in the optimal strategic asset allocation. (5 marks)

Determine with reference to the tangency portfolio, the portfolio to be combined in a new strategic asset allocation based on the information in the directors’ concern. (4 marks)

(Total: 20 marks)

QUESTION FOUR

1. In relation to active equity investing, explain the two major approaches in identifying equity investment styles. (4 marks)

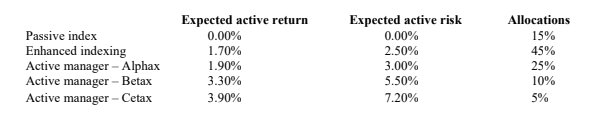

2. Twiga Investments is a large investment firm that utilises a core-satellite approach to allocate funds in its portfolio amongst equity managers. For each equity manager that has been allocated funds in the last 6 months up to 30 June 2022, the expected active return, expected active risk and allocations are as follows:

Required:

Determine Twiga Investments’ core and satellites. (2 marks)

The portfolio expected active return. (2 marks)

The portfolio active risk. (2 marks)

The information ratio. (2 marks)

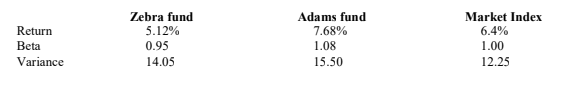

3. The following data have been collected to appraise the performance of two asset management firms:

The risk free rate of return is 4%.

Required:

Calculate the following risk adjusted performance measures and rank them from the highest performing fund to the lowest.

Treynor’s measurers. (2 marks)

Modigliani – Modigliani (M2) measure. (2 marks)

Sharpe’s measure. (2 marks)

Jensen’s alpha measure. . (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. In the context of investment performance standards, summarise four fundamental compliance requirements. (4 marks)

2. Assess four types of risk associated with distressed securities investments that a portfolio manager should take into consideration before including distressed securities in the portfolio. (4 marks)

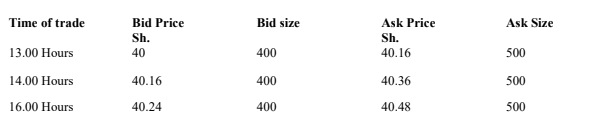

3. John Kirima, an investment analyst with Ndege Asset management firm has gathered the following sell orders that he executed on the afternoon hours on 26 July 2022. The quoted bid and ask quotes were as follows:

Additional Information:

1. At 13.00 hours, John Kirima placed an order to sell 200 shares. The execution price was Sh.40.04.

2. At 14.00 hours, John Kirima placed an order to sell 300 shares. The execution price was Sh.40.22.

3. At 16.00 hours, John Kirima placed an order to sell 500 shares. The average execution price was Sh.40.18.

Required:

The quoted spread at each time of trade. (2 marks)

The mid-point at each time of trade. (2 marks)

The effective spread at each time of trade. (2 marks)

Comment on any possible price improvement based in your answer in 3 (i) – (iii) above. (2 marks)

4. Determine four considerations that a bond portfolio manager should take into account before moving from a pure indexing position to more active management. (4 marks)

(Total: 20 marks)