THURSDAY: 2 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. The best execution rule requires that firms, when executing orders, take all reasonable steps to obtain the best possible result for their clients.

In the context of the above statement, highlight four factors that a market intermediary should consider in order to achieve the best execution for their clients. (4 marks)

2. A portfolio manager concerned with trade execution decisions decides to use the volume weighted average price (VWAP) as his benchmark.

He receives the following information from his broker on a series of trade for Sigma Limited’s shares:

- 10 million shares at Sh.5 per share.

- 7 million shares at Sh.5.50 per share.

- 4 million shares at Sh.6 per share.

Sell order for the company’s shares was executed at Sh.5.60 per share.

Required:

The volume weighted average price for Sigma Limited shares. (3 marks)

Determine whether the manager outperformed the benchmark. (2 marks)

3. Ryan Benson has started a foundation to support green energy causes in his country and intends the foundation to make contribution to these causes in perpetuity. The foundation will be a tax-exempt entity. Benson made an initial gift to the foundation of Sh.200 million on 1 January of year 1. In addition, Benson intends to make ongoing annual contributions to the foundation of Sh.3 million on 1 January of each subsequent year. The foundation will make a one-time distribution of Sh.7 million at the beginning of year 1 to fund projects deserving” immediate attention.

Beginning of year 2, the foundation will have an annual spending requirement of 4% of the market value of its portfolio at the end of the preceding year. The annual contributions from the foundation will be used to cover a portion of the operating expenses. The expected inflation rate is 6.5% per year.

The foundation goal is to preserve the real value of its investment portfolio and any future contributions while also meeting its spending requirements. A consultant hired to be the foundation advisor will be paid a management fee of 0.30% per year and the fee is calculated based on the year end value of the portfolio and paid in arrears on the first day of the following year.

The consultant is tasked with preparation of an investment policy statement (IPS) for the foundation and the consultant concludes that the foundation has an above average risk tolerance.

In the first year of the foundation’s operations, the return on the benchmark was 10.8% and the return on the foundations portfolio was 10.0%. The foundation received the planned Sh.3 million contribution on 1 January of year 2.

Three years have lapsed and Benson is not able to make additional contributions to the foundations and the IPS has been revised to reflect the foundation’s changed circumstances.

Required:

Identify three factors that supports the above average risk tolerance of the foundation. (3 marks)

Determine the nominal required rate of return for the foundation in year 2. (2 marks)

Calculate the liquidity requirement of the foundation in year 2. (4 marks)

Explain the effect of the foundation’s changed circumstances on the foundation’s return objective and liquidity requirement. (2 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain the following value and growth substyles in actively managed equity portfolios:

Contrarian. (2 marks)

High yield. (2 marks)

Consistent growth. (2 marks)

Earnings momentum. (2 marks)

2. Wema employees’ pension plan (WEPP) is the pension fund of a composite company. WEPP is fully funded with Sh.800 million in assets and has the following investment policy objectives:

- Earn a 10.3% annual portfolio return.

- Have a maximum Roy’s safety first ratio with a minimum return threshold of 8%.

- Maintain a cash balance sufficient to meet liquidity requirements.

- Maintain a maximum of 10% of assets in a passively managed sub portfolio that is indexed to the stock market index (SMI).

Additional information:

- WEPP expects to pay Sh.32 million in pension benefits this year.

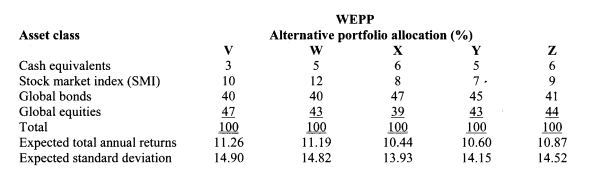

- At an investment committee meeting regarding possible changes to WEPP’s strategic asset allocation policy, the investment committee reviewed five alternative portfolio allocations that met WEPP’s return objectives. These alternatives are shown below:

Required:

Citing four reasons, determine the most appropriate portfolio for WEPP. (8 marks)

3. Examine four roles of equity indices in relation to passive equity investing. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Explain four factors that could influence the return on a fixed income portfolio. (4 marks)

2. A fixed income portfolio manager was hired to manage an investment portfolio for Kimbo Ltd. The investment portfolio has a total market value of Sh.400 million and a modified duration of 7.2. Kimbo Ltd.’s liabilities amount to Sh. 180 million and has a modified duration of 6.

Required:

Calculate the effect on Kimbo Ltd’s assets and liabilities assuming interest rates decline by 100 basis points. (4 marks)

3. Capricon Investment Advisors manages indexed bond portfolios that are constructed using two different methods. The Investment Advisors have stated that the source of tracking error is different for each method.

Required:

Discuss how an indexed portfolio is constructed under stratified sampling method and optimisation method. (4 marks)

4. Explain the meaning of the term “active return” with respect to equity portfolio management. (2 marks)

5. Solomon Naitu is a portfolio manager of Wise Investment Fund. In the year 2020, he managed a portfolio of five

stocks namely; A, B, C, D and E. The following table shows the portfolio weights and actual returns:

Stock Portfolio weight (%) Portfolio return (%)

A 20 15

B 25 10

C 15 —8

D 25 — 2

E 15 4

Required:

Assuming that the stocks are equally weighted in the benchmark, calculate the active return. (3 marks)

Assuming that the active return in the previous 6 years was 2%, — 1%, 0.5%, 0.75%, — 3% and 0.6%, calculate the active risk and information ratio. (3 marks)

(Total: 20 marks)

QUESTION FOUR

1. Describe four factors to consider when selecting active managers of alternative investment scheme. (4 marks)

2. The following information relates to the performance of three portfolios namely; X, Y and Z during the year ended 31 December 2020:

Portfolio Average return Standard deviation Co-variance of portfolio

(%) (%) returns with market returns

X 16.5 29 0.0081

Y 13.7 31 0.0799

Z 9.6 27 0.0026

Additional information:

- During the year ended 31 December 2020, the market return and the risk free rate of return averaged 12% and 5% respectively.

- The standard deviation on the market return is 10%.

Required:

Evaluate the performance of the three portfolios using:

Sharpe’s performance measure. (3 marks)

Treynor’s performance measure. (3 marks)

3. A portfolio manager has Sh.500 million worth of portfolio with Sh.300 million comprising of equities and the rest in cash and cash equivalents. The constant mix (CM) and Buy and Hold (BH) portfolio rebalancing strategies at inception both allocate Sh.300 million to equities and the constant proportion portfolio insurance (CPPI) strategy has the floor value set at Sh.250 million with a multiple of 1.2 to equities.

Required:

1. Assuming that the first period, equity value decreases to Sh.250 million, compute the portfolio composition values after rebalancing with each of the three rebalancing strategies stated above. (3 marks)

2. Assuming that in the second period equity values decline further by 10%, compute the portfolio composition percentages under each of the three rebalancing strategies mentioned in the question. (3 marks)

3. Assuming that instead, equity composition increases by 20% in the second period as opposed to the decline in 2 above, compute the portfolio composition percentages under each of the portfolio rebalancing strategies mentioned. (3 marks)

4.Comment on the observation of the performance of the three rebalancing strategies based on your answer in part 1 above. (1 mark)

(Total: 20 marks)

QUESTION FIVE

1. Joseph Mutiso is a portfolio manager responsible for a large pension fund in his country and is interested in determining the sources of the fund’s returns. The results of his macroattribution analysis are presented below:

Decision making levels Returns (%)

Aggregate manager investment style benchmarks 3.65

Aggregate asset category benchmarks 3.76

Aggregate actual return of the managers 3.81

Allocation effects 0.00

The results of his microattribution analysis are presented below:

Economic Portfolio Sector benchmark Portfolio Sector benchmark

sectors weights (%) weights (%) return (%) return (%)

Banking 49.75 39.00 6.50 4.25

Agricultural 6.40 7.50 8.90 6.45

Energy 12.50 24.80 2.50 3.25

Telecommunication 31.35 28.70 6.80 5.50

Required:

For macroattribution analysis, determine the return to style bias and return to active management. (2 marks)

For macroattribution analysis, determine which sector has the highest within-sector allocation return. (3 marks)

For microattribution analysis, determine which sector has the highest allocation/selection interaction return. (3 marks)

2. Stephen Macharia is a portfolio manager for a large bank which has written a guaranteed liability due in four years.

The liability is for Sh.93.5 million at the end of the period and guarantees a bond equivalent yield of 2.75% over the period. Stephen calculates the present value of the liability at Sh.83,884,996.

He currently holds two bonds in a portfolio and would like to add a third bond to immunise the portfolio for the liability. The current portfolio and three possible choices for immunisation are as shown below:

Bonds in the portfolio

Bond Market value (Sh.) Total market value (Sh.) Total money duration (Sh.)

Bond A 101.75 22,500,000 525,000

Bond B 95.6 31,250,750 2,253,750

Bonds available to complete portfolio

Bond Market value (Sh.) Yield to maturity (YTM) Modified duration

Bond C 99.97 3.25% 1.45

Bond D 99.36 3.50% 1.91

Bond E 99.35 2.50% 1.89

Required:

Determine the bond that is most suitable to complete the immunised portfolio using:

Modified duration approach. (4 marks)

Money duration approach. (4 marks)

3. A global fund based in Kenya has determined that a Sh.39,550,000 investment in an equity portfolio of South African stock with a beta of 1.27 would be appropriate. The fund will make this investment for a year starting from 31 January 2022. The fund is uncertain about future movements of the South African Rand and Kenya Shilling exchange rate and wants to fully hedge the currency risk associated with the investment. The fund has approached a currency dealer who has given the following quotes.

- A stock index future contract on a Rand-denominated index trades at ZAR 10,000 and has a beta of 1.10.

- A currency forward contract based on ZAR/KES exchange rate has a price of Sh.7.52/ZAR.

The fund has determined Kenya risk free rate is 4.67% and South Africa risk free rate is 2.95%. Both rates are annually compounded. The current spot exchange rate is Sh.8.50/ZAR.

Required:

Determine the hedging strategy that should be implemented to fully hedge currency risk. (4 marks)

(Total: 20 marks)