FRIDAY: 3 September 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. National economies have recently become more closely linked not only because of growing international trade and investment opportunities, but also due to terms of international financial transactions.

In light of the above statement, discuss five factors that could have contributed to an increased general level of correlation among markets and market integration. (5 marks)

2. Highlight two merits and two demerits of the theory of comparative advantage in international trade. (4 marks)

3. The following information relates to the Republic of Ziji for the year ended 31 December 2020:

USD “million”

Export of goods 15,000

Import of goods 10,000

Receipts from shipping 4,000

Payments for property 1,000

Gifts received from abroad 500

Gifts granted to foreigners 200

Interest paid to foreigners 100

Required:

Current account for the year ended 31 December 2020. (4 marks)

Venus Limited intends to invest Sh.30,000,000 in a venture in China. The project is expected to generate the following cash inflows:

Cash inflows

Year (Chinese Yuans)

1 500,000

2 650,000

3 700,000

4 800,000

Additional information:

- The company’s cost of capital is 12%.

- The exchange rate between Kenya Shillings and Chinese Yuan is Ksh.16.50.

- The Yuan is expected to appreciate by 10% per annum.

- Assume that there is no taxes and that all the cash flows are remitted to the parent company every year.

Required:

Advise the management on whether to undertake the investment using the net present value (NPV) approach. (4 marks)

Suggest three reasons that could make a parent company to reject a project with a positive net present value (NPV) from the subsidiary perspective. (3 marks)

(Total: 20 marks)

QUESTION TWO

1. Explain four factors that could lead to differences in cost of capital between domestic firms and multinational corporations (MNCs). (4 marks)

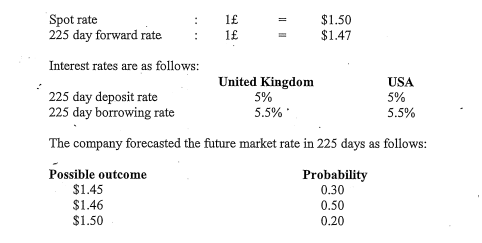

2. Faraja Limited, a company based in the United States, expects to receive 350,000 United KingdOni Pound (£) in 225 days. The company is wondering whether to use a forward market hedge, a money market hedge or no hedge strategies to manage its foreign exchange exposure. The company’s financial analysts has provided the following information which could be used to assess alternative strategies:

Required:

Demonstrate how the firm will apply the following hedging strategies:

Forward market hedge. (2 marks)

Money market hedge. (3 marks)

No hedging strategy. (2 marks)

Advise the management of Faraja Limited on the hedging strategy to undertake based on your results in (i) — (iii) above. (2 marks)

3. You are provided with the following information relating t6 one year average interest rates and inflation rates in Kenya and the United States of America (USA):

Kenya USA

Interest rates 14% 8%

Inflation rates 23% 13%

The current spot rate of the Kenyan shilling (Ksh.) against the US dollar (USD) is:

1 USD = Ksh.108.

Required:

The expected exchange rate between the Kenyan shillings and the US dollar in One year’s time under the following parity conditions:

Interest rate parity (IRP). (3 marks)

Purchasing power parity (PPP). (3 marks)

Give one reason that explain why PPP may not always hold. (1 mark)

(Total: 20 marks)

QUESTION THREE

1. In relation to international tax environment:

Distinguish between “Base Erosion and Profit Shifting (BEPS)” and “transfer pricing (TP)”. (4 marks)

Describe two forms of double taxation. (2 marks)

Explain three implications of double taxation in international trade. (3 marks)

Suggest one measure that a multinational corporation, could take to avoid double taxation. (1 mark)

2. The World Trade Organisation (WTO) is a global trade organisation that was formed to ensure trading among nations was conducted lon a fair level ground among other functions.

Required:

Summarise five key objectives of WTO. (5 marks)

3. Jeremy Kiptoo, a forex trader has 10,000,000 Swiss Francs (SF). He is considering selling or buying the Japanese Yens (Y), US dollars ($) or the Swiss Francs (SF) quoted at the following exchange rates:

Bank Exchange rate

A Y120.00/US$

B SF1.60/USS

C Y80.00/SF

Required:

The profit the forek trader could earn through triangular arbitrage. (5 marks)

(Total: 20 marks)

QUESTION FOUR

1. Differentiate between “leading” and “lagging” in relation to international trade. (4 marks)

2. Evaluate three debt restructuring options available to governments experiencing a debt crisis. (6 marks)

3. Discuss two impediments to economic trading blocs among nations. (4 marks)

4. The current global Covid-19 pandemic has triggered multinational corporations (MNCs) to conduct most of their trade through online platforms due to movement restrictions across borders.

Required:

Examine three ethical concerns that are likely to arise while conducting international business over the intemet platforms. (3 marks)

5. Sovereign risk is perhaps the most detrimental of all the political risks that a multinational company is exposed to.

This is because a host government could take over the business of a multinational corporation (MNC) without ,compensation.

Required:

Outline three strategies that a MNC could apply to reduce exposure to sovereign risk. (3 marks)

(Total: 20 marks)

QUESTION FIVE

1. Cite four reasons why developing countries adopts deficit financing. (4 marks)

2. Propose three strategies that could be adopted by a multinational corporation (MNC) to repatriate blocked funds from the host country. (6 marks)

3. Examine two forms of hedge used by multinational companies to manage transaction exposures. (4 marks)

4. Foreign Direct Investments (FDIs) have been criticised for exerting pressure on host countries in terms of foreign policy.

In relation to the above statement, analyse three limitations associated with FDIs in your country. (6 marks)

(Total: 20 marks)