WEDNESDAY: 15 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

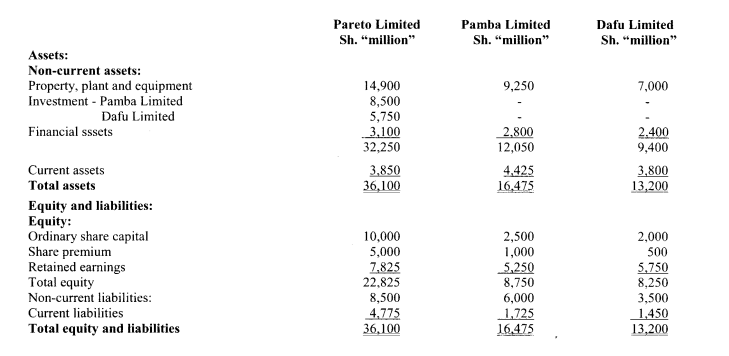

Pareto Limited is the holding company of a listed group of companies with its year ended 30 June 2021.

Pareto Limited has made a number of acquisitions and a disposal of an investment.

The following summarised draft statements of financial position relate to the group companies for the year ended 30 June 2021:

Additional information:

- On 1 October 2020, Pareto Limited acquired an 80% equity interest in Pamba Limited when its retained earnings stood at Sh.3,500 million. The purchase consideration comprised 1,250 million of Pareto Limited’s shares with a nominal value of Sh.1 each and a market price of Sh.6.80 each. At acquisition of Pamba Limited, the only adjustment required to the identifiable net assets of Pamba Limited was for land which had a carrying amount of Sh.625 million less than its fair value.

- The group policy is to measure the non-controlling interest at fair value. At the date of acquisition of Pamba Limited, the non-controlling interest had a fair value of Sh.2,125 million.

- Pareto Limited had acquired a 100% equity interest in Dafu Limited a number of years ago when its retained earnings amounted to Sh.1,750 million. At acquisition, the fair values of the identifiable net assets of Dafu Limited approximated their carrying values. The purchase consideration comprised cash amounting to Sh.5,750 million.

- Pareto Limited disposed of 60% of its investment in Dafu Limited on 1 April 2021 for Sh. 4,700 million when the fair values of the identifiable net assets of Dafu Limited were Sh. 6,250 million. The fair value of the remaining 40% equity interest was Sh.4,300 million at disposal. Pareto Limited has not accounted for the disposal.

- None of the companies had issued any shares since Pareto Limited acquired its shareholding in them.

- Neither the goodwill on acquisition of subsidiaries nor the investment in the associate had been impaired.

Required:

1. Goodwill arising on acquisition of the investments in subsidiaries. (4 marks)

2. Gain or loss arising on disposal of the investment in Dafu Limited as reported in:

The individual financial statements of Pareto Limited. (2 marks)

The consolidated statement of profit or loss. (2 marks)

3. Consolidated statement of financial position as at 30 June 2021. (12 marks)

(Total: 20 marks)

QUESTION TWO

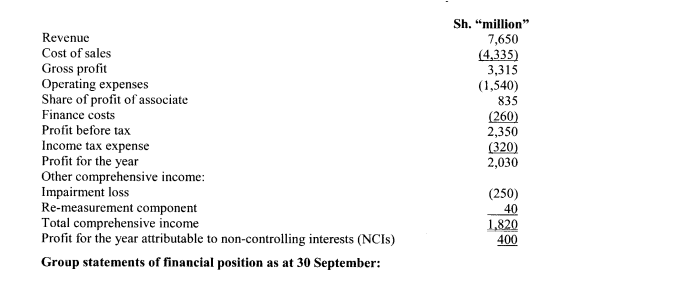

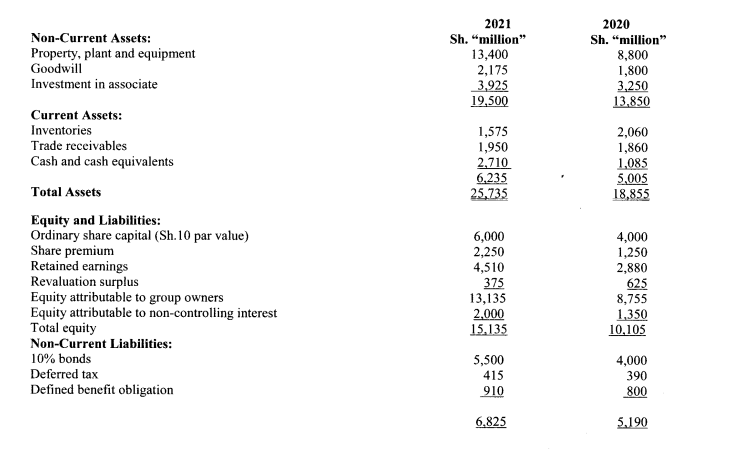

The following extracts are from the consolidated financial statements of Euro Group for the years ended 30 September 2020 and 2021:

Group statement of profit or loss and other comprehensive income for the year ended 30 September 2021:

Additional information:

- During the year ended 30 September 2021, Euro Group acquired an 80% equity interest in Sporty Limited, a local subsidiary quoted in the securities exchange. The purchase consideration on acquisition comprised a share exchange of Sh.2,000 million and cash consideration of Sh.500 million. The market value of the parent entity’s share was Sh.16 at the time of acquisition. Sporty Limited’s net assets at acquisition had the following fair values:

Sh “million”

Property, plant and equipment 1,800

Inventories 640

Trade receivables 580

Trade payables (350)

Cash and cash equivalents (120)

Current tax (50)

2,500

It is the group policy to measure the non-controlling interests in subsidiaries at their proportionate share of the net assets at acquisition.

- Depreciation charged during the year ended 30 September 2021 amounted to Sh.1,240 million and an impairment loss of Sh.535 million was recognised on property. Prior to the impairment review, the group had a balance on the revaluation surplus of Sh.625 million of which Sh.250 million related to property impaired in the current year.

- Goodwill was reviewed for impairment at the reporting date and the impairment loss reported in profit or loss.

- Euro Group operates a defined benefit scheme. A service cost component of Sh.300 million has been included within the operating expenses while a net interest cost of Sh.40 million has not been accounted for. The re- measurement component for the year ended 30 September 2021 was a gain of Sh.40 million. Benefits paid out of the scheme were Sh.380 million.

Required:

A consolidated statement of cash flows for Euro Group for the year ended 30 September 2021 using the indirect method in accordance with International Accounting Standard (IAS) 7: “Statement of Cash Flows”. (Total: 20 marks)

QUESTION THREE

1. Heri Limited sold a building at its fair value of Sh.112 million to a finance company on 31 October 2020 when its carrying amount was Sh. 78.4 million. The building was leased back from the finance company for a five year period. The remaining economic useful life of the building was deemed to be 25 years so it could be concluded that control of the building had transferred to the finance company. Lease rentals are Sh.9,856,000 payable annually in arrears. The interest rate implicit in the lease is 7%. The present value of the annual lease payments was Sh.40,320,000. Heri Limited recorded the cash proceeds, derecognised the building and recorded a profit on disposal of Sh.33.6 million in the statement of profit or loss. No other accounting entries had been posted. °

Required:

With reference to International Financial Reporting Standard (IFRS) 16 “Leases”, and with suitable calculations, explain the accounting treatment of the above transactions in the financial statements of Hen Limited for the year ended 31 October 2021. (8 marks)

2. On 1 July 2021, Blanket Limited purchased a debt instrument (5% bond) with a nominal value of Sh.2.5 million. The purchase consideration was Sh.2,375,000 and the company incurred Sh.50,000 transaction costs. The bond will be redeemed at a premium of Sh.149,000 above the nominal value on 1 July 2024. The effective interest rate on the bond is 8%. Blanket Limited’s business model is to hold financial assets to collect the contractual cash flows but also sell financial assets if investments with higher returns become available. There has not been a significant increase in credit risk since inception. Expected credit losses are immaterial.

The fair value of the bond was as follows:

Sh.

30 June 2022 2,750,000

30 June 2023 2,600,000

The directors of Blanket Limited are unsure of how to account for this financial instrument.

Required:

Prepare extracts of the financial statements for Blanket Limited for the years ended 30 June 2022, 2023 and 2024 to show the accounting treatment of the above transactions. (8 marks)

3. The International Financial Reporting Standard for Small and Medium Sized Entities (IFRS for SMEs standard) was issued for use by entities that have no public accountability. This standard reduces the burden of producing information that is not likely to be of interest to the stakeholders of a small or medium entity.

Required:

Discuss any four simplifications introduced by the IFRS for SMEs standard as compared to the full IFRS standard requirements. (4 marks)

(Total: 20 marks)

QUESTION FOUR

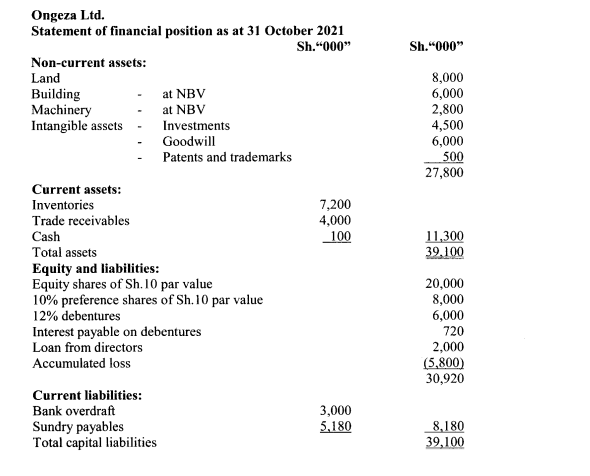

Ongeza Ltd., a local company operating in the mineral water bottling industry, is in financial difficulty due to the unfavourable economic conditions. The company’s statement of financial position as at 31 October 2021 was as given below:

Additional information:

The authorised share capital of Ongeza Ltd. is 5 million ordinary shares of Sh.10 each and one million 10% preference shares of Sh.10 each. It was decided during a meeting of the shareholders and directors of the company to carry out a scheme of internal reconstruction, with effect from 1 November 2021, as follows:

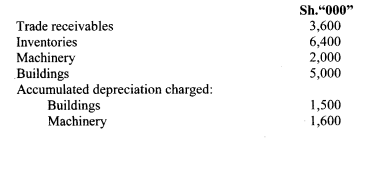

- Assets are to be adjusted to their fair values as follows:

- Each ordinary share is to be re-designated as a share of Sh.2.50. The ordinary shareholders are to accept a reduction in the nominal value of their shares from Sh.10 to Sh.2.50. In addition, the shareholders are to subscribe for a new issue on the basis of one share for every two held at a price of Sh.4 per share.

- The existing preference shares are to be exchanged for a new issue of 6 million 15% preference shares of Sh.10 each and 800,000 ordinary shares of Sh.2.50 each.

- The debenture holders are to accept 200,000 ordinary shares of Sh.2.50 each in lieu of interest payable. The 12% debentures are to be converted to 14% debentures. A further Sh.2 million of 14% debentures of Sh.100 each are to be issued and taken up by the existing debenture holders at Sh.90 each.

- Sh.800,000 of the loan from directors is to be cancelled. The balance of the loan is to be settled by the issue of 200,000 ordinary shares of Sh.2.50 each.

- The investments are to be sold at their current market price of Sh.6 million.

- The bank overdraft is to be paid in full.

- A sum of Sh.3.18 million is to be paid to offset the sundry payables immediately and the balance in four equal instalments at the end of each quarter.

- All intangible assets are to be eliminated.

- It is estimated that under the new arrangement, the net profit before interest and tax will be Sh.5 million per year. There will be no tax liability relating to the company for the next five years.

Required:

Journal entries to effect the scheme of internal reconstruction. (10 marks)

Statement of financial position as at 1 November 2021 (immediately after reconstruction). (8 marks)

A statement showing how the anticipated profits under the new arrangement will be distributed to the various providers of capital. (2 marks)

(Total: 20 marks)

QUESTION FIVE

1. Management commentary provides users of financial statements with more context through which to interpret the financial position, financial performance and cash flows of an entity.

Required:

In view of the above statement, describe four elements of management commentary in a set of financial statements of an entity. (4 marks)

2. International Accounting Standard (IAS) 36 “Impairment of Assets”, states that impairment of an asset or a Cash Generating Unit (CGU) occurs where the carrying amount exceeds the recoverable amount. The recoverable amount is the higher of the fair value less costs of disposal and the value in use.

Required:

In the context of International Accounting Standard (IAS) 36 “Impairment of Assets”, briefly explain how the “value in use” of an asset or a Cash Generating Unit (CGU) would be determined for the purpose of an impairment review. (6 marks)

3. The objective of International Public Sector Accounting Standard (IPSAS) 9: “Revenue from Exchange Transactions” is to prescribe the accounting treatment of revenue arising from exchange transactions and events.

Required:

With reference to International Public Sector Accounting Standard (IPSAS) 9: “Revenue from Exchange Transactions”, briefly explain how revenue from exchange transactions should be recognised and how the recognition criterion under IPSAS 9 differs from that of commercial sector entities under International Financial Reporting Standard (IFRS) 15: “Revenue from Contracts with Customers”. (6 marks)

4. International Accounting Standard (IAS) 40: “Investment Property”, prescribes the accounting treatment for investment property and related disclosure requirements.

Required:

With reference to International Accounting Standard (IAS) 40: “Investment Property“, discuss the accounting treatment of investment property both upon initial recognition and subsequent measurement. (4 marks)

(Total: 20 marks)