THURSDAY: 16 December 2021. Time Allowed: 3 hours.

Answer ALL questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings.

QUESTION ONE

1. Summarise four assumptions of Modigliani and Miller (MM) hypothesis. (4 marks)

2. Zeka Ltd. has a cost of equity of 20%. The company currently has in issue 500,000 shares outstanding and selling on the Securities Exchange at Sh.200 each. The firm’s earnings per share (EPS) at the end of the current year is estimated at Sh.15 and it intends to maintain a constant dividend payout ratio of 60%.

The company’s expected net income is Sh.6 million and the available investment proposals are estimated to require Sh.12 million.

Required:

Using Modigliani and Miller’s proposition on dividend irrelevance, show that the payment or non-payment of dividend does not affect the current value of the firm. (10 marks)

3. XYZ Limited’s share is currently selling at Sh.l0. The share price will increase by 5% or reduce by 5% six months from now. The risk free rate of return is 6% and the strike price is Sh.10. The option will be exercised after six months.

Required:

Using the risk neutral approach, determine the value of a put option at the initial node of the binomial tree. (6 marks)

(Total: 20 marks)

QUESTION TWO

1. Imelda Nasimiyu holds the following portfolio of four risky assets and a deposit in a risk free asset:

Asset Portfolio weight (%) Current return (%) Beta

A 20 12 1.5

B 10 18 2.0

C 15 14 1.2

D 25 8 0.9

Risk free asset 30 5 0

The overall return on the market portfolio of risky assets is 11%.

Required;

Determine the assets that are inefficient, efficient or super efficient using the capital asset pricing model (CAPM). (6 marks)

Highlight four weaknesses of using CAPM in (i) above. (4 marks)

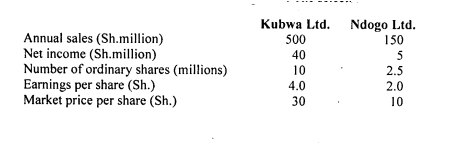

2. Kubwa Ltd. is considering acquiring Ndogo Ltd. The selected financial data for the two companies is as follows:

Both companies are in the 30% tax bracket.

Required:

Kubwa Ltd.’s post acquisition earnings per share (EPS) assuming the two companies settle on an offer price of Sh.20 on a share for share exchange. (3 marks)

Kubwa Ltd.’s post acquisition earnings per share (EPS) assuming Ndogo Ltd.’s shareholders accept one 10% debenture (par value of Sh.1.000 each) for every 50 ordinary shares held. (3 marks)

The level of combined operating profit (EBIT) that Kubwa Ltd. will be indifferent between financing options in (b) (i) and (b) (ii) above. (4 marks)

(Total: 20 marks)

QUESTION THREE

1. Different companies have varied aims and timings for undertaking corporate restructuring. However, the single common objective in every restructuring exercise is to minimise the disadvantages and maximise on the advantages.

Comment on the above statement highlighting five reasons for undertaking corporate restructuring. (5 marks)

2. Distinguish between the following terms in relation to corporate restructuring and reorganisation:

“Demerger” and “spin-off’. (2 marks)

“Management buyout” and “management buy-in”. (2 marks)

“Unbundling” and “capital re-organisation”. (2 marks)

3. The following data relates to Kaban Ltd., a company that operates in the manufacturing sector for the year ended 31 December 2020:

Sh. “000”

Sales 25,678

Total assets 49,579

Total liabilities 5,044

Retained earnings 1,770

Net working capital (1,777)

Earnings before interest and taxes 2,605

Market value of equity 10,098

Book value of total liabilities 5,044

The company is currently paying interest on a long term debt instrument amounting to Sh.905,000 per year and that the company’s total liabilities is constituted in the ratio of 2:5 between current and non-current components.

Required:

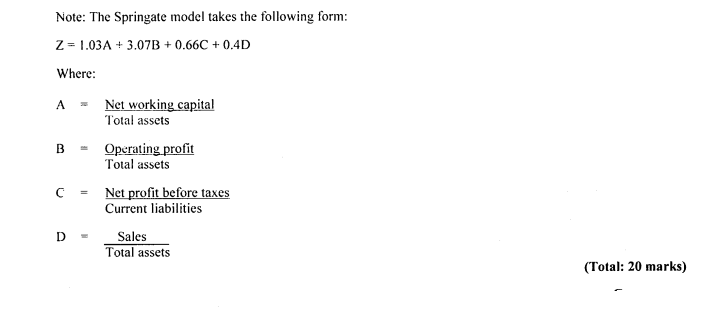

Using the Springate model, assess the financial health of the company. (9 marks)

QUESTION FOUR

1. Discuss four defense tactics available to target companies facing hostile takeover by predators. (4 marks)

2. Explain three differences between traditional finance and behavioural finance. (6 marks)

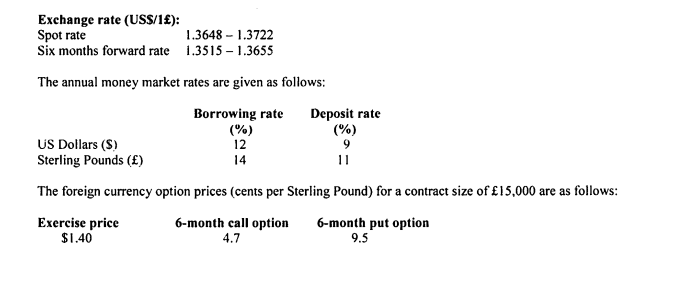

3. Jaram Ltd., a United Kingdom (UK) based firm bought goods on credit worth 365,000 United States Dollars (USD) from a firm in the United States of America (USA) payable in six months time from now. The company is considering various choices in order to hedge the transactions exposure and has collected the following data:

Required:

Determine the amount payable using:

Forward market cover. (2 marks)

Money market cover. (4 marks)

Currency options. (4 marks)

(Total: 20 marks)

QUESTION FIVE

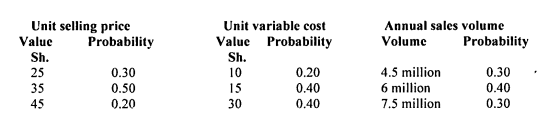

1. An investor is considering introducing new classic pens into the market. The firm is contemplating investing in purchase of a new plant costing Sh.250 million. The plant has a useful life of five years and is to be depreciated to zero on a straight line basis. Due to market uncertainties, selling price per unit, unit variable cost and annual sales volume of the new classic pens have been estimated stochastically as follows:

The firm will incur annual fixed operating costs excluding depreciation of Sh.20 million. The company’s cost of capital is 10% and corporation tax rate applicable is 30%.

Required:

The expected net present value (NPV) of the project. (4 marks)

Simulate the net present value (NPV) using the following random numbers:

(752560 658055 957530 869950 544025) and hence determine the expected Net Present Value of the project. (10 marks)

Determine the probability that the product will be a success. (1 mark)

2. Due to restrictions in the capital markets, Rahim Ltd.’s financial manager is able to provide only Sh.900 million for investments in the next financial year.

An analysis of the project’s allowable for investment during the next financial year shows the following expected net present values (ENPV) for each project:

Project Initial investment Net present value

Sh. (millions) Sh. (millions)

P 300 120

Q 300 90

R 600 150

S 300 30

T 150 12

Project Q and R are mutually exclusive.

Required:

Advise the management on the project(s) to undertake. (5 marks)

(Total: 20 marks)