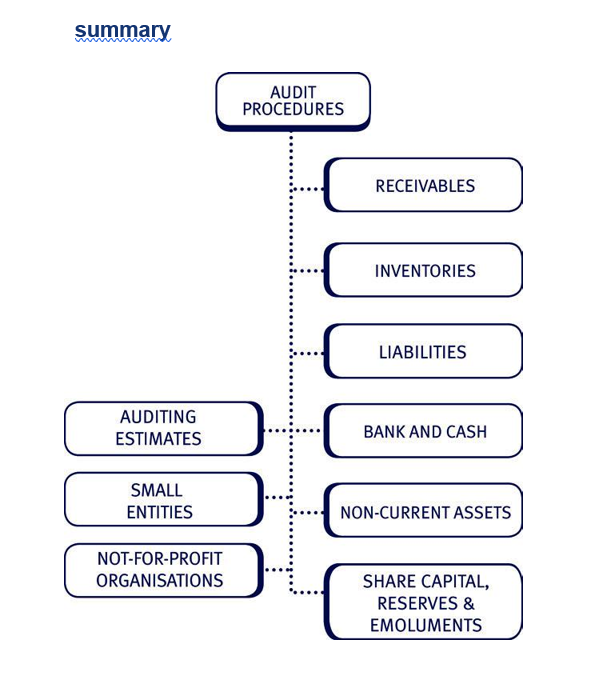

We dealt with the principles of audit evidence in an earlier . This deals with the application of those principles.

Audit procedures must be designed to respond to the specific risks of material misstatement identified for each individual client. In the exam, you should make your answers specific to the scenario. It is highly likely the scenario focuses on a specific risk such as valuation of inventory, recoverability of receivables, etc. Therefore audit procedures must focus on these features rather than general audit procedures over inventory or receivables.

This is a starting point to help you familiarise yourself with the basic auditing techniques to allow you to apply them to questions. It is not an exhaustive summary of all audit procedures. Each section starts with the key assertions. These are the assertions most likely to be at risk, however, the auditor must obtain assurance over all relevant assertions.

Remember that the auditor’s role is to obtain sufficient appropriate evidence that the financial statements are prepared in all material respects with the relevant financial reporting framework. For this reason, you will need to have a good understanding of the accounting standards.

1 Directional testing

The concept of directional testing derives from the principle of double-entry bookkeeping, i.e. for every debit there should be a corresponding credit. Therefore any misstatement of a debit entry will also result in a misstatement of a credit entry.

Auditors primarily test debit entries (assets and expenses) for overstatement and credit entries (liabilities and income) for understatement, indirectly testing the corresponding entries at the same time, e.g. directly testing payables for understatement also indirectly tests expenses/cost of sales for understatement.

- Testing for understatement tests completeness.

- Testing for overstatement tests valuation, existence, rights and obligations, and occurrence.

2 Bank and cash

The key assertions for bank and cash are existence and valuation.

Bank and cash is a good example of where the reliability of the evidence available means that only a small quantity of evidence is needed. The auditor relies mainly on just two key pieces of evidence: the bank confirmation letter and the bank reconciliation.

Test your understanding 1 – Bank and cash Murray Co

| Bank reconciliation as at 31 December 20X4 | $ |

| Balance per cash book | (180,345.22) |

| Add Unpresented cheques | 2,223.46 |

| Less Outstanding lodgements | (1,600.34) |

| Difference | 1.34 |

| –––––––––– | |

| Balance per bank statement | (179,720.76) |

| –––––––––– | |

Required:

Describe the substantive procedures the auditor should perform to verify the bank and cash balance of Murray Co.

Illustration 1 – Murray Co Bank confirmation letter

Wimble & Co

14 The Grove

Kingston

KI4 6AP

Manager (Audit Confirmations)

National Bank Anytown Branch

High Street, Anytown, AT1 1 HS

14 December 20X4

Dear Sir,

Re: Murray Co

In accordance with the agreed practice for provision of information to auditors, please forward information on our mutual client as detailed below on behalf of the bank, its branches and subsidiaries. This request and your response will not create any contractual or other duty with us.

Company name: Murray Co

Main account number: 01789311

Sort code: 4-83-12

Information required

Standard

x

Trade finance

x

- Derivative and commodity trading

- Custodian arrangements

- Other information (see attached)

Audit confirmation date: 31/12/X4

The Authority to Disclose Information signed by your customer is already held by you. This is dated 30/11/X4. Please advise us if this Authority is insufficient for you to provide full disclosure of the information requested.

The contact name is: Don Henman (Audit Partner)

Telephone: 01234 123456

Yours faithfully,

Wimble & Co

Wimble & Co

The bank confirmation letter provides direct confirmation of bank balances from the bank. It is third party, independent, written evidence and therefore very reliable.

Permission must have been given by the client for the bank to release this information to the auditors, as they too have a duty of confidentiality to their clients.

The letter should be sent a minimum of two weeks before the client’s year-end. The letter should include enough information to allow the bank to trace the client. The bank should then forward on all details of all balances for the client.

Cash counts

Where cash in hand is material, or when fraud is suspected, a cash count should be arranged to verify existence.

The auditor should make sure that all cash balances are counted at the same time to avoid manipulation of the balances between different sites.

The auditor should always be accompanied by a member of the client staff to avoid any allegations from the client of theft by the auditor.

The details of the cash counts should be recorded such as the locations counted, the amount counted at each location, the client staff present, the auditor performing the tests and the date performed.

Non-current liabilities

The key assertion for liabilities is completeness. Allocation must also be assessed as there is a need to split the liability into its current and non-current elements.

The bank confirmation letter will provide details of loans held, the amounts outstanding, accrued interest and any security provided in relation to those loans. Additional procedures that the auditor will need to perform in relation to loan payables include:

- Obtain a breakdown of all loans outstanding at the year-end, cast to verify arithmetical accuracy and agree the total to the financial statements: completeness.

- Agree the balance outstanding to the bank confirmation letter: accuracy & valuation, rights & obligations.

- Inspect bank confirmation letters for any loans listed that have not been included in the financial statements: completeness.

- Inspect the bank confirmation letter for details of any security over assets and agree the details to the disclosure in the financial statements: presentation.

- Inspect financial statements for disclosures of interest rates, and the split of the loan between current and non-current: allocation, classification, presentation.

- Recalculate the split between current and non- current liabilities: allocation, classification, and presentation.

- Inspect the loan agreement for restrictive covenants (terms) and determine the effect of any loan covenant breaches: allocation, classification, presentation. [If loan covenants have been breached the loan may become repayable immediately and should therefore be included as a current liability].

- Inspect the cash book for loan repayments made: existence, accuracy & valuation.

For the related finance cost in the statement of profit or loss, recalculate the interest charge and any interest accrual in accordance with terms within the loan agreement, to ensure mathematical accuracy: accuracy of finance costs in the statement of profit or loss, completeness of accruals.

3 Non-current assets

The key assertions for non-current assets are existence, valuation, completeness and rights and obligations.

The auditor needs to obtain sufficient appropriate evidence over many areas:

- Existing assets

- Additions

- Disposals and the related profit/loss in the statement of profit or loss

- Depreciation

- Revaluations

- Related disclosures (the property, plant and equipment note, depreciation policies, useful economic lives, revaluations).

Test your understanding 2 – Non-current assets

| Murray Co | |||||

| Non-current assets: Property, plant and equipment note | |||||

| Land & | Fixtures, | Motor | Total | ||

| buildings | fittings & | vehicles | |||

| equipment | |||||

| Cost at 1 January 20X4 | $000 | $000 | $000 | $000 | |

| 3,000 | 2,525 | 375 | 5,900 | ||

| Additions | – | 1,050 | 75 | 1,125 | |

| Disposals | – | (300) | – | (300) | |

| Cost at 31 December | ––––– | ––––– | ––––– | ––––– | |

| 3,000 | 3,275 | 450 | 6,725 | ||

| 20X4 | |||||

| Accumulated | 386 | 489 | 125 | 1,000 | |

| depreciation at | |||||

| 1 January 20X4 | |||||

| Charge for the year | 97 | 338 | 56 | 499 | |

| Disposals | – | (116) | – | (124) | |

| Accumulated | ––––– | ––––– | ––––– | ––––– | |

| 483 | 711 | 181 | 1,375 | ||

| depreciation at 31 | |||||

| December 20X4 | ––––– | ––––– | ––––– | ––––– | |

| Carrying value at 31 | |||||

| 2,517 | 2,564 | 269 | 5,350 | ||

| December 20X4 | |||||

| Carrying value at 31 | 2,614 | 2,036 | 250 | 4,900 | |

| December 20X3 | ––––– | ––––– | ––––– | ––––– | |

Required:

Describe the substantive procedures the auditor should perform to confirm the non-current assets included in Murray Co’s financial statements.

Illustration 2 – Depreciation proof-in-total

The depreciation charge for fixtures and fittings for the year-ending

31 December 20X4 included in the draft financial statements of Murray Co is $338,000 (to the nearest $000).

Murray Co’s depreciation policy is to depreciate fixtures and fittings using the straight line method. The useful economic life for fixtures and fittings is ten years.

Exercise:

Create an expectation of what total depreciation for fixtures and fittings should be for year-ending 31 December 20X4.

Solution

The total cost of fixtures and fittings in the draft financial statements of Murray Co is $3,275,000 (to the nearest $000).

We can set an expectation for total depreciation for fixtures and fittings for the year-ending 31 December 20X4 as $3,275,000/10 = $328,000 (to the nearest $000).

The difference of $10,000 is only 3% more than our expectation, and we can therefore conclude that depreciation is materially correct.

Intangible non-current assets

Development costs

The key assertion for development costs is existence. Development costs should only be capitalised as an intangible asset if the recognition criteria of IAS 38 Intangible Assets have been met. The audit procedures suggested below focus on obtaining evidence that the treatment of the relevant item conforms with these requirements.

- Obtain a breakdown of costs capitalised, cast for mathematical accuracy and agree to the amount included in the financial statements valuation.

- For a sample of costs included in the breakdown, agree the amount to invoices or timesheets: valuation.

- Inspect board minutes for any discussions relating to the intended sale or use of the asset: existence.

- Discuss the details of the project with the project manager or management to evaluate compliance with IAS 38 criteria: existence.

- Inspect project plans and other documentation to evaluate compliance with IAS 38 criteria: existence.

Inspect budgets to confirm financial feasibility: existence.

Other intangible assets

- Inspect purchase documentation for the company name and the cost of the purchased intangible assets: existence, rights and obligations and valuation.

- Inspect specialist valuation report and agree to the amount included in the general ledger and the financial statements: valuation.

Amortisation

- Inspect the budgets/forecasts for the next few years to ascertain the period over which economic benefits are expected to be generated and compare with the amortisation policy to assess reasonableness of the amortisation period: valuation.

- Recalculate the amortisation charge to verify arithmetical accuracy: accuracy, valuation.

- For intangibles such as licences, inspect the licence agreement to confirm the amortisation period corresponds to the licence period: valuation.

- Inspect the financial statement disclosure in the draft financial statements to ensure compliance with IAS 38: presentation.

4 Inventory

The key assertions for inventory are existence, valuation, completeness and rights and obligations.

The main source of evidence for inventory is normally the year-end inventory count (although some clients may use perpetual or continuous inventory counting, throughout the year).

ISA 501 Audit Evidence – specific considerations for selected items requires the auditor to:

- Attend the physical inventory count (unless impracticable), if inventory is material to the financial statements, and

- Perform procedures on the final inventory records to determine whether they accurately reflect the count results.

[ISA 501, 4]

The inventory count is the responsibility of the client. The auditor does not perform the count.

Attendance at the inventory count is required to:

- Evaluate management’s instructions and procedures for the inventory count.

- Observe the performance of the count.

- Inspect the inventory.

- Perform test counts.

[ISA 501, 4]

Test your understanding 3 – Inventory

Murray Co’s inventory count instructions are as follows:

- A finance manager must supervise the inventory count.

- No goods are to be received or despatched during the inventory count.

- Each team will consist of two members of staff from the finance department. One person must count the items. The second person will record the count on sequentially numbered count sheets.

- The teams will be allocated a team number and will be provided with a map of the warehouse. Each area of the warehouse is marked on the map with the number of the team that is to count inventory in that area. The warehouse manager will be in attendance to ensure that each team is clear about which area they are counting, before it is counted.

- Once a section is counted it must be tagged to confirm it has been counted. Yellow tags are to be used by the first counting team to confirm the count has been performed.

- Once the first count is complete, a second count will take place, with each team counting an area that they were not responsible for on the first count (again according to the warehouse map). Any discrepancies should be notified to the finance director immediately. Green tags are to be used to confirm the count has been checked by a second team.

- Sequentially numbered count sheets will contain the product description from the inventory system but no system quantities.

- Any items of inventory in the warehouse that are not listed on the count sheets should be recorded on a blank, sequentially numbered count sheet.

- Inventory count sheets must be recorded in ink. If a mistake is made, it should be crossed out neatly and the correct information written next to it.

- Any damaged or obsolete items will be moved to a designated area. After the count, an assessment of the goods will be made by the finance manager with advice from a sales manager and the warehouse manager, to determine the allowance appropriate for the condition of the items.

- After the count, the finance manager should review the warehouse to ensure all sections have been tagged with both yellow and green tags to confirm the count is complete.

- The count sheets must be signed by each team member responsible for completing the sheets and returned to the finance manager who will perform a sequence check to confirm all count sheets have been returned.

- The finance manager will compare the inventory count sheets to the inventory records and any adjustments will be updated by another finance manager not involved in the count.

Required:

- Describe the procedures that should be performed by the auditor before attending the inventory count of Murray Co.

- Describe the audit procedures that should be performed whilst in attendance at the inventory count of Murray Co.

- Describe the substantive procedures that should be performed during the final audit of Murray Co.

Inventory held by third parties

- Where a third party holds inventory on behalf of the client, obtain external confirmation from the third party of the quantity and condition of the goods to confirm rights and valuation.

- If the goods held by the third party are material the auditor should attend the inventory count to verify existence of the inventory.

- The auditor can also obtain a report from the third party’s auditors confirming the reliability of the internal controls at the third party.

Standard costs

- Obtain the breakdown of the standard cost calculation and agree a sample of costs to invoices.

- Enquire of management the basis for the standard costs and how often they are updated to reflect current costs.

- Inspect the variance account and assess the level of variance for reasonableness. Discuss with management any significant variances arising.

Continuous/perpetual inventory systems

The procedures suggested above apply to all inventory counts, whether carried out as a one-off year -end count or where inventory is counted on a rolling basis throughout the year. The objective is the same:

- To identify whether the client’s inventory system reliably records, measures and reports inventory balances.

Where the client uses a continuous counting system, lines of inventory are counted periodically (say monthly) throughout the year so that by the end of the year all lines have been counted.

Where the client uses a perpetual system the auditor should:

- Attend at least one count to ensure that adequate controls are applied during the counts (in the same way as for a year-end count).

- Inspect the number and value of adjustments made as a result of the count. If significant adjustments are required each month, this would indicate that the system figures for inventory cannot be relied on at the year-end and a full count will be required.

- If the system balance for inventory is deemed reliable as a result of these procedures, further procedures to verify valuation and rights will still be required.

- The auditor should still inspect GRNs and GDNs around the year-end to confirm correct cut-off. Goods received before the year-end should be traced through to inclusion in the inventory listing whilst goods received after the year-end should not be included. Similarly, goods despatched before the year-end should not be included within inventory whereas goods despatched post year-end should be included in the year-end inventory balance.

- NRV testing and comparison of inventory days with prior year will be performed to identify issues with valuation.

- Inspection of purchase invoices for the name of the client will enable rights to be confirmed.

Advantages and disadvantages of perpetual counts Advantages

- Reduces time constraints for the auditor, and enables them to attend counts relating to lines at greater risk of material misstatement.

- Slow-moving and damaged inventory is identified and adjusted for in the client’s records on a continuous basis meaning the year-end valuation should therefore be more accurate.

Disadvantages

- The auditor will need to obtain sufficient appropriate evidence that the system operates effectively at all times, not just at the time of the count.

- Additional procedures will be necessary to ensure that the amount included for inventory in the financial statements is appropriate, particularly with regard to cut-off and year-end allowances.

Inventory count: cut-off procedures

The inventory count(s) will be affected by goods despatched and goods received.

During the count, inventory movements should preferably stop to enable the count to be conducted without being affected by deliveries.

For some organisations this won’t be possible as they may operate production and deliveries 24 hours a day.

In these types of organisations the client should move the items requiring despatch to a different location to that being counted prior to the count taking place. Any deliveries of goods should be made to a different location while the count is ongoing to enable the count to be conducted without movement of items.

A separate count can then be performed on the items delivered during the count and these can be added to the warehouse items counted.

By having such controls in place, the completeness and existence of inventory at the count date can be verified as well as the cut-off assertion for purchases and sales.

- Receivables

The focus of testing for receivables is valuation and existence. Note the effect of directional testing, e.g. directly testing receivables for overstatement also indirectly tests revenue for overstatement

(Dr: Receivables, Cr: Revenue).

Test your understanding 4 – Receivables

| Murray Co | ||||||||

| Aged receivables analysis at 31 December 20X4 ($000) | ||||||||

| Ref | Customer | Total | Current | 30–60 | 60–90 | 90–120 | 120 | |

| Name | days | days | days | days | ||||

| A001 | Anfield | 176 | 95 | 76 | 5 | 0 | 0 | |

| United Shop | 0 | |||||||

| B001 | Bibs and | 0 | (24) | 0 | 24 | 0 | ||

| Balls | 84 | |||||||

| B002 | The Beautiful | 62 | 0 | 20 | 0 | 2 | ||

| Game | 42 | |||||||

| B003 | Beckham’s | 32 | 10 | 0 | 0 | 0 | ||

| C001 | Cheryl & | 12 | 12 | 0 | 0 | 0 | 0 | |

| Coleen Co | 45 | |||||||

| D001 | Dream | 0 | 31 | 14 | 0 | 0 | ||

| Team | 235 | |||||||

| E001 | Escot | 97 | 65 | 0 | 0 | 73 | ||

| Supermarket | 211 | |||||||

| G001 | Golf is Us | 0 | 0 | 0 | 100 | 111 | ||

| G002 | Green Green | 61 | 50 | 11 | 0 | 0 | 0 | |

| Grass | 59 | |||||||

| H001 | HHA Sports | 40 | 0 | 19 | 0 | 0 | ||

| J001 | Jilberts | 21 | 11 | 10 | 0 | 0 | 0 | |

| J002 | James Smit | 256 | 73 | 102 | 34 | 45 | 2 | |

| Partnership | 419 | |||||||

| J003 | Jockeys | 278 | 120 | 21 | 0 | 0 | ||

| O001 | The Oval | 92 | 48 | 44 | 0 | 0 | 0 | |

| P001 | Pole | 76 | 0 | 0 | 76 | 0 | 0 | |

| Vaulters | 0 | |||||||

| P002 | Polo Polo | 0 | 0 | 0 | 0 | 0 | ||

| S001 | Stayrose | 97 | 24 | 23 | 23 | 27 | 0 | |

| Supermarket | 93 | |||||||

| T001 | Trainers and | 73 | 20 | 0 | 0 | 0 | ||

| More | (54) | |||||||

| T002 | Tike Co | 0 | 0 | 0 | 0 | (54) | ||

| W001 | Wanderers | 89 | 60 | 29 | 0 | 0 | 0 | |

| W002 | Whistlers | (9) | 645 | (654) | 0 | 0 | 0 | |

| W003 | Walk Hike | 4 | 0 | 0 | 0 | 0 | 4 | |

| Run | 31 | |||||||

| W004 | Winners | 21 | 10 | 0 | 0 | 0 | ||

| Total | 2,040 | 1,621 | (127) | 212 | 196 | 138 | ||

Required:

- Identify, with reasons, four trade receivables balances from the aged receivables analysis that should be selected for further testing.

- Describe substantive procedures that should be performed to confirm the receivables balance of Murray Co.

Illustration 3 – Murray Co positive confirmation letter

Customer Co

Customer’s address

7 January 20X5

Dear Sirs

As part of their normal audit procedures we have been requested by our auditors, Wimble & Co, to ask you to confirm the balance on your account with us at 31 December 20X4, our year-end.

The balance on your account, as shown by our records, is shown below. After comparing this with your records will you please be kind enough to sign the confirmation and return a copy to the auditor in the prepaid envelope enclosed. If the balance is not in agreement with your records, will you please note the items making up the difference in the space provided.

Please note that this request is made for audit purposes only and has no further significance.

Your kind co-operation in this matter will be greatly appreciated.

Yours faithfully

Chief Accountant

Murray Co

Wimble & Co address

Dear Sirs

We confirm that, except as noted below *, a balance of $XX was owing by us to Murray & Co at 31 December 20X4.

(space for customer’s signature)

* Details of differences

A positive receivables circularisation is considered to be a reliable source of evidence because it is documentary evidence sent directly to the auditor from an external source. A positive receivables circularisation requires customers to respond to the auditor’s request for information. The auditor can include the balance per the client’s ledger and ask the customer to reply stating whether or not the balance is correct. Alternatively the auditor can ask the customer to respond by stating the balance they believe they owe the client but the auditor does not provide the balance per the client’s ledger to the customer.

A negative receivables circularisation requests customers to respond only if they disagree with the balance provided by the auditor. This is only suitable if the risk of material misstatement is low.

“7 January 20X5”: The confirmation letter should be sent as soon as possible after the year-end, to increase the chance of an accurate and timely response.

“As part of their normal audit procedures, we have been requested by our auditors to confirm the balance on your account with us at 31 December

20X4… please be kind enough to sign the confirmation and return a copy to the auditor…”: It is the client who writes to their customers requesting the information but the response must be sent directly to the auditors to reduce the risk of the client interfering with any response.

“…in the prepaid envelope enclosed“: Making it as easy as possible to respond increases the chance that sufficient customers will confirm balances for it to be a valid audit test.

“If the balance is not in agreement with your records, will you please note the items making up the difference in the space provided”: Requesting the customer to complete the reconciliation increases the reliance the auditor can place on this evidence (although the auditor will review the reconciliation and investigate any unreconciled differences or disagreements).

ISA 505 External confirmations

ISA 505 External confirmations requires the auditor to maintain control over external confirmation requests when using external confirmations as a source of audit evidence.

This can be achieved by the auditor:

- Preparing the confirmation letters and determining the information to be requested and the information that should be included in the request.

- Selecting the sample of external parties from which to obtain confirmation.

- Sending the requests to the confirming party.

Prepayments

Prepayments are services or goods which a company has paid for in advance.

- Inspect bank statements to ensure payment has been made: existence.

- Inspect invoices to ensure payment relates to goods or services not yet received: existence.

- Recalculate the amount prepaid to confirm mathematical accuracy: valuation.

- Compare prepayments with the prior year to identify any missing items or any new prepayments which require further testing: existence, valuation, and completeness. (Analytical procedure).

- Payables and accruals

The focus of testing for liabilities is completeness. Note the effect of directional testing, e.g. directly testing payables for understatement also indirectly tests purchases for understatement (Dr: Payables,

Cr: Purchases).

Payables

- Obtain a list of trade payables, cast to verify arithmetical accuracy and agree to the general ledger and the financial statements: verifies completeness, classification, presentation.

- Reconcile the total of the individual payables accounts with the control account: verifies completeness.

- Obtain supplier statements and reconcile these to the payables balances. Investigate any reconciling items: existence, completeness, obligations and valuation. Note: Supplier statement reconciliations provide the most reliable evidence in respect of payables as they provide external confirmation of the balance.

- Inspect after date payments, if they relate to the current year then follow through to the payables ledger or accrual listing: completeness.

- Inspect invoices received after the year-end to ensure no further items need to be accrued: completeness.

- Enquire of management their process for identifying goods received but not invoiced and ensure that it is reasonable: completeness.

- Select a sample of goods received notes immediately before the yearend and follow through to inclusion in the year-end payables balance: completeness of payables and cut-off of purchases.

- Select a sample of payable balances and perform a trade payables’ circularisation, follow up any non-replies and any reconciling items between balance confirmed and trade payables’ balance: completeness and existence.

- Insect the payables ledger for any debit balances, for any significant amounts discuss with management and consider reclassification as current assets: valuation of payables and completeness of receivables, classification.

- Compare the list of trade payables and accruals against the prior year list to identify any significant omissions: (Analytical procedure)

- Calculate the trade payable days and compare to prior years, investigate any significant differences: completeness and valuation. (Analytical procedure)

Accruals

- Obtain the list of accruals from the client, cast it to confirm mathematical accuracy and agree to the general ledger and the financial statements: completeness, classification.

- Recalculate a sample of accrued costs by reference to contracts and payment schedules (e.g. loan interest): valuation (accuracy of purchases and other expenses).

- Inspect invoices received post year-end to confirm the actual amount and assess whether the accrual is reasonable: valuation.

- Compare the accruals this year to last year to identify any missing items or unusual fluctuation in amount and discuss this with management: completeness and valuation. (Analytical procedure)

Test your understanding 5 – Payables

Murray Co’s trade payables balance at 31 December 20X4 is $1,400,000 (to the nearest $ 000). The total balance has already been agreed to the payables ledger which shows that trade payables consists of fifteen suppliers.

A junior member of the audit team, Rob Cash, has been testing five of these balances by reconciling supplier statements to the balances on the payables ledger. He is unable to reconcile a material balance, relating to Racket Co, who supply Vectran material to Murray Co, for stringing tennis rackets. He has asked for your assistance on the audit work which should be carried out on the differences.

The balance of Racket Co on Murray Co’s purchase ledger is shown below:

| Payables ledger Supplier: Racket Co | |||||||

| Date | Type | Reference | Status | Dr | Cr | Balance | |

| ($) | ($) | ($) | |||||

| 10.10 | Invoice | 6004 | Paid 1 | 21,300 | |||

| 18.10 | Invoice | 6042 | Paid 1 | 15,250 | |||

| 23.10 | Invoice | 6057 | Paid 1 | 26,340 | |||

| 04.11 | Invoice | 6080 | Paid 2 | 35,720 | |||

| 15.11 | Invoice | 6107 | Paid 2 | 16,320 | |||

| 26.11 | Invoice | 6154 | Paid 2 | 9,240 | |||

| 30.11 | Payment | Cheque | Alloc 1 | 61,630 | |||

| Discount | Alloc 1 | 1,260 | |||||

| 14.12 | Invoice | 6285 | 21,560 | ||||

| 21.12 | Invoice | 6328 | 38,240 | ||||

| 31.12 | Payment | Cheque | Alloc 2 | 60,050 | |||

| Discount | Alloc 2 | 1,230 | |||||

| 31.12 | Balance | 59,800 | |||||

| Racket Co have sent the following supplier statement: | |||||||

| Date | Type | Reference | Status | Dr | Cr | Balance | |

| ($) | ($) | ($) | |||||

| 07.10 | Invoice | 6004 | 21,300 | ||||

| 16.10 | Invoice | 6042 | 15,250 | ||||

| 22.10 | Invoice | 6057 | 26,340 | ||||

| 02.11 | Invoice | 6080 | 37,520 | ||||

| 13.11 | Invoice | 6107 | 16,320 | ||||

| 22.11 | Invoice | 6154 | 9,240 | ||||

| 10.12 | Receipt | Cheque | 61,630 | ||||

| 04.12 | Invoice | 6210 | 47,350 | ||||

| 12.12 | Invoice | 6285 | 21,560 | ||||

| 18.12 | Invoice | 6328 | 38,240 | ||||

| 28.12 | Invoice | 6355 | 62,980 | ||||

| 31.12 | Balance | 234,470 | |||||

Racket Co’s terms of trade with Murray Co allow a 2% cash discount on invoices where Racket Co receives a cheque from the customer by the end of the month following the date of the invoice (i.e. a 2% discount will be given on November invoices paid and received by 31 December).

On Murray Co’s payables ledger, under ‘Status’ the cash and discount marked ‘Alloc 1’ pay invoices marked ‘Paid 1’ (similarly for ‘Alloc 2’ and ‘Paid 2’).

Murray Co’s goods received department checks the goods when they arrive and issues a goods received note (GRN). A copy of the GRN and the supplier’s advice note is sent to the purchases accounting department.

Required:

- Prepare a statement reconciling the balance on Murray Co’s payables ledger to the balance on Racket Co’s supplier’s statement.

- Describe the audit work you will carry out on each of the reconciling items you have determined in your answer to part

(a) above, in order to determine the balance which should be included in the financial statements.

- Provisions

IAS 37 Provisions, Contingent Liabilities and Contingent Assets requires an entity to recognise a provision if: a present obligation has arisen as a result of a past event; payment is probable (‘more likely than not’); and the amount can be estimated reliably. If payment is only possible, a contingent liability must be disclosed in the notes to the financial statements.

As such, audit testing will focus on whether an obligation exists and whether the provision is valued appropriately. Completeness is also a key assertion as the company may understate liabilities to improve their financial position.

- Obtain a breakdown of the items to be provided, cast it and agree the figure to the financial statements: accuracy and presentation.

- Enquire with the directors or inspect relevant supporting documentation to confirm that a present obligation exists at the year-end: rights and obligations.

- Inspect relevant board minutes to ascertain whether payment is probable: existence.

- Recalculate the provision and agree components of the calculation to supporting documentation: completeness.

- Inspect post year-end bank statements to identify whether any payments have been made, compare actual payments to the amounts provided to assess whether the provision is reasonable: valuation.

- Obtain confirmation from client’s lawyer about the likely outcome and chances of payment (e.g. for a legal provision): existence and rights and obligations.

- Inspect correspondence received from the lawyer regarding the legal provision to assess whether a provision should be recognised and if so, whether the amount of the provision is adequate: valuation and completeness.

- Inspect the financial statement disclosure of the provision to ensure compliance with IAS 37: presentation.

- Obtain a written representation from management that they believe the provision is valued appropriately and is complete: valuation and completeness.

Note: ISA 501 Audit Evidence – special considerations for selected items requires the auditor to design and perform audit procedures in order to identify litigation and claims involving the entity which may give rise to a risk of material misstatement. [para 9]

Illustration 4 – Murray Co provisions

The statement of financial position shows that Murray Co has $240,000 provisions for the year ended 31 December 20X4. The majority of the balance relates to provisions for warranties ($200,000). $40,000 of the provision relates to a claim made by an ex-employee of Murray Co who is claiming for unfair dismissal.

The audit plan includes the following audit procedures in relation to these provisions:

Warranty provision

- Obtain a breakdown of the warranty provision and recalculate to verify arithmetical accuracy.

- Enquire of management the basis used for the provision and assess whether this is reasonable.

- Compare previous year actual warranty costs with the amount provided for to assess whether management’s process if reasonable.

- Compare warranty claims post year-end to the warranty provision at the year-end to assess whether the provision is adequate.

- Review product returns and complaints to assess whether there is a need for a higher provision than in previous years.

- Calculate warranty costs/revenue and compare with prior year to assess whether the level of provision is consistent with the prior year. Discuss any change in proportion with management.

Unfair dismissal claim

- Enquire with the directors when the employee was dismissed in order to confirm that a present obligation exists at the year-end.

- Inspect correspondence between the employee and Murray to verify that the employee was dismissed before the year-end.

- Inspect relevant board minutes to ascertain whether it is probable that the payment will be made to the employee.

- Enquire with the solicitors on the merits of the unfair dismissal case and the likely payment.

- Obtain a breakdown of the costs to be provided for and recalculate to ensure completeness.

- Agree the components of the calculation to supporting documentation, e.g. fee estimate from Murray Co’s solicitors, claim received from the ex-employee.

- Inspect post year-end bank statements to identify whether any payments have been made to the solicitors or the ex-employee, compare actual payments to the amounts provided to assess whether the provision is reasonable.

Procedures relevant to both provisions

- Obtain a written representation from management to confirm the adequacy and reasonableness of the provisions.

- Inspect the financial statement disclosure of the provision to ensure compliance with IAS 37 Provisions, Contingent Liabilities and Contingent Assets.

- Accounting estimates

There are many accounting estimates in the financial statements, e.g. allowances for receivables, depreciation of property, plant and equipment, provisions, etc. Accounting estimates are inherently risky because they are about the future, are often not supported by documentary evidence and therefore accuracy may not be able to be verified.

ISA 540 Auditing Accounting Estimates, Including Fair Value Accounting Estimates and Related Disclosures requires the auditor to:

- Obtain an understanding of how management identifies those transactions, events or conditions that give rise to the need for an estimate. [8b]

For each estimate in the financial statements, the auditor must also:

- Enquire of management how the accounting estimate is made and the data on which it is based. [8b]

- Review the outcome of accounting estimates included in the prior period financial statements. [9]

- Determine whether events up to the date of the auditor’s report provide additional evidence with regard to the appropriateness of estimates. [13a]

- Test how management made their estimates and evaluating whether the method is appropriate. [13b]

- Test the effectiveness of controls over estimations. [13c]

- Develop a point estimate to use in comparison to managements’. [3d]

- If there are significant risks associated with estimates the auditor should also enquire whether management considered any alternative assumptions and why they rejected them and whether the assumptions used are reasonable in the circumstances. [15]

- Obtain written representations from management confirming that they believe the assumptions used in making estimates are reasonable. [22]

9 Share capital, reserves and director’s remuneration

Each of the following areas are material by nature.

Share capital

- Agree authorised share capital and nominal value disclosures to underlying shareholding agreements/statutory constitution documents.

- Inspect cash book for evidence of cash receipts from share issues and ensure amounts not yet received are correctly disclosed as share capital called-up not paid in the financial statements.

- Inspect board minutes to verify the amount of share capital issued during the year.

Dividends

- Inspect board minutes to agree dividends declared before the year-end.

- Inspect bank statements to agree dividends paid before the year-end.

- Inspect dividend warrants to agree dividend payment.

Director’s emoluments

- Obtain and cast a schedule of director’s remuneration split between wages, bonuses, benefits, pension contributions and other remuneration, and agree to the financial statement disclosures.

- Inspect payroll records and agree the figures disclosed for wages, bonuses, and pension contributions.

- Inspect bank statements to verify the amounts actually paid to directors.

- Inspect board minutes for discussion and approval of directors’ bonus announcements or other additional remuneration.

- Obtain a written representation from directors that they have disclosed director’s remuneration to the auditor.

Reserves

- Agree opening reserves to prior year closing reserves and reconcile movements.

- Agree movements in reserves to supporting documentation

(e.g. revaluation reserve movements to the independent valuers report).

- Statement of profit or loss

The majority of transactions and events in the statement of profit or loss are audited indirectly through the direct tests performed on the corresponding debits or credits in the statement of financial position (directional testing). However, the auditor will normally perform substantive analytical procedures on these areas and some specific additional procedures, such as those suggested below.

Payroll

- Agree the total wages and salaries expense per the payroll system to the general ledger and the financial statements: completeness and presentation.

- Cast the monthly payroll listings to verify the accuracy of the payroll expense: accuracy.

- Recalculate the gross and net pay for a sample of employees and agree to the payroll records: accuracy.

- Re-perform calculation of statutory deductions to confirm whether correct deductions for this year have been included within the payroll expense: accuracy.

- Select a sample of joiners and leavers, agree their start/leaving date to supporting documentation, recalculate that their first/last pay packet was accurately calculated and recorded: completeness, occurrence, accuracy.

- For salaries, agree the total net pay per the payroll records to the bank transfer listing of payments and to the cashbook: occurrence.

- For wages, agree the total cash withdrawn for wage payments equates to the weekly wages paid plus any surplus cash subsequently banked: completeness, occurrence.

- Agree the year-end tax liabilities to the payroll records and subsequent payment to the post year-end cash book: occurrence.

- Agree the individual wages and salaries per the payroll to the personnel records and records of hours worked per clocking in cards: accuracy.

Analytical procedures

- Perform a proof in total of total wages and salaries incorporating joiners and leavers and the pay increase. Compare this to the actual wages and salaries in the financial statements and investigate any significant differences.

- Compare the payroll figure for this year to last year to identify any unusual fluctuations and discuss them with management.

Completeness and accuracy.

Illustration 5 – Murray Co payroll proof in total

Total payroll for the year-ending 31 December 20X3 was $1,220,000 (to the nearest $000). At this time Murray Co had 34 employees.

Total payroll for the year-ending 31 December 20X4 is $1,312,000 (to the nearest $000). Murray Co now has 37 employees.

All employees received a 5% pay rise on 31 March 20X4.

Exercise:

Create an expectation of what total payroll will be for year-ending 31 December 20X4.

Solution

The average salary per employee in 20X3 was $35,882 ($1,220,000/34).

We know that all employees received a pay rise of 5% in March. The average value of this pay rise is therefore $1,346 per employee in 20X4 (5% × 9/12 × $35,882).

The average salary for 20X4 should therefore equal $37,228 ($35,882 + $1,346).

We can set an expectation for total payroll for the year-ending

31 December 20X4 as 37 × $37,228: $1,377,000 (to the nearest $000).

The difference ($65,000) is less than 5% more than our expectation, and we can therefore conclude that the payroll cost is materially correct.

Revenue

- Inspect a sample of GDNs before and after the year-end and ensure they have been recorded in the sales day book in the correct period: cut-off. In most cases, the despatch of goods indicates that the seller has fulfilled its performance obligations and therefore the sale can be recorded.

- Recalculate discounts and sales tax applied for a sample of large sales invoices: accuracy.

- Select a sample of customer orders and agree these to the despatch notes and sales invoices through to inclusion in the sales day book: completeness.

- Inspect credit notes issued after the year-end, trace to GDN and invoice and ensure the sale has been reversed:

Analytical procedures

- Compare revenue against prior year and investigate any significant fluctuations.

- Compare revenue with budget/forecast and investigate any significant fluctuations.

- Calculate the gross profit margin and compare to prior year. Investigate any significant differences.

Occurrence, accuracy and completeness.

Purchases and other expenses

- Inspect GRNs before and after the year-end and ensure they have been recorded in the purchase day book in the correct period: cut-off.

In most cases, the company takes ownership for goods when they are received and therefore the purchase expense (and corresponding liability) should be recorded.

- Recalculate discounts and sales tax applied for a sample of purchase invoices: accuracy.

- Select a sample of purchase orders and agree these to the GRNs and purchase invoices through to inclusion in the purchases day book: completeness.

- Inspect purchase invoices for a sample of purchases/expenses in the ledger for the amount, name of the client and description of the goods: accuracy, occurrence and classification.

Analytical procedures

- Compare expenses for each category year on year and investigate any significant fluctuations.

- Compare expenses against budget and investigate any significant fluctuations and investigate any significant fluctuations.

- Calculate gross profit margin and compare with prior year to identify any possible misstatement of purchases. Discuss any significant movement with management.

- Calculate operating profit margin and compare with prior year. Investigate any significant fluctuations.

Accuracy, completeness, classification and occurrence.

11 Audits of smaller entities

The characteristics of smaller commercial entities can lead to both advantages and disadvantages:

- Lower risk – Smaller entities may be engaged in relatively simple activities which reduces risk.

- Direct control by owner managers – Can be a strength because they know what is going on and have the ability to exercise real control. However, they are also in a strong position to manipulate the figures or put private transactions through the business.

- Simpler systems – Smaller entities are less likely to have sophisticated IT systems, but pure, manual systems are becoming increasingly rare. This is good news in that many of the bookkeeping errors associated with smaller entities may now be less prevalent. However, a system is only as good as the person operating it.

Evidence implications

- The normal rules concerning the relationship between risk and the quality and quantity of evidence apply irrespective of the size of the entity.

- The quantity of evidence may be less than for a larger organisation due to fewer transactions being carried out.

- It may be more efficient to carry out 100% testing in a smaller organisation.

Problems

- Management override – Smaller entities will have a key director or manager who will have significant power and authority. This could mean that controls are lacking in the first place or they are easy to override.

- No segregation of duties – Smaller entities tend to have a limited number of accounts clerks who process information. To overcome this the directors should authorise and review all work performed.

- Less formal approach – Smaller entities tend to have simple systems and very few controls due to the trust and the lack of complexity. It is therefore difficult to test the reliability of systems and substantive testing tends to be used more.

12 Audits of Not-For-Profit Organisations

Not-for-profit (NFP) organisations include charities and public sector entities.

Below are some important features of a NFP.

- Profit maximisation is not their main objective. Objectives will be either social or philanthropic.

- There are no shareholders.

- They will not distribute dividends.

Financial statements

NFP organisations such as charities which are not established as charitable companies will need to prepare:

- A statement of financial activities – showing income and expenditure similar to a statement of profit or loss. As the organisation does not exist to make a profit, any additional income over expenditure is known as a surplus and any expenditure in excess of income is a deficit.

- A balance sheet – showing assets and liabilities, the same as a statement of financial position.

- A cash flow statement.

- Notes to the financial statements.

Audit risks

Control risk

Some NFP entities, particularly small charities, may have weaker control systems due to:

- being controlled by trustees who usually only work on a part time basis and are volunteers. They may not devote sufficient time to adequately oversee the strategic direction of the organisation.

- a lack of segregation of duties, as the organisation may not employ many staff in order to keep overheads down.

- the use of volunteers, who are likely to be unqualified and have little awareness of the importance of controls.

- the use of less formalised .

Income

With many charities, much of the income received is by way of donation. Some of these transactions will not be accompanied by invoices, orders or despatch notes. For cash donations in particular there is a greater risk of theft.

NFPs may apply for grant income which will only be provided if certain criteria are met otherwise the money may have to be repaid. There is a risk that grant income may have to be repaid if the organisation does not use the money for its intended purpose.

Restricted funds

Some donations are given with clauses stating the money must be used for a particular reason. For example, money may be donated to a hospital for them to purchase a specific piece of equipment or to be used by a specific department. These restricted funds must be shown separately in the balance sheet and the auditor must review donations to ensure that restricted funds are shown as such.

Going concern

Assessing the going concern status of a NFP entity may also be more difficult, particularly for charities who are reliant on voluntary donations. Many issues, such as the state of the economy, could impact on their ability to generate income in the short term. Trends can also have an effect. For example charities raising money for medical research such as cancer and heart disease are seeing higher numbers of donations whereas charities such as animal protection are seeing a decline in income.

Complexity of regulations

NFPs may have complex internal and external regulations governing their activities, reporting requirements and taxation system. This will mean the audit team should have knowledge of these regulations and experience of auditing this type of specialised entity in order to be able to perform the audit with sufficient competence and due care.

Audit testing

Sufficient appropriate evidence will still need to be obtained through either a mixture of tests of controls and substantive procedures or just substantive procedures if the controls are ineffective or not in place.

Procedures will still involve enquiries, inspection, analytical procedures, etc.

Other planning activities

In addition to the specific audit risks that need to be considered at the risk assessment stage, the same planning activities are required as for the audit of a company. Differences that will require consideration are:

- The materiality assessment may be lower to address the higher risk and therefore more testing.

- The choice of audit team staff should include staff with experience of this type of entity and knowledge of the regulations and financial reporting requirements.

Reporting

If sufficient appropriate evidence is not obtained with respect to the above matters as well as the usual risks of material misstatement faced by any organisation, the auditor will have to modify the auditor’s report.

Other reporting responsibilities

Quite often, the scope of the external audit of a NFP is much larger than that for a company.

Auditors of NFPs may be required to perform additional assignments such as:

- Value for money audits – assessing whether the organisation is getting the most out of the money spent. These are discussed in more detail in the ‘Internal audit’.

- Regularity audits – ensuring the expenditure of the organisation is in accordance with the regulations/legislation governing it.

- Performance indicators – auditing the targets of the organisation that have to be reported to stakeholders such as waiting times in an A&E department.

Test your understanding 6

- List and explain FOUR assertions from ISA 315 Identifying and Assessing the Risk of Material Misstatement Through Understanding the Entity and its Environment that relate to the recording of classes of transactions.

(4 marks)

- List FOUR assertions relevant to the audit of tangible non-current assets and state one audit procedure which provides appropriate evidence for each assertion.

(4 marks)

Test your understanding 7

You are an audit senior working at a medium sized firm of auditors. One of your clients is an exclusive hotel, Numero Uno, situated in the centre of Big City.

Numero Uno prides itself on delivering a first class dining experience and is renowned for its standards of service and cooking that few restaurants in the country come close to. Its inventory therefore consists of the very best foods and beverages from across the globe.

Food products held in inventory are mostly fresh as the head chef will only work with the very best ingredients. Food inventory is stored in the kitchens and managed by the head chef himself.

The majority of beverages held at the hotel are expensive wines that have been sourced from exclusive vineyards. The hotel also stocks a wide range of spirits and mixers. All beverages are stored either in the hotel cellar or behind the bar. The cellar can only be accessed by the duty manager who holds the key. As part of your audit procedures you will attend the year-end inventory count of the hotel’s beverages.

Required:

- Describe the audit procedures an auditor would conduct before and whilst attending the inventory count of the beverages in the hotel.

(7 marks)

- Identify and explain THREE financial statement assertions that are most relevant to inventory.

(3 marks)

- Apart from attending the inventory count, describe the substantive procedures an auditor would carry out to confirm the valuation of the wine and spirits held in inventory at the year-end.

(5 marks)

(Total: 15 marks)

Test your understanding 8

- Describe the steps an auditor should take when conducting a trade receivables confirmation (circularisation) test.

(3 marks)

- Explain why a direct confirmation test may not provide sufficient appropriate audit evidence on its own.

(3 marks)

You are the audit manager in charge of the audit of Builders Mate, a limited liability company. The company’s year-end is 31 March, and Builders Mate has been an audit client for three years. Builders Mate sells small tools, plant and equipment exclusively to the building trade. They have 12 warehouse style shops located throughout the country. Builders Mate does not manufacture any products themselves.

The audit fieldwork is due to commence in 3 weeks time and you are preparing the audit work programme for the trade receivables section of the audit. Extracts from the client’s trial balance show the following information.

From your review of last year’s audit file you have determined that last year there were 2 specific allowances of $5k and $2k as well as a 3% general allowance.

| $ | |

| Trade receivables control account | 124,500 |

| General trade receivables allowance | (2,490) |

| Specific trade receivables allowance | 0 |

From your review of last year’s audit file you have determined that last year there were 2 specific allowances of $5k and $2k as well as a 3% general allowance.

Initial conversations with the client indicate that there are no specific allowances that are to be made this year however they intend to reduce the general allowance from 3% to 2%.

You are aware that two of Builders Mate’s major customers went into administration during the year and they are likely to be liquidated in the near future. Both of these customers owed material amounts at the year-end.

Required:

- Describe substantive procedures the auditor should perform on the year-end trade receivables of Builders Mate.

(9 marks)

- Describe how audit software could facilitate the audit of trade receivables.

(4 marks)

(Total: 20 marks)

Test your understanding 9

You are auditing the revenue section of the financial statements of Ningaloo Co. Tests of controls have been performed and have been evaluated as effective. Substantive procedures have not yet been performed. During the risk assessment you identified that a performance related bonus has been introduced for salesmen who reach a target sales figure each quarter.

- Which of the following statements is correct?

A As controls are working effectively within Ningaloo Co the audit plan does not need to contain any substantive procedures as full reliance can be placed on the control system

B The auditor will perform the same level of substantive procedures as were performed in the prior year

C The level of substantive procedures may be reduced as a result of the controls being found to work effectively

D The level of substantive procedures should increase if controls are found to be working effectively

- ‘Select a sample of goods despatched notes from just before and just after the year-end and trace to the sales day book’. Which of the following financial statements does the described audit procedure help to confirm?

A Occurrence

B Completeness C Cut-off

D Accuracy

- Which of the following statements is correct with regard to directional testing?

A A procedure that directly tests receivables for overstatement would indirectly test revenue for understatement

B A procedure that directly tests receivables for overstatement would indirectly test revenue for overstatement

C To test revenue for overstatement the auditor must choose a sample from outside of the accounting system, such as GDNS, and trace them into the accounting system

D To test revenue for understatement the auditor must choose a sample from within the accounting system and trace it to the

GDN

- Which of the following is an analytical procedure that can be used to test revenue?

A Comparison of revenue in the current year to revenue in the prior year

B Review of credit notes issued post year-end

C Inspection of a sample of goods despatch notes and sales invoices

D Recalculation of the sales day book

- Sales managers have recorded fictitious sales in order to earn a larger bonus. Which of the following assertions is affected by this?

A Existence

B Completeness C Accuracy

D Occurrence

Test your understanding 10

You are performing procedures over the non-current assets balance for your client Leveque Co. The balance consists of motor vehicles, fixtures and fittings and land and buildings. Motor vehicles are replaced on a three year cycle. Fixtures and fittings are replaced as and when required. The company uses the following depreciation rates:

- Land and buildings – no depreciation is charged due to values increasing

- Fixtures and fittings – 10% straight line

- Motor vehicles – 20% straight line.

- Which of the following best describes the audit risk resulting from the depreciation policy used for land and buildings?

A Land and buildings may not exist

B Land and buildings may not be completely recorded C Land and buildings may be understated

D Land and buildings may be overstated

- Which of the following procedures provides the most reliable evidence to assess whether 10% straight line is an appropriate rate for fixtures and fittings?

A Enquire of the client whether the rate is appropriate and how they chose that rate

B Contact the supplier of the fixtures to ask how long the fixtures should last

C Review disposals of fixtures and fittings to identify how long the assets had been used by Leveque and whether any significant profit or loss on disposal arose

D Compare the rate with other audit clients of your firm

- Which of the following statements is true in respect of Leveque’s motor vehicles?

A The depreciation rate is unreasonable as the company only uses the assets for three years therefore depreciation should be charged over three years

B Motor vehicles have a useful life of longer than five years therefore depreciation should be charged over a longer period

C The depreciation rate is reasonable

D The depreciation charge for motor vehicles is unlikely to be material therefore the rate used does not matter

- The audit plan includes a procedure to trace a sample of assets included in the non-current asset register to the physical asset. Which assertion is being tested?

A Existence

B Completeness C Valuation

D Rights and obligations

- Which of the following procedures provides the most reliable evidence when confirming rights and obligations for a non-current asset?

A Physical inspection of the assets

B Inspection of the fixtures and fittings invoice

C Inspection of a valuation report for land and buildings

D Written representation from management confirming ownership

Test your understanding 11

You are assigned to the audit team of Carnarvon Co performing testing over non-current assets.

- Which of the following is NOT an audit procedure from ISA 500 Audit Evidence?

A Inspection B Enquiry C Check

D Recalculate

- Which of the following audit procedures would confirm the existence of property, plant and equipment?

A Recalculation of depreciation using the company’s accounting policy

B Physical inspection of a sample of assets listed in the non-current asset register

C Reconcile the schedule of property, plant and equipment with the general ledger

D Review the repairs and maintenance expense account in the statement of profit or loss for items of a capital nature

- Which of the following is NOT a financial statement assertion relevant to your testing of non-current assets?

A Occurrence

B Completeness

C Rights and obligations D Existence

- Which of the following issues would result in a misstatement in the non-current assets balance?

- An error in recording the cost of the asset.

- A misclassification between fixtures & fittings and motor vehicles.

- The depreciation charge has been correctly credited to accumulated depreciation but debited to the irrecoverable debt expense account.

- A purchase invoice not being recorded in the asset register.

- (ii) and (iv)

- (i) and (iii)

- (ii) and (iii)

- (i) and (iv)

- When testing the assertion of rights and obligations over land and buildings, which of the following would provide the most reliable evidence?

- Inspection of the insurance policy

- Physical inspection of the land and buildings

- Inspection of the title deeds

- Inspection of the non-current asset register

Test your understanding 1 – Bank and cash

- Obtain the bank reconciliation and cast to ensure arithmetical accuracy.

- Obtain a bank confirmation letter from Murray’s bankers to confirm existence and rights & obligations.

- Agree the balance per the cash book on the reconciliation to the year-end cash book and financial statements to confirm accuracy & valuation.

- Agree the balance per the bank statement to an original year-end bank statement and also to the bank confirmation letter to confirm accuracy & valuation.

- Trace all of the outstanding lodgements to the pre year-end cash book, post year-end bank statement and to paying-in-book pre year-end to confirm accuracy & valuation and existence.

- Trace all unpresented cheques through to a pre year-end cash book and post year-end statement. For any unusual amounts or significant delays obtain explanations from management to confirm accuracy & valuation and completeness.

- Examine any old unpresented cheques to assess if they need to be written back into the purchase ledger to confirm accuracy & valuation and completeness.

- Inspect the bank confirmation letter for details of any security provided by the company or any legal right of set-off as this may require disclosure to confirm appropriate presentation.

- Review the cash book and bank statements for any unusual items or large transfers around the year-end, as this could be evidence of window dressing. This verifies completeness, existence.

- Count the petty cash in the cash tin at the year-end and agree the total to the balance included in the financial statements to confirm accuracy & valuation, and existence.

Test your understanding 2 – Non-current assets

- Obtain the non-current asset register, cast and agree the totals to the financial statements: verifies completeness, classification, presentation.

- Select a sample of assets from the non-current asset register and physically inspect them: verifies existence.

- Select a sample of assets visible at the Murray’s premises and inspect the asset register to ensure they are included: verifies completeness.

- Inspect assets for condition and usage to identify signs of impairment: verifies valuation.

- For revalued assets, inspect the independent valuation report and agree the amount stated to the amount included in the general ledger and the financial statements: verifies valuation; and ensure that all assets in the same class have been revalued.

- Select a sample of additions and agree the cost to supplier invoice: verifies valuation.

- Obtain a list of additions and inspect the description to confirm that they relate to capital expenditure items rather than repairs and maintenance: verifies existence.

- Inspect a breakdown of repairs and maintenance expenditure for the year to identify items of a capital nature: verifies

- Inspect supplier invoices (for equipment), title deeds (for property), and registration documents (for motor vehicles) to ensure they are in the name of the client: verifies rights and obligations.

- If assets have been constructed by the client, obtain an analysis of the costs incurred, cast for arithmetical accuracy and agree a sample of costs to supporting documentation (e.g. payroll, material invoices): verifies valuation.

Disposals

- Obtain a breakdown of disposals, cast the list and agree all assets have been removed from the non-current asset register: verifies existence.

- Select a sample of disposals and agree sale proceeds to supporting documentation such as sundry sales invoices: verifies accuracy of profit on disposal.

- Recalculate the profit/loss on disposal and agree to the statement of profit or loss: verifies accuracy of profit on disposal.

Depreciation

- Inspect the capital expenditure budgets for the next few years to assess the appropriateness of the useful economic lives in light of plans to replace assets: verifies valuation.

- Recalculate the depreciation charge for a sample of assets to verify arithmetical accuracy: verifies accuracy, valuation.

- Inspect the financial statement disclosure of the depreciation charges and policies in the draft financial statements and compare to the prior year to ensure consistency: verifies presentation.

- Recalculate the depreciation charge for revalued assets to ensure the charge is based on the new carrying value: verifies accuracy, valuation.

- Review profits and losses on disposal of assets disposed of in the year to assess the reasonableness of the depreciation policies (if depreciation policies are reasonable, there should not be a significant profit or loss): verifies valuation.

- Compare depreciation rates to companies with the same type of assets to assess reasonableness: verifies valuation.

- Perform a proof in total calculation for the depreciation charged for each category of assets, discuss with management if significant fluctuations arise: verifies completeness, valuation. (Analytical procedure)

Test your understanding 3 – Inventory

- Before the inventory count

– Contact the client to obtain a copy of the inventory count instructions to understand how the count will be conducted and assess the effectiveness of the count process.

– Inspect prior year working papers to understand the inventory count process and identify any issues that would need to be taken into account this year.

– Book audit staff to attend the inventory counts.

– Ascertain whether any inventory is held by third parties, and if applicable determine how to gather sufficient appropriate evidence.

– Consider the need for using an expert to assist in valuing the inventory being counted.

– Send a letter requesting direct confirmation of inventory balances held at year-end from any third party warehouse providers used regarding quantities and condition.

- Audit procedures during the count Tests of controls

– Observe the count to ensure that the inventory count instructions are being followed. For example:

– No movements of inventory occur during the count.

– Teams of two people perform the count.

– Sections of inventory are tagged as counted to prevent double counting.

– Damaged/obsolete items have been separately identified so they can be valued appropriately.

– Inspect the count sheets to ensure they have been completed in pen rather than pencil.

– Inspect the count sheets to ensure they show the description of the goods but do not show the quantities expected to be counted.

– Re-perform the sequence check on the count sheets to ensure none are missing.

– Enquire of the counting staff which department they work in to ensure they are not warehouse staff.

Substantive procedures

– Select a sample of items from the inventory count sheets and physically inspect the items in the warehouse: verifies existence.

– Select a sample of physical items from the warehouse and trace to the inventory count sheets to ensure that they are recorded accurately: verifies completeness.

– Enquire of management whether goods held on behalf of third parties are segregated and recorded separately: verifies rights and obligations.

– Inspect the inventory being counted for evidence of damage or obsolescence that may affect the net realisable value: verifies valuation.

– Record details of the last deliveries prior to the year-end. This information will be used in final audit procedures to ensure that no further amendments have been made thereby overstating or understating inventory: verifies completeness & existence.

– Obtain copies of the inventory count sheets at the end of the inventory count, ready for checking against the final inventory listing at the final audit: verifies completeness and existence.

– Attend the inventory count at the third party warehouses: verifies completeness and existence.

- Substantive procedures to be performed during the final audit

– Trace the items counted during the inventory count to the final inventory list to ensure it is the same as the one used at the year-end and to ensure that any errors identified during counting procedures have been rectified: verifies completeness, presentation.

– Cast the list (showing inventory categorised between finished goods, WIP and raw materials) to ensure arithmetical accuracy and agree totals to financial statement disclosures: verifies completeness, classification.

– Inspect purchase invoices for a sample of inventory items to agree their cost to verify valuation.

– Inspect purchase invoices for the name of the client to verify rights.

– Inspect post year-end sales invoices for a sample of inventory items to determine if the net realisable value is reasonable. This will also assist in determining if inventory is held at the lower of cost and net realisable value: verifies valuation.

– Inspect the ageing of inventory items to identify old/slow-moving amounts that may require an allowance, and discuss these with management: verifies valuation.

– Recalculate work-in-progress and finished goods valuations using payroll records for labour costs and utility bills for overhead absorption: verifies valuation.

– Trace the good received immediately prior to the year-end to year-end payables and inventory balances: verifies completeness & existence.

– Trace goods despatched immediately prior to year-end to the nominal ledgers to ensure the items are not included in inventory and revenue (and receivables where relevant) has been recorded: verifies completeness & existence.

– Calculate inventory turnover/days ratio and compare this to prior year to identify slow-moving inventory which requires an allowance to bring the value down to the lower of cost and NRV: verifies valuation. (Analytical procedure)

– Calculate gross profit margin and compare this to prior year, investigate any significant differences that may highlight an error in costs of sales and closing inventory: verifies valuation.

(Analytical procedure)

Test your understanding 4 – Receivables

- Jockeys: the outstanding balance is over 20% of the total receivables balance at the year-end and is therefore material.

Golf is Us: this large and old balance may require write-off or a specific allowance to be made if the recoverability of the amount is in doubt (similarly for Escot supermarket).

Tike & Co: the large and old credit balance on the listing suggests that an error may have been made. A payment from another customer may have been misallocated to this account or the client may have overpaid an invoice, or paid an invoice twice in error. It may be appropriate to reclassify this balance, along with the balance for Whistlers, as a trade payable.

Whistlers: although the amount is small, the credit balance appears to be due to a difference between a recent large payment and the outstanding balance. This error may indicate other potential errors, and requires further investigation.

There are other balances that could be identified and justified for similar reasons to the above.

- Receivables procedures

– Obtain the aged receivables listing, cast it and agree the total to the financial statements: verifies accuracy and presentation.

– Agree the receivables ledger control account with the receivables ledger list of balances: verifies completeness and existence.

– Select a sample of year-end receivable balances and agree back to valid supporting documentation of GDN and sales order: verifies existence.

– Inspect after date cash receipts and follow through to pre year-end receivable balances: verifies valuation, rights and obligations and existence.

– Select a sample of goods despatched notes (GDN) before and just after the year-end and follow through to the sales invoice to ensure they are recorded in the correct accounting period: verifies completeness and existence (cut-off of revenue).

– Perform a positive receivables circularisation of a representative sample of Murray Co’s year-end balances, for any non-replies, with Murray Co’s permission, send a reminder letter to follow-up: verifies existence and rights and obligations.

– Inspect the aged receivables report to identify any slow-moving balances (such as Bibs and Balls, Golf is Us, James Smit Partnership) and discuss these with the credit control manager to assess whether an allowance or write-down is necessary: verifies valuation and allocation.

– Discuss any significant balances with management (such as Escot, Jockeys, Golf is Us, James Smit Partnership, Stayrose Supermarket) to identify any issues regarding payment: verifies valuation.

– Inspect customer correspondence in respect of any slow-moving/aged balances to assess whether there are any invoices in dispute: verifies existence and rights and obligations.

– Inspect board minutes of Murray Co to assess whether there are any material disputed receivables that may require write-off: verifies existence and rights and obligations.