INTRODUCTION

Financial accounting is a branch of economics. It involves gathering, recording, summarising and presenting information to the various users of financial information.

THE OBJECTIVE OF FINANCIAL STATEMENTS

The objective of financial statements is to provide information about the financial position, performance and changes in financial position of an entity that is useful to a wide range of users in making economic decisions.

Financial position reveals information about the economic resources that an entity controls, its financial structure, its liquidity and solvency and its ability to change. This information is contained in the Statement of Financial Position. Changes in financial position are revealed in a Cash Flow Statement.

Financial Performance means the return obtained on the resources which the entity controls.

This information can be extracted from the profit and loss account. In International Accounting the profit and loss account is referred to as the Statement of Comprehensive Income .

The Reporting Entity

Financial Statements report on all of the activities and resources under the control of the entity that has prepared them whether it is a sole trader, a club or society or a limited company.

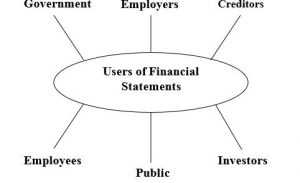

USERS OF FINANCIAL STATEMENTS

Users of financial statements include the following:

- Existing and potential shareholders

Information is required in relation to profit, dividends, trends and prospects in connection with share price.

- Loan Creditors

Information is required in relation to liquidity and to highlight the risk of non-payment.

- Business Contact Groupe. suppliers, customers, competitors and merger/acquisition situations. Information is required to ensure ability to pay debts, continuity of supply and trade information.

- Analysts and investors

Information on performance, trends and prospects is required for clients

- Government

Information is required as a base for taxation and to ensure compliance with company law

- Employees

Information about employment security and to assist with collective pay bargaining

Public

Any member of the public may require details of the contribution to the local and national economy made by the company and the environmental impact.

STEWARDSHIP AND ECONOMIC DECISIONS

Stewardship entails the safekeeping and proper use of an entity’s resources and their efficient and profitable use. Existing investors assess management’s stewardship in order to decide whether to seek a change in management or to change the level of their shareholding in the entity.

THE QUALITATIVE CHARACTERISTICS OF FINANCIAL INFORMATION

In deciding what information should be included in financial statements, when it should be included and how it should be presented, the aim is to ensure that financial statements yield useful information. Financial information is useful if it is:

| Relevant | – | If it has the ability to influence the economic decisions of users and is provided in time to influence those decisions |

| Reliable | – | Reliability is characterised by:

• Faithful representation • Substance over form recognition of the economic substance of a transaction over its legal form • Neutrality – free from bias • Prudence – a degree of caution in making estimates in conditions of uncertainty • Completeness – an omission can cause information to be false or misleading |

| Comparable | – | It enables users to discern and evaluate similarities in, and differences between, the nature and effects of transactions and other events over time and across different reporting entities. |

Understandable – Its significance can be perceived by users who have a reasonable knowledge of business and economic activities and accounting and a willingness to study with reasonable diligence the information provided.

If a conflict arises between these characteristics, a trade-off needs to be found that still enables the objective of financial statements to be met. For example, if the information that is the most relevant is not the most reliable and vice versa, it will usually be appropriate to use the item of information that is the most relevant of those that are reliable.

Financial information with the above characteristics will be most useful to the users of financial statements. In deciding whether to present financial information separately in the financial statements the accountant must assess the information’s ability to influence economic decisions it is considered to be material and should be presented separately in the financial statements.

COMPONENTS OF FINANCIAL STATEMENTS

The primary financial statements are currently:

- Trading Profit and Loss Account/the Statement of Comprehensive Income

- A Statement of Changes in Equity

- The Statement of Financial Position

- The Cash Flow Statement

Notes to these primary financial statements are used to amplify and explain the primary statements. The notes on primary financial statements form an integral part of the financial statements.

THE STATEMENT OF FINANCIAL POSITION

This is a financial statement of the assets, liabilities and ownership interests drawn up at a particular point in time. This point in time for the annual financial statement is referred to as the entity’s year end.

THE STATEMENT OF COMPREHENSIVE INCOME (PROFIT & LOSS)

The Statement of Comprehensive Income details the trading results for the period. It details the Revenue earned and the expenses incurred.

THE STATEMENT OF CHANGES IN EQUITY

A statement of changes in equity shows the following items:

- Net profit/loss for the period

- Gains/losses recognised directly in equity e.g. surplus on revaluation of land and buildings

- Cumulative effect of changes in accounting policy and the correction of fundamental errors (per IAS 8, which will be dealt with in a later chapter)

- Capital transactions with owners, for example, dividend payments share issue.

- Accumulated profit/loss − At start of the year

− Movement for year

− At end of year

- Reconciliation between carrying amount at the start and end of the year for:

− Each class of equity

− Share premium

− Each reserve

THE CASH FLOW STATEMENT

This statement shows the increase or decrease in the amount of cash/cash equivalents the entity has generated since the previous year end.

ELEMENTS OF FINANCIAL STATEMENTS

Financial statements need to reflect the effects of transactions and other events on the reporting entity’s financial performance and financial position. This involves a high degree of classification and aggregation. Order is imposed on this process by specifying and defining the classes of items – the elements – that encapsulate the key aspects of the effects of those transactions and other events. The main elements and their definitions are as follows:

- Assets – a resource controlled by an entity as a result of past events from which future economic benefits are expected to flow. Assets are broken down between current assets and non-current assets (formerly known as fixed assets).

- Liabilities – present obligations of the entity arising from past events, settlement of which is expected to result in an outflow of resources embodying economic benefits. Liabilities are broken down between current liabilities and non-current liabilities.

- Equity – the residual interest in the assets of the entity after deducting all its liabilities.

- Income – increases in economic benefits in the form of inflows of assets or decreases of liabilities that result in increases in equity.

- Expenses – decreases in economic benefits in the form of outflows of assets or incurrence of liabilities that result in decreases in equity.

- Assets

Future Economic Benefits – If an item does not generate future economic benefits it is not an asset. There must be evidence that cash will be received in the future.

Controlled by an Entity – Though ownership is not essential control is a vital element. Control means the ability to restrict use.

Past Transactions or Events – The transaction or event must be in the past before an asset can arise. Access to economic benefits obtained after the Statement of Financial Position date cannot constitute an asset.

- Liabilities

Obligations – These may be legal or constructive. A legal obligation derives from a contract, legislation or other operation of law. A constructive obligation derives from the entity’s actions e.g. refunds to dis-satisfied customers.

Transfer of Economic Benefits – This normally represents a transfer of cash but could involve the exchange of an asset e.g. trade in of a motor vehicle.

Obligations that are not expected to result in a transfer of economic benefits e.g. the guarantee of a loan, are referred to as contingent liabilities

Past Transactions or Events – The transaction or event must be in the past.

RECOGNITION IN FINANCIAL STATEMENTS

The objective of financial statements is achieved to a large extent by showing in the primary financial statements, in words and by a monetary amount, the effects that transactions and other events have on the elements. This process is known as recognition.

For example, if the effect of a transaction is to create a new asset or liability or to add to an existing asset or liability, that new asset or liability or addition will be recognised in the Statement of Financial Position if there is sufficient evidence that it exists and it can be measured reliably enough as a monetary amount. A gain or loss will be recognised at the same time, unless there has been no change in the total net assets or the whole of the change is the result of capital contributions or distributions.

MEASUREMENT IN FINANCIAL STATEMENTS

In order that an asset or liability can be recognised, it needs to be assigned a monetary carrying amount. Two measurement bases could be used for this purpose:

- Historical Cost – which is the lower of cost and recoverable amount (as defined below) Or

- Current Value – which is the lower amount of replacement cost and recoverable amount.

Most assets and liabilities arise from arm’s length transactions. In such circumstances and regardless of the measurement basis used, the carrying amount assigned on initial recognition will be the transaction cost.

The carrying amounts derived from the two bases will usually change after initial recognition, making it necessary to decide which basis to use. The approach adopted by many entities involves measuring some Statement of Financial Position categories at historical cost and some at current value. Although this is often referred to as the modified historical cost basis, it is more accurately referred to as the mixed measurement system.

It is envisaged that the measurement basis used for a category of assets or liabilities will be determined by reference to factors such as the objective of financial statements, the nature of the assets or liabilities concerned and the particular circumstances involved. It is also envisaged that a separate decision as to the appropriate measurement basis will be taken for each Statement of Financial Position category. That decision will need to be kept under review as accounting thought, access to markets, and circumstances change.

Whatever the measurement base chosen, the carrying amount may need to be changed from time to time. This process is known as re-measurement.

- When historical cost measure is used, re-measurements are necessary to ensure that items are stated at the lower of cost and recoverable amount.

- When a current value is used, re-measurements are necessary to ensure that items are stated at up to date current value.

Re-measurements will be recognised only if there is sufficient evidence that the monetary amount has changed and the new amount can be measured with sufficient reliability.

Recoverable amount is the higher of realisable value and value in use. Realisable value is the amount that could be obtained by selling the asset in an orderly disposal. Value in use is the present discounted value of the future cash flows obtainable as a result of an asset’s continued use, including those resulting from its ultimate disposal.

THE HISTORICAL CONVENTION/SYSTEM

Conventionally, financial accounts are based on historical cost – which is assets/liabilities recorded in the Statement of Financial Position at their cost of acquisition. Expenses are charged against revenues in determining profit based upon historic cost of assets used in generation of the revenues.

Advantages of Historical Cost Accounting:

- Consistent with fundamental accounting concepts

- Objective and the information it produces is easily verified.

- Simple and inexpensive to record the information.

- Easily understood by the users of financial statements.

Disadvantages of Historical Cost Accounting:

- Assets values unrealistic, in particular land and buildings.

- Comparisons over time meaningless.

- Maintenance of the physical substance of business ignored.

THE ACCOUNTING PROFESSION AND THE ROLE OF THE ACCOUNTANT

Professional independence is a concept fundamental to the accountancy profession. It is essentially an attitude of mind characterised by integrity and an objective approach to professional work. A practising member should both be and appear to be, in each professional assignment he undertakes, free of any interest, which might be regarded, whatever its actual effect, as being incompatible with objectivity. The fact that this is selfevident in the exercise of the reporting function must not obscure its relevance in respect of other professional work. Accountants cannot avoid external pressures on their integrity and objectivity in the course of their professional work, but they are expected to resist these pressures. They must, in fact, retain their integrity and objectivity in all phases of their practice and, when expressing “opinions” on financial statements avoid involvement in situations that would impair the credibility of their independence in the minds of reasonable people familiar with the facts.

The accountancy profession exists to ensure that all interested parties entitled to knowledge of certain facts have those facts presented objectively. That is the essence of high professional standards and is as appropriate to the accountant in commerce and industry as to the accountant in public practice. Anything, which tends to impair or might appear to impair objectivity, in relation to any particular assignment or client must cast grave doubt on the propriety of the accountant acting in the assignment for the client in question. Examples of undesirable financial involvement are

- An accountant should not make a loan to a client or guarantee a client’s overdraft

- A loan should not be accepted from a client

- An accountant should not give advice to a client, where such advice, if acted upon would result in receipt of commission by the accountant, unless the client is made aware of the receipt of such commission

It is undesirable that a practice should derive too great a part of its professional income from one client or group of connected clients. A practice, therefore, should endeavour to ensure that the recurring fees paid by one client or group of connected clients do not exceed 10% of the gross fees of the practice or, in the case of a member practising parttime, 10% of his gross earned income. It is recognised that a new practice seeking to establish itself or an old practice running itself down may well not, in the short term, be able to comply with this criterion. If a member is dependent for his income on the profits of any one office within a practice and the gross income of that office is regularly dependent on one client or a group of connected clients for more than 10% of its gross fees, a partner from another office of the practice should take final responsibility for any report made by the practice on the affairs of that client.

The conduct towards which an accountant should strive is embodied in six broad principles stated as affirmative Ethical Principles:-

- Independence, Integrity and Objectivity

An accountant should maintain his/her integrity and objectivity and, when engaged in the practice of public accounting, be independent of those he/she serves 2. Competence and Technical Standards

An accountant should observe the profession’s technical standards and strive continually to improve this competence and the quality of his/her services

- Responsibilities to Clients

An accountant should be fair and candid with his/her clients and serve them to the best of his/her ability, with professional concern for their best interests, consistent with his/her responsibilities to the public

- Responsibilities to Colleagues

An accountant should conduct himself/herself in a manner, which will promote cooperation and good relations among members of the profession

- Other Responsibilities and Practice

An accountant should conduct himself/herself in a manner, which will enhance the

stature of the profession and its ability to serve the public

- Responsibility of Members Not In Practice

An accountant not in practice must uphold the standards and etiquette of the profession The foregoing Ethical Principles are intended as a broad guideline. They constitute the philosophical foundation upon which the professional conduct of accountants is based.