GENERALLY ACCEPTED ACCOUNTING PRINCIPLES (GAAP)

The phrase Generally Accepted Accounting Principles is a technical accounting term that encompasses the conventions, rules and procedures necessary to define accepted accounting practice at a particular time. It includes not only broad guidelines of general application, but also detailed practices and procedures. These conventions, rules and procedures provide a standard by which to measure financial presentations.

GAAP includes the requirements of the Companies Acts and accounting standards. It also includes acceptable accounting treatments whether or not they are set out in law and accounting standards.

Sources of GAAP

The main sources of GAAP are:

- Company Law

- International and Local Accounting Standards

- Stock Exchange Requirements

- The International Framework for the preparation and presentation of financial

- Any other generally accepted concepts and principles e.g. the money measurement concept.

THE REGULATORY FRAMEWORK – NON STATUTORY

Accounting rules and regulations in certain jurisdictions for example (Ireland, UK) are governed by a Financial Reporting Council (FRC). The FRC (UK & Ireland) has two divisions – the Accounting Standards Board (ASB) and the Review Panel. There are 25 members on the council plus some observers, comprising a chairman and three deputy chairmen. Member representation is from both users and preparers and from auditors and drawn from three broad establishments – the accountancy profession, the financial community and the world of business and administration at large. The council meets approximately three times a year.

The main functions of a Financial Reporting Council (FRC) are to:

- Provide funding for its two divisions – the ASB and the Review Panel.

- Enforce compliance with standards currently in issue and in particular to the Review Panel – it is the FRC which takes companies to court to enforce changes to accounts where a company has refused to make changes recommended by the review panel.

- Set a general work programme for the ASB.

- Give guidance to the ASB and the Review Panel to ensure their work is carried out efficiently and economically.

- Provide a forum for public debate and support of accounting standards.

Prior to the creation of the FRC (UK & Ireland) accounting rules and regulations were governed by the Accounting Standards Committee (ASC). In total the ASC issued 25 Statements of Standard Accounting Practice (SSAP) covering such areas as stocks and long term contracts research and development and post balance sheet events.In Rwanda: The Companies Act, Law No 7/2009 of 27/4/2009 Relating to Companies (Article 254 and others) mandates the application of International Accounting Standards with regard to financial reporting by the registered companies. At present, the banks and other financial institutions are required by the National Bank of Rwanda to follow IFRS. The newly established ICPAR has been legally mandated to prepare accounting and auditing standards consistent with IFRS and ISA respectively.

International Accounting Standards Board (IASB): In April 2001 the International

Accounting Standards Board was formed to take over the work of the International Accounting Standards Committee (IASC).

The International Accounting Standards Committee was set up in 1973. The role of this body was to formulate and publish accounting standards to be observed in the presentation of financial statements and to promote their world-wide acceptance and observance and to work for the improvement and harmonisation of regulations, accounting standards and procedures relating to the presentation of financial reporting.

Objectives of the IASB

The objectives of the IASB are set out in its mission statement:

- “To develop, in the public interest a single set of high quality, understandable and enforceable global accounting standards that require high quality transparent and comparable information in financial statements.”

- To promote the use of rigorous application of these standards.

- To work actively with actual standard-setters to achieve conveyance of accounting standards around the world.

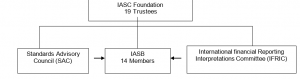

These are 19 individuals from different geographical and functional backgrounds.

Among their functions are the appointment of the Council, The Board and The Interpretation Committee. Also they monitor the effectiveness of the IASB, secure funding and approve budgets and have responsibility for constitutional change.

IASB

This comprises 14 members (12 full time) who are appointed by the trustees for an initial term of three to five years. The Board’s responsibilities include:

- Develop and publish discussion documents for public comment

- Prepare and issue exposure drafts

- Setting up procedures for reviewing comments received on documents published for comment

- Preparation and issue of International Accounting Standards

Standards Advisory Council (SAC)

About 45 members make up the Standards Advisory Council. It meets in public at least three times a year with the Board. It advises the Board on agenda decisions and priorities.

International Financial Reporting Interpretations Committee (IFRIC)

The committee is made up of accounting experts from different countries. The objective of IFRIC is to develop conceptually sound and practicable interpretations of International Accounting Standards to be applied on a global basis.

These interpretations are developed for financial reporting issues not specifically addressed by the International Accounting Standard and where unsatisfactory conflicting interpretations of a standard have developed. These pronouncements have the same force as an International Accounting Standard.

Discussion Documents

The IASB develops and publishes discussion documents. These represent a study of a financial reporting issue. They present alternative solutions to the issue under consideration and set out arrangements and implications relative to each. Following the receipt of comments IASB develops and publishes on Exposure Draft.

Exposure Draft

An exposure draft is a proposed accounting standard. The IASB invites comments thereon. After a reasonable time period, normally 120 days, an accounting standard is produced.

International Accounting Standards/International Financial Reporting Standards The International Accounting Standards Committee (IASC) produced accounting standards called International Accounting Standards (IAS). It has published 41 International Accounting Standards some of which are no longer in force.

The International Accounting Standards Board, which took over from the IASC produces accounting standards called International Financial Reporting Standards IFRS. To date it has produced five of these.

Rwandan Stock Exchange

Public limited companies (Ltd) are required to observe requirements as set by the Rwandan Stock Exchange. Most of its requirements are covered by compliance with company law.

Statements of Recommended Practice (SORPs)

Statements of Recommended Practice are developed in the public interest and set out current best accounting practice. The primary aims in issuing SORPs are to narrow the areas of difference and variety in the accounting treatment of the matters with which they deal and to enhance the usefulness of published accounting information. SORPs are issued on subjects on which it is not considered appropriate to issue an accounting standard at the time.

SORPs may be developed and issued by the Accounting Standards Board or they may be developed and issued by an “industry” group which is representative of the industry concerned for the purpose of the developing SORPs specific to that industry and is recognised as such by the ASR. Such SORPs are sent for approval and franking by the ASB and are referred to as “franked SORPs”. Before approving and franking a franked SORP, the ASB will review the proposed statement and the procedures involved in its development.

Although SORPs are not mandatory, entities falling within their scope are encouraged to follow them and to state in their accounts that they have done so. They are also encouraged to disclose any departure from the recommendations and the reasons for it. The provisions need not be applied to immaterial items.

Advantages of Standards

- Provide the accounting profession with a manual of useful working rules

- Forces improvements in the quality of the work of the accountant

- Strengthen the accountant’s resistance against pressure from directors to use an accounting policy which may be suspect

- Ensure that the users of financial statements get more complete and clearer information on a consistent basis from period to period

- Help in the comparison users may make between the financial statements of one organisation and another

- Direct financial statements towards establishing the economic truth of the entity’s performance

Disadvantages of Standards

- The working rules are bureaucratic and lead to rigidity

- The quality of the work is restricted because firms and industries differ and change, as do the environments within which they operate. Standards, which are based on averages, lead to rigidity and reduce the scope for professional judgements.

- Official acceptance reduces the accountant’s strength to resist the application of an inappropriate standard when the directors wish to follow it

- Users are likely to think that the financial statements produced using accounting standards are infallible

- Although providing formulae, standards are still low for the figures used as inputs are selected with some subjectivity, which reduces the possible benefits of comparison between firms, when the input base may not be known

- They have been derived through social or political pressures which may reduce the freedom and lead to manipulation of the profession

- They impair the development of critical thought

- The more standards there are the more costly the financial statements are to produce True and Fair

True relates to the correctness of an item in the financial statements. Fair is a judgmental characteristic relating to the description and measurement of an item in the financial statements. Consider the following sentence: A motor vehicle cost RWF15,000,000 and its expected useful life is five years, the cost of RWF15,000,000 can be verified, it is true, however the useful life of five years is an estimate which can be regarded as fair. If the expected life was stated as 50 years this would not be regarded as fair.

Compliance with accounting standards is taken as the best indication that the financial statements show a true and fair view.

Framework for the Presentation and Preparation of Financial Statements

An accounting standard-setter’s conceptual framework or statement of principles describes the accounting model that it uses as the conceptual underpinning for its work. The Statement describes the standard-setter’s views on:

- The activities that should be reported on in financial statements

- The aspects of those activities that should be highlighted

- The attributes that information needs to have if it is to be included in the financial statements

- How information should be presented in those financial statements

The Purpose of the Framework

The framework documents can have a variety of roles. The main role of the Framework is to provide conceptual input into the IASB’s work on the preparation and appraisal of accounting standards. The Framework is not, therefore, an accounting standard, nor does it contain any requirements on how financial statements are to be prepared.

A number of the principles in the Framework play fundamental roles in existing accounting standards, for example, several draw on the statement’s definitions of assets and liabilities; IAS 37: Provisions, Contingent Liabilities and Contingent Assets.

The Framework therefore plays a very important role in the standard-setting process, although it is only one of the factors that the ASB takes into account when setting standards. Other factors include legal requirements, cost-benefit considerations, industry-specific issues, and the desirability of evolutionary change and implementation issues.

THE REGULATORY FRAMEWORK – STATUTORY

Company Law

The main law governing financial statements is the Companies Act Law no. 7/2009 of 27/4/2009 relating to companies.

- It applies to companies both private and public.

- All companies should file accounts with the Office of Registrar General.

- All accounts must show a true and fair view.

- IFRS and IASB standards must be adhered to.

CONCEPTS

Prior to the introduction of the Framework the following accounting concepts were used:

| Going Concern | Continuity of the entity in its present form for the foreseeable future/there is no intention to put the company into liquidation or to drastically cut back the scale of operations |

| Prudence | Cautious presentation of the entity’s financial position. Profits are recognised only when realised while losses are provided for as soon as they are foreseen |

| Accruals | Revenue earned in the period matched with costs incurred in earning it, not as money is received or paid |

| Consistency | There is similar accounting treatment of like items within each accounting period and from one period to the next |

| Entity | That the accounts recognise the business as a distinct separate entity from its owners |

| Money Measurement | Accounts only deal with those items to which a monetary value can be attributed |

| Materiality | If omission, misstatement or non-disclosure affects the view given, the item is material and disclosure is required |

| Substance over Legal Form | Recognises economic substance from legal form e.g. assets acquired on hire purchase |

| Stable Monetary Unit | That the value of the monetary unit used is consistent over time |

| Accounting Periods

|

Accounts are prepared for discrete time periods |