ECONOMIC INTEGRATION

All countries must devise a commercial policy which will govern their trading relationships with other countries. At an early stage in their economic development, countries might pursue a policy of self-sufficiency with a view to cultivating home industries. However, there are gains from specialisation and international trade (Section 13B) and there are few countries willing to forego these gains in the longer term.

Countries can enter into a variety of trading relationships including the following:

- Preferential tariffs: countries reduce tariffs for certain products from certain countries;

- Free trade area: participating countries agree to abolish tariffs and quotas with a view to liberalising merchandise trade;

- Customs union: participating countries agree to free trade among themselves but also they agree to common commercial policies regarding non-members;

- Single market: as well as the elimination of tariffs and quotas, members agree to the abolition of a range of non-tariff barriers (NTB’s); allow free factor mobility and adopt a common set of rules regarding competition, etc;

- Economic and Monetary Union (EMU): members agree to a single currency (or at least irrevocable locked exchange rates), a single Central Bank operating a common monetary policy and harmonisation of fiscal policies where appropriate.

The European Union (EU) was always more than merely a set of economic relationships between members. Since its inception in 1957, the EU (then called EEC) has had a strong political dimension. ‘Federalists’ wish to see the EU evolve into a modern superstate with power residing in European institutions such as the European Parliament and European Court of Justice. Others (‘confederalists’) prefer to see the EU remain as basically a set of agreements between sovereign governments. These want power to be exercised on an intergovernmental basis and exercised through a Council of Ministers representing national interests.

From an economics perspective however, the EU can conveniently be viewed as having evolved from the stage of customs union, is currently in the single market phase and planning to proceed to the EMU phase.

TRADE CREATION AND TRADE DIVERSION EFFECTS OF A CUSTOMS UNION

Up until the mid 1980s the economic relationship between members of the EU was largely that of a customs union with the addition of a Common Agricultural Policy financed through (a rather meagre) centralised budget.

When analysing the effects of a customs union it is important to realise that a customs union requires the harmonisation of two sets of tariffs: abolition of internal tariffs but the adoption of common external tariffs. The abolition of internal tariffs can be expected to have a tradecreation effect. However adopting a common external tariff can have a trade-diversion effect in certain circumstances.

Trade-creation occurs when a change in tariffs enables consumers to buy cheaper products from more efficient producers. Trade-creation benefits consumers and efficient producers at the expense of inefficient producers.

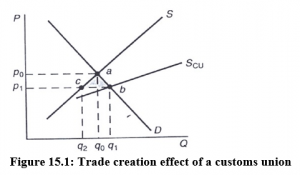

Trade-diversion occurs when a change in tariffs requires consumers to purchase higher cost products from less efficient producers. Trade-diversion benefits inefficient producers at the expense of consumers and efficient producers. This trade-diversion effect can occur if, when harmonising external tariffs, a country ends up with a relatively higher tariff on a product from a non-member that it was previously trading with. Figure 15.1 illustrates the tradecreation effect of a customs union.

Assume to begin with that a country prevents the importation of a particular product. If so the equilibrium in the domestic market will be determined at the intersection of the domestic supply (S) and domestic demand (D). This is at point a in Figure 15.1. with an equilibrium price of po and an equilibrium quantity of qo. Assume now that this country forms a customs union with one or more other countries. If the removal of trade barriers leads to foreign suppliers entering the domestic market, supply to the domestic market will expand. This effect is illustrated by the customs union supply curve (Scu). The new equilibrium will be at point b with an equilibrium price of p 1 and quantity of q 1.

Figure 15.1: Trade creation effect of a customs union

The giving to foreign suppliers freedom of entry to the home market has led to increased domestic consumption (q 0 → q 1) at a lower price (p 0 → p1). However at the lower price domestic producers will only supply q 2. Less efficient domestic producers have been squeezed out of the market resulting in a fall in domestic production (q 0 → q 2). The country is importing q 1 – q 2 from foreign suppliers and this represents the trade-creation effect. Consumers’ surplus has increased by p 1P 0 ab while there is a loss of profits to domestic firms of p 1P 0 ac . The result is a net welfare gain equal to the shaded triangle cab.

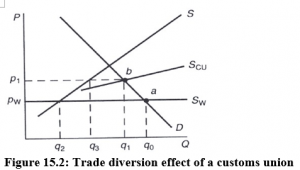

Figure 15.2: Trade diversion effect of a customs union

Figure 15.2 illustrates a trade-diversion effect resulting from a customs union. Sw represents the world supply of a product to an economy at a world price of p w. If we assume that initially the country imposes no barriers to the importation of this product the equilibrium will be at point a with a price of p w and domestic consumption at q 0. Of this, q 2 is supplied by domestic producers and q 0 – q 2 is imported.

If we assume that the country now enters a customs union which entails prohibitive tariff barriers for this product to non-members the relevant supply curve is now S cu. There is a new equilibrium at point b with price p 1 and quantity q 1. Inefficient customs union producers are now benefiting at the expense of consumers and more efficient world suppliers. Imports from efficient world producers (qo – q2) cease. Less efficient domestic producers increase production ( q 2 → q 3) .The country now imports q 1 – q 3 from less efficient producers in other members of the customs union. Consumer’s surplus falls by pwP1ba.

The Common Agricultural Policy traditionally meant high prices for EU farmers and high tariffs on imported foods. There would therefore have been significant trade-diversion effects on joining the EU for countries such as the UK who were major importers of food from nonmembers. As the Republic of Ireland’s trade with non-members was relatively small at the time of joining, trade-diversion effects were not likely to have been significant.

The net welfare effect of membership of a customs union will be influenced by the extent of trade-creation and trade-diversion effects. However, additional economic gains are likely to arise from the removal of internal tariffs in the form of greater efficiency due to the increased competition and also economies of scale resulting from larger markets.

THE SINGLE MARKET PROGRAMME

In 1987 the member states of the EU ratified the Single European Act (SEA). The SEA represented significant reform of the way in which the EU conducted its political and economic affairs. The economic dimension of the SEA was a commitment to a single market programme (SMP). Member states were given a five year adjustment period so that the single market could be in place by the end of 1992.

The background to the SMP was accumulating evidence that the EU was being outperformed economically by its major international competitors, i.e. the USA and Japan. In a range of areas such as job-creation, unemployment, international competitiveness (particularly in modern hi-tech sectors), investment in research and development, innovation, etc. the relative performance of the EU was an increasing cause for concern.

The poor performance was put down to the fragmentation of the EU economy. The EU represented a collection of distinct national economies that still retained a wide range of nontariff barriers (NTB’s) to trade rather than a single integrated European economy. These NTB’s had a distorting effect on intra-community trade and in many cases, prevented crossborder trade altogether. The EU had succeeded in removing tariffs and quotas on merchandise trade but the NTB’s remained a major obstacle to intra-community trade and competition.

The NTB’s come under four broad headings:

Physical barriers – delays at border crossings resulting from the monitoring of ‘imports’ and ‘exports’ – excessive paperwork associated with cross-border trade.

Technical barriers – different countries having different national standards regarding health and safety, etc. with the result that goods satisfying the requirements of one member country might not be permitted into another member country.

Fiscal barriers – indirect taxes influence retail prices. Different rates of tax have a distorting effect on trade particularly in border regions.

National preferences in public procurements – government contracts (roads, schools, hospitals, defence, etc.) represent approximately 15% of economic activity in the EU. The practice of governments was to give preference to local firms when awarding these contracts which effectively precluded cross-border competition.

The SMP is based on the four freedoms – free movement of goods, services, labour and capital. Firms supplying goods or services in one part of the single market should be free to supply the same in any other part. Workers from any part of the EU should be free to seek employment in any other part and on equal terms with local workers. There should be no restriction on investors from one member state transferring funds to any other member state.

The SMP has meant the abolition of border checks on goods (and within the Schengen group of countries on the movement of people). In the absence of the total harmonisation of standards, there should be mutual recognition so that goods or services satisfying the requirements of one member state should have unrestricted access to others. Policies for the approximation of indirect taxes have been agreed (despite the fact that national governments are extremely reluctant to give up their independence regarding general taxation). There is now a system of compulsory competitive tendering for public contracts with legal redress for firms who feel they are being discriminated against on the basis of nationality.

New competition rules have been devised with a view to creating a level playing field for firms competing in the single market. In particular, national governments are no longer free to subsidise domestic firms, nor are they free to restrict access to domestic markets. For example, the Irish government is no longer free to subsidise Aer Lingus, nor could it prevent BUPA entering the health insurance market to compete against the VHI and it was to open up the whole telecommunications sector to foreign competition by the year 2000.

The SMP is designed to create a more competitive economy in the EU. Greater efficiency should result from:

- more competitive pressure as barriers to entry are removed from national markets;

- improved resource allocation through freer play of comparative advantage;

- exploitation of economies of scale as firms gain access to larger markets;

- restructuring as firms adopt pan-European rather than national strategies;

- product innovation and process innovation resulting from greater competitive pressure.

The Cecchini Report published by the European Commission (1988) attempted to quantify the expected gains from the removal of the NTB’s (which were referred to as the costs of non-Europe).

Stage 1 gains would come through quickly as the removal of physical and technical barriers gave consumers greater choice by enabling firms to operate in wider markets. Cecchini estimated these static gains as being of the order of 2½% of (EU) GDP.

Stage 2 gains were longer term gains as industry adapted to the new more competitive environment. Restructuring would take place as domestic monopolies were forced to compete and firms in general sought to exploit the new opportunities. Cecchini estimated stage 2 gains as being of the order of 3% of (EU) GDP.

Stage 3 gains were macroeconomic benefits which were envisaged for the longer term. Improvements in economic conditions (more jobs, rising GDP) would relax the pressure on national budgets enabling governments to further stimulate their economies through fiscal measures. The best case scenario was an overall increase in GDP of 7% with increased employment of 5m.

The SMP has resulted in increased competition in many sectors of the EU economy. However, the results do not yet add up to the expectations in the Cecchini Report. A number of explanations can be advanced for the relatively poor outcome:

- Failure by governments to fully implement SMP measures particularly in the areas of state subsidies and public procurements.

- An unfavourable macroeconomic background to SMP. Tight monetary policy resulting in high interest rates in the EU in the early phase followed by tight fiscal policies designed to satisfy EMU requirements.

It is also possible that the Cecchini analysis is, at least partially, flawed:

- Overemphasis on the scope for exploiting economies of scale in the single market. Critics argue that economies of scope, i.e. the ability of firms to produce a flexible product mix, is of increasing importance.

- Failure to highlight issues other than NTB’s which may be greater sources of inefficiency. For example, the lack of flexibility in EU labour markets or the failure of managers to adopt advanced managerial techniques.

- National preferences on the part of consumers indicates that fragmentation is at least partially the result of demand-side rather than supply-side factors.

Whatever the longer term impact of the SMP, it is clear that it represents a major transfer of power from national governments to the European Commission in the economic sphere. Governments will inevitably have to adapt their industrial strategies and may be required to harmonise them in some respects. For example, as the SMP refuses to distinguish between private sector and state sector enterprises for the purposes of competition policy and as governments are restricted regarding subsidies, there is a developing trend to privatise state enterprises. In the longer term, the ability of governments and regional development agencies to offer special incentives in a competitive effort to attract FDI may be open to question.