Two long-term securities that are available to a company for raising capital are shares and debentures. Shares include ordinary shares and preference shares.* Ordinary shares provide ownership rights to investors. Debentures or bonds provide loan capital to the company, and investors get the status of lenders. Loan capital is also directly available from the financial institutions to the companies. What are the characteristics of loan capital and equity capital? What are their merits and demerits?

ORDINARY SHARES OR EQUITY

Ordinary shares represent the ownership position in a company. The holders of ordinary shares or equity, called shareholders (or stockholders in USA), are the legal owners of the company. Ordinary shares are the source of permanent capital since they do not have a maturity date. For the capital contributed by purchasing ordinary shares, the shareholders are entitled for dividends. The amount or rate of dividend is not fixed; the company’s board of directors decides it. An ordinary share is, therefore, known as a variable income security. Being the owners of the company, shareholders bear the risk of ownership; they are entitled to dividends after the income claims of others have been satisfied. Similarly, when the company is wound up, they can exercise their claims on assets after the claims of other suppliers of capital have been met.

Reporting of Ordinary Shares

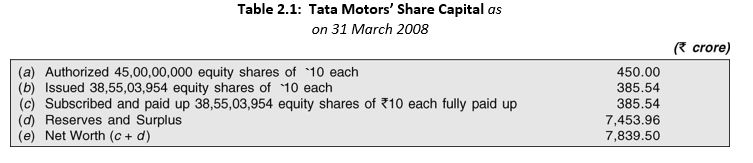

The capital represented by ordinary shares is called share capital or equity capital. It appears on the left-hand side of a firm’s account-form balance sheet or on the top of sources of capital in the step-form balance sheet. Details about share capital are generally contained in schedules attached to the balance sheet. Table 2.1 shows the details of share capital for the Tata Motors Company Limited.

Shareholder’s equity includes both ordinary shares and preference shares (if any). Therefore, the capital attributable to ordinary shares excludes preference shares capital. In Tata Motors’ case, the ordinary shareholders’ equity capital is: `7839.50 crore. Authorized share capital represents the maximum amount of capital, which a company can raise from shareholders. A company can, however, change its authorized share capital by altering its Memorandum of Association (a charter of the company). The alteration of the memorandum involves somewhat complicated legal procedures. The portion of the authorized share capital, which has been offered to shareholders, is called issued share capital. Subscribed share capital represents that part of the issued share capital, which has been accepted by shareholders. The amount of subscribed share capital, actually paid up by shareholders to the company is called paid-up share capital. Often, subscribed and paid-up share capital may be the same.

The total paid-up share capital is equal to the issue price of an ordinary share multiplied by the number of ordinary shares. The issue price may include two components: the par value and the share premium. The par value is the price per ordinary share stated in the

Memorandum of Association. Generally, the par value of a ordinary share is in the denomination of `100 or `10. Any amount in excess of the par value is called the share premium. In the case of new companies, the par value and the issue price may be the same. The existing, highly- profitable companies may issue ordinary shares at a premium. The paid-up share capital is stated at the par value. The excess amount is separately shown as the share premium. The company’s earnings, which have not been distributed to shareholders and have been retained in the business, are called reserves and surplus. They belong to owners—ordinary shareholders. Thus, the total shareholders’ equity is the sum of: (i) paidup share capital, (ii) share premium, and (iii) reserves and surplus. The total shareholders’ equity or share capital is also called net worth.

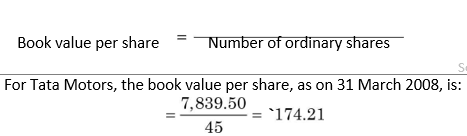

The book value per ordinary share is calculated as follows:

Features of Ordinary Shares

Note that the book value is based on historical figures in the balance sheet. It is in no way related with the market value of an ordinary share. The market value of a share is the price at which it trades in the stock market. It is generally based on expectations about the performance of the economy, in general and the company, in particular. Tata Motors’ market price per share on Bombay Stock Exchange has generally been higher than its book value. For example, on 24 April 2009, the market price of a Tata Motors share was ranging between `245 to `249. The market prices of many companies’ shares trade at below their book values. Ordinary shares of all companies may not be traded on stock markets. Therefore, the market value of ordinary shares of all companies may not be available.

Ordinary share has a number of special features which distinguish it from other securities. These features generally relate to the rights and claims of ordinary shareholders.

Claim on Income

Ordinary shareholders have a residual ownership claim. They have a claim to the residual income, which is, earnings available for ordinary shareholders, after paying expenses, interest charges, taxes and preference dividend, if any. This income may be split into two parts: dividends and retained earnings. Dividends are immediate cash flows to shareholders. Retained earnings are reinvested in the business, and shareholders stand to benefit in future, in the form of the firm’s enhanced value and earnings power and ultimately enhanced dividend and capital gain. Thus, residual income is either directly distributed to shareholders in the form of dividend or indirectly in the form of capital gains on the ordinary shares held by them.

Payable dividends depend on the discretion of the company’s board of directors. A company is not under a legal obligation to distribute dividends out of the available earnings. Capital gains depend on future market value of ordinary shares. Thus, an ordinary share is a risky security from the investor’s point of view. Dividends paid on ordinary shares are not tax deductible for the company. In India, if a company pays dividend, it has to pay tax on the distributed dividend.

Claim on Assets

Ordinary shareholders also have a residual claim on the company’s assets in the case of a liquidation. Liquidation can occur on account of business failure or sale of business. Out of the realized value of assets, first the claims of debt-holders and then preference shareholders are satisfied, and the remaining balance, if any, is paid to ordinary shareholders. In case of liquidation, the claims of ordinary shareholders may generally remain unpaid.

Right to Control

Control in the context of a company means the power to determine its policies. The board of directors approves the company’s major policies and decisions while managers appointed by the board carry out the day-to-day operations. Thus, control may be defined as the power to appoint directors. Ordinary shareholders have the legal power to elect directors on the board. If the board fails to protect their interests, then they can replace directors. Ordinary shareholders are able to control the management of the company through their voting rights and right to maintain proportionate ownership.

Voting Rights

Ordinary shareholders are required to vote on a number of important matters. The most significant proposals include: election of directors and change in the memorandum of association. For example, if the company wants to change its authorized share capital or objectives of business, it requires ordinary shareholders’ approval. Directors are elected at the annual general meeting (AGM) by the majority votes. Each ordinary share carries one vote. Thus, an ordinary shareholder has votes equal to the number of shares held by him. Shareholders may vote in person or by proxy. A proxy gives a designated person right to vote on behalf of a shareholder at the company’s annual general meeting. When management takeovers are threatened, proxy fights—battles between rival groups for proxy votes—occur. An earlier example in this regard was that of Gamon India where both existing management and the Chhabrias fought for the control of the company and put all efforts to collect proxy votes. The existing management could continue its hold on the company with the help of majority shareholders including the financial institutions.

Pre-emptive Rights

Limited Liability

The pre-emptive right entitles a shareholder to maintain his proportionate share of ownership in the company. The law grants shareholders the right to purchase new shares in the same proportion as their current ownership. Thus, if a shareholder owns 1 per cent of the company’s ordinary shares, he has pre-emptive right to buy 1 per cent of new shares issued. A shareholder may decline to exercise this right. The shareholders’ option to purchase a stated number of new shares at a specified price during a given period is called rights. These rights can be exercised at a subscription price, which is generally much below the share’s current market price, or they can be allowed to expire, or they can be sold in the stock market.1

Ordinary shareholders are the true owners of the company, but their liability is limited to the amount of their investment in shares. If a shareholder has already fully paid the issue price of shares purchased, he has nothing more to contribute in the event of a financial distress or liquidation. This position of shareholders is different from the owners in the case of sole proprietary businesses or partnership firms where they have unlimited liability. In the event of the insolvency of these firms, owners are required to bring in additional capital from their personal savings to pay claims of creditors. The limited liability feature of ordinary share encourages otherwise unwilling investors to invest their funds in the company. Thus, it helps companies to raise funds.

Pros and Cons of Equity Financing

Equity capital is the most important long-term source of financing. It offers the following advantages to the company:

Permanent capital Since ordinary shares are not redeemable, the company has no liability for cash outflow associated with its redemption. It is a permanent capital, and is available for use as long as the company exists.

Borrowing baseThe equity capital increases the company’s financial base, and thus its borrowing limit. Lenders generally lend in proportion to the company’s equity capital. By issuing ordinary shares, the company increases its financial capability. It can borrow when it needs additional funds.

Dividend payment discretionA company is not legally obliged to pay dividend. In times of financial difficulties, it can reduce or suspend payment of dividend. Thus, it can avoid cash outflow associated with ordinary shares. In practice, dividend cuts are not very common or frequent. A company tries to pay dividend regularly. It cuts dividend only when it cannot manage cash to pay dividends. For example, in 1986, the Reliance Industries Limited experienced a sharp drop in its profits and had a severe liquidity problem. As a consequence, it had to cut its dividend rate from 50 per cent to 25 per cent. The company, however, increased the dividend rate next year when its performance improved.

Equity capital has some disadvantages to the firm compared to other sources of finance. They are as follows:

Cost Shares have a higher cost at least for two reasons: Dividends are not tax deductible as are interest payments, and the flotation costs on ordinary shares are higher than those on debt. The tax on distributed dividend in India increases a firm’s taxes. Risk Ordinary shares are riskier from investors’ point of view as there is uncertainty regarding dividend and capital gains. Therefore, they require a relatively higher rate of return. This makes equity capital as the highest cost source of finance.

Earnings dilution The issue of new ordinary shares dilutes the existing shareholders’ earnings per share if the profits do not increase immediately in proportion to the increase in the number of ordinary shares.

Check Your Concepts

Ownership dilution The issuance of new ordinary shares may dilute the ownership and control of the existing shareholders. While the shareholders have a pre-emptive right to retain their proportionate ownership, they may not have funds to invest in additional shares. Dilution of ownership assumes great significance in the case of closely held companies. The issuance of ordinary shares can change the ownership.

- Define ordinary shares. How is the book value of a share calculated?

- How does market value of a share differ from its book value?

- Define authorized, issued, subscribed and paid-up capital.

- What are the features of ordinary shares?

- Explain the merits and demerits of shares.

Public Issue of Equity

Public issue of equity means raising of share capital directly from the public. For example, Riga Sugar Company Limited, a subsidiary of Belsund Sugar Limited, made a public issue of equity shares of `10 crore on 12 July 1994. The issue price per share is `50—representing a premium of `40 over its par value. The issue price is also higher than its book value of `26.35 per share. The company needs funds for expansion and modernization of its plant as well as for diversification into the manufacture of ethyl alcohol. The company expects to pay a dividend of 20 per cent in 1993–94 and 1994–95 and 25 per cent in 1995–96.

Consider another case: N R Agarwal Industries Limited is approaching the public for the first time to raise `3.20 crore on 7 July 1994. Incorporated as a public limited company in December 1993, the maiden issue of equity shares is intended to part-finance its project for manufacturing industrial paper in Vapi, Gujarat. The share is issued at par at `10.

Yet another example of public issue is the proposal to issue 95 lakh equity shares of `10 each by CG Lifesciences. The issue price per share will be decided by the book building process. As per the existing norms, a company with a track record is free to determine the issue price for its shares. Thus, it can issue shares at a premium (as compared to the par value).

Underwriting of Issues

It is legally obligatory to underwrite a public and a rights issue. In an underwriting, the underwriters—generally banks, financial institution, brokers, etc.—guarantee to buy the shares if the issue is not fully subscribed by the public. The agreement may provide for a firm buying by the underwriters. The company has to pay an underwriting commission to the underwriter for their services.

Private Placement

Private placement involves sale of shares (or other securities) by the company to a few selected investors, particularly the institutional investors like the Unit Trust of India (UTI), the Life Insurance Corporation of India (LIC), the Industrial Development Bank of India (IDBI), etc. Private placement has the following advantages:

Size It is helpful to issue small amount of funds.

Cost It is less expensive. In the case of public issue of securities, the issue costs, including both statutory and other costs, are quite high, ranging between 10 to 20 per cent of the size of issue. A substantial part of these costs can be avoided through private placement.

Check Your Concepts

Speed It takes less time to raise funds through private placement, say, less than 3 months. Public issues involve a number of requirements to be fulfilled, and this requires a lot of time to raise capital.

- Explain the difference between public and private issues of shares?

- What are the advantages of private placement of shares?

- Why are shares’ issues underwritten?

RIGHTS ISSUE OF EQUITY SHARES

A rights issue involves selling of ordinary shares to the existing shareholders of the company. The law in India requires that the new ordinary shares must be first issued to the existing shareholders on a pro rata basis. Shareholders through a special resolution can forfeit this pre-emptive right. Obviously, this will dilute their ownership.

Terms and Procedures

A company can make rights offering to its shareholders after meeting the requirements specified by the Securities and Exchange Board of India (SEBI). Those shareholders who renounce their rights are not entitled for additional shares. Shares becoming available on account of non-exercise of rights are allotted to shareholders who have applied for additional shares on pro rata basis. Any balance of shares left after issuing the additional shares can be sold in the open market.

Let us assume that a company announces on 2nd January 2009 that all shareholders whose names are in the register of members as on 25th February 2009 will be issued rights, which will expire on 10th March 2009. The company will mail the ‘letter of rights’ on 5th April 2009. In the example, 2nd January 2009 is the announcement date, 25th February 2009 is the holder-of-theregister-of-members date, 5th April 2009 is the offer-of-rights date and 10th March 2009 is the expiration-of-rights date. It may be possible that the share may be traded (bought and sold) a few days before the holder-of-the-register-of-members date (5th April 2009 in the example), and it may not be transferred and registered in the new name. The rights might then be wrongly sent to the old shareholder. If the share is traded within the ex-rights date, it will be duly registered in the name of purchaser. The ex-rights date occurs a few days prior to the holderof-the-register-of-member date. This implies that after the ex-rights date the share sells without the rights. The price of the share before the ex-rights date is called as right-on or cum-rights while the price after this date is referred to as the ex-rights price.

In India along with the letter of rights, four forms may be sent. Form A is intended for accepting the rights and applying for additional shares. Form B is meant for the purpose of foregoing the rights in favour of other person. Form C has to be used by the person in whose favour the rights have been renounced for making application. Form D is for the purpose of requesting for the split forms.

When the rights are offered for raising funds, three issues are involved: (i) the number of rights needed to buy a new share, (ii) the theoretical value of a right, and (iii) the effect of rights offerings on the value of the ordinary shares outstanding. We shall consider an example to discuss these issues.

Value of a Right

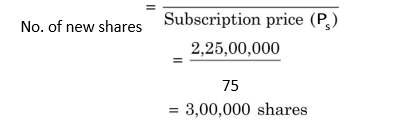

We can first determine the number of new shares to be issued to raise `22.50 million at `75 per share:

Suppose Sunshine Industries Limited has 9,00,000 shares outstanding, at current market price of `130 per share. The company needs `22.50 million (or `2.25 crore) to finance its proposed modernization-cum-expansion project. The board of the company has decided to issue rights for raising the required money. The subscription (issue) price (Ps) has been fixed at `75 per share. The subscription price has been set below the market price to ensure that the rights issue is fully subscribed. How many rights required purchasing a new share? What is the value of a right?

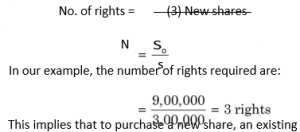

We know that each ordinary share will get one right; therefore, there are a total number of 9,00,000 rights. The company wants to sell 3,00,000 new shares. The number of rights required to buy on new share will be equal to the number of existing shares outstanding (So) divided by new share(s) to be sold:

This implies that to purchase a new share, an existing shareholder should have 3 rights and `75. What is the price of one share after rights offering? The price of the share after the rights issue is called ex-rights price (Px). It is equal to the value of 3 rights plus `75.

Price of a share after rights issue (Px) = Value of 3 rights + `75

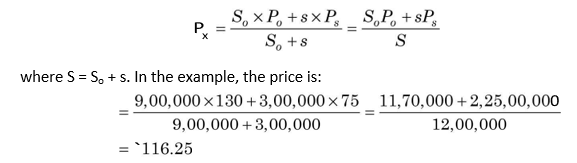

The formula for the ex-rights issue (Px) can be written as follows:

Px = N × R + Ps

where N is the number of rights needed to buy one share, R is the value of a right and Ps is the subscription price. In fact, this price can be found out directly. The price of a share after rights issue is equal to the sum of value of existing shares (9,00,000) at the current marketprice (`130) and the value of new shares (3,00,000) at subscription price (`75) divided by total number of shares after the rights issue (9,00,000 + 3,00,000 = 12,00,000): Price of share after rights issue

= (Existing shares × Current market price

+ New shares × Subscription price)

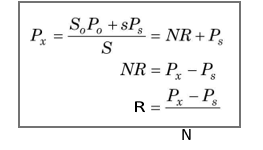

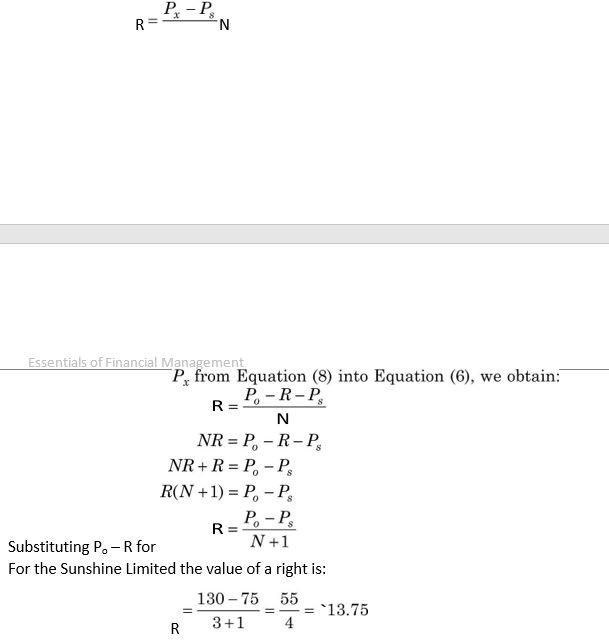

We can also use other formulae to determine the value of a right. We can combine Equations (4) and (5) to find out value of a right as follows:

In the case of the Sunshine rights issue, we know that a shareholder can buy one new share for `75 plus 3 rights. The company’s share after the ex-rights date is theoretically worth `116.25. Therefore, the total value of 3 rights together is `41.25. (`116.25 – `75), and the value of each right is `13.75 (`41.25/3). Thus the share price on the ex-right date drops by `13.75 from the cum-rights (rights-on) price of `130 to the ex-rights price of `116.25. This drop is the value of one right. In fact, what has happened is that the cum-rights (rights-on) price (Po = `130) has divided into the ex-rights price (Px = `116.25) and the value of a right (R = `13.75). Thus, Po = Px + R.

Notice that Equation (6) gives the value of a right when the share is selling ex-rights. What is the value of a right when the share is selling cum-rights (rights-on)? We know that the cum-rights price (Po) is:

| Po = Px + R and the ex-rights price (Px) is: | (7) |

| Px = Po – R | (8) |

The value of a right when share is selling ex-rights is:

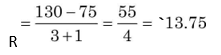

Substituting Po – R for

For the Sunshine Limited the value of a right is:

This is the same value as found by Equation (6) under the assumption that the share was selling ex-rights.

Effect on Shareholders’ Wealth

Suppose a shareholder in Sunshine owns 3 shares. At a current market price of `130, his total wealth is `390. Let us assume that he exercises his rights as offered by the company. After the exercise of his rights, he will own 4 shares at the ex-rights price of `116.25. Therefore, his total wealth is: `116.25 × 4 = `465. But he has spent `75 to obtain the additional share. So his net wealth is: `465 – `75 = `390, same as before the rights issue. Now assume that he does not exercise his rights rather sells them at `13.75 per right. He still own 3 shares but at a price of `116.25 per share (ex-rights price). So his total value of shares is: `116.25 × 3 = `348.75. But he also obtains: `13.75 × 3 = `41.25 by selling his rights. Therefore, his net wealth is: `348.75 + `41.25 = `390—once again same as before the rights issue. Let us now assume that he does nothing. This means that he would simply own 3 shares at a price of `116.25 after the expiry of rights issue. Thus his wealth would decline to `348.75 from `390.

From the calculations of the value of a right, when the share is selling ex-rights, or cumrights, it should be clear that the existing shareholder does not benefit or lose from a rights issue. What he receives in the form of the value of a right, he loses in the form of decline in the share price. His wealth remains unaffected when he exercises his rights. Of course, he will lose if he does not exercise his rights or sells them. Thus, the shareholder has three options: (i) he exercises his rights, (ii) he sells his rights, or (iii) he does not exercise or sell his rights. He will lose under the third option. Let us illustrate.2

Is the Subscription Price of any Significance?

Is the subscription price (Ps) significant? It is irrelevant in terms of the impact on the shareholders’ wealth. It can be fixed at any level below the current market price. What the shareholder gains in terms of the value of rights, he loses in terms of decline in the share price. The primary objective in setting the subscription price low is that after the rights offering, the market price should not fall below it.

Will the theoretical value of a right always equal its actual market value? The theoretical value could differ from the actual value for three reasons.3 First, the high transaction costs can limit the investor arbitrage that would otherwise push the market price of the right to its theoretical value. Second, speculation over the subscription period can push the market price above or below the theoretical value. Third, large flotation costs can also affect these two values.

Pros and Cons of Rights Issue

There are three main advantages of the rights issue. First, the existing shareholders’ control is maintained through the pro rata issue of shares. This is significant in the case of a closely held company or when a company is going into financial difficulties or is under a takeover threat. Second, raising funds through the sale of rights issue rather than the public issue involves less flotation costs as the company can avoid the underwriting commission. Third, in the case of profitable companies, the issue is more likely to be successful since the subscription price is set much below the current market price.

The main disadvantage is to the shareholders who fail to exercise their rights. They lose in terms of decline in their wealth. Yet another disadvantage is for those companies whose shareholding is concentrated in the hands of financial institutions, because of the conversion of loan into equity. They would prefer public issue of shares rather than the rights issue.

Check Your Concepts

- What is meant by rights issue of shares? What are its advantages and disadvantages?

- What is the value of a right? How is it calculated?

- How is the shareholders’ wealth affected by rights issue?

- Do existing shareholders lose if the subscription price of a share under the rights issues is lessthan its market value? Justify your answer.

PREFERENCE SHARES

(a) the non-payment of dividends does not force the company to insolvency, (b) dividends are not deductible for tax purposes, and (c) in some cases, it has no fixed maturity date. On the other hand, it is similar to debentures in that (a) dividend rate is fixed, (b) preference shareholders do not share in the residual earnings, (c) preference shareholders have claims on income and assets prior to ordinary shareholders, and (d) they usually do not have voting rights.

Preference share is often considered to be a hybrid security since it has many features of both ordinary shares and debentures. It is similar to ordinary shares in that

Features

Preference share has several features. Some of them are common to all types of preference shares while others are specific to some.4

Claims on Income and Assets

Preference share is a senior security as compared to an ordinary share. It has a prior claim on the company’s income in the sense that the company must first pay preference dividend before paying ordinary dividend. It also has a prior claim on the company’s assets in the event of liquidation. The preference share claim is honoured after that of a debenture and before that of ordinary share. Thus, in terms of risk, preference share is less risky than ordinary share. There is a cost involved for the relative safety of preference investment. Preference shareholders generally do not have voting rights and they cannot participate in any extraordinary profits earned by the company. However, a company can issue preference share with voting rights, which are called participative preference shares.

Fixed Dividend

The dividend rate is fixed in the case of a preference share, and preference dividends are not tax deductible. The preference dividend rate is expressed as a percentage of the par value. The amount of preference dividend will thus be equal to the dividend rate multiplied

by the par value. Preference share is called fixed-income security because it provides a constant income to investors. The payment of preference dividend is not a legal obligation. Usually, a profitable company will honour its commitment of paying preference dividend.

Cumulative Dividends

Most preference shares in India carry a cumulative dividend feature, requiring that all past unpaid preference dividend are to paid before any ordinary dividends are paid. This feature is a protective device for preference shareholders. The preference dividends could be omitted or passed without the cumulative feature. Preference shareholders do not have power to force company to pay dividends; non-payment of preference dividend also does not result into insolvency. Since preference share does not have the dividend enforcement power, the cumulative feature is necessary to protect the rights of preference shareholders.

Redemption

Theoretically, both redeemable and perpetual (irredeemable) preference shares can be issued.* Perpetual or irredeemable preference share does not have a maturity date. Redeemable preference share has a specified maturity. In practice, redeemable preference shares in India are often not retired in accordance with the stipulation since there are no serious penalties for the violation of redemption feature.

Sinking Fund

Like in the case of debentures, a sinking fund provision may be created to redeem preference share. The money set aside for this purpose may be used either to purchase preference share in the open market or to buy-back (call) the preference share. Sinking funds for preference shares are not common.

The call feature permits the company to buy back preference shares at a stipulated buyback or call price. The call price may be higher than the par value. Usually, it decreases with the passage of time. The difference between call price and par value of the preference share is called call premium.

Call Feature

Participation Feature

Preference shares may, in some cases, have participation feature which entitles the preference shareholders to participate in extraordinary profit earned by the company. This means that a preference shareholder may get dividend amount in excess of the fixed dividend. The formula for determining extra dividend would differ. A company may provide for extra dividend to preference shareholders equal to the amount of ordinary dividend that is in excess of the regular preference dividend. Thus if the preference dividend rate is 10 per cent and the company pays an ordinary dividend of 16 per cent, then preference shareholders will receive extra dividend at 6 per cent (16 – 10 per cent). Preference shareholders may also be entitled to participate in the residual assets in the event of liquidation.

Voting Rights

Preference shareholders ordinarily do not have any voting rights. They may be entitled to contingent or conditional voting rights. In India, if a preference dividend is outstanding for two or more years in the case of cumulative preference shares, or the preference dividend is outstanding for two or more consecutive preceding years or for a period of three or more years in the preceding six years, preference shareholders can nominate a member on the board of the company.

Convertibility

Preference shares may be convertible or non-convertible. A convertible preference share allows preference shareholders to convert their preference shares, fully or partly, into

ordinary shares, at a specified price, during a given period of time. Preference shares, particularly when the preference dividend rate is low, may sometimes be converted into debentures. For example, the Andhra Cement converted its preference shares of `0.33 crore into debentures in 1985. To make preference shares, attractive, the government of India has introduced convertible cumulative preference share (CCPS). Unfortunately, companies in India have hardly used this security to raise funds.

Pros and Cons of Preference Shares

Preference share has a number of advantages to the company, which ultimately occur to ordinary shareholders.5

Riskless leverage advantage Preference share provides financial leverage advantages since preference dividend is a fixed obligation. This advantage occurs without a serious risk of default. The non-payment of preference dividends does not force the company into insolvency. Dividend postponability Preference share provides some financial flexibility to the company since it can postpone the payment of dividend.

Fixed dividend The preference dividend payments are restricted to the stated amount. Thus preference shareholders do not participate in excess profits as do the ordinary shareholders.

Limited voting rights Preference shareholders do not have voting rights except in case dividend arrears exist. Thus, the control of ordinary shareholders is preserved. The following are the limitations of preference shares:

Preference shares provide more flexibility and lesser burden to a company. The dividend rate is less than that on equity and it is fixed. Also, the company can redeem it when it does not require the capital. In practice, when a company reorganizes its capital, it may convert preference capital into equity. Sometimes equity may be converted into preference capital. For example, IDBI in 1994 proposed to convert its equity capital into preference capital.

Non-deductibility of dividends The primary disadvantage of preference shares is that preference dividend is not tax deductible. Thus, they are costlier than debentures. Commitment to pay dividend Although preference dividends can be omitted, they may have to be paid because of their cumulative nature. Non-payment of preference dividends can adversely affect the image of a company, since equity holders cannot be paid any dividends unless preference shareholders are paid dividends.

Check Your Concepts

- Define preference shares. What are their features?

- What is the difference between participative and non-participative preference shares?

- What are the merits and demerits of preference shares?

DEBENTURES

A debenture is a long-term promissory note for raising loan capital. The firm promises to pay interest and principal as stipulated. The purchasers of debentures are called debenture holders. An alternative form of debenture in India is a bond. Mostly public sector companies in India issue bonds. In USA, the term debenture is generally understood to mean unsecured bond.

Features

A debenture is a long-term, fixed-income, financial security. Debenture holders are the creditors of the firm. The par value of a debenture is the face value appearing on the debenture certificate. Corporate debentures in India are issued in different denominations. The large public sector companies issue bonds in the denominations of `1,000. Some of the important features of debentures are discussed below.

Interest rate The interest rate on a debenture is fixed and known. It is called the contractual rate of interest. It indicates the percentage of the par value of the debenture that will be paid out annually (or semi-annually or quarterly), in the form of interest. Thus, regardless of what happens to the market price of a debenture, say, with a 15 per cent interest rate, and a `1,000 par value, it will pay out `150 annually in interest until maturity. Payment of interest is legally binding on a company. Debenture interest is tax deductible for computing the company’s corporate tax. However, it is taxable in the hands of a debenture holder as per the income tax rules. However, public sector companies in India are sometimes allowed by the government to issue bonds with tax-free interest. That is, the bond-holder is not required to pay tax on his bond interest income.

Maturity Debentures are issued for a specific period of time. The maturity of a debenture indicates the length of time until the company redeems (returns) the par value to debenture-holders and terminates the debentures. In India, a debenture is typically redeemed after 7 to 10 years in instalments.

Redemption As indicated earlier, debentures are mostly redeemable; they are generally redeemed on maturity. Redemption of debentures can be accomplished either through a sinking fundorbuy-back (call) provision.

Indenture An indenture or debenture trust deed is a legal agreement between the company issuing debentures and the debenture trustee who represents the debenture holders. It is the responsibility of the trustee to protect the interests of debenture holders by ensuring that the company fulfils the contractual obligations. Generally, a financial institution, or a bank, or an insurance company or a firm of attorneys is appointed as a trustee. The debenture trust deed (indenture) provides the specific terms of the agreement, including a description of debentures, rights of debenture holders, rights of the issuing company and responsibilities of the trustee.

Sinking fundA sinking fund is cash set aside periodically for retiring debentures. The fund is under the control of the trustee, who redeems the debentures either by purchasing them in the market or calling them in an acceptable manner. In some cases, the company itself may handle the retirement of debentures using the sinking funds. The advantage of a sinking fund is that the periodic retirement of debt through the sinking funds reduces the amount required to redeem the remaining debt at maturity. Particularly, when the firm faces temporary financial difficulty at the time of debt maturity, the repayment of huge amount of principal could endanger the firm’s financial viability. The use of the sinking fund eliminates this potential danger. Buy-back (call) provision Debenture issues include buy-back provision. Buy-back provisions enable the company to redeem debentures at a specified price before the maturity date. The buy-back (call) price may be more than the par value of the debenture. This difference is called call or buy-back premium. In India, it is generally 5 per cent of the par value.

Security Debentures are either secured or unsecured. A secured debenture is secured by a lien on the company’s specific assets. If the company defaults, the trustee can seize the security on behalf of the debenture holders. In India, debentures are usually secured by a charge on the present and future immovable assets of the company. This is called equitable mortgage. When debentures are not protected by any security, they are known as unsecured or naked debentures. As stated earlier, in USA the term debenture always means unsecured bond while bond could be secured or unsecured. If the debentures are unsecured, it will generally be difficult for the firm to attract investors to subscribe to them. Security, however, does not necessarily ensure the safety of a debenture/bond from the investor’s point of view.

Credit rating Professional bodies rate bonds/debentures to indicate the degree of their safety. Credit rating of a bond/debenture shows the chances of timely payment of interest and principal by a borrower. In India, the Credit Rating and Information Services of India Limited (CRISIL) provides rating for bonds/debentures, fixed deposits and commercial papers. Other rating companies include FAIRE, CARE and ICRA. Exhibit 2.1 explains the nature of debenture ratings given by CRISIL.

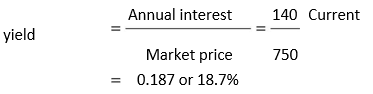

Yield The yield on a debenture is related to its market price; therefore, it could be different from the coupon rate of interest. Two types of yields can be distinguished. The current yield on a debenture is the ratio of the annual interest payment to the debenture’s market price. For example, the current yield of a 14 per cent, `1,000 debenture, currently selling at `750 is:

The yield-to-maturity takes into account the payments of interest and principal, over the life of the debenture. Thus, it is the internal rate of return of the debenture. Mathematically, the yield-to-maturity is the discount rate that equates the present value of the interest and principal payments with the current market price of the debentures. Yield-to-maturity has been discussed in Chapter 4.

EXHIBIT 2.1 Credit Rating of Debentures in India

Claims on assets and income Debenture holders have a claim on the company’s earnings, prior to that of the shareholders. Debentures interest has to be paid before paying any dividends to preference and ordinary shareholders. A company can be forced into bankruptcy if it fails to pay interest to debenture holders. Therefore, in practice, the debenture holders’ claim on income is generally honoured, except in the case of extreme financial difficulties faced by the company.

CRISIL provides the following ratings to bonds/debentures.

AAA (highest safety)Triple A (AAA) rated debentures imply highest safety in the timely payment of interest and principal, even if changes take place in the circumstances subsequently. AA (high safety) Double A (AA) rated debentures ensure high safety—marginally less than the safety provided by triple A debentures.

A (adequate safety) Single A rated debentures provide for timely payment of interest and principal, but the changed circumstances in future may affect such debentures as compared to the higher rated debentures.

BBB (low safety) Triple B (BBB) debentures ensure sufficient safety with regard to the payment of interest and principal. But under the changed circumstances, later on, are more likely to weaken the capacity of the issuing company to pay interest and principal.

BB (inadequate safety) Double B (BB) rated debentures do not provide adequate safety of timely payment of interest and principal. The uncertainties of future can lead to inadequate capacity to make timely payment of interest and principal.

- (high risk) Single B rated debentures are likely to default. Adverse circumstances can render the ability or willingness of a borrower quite weak to pay interest or principal.

- (substantial risk) C rated debentures have current factors that make them vulnerable to default.

For no default on payment of interest or principal, favourable circumstances must continue. D (in default) D rated debentures are in default or are expected to be in default.

Source: Information published by CRISIL.

In liquidation, the debenture holders have a claim on assets prior to that of shareholders. However, secured debenture holders will have priority over the unsecured debenture holders. Thus, different types of debt may have a hierarchy among themselves as their order of claim on the company’s assets.

Types of Debentures

Debentures may be straight debentures or convertible debentures. A convertible debenture (CD) is one which can be converted, fully or partly, into shares after a specified period of time. Thus on the basis of convertibility, debentures may be classified into three categories.

Non-convertible debentures (NCDs)

Fully-convertible debentures (FCDs)

Partly-convertible debentures (PCDs)

Non-convertible Debentures (NCDs)

NCDs are pure debentures without a feature of conversion. They are repayable on maturity.

The investor is entitled for interest and repayment of principal. The erstwhile Industrial Credit and Investment Corporation of India (ICICI) issued debentures for `200 crores, fully non-convertible bonds of `1,000 each, at 16 per cent rate of interest, payable half-yearly. The maturity period was five years. However, the investors had the option to be repaid fully or partly, the principal after 3 years, after giving due notice to ICICI.

Companies, in practice, also issue zero-interest debentures (ZID) (see Chapter 4). These debentures are issued at a highly discounted issue price. The difference between the issue price and the maturity value is the implicit amount of interest. Zero-interest debentures are also called deep-discount debentures (bonds).

FCDs are converted into shares as per the terms of the issue, with regard to the price and time of conversion. The pure FCDs carry interest rates, generally less than the interest rates on NCDs since they have the attraction feature of being converted into equity shares. Recently, companies in India are issuing FCDs with zero rate of interest. For example, Jindal Iron and Steel Company Limited raised FCDs at `111.2 each. After 12 months of allotment, each FCD was convertible into one share of `100, where `90 is the premium.

Fully-convertible Debentures (FCDs)

Partly-convertible Debentures (PCDs)

A number of debentures issued by companies in India have two parts: a convertible part and a non-convertible part. Such debentures are known as partly-convertible debentures (PCDs). The investor has the advantages of both convertible and non-convertible debentures blended a into single debenture. For example, Proctor and Gamble Limited (P&G) issued 4,00,960 PCDs, of `200 each, to its existing shareholders, in July 1991. Each PCD had two parts: convertible portion of `65 each to be converted into one, equity share of `10 each, at a premium of `55 per share, at the end of 18 months from the date of allotment and a non-convertible portion of `135, payable in three equal instalments on the expiry of the 6th, 7th and 8th years from the date of allotment.

Pros and Cons of Debentures

Debenture has a number of advantages as a long-term source of finance:

Less costly It involves less cost to the firm than the equity financing because (a) investors consider debentures as a relatively less risky investment alternative and therefore, require a lower rate of return and (b) interest payments are tax deductible. No ownership dilution Debenture-holders do not have voting rights; therefore, debenture issue does not cause dilution of ownership.

Fixed payment of interest Debenture holders do not participate in extraordinary earnings of the company. Thus the payments are limited to interest specified.

Reduced real obligation During periods of high inflation, debenture issue benefits the company. Its obligation of paying interest and principal which are fixed decline in real terms.

Debenture has some limitations also:

Obligatory payments Debenture results in legal obligation of paying interest and principal, which, if not paid, can force the company into liquidation.

Financial risk It increases the firm’s financial leverage, which may be particularly disadvantageous to those firms which have fluctuating sales and earnings.

Cash outflows Debentures must be paid on maturity, and therefore, at some points, they involve substantial cash outflows.

Restricted covenants Debenture indenture may contain restrictive covenants which may limit the company’s operating flexibility in future.

Suppose a company issues 8 lakh 15 per cent convertible debentures of `125 each, that are convertible into two equity shares of `62.50 each, after two years from the date of allotment but within three months after this period. At the time of issue, the company will receive a cash inflow of: 8 lakh × `125 = `1,000 lakh (less flotation cost). Owners of the convertible debentures will get a fixed income in the form of interest of `1,000 × 15 per cent = `150 lakh for two years. After two years, the owner can exchange one debenture for two equity shares at `62.50 each. Assuming that all debenture holders have exercised their option, the company would have actually issued: `1,000 lakh `62.5 = 16 lakh equity shares, and the convertible debentures would have fully redeemed and disappeared from the company’s balance sheet. The company does not get any cash at the time of conversion. The debenture holders now become shareholders, and they will be entitled to dividends and capital gains on their holdings.

A convertible debenture is a debenture that can be changed into a specified number of ordinary shares, at the option of the owner. A company is, in fact, issuing equity shares in future whenever it offers convertible debentures. The most notable feature of this debenture is that it promises a fixed income associated with debenture as well as chance of capital gains associated with equity share after, the owner has exercised his conversion option. Because of this combination of fixed income and capital gains in the convertible debenture, it has been called a hybrid security. A company can also issue convertible preference share. In our discussion in this section, however, we will consider only examples of convertible debentures.

Characteristics of Convertible Debentures

When a company issues a convertible debenture, it clearly specifies the conversion terms, which indicate the number of equity shares in exchange for the convertible debenture, the price at which conversion will take place and the time when the conversion option can be exercised.

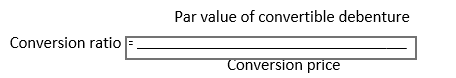

Conversion Ratio and Conversion Price

The conversion ratio is the number of ordinary shares that an investor can receive, when he exchanges his convertible debenture. In other words, the number of ordinary shares per one convertible security is called the conversion ratio. The conversion price is the price paid for the ordinary share at the time of conversion. If you know the par value of the convertible security and its conversion price, you can easily find out the conversion ratio:

In our earlier example of the convertible debenture, the conversion ratio is: `125/ `62.5 = 2

You can also find the conversion price if the par value of the debenture and conversion ratio are known. In India, companies generally specify both conversion ratio as well as conversion price. For example, in May 1989, Tata Steel announced two types of convertible debentures. First, it issued 32.54 lakh 12 per cent, fully convertible debentures of `600 each, at par, on rights basis, to its existing shareholders. Each convertible debenture was fully convertible into one share of `600 (i.e., `100 par plus a premium of `500) within six months from the date of allotment of debentures. Thus, the company stated both conversion ratio of one share for each convertible and conversion price of `600 each share. Tata Steel also announced a public issue of 30 lakh 12 per cent, partly convertible debentures of `1,200 each. Like the rights issue, `600 of the debentures’ face value was convertible. The non-convertible portion of the debentures was to be redeemed at the end of 8 years from the date of allotment.

The purchasers of convertible securities are generally safeguarded against dilution, arising on account of bonus shares issue or share split. For example, if Tata Steel were to issue bonus shares in the ratio of 3 : 5, the conversion price and conversion ratio will be adjusted. The new conversion price will be: `600 × 5/8 = `375 and the new conversion ratio will be: 8/5 = 1.6.

There is a peculiar difference between the ways a conversion price is set in a developed capital market like USA and in a developing capital market like India. In USA, the conversion price is set about 20 per cent above the equity share’s market price, prevailing at the time of issue. In India, the conversion price is set much below the equity share’s prevailing market price. For example, in May 1989, Tata Steel’s market price of each equity share was around `1,265. Thus, the conversion price (`600) was set at a discount of `665 per share (i.e., 52.6 per cent), in contrast to the prevailing market price.

Why Issue Convertible Debentures?

At least four reasons can be cited for issuing the convertible debentures. They are: (a) ‘sweetening’ debenture offers to make them attractive, (b) selling ordinary shares in the future at a higher price, (c) avoiding immediate dilution of earnings, and (d) using low-cost capital initially.

Sweetening Fixed-income Securities

The primary purpose of issuing convertible debenture to make the issue attractive enough so that it is fully subscribed. Investors generally prefer fixed-interest convertible debentures to non-convertible because this enables them to earn a definite, fixed income, with the chance of making capital gains. Hence, the convertibility feature ‘sweetens’ the offer. Also, the company may offer relatively low interest rate on convertible debentures because of the value of the conversion feature as compared to a non-convertible debenture. In our example of Tata Steel, the company is proposing raising large amount of capital by issuing fixedinterest debentures on rights basis to the public. The company is offering only 12 per cent interest rate while the current yield on a similar non-convertible debenture would be around 15 per cent. By adding the convertibility feature, the company has ‘sweetened’ the offer and ensured its success. Also, it has been able to save on interest cost.

Deferred Equity Financing

By issuing a convertible debenture, the firm is, in effect, selling ordinary shares in future. A company would do so when it considers the current market price of its share to be low, but wants to issue shares at a higher price. This can be achieved by setting the conversion price to be higher than the ordinary share’s prevailing market price. In USA, as we have stated earlier, conversion price is set 10 to 20 per cent higher than the prevailing market price. ‘Selling ordinary shares in future, at a premium’ does not seem to be an argument for convertible debentures in India, where the conversion price in most cases is much below the prevailing market price. Tata Steel’s market price in May 1989 was around `1,265 and it announced an issue of convertible debentures at a conversion price of `600. Also, the conversion option would be applicable after six months of the allotment of the convertible debentures. What would Tata Steel gain by deferring equity issue just by six months? This was an indirect way of obtaining higher premium on equity since the Controller of Capital Issue (CCI),* in existence at that time, was quite conservative in allowing direct equity issue at a high premium.

Avoiding Earnings Dilution

Yet another reason for issuing convertible debentures as a mode of deferred equity financing could be to avoid immediate dilution of the earnings per share. The company may like to use fixed-income security and not increase the number of issued shares until its investment starts paying off. In the case of Tata Steel, since the conversion will take place after six months of the debenture issue, it is unlikely that the company will be able to avoid dilution of its earnings per share.

Raising Low-cost Capital

Debt capital of a company may consist of either debentures or bonds which are issued to public for subscription, or term loans, which are obtained directly from the banks and financial institutions. Term loans are sources of long-term debt. In India, they are generally obtained for financing large expansion, modernization or diversification projects. Therefore, this method of financing is also called project financing.

A company may raise funds to finance a large expansion or modernization or diversification. It may like to finance such needs through equity financing, but it may instead choose a convertible debenture. By doing so, the company is able to use the lower cost of capital (as interest on debt is tax deductible), during the initial stage of investment when its effects are not fully reflected in the earnings. When the project is complete, the company’s earnings will rise, increasing the share prices. The holders of the convertible debentures, who initially provided cheap funds to the company, can now convert their debentures into ordinary shares and participate in the prosperity of the company.

Features of Term Loans

Term loans represent long-term debt with a maturity of more than one year. They are obtained from banks and specially created financial institutions (FIs) in India, by private placement rather than a public subscription, as is the case with most debenture issues. The purpose of term loans is mostly to finance the company’s capital expenditures. Term loans have a number of basic features. They include the following: (i) maturity, (ii) direct negotiation, (iii) security, (iv) restrictive covenants, (v) convertibility, and (vi) repayment schedule.

Maturity

Banks and specially created financial institutions (FIs) are the main sources of term loans in India. FIs provide term loans generally for a period of 6 to 10 years. In some cases, a grace period (moratorium) of 1 to 2 years is also granted. This is the period during which the company will not need to make any payment. Commercial banks advance term loans for a period of 3 to 5 years.

Direct Negotiation

A firm negotiates term loans for project finance directly with a bank or FI. Thus, term loan is a private placement. Sometimes debentures may also be privately placed to FIs, but most debenture issues are placed for public subscription. The advantages of private placement are the ease of negotiation and low cost of raising loan. Unlike in the case of a public issue, the firm need not underwrite term loans. Thus, it avoids underwriting commission and other flotation costs.

Security

Term loans are always secured. Specifically, the assets acquired using term loan funds secure them. This is called primary security. The company’s current and future assets also generally secure term loans. This is called secondary or collateral security. Also, the lender may create either fixed or floating charge against the firm’s assets. Fixed charges means legal mortgage of specific assets. For creating a fixed charge, the firm has to pay a heavy stamp duty which may be equal to 212 per cent of the amount of loan. Floating charge is a general mortgage (equitable mortgage), covering all assets. In this case, stamp duty is only 1/2 per cent. Floating charge provides the firm with relative flexibility as it can deal with its assets in the normal course of business without obtaining lender’s approval.

Restrictive Covenants

Asset-related covenants The lender would like the firm to maintain its minimum asset base. Therefore, restrictions may include conditions to maintain minimum working capital position, in terms of a minimum current ratio and not to sell fixed assets without the lender’s approval. The firm may also be required to refrain from creating any additional charge on its assets.

In addition to the asset security, a lender would like to protect itself further. Therefore, FIs add a number of restrictive covenants. A financially weak firm attracts stringent terms on loan from lenders. The borrowing firm has generally to keep the lender informed by furnishing financial statements and other information periodically. The restrictive covenants may be categorized as follows:

Liability-related covenants The firm may be restrained from incurring additional debt or repay existing loan. It may be allowed to do so with the concurrence of the lender. The firm may also be required to reduce its debt–equity ratio by issuing additional equity and preference capital. The freedom of promoters to dispose of their shareholding may also be limited.

Cash flow-related covenants Lenders my restrain the firm’s cash outflow by restricting cash dividends, capital expenditures, salaries and perks of managerial staff, etc.

Control-related covenants Lenders expect that the firm’s management will be competent enough to manage its operations. They may therefore provide for the effective organizational set-up and appointment of suitable staff and the broad-base Board of Directors. One special feature of term loans in this regard could be the provision for the appointment of nominee director by FIs. Nominee director may be appointed in case of those firms, which have been granted substantial financial help by FIs. His role is to safeguard the interests of FIs. He should keep himself well acquainted with the operations of the company without undue interference. He should contribute to the company’s policies and sound financial management.

Convertibility

FIs in India provide huge amount of loan assistance to the companies. Because of the substantial financial stake of these institutions, in the past they had the option to convert a part of the rupee loan into equity. FIs would state the terms and conditions of the conversion. FIs in India insist on the option of converting loans into equity.

Repayment Schedule

Repayment schedule has been discussed at length in the next section.

Repayment Schedule

The repayment schedule or loan amortization specifies the time schedule for paying interest and principal. Payment of loan is a legal obligation. Interest charges are tax deductible, in the hands of the borrowing firm. The general rate of interest on term loans in India is about 14 or 15 per cent. For companies undertaking their projects in specified backward areas, loans at concessional interest rate are available.

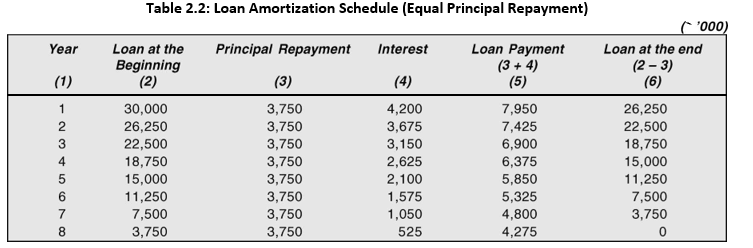

The common practice in India to amortize loan is to require repayment of principal in equal instalments (semi-annual or annual) and pay interest on the unpaid (outstanding) loan. Thus, interest payment will decline over the years, and the total loan payment (interest plus principal) will not be equal in each period. Repayment of loan in instalments saves the company from repaying huge amount at the end of loan maturity. Such payments are called balloon payments.

Consider an example. Suppose a company negotiates a `3 crore loan for eight years from FIs. The interest rate will be 14 per cent per annum on the outstanding balance. The principal will be repaid in eight equal year-end instalments. What is the payment schedule?

The payment schedule will include both interest and principal payment. Interest will be calculated on the outstanding balance on loan. Note that `3 crore was borrowed in the beginning of first year; therefore, the interest charges at the end of the year will be: 0.14 × 3 = `0.42 crore. The instalments of principal will be: 3/8 = `0.375 crore. Thus, loan balance at the end of first year will be: 3.0 – 0.375 = `2.62. This balance will be the basis for calculating interest next year. Calculations are shown in Table 2.2.

An alternative way for amortizing loan is a requirement to pay equal loan instalments including both interest and principal payments. If this is done, then we find out the amount of instalment by using the concept of capital recovery. The concept of capital recovery is explained in Chapter 3.

Check Your Concepts

- What is meant by term loan? How does it differ from debenture borrowing?

- Explain features of term loan.

- What is meant by loan amortization? How is it done?

FIXED DEPOSITS FROM PUBLIC

There are several modes through which a company can borrow funds for its short-term working capital requirements. This includes borrowings from banks, corporate bodies, individuals, etc. These borrowings may either be secured or unsecured. A company may also obtain fixed deposits from public/shareholders to meet its short-term fund requirements, subject to certain provisions under the Companies Act, 1956 (the Act).

Pursuant to the provisions of the Act (Section 58A), the company can invite deposit subject to the following conditions:

It is in accordance with the prescribed rules

An advertisement is issued showing the financial position of the company

The company is not in default in the repayment of any deposit or interest

Guidelines

In case of non-banking and non-financial companies, the Central Government has issued ‘Companies (Acceptance of Deposits) Rules, 1975’ and in case of non-banking financial companies, the Reserve Bank of India has issued ‘Non-Banking Financial Companies Acceptance of Public Deposits (Reserve Bank) Directions, 1998’, which have to be complied with along with the provisions of Section 58A of the Act.

Reasons for Fixed Deposits

For its short-term requirements, a company may prefer to accept fixed deposits instead of taking loans from banks depending on the rates of interest being charged. Normally, listed companies come out with the schemes of ‘fixed deposits’ as they are better known. Response to such listed companies from public is better as compared to unlisted companies.

A non-banking and non-financial company can borrow deposits up to the extent given below:

Therefore, the maximum deposit a company can accept from public/shareholders is 35% of its paid-up capital and free reserves, as mentioned above.

(i) Up to 25% of the paid-up capital and free reserves of the company from the public and (ii) Up to 10% of its paid-up capital and free reserves from its shareholders.

If the company is a Government Company, then it can accept or renew deposits from public up to 35% of its paid up capital and free reserves.

Period of Fixed Deposits

As per the existing rules the period of fixed deposits is from 6 months to 36 months from the date of acceptance of such deposits or from the date of its renewal. However, a company may accept deposits up to 10% of its paid-up capital and free reserves which are repayable after three months, from the date of such deposits or renewal thereof, to meet any of its shortterm requirements.

Rate of Interest

Maximum rate of interest that a company can offer on fixed deposits is fixed from time to time.

Statement of Advertisement

Before accepting deposits, it is mandatory for such companies to issue an advertisement in a leading English newspaper and also in a vernacular newspaper circulating in the state in which the registered office of the company is situated. Such advertisement should be approved by the Board of Directors of the company at its meeting, duly signed by majority of the Directors.

Contents of Advertisement

The advertisement must contain the following details:

- Name of the company

- Date of incorporation

- Business carried on by the company and its subsidiaries with details of branches or units, if any

- Brief particulars of the management of the company

- Names, address and occupation of Directors

- Profits before tax and after tax for three financial years preceding the date of the advertisement

- Dividends declared for the last three years.

The advertisement should provide the summarized financial position of the company from the audited annual accounts for two years preceding the date of the advertisement.

Maintenance of Liquid Assets

It is mandatory for a company to deposit certain amount from deposits received with banks or deal with them in such a manner so as to enable it to make repayment of the deposits on the due date.The minimum amount to be deposited in liquid assets as mentioned above is 15% of the amount of deposits maturing up to 31 March of the following year. The amount so deposited as above cannot be utilized for any purpose other than the repayment of deposits maturing during the year up to 31 March of the following year.

Annual Return

Companies accepting deposits are required to file an annual return in the prescribed format with the Registrar of Companies on or before 30 June of every year for the year ended 31 March of that year. This annual return must be certified by the auditors of the company.

Repayment of Deposits before Maturity

Deduction of Tax

A company, in response to a request from the depositor may make repayment of a deposit after the expiry of six months from the date of receipt but before the expiry of the period for which the deposit was accepted. Under such circumstances, the company shall pay rate of interest on the deposit at a rate lower than 1% from the rate applicable for the period for which the deposit was made.

The company has to deduct income-tax at source on the interest paid to the depositors as per the rate applicable under the Income-tax Act, 1961. Presently, no tax is to be deducted from the interest payable upto `5,000.

Failure to Repay Deposits on Maturity

If a company fails to repay deposit on maturity, the Company Law Board (CLB) has the power to consider the matter either on its own motion or on the application of a depositor and can order the company to make repayment of the deposit in such a manner as the CLB may deem fit.

Non-banking Financial Companies (NBFCs)

The RBI regulates NBFCs engaged in equipment leasing, hire purchase finance, loan and investment, residuary non-banking companies (RNBCs) and the deposit taking activity of miscellaneous non-banking companies (chit funds). With the amendment of the RBI Act in 1997, it is obligatory for NBFCs to apply for a certificate of registration (COR).

As per extant guidelines, NBFCs that were granted certificate of registration (COR) in the non-public deposit-taking category should meet the minimum capital requirement of `2 crore for being eligible to apply to the RBI for accepting deposits. By the end of March 2005, the RBI had received 38,096 applications for grant of COR. Of these, the RBI has approved 13,187 applications (net of cancellation), including 474 applications (net of cancellation) of companies authorized to accept/hold public deposits. By end-June 2005, the total number of NBFCs increased to 13,261 (net of cancellation), of which 507 were public-deposit accepting companies. In recent years, a declining trend has been observed in the number of operating NBFCs owing to strict application of registration norms.

The number of Residuary Non-banking Companies (RNBCs), which were five at endMarch 2003, declined to three at end-March 2004 and remained unchanged at that level at end-March 2005.

Deposits of reporting NBFCs constituted 1.1 per cent of aggregate deposits of scheduled commercial banks at end-March 2005 as against 1.2 per cent at end-March 2004 and 1.5 per cent at end-March 2003. The deposits of NBFCs have been stagnant at around `20,000 crores for the last three years.

The maximum rate of interest that the NBFCs including NIDHI and chit fund companies can pay is at present 11.0 per cent per annum (effective 4 March 2003). The minimum rate of interest payable by RNBCs also remained unchanged at 5 per cent per annum (to be compounded annually) on the amount of deposits received in lump sum or at monthly or longer intervals and at 3.5 per cent per annum ( to be compounded annually) on the amount deposited under daily deposit scheme.

Check Your Concepts

- What is the main reason for companies to raise funds in the form of public deposits?

- Who are the main regulators in the case of public deposits?

LEASE FINANCING

Lease Defined

Leasing is widely used in Western countries to finance investments. In USA, which has the largest leasing industry in the world, lease financing contributes approximately one-third of the total business investments. In the changing economic and financial environment of India, it has assumed an important role. What is lease financing? What are its advantages and disadvantages? How can a lease be evaluated?

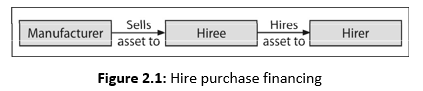

Lease is a contract between a lessor, the owner of the asset, and a lessee, the user of the asset. Under the contract, the owner gives the right to use the asset to the user, over an agreed period of time, for a consideration called the lease rental. The lessee pays the rental to the lessor as regular fixed payments, over a period of time at the beginning or at the end of a month, quarter, half-year, or an year. Although generally fixed, the amount and timing of payment of lease rentals can be tailored to suit the lessee’s profits or cash flows. In up-fronted leases, more rentals are charged in the initial years and less in the later years of the contract. The opposite happens in back-ended leases. At the end of the lease contract, the asset reverts to the lessor, who is the legal owner of the asset. As the legal owner, it is the lessor not lessee, who is entitled to claim depreciation on the leased asset. In long-term lease contracts, the lessee is generally given an option to buy or renew the lease. Sometimes, the lease contract is divided into two parts—primary lease and secondary lease, for the purposes of lease rentals. Primary lease provides for the recovery of the cost of the asset and profit through lease rentals, during a period of about four or five years. A perpetual, secondary lease may follow it on nominal lease rentals. Various other combinations are possible.

Although the lessor is the legal owner of a leased asset, the lessee bears the risk and enjoys the returns. The lessee benefits if the leased assets operates profitably, and suffers if the asset fails to perform. Leasing separates ownership and use as two economic activities, and facilitates asset use without ownership.6

A lessee can be individual or a firm, interested in the use of an asset without owning it. Lessors may be equipment manufacturers or leasing companies who bring together the manufacturers and the users. In USA, equipment manufacturers are the largest group of lessors followed by banks. In India, independent leasing companies form the major group in the leasing industry. Banks, together with financial institutions, are the largest group in terms of the volume of business.

Types of Leases

Different types of leases can be distinguished as:

Operating lease

Financial lease

Sale-and-lease-back

Operating Lease

Short-term, cancellable lease agreements are called operating leases. Convenience and instant services are the hallmarks of operating leases. Examples are: a tourist renting a car, lease contracts for computers, office equipment, car, trucks and hotel rooms. For assets such as computers or office equipment, an operating lease may run for 3 to 5 years. The lessor is generally responsible for the maintenance and insurance of the asset. He may also provide other services. A single operating lease contract may not fully amortize the original cost of the asset; it covers a period considerably shorter than the useful life of the asset. Because of the short duration and the lessee’s option to cancel the lease, the risk of obsolescence remains with the lessor. Naturally, the shorter the lease period and/or higher the risk of obsolescence, the higher will be the lease rentals.

Financial Lease

Sale-and-lease-back

Long-term, non-cancellable lease contracts are known as financial leases. Examples are plant, machinery, land, building, ships, and aircraft. In India, financial leases are very popular with high-cost and high technology equipment. Financial leases amortize the cost of the asset over the term of lease. They are, therefore, also called capital or full-payout leases. Most financial leases are direct leases. The lessor buys the asset identified by the lessee from the manufacturer and signs a contract to lease it out to the lessee.

Sale-and-lease-back is a special financial lease arrangement. Sometimes, a user may sell an (existing) asset owned by him to the lessor (leasing company) and lease it back from him. Such sale-and-lease-back arrangements may provide substantial tax benefits. For example, in April 1989, Shipping Credit and Investment Corporation of India (SCICI) purchased Great Eastern Shipping Company’s bulk carrier, Jag Lata, for `12.5 crore and then leased it back to Great Eastern on a five-year lease, the rentals being `28.13 lakh per month. The ship’s writtendown book value was `2.5 crore.

In financial lease, the maintenance and insurance are normally the responsibility of the lessee. The lessee also bears the risk of obsolescence. A financial lease agreement may provide for renewal of contract or purchase of the asset by the lessee after the contract expires. The option of purchasing the leased asset by the lessee is not incorporated in the lease contract in India, because if such an option is provided, the lease is legally construed to be a hire purchase agreement.

Myths About Leasing

We can now examine some myths on leasing.7

Leasing provides 100 per cent financing One misconception about leasing is that it provides 100 per cent financing for the asset, as the lessee can avoid payment for acquiring the asset. The lessee, it is assumed, can preserve his liquid resources for other purposes. When a firm borrows to buy an asset, cash flow increases with borrowing and decreases by the same amount, with the purchase of the asset. The firm has the asset to use but a liability to repay the loan and interest. In leasing also, the firm acquires the asset and incurs the liability to make fixed payments in future. In practice, therefore, leasing, like borrowing, commits the company for a stream of payments, in future.

Leasing provides off-the-balance-sheet financing As the lessee may not be obliged to disclose his lease liability on the balance sheet, it is believed that leasing does not affect the debt–equity ratio, while borrowing increases his debt–equity ratio. The myth goes, therefore, that leasing provides off-the-balance-sheet financing, leaving the firm’s debt raising ability intact. This is a fallacious argument. First, a debt–equity norm puts a limit on the firm’s total borrowings. Its debt capacity depends on its debt servicing ability rather than the balance sheet ratios. Contractual obligations of any form through a lease or loan, reduce debt servicing ability and add to financial risk. Lenders recognize the lessee’s cash flow burden arising from lease payments. As a lease uses the firm’s debt capacity, it displaces debt.

Leasing can certainly help companies which have enough debt servicing ability but cannot borrow from banks or financial institutions, on account of institutional norms on debt–equity or regulations. Under no circumstances can a lease enhance the firm’s debt capacity.

Leasing improves performance Another myth is that the return on investment (profits divided by investment) will increase, since a lease does not appear as an investment on the books or the balance sheet. Besides, back-ended leases enable showing higher profits in the initial years of the lease. Such performance ratios are illusory.

A firm’s value is affected by the value of its assets and liabilities rather than book profits created through accounting adjustments. A lease will create value to the firm only if the benefits from it are more than its costs.

Advantages of Leasing