Exam focus

One of the questions in the exam will focus on completion and reporting.

may be examined in several ways. You may be asked to:

Describe the implications for the auditor’s report if issues identified during the audit are not resolved.

Critically evaluate extracts of a draft report i.e. say what is wrong with it and explain why.

Explain the matters the auditor should communicate to those charged with governance.

1 The objectives of the auditor

The objectives of the auditor are:

To form an opinion on the financial statements based on an evaluation of the conclusions drawn from the audit obtained, and

To express clearly that opinion through a written report.

[ISA 700 Forming an Opinion and on Financial Statements, 6]

When the auditor concludes that the financial statements are prepared, in all material respects, in accordance with the applicable financial framework they issue an unmodified opinion in the auditor’s report.

[ISA 700, 16]

If there are no other matters which the auditor wishes to draw to the attention of the users, they will issue an unmodified report.

2 The independent auditor’s report

ISA 700 and ISA (UK) 700 prescribe the following structures for the auditor’s report:

| INT syllabus | UK syllabus | |||

| ISA 700 | ISA (UK) 700 | |||

| Para 21 – 49 | Para 21 – 49 | |||

| 1 | Title | 1 | Title | |

| 2 | Addressee | 2 | Addressee | |

| 3 | Auditor’s opinion | 3 | Auditor’s opinion | |

| 4 | Basis for opinion | 4 | Basis for opinion | |

| 5 | [Material uncertainty related to | 5 | Conclusions relating to going | |

| going concern] (if applicable) | concern/[Material uncertainty | |||

| related to going concern] | ||||

| 6 | [Emphasis of matter] (if applicable) | 6 | [Emphasis of matter] (if | |

| applicable) | ||||

| 7 | Listed entities: | 7 | Listed entities: | |

| Key audit matters | Key audit matters | |||

| Our application of materiality | ||||

| An overview of the scope of | ||||

| our audit | ||||

| 8 | Other information | 8 | Other information | |

| 9 | Responsibilities of management | 9 | Opinions on other matters | |

| prescribed by the Companies | ||||

| Act 2006 | ||||

| 10 | Auditor’s responsibilities | 10 | Matters on which we are | |

| required to report by exception | ||||

| 11 | Report on other legal and regulatory | 11 | Responsibilities of directors | |

| requirements | ||||

| 12 | [Other matter] (if applicable in | 12 | Auditor’s responsibilities | |

| accordance with ISA 706) | ||||

| 13 | Name of the engagement partner | 13 | [Other matter] (if applicable in | |

| Signature | accordance with ISA (UK) 706) | |||

| 14 | Auditor’s address | 14 | Signature | |

| 15 | Date | 15 | Auditor’s address | |

| 16 | Date |

The expectation gap

Over time the wording of the auditor’s report has grown longer in an attempt to counteract the expectation gap, i.e. the difference between what an auditor’s responsibility actually is and what the public perceives the auditor’s responsibility to be.

The auditor’s report is not:

a certificate of the accuracy of the contents of financial statements

a guarantee against fraud

confirmation that an entity is being run in accordance with the principles of good corporate governance.

The wording of the auditor’s report is intended to ensure that users of the financial statements understand what level of assurance they are being given and how much reliance they may place on a set of audited financial statements.

INT syllabus: Illustrative auditor’s report

INDEPENDENT AUDITOR’S REPORT

To the Shareholders of XYZ Company

Report on the Audit of the Financial Statements [sub-title is not included if there is no separate Report on Other Legal and Regulatory Requirements]

Opinion

We have audited the financial statements of the XYZ Company (the Company), which comprise the statement of financial position as at 31 December, 20X4, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, (or give a true and fair view of) the financial position of the Company as at December 31, 20X4, and its performance and its cash flows for the year then ended in accordance with International Financial Standards.

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in [jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit we have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters [listed companies only]

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

[Description of each key audit matter in accordance with ISA 701] Other information

Management is responsible for the other information. The other information comprises the [description of other information, for example] Chairman’s statement, but does not include the financial statements and the auditor’s report thereon.

Our opinion on the financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If based on the work we have performed, we conclude that there is a material misstatement of this information, we are required to report that fact. We have nothing to report in this regard.

Responsibilities of Management and Those Charged With Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with International Financial Standards, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s ability to continue as a going concern, disclosing as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional scepticism throughout the audit. We also:

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain audit that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control.

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by management.

Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease trading as a going concern.

Evaluate the overall presentation, structure and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards.

From the matters communicated with those charged with governance, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

Report on Other Legal and Regulatory Requirements

[As required by local law, regulation or national auditing standards]

The engagement partner on the audit resulting in this independent auditor’s report is [name].

Signature (the name of audit firm, the name of the auditor, or both)

Auditor address

Date

[ISA 700, Appendix]

UK syllabus: Illustrative auditor’s report

INDEPENDENT AUDITOR’S REPORT TO THE MEMBERS OF

XYZ PLC

Opinion

We have audited the financial statements of (name of company) for the year ended … which comprise [specify the titles of the primary statements such as the Statement of Financial Position, the Statement of Comprehensive Income, the Statement of Cash Flows, the Statement of Changes in Equity] and notes to the financial statements, including a summary of significant accounting policies. The financial framework that has been applied in their preparation is applicable law and International Financial Standards as adopted by the European Union.

In our opinion the financial statements:

give a true and fair view of the state of the company’s affairs as at [date] and of its [profit/loss] for the year then ended

have been properly prepared in accordance with IFRS Standards as adopted by the European Union; and

have been prepared in accordance with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the company in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard as applied to listed entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Key audit matters [listed companies only]

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period and include the most significant assessed risks of material misstatement (whether or not due to fraud) we identified, including those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit; and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

[Description of each key audit matter in accordance with ISA (UK) 701] Our application of materiality

[Explanation of how the auditor applied the concept of materiality in planning and performing the audit. This is required to include the threshold used by the auditor as being materiality for the financial statements as a whole but may include other relevant disclosures.]

An overview of the scope of our audit

[Overview of the scope of the audit, including an explanation of how the scope addressed each key audit matter and was influenced by the auditor’s application of materiality.]

Other information

The directors are responsible for the other information. The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

the information given in the strategic report and directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements; and

the strategic report and director’s report have been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company and its environment obtained in the course of the audit, we have not identified material misstatements in the strategic report or the directors’ report.

We have nothing to report in respect of the following matters in relation to which the Companies Act 2006 requires us to report to you if, in our opinion:

adequate accounting records have not been kept, or returns adequate for our audit have not been received from branches not visited by us; or

the financial statements are not in agreement with accounting records and returns: or

certain disclosures of directors’ remuneration specified by law are not made; or

we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement [set out on page …], the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the directors are responsible for assessing the company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Council’s website at: [website link]. This description forms part of our auditor’s report.

[Signature]

John Smith (Senior statutory auditor)

For and on behalf of ABC LLP, Statutory Auditor

Address

Date

[FRC Bulletin: Compendium of illustrative auditor’s reports on United Kingdom private sector financial statements]

Explanation of the sections

| Section | Purpose | |

| 1 | Title | To clearly identify the report as an |

| Independent Auditor’s Report. | ||

| 2 | Addressee | To identify the intended user of the |

| report. | ||

| 3 | Auditor’s opinion | Provides the auditor’s conclusion |

| as to whether or not the financial | ||

| statements give a true and fair | ||

| view. | ||

| 4 | Basis for opinion | Provides a description of the |

| professional standards applied | ||

| during the audit to provide | ||

| confidence to users that the report | ||

| can be relied upon. | ||

| 5 | Key audit matters | To draw attention to any other |

| significant matters of which the | ||

| users should be aware to aid their | ||

| understanding of the entity. (Note: | ||

| This section is only compulsory for | ||

| listed entities.) | ||

| 6 | Other information | To clarify that management are |

| responsible for the other | ||

| information. The auditor’s opinion | ||

| does not cover the other | ||

| information and the auditor’s | ||

| responsibility is only to read the | ||

| other information and report in | ||

| accordance with ISA 720. | ||

| 7 | Responsibilities of | To clarify that management are |

| management | responsible for preparing the | |

| financial statements and for the |

internal controls. Included to help

minimise the expectations gap.

| 8 | Auditor responsibilities | To clarify that the auditor is |

| responsible for expressing | ||

| reasonable assurance as to | ||

| whether the financial statements | ||

| give a true and fair view and | ||

| express that opinion in the | ||

| auditor’s report. The section also | ||

| describes the auditor’s | ||

| responsibilities in respect of risk | ||

| assessment, internal controls, | ||

| going concern and accounting | ||

| policies. Included to help minimise | ||

| the expectations gap. | ||

| 9 | Other | To highlight any additional |

| responsibilities | responsibilities, if | |

| applicable. This may include | ||

| responsibilities in some |

jurisdictions to report on the

adequacy of accounting records,

internal controls over financial

, or other information

published with the financial

statements.

- Name of the engagement partner

To identify the person responsible for the audit report in case of any queries.

| 11 | Signature | Shows the engagement partner or |

| firm accountable for the opinion. | ||

| 12 | Auditor’s address | To identify the specific office of the |

| engagement partner in case of | ||

| any queries. | ||

| 13 | Date | To identify the date up to which |

| the audit work has been | ||

| performed. Any information that | ||

| comes to light after this date will | ||

| not have been considered by the |

auditor when forming their opinion.

The report must be signed and

dated after the directors have

approved the financial statements.

Often the financial statements and

the auditor’s report are signed on

the same day.

UK specific sections

Conclusions relating to going concern

The auditor must state within the auditor’s report whether there are any matters to report in relation to the basis of preparation or disclosures of going concern. If there are no matters to report i.e. the auditor is satisfied with the basis of preparation and disclosures relating to going concern, the auditor must make a statement to this effect.

Opinions on other matters prescribed by the Companies Act 2006

In the UK there is a requirement for auditor’s to report on whether the strategic report and directors’ report are consistent with the financial statements and prepared in accordance with the applicable legal requirements i.e. Companies Act 2006.

All companies must prepare a strategic report unless they are entitled to the small companies exemption.

The purpose of the strategic report is to inform members and help them assess how the directors have performed in their duty to promote the success of the company.

The strategic report must contain:

A fair review of the company’s business including a detailed analysis of the performance of the company and the position of the company at the year-end.

A description of the principal risks and uncertainties facing the company.

The strategic report must be approved by the board of directors and signed on behalf of the board by a director or secretary.

Matters on which we are required to report by exception

Under the Companies Act 2006, the auditor is required to report by exception on certain matters such as whether they have received all information and explanations for their audit and whether the directors’ remuneration has been disclosed as required. In the past these matters were only mentioned in the auditor’s report if problems were encountered but are now included in the UK auditor’s report specifically and will state whether or not there is anything to report.

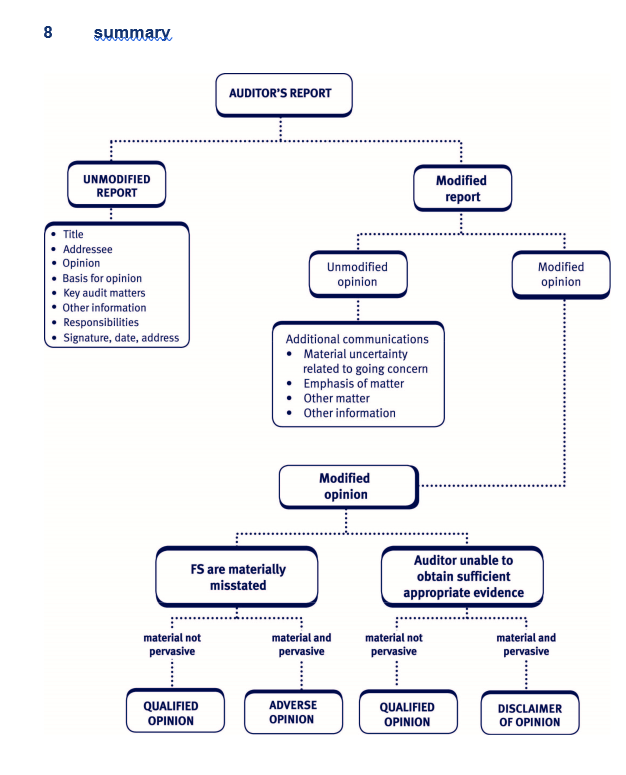

As can be seen from the diagram, the report can be:

Unmodified – the financial statements show a true and fair view (ISA 700).

Modified without modifying the opinion – the financial statements show a true and fair view but there is additional communication required to bring something to the attention of the user.

Modified with a modified opinion – the financial statements don’t fully show a true and fair view or the auditor has not obtained sufficient appropriate to make that conclusion (ISA 705 Modifications to the Opinion in the Independent Auditor’s Report).

4 Modified report with unmodified opinion

In certain circumstances auditors are required to make additional communications in the auditor’s report even though the financial statements show a true and fair view. Issues requiring communication include:

Material Uncertainty Related to Going Concern (ISA 570 Going Concern)

Emphasis of Matter paragraph (ISA 706 Emphasis of Matter Paragraphs and Other Matter Paragraphs in an Auditor’s Report)

Other Matter paragraph (ISA 706)

Inconsistencies in the Other Information (ISA 720 The Auditor’s Responsibilities Relating to Other Information)

It is important to note that these do not impact the wording of the opinion and do not constitute either a qualified, adverse or disclaimer of opinion.

Material Uncertainty Related to Going Concern

Purpose

This section is included when there is a material uncertainty regarding the going concern status which the directors have adequately disclosed in the financial statements. The auditor uses this section to draw the attention of the user to the client’s disclosure note. [ISA 570, 22]

Position in the auditor’s report

Below the Basis for Opinion section.

Emphasis of Matter paragraph

Purpose

An Emphasis of Matter paragraph is used to refer to a matter that has been appropriately presented or disclosed in the financial statements by the directors. The auditor’s judgment is that these matters are of such fundamental importance to the users’ understanding of the financial statements that the auditor should emphasise the disclosure. [ISA 706, 7a]

Examples of such fundamental matters include:

Where the financial statements have been prepared on a basis other than the going concern basis.

An uncertainty relating to the future outcome of exceptional litigation or regulatory action.

A significant subsequent event occurs between the date of the financial statements and the date of the auditor’s report.

Early application of a new accounting standard.

Major catastrophes that have had a significant effect on the entity’s financial position.

Where the corresponding figures have been restated.

Where the financial statements have been recalled and reissued or when the auditor provides an amended auditor’s report.

[ISA 706, A5]

Position in the auditor’s report

Below the Basis for Opinion section.

When a Key Audit Matters section is presented in the auditor’s report, an Emphasis of Matter paragraph may be presented either directly before or after the Key Audit Matters section, based on the auditor’s judgment as to the relative significance of the information included in the Emphasis of Matter paragraph.

The heading of the paragraph can be amended to provide further context, for example, Emphasis of Matter – Subsequent event. [ISA 706, A16]

Tutorial notes

An Emphasis of Matter paragraph is not used to draw attention to immaterial misstatements. The fact that they are immaterial means they do not warrant the attention of the shareholders.

An Emphasis of Matter paragraph can only be used when adequate disclosure has been made of the matters mentioned above. The auditor can only emphasise something that is already included.

Where adequate disclosure has not been made the opinion will need to be modified and an Emphasis of Matter paragraph should NOT be used.

INT syllabus: An Emphasis of Matter should not be used to highlight an issue already included in the Key Audit Matters section. The auditor must use judgment to determine which section they consider is the most appropriate to highlight the issue.

UK syllabus: Law or regulation may require a matter to be emphasised in the auditor’s report in addition to communicating such a matter as a key audit matter in accordance with ISA (UK) 701.

Example wording of an ‘Emphasis of Matter’ paragraph

We draw attention to Note 12 of the financial statements, which describes the effects of a fire at the premises of a third party warehouse provider. Our opinion is not modified in respect of this matter.

BP plc

The auditors of BP plc, Ernst & Young LLP, have issued a modified auditor’s report on the financial statements since 2010 in relation to the Gulf of Mexico oil spill. A fund of $20bn was established to settle claims made against the company as a result of the Deepwater Horizon accident and oil spill, however, the full cost still isn’t known. BP plc have included several disclosures in the notes to the financial statements relating to the uncertainty over the provisions and contingencies. An Emphasis of Matter paragraph has been included in the auditor’s report referring to these disclosure notes.

Other Matter Paragraphs

Purpose

An Other Matter paragraph is included in the auditor’s report if the auditor considers it necessary to communicate to the users regarding matters other than those presented or disclosed in the financial statements that, in the auditor’s judgment, are relevant to understanding the audit, the auditor’s responsibilities, or the auditor’s report. [ISA 706, 7b]

Examples of its use include:

To communicate that the auditor’s report is intended solely for the intended users, and should not be distributed to or used by other parties. [ISA 706, A14]

When law, regulation or generally accepted practice requires or permits the auditor to provide further explanation of their responsibilities.

[ISA 706, A11]

To explain why the auditor has not resigned, when a pervasive inability to obtain sufficient appropriate is imposed by management

(e.g. denying the auditor access to books and records) but the auditor is unable to withdraw from the engagement due to legal restrictions.

[ISA 706, A10]

To communicate audit planning and scoping matters where laws or regulations require. [ISA 706, A9]

Where an entity prepares one set of accounts in accordance with a general purpose framework and another set in accordance with a different one (e.g. one according to UK and one according to International standards) and engages the auditor to report on both sets.

[ISA 706, A13]

Position in the auditor’s report

When an Other Matter paragraph is included to draw the users’ attention to a matter relating to other responsibilities addressed in the auditor’s report, the paragraph may be included in the Report on Other Legal and Regulatory Requirements section.

When relevant to all auditor’s responsibilities or users’ understanding of the auditor’s report, the Other Matter paragraph may be included as a separate section following the Report on the Other Legal and Regulatory Requirements.

The heading may be amended to provide further context, for example, Other

Matter – Scope of the audit.

[ISA 706, A16]

Tutorial notes

An Other Matter paragraph does not include confidential information or information required to be provided by management. [ISA 706, A15]

Example wording of ‘Other Matter’ paragraph

The financial statements of ABC Company for the year ended December 31, 20X0, were audited by another auditor who expressed an unmodified opinion on those statements on March 31, 20X1. [ISA 706, Appendix 3]

Other Information

Other information refers to financial or non-financial information, other than the financial statements and auditor’s report thereon, included in the entity’s annual report. [ISA 720, 12c]

Examples of other information include:

Chairman’s report

Operating and financial review

Social and environmental reports

Corporate governance statements.

Purpose

If the auditor obtains the final version of the other information before the date of the auditor’s report, they must read it to identify any material inconsistencies with the financial statements or the auditor’s knowledge obtained during the audit. [ISA 720, 3]

If the auditor identifies a material inconsistency they should:

Perform limited procedures to evaluate the inconsistency. The auditor should consider whether it is the financial statements or the other information that requires amendment. [ISA 720, 16]

Discuss the matter with management and ask them to make the correction. [ISA 720, 17a]

If management refuse to make the correction, communicate the matter to those charged with governance. [ISA 720, 17b]

If the matter remains uncorrected the auditor must describe the material misstatement in the auditor’s report. [ISA 720, 18a]

Alternatively, the auditor should withdraw from the engagement if possible under applicable law or regulation as the issue casts doubt over management integrity. [ISA 720, 18b]

A separate section is included in the auditor’s report under the heading ‘Other Information’. [ISA 720, 21]

This section:

Identifies the other information obtained by the auditor prior to the date of the auditor’s report.

States that the auditor has not audited the other information and accordingly does not express an opinion or conclusion on that information.

Includes a description of the auditor’s responsibilities with respect to the other information.

States either that the auditor has nothing to report or provides a description of the material misstatement if applicable.

[ISA 720, 22]

Position in the auditor’s report

The Other Information section is included in the auditor’s report below the Basis for Opinion and Key Audit Matters section (if applicable) and above the Responsibilities of Management.

Tutorial notes

Misstatement of other information exists when the other information is incorrectly stated or otherwise misleading (including because it omits or obscures information necessary for a proper understanding of a matter).

Material misstatements or inconsistencies in the other information may undermine the credibility of the financial statements and the auditor’s report. [ISA 720, 2]

The auditor must not be knowingly associated with information which is misleading. [ISA 720, 4]

The auditor must retain a copy of the final version of the other information on the audit file. [ISA 720, 25b]

If the auditor issues a disclaimer of opinion on the financial statements, the Other Information section should not be included in the auditor’s report as to do so may overshadow the disclaimer of opinion. [ISA 720, A58]

UK syllabus: ISA (UK) 720

ISA (UK) 720 The Auditor’s Responsibilities Relating to Other

Information (Revised June 2016)

In addition to the requirements of ISA 720, ISA 720 (UK) contains additional requirements for UK auditors.

In the UK, an annual report includes at least:

The statutory other information

Any other documents that are incorporated by cross-reference in, or distributed to shareholders with, statutory other information either voluntarily or pursuant to law or regulation or the requirements of a stock exchange listing.

A misstatement of the other information exists when the statutory other information has not been prepared in accordance with the legal and regulatory requirements applicable to the statutory other information.

In the UK, the statutory other information includes, where required to be prepared:

The directors’ report The strategic report

The separate corporate governance statement.

For entities that are required to prepare statutory other information, as part of obtaining an understanding of the entity and its environment, the auditor shall obtain an understanding of:

The legal and regulatory requirements applicable to the statutory other information

How the entity is complying with those legal and regulatory requirements.

The auditor shall perform such procedures as are necessary to identify whether the statutory other information appears to be materially misstated in the context of the auditor’s understanding of the legal and regulatory requirements applicable to the statutory other information.

5 Key Audit Matters – Listed companies only

ISA 701 Communicating Key Audit Matters in the Independent Auditor’s Report requires auditors of listed companies to determine key audit matters and to communicate those matters in the auditor’s report. [ISA 701, 5]

Auditors of non-listed entities may voluntarily, or at the request of management or those charged with governance, include key audit matters in the auditor’s report.

Key audit matters are those that in the auditor’s professional judgment were of most significance in the audit and are selected from matters communicated to those charged with governance. [ISA 701, 8]

The purpose of including these matters is to assist users in understanding the entity, and to provide a basis for the users to engage with management and those charged with governance about matters relating to the entity and the financial statements. [ISA 701, 3]

Each key audit matter should describe why the matter was considered to be significant and how it was addressed in the audit.

Key audit matters include:

Areas of higher assessed risk of material misstatement, or significant risks identified in accordance with ISA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment.

Significant auditor judgments relating to areas in the financial statements that involved significant management judgment, including accounting estimates that have been identified as having high estimation uncertainty.

The effect on the audit of significant events or transactions that occurred during the period.

[ISA 701, 9]

Specific examples include:

Significant fraud risk Goodwill

Valuation of financial instruments

Fair values

Effects of new accounting standards

Revenue recognition

Material provisions such as a restructuring provision

Implementation of a new IT system, or significant changes to an existing system.

Note that a matter giving rise to a qualified or adverse opinion, or a material uncertainty related to going concern are by their nature key audit matters. However, they would not be described in this section of the report. Instead, a reference to the Basis for qualified or adverse opinion or the going concern section would be included. [ISA 701, 15]

If there are no key audit matters to communicate, the auditor shall:

Discuss this with the engagement reviewer, if one has been appointed.

Communicate this conclusion to those charged with governance. [ISA 701, 17b]

Explain in the key audit matters section of the auditor’s report that there are no matters to report. [ISA 701, 16]

Example wording of Key Audit Matters

Key Audit Matter How our audit addressed the Key Audit Matter

Goodwill

The Group has goodwill of $X million relating to ABC Co. ABC Co incurred losses in the year ended 31st December 20X5. This has increased the risk that the carrying values of goodwill and other assets may be impaired. Management has concluded that there is no impairment. This conclusion was based on a value in use model that required significant management judgement with respect to the discount rate and the underlying cash flows, in particular future revenue growth.

Our procedures in relation to management’s impairment assessment included:

- Assessing the valuation methodology

- Challenging the reasonableness of key management assumptions based on our knowledge of the business and industry

- Reconciling input data to supporting , such as approved budgets and considering the reasonableness of these budgets.

We found the assumptions made by management in relation to the value in use calculations to be reasonable based on available .

| Revenue recognition | |||||

| Revenue amounted to $X million for the | Testing controls over the | ||||

| year ended 31st December 20X4. | revenue systems | ||||

| Revenue is recorded when the service | Performing analytical | ||||

| is provided, using complex information | |||||

| procedures on revenue | |||||

| technology systems to track the point of | |||||

| service delivery and, where necessary, | Examining manual | ||||

| estimates of fair values for the services | journals related to | ||||

| provided. These fair value estimates | revenue to assess the | ||||

| involve a significant degree of | fair values and timings of | ||||

| management judgment. | revenue. | ||||

6 Modified report with modified opinion

Actions when the opinion is to be modified

Modification of the audit opinion is always the final course of action. As the directors have a legal responsibility to prepare the financial statements to show a true and fair view, the number of modified opinions in real life is very low.

If the auditor is expecting to modify the opinion the following actions will be taken:

- Discuss the matter with those charged with governance

This may lead to the matter being resolved as the client may decide to amend the financial statements or the auditor may be provided with further to conclude that a modification is not necessary.

- Consider management integrity

It is generally expected that the client would want to avoid a modified opinion, therefore if the issue cannot be resolved satisfactorily it casts doubt over management integrity. This will mean that any representations from management may not be reliable. If representations cannot be relied on, this would lead to a disclaimer of opinion in accordance with ISA 580 Written Representations.

- Seek external advice

Before resigning, the auditor may decide to seek legal advice or consult with the ACCA about the issues.

- Resign

Where the auditor has reason to doubt management integrity or where the auditor expects in future that there will be a need to issue a disclaimer, resignation must be considered. These are both matters that would have been considered at the acceptance stage and they must be reconsidered at the end of the audit to decide whether to continue with the engagement.

Modifications to the audit opinion

The auditor may decide they need to modify the opinion when they conclude that:

Based upon the obtained the financial statements as a whole are not free from material misstatement. This is where the client has not complied with the applicable financial framework.

They have been unable to gather sufficient appropriate to be able to conclude that the financial statements as a whole are free from material misstatement. This is the auditor would expect to exist to support the figures in the financial statements.

[ISA 705, 6]

The nature of the modification depends upon whether the auditor considers the matter to be material but not pervasive, or material and pervasive, to the financial statements.

Material but not pervasive – Qualified opinion

If the misstatement or lack of sufficient appropriate is material but not pervasive, a qualified opinion will be issued.

This means the matter is material to the area of the financial statements affected but does not affect the remainder of the financial statements.

‘Except for‘ this matter, the financial statements give a true and fair view.

Whilst significant to users’ decision making, a material matter can be isolated whilst the remainder of the financial statements may be relied upon.

[ISA 705, 7]

Material and pervasive

A matter is considered ‘pervasive‘ if, in the auditor’s judgment:

The effects are not confined to specific elements, accounts or items of the financial statements

If so confined, represent or could represent a substantial proportion of the financial statements, or

In relation to disclosures, are fundamental to users’ understanding of the financial statements.

[ISA 705, 5a]

In brief, a pervasive matter must be fundamental to the financial statements, therefore rendering them unreliable as a whole.

Adverse opinion

An adverse opinion is issued when a misstatement is considered material and pervasive. [ISA 705, 8]

This will mean the financial statements do not give a true and fair view.

Examples include:

Preparation of the financial statements on the wrong basis. Non-consolidation of a subsidiary.

Material misstatement of a balance which represents a substantial proportion of the assets or profits e.g. would change a profit to a loss.

Disclaimer of opinion

A disclaimer of opinion is issued when the auditor has not obtained sufficient appropriate and the effects of any possible misstatements could be pervasive. [ISA 705, 9]

The auditor does not express an opinion on the financial statements in this situation.

Examples include:

Failure by the client to keep adequate accounting records. Refusal by the directors to provide written representation.

Failure by the client to provide over a single balance which represents a substantial proportion of the assets or profits or over multiple balances in the financial statements.

Impact of a disclaimer of opinion

Where a disclaimer of opinion is being issued:

The statement that sufficient appropriate to provide a basis for the auditor’s opinion has been obtained is not included.

The statement that the financial statements have been audited is changed to ‘we were engaged to audit the financial statements’.

[ISA 705, 19]

The statements regarding the audit being conducted in accordance with ISAs, and independence and other ethical responsibilities, are positioned within the Auditor Responsibilities section rather than the Basis for Disclaimer of Opinion section. [ISA 705, A25]

The Key Audit Matters section is not included in the report as to do so would suggest the financial statements are more credible in relation to those matters which would be inconsistent with the disclaimer of opinion on the financial statements as a whole. [ISA 705, 29]

Basis for modified opinion

When the auditor decides to modify the opinion, they must amend the heading ‘Basis for Opinion’ to ‘Basis for Qualified Opinion’, ‘Basis for Adverse Opinion’ or ‘Basis for Disclaimer of Opinion’, as appropriate.

Where a qualified or adverse opinion is being issued, the auditor must amend the statement ‘…the audit is sufficient and appropriate to provide a basis for the auditor’s qualified/adverse opinion.’

[ISA 705, 20a]

The section will explain the reason why the opinion is modified e.g. which balances are misstated, which disclosures are missing or inadequate, which balances the auditor was unable to obtain sufficient appropriate over and why. [ISA 705, 20b]

If possible, a quantification of the financial effect of the modification will be included. [ISA 705, 21]

If the material misstatement relates to narrative disclosures, an explanation of how the disclosures are misstated should be included, or in the case of omitted disclosures, the disclosure should be included if the information is readily available. [ISA 705, 22]

The following table illustrates the impact on the audit opinion and auditor’s report.

[ISA 705, A1]

| Material but Not | Material & | ||

| Pervasive | Pervasive | ||

| Qualified Opinion | Adverse Opinion | ||

| Financial statements | FS do not give a true | ||

| Except for … | |||

| are materially | and fair view | ||

| Basis for qualified | |||

| misstated | Basis for adverse | ||

| opinion | |||

| opinion | |||

| Disclaimer of | |||

| Inability to obtain | Qualified Opinion | Opinion | |

| Except for … | Do not express an | ||

| sufficient appropriate | |||

| Basis for qualified | opinion | ||

| audit | |||

| opinion | Basis for disclaimer | ||

| of opinion | |||

Management imposed limitation of scope

If after accepting the engagement management impose a limitation of scope that will result in a modified opinion, the auditor will request management remove the limitation. [ISA 705, 11]

If management refuse, the matter must be discussed with those charged with governance. [ISA 705, 12]

The auditor should perform alternative audit procedures to obtain sufficient appropriate , if possible. [ISA 705, 12]

If the auditor is unable to obtain sufficient appropriate and the matter is material but not pervasive, the auditor must issue a qualified audit opinion. [ISA 705, 13a]

If the matter is considered pervasive, the auditor must withdraw from the audit. [ISA 705, 13bi]

If withdrawal is not possible before issuing the auditor’s report, a disclaimer of opinion should be issued. [ISA 705, 13bii]

If the auditor decides to withdraw from the audit, the auditor must communicate any material misstatements identified during the audit to those charged with governance before withdrawing.

[ISA 705, 14]

University of Oxford

The auditors of the University of Oxford, Deloitte, have issued a Qualified Opinion due to material misstatement for a number of years. The results of Oxford University Press (OUP), a department of the University, are not consolidated in the financial statements of the University because the financial regulations of the Council of the University do not apply to OUP. The financial statements do not comply with UK GAAP in this respect, and are therefore materially misstated.

Example wording of a Qualified Opinion (a)

Example where the auditor concludes that the financial statements are materially (but not pervasively) misstated:

Qualified Opinion

We have audited the financial statements of ABC Company (the Company), which comprise the statement of financial position as at December 31, 20X1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, except for the effects of the matter described in the Basis for Qualified Opinion section of our report, the accompanying financial

statements give a true and fair view……………… (remainder of wording as

per an unmodified report).

Basis for Qualified Opinion

The Company’s inventories are carried in the statement of financial position at xxx. Management has not stated the inventories at the lower of cost and net realisable value but has stated them solely at cost, which constitutes a departure from IFRS Standards. The Company’s records indicate that, had management stated the inventories at the lower of cost and net realisable value, an amount of xxx would have been required to write the inventories down to their net realisable value. Accordingly, cost of sales would have been increased by xxx, and income tax, net income and shareholders’ equity would have been reduced by xxx, xxx and xxx, respectively.

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the financial statements in [jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit we have obtained is sufficient and appropriate to provide a basis for our qualified opinion.

Example wording of a Qualified Opinion (b)

Example where the auditor concludes that they have been unable to gather sufficient appropriate and the possible effects are deemed to be material but not pervasive:

Qualified Opinion

We have audited the financial statements of the ABC Company (the Company), which comprise the statement of financial position as at 31 December, 20X1, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies.

In our opinion, except for the possible effects of the matter described in the Basis for Qualified Opinion section of our report, the accompanying

financial statements give a true and fair view………………… (remainder of

wording as per an unmodified report).

Basis for Qualified Opinion

The Group’s investment in XYZ Company, a foreign associate acquired during the year and accounted for by the equity method, is carried at xxx on the consolidated statement of financial position as at December 31, 20X1, and ABC’s share of XYZ’s net income of xxx is included in ABC’s income for the year then ended. We were unable to obtain sufficient appropriate audit about the carrying amount of ABC’s investment in XYZ as at December 31, 20X1 and ABC’s share of XYZ’s net income for the year because we were denied access to the financial information, management, and the auditors of XYZ. Consequently, we were unable to determine whether any adjustments to these amounts were necessary.

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in [jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit we have obtained is sufficient and appropriate to provide a basis for our qualified opinion.

Example wording of an Adverse Opinion

Example where the auditor has concluded that the financial statements are misstated and deemed pervasive to the financial statements:

Adverse Opinion

In our opinion, because of the significance of the matter discussed in the Basis for Adverse Opinion paragraph, the consolidated financial

statements do not give a true and fair view………………. (remainder of wording as per an unmodified report).

Basis for Adverse Opinion

As explained in Note X, the Group has not consolidated subsidiary XYZ Company that the Group acquired during 20X1 because it has not yet been able to determine the fair values of certain of the subsidiary’s material assets and liabilities at the acquisition date. This investment is therefore accounted for on a cost basis. Under IFRS Standards, the Company should have consolidated this subsidiary and accounted for the acquisition based on provisional amounts. Had XYZ Company been consolidated, many elements in the accompanying consolidated financial statements would have been materially affected. The effects on the consolidated financial statements of the failure to consolidate have not been determined.

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements section of our report. We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the consolidated financial statements in [jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit we have obtained is sufficient and appropriate to provide a basis for our adverse opinion.

Example wording of a Disclaimer of Opinion

Example where the auditor was unable to obtain sufficient appropriate and has concluded that the possible effects of this matter are both material and pervasive to the financial statements:

Disclaimer of Opinion

We were engaged to audit the consolidated financial statements of ABC Company and its subsidiaries (the Group), which comprise the consolidated statement of financial position as at December 31, 20X1, and the consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including a summary of significant accounting policies.

We do not express an opinion on the accompanying consolidated financial statements of the Group. Because of the significance of the matter described in the Basis for Disclaimer of Opinion section of our report, we have not been able to obtain sufficient appropriate audit to provide a basis for an audit opinion on these consolidated financial statements.

Basis for Disclaimer of Opinion

The Group’s investment in its joint venture XYZ Company is carried at

- on the Group’s consolidated statement of financial position, which

represents over 90% of the Group’s net assets as at December 31, 20X1. We were not allowed access to the management and the auditors of XYZ Company, including XYZ Company’s auditors’ audit documentation. As a result, we were unable to determine whether any adjustments were necessary in respect of the Group’s proportional share of XYZ Company’s assets that it controls jointly, its proportional share of XYZ Company’s liabilities for which it is jointly responsible, its proportional share of XYZ’s income and expenses for the year, and the elements making up the consolidated statement of changes in equity and the consolidated cash flow statement.

Responsibilities of Management and Those Charged with Governance for the Consolidated Financial Statements

[Wording as per ISA 700]

Auditor’s Responsibilities for the Audit of the Consolidated

Financial Statements

Our responsibility is to conduct an audit of the Group’s consolidated financial statements in accordance with International Standards on Auditing and to issue an auditor’s report. However, because of the matter described in the Basis for Disclaimer of Opinion section of our report, we were not able to obtain sufficient appropriate audit to provide a basis for an audit opinion on these consolidated financial statements.

We are independent of the Group in accordance with the ethical requirements that are relevant to our audit of the financial statements in [jurisdiction], and we have fulfilled our other ethical responsibilities in accordance with these requirements.

[ISA 705, Appendix]

IAASB: Auditor : FAQ

- When a KAM is necessary in respect of the audit of consolidated financial statements is the auditor also required to communicate a KAM in the auditor’s report of the separate financial statements?

The auditor should determine KAM in respect of each set of financial statements. A matter may give rise to a KAM for both audits. The KAM should be described in the context of each set of financial statements. If the KAM is only relevant to one set of financial statements it should only be included in the relevant auditor’s report.

- What is the effect on the KAM previously communicated in the auditor’s report in circumstances when the auditor reissues the report or amends the report previously issued?

When the auditor reissues or amends the auditor’s report an emphasis of matter or other matter paragraph will be included which refers to the note to the financial statements that discusses the reason for the amendment.

The auditor should consider whether the matter that has resulted in the new or amended report gives rise to an additional KAM. KAMs included in the original report are unlikely to be affected because such matters were previously determined to be matters of most significance. If the matter resulting in the new or amended report affects the KAM, updates to the KAM may be necessary. The KAM should then also cross-reference to the EOM or OM paragraph to clarify that both are in respect of the same matter.

- Should KAM be communicated in respect of each period when comparative financial statements are presented?

KAM should only be communicated in respect of the current period.

- Are all significant risks considered to be KAM?

KAM are matters of most significance. Depending on their nature, significant risks may not necessarily require significant auditor attention and therefore would not be considered KAM.

- What are the auditor’s responsibilities in relation to other information in circumstances when the auditor reissues or amends the report previously issued?

The auditor may restrict audit procedures on subsequent events to the subsequent events causing the amendment. The auditor is not required to report on any other information obtained after the date of the original report.

If the auditor does not restrict the audit procedures to the subsequent events causing the amendment, the Other Information section of the reissued report would cover all other information obtained as of the date of the reissued report.

UK syllabus: Recent developments affecting UK Auditor’s reports ISA 700 (UK) (Revised June 2016)

For audits of financial statements of public interest entities, the auditor’s report shall:

State by whom or which body the auditor(s) was appointed.

Indicate the date of the appointment and the period of total uninterrupted engagement including previous renewals and reappointments of the firm.

Explain to what extent the audit was considered capable of detecting irregularities, including fraud.

Confirm that the audit opinion is consistent with the additional report to the audit committee. The auditor’s report shall not contain any cross-references to the additional report to the audit committee unless specifically required.

Declare that the non-audit services prohibited by the FRC’s Ethical Standard were not provided and that the firm remained independent of the entity in conducting the audit.

Indicate any services, in addition to the audit, which were provided by the firm to the entity and its controlled undertaking(s), and which have not been disclosed in the annual report or financial statements.

ISA 701 (UK) Communicating Key Audit Matters in the Independent Auditor’s Report

ISA 701 (UK) requires the auditor to communicate other audit planning and scoping matters in the auditor’s report.

KAM include the most significant assessed risks of material misstatement (whether or not due to fraud) identified by the auditor, including those which had the greatest effect on the overall audit strategy, the allocation of resources in the audit, and directing the efforts of the engagement team.

In describing each of the key audit matters, the auditor’s report shall provide:

A description of the most significant assessed risks of material misstatement, (whether or not due to fraud)

A summary of the auditor’s response to those risks

Where relevant, key observations arising with respect to those risks.

Where relevant to the above information provided in the auditor’s report concerning each of the most significant assessed risks of material misstatement (whether or not due to fraud), the auditor’s report shall include a clear reference to the relevant disclosures in the financial statements.

In describing why the matter was determined to be a key audit matter, the description shall indicate that the matter was one of the most significant assessed risks of material misstatement (whether or not due to fraud) identified by the auditor.

Communicating Other Audit Planning and Scoping Matters The auditor’s report shall provide:

An explanation of how the auditor applied the concept of materiality in planning and performing the audit, specifying the threshold used by the auditor as being materiality for the financial statements as a whole.

An overview of the scope of the audit, including an explanation of how such scope:

– Addressed each KAM relating to one of the most significant risks of material misstatement disclosed.

– Was influenced by the auditor’s application of materiality disclosed.

Auditing the Directors’ Remuneration Report

The Companies Act 2006 requires the directors to prepare a directors’ remuneration report. Some of this information is required to be audited. The auditor’s report must therefore describe accurately which sections of the remuneration report have been audited. The auditor will ask the directors to make the disclosure of the audited information clearly distinguishable from that which is not audited.

The auditor must form an opinion as to whether the auditable part of the company’s directors’ remuneration report:

has been properly prepared in accordance with the Companies Act 2006

is in agreement with the accounting records and returns.

If this is not the case, the auditor should include in their report the required information.

Companies disclosing compliance with the UK Corporate Governance Code

ISA (UK) 700 requires the auditor to report by exception on the following matters in the auditors’ reports of companies disclosing compliance with the UK Corporate Governance Code where the annual report includes:

A statement given by the directors that they consider the annual

report and accounts taken as a whole is fair, balanced and understandable and provides the information necessary for shareholders to assess the entity’s performance, business model and strategy, that is inconsistent with the knowledge acquired by the auditor in the course of performing the audit.

A section describing the work of the audit committee that does not appropriately address matters communicated by the auditor to the audit committee.

An explanation, as to why the annual report does not include such a statement or section, that is materially inconsistent with the knowledge acquired by the auditor in the course of performing the audit.

Other information that, in the auditor’s judgment, contains a material inconsistency or a material misstatement of fact.

The auditor shall include a suitable conclusion on these matters in the auditor’s report.

Bulletin 2009/4 Developments in corporate governance affecting responsibilities of auditors of UK companies provides guidance for auditors and require the auditors to review:

the statement of directors responsibilities in relation to going concern

the part of the corporate governance statement relating to compliance with the nine provisions of the UK Corporate Governance Code. The corporate governance statement may be included within the directors’ report or may be a separate statement within the annual report or cross referenced to the company’s website.

FRC Extended auditor’s reports – A review of experience in the second year

A review of experience in the second year found:

Positives

Investors welcomed extended auditor , particularly where there are fewer sources of other information available about the entity, e.g. smaller companies.

Reports which were well structured and signposted key information earned the most praise.

Reports are using better descriptions and less generic language. Areas for improvement

More can be done to enhance auditor’s reports including providing more complete information about sensitivity ranges used in testing, assessment of the internal controls, and transparency about assumptions made by management and benchmarks used by auditors.

There is a widespread absence of explanations by auditors of changes in their audit approach and levels of materiality used from one year to the next.

Only one audit firm provides information on their application of performance materiality. Other firms comment that it is too difficult and technical to explain.

UK syllabus: Senior statutory auditor

Senior statutory auditor under the Companies Act 2006

Senior statutory auditor (SSA) has the same meaning as engagement partner when the audit is conducted in accordance with ISAs and is the person responsible for signing the auditor’s report. The SSA signs the auditor’s report in his own name on the original report but is not required to physically sign the copies of reports which are sent to the Registrar. Copies of reports just need to state the name of the SSA.

If there is a change to the SSA during the engagement, the new SSA must review the work performed to date to ensure it has been properly planned and performed in accordance with regulations.

If the SSA is absent for any reason at the time the report needs to be signed, the SSA may sign the report electronically by email or fax.

If the auditor’s report needs to be signed by a certain date, a contingency plan should be put in place in case the SSA is unable to sign the report. If another partner is actively involved in the audit, the contingency plan should be for the other partner to work in parallel with the SSA and can therefore take over as SSA if the need arises.

A SSA cannot be appointed a review partner for a client as objectivity will be affected by having been the SSA.

UK syllabus: Bulletin 2010/1 XBRL tagging of information

In February 2010, the IAASB issued Bulletin 2010/1 XBRL: Tagging of information in audited financial statements – guidance for auditors.

XBRL (eXtensible Business Language), is a language for the electronic communication of business and financial data. XBRL assigns all individual disclosure items within business reports a unique, electronically readable tags (like a barcode). HMRC requires companies to file their tax returns online using XBRL for returns submitted after 31 March 2011.

As we have seen, ISA 720 sets out the auditor’s responsibilities relating to other information in documents containing audited financial statements. XBRL – tagged data does not represent “other information” as referred to in ISA 720.

Auditors are not required to provide assurance on XBRL data in the context of an audit of financial statements.

However, auditors may be able to provide other services in relation to

XBRL data, including:

Performing the tagging exercise.

Agreed-upon procedures engagements such as the accuracy of the tagging by management.

Providing advice on the selection of tags.

Supplying accounts preparation software which automates the tagging process.

Training management in XBRL tagging.

As a result of these other services, self-review and management threats may arise which would need to be assessed and safeguarded as discussed in the ethics section.

Approach to exam questions:

There are two common styles of question requirement relating to auditor’s reports:

- Explain the implications for the auditor’s report

- Critically appraise the suggested auditor’s report.

Below are suggested approaches/considerations you can make when answering these questions.

Explain the implications for the auditor’s report

- Materiality assessment – if the issue is not material it won’t affect the auditor’s report. Calculate the percentage of assets and profit the issue represents and state whether this is material or not material.

- Identify the type of issue

– Material misstatement – non-compliance with an accounting standard.

– Inability to obtain sufficient appropriate – the auditor would expect to obtain hasn’t been obtained.

– Material uncertainty – significant events where the outcome will only be known in the future.

– Inconsistency with the other published information – contradiction between the financial statements and the other information which is not subject to audit e.g. directors report, chairman’s statement, CSR report, etc.

– A matter that is of importance to the scope of the audit, the auditor’s assessment of materiality, assessment of risk of material misstatement or other key audit matter that the auditor should specifically refer to in their report.

- Comment on the issue

– Which accounting standard has not been complied with and why

– Which piece of has not been obtained and why

– What event/outcome is uncertain

– What is the contradiction in the unaudited information

– Explain why the auditor focused specifically on the key audit matters described in greater detail in the auditor’s report e.g. involved a high degree of management judgment, required complex accounting treatment creating significant risk of material misstatement.

- State whether the issue is material or material and pervasive – is it isolated or relatively small in impact or does it make the financial statements as a whole unreliable.

- Conclude on the opinion

– Unmodified – if no material misstatements or lack of

– Qualified – if there is a material (but not pervasive) misstatement or a lack of over a material balance

– Adverse – if there is a pervasive misstatement

– Disclaimer – if there is a lack of which is considered pervasive.

- State any other implications

– Basis for modified opinion if the opinion is modified

– Going concern section

– Emphasis of matter paragraph

– Other matter paragraph

– Requires inclusion in the Key Audit Matters section for a listed entity

– UK syllabus: Requires by exception under ISAs or Companies Act.

Critically appraise the suggested auditor’s report

In order to say what is wrong with the suggested report you must understand the following:

The main elements of an auditor’s report.

The order of the paragraphs within the report.

Appropriate titles for the opinion and basis for opinion paragraphs.

Professional and appropriate wording and content.

Which opinion is the appropriate one to use in the circumstances.

When it is appropriate to use key audit matters, emphasis of matter and other matter paragraphs.

Look out for:

Paragraphs being included in the wrong order. Titles of paragraphs using the wrong wording.

Incorrect use of KAM, EOM and OM paragraphs.

Inappropriate opinion being suggested for the issue.

Inconsistent opinion wording with the name of the opinion e.g. adverse opinion being suggested but the wording within the opinion using ‘except for’ which is the wording for a qualified opinion.

Unprofessional wording of the report in general e.g. the auditor ‘feels’ the financial statements ‘may’ be materially misstated. The auditor needs to provide greater confidence to the user than just a feeling. If the issue may be material, equally it may not be material and therefore should not be referred to in the report. The auditor needs to use their professional judgment to conclude that the issue is or is not material, they cannot sit on the fence.

Insufficient explanation of the reason for the modification.

Test your understanding 1

You are a partner of Finbar & Sons, a firm of accountants. You are conducting a review of the draft financial statements of a major client, Holly & Ivy Co, for the year ended 30 April 20X4. According to the draft accounts revenue for the year was $125 million, profit before tax was $9 million and total assets were $100 million. You also identify the following issues:

- The accounting policies note state that all development costs are expensed as incurred. The audit work performed shows that these costs totalled $6 million during the year and that of these

$1.3 million should have been capitalised as development assets in accordance with relevant financial standards.

The audit senior has suggested a qualified audit opinion with a disclaimer paragraph, given the highly material nature of the matter above in comparison to profit before tax. She has also included an emphasis of matter paragraph, due to the perceived significance of the issue.

- The directors of Holly & Ivy have, for the first time, stated their intention to publish the annual report on the company’s website.

Required:

Explain the implications of the above matters on the auditor’s report for the year ended 30 April 20X4 and comment on the audit senior’s suggestion. (10 marks)

7 to those charged with governance

Management and those charged with governance

Those charged with governance and management are defined in ISA 260

Communication with Those Charged With Governance as:

Those charged with governance

The persons with responsibility for overseeing the strategic direction of the entity and obligations related to the accountability of the entity. [ISA 260, 10a]

This includes the directors (executive and non-executive) and the audit committee.

Management

The persons with executive responsibility for the conduct of the entity’s operations. [ISA 260, 10b]