WEDNESDAY: 23 May 2018. Time Allowed: 3 hours.

Answer ALI. questions. Marks allocated to each question are shown at the end of the question. Show ALL your workings. Any assumptions made must be clearly and concisely stated.

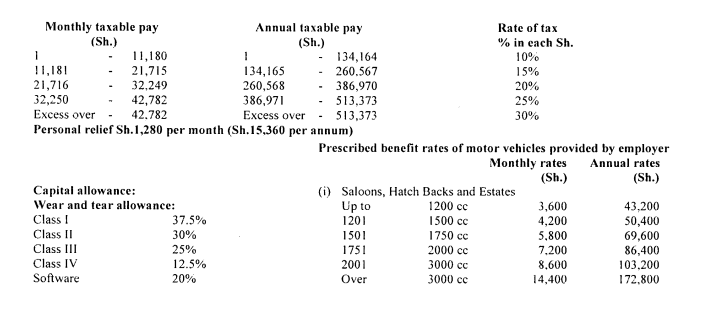

RATES OF’ TAX (Including wife’s employment, self-employment and professional income rates of tax). Year of income 2017.

QUESTION ONE

1. When the Cabinet Secretary for the National Treasury or equivalent ministry presents the Division of Revenue Bill to Parliament. it should be accompanied by a memorandum explaining various matters.

With reference to the above statement, identify four such matters. (4 marks)

2. Outline six functions performed by the Controller of Budget in relation to public finance management. (6 marks)

3. Summarise the steps that each public entity should follow under the e-procurement process. (10 marks)

(Total: 20 marks)

QUESTION TWO

1. Identify four factors that are considered by the Commission on Revenue Allocation (CRA) or equivalent body while selecting marginalised counties for purposes of allocating the equalisation funds. (4 marks)

2. Discuss three functions of the Council of Governors in county financial management. (6 marks)

3. Mwanahawa Hamisi is a trader dealing in fast moving consumer goods and electronics. She is duly registered for value added tax (VAT). Details of her business transactions for the month of October 2017 were as follows:

- Sales during the month:

Sh.

Standard rate 1,900,000

Zero rated 418,000

Exempt 342,000

- Customers for the sales at standard rate are offered a 15% discount if they settle within the same month. From past experience, 40% of the customers take advantage of the discount facility.

- Purchases of goods constituted Sh.1,200,000 made at the standard rate and Sh.500,000 exempt. All the purchases are made in cash.

- The exempt sales were all from the batch of exempt purchases with some remaining in inventory at the end of the month.

- During the month, she paid rent for the business premises for the month of October and the remaining portion of the year. The landlord charges Sh.80,000 per month.

- The business accountant wrote off debts amounting to Sh.280,000 as irrecoverable and made an allowance for specific irrecoverable debts of Sh.11,600 as the portion for that month.

- During the month, a supplier from whom the business had made purchases of goods worth Sh.292.000 and a a customer to whom goods were sold at standard rate in July 2017 and still owed Sh.325,000 were declared bankrupt.

- A pick-up vehicle was acquired at a cost of Sh.870,000 (inclusive of VAT) for business purposes.

- At the end of every month, Mwanahawa prepays the electricity for the following month using prepaid meter tokens. This is done by establishing her standard usage for the following month. During the month, she paid Sh.42,500 whereas in the previous month she had paid Sh.38.500.

- Other expenses paid during the month of October 2017 were as follows:

Sh.

Telephone 13,200

Audit fee (Tax invoice including VAT) 111.070

Stationery 36,000

- Mwanahawa made donations to registered charities consisting of Sh.100.000 in cash and Sh.280,000 in form of goods.

- Closing inventory for the month was valued at Sh.340.000.

(All the above transactions are quoted exclusive of VAT at a rate of 16% where applicable unless otherwise stated).

Required:

The value added tax (VAT) payable by (or refundable to) Mwanahawa Hamisi for the month of October 2017. (10 marks)

(Total: 20 marks)

QUESTION THREE

1. Distinguish between “objection” and “appeal” as used in administration of income tax. (4 marks)

2. Outline four disadvantages of a multiple tax system. (4 marks)

3. Bonface Huka is a resident individual and a qualified pharmacist who has been employed by Sawa Hospital since his early retirement from the public service in 2016.

The following details were availed to you in respect of his earnings for the year ended 31 December 2017:

- He received a monthly basic salary of Sh.184,000 from Sawa Hospital. Additional one month’s basic salary was paid to him in December 2017 as a bonus. PAYE deducted during the year was Sh.897,600.

- Pension received from the public service was Sh.540,000 as a lumpsum amount.

- A commission of Sh.199,000 was paid to him for the promotion of drugs under identified brands during the year.

- During the year, he was sent to Mombasa for a four day medical conference and was paid daily subsistence allowance of Sh.18,000 by the hospital.

- He has a fixed deposit account of Sh.1,500,000 at the Broad Bank Ltd. from which he received an interest of Sh.105,000 during the year.

- He has a life insurance policy where he contributes 40% of the premiums. while the employer contributes 60%. Annual premiums as per the insurance policy during the year was Sh.460,000.

- He was provided with a saloon car of 2000 cc by the hospital for personal and official duties on I July 2017. The saloon car had an initial cost of Sh.2,800,000.

- The hospital has a medical cover for all staff. He was entitled to a maximum cover of Sh.I 80,000 per annum while he utilised Sh.74,000 on medical bills during the year.

- During the year, he was provided with a house. The market value of the house was Sh.120,000 per month and he contributed Sh.20,000 per month as nominal rent.

- During the year, the hospital settled his bills as follows: telephone S11.68,000. water Sh 18,200 and electricity Sh.24.600.

- The hospital contributed 5% of his basic salary towards a registered pension scheme while he contributed an equal amount to the scheme.

- The hospital paid subscription fees on his behalf to the Pharmacy and Poisons Board amounting to Sh.54,000 during the year.

- He was reimbursed private entertainment expenses of Sh.120,000 by the hospital during the year.

Required:

Taxable income for Bonface Iluka for the year ended 31 December 2017. (10 marks)

Tax payable (if any) on the income computed in (c)(i) above. (2 marks)

(Total: 20 marks)

QUESTION FOUR

1. The following information was extracted from the books of Fanaka Ltd. for the year ended 31 December 2017:

Sh.

Sales 4,800,000

Purchases 1,100,000

Bad debts recovered 540,000

Rent received (commercial premises) 280,000

Dividends received (Mkopo Ltd.) 100,000 (net)

Interest received (Hekima Bank Ltd.) 340,000 (net)

Discount allowed 54,000

Discount received 133,000

Salaries 960,000

Electricity 180,000

Advertising 395,000

Provision for bad debts 45,000

Subscriptions to a trade association 65.000

Audit fees 168,000

Legal fees 139,500

Car hire expenses 420,000

Purchase of machinery 1,600,000

Loss of stock 530,000

Installation of machinery 42,000

Foreign exchange gain (realised) 232,000

Donations to a political party 1,050,000

General expenses 52,000

Additional information:

- Opening stock and closing stock were valued at Sh.912,000 and Sh.840,000 respectively.

- Included in the sales figure was a sale of Sh.928,000 that was inclusive of VAT at the rate of 16%, while the other sales were recorded net of VAT.

- Advertising includes an amount of Sh.195,000 spent in the erection of a bill board.

- Loss of stock includes Sh.120,000 relating to insured stock.

- Two thirds of the bad debts recovered relate to bad debts which were previously written off from the company’s books.

- Legal fees relate to the following:

Sh.

Conveyance of land 42,000

Trade dispute 27,000

Breach of contract 36,500

Preparation of employment contracts 34,000

Required:

Adjusted taxable income for Fanaka Ltd. for the year ended 31 December 2017. (8 marks)

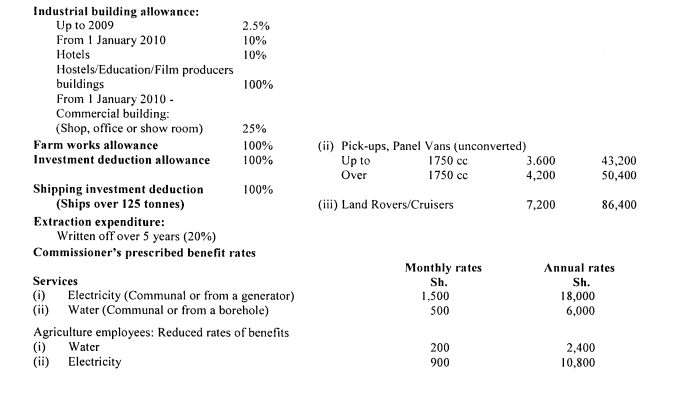

2. Zuret Products Ltd. which is engaged in the business of manufacturing and selling of canned fish commenced its operations on I January 2014 after incurring the following expenditure:

Sh.

Land 4,800.000

Processing machinery 3,200,000

Factory buildings 2,800,000

Staff canteen 860,000

Generator 250,000

Labour quarters 3,600,000

Staff clinic 960,000

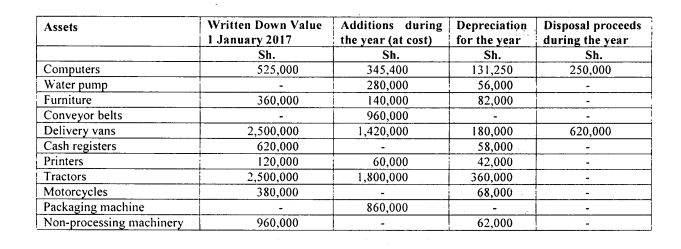

Details of property, plant and equipment schedule reflected the following as at 31 December 2017:

Additional information:

- A perimeter wall was constructed at a cost of Sh.960,000 during the year ended 31 December 2017.

- A godown and a drainage system were constructed at a cost of Sh.2,860,000 and Sh.1,780,000 respectively and put into use on 1 October 2017.

- The company constructed a borehole at a cost of Sh.1,500,000 during the year which was put in use on 1 July 2017.

Required:

Capital allowances due to Zuret Products Ltd. for the year ended 31 December 2017. (12 marks)

(Total: 20 marks)

QUESTION FIVE

1. Highlight four circumstances under which duty paid on imported goods may be refunded by the commissioner. (4 marks)

2. Argue four cases against capital gains tax or equivalent tax in your country. (4 marks)

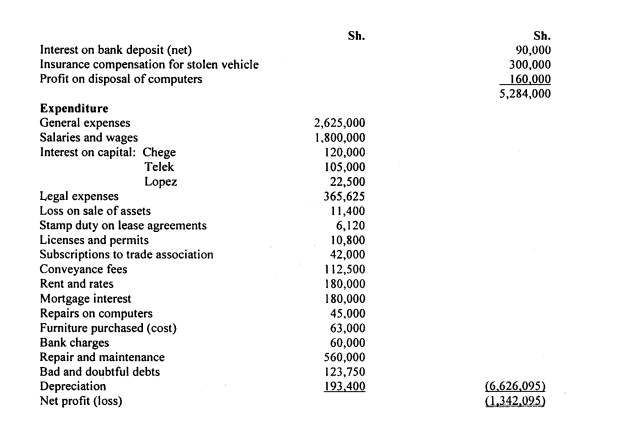

3. Chege and Telek have been partners trading as Chetel Traders. On 1 September 2017, they admitted Lopez in the business and changed the partnership name to Chetelop Traders. Prior to the admission of Lopez, the profit and loss sharing ratio was 2:3 between Chege and Telek respectively. However, with the admission of Lopez, they revised the profit and loss sharing ratio to 2:3:1 for Chege, Telek and Lopez respectively.

The partners have presented the following income statement for the year ended 31 December 2017:

Income Sh. Sh.

Gross profit 4,500,000

Foreign exchange gain 234,000

Additional information:

- General expenses comprise:

Sh.

Embezzlement by a cashier 900,000

Staff christmas party 600,000

Replacement of car engine 105,000

Partition of an office 450,000

Partners private insurance policy 570,000

- Salaries and wages include Sh.525,000, Sh.600,000 and Sh.235,000 paid to Chege, Telek and Lopez respectively.

- Mortgage interest relates to a partner’s residential house.

- Assume that the income accrued evenly throughout the year.

- Legal expenses comprise:

Sh.

Parking fines paid to county government 11,400

Legal fees for breach of contract 150,000

Drafting a tender document 13,500

Drafting a lease agreement (1.00 years) 6,750

Defending a partner in a tax case 9,000

Legal cost of debt collection 174,975

- Repair and maintenance costs comprise:

Sh.

Purchase of weighing scale 252,000

Installation of CCTV cameras 224,000

Fixing a leaking roof 84,000

- Bad and doubtful debts comprise:

Sh.

Specific bad debts 74,250

General provision 49,500

- Capital allowance was agreed with the commissioner of revenue authority at Sh.260,800.

Required:

Adjusted taxable profit or loss for the partnership for the year ended 31 December 2017. (8 marks)

Allocation of profit or loss to the partners. (4 marks)

(Total: 20 marks)